Summary

- An 8-K filed on 12/30/15 indicates that Cadiz Inc. (NASDAQ:CDZI) has leased part of its farmable land for a one-time payment of $12M, with the remaining land an option for $43M

- The land is being leased to the company’s largest shareholder, who has the rights to buy it after 20 years for $1 if CDZI doesn’t buy it back with interest

- Cash raised must be used to pay back secured lenders and we believe this is the only way lenders & CDZI’s large shareholders can avoid default and an equity wipeout

- We believe a conservative estimate on the sale of the remaining 30,000 acres of CDZI property would still put them well short of being able to pay off their entire debt obligation

- Thus, we believe the company is still worth $0 intrinsically. Additionally, we present new evidence that the company’s remaining sole project, its water project, is still hitting hang-ups

Delaying the Inevitable: Bankruptcy or Equity Issuance

By now, most people have had a chance to digest the 8-K that was filed by Cadiz Inc. (CDZI) during the day on Wednesday, December 30, 2015. At first glance, it looks like great news from the company. The 8-K describes 2100 acres of land that the company was able to lease to its largest shareholder, Water Asset Management, LLC (“WAM”), for a lump sum of $12 million.

Water Asset Management also has the option to enter into a similar agreement for the remaining 7500 acres of farmable land that CDZI has for $43 million, according to the 8-K. This would literally amount to CDZI “selling the farm,” as the company also notes in numerous filings that it has just 9,600 acres of farmable land. The stock popped almost 30% on this news as investors looked through the content of the 8-K and its corresponding exhibits, trying to piece together what this means for the long term story at Cadiz.

We see this development as more of a Chapter 11 reorganization without actually being a Chapter 11 reorganization. In that type of bankruptcy, debts are restructured, assets are liquidated and generally the company comes out ahead. In this case, the same actions are taking place, but the company may not be coming out ahead at all.

We believe that this development does not take away from the short case, but rather pushes out the length of time which it may need to develop. We see a best case scenario for CDZI of potentially being able to pay off some debt and maybe return the balance sheet to a point where the equity in the company remains slightly negative, but not as bad as it is now. We also don’t think the company is going to be able to sustain operations/its cash burn under these circumstances. Also, in a situation where land continues to be leveraged in order to pay off debt, Cadiz will be left with little to nothing in terms of its business going forward, which should inevitably continue to push them toward equity issuance or bankruptcy. Should the company want to make a meaningful charge at buying back this property or focusing on another business venture, we still believe the likely scenario for them is to issue equity. Thus, we continue to believe that the equity in CDZI is worthless, however we are readjusting the timeframe with which we are looking at this company as maturities and debt obligations will likely be able to be met in the coming year or so.

“Selling the Farm”

The 8-K describes an agreement where CDZI is literally “selling the farm”. The company states in its 10-K that it has 9600 acres of farmable land out of a total of over 30,000 acres of land. Of this, it has now leased (with an option to buy for $1 after 20 years) 2,100 acres of this to its largest shareholder.

We’re guessing that the 2,100 acres that it just leased out are comprised of the 1,920 acres that “the company has developed”. In other words, we find it likely that the company leased out the best and furthest developed land that they own.

Regardless, we believe that the total value of all of this land falls well short of the company’s total debt and if it’s monetized at an amount that we believe to be optimistic, the company would still wind up essentially worthless on paper. Thus, we believe today’s price of $5.30 per-share is essentially just a pure play or call option on the company’s water project, which we have written about in the past and have deemed a optimistic investor in endeavor. As there have been no positive developments with the water project, it’s tough for us to reconcile the stock price moving higher at this point.

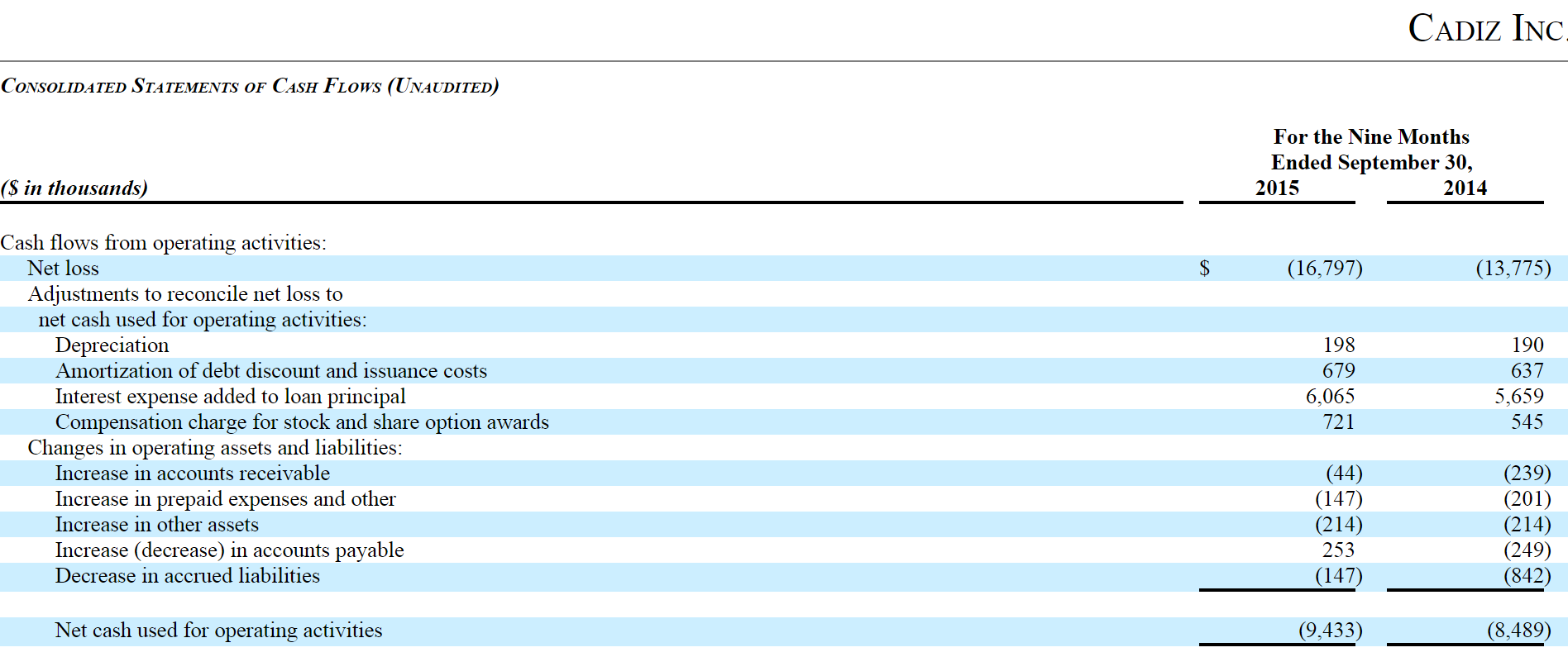

Once assets are sold, you’re left with a company with little business prospects and a company that has already burnt $9.4 million in cash this year through September 30, 2015. The cash burn, which is the silent killer of equity for the company, amounts to about $1 million per month.

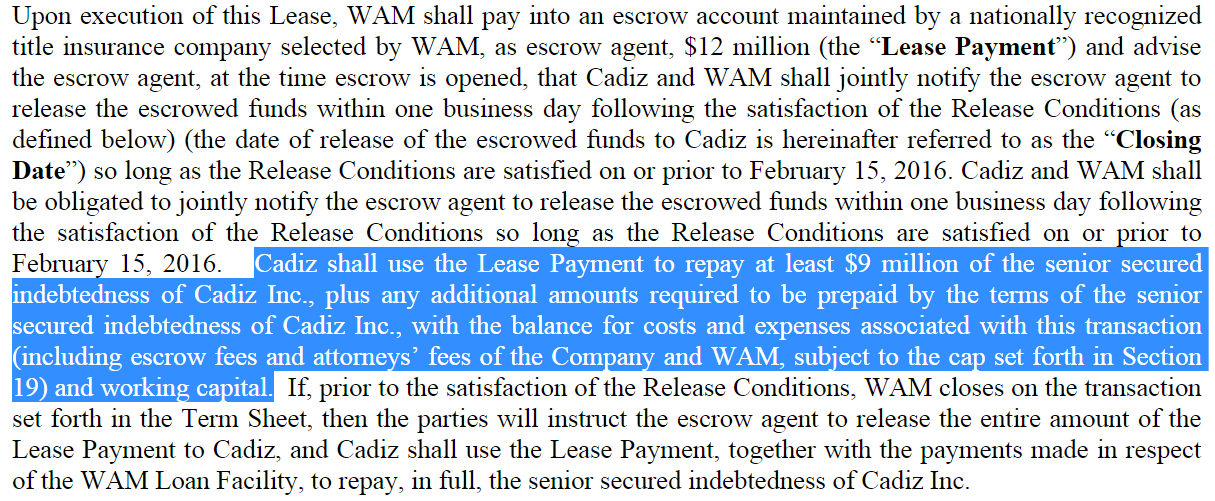

Further, the newly disclosed 8-K describes that the company must use the proceeds of this sale in future sales only to pay down senior secured debt. From the exhibit:

The same language is used regarding the potential option:

“Any proceeds paid by WAM to Cadiz in connection with the exercise of any expansion option described in this Section 5, net of any fees and transactions costs incurred in connection therewith, shall be used solely to repay the senior secured indebtedness of Cadiz, Inc.“

In addition, WAM now has access to the company’s Limoneira Lease, and rights to receive payments and rent thereunder:

What we believe could be happening, is that MSD, the company’s senior secured creditor, is essentially doing a dance with Water Asset Management, the company’s largest shareholder, in order to hedge and insure both of their positions — one as a creditor and the other as a common shareholder. MSD wins and WAM now basically owns the land, not all that different from what would happen if MSD called the secured loan, except there’s no headline that says “CDZI defaulted on their senior secured notes”.

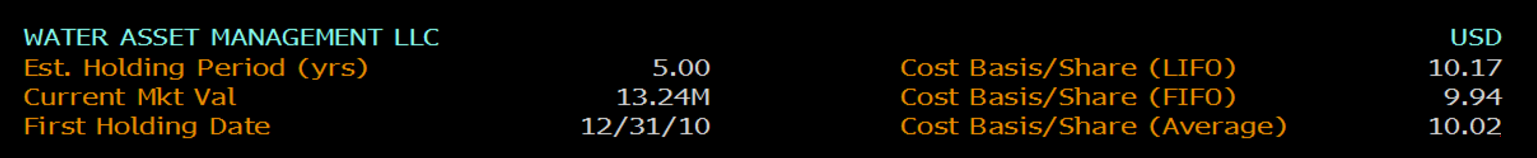

MSD looks like they will ultimately get paid everything they are owed with interest, which obviously benefits them, and Water Asset Management looks like they will essentially hedge their already losing position in the company’s common stock. They have a cost basis of around $10, so they are still well in the red on their CDZI position.

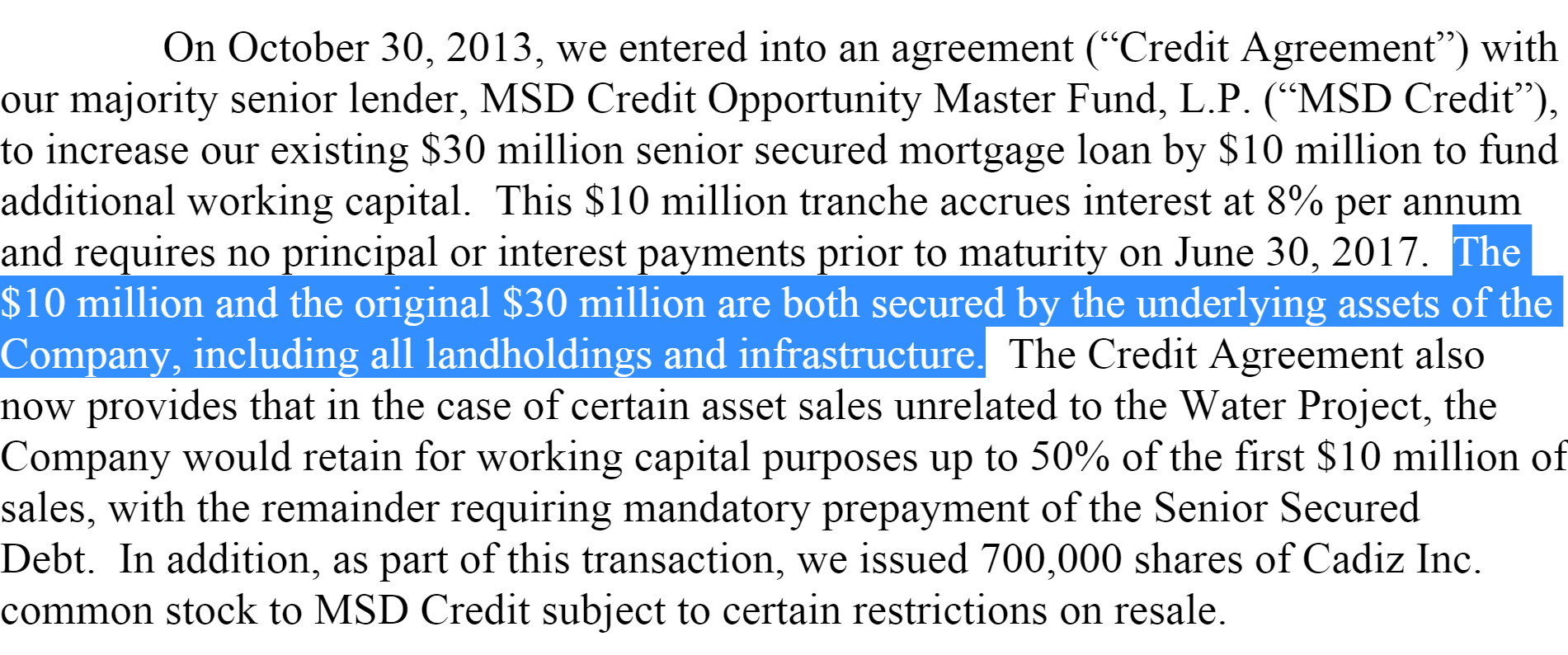

The company’s senior secured lenders, MSD, have the current mortgage secured by the assets.

Ostensibly what could be happening is that WAM is buying up what’s left of the value in the company, in the debt. Meanwhile, those junior to the secured debt, like the convertible holders who just extended their maturities with the company, now move to the top of the superlative list of “Most Likely to be Voted Bagholder,” second only to a collective picture of all remaining common shareholders.

We believe the unfortunate losers in the deal, aside from the convertible holders, will be the long term CDZI shareholders. The winners will be the executives that continue to draw absurd amounts of cash from this company and the senior lenders. While we admit this is not a terrible solution to free up some temporary liquidity, versus the only other option of issuing equity immediately, we believe that CDZI is left with little to no business at all, assuming they option off the rest of this farmland. We still don’t know how the company is going to continue to pay interest and burn cash in the interim. The company had previously stated that they were looking to potentially move into agriculture and farming to hedge against the water project, but that is now going to be tough to do without the rights to the land where they have their farming permits.

This looks like it is no longer an option.

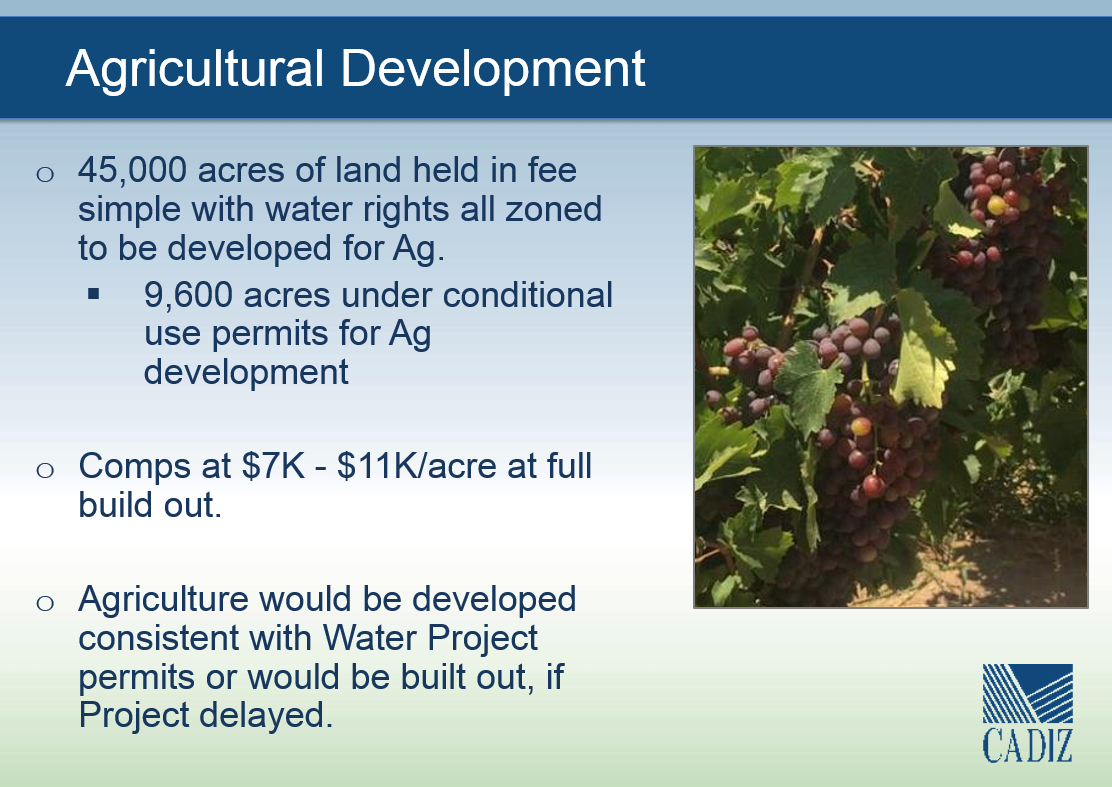

Plus, the land here sold to Water Asset Management seems to be at a price of about $5000 an acre, which is far less than the company has stated that the land was worth in a corporate presentation. This means either:

- They’re in a rush to unload it

- They’re telling investors its worth more than it actually is

This is a slide from the Rodman and Renshaw September 2015 presentation located on Cadiz’ Investor Relations page, where they list this land at $7,000-$11,000/acre:

On top of that, the additional 30,000 acres of land that CDZI owns appears to be worth, at an optimistic value, maybe $30 million total. This is not enough for the company to pay off all of its total debt, which is near about $100M before last week’s transaction took place.

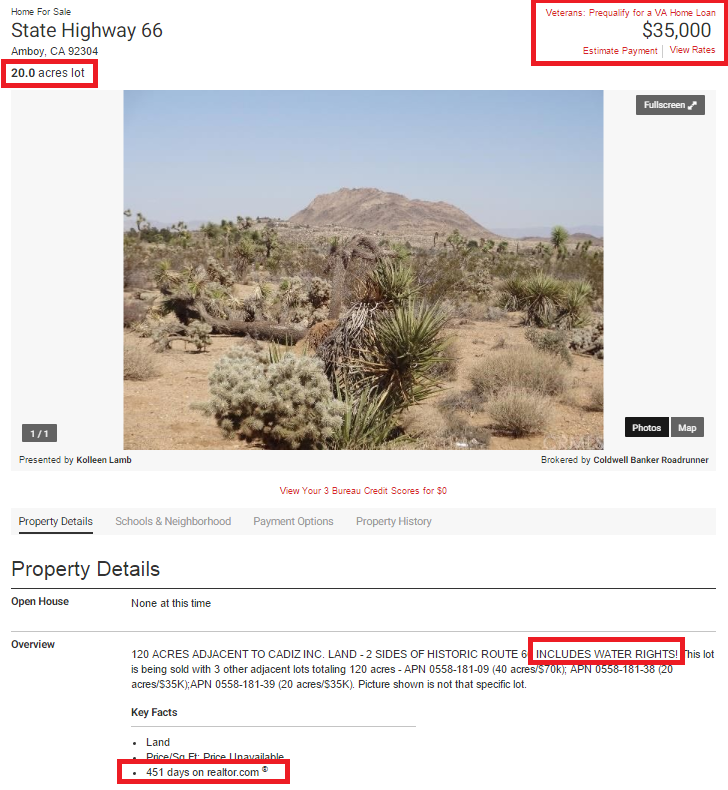

Here is a comparable piece of land that borders their land with water rights that is selling for about $1750 an acre.

Land without Water Rights or land that needs to be liquidated quickly would likely go for about half of this, so we’re going to estimate an optimistic $1,000/acre, which would result in about $30 million. You’ll notice that this price is significantly less than what was paid for the company’s farmable land and you can also notice from this listing that the land has been on the market for almost 500 days. This leads us to believe that there would be little to no buyers for potential leases, especially at the prices of this land is listed.

If the company was forced to liquidate, who knows how cheap they would lease this land for?

Other Negative Impacts to Cadiz

We also recently pointed out to our members two newer items of note in the Cadiz story that we haven’t covered as of yet.

First, page 770 of this massive 2000 page appropriations bill, released December 15, 2015, states the following — obviously a continued negative development for the continuation of the company’s Water Project, should they continue to pursue the ROW method of approval:

PROHIBITION ON USE OF FUNDS 2 SEC. 121. (a) Any proposed new use of the Arizona & California Railroad Company’s Right of Way for conveyance of water shall not proceed unless the Secretary of the Interior certifies that the proposed new use is within 6 the scope of the Right of Way. (b) No funds appropriated or otherwise made available to the Department of the Interior may be used, in relation to any proposal to store water underground for the purpose of export, for approval of any right-of-way or similar authorization on the Mojave National Preserve or lands managed by the Needles Field Office of the Bureau of Land Management, or for carrying out any activities associated with such right-of-way or similar approval.

Second, it is also being proposed that the land sought out for use by CDZI, the aquifer in the Mojave Desert, could be designated a national monument if a recent bill proposed by CDZI critic Sen. Dianne Feinstein is passed. Her bill states specifically that “extracting groundwater from aquifers” would be prohibited. Commentary from Feinstein on this proposal has been as follows:

“In my view, the California desert is an American treasure that is highly worthy of preservation. I think the public meeting today only further proved that,” Sen. Feinstein said. “Public input in desert conservation is absolutely vital. I’ve worked with the desert stakeholders for years, and I know how diverse their views are-which makes discussions like these even more important. I’m especially grateful that Deputy Secretary Connor and Under Secretary Bonnie attended and were able to hear local goals for the desert, and I thank the Obama administration for considering these monuments.”

Senator Feinstein’s proposal would protect more than one million acres in San Bernardino County as the Mojave Trails National Monument. The area, known for its spectacular vistas and intact stretch of historic Route 66, would connect the Mojave National Preserve to the north with Joshua Tree National Park to the south. The Sand to Snow National Monument would span up to 140,000 acres from the snowy mountain peaks of the San Bernardino National Forest to the desert sands of Joshua Tree National Park, including some of the most biologically and culturally rich areas in southern California. The Castle Mountains National Monument would add 20,000 acres of key desert grassland to be managed by the National Park Service as a part of the Mojave National Preserve while respecting existing mining operations in the area.

This would effectively be yet another nail in the coffin of CDZI’s proposed project, adding to the demonstrable amount of publicly available evidence that we believe shows that the project will never happen and that CDZI remains destined for bankruptcy or toxic dilution.

Something Has to Give

While our timelines have been altered a bit from this chain of events, we still believe this doesn’t put Cadiz at any better of a position than it was in prior to this move. We think equity holders have it wrong bidding up the stock on this news and that CDZI remains significantly overpriced — by 100%. The only question now is how long this narrative is going to continue to take to play out.

Of course, the one main risk here remains the company’s Water Project. Never mind the hundreds of millions it would need to implement such a project, nor the fact that the rest of the company’s land is the land that would be used for the Water Project, if the company can show a glimpse — even a suggestion of progress — equity holders could continue to bid the stock higher.

Conversely, we think the stock price’s recent spike actually makes it more susceptible for CDZI to issue equity in order to right its balance sheet.

We actually see this recent move as a backhanded admission that the company doesn’t expect things to go well for the Water Project — otherwise why start deleveraging by essentially selling assets? Could it be that MSD was looking at Chapter 11 scenarios and this was the only way WAM could save the value in their equity?

We think that WAM may not have a choice but to take out the rest of the MSD debt owed via purchasing more CDZI land. That leaves us with a shell and no business prospects, which would place the company somewhere around a nice round $0 figure when it comes to the equity — but one has to keep in consideration the cash fix that the company has gotten accustomed to, which amounts to over $10 million per year, according to the latest 10-Q.

Where is this cash going to come from? Something’s going to have to give.

So new investors would just have the option on the water project, buried under converts that don’t seem to worth the paper they’re printed on.

Without tangible progress on the front of the company’s water project, we believe that the company, in a very best case scenario, may return to some point close to barely not having negative equity. We still do not believe that there is any intrinsic value in CDZI shares and we believe the likelihood of an equity offering has increased with the company’s stock price going up. Again, we do believe that the short thesis may take longer to play out, but as long as the water project fails to gain any traction, CDZI remains worthless and is now officially a pure play call option on whether or not the company’s water project will survive. We continue to bet that it will not.