Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

While the majority of our microcap research is generated in-house, we believe in the power of research collaboration and the strength of our GeoInvesting contributor community that’s been cultivated over the last 16 years. Our success is not just measured by the performance of the stocks we research and wear on our sleeves, but by the dedicated authors who selflessly pitch their own ideas, enriching our collective investment knowledge.

By the way, although Jeremy Diller is not on the list of authors we will be highlighting, we need to give him a special accolade on his bullish call on NTG Clarity Networks Inc. (OTC:NYWKF) (NCI.V). Jeremy actually reached out to me in October 2023 to pitch the idea to me. I unfortunately passed on the Idea and the stock is now up 167%. You can read their Q1 2024 earnings report that was just released today, here.

Before we dive into our appreciation of the returns of some outstanding contributions, we did want to address the unleashing of the potential energy that one of our favorites, Tss Inc (OOTC:TSSI), has been storing since it was added to our Select Coverage Universe.

Now that the cat is out of the bag, investors have widely noticed the message TSSI has been telegraphing in parallel with the data center boom that appears to be here to stay. While we liked TSSI for multiple reasons, the company’s harnessing of the low-hanging-fruit opportunities right in front of them is still a story that is unfolding, but nonetheless has produced a 633% return from it’s low of $0.27 in February to its closing price of $1.98 a few days ago.

We understand that the stock is hard to value, but are by no means surprised by the run, especially given the very sharp, yet subtle, messaging that management has delivered to showcase TSSI’s capabilities and its place in Data Center infrastructure buildout trends, possibly alongside Dell Technologies Inc. (NYSE:DELL) and its AI Data Center “partner,” Nvidia Corporation (NASDAQ:NVDA).

Pivoting back to our contributors, we wanted to use this week to briefly tip our hats to the talented individuals who provided insights into companies that have shown some impressive returns this year.

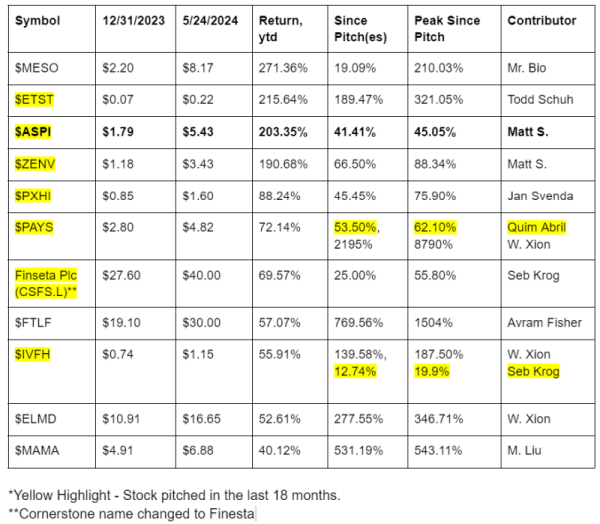

Here’s just a sample of some of the year to date returns from stocks in our Contributor Index:

As you can see, three stocks are up over 200% this year, with one of them being a very recent addition that was pitched during GeoInvesting’s April 3, 2024 live Open Forum, ASPI.

Maj visited the subject of Asp Isotopes Inc. with contributor Matt S., who discussed the company’s niche technology in isotope separation, vital for both the medical and energy sectors. He explained that the company’s unique method for producing high-purity isotopes has applications ranging from cancer treatment to nuclear energy, positioning it in a market with limited competition and significant growth potential. Even though ASPI is a speculative story, we found Matt’s summarization of the opportunity to be interesting.

(And by the way, Matt‘s other pitch, Zenvia Inc. (NASDAQ:ZENV), has also done well, but he just reached out to us to let us know he exited the position and may look to reenter at some point).

ASPI’s initial products, Carbon-14 and Molybdenum-100, have specialist uses, and the company’s marketing strategy and upcoming catalysts make it a stock to watch. One major catalyst is the planned spin-out of Quantum Leap Energy, which will focus on uranium HALEU enrichment, a critical component for Small Modular Reactors (SMRs) in the US and UK. This spin-out is expected to be financed through customer funding and project debt, with Iceland as a potential location due to its cheap energy supply.

At the time of Matt’s pitch, insiders owned over half the shares and the stock had a market cap just under $200 million (now, it’s $280 million). Matt believes that ASPI also has the potential to be included in the Russell 2000 index if its price continues to outperform. Matt contended that this inclusion, coupled with increasing interest from uranium-focused investors, positions ASPI for significant re-rating.

We are immensely proud of our community, and we want to continue fostering an environment where great ideas thrive. To all our authors, thank you for your unwavering commitment and outstanding contributions. Keep the ideas coming – your next pitch could be the game-changer we’re all looking for!

We have some exciting ideas on how to ensure that contributor pitches will be best of breed pitches. We will let you know how that progress goes.

Together, let’s continue to uncover the hidden gems.

The remainder of this post is only visible to paid subscribers of GeoInvesting

—