GeoInvesting Premium Members Received this Note on July 5, 2016 – to join our community, click here.

With the recent run up in BSPM shares, we wanted to perform some due diligence of our own to try and confirm the market’s euphoria or potentially stop it in its tracks.

Over the last month, BSPM has risen from about $1.19 per share to today’s price around $4.30 per share, a gain of about 260%.

BSPM develops, manufactures, and markets over-the-counter (OTC) and prescription pharmaceutical products for various diseases and conditions in the People’ s Republic of China. The company principally offers Xin Ao Xing Oleanolic Acid capsule, an OTC medicine for chronic hepatitis B. Its product line also includes 12 other OTC products and 17 prescription-based pharmaceuticals.

We decided to employ our team of in house investigators to make stops at the company’s two Chinese subsidiaries and we wanted to share our findings with our members. As a reminder, we brought this up for the first time on June 15, 2016 in our morning e-mail to members when we stated:

It is unclear what caused the spike in shares, although we believe it could be related to optimism surrounding the Company’s ability to renew its GMP certificates for its Aoxing Pharmaceutical Products facility, its main revenue driver. While conducting our due diligence on Biostar, we noticed some troubling language in the company’s recently filed Form 10-Q from May 23, 2016 which was also present in the Company’s 10-K.

To summarize, one of the Company’s bank accounts has been frozen due to violation of debt covenants as the Company seeks to resolve the issues related to the loss of its GMP certificate for Aoxing. The loss of the GMP certificate has prevented the Company from generating any revenues from its Aoxing Pharmaceutical line. BSPM has been targeting a second quarter 2016 resolution of the issues necessary to regain its certifications. We caution that if the Company is unable to regain its GMP certificate for Aoxing that the stock price could implode.

You can read our full June 15, 2016 note here.

Here are our findings after visiting the company’s two subsidiaries, Shaanxi Weinan and Aoxing Pharmaceuticals.

Shaanxi Weinan

We visited Shaanxi Weinan on June 20-22, 2016 and confirmed that Shaanxi Weinan was currently manufacturing product. At this facility, there were around 150-180 employees without a substantial head count increase over the last 12 months. The manufacturing activities didn’t seem overtly busy and there is reportedly no substantial overtime assignment for workers at this facility.

While Shaanxi Weinan only contributed about $400K to the company’s $6.9 million in total revenue in Q1 2015, its $801K contribution in Q1 2016 represents 100% of the company’s total revenue. This means Shaanxi Weinan is the sole revenue center of the company for the time being and that it has produced almost double the sales that it did in Q1 2015.

We were unable to confirm an obvious manufacturing or employment ramp up to correspond with this increase in revenue.

During our investigation, we also noticed that Shaanxi Weinan was on several government warning lists (different provincial State Food and Drug Administrations) for the quality of the products they’ve produced.

We do not want people to think that we are endorsing this company due to this segment’s doubling of revenue. This segment’s revenue is for all intents and purposes immaterial and a bullish investment thesis at this valuation would rely heavily on the company’s Aoxing subsidiary receiving its GMP license.

Aoxing Pharmaceuticals

We visited Aoxing Pharmaceuticals on June 23-25, 2016 and confirmed that Aoxing did not have on-site manufacturing activities. Aoxing is the larger of the two subsidiaries and contributed more than 80% of the company’s total revenue in Q1 2015 when the company had its GMP license. We were, however, able to find office workers and administrative personnel on site.

On the Ground Diligence Confirms Potential Undisclosed Legal Issues

We noticed during the course of our investigation that there are legal judgement(s) against the company that it has yet to fulfill its payment obligation on. We don’t know the details of the judgment(s), but if we are able to obtain further information via our investigators or the company’s filings, we will note it in future research to our members.

The company’s 10-K and 10-Q fail to disclosure any individual lawsuits under “Legal Proce edings” or “Contingent Liabilities”.

During the course of our investigation, however, we did find lawsuits against the company.

On March 29, 2016, Xianyang City Intermediate People’s Court issued a verdict to freeze RMB 10M and/or Shaanxi Weinan’s equity interest equal to RMB 10M based upon the lawsuit between Xi’an Lantai Phama Co., Ltd. and Aoxing Pharmaceuticals. This case means that Xi’an Lantai sued Aoxing Phama for RMB 10M on or before March 29, 2016. In the 10-K dated on April 14, 2016, BSPM did not appear to disclose this pending lawsuit.

Many investors won’t take the time to go through the company’s 10-Q or 10-K to seek out hidden language about potential liabilities, but w hile conducting our due diligence on Biostar, we noticed some troubling language in the company’s recently filed Form 10-Q from May 23, 2016 which was also present in the Company’s 10-K.

To summarize, one of the Company’s bank accounts has been frozen due to violation of debt covenants as the Company seeks to resolve the issues related to the loss of its GMP certificate for Aoxing. The loss of the GMP certificate has prevented the Company from generating any revenues from its Aoxing Pharmaceutical line.

We had experienced a substantial decrease in sales volume of all Aoxing Pharmaceutical Products due to the temporarily suspension of production to conduct maintenance of its production lines to renew its GMP certificates by the second quarter in 2016. While our production levels of Shaanxi Weinan products helped to offset the substantial decrease in our sales volume in the most recent fiscal quarter, our sales volume continued to remain at the present decreased levels. There is no assurance that the production lines at Aoxing will resume and the renewal of GMP certificates will occur when anticipated, or even if they are renewed, we will be able to return to the production levels as anticipated. Our inability to regain our production levels as anticipated may have material adverse effects on our business, operations and financial performance, and the Company may become insolvent. In addition, the Company already violated its financial covenants included in its short-term bank loans as discussed in Note 5 “Short-term Bank Loans”.

These filings also detail executive bank accounts being frozen and loans made that appear to have used the company for collateral.

During 2015, as a result of outstanding personal debts of the Chief Executive Officer, Mr. Ronghua Wang, one of the Company’s bank accounts was frozen, the Company’s properties were transferred, and the Company’s land use rights and buildings were at the risk of being seized and auctioned. As of May 9, 2016, Mr. Ronghua Wang had partially repaid the outstanding balance of the loan, thus avoiding the Company’s land use rights and buildings being seized and auctioned with proceeds used to settle this debt. Mr. Ronghua Wang intends to repay the Company in full for the loss. The Company has disclosed the above legal proceedings related to the Company to the best of its knowledge. There is no assurance that Mr. Ronghua Wang will be able to repay his personal debts in full before his creditors take any other further legal action. There is also no assurance that there will be no other cases that would put the Company’s properties at risk.

The factors discussed above raise substantial doubt as to our ability to continue as a going concern. Based on our current plans for the next twelve months, we anticipate that the sales of the Company’s pharmaceutical products in Shaanxi Weinan after having recently gained renewal of its GMP certificates, will be the primary organic source of funds for future operating activities in 2016. The Company will also make substantial efforts to collect outstanding accounts and other receivables to meet its debt obligations; we may also try to procure bank borrowing, if available, as well as capital raises through public or private offerings. There is no assurance that we will find such funding on acceptable terms, if at all. The accompanying consolidated financial statements do not include any adjustments that might result from these uncertainties.

While it’s unclear if the company has disclosed the details surrounding these loans in the past, we wanted to point out the verbiage in the 10-K may hold more risk than investors anticipate.

Conclusion

We can’t help but conclude that the company is short of cash to fulfill its obligations, based on the unpaid judgement we were able to ascertain. Although we can’t comment on whether or not the company is going to get its GMP license, we saw little to no signal on-site that Aoxing will get its GMP license at the end of second quarter as it mentioned (the second quarter is now officially over). Even if Aoxing obtained its GMP license, the company may still need to raise money to restart its manufacturing activities.

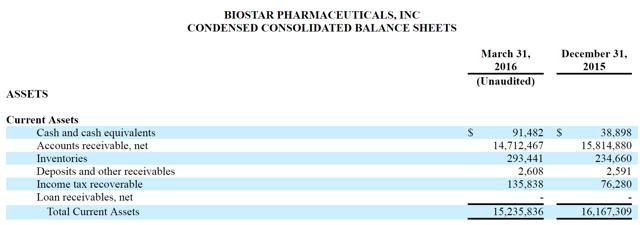

According to the company’s latest balance sheet, it has just $91,482 in cash, despite having $14.7 million in receivables.

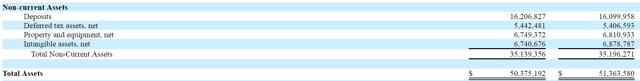

There are also $16M in “non-current” assets listed on the company’s balance sheet, which according to the 10-K include a “deposit paid for intended acquisition of a health product material supplier” and a “deposit paid for intended acquisition of a health product manufacturer”.

We question the quality of these assets which help contribute to the company’s absurd $19/share book value.

Even though Shaanxi Weinan is still manufacturing, we cannot confirm its revenue growth from 2015 Q1 to 2016 Q1 due to lack of increased headcount or activity.

Our initial conclusions lead us to believe that Shaanxi Weinan’s production activity may not support BSPM’s total market cap and business operations on its own.

BSPM is no doubt risky either way. We believe in the interest of protecting investors that regulators should take a closer look at the nature of BSPM’s legal proceedings and methods with which they them. We have no position in BSPM and we remind our readers that the company has a small float and can be volatile.