By Maj Soueidan, Co-founder GeoInvesting

By Maj Soueidan, Co-founder GeoInvesting

The bullish focus of this brief information arbitrage (“InfoArb”) piece is on Bluelinx Holdings Inc. (NYSE:BXC). Information arbitrage is one of the biggest opportunities in the microcap investing space. It exists when information that is public is not picked up on by the financial media, analysts, or investors of a specific company. I spend a good deal of time researching these information arbitrage opportunities, and stumbled upon one a few weeks ago. The GeoTeam produces a steady stream of InfoArbs to our premium members at our portal.

BlueLinx is a 40 years old company and leading distributor of building products in North America. Revenues are dependent on housing starts and to a lesser extent the home remolding market. The Company is headquartered in Atlanta, Georgia and operates its distribution business through its network of distribution centers.

We first pointed out Bluelinx Holdings to members in June of this year:

“We are considering constructing Reasons for Tracking on BXC. Bluelinx distributes building products in North America. The company distributes products in two principal categories, structural products and specialty products. This $7.20 per share company is taking steps to improve margins and reduce its mountain of debt. If successful, there could be massive incremental gains in EPS and EBITDA. We encourage our members to review the company’s conference call transcripts for more information while we continue our research.”

On June 13, 2016 the company effected a 1 for 10 reverse split reducing its share count to $9.0 million.

We usually observe low quality pump and dump stocks implement reverse splits to cosmetically massage their stocks. So to see an NYSE company with substantial revenue do this naturally put the stock on our radar.

Part of the reason I am attracted to BXC is due to positive industry currents I became aware of when I researched Huttig Building Products Inc. (NASDAQ:HBP). From HBP filings it looks like he housing recover has a ways to go:

“New housing activity in the United States has shown modest improvement each year since 2009, the trough period of the recent housing downturn. However, 2015 activity was still below the historical average of total housing starts from 1959 to 2015 of approximately 1.4 million starts based on statistics tracked by the U.S. Census Bureau (“Historical Average”). Total new housing starts in the United States were approximately 1.1 million, 1.0 million and 0.9 million in 2015, 2014 and 2013, respectively. Single family starts were 0.7 million, 0.6 million and 0.6 million in 2015, 2014 and 2013, respectively, based on data from the U.S. Census Bureau. According to the U.S. Census Bureau, total spending on new single family residential construction was $219 billion, $194 billion and $171 billion in 2015, 2014 and 2013, respectively.”

Bluelinx Press Release Information Arbitrage: GAAP vs. non-GAAP

On August 4, 2016, BXC reported Q2 financial results. The headline numbers in the press release were:

- Sales of $509.0 million vs $515.6 million in the prior year

- GAAP EPS of a loss of $0.35 vs a profit of $0.33 in the prior year

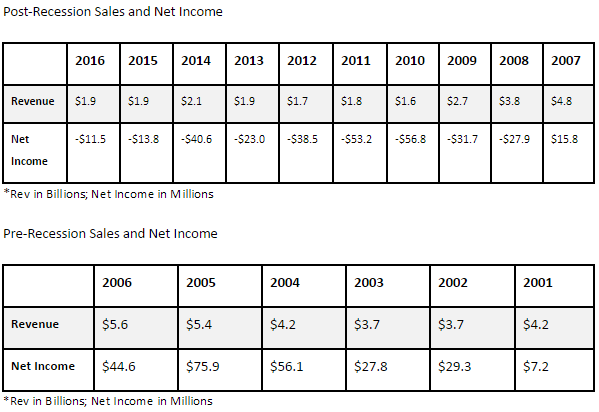

Fortunately, I am tracking the company. Management is in the process of implementing a significant restructuring to stop the “bleeding” at the bottom line. The Great Recession, rising debt levels going into the recession and some strategic growth issues punished BXC sales and earnings.

I like to say “buy when others are sleeping.” Pinpointing inflection points of growth and change is a great way to find entry points in hibernating stocks.

Management is in the midst of closing and/or selling some assets to reduce its debt burden, currently standing at about $400 million. They are also making strategic moves to increase margins and sales , while it connects better with its customers. For example, the company now assigns permanent sales associates to local markets.

So, I am not really concerned about sales growth at this juncture. Buying companies that look dead where there is tangible hope is one of my favorite ways to sneak into a stock that others are ignoring.

As is often the case in restructuring plays, a lot of “junk” can be included in GAAP numbers, which can mask real operational progress. Knowing this to be the case, we reviewed the company’s results more closely. If you are willing to consider not taking the media hype about the misuse of non-GAAP presentations at face value you will be rewarded for good research. You can see an article I recently published on this subject here. Surprisingly, the company did not provide non-GAAP EPS numbers. But management did break out an adjusted EBITDA calculation in the press release:

The size of the $7.5 million “Restructuring, severance, and legal” expense stuck out like a sore thumb. Some press release verbiage also touched on non-recurring expenses:

“The inventory and facility rationalization initiatives reduced net income by $7.7 million during the quarter.”

Many investors probably do not care to look past head line numbers. With 9 million shares outstanding, we calculated that non-GAAP EPS for Q2 2016 vs Q2 2015 were: $0.43 vs $0.08.

Our additions to GAAP numbers are

- Share based compensation

- Restructuring, severance, and legal

- Refinancing related expenses (debatable)

And our subtractions are

- Benefit from income taxes

- Gain on sale of property

What I find particularly interesting is that our research team did not expect the company to even come close to reporting quarterly earnings per share north of $0.30 until after it paid down a substantial amount of its debt. So with shares hovering around $8.00 on the day of earnings the stock looked pretty cheap. Based on the numbers reported in Q2 2016, shares were trading at a:

- Run Rate Adjusted P/E of around 5

- Run Rate EV/S of 0.2

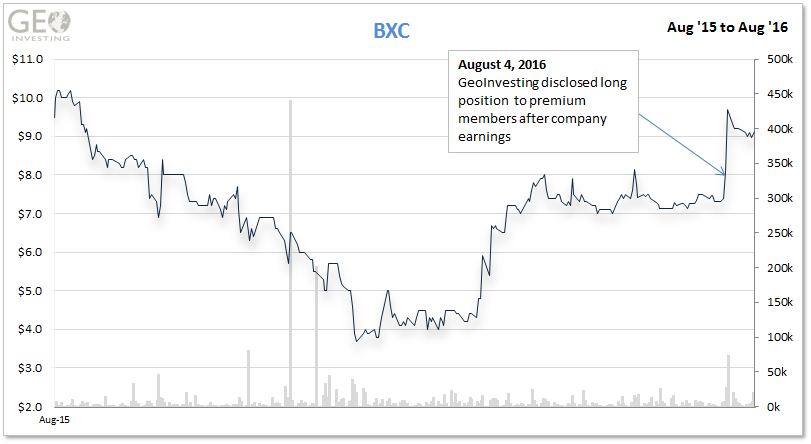

We soon issued a couple alerts to Premium Members, one disclosing that we took a position in Bluelinx.

The stock chart shows that shares are gradually moving higher. We believe that investors are slowly digesting the numbers

Conference Call Arbitrage

BXC’s plan is to sell assets to retire debt and return the company to profitability. I need to get more color on these goals. So, I turned my attention to the company’s Q2 2016 conference call held on the morning of the day of the earnings release. I along with a couple GeoTeam analysts listened to the call live and later studied the transcript. Conference call transcripts are an excellent tool to dig up info not fully discussed in related press releases.

Bullish Hints:

Compared to the press release, the following management commentary more directly addresses the charges/expenses responsible for the Q2 loss. It also infers that the company is poised for further net income growth in the second half of 2016. Additionally, it indicates that our non-GAAP EPS calculation of $0.42 cents ($3.8 million) is light:

“We are very pleased to once again report a good quarter for BlueLinx, while we have a net loss $3.1 million it would have exceeded $4 million of net income without the $7.7 million and charges associated with our facility closures and inventory rationalization.

Although, these charges hurt us in the second quarter, we fully expect our net income to be positively impacted well in excess of these charges in the second half of 2016 as we sell the properties associated with the facility closures.”

The following comments and exchange with an analyst infers that the Q2 performance may not have been an aberration:

“So let’s just discuss the impact on our sales of our facility closures and our product rationalization efforts. These initiatives are key delveering BlueLinx and also now bring us to a new normal. After we annualize these initiatives we anticipate a leaner more capital efficient BlueLinx.”

Analyst

“So, can I assume operational then as this third quarter commences we get a fairly clean look at what the company looks like going forward not assuming any additional improvements operationally but this is your new baseline working off that at least until the next round.”

Mitchell Lewis (Management)

“Yes, I think that’s a fair assumption with again the caveat that we are working every day to operate more efficiently and have some issues to do that, but I think generally from a based on standpoint that will be a good way to look at it.”

Seeking More Clarity

There are a few things about the restructuring I want to gain a better understating of before getting 100% behind BLX. Specifically, I want to know:

- How much capital being raised from selling assets/real-estate will be used to retire debt? Basically, I want to know how much debt will remain on the balance sheet once the restructuring is complete. That way I can prepare a pro-forma income statement to calculate net income and EBITDA.

- How much real estate will the company outright sell compared to engaging in leaseback transactions?

- How much EBITDA is the company going to lose relative to interest savings gained from paying down debt from the sale of revenue generating assets?

- Will the company’s margins improve past the debt restructuring efforts?

I need more time to gain a better handle of numbers “1” and “2”. But the conference call transcript offers perspective on number “3” and “4.”

Discussion on Concern 3- EBITDA loss vs. Interest Expense Savings

“We made the decision during the second quarter to close four distribution centers that were generating low returns on invested capital. In addition, we exited our Canadian operation, which was basically a brokerage business with the sales office based in Vancouver.

The closures will have an adverse impact on our revenue and EBITDA as they represented approximately a $130 million in annual revenue and $2 million in annual EBITDA. Our strategy of course is not to reduce EBITDA, we expect to reduce debt in excess of $45 million from these closures or multiple of over 20 times the annual EBITDA we received from the closed facilities.”

So, there is going to be some give and take between loss of EBITDA and interest expense savings as the company sells assets to pay down debt. However, we estimate that the overall impact the eventual sale of assets sold in Q2 to retire around $45 million in debt will be close to neutral to net income.

Management is targeting another $60.0 million in debt reduction by the end of q1 2017. We would like to get a better understanding of the reduction in EBITDA vs. interest expense trade off moving forward.

“We anticipate negotiating long-term leases that will enable us to remain in this facilities and continue to serve our local markets. We expect that through the outlined sale of the properties and which we no longer operate and the sale leased that transactions in certain facilities were we will remain and we will pay off more than $60 million of our mortgage balance by the end of the first quarter of 2017 as we further delever our Company.

Discussion on Concern 4 Above – Margins

It looks like the company is doing the right things to focus on products that can drive margins:

“Another strategic activity that took place during the second quarter was our product rationalization efforts. Our teams identified at the local level, our performing products, either on a product category level or by individual SKU.

Our decision to enable our local management and their teams to determine which product to exit, is consistent with our philosophy that our business is predicated on our customers preferences and their individual agents. This preferences are truly local and highly desperate across the country.

This product rationalization resulted in the elimination of SKUs that were not core to our local business. We recovered approximately $21 million from underperforming inventories during this process and 85% recovery rate both of which exceeded our expectations.”

Caveat

There is an aspect to the story that I don’t love. While I do like that the company is playing in an industry that is still in recovery mode, margins will always be thin. This could limit expansion of valuation multiples. But a key to making money in the initial phase of company turnarounds is not all about the raw margin number. It is more about where margins can go. We can take a look at valuation multiples of another publicly traded company, Huttig Building products, (HBP:NASDAQ). HBP is humming after successfully implementing a multi-year restructuring.

INSERT HBP STOCK CHRT

Margin Comparison DELETE TWO EMPTY COLUMNS HEADERS

| Symbol | EV/Adjusted EBITDA (run-rate) | Gross Margin | Adjusted EBITDA Margin | ||

| HBP | 5 | 6 | 0.3 | 21.3% | 5.8% |

| BXC | 10 | 5 | 0.2 | 11.3% | 2.5% |

So, BXC looks to be in the early innings of a margin expansion cycle. Although I believe HBP targets the higher margin home remodeling market more aggressively than BXC. The bullish case for a “reversion to mean” argument gains support by looking pre-tax margins. Pre-tax margins between 2001 and 2006, when BXC was profitable, ranged between 1.2% to 2.2%. This compares to 2016 non-GAAP Q3 of 0.6%. I actually interviewed HBP a few weeks ago. Interestingly, BXC restructuring moves mirror HBP’s.

Conclusion

The short-term “trade” is the BXC information arbitrage opportunity as investors begin to look at the company’s potential earning power past GAAP earnings. But there may be a case for longer term optimism.

It appears that Bluelinx is reaching an inflection point in its restructuring plan. I am not certain that BXC will reach the level of profitability in Q3 2016 that it did in Q2. There are unknowns regarding how fast it sells the assets shuttered in Q2 that will lead to a reduction in EBITDA. However, I think Q2 numbers could be an achievable baseline within the next 6 to 9 months as assets and real estate divestitures accelerate and further operational inefficiencies are achieved. Once the company solidifies its balance sheet, management can turn its attention toward driving revenue growth.

Overall everything is moving in the right direction for BXC:

- Debt is coming down

- The company is collecting cash faster

- Core margins are improving

- Company employees are getting more in touch with customers

- Focusing on higher margin products

I would not be surprised if Bluelinx becomes a takeover target in a competitive market that is in consolidation mode. I will be taking a look at the take-over angle in coming weeks.

Get Daily Doses of Information Arbitrage

Information arbitrage is our focus on a daily basis at GeoInvesting. Our members get access to our information arbitrage ideas daily, as they occur, both in their email and on our exclusive portal webpage for members only. If you have questions about joining or would like to become a member, contact me directly at maj@geoinvesting.com or visit www.geoinvesting.com.