It’s not often that evidence gathered in one of our investigations into a company that is not a classic pump and dump or U.S. listed China Based company would lead the GeoTeam to conclude that the subject company’s shares could ultimately become essentially worthless. We believe, however, that the risks facing Aegerion Pharmaceuticals (AEGR) are of such gravity that we’re considering that possibility. AEGR is a one-drug company that sells JUXTAPID, a drug that can only be prescribed under the strict and very limited guidelines imposed by the FDA.

Company Background

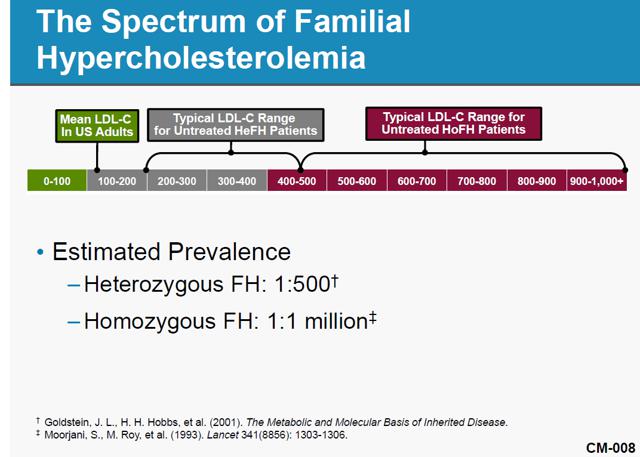

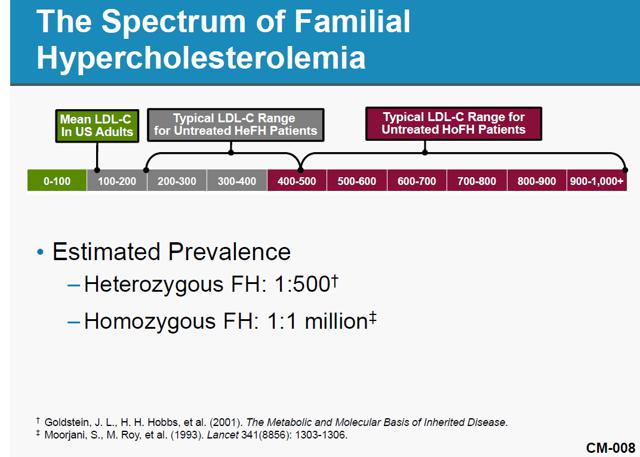

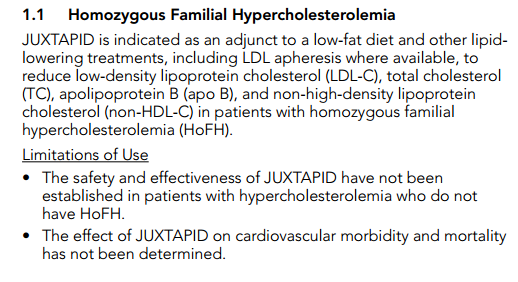

Aegerion Pharmaceuticals, a one-drug company, received approval for and began selling JUXTAPID (aka, lomitapide) in December 2012. JUXTAPID is an LDL-cholesterol-reducing treatment for patients with Homozygous Familial Hypercholesterolemia (“HoFH”). HoFH is an extremely rare (widely believed prevalence of one-in-a-million population) genetic lipid disorder usually caused by defects in the low-density lipoprotein, or LDL, receptor genes, inherited from both parents. Simply put, HoFH is a condition in which normal mechanisms for clearing cholesterol from the body don’t work, leading to fatty deposits under the skin and a high risk of heart attacks. JUXTAPID is an effective drug in the treatment of HoFH. However, patients taking the drug face possible serious side effects that can lead to a buildup of fat in the liver, a condition that may cause liver damage and possibly death. Given the risks inherent in the use of JUXTAPID, the FDA has approved the drug for adult HoFH patients only.

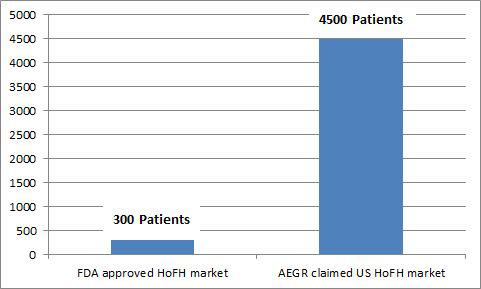

AEGR Is Facing a Buzzsaw

JUXTAPID’s addressable market has been questioned in a number of articles over the last few months1. After receiving approval, AEGR’s management changed their tune and claims that the addressable market in the US is 4,500 patients and over 15,000 globally. Previously, during the approval process, AEGR told the FDA the addressable market for JUXTAPID was of one-in-a-million people or approximately 300 patients in the US. In fact, the small addressable market factored in the FDA’s decision. Additionally, two recent European studies have found that the addressable market is between 5 and 12.5 times less than that claimed by AEGR. There is little question management has tried to redefine the HoFH patient and reach a far broader population than the JUXTAPID boxed label allows. While previous articles on AEGR focus on debating the merits of the market size we think the market size debate is much more telling. We suspect that management uses the higher population estimate that inappropriate includes off-label prescriptions.

Regulators have taken note of AEGR’s actions and in November 2013, the FDA issued a warning letter to AEGR concerning public statements made by the Company’s CEO, Marc Beer, claiming a broad array of off-label uses for the drug. On the heels of the FDA’s action, the US Department of Justice launched an investigation into AEGR’s marketing practices and materials. What has not been thoroughly discussed is that this was soon followed by anti-corruption investigations by the Brazilian authorities into AEGR’s selling practices.

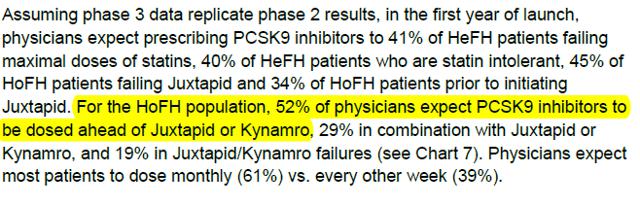

We provide fresh evidence in this report that shows AEGR’s management is not only promoting a far greater addressable market than allowed but the company is in fact marketing JUXTAPID off-label. We do not think the market will ignore this reality now that the FDA and DOJ have brought the issue center stage. Even if AEGR escapes regulatory censure, shareholders will likely find that AEGR’s avenues to a larger addressable market will have been cut off by the EU requiring genetic testing where possible, insurance companies taking a tough stance on reimbursing non-HoFH patients and intense competition from safer cheaper drugs. In fact, on the competitive front, a BAML analysts’ survey found that 52% of physicians expect PCSK9 inhibitors to be prescribed ahead of JUXTAPID and the other current available treatment, Kynamro, to address HoFH patients. The regulatory and financial consequences of AEGR’s off-label product claims and marketing practice could be devastating to the company and its shareholders. Perhaps as a display of their own concerns, in the past year, managers who are the most informed about the business and its prospects sold shares as their options were exercised, with some holding no stock at all. In fact officers and directors as a whole only own around 7% of the stock.

The Main Threats To AEGR’s Survival Are:

- Management appears to have been reckless in its promotion of JUXTAPID, at times disregarding patient safety as per an FDA warning letter we have included in this report. Additionally, note that Marc Beer recently stated that they market to the 3,000 patients, which by definition would have to be mainly to non-HoFH patients.

- The FDA showed serious concerns over off-label use of JUXTAPID during the approval process. With criticism from the FDA detailed in its warning letter and ongoing DOJ and Brazilian investigations any censure could severely limit or even stop off-label sales.

- EU label requires genetic testing wherever possible which would stop all off-label prescriptions in Europe.

- Insurance companies are refusing to reimburse the annual cost ($235,000 to $295,000) of the drug for non-HoFH patients and very few patients could afford it themselves or even cover co-insurance.

- Physicians will likely prescribe lomitapide to fewer off-label patients due to regulatory scrutiny and potential malpractice suits.

- Significantly cheaper competitive drugs with less severe side-effects are expected to be on market in 2016. We believe the new drugs will usurp AEGR’s entire off-label (non-HoFH) market and take at least part of its on-label market.

- Genzyme, with much greater resources than AEGR, continues to invest in expanding Kynamro, a drug that currently competes directly with JUXTAPID. Additionally, Isis, Kynamor’s developer, has managed to reduce the painful injection site reactions which were keeping some patients away.

- AEGR’s on-label market is suffering from higher dropout rates for patients that begin and later stop therapy and newly disclosed non-starters being patients prescribed the drug but do not begin therapy.

- The US patent on JUXTAPID ends in 2015, although AEGR has applied for an additional five year extension but this remains a risk.

Brief Overview:

We will discuss what we see as a cavalier attitude analysts and AEGR’s management have regarding the restrictions placed on the drug’s usage as both admit that JUXTAPID is being prescribed off-label. In fact, AEGR acknowledges that this dangerous drug, intended for a very small fraction adult population, is being prescribed off-label to adolescents.

Apparently, analysts are failing to consider very probable scenarios where AEGR will not be able to sell off-label, whether due to the DOJ’s investigation, EU restrictions, insurance reimbursement constraints or safer and cheaper competition. But herein lies the problem; AEGR readily admits needs to market JUXTAPID to a broader population than currently permitted by the FDA to achieve and maintain profitability. Once analysts are forced to face the facts, probably due to FDA and/or DOJ actions, AEGR’s business prospects and therefore price targets for its shares will have to be sharply reduced. Sure, we get it. Marketing drugs off-label is a common practice, but this is a very different scenario. While a larger pharmaceutical company may survive past regulatory fines and sanctions, AEGR is a one-drug company so it’s do or die.

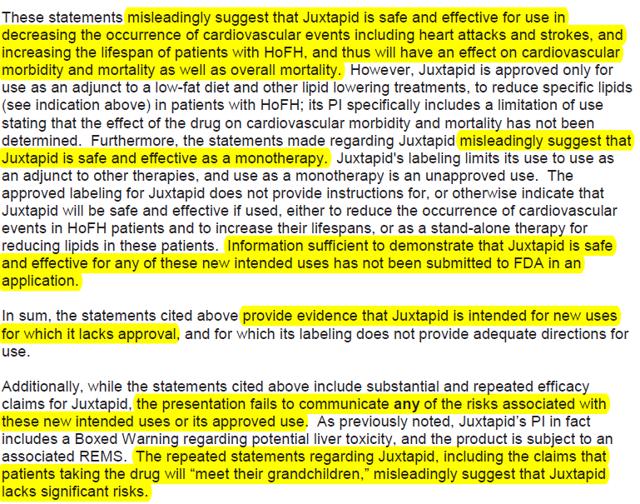

Furthermore, we will show that the FDA from the beginning made it clear during JUXTAPID’s approval process that they were very concerned that the drug would be prescribed off-label. We will also show revealing excerpts from the FDA letter which include several statements regarding how marketing material “misleadingly suggest that JUXTAPID lacks significant risks” and that the drug is being marketed “for new uses for which it lacks approval.”

We are forced to ask ourselves; is management choosing to accept the risks of fines and sanctions for the sake of reaching as broad a population as possible before their business becomes terminal?

Valuation: Lose-Lose Proposition

Based on the current stock price, the market is estimating that AEGR would treat 1,800 patients per annum worldwide2. We believe that by 2016, AEGR will, at a maximum, treat 500 patients worldwide per annum, a 72% revenue downside from current estimates. In a worst case scenario regulatory sanctions could imperil the drug and, therefore AEGR, ultimately in our opinion making insolvency a very likely scenario.

If Management Won’t Hold AEGR Shares, Why Should We?

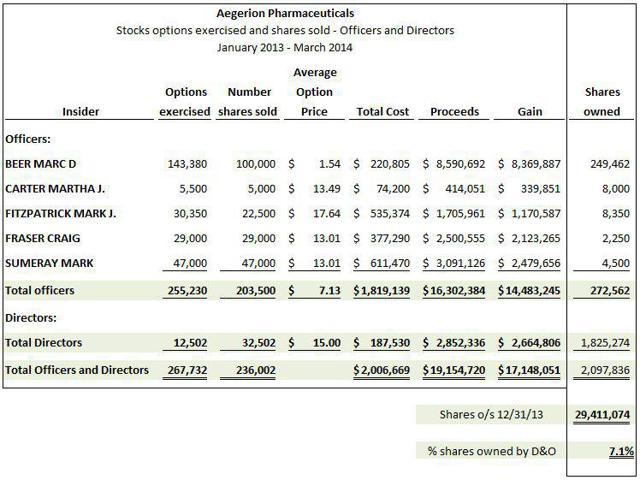

AEGR’s managers, at least based on their share transaction histories, also seem to have concerns about the company’s future. Shortly after its IPO debut on October 25, 2010, management owned around 52% of the stock. It’s now over a year since AEGR received approved from the FDA to market JUXTAPID. One would think that with sales of the drug about to “take off “management would be adding to their positions. Instead, they now only own around 7% of the company. In a telling move, the company’s managers have been selling shares as soon as their options are exercised. In the past year managers who are the most informed about the business and its prospects sold shares, generating gross proceeds in excess of $16 million including $8.6 million to CEO, Marc Beer.

Consider the following managers that recently exercised options and immediately sold their shares:

- Marc Beer, CEO. A display of leadership. Enough said.

- Mark Sumeray, Chief Science Officer, is in the unique position of truly understanding the HoFH market from the medical perspective. He should know better than anyone else in AEGR whether the HoFH market is as large as they represent to investors, yet he sells all of his shares as stock options vest. If he truly believed AEGR’s story regarding the expanded HoFH market then wouldn’t he be holding his shares?

- Craig Fraser, President of US and International Supply, heads and monitors the launch of the JUXTAPID in the US and international markets. Again, he knows more than any other person about the patients being added to the drug program and yet he also sells all of the stock he has been issued. It does not appear as though he puts much stake in the AEGR story either.

The following chart summarizes stock options exercised and shares sold and shares currently owned by officers and directors during the period January 2013 – March 2014:

Supporting Evidence

AEGR’S Depends On Off-Label Prescriptions To Be Profitable

While the prevalence of HoFH can be debatable, there is no question it is extremely low. The population of HoFH patients and addressable market really do matter for AEGR and its investors. The company discloses in its 2013 10-K that if they can only sell to qualified HoFH patients then they will find it difficult to achieve or maintain profitability. It is therefore not a surprise that AEGR has been promoting its own internal estimates of addressable HoFH market size to investors. The following chart graphically displays the estimated number of HoFH patients AEGR presented to the FDA and other estimates presented to investors:

HoFH is traditionally believed to affect one person in a million, as AEGR presented to the FDA during the approval process. Two recent European studies have been published that indicate that the HoFH market is potentially slightly larger than previously thought but even those results do not yield data that support AEGR’s market size estimates, with the highest being about 17.6% of AEGR’s estimate.

AGER also believes as per presentation

A German study sponsored by AEGR found that there were 95 HoFH cases in Germany. That implies HoFH affects one person in every 860,000 people3 and therefore supports the consensus view of approximately one person in every million. If we apply the German ratio to the US market the number of addressable cases in the US would increase from 313 to 360 cases. It’s important to remember that the German estimate does not distinguish between adult and pediatric populations so the portion of the population AEGR can actually address would be less. In any event, the true addressable population is far less than AEGR’s estimated US adult and pediatric estimation of over 4,500 HoFH patients.

A second study being promoted by AEGR was published in the European Heart Journal (“EHJ study”) in December 20134. Unlike the German study, this article did not survey the actual number of HoFH patients but instead applied the assumption that since Familial Hypercholesterolemia (“FH”) patients are under-diagnosed then it is likely that HoFH patients are as well. Traditionally, FH was expected to affect one person in every 500. However, the study indicates that it could potentially affect one person in every 200, a 2.5x increase. Applying these findings to HoFH would mean the HoFH could affect one in every 400,000. That ratio, when applied to the US population, would indicate the maximum potential HoFH population to be only approximately 790 people. Note that this study included the total population regardless of age.

None of three views (FDA, German, and EHJ) are anywhere near the 4,500 addressable patients in the US, including pediatrics, that AEGR promotes to investors. The EHJ study which estimated the highest prevalence of HoFH is still just 17.6% of AEGR’s estimate. No matter how you massage the data to get the most favorable results, it is simply not possible to come up with a credible estimate of individuals with HoFH that matches AEGR’s assumptions.

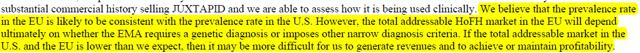

AEGR openly admits that if the market is smaller than they have led investors to believe then they will struggle to be profitable:

“If the total addressable market in the U.S. and the EU and other key markets are smaller than we expect, then it may be more difficult for us to generate revenues and to achieve or maintain profitability5.

The lack of approval to market JUXTAPID for the pediatric HoFH population will limit our product revenue potential, and may make it more difficult for us to achieve or maintain profitability.6“

AEGR Promotes JUXTAPID Story With Estimates Of A Far Greater Population Of Hofh Patients Than The Data Supports

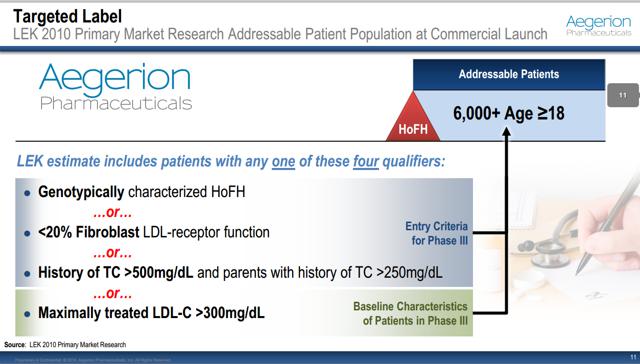

Some investors might think AEGR is a bargain at current prices. After all, the stock traded at around $100 last November and is now around half that price (52 week range: $36.63 – $101). Shares have fallen recently amid several articles that questioned AEGR’s estimates of the size of the addressable market for JUXTAPID, its only drug. The conventional wisdom and the estimate used by AEGR management during the drug’s FDA approval process is that the prevalence of HoFH is one person in a million (approximately 300 US adult patients). Yet, post FDA approval management has been promoting its own internal estimate of the number of US adults with HoFH to investors that is 10X this size. The greater market size estimate is based on a much broader application of the drug than approved by the FDA. Astonishingly, even during a recent investor presentation, AEGR management defined the addressable market using criteria that was far broader than approved by the FDA.

AEGR’s management has been incorrectly claiming that there are at least 3,000 HoFH patients in the US over the age of 187,8 based on a report from LEK Consulting (“LEK”). More recently, they have commented that there is an additional 1,000 to 1,500 HoFH pediatric patients9. Note that in 2011 management was estimating a much higher pediatric HoFH population of 2,100 to 3,000 (between 75% and 100% of the adult HoFH population size)10.

LEK is a management consulting firm headquartered in Boston11. As per AEGR’s registration documents, LEK estimates that there are 3,000 cases in the USA which is in sharp contrast to the one in a million ratio AEGR presented to the FDA in order to facilitate approval of JUXTAPID. The following is from the IPO prospectus:

“In a report that we commissioned, L.E.K. Consulting LLC, or LEK, an international business consulting firm, estimates that, subject to, among other things, product pricing and access, there is a total addressable HoFH population in each of the United States and, collectively, Germany, the United Kingdom, France, Italy and Spain, which are referred to in this prospectus as the European Union Five, of approximately 3,000 patients, or a combined total of approximately 6,000 patients12.”

They changed their tune in the 2011 10-K, where the risk factors now say that LEK’s 3,000 patient estimate includes non-HoFH patients which are not approved patients for the drug by the FDA:

“This consultant’s estimates, however, included a segment of severe HeFH patients whose levels of LDL-C are not controlled by current therapies. These patients may be phenotypically indistinct from HoFH patients. JUXTAPID is indicated solely for HoFH. Our prescribing information in the U.S. specifies that the safety and effectiveness of JUXTAPID have not been established in patients with hypercholesterolemia who do not have HoFH. We are not permitted to promote JUXTAPID for any indication other than HoFH. In addition, as part of the prescriber authorization form under our REMS program in the U.S., the prescriber must affirm that the patient has a clinical or laboratory diagnosis consistent with HoFH.”13

At the 5th Annual Canaccord Genuity Cardiovascular, Diabetes & Obesity Conference and Corporate Presentation in March 201114,15 AEGR finally presented the criteria that LEK used in estimating the population size.

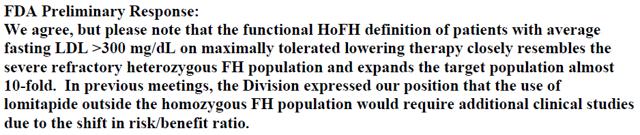

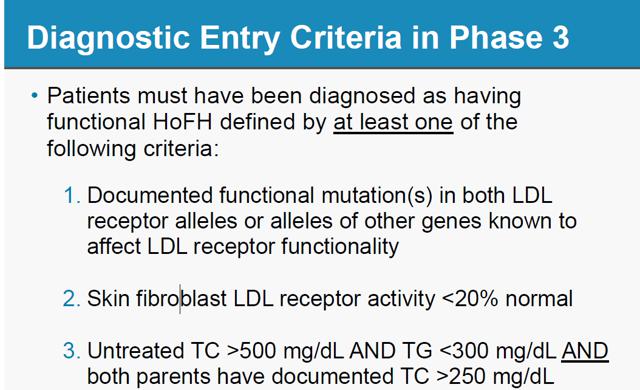

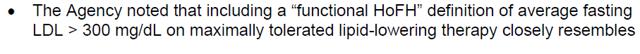

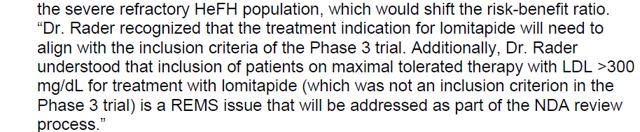

Notice this includes “Maximally treated LDL-C >300mg/dL”. The exact same criterion was rejected by the FDA as it would include severe HeFH patients. This totally shifts the risk/benefit ratio and would require additional clinical studies16 so the FDA is perfectly clear that these patients are not approved for JUXTAPID:

AEGR appears to disguise the rejection in the notes to the financial statements. Instead they put the best possible spin on the situation by stating that the FDA ‘may‘ require a narrow diagnosis of HoFH and some of the patients with the company’s definition of HoFH ‘may ultimately‘ not be part of the HoFH population. We surmise that AEGR is trying to spin the FDA’s position as somewhat flexible or subject to interpretation.

“Finally, any final labeling may be approved with limitations. For example, the FDA has stated that a phenotypic HoFH definition of patients with average fasting LDL-C greater than 300 mg/dL on maximally tolerated lipid lowering therapy closely resembles the severe refractory heterozygous familial hypercholesterolemia, or HeFH, population. The FDA or other regulatory authorities may require a narrow diagnosis criteria for HoFH which may reduce the addressable population. As a result, some of the patients who meet the phenotypic definition of HoFH may ultimately be considered to be outside the HoFH population, reducing the estimated addressable patients, and it may be more difficult for us to achieve or maintain profitability.” 17

Contrary to what management tells investors, AEGR openly presents to the FDA that HoFH is indeed a one in a million disease, a far cry from the 3,000 adult HoFH patients in the USA that they have been continuously promoting to its investors. We understand why management would not want to emphasize that AEGR is a one drug company addressing a one in a million market. Below is a slide from AEGR’s presentation to the FDA during the approval hearings18. The material in this presentation is in contrast to the prospectus.

AEGR presented the correct definition of HoFH in their presentation to the FDA during the approval process.19 There does not appear to be any disagreement as to what HoFH is here:

FDA Rejected AEGR’s Attempts To Broaden Authorized Uses For JUXTAPID

AEGR did ask the FDA to expand the criteria to include fasting LDL > 300mg/dL but the FDA refused since that this would shift the risk: benefit ratio and would require further trials. Even Dr Daniel Rader, the inventor of the drug, recognized that the criteria should be kept the same as the trial.20

AEGR has not initiated the clinical trials that are required to broaden the patient population that the drug can be marketed to. They, like us, may conclude the trials would be a waste of time and money given that there are a number of additionally competitors expected to enter the market in 2016 with drugs that address both the HeFH and HoFH markets. For example, Amgen (AMGN) will be release Evolocumab, which has not exhibited any safety risks21 to date and is significantly cheaper than JUXTAPID, costing just $10-15k per annum22 compared to JUXTAPID’s price of $295k per annum. These drugs are expected to compete with JUXTAPID in at least a third of its addressable HoFH23 market.

Regulatory Risks Associated With Off-Label Marketing

JUXTAPID can only be prescribed under the strict and very limited guidelines imposed by the FDA. There is strong evidence that suggests AEGR is marketing the drug to patients outside the scope of its approval.

Management certainly has strong motivation to market its only drug off-label. Indeed the very survival of AEGR probably depends on management’s ability either get approval to address a broader market or they have to sell off-label, opening the company to fines, sanctions and even withdrawal of the drug from the market.

Investors should note that the FDA has already rejected AEGR’s attempts to broaden the authorized uses for JUXTAPID. The FDA issued a warning letter concerning management’s public statements concerning lomitapide and the US Department of Justice launched an investigation into AEGR’s marketing materials and practices. What investors might not know, however, is that more recently Brazilian government authorities began their own investigation of AEGR’s sales practices to determine whether its employees violated anti-corruption laws.

Perhaps most disturbing of all is that AEGR’s CEO Marc Beer recently stated that they are marketing to 3,000 HoFH patients…

“We see the patients in this market — there’s 3,000 patients that we believe are out there that we’re marketing to — this HoFH patient — very severe patient — and the response from the physicians to therapy has been positive”.24

… which, based on the findings we have already presented, include off-label patients, an action that the DOJ and Brazilian government authorities are looking into.

As mentioned, marketing drugs off-label may to some extent be common practice, but this is a very different scenario. As we discuss in more detail later in this report, the FDA made it clear during the approval process that they were very concerned that the drug would be prescribed off-label.

The FDA Takes Action Against Loose Talking CEO

The FDA imposed very specific label restrictions on the use of JUXTAPID for good reasons and is well aware of the likelihood that AEGR would be motivated to market lomitapide off-label. Accordingly, the agency monitors selling and promotional activities to ensure compliance. Despite the scrutiny AEGR’s marketing of the drug is under, statements by Marc Beer indicate a cavalier attitude that is likely reflected in the company’s broader sales and marketing activities. The FDA noted this behavior and acted. In November 2013, it issued a warning letter demanding the company’s management stop making inappropriate claims regarding potential off-label uses for the drug. Investors enthused by management’s claims should be mindful that at the end of the day, it’s the FDA, not AEGR that decides how the drug can be used and therefore its addressable market. The following excerpt from the FDA’s warning letter best describes AEGR’s out of bounds promotion of lomitapide:

DOJ And Brazilian Government Authorities Launch Investigations Of Selling And Marketing Practices While Law Firms Line Up With Class Action Lawsuits

On the heels of the FDA’s warning, AEGR now faces a US Department of Justice (“DOJ”) investigation into its marketing materials and practices. The DOJ investigation will burden the company with extensive legal, time and other costs as they comply with requests for information. Adding to the company’s woes is that it was disclosed in its Form 10-K filing that Brazilian authorities are investigating whether AEGR’s employees have violated anti-corruption laws selling lomitapide. Add to that a growing list of class action lawsuits against the company and its officers. All this indicates that AEGR’s promotional and marketing issues appear to be systematic, not just one-off slipups by a couple of its managers. Frankly, we are amazed that the stock is still trading at an over $1.5 billion market valuation despite what are far more than just boilerplate risk factors facing the company.

Investors who believe that debating the size of the potential HoFH market is nitpicking and that the only real risk AEGR faces from the FDA and DOJ is just a fine and slap-on-the-wrist should consider what management’s claims really imply. They are allowing the use of a very dangerous drug off-label. That drug can possibly cause permanent liver damage and even death.

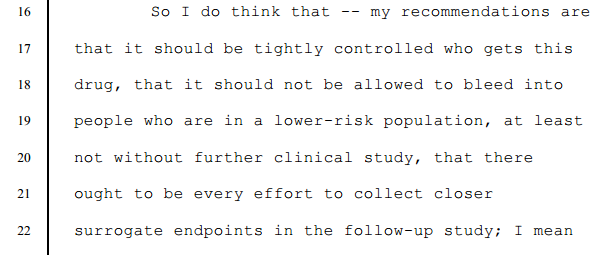

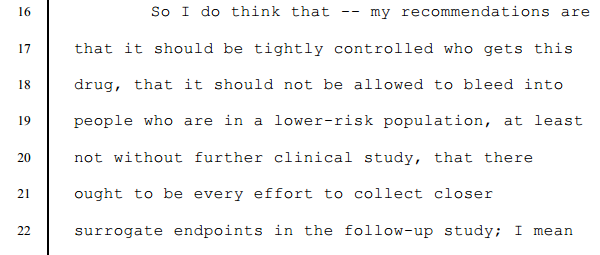

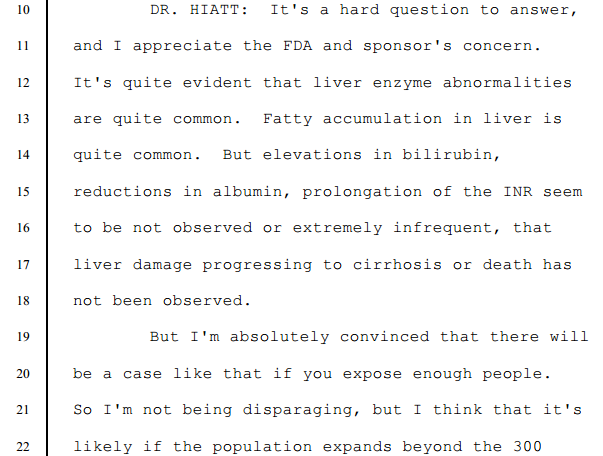

Comments by FDA panel members concerning the issue of off-label marketing during the drug approval process, some included in this report (seven paragraphs), were very specific and, by the management’s public statements and marketing practices, seem clearly justified. Following is one of the quotes we found from an FDA voting committee member:

Source: Food And Drug Administration Center For Drug Evaluation And Research Endocrinologic And Metabolic Drugs Advisory Committee, Wednesday, October 17, 2012

Any one or all of the FDA, DOJ and Brazilian actions could result in material fines and sanctions, increased vigilance to stop off-label sales or even forced withdrawal of the drug from the market. One likely impact of all of this is that previously misinformed doctors now aware of the controversies and legal implications will be less likely to prescribe JUXTAPID knowing that many alternative drugs are right around the corner. Additionally, the few insurance companies that did not already reject off-label prescriptions are likely to now tighten up reimbursement controls.

Readers should be aware that the issues facing AEGR are not just due to overly enthusiastic statements about the market potential for lomitapide. There is growing evidence that the company, in an effort to reach a broader than allowed market, has been tacitly allowing and even encouraging the prescription of JUXTAPID off-label. Management has publicly admitted as much. During the Q IV 2013 conference call with investors Marc Beer acknowledged the drug that can cause liver damage and even death has been prescribed off-label to pediatric patients, including children!

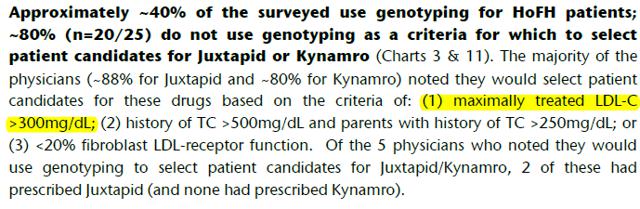

“Now, a physician can sign the attestation that we do not have any clinical development on pediatric, but they have to sign that and tell us that they’re well aware and they’re educated that we do not have clinical development on pediatric patients. Because of acting that way as an organization from a marketing and medical affairs standpoint, obviously, we have very few pediatric patients. So the vast majority of our patients are adult.“

In other words, management is aware that the drug is being prescribed off-label and they allow it to happen despite the zero tolerance for exceptions the FDA imposed when approving the drug intended only for HoFH adults. It only takes one incidence of serious harm to a patient or death to cause irreparable harm to the JUXTAPID brand and AEGR’s reputation.

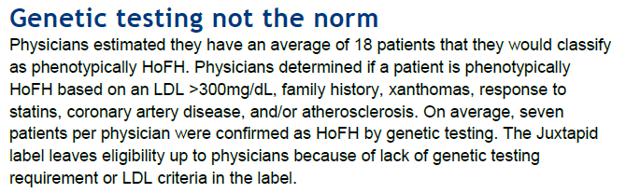

Analysts’ reports also indicate that AEGR has been notified that doctors are prescribing the drug outside of the FDA criteria. Recent BAML and Jeffries surveys have found that physicians are prescribing the drug to patients diagnosed under wider criteria, maximally treated LDL-C>300mg/dL that the FDA rejected25,26.

In our opinion, even if AEGR escapes with a fine and minor sanctions, the company’s hopes to hold onto market share seem slim. There are a number of competitive drugs in the pipeline, some in late stages that could hit the market as early as 2015, that have broader addressable markets and lower risk profiles and costs than lomitapide. Potential competitors include behemoth companies like Amgen, Regeneron Pharmaceuticals, Inc. (REGN) and Pfizer (PFE). Those companies have been targeting the PCSK9 gene that controls the number of LDL receptors on cells responsible for removing LDL from the bloodstream.

FDA Very Concerned About Off-Label Use Because Of Dangerous Side-Effects

The FDA was well aware of the risk that AEGR would seek to market JUXTAPID to a wider population of patients than those diagnosed with HoFH. After all, there is certainly strong economic incentive to sell more prescriptions of a drug that commands an annual price tag of $235,000 to $295,000. The concerns of the committee are clearly expressed in the quotes below:

Dr Thomas – Acting Chairperson – Division Head, Endocrinology, Diabetes, Bone, and Mineral Disorders, Henry Ford Hospital, Whitehouse Chair of Endocrinology, Detroit, Michigan27

Dr Gardner – Voting Committee Member – Professor Emeritus, Department of Pharmacy, University of Washington28

Dr Conjeevarm – Voting Committee Member – Associate Professor, Division of Gastroenterology and Hepatology, University of Michigan29

Dr Gordon – Voting Committee Member – Special Assistant for Clinical Studies, Cardiovascular Clinical Trials, Division of Cardiovascular Sciences, National Heart, Lung, and Blood Institute, NIH30

Dr Hiatt – Voting Committee Member – Professor of Medicine, Division of Cardiology, University of Colorado School of Medicine, President, Colorado Prevention Center (“CPC”), Clinical Research, Aurora, Colorado31

Given the concerns expressed by the committee, it is abundantly clear that the FDA does not want JUXTAPID prescribed outside HoFH adult population that they know is extremely small and generally estimated to be around 300 to 400 individuals in the US. The risk of liver damage is just too great.

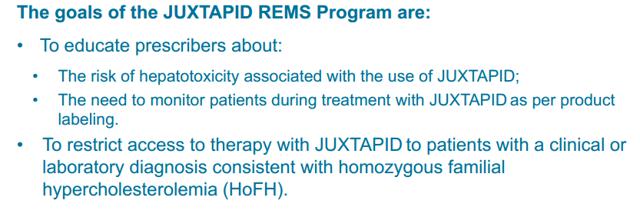

The Usage Label And REMS Program Designed To Restrict Access To The Drug

Based on the FDA’s comments above, strict guidelines have been imposed on the use of JUXTAPID because of the risk of hepatic toxicity (i.e. liver damage). Accordingly, the FDA mandated that the drug can only be prescribed by doctors that have signed up to the Approved Risk Evaluation and Mitigation Strategies (REMS) program in order to avoid off-label prescriptions. The REMS programs were created for circumstances where the FDA has serious patient safety concerns for an approved drug and wish to manage these risks to patients32. Due to the severity of HoFH and the current lack of alternative drugs to address it, the FDA decided that, for this extremely small group, the choice of liver damage versus a heart attack meant the drug should be approved. That approval, however, was very guarded and use of the drug is highly restricted. Following are the indications and usage label33 for JUXTAPID.

As a further safeguard, the REMS Program is intended to restrict access to the drug.34

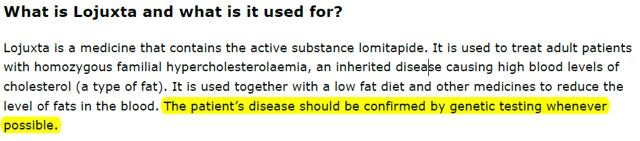

EU Approval Severely Limits Off-Label Use

The EU approval requires genetic testing wherever possible so they are unlikely to access many more patients than those from the one person in one million estimate. This requirement will no doubt reduce AEGR’s international revenue and profit projections.35 See below:

Prior to receiving this approval requiring the genetic testing wherever possible, AEGR had highlighted the possible risk of this EU requirement posed on its abilities to achieve or maintain profitability.36

Additionally, the EU did not grant AEGR’s drug orphan status and this could make it much more difficult for AEGR to gain reimbursement approvals.

“As noted above, LOJUXTA was not granted orphan drug status by the EMA and it may not be eligible for such automatic exemptions or waivers. Therefore, we may not be able to provide all of the data required to obtain pricing/reimbursement approvals in certain EU Member States, which could result in delays of pricing/reimbursement approvals for LOJUXTA, LOJUXTA not obtaining pricing/reimbursement approval at all, or LOJUXTA obtaining approvals at less than acceptable levels or with significant restrictions on use or reimbursement“.37

This is also coupled with spending constraints in EU counties which would make the cheaper apheresis the more desired treatment:

“The widespread use and availability of apheresis as a treatment for HoFH in the EU, combined with the lower cost of apheresis as compared to LOJUXTA, may make it more difficult for us to obtain commercially acceptable pricing and reimbursement approvals for lomitapide in the key markets of the EU and, even where commercially acceptable approvals are obtained, may limit the use of LOJUXTA as a treatment for HoFH patients.38“

AEGR has claimed that there are 3,000 potential patients in the EU. We believe the genetic test requirement where possible will stop off-label prescriptions, limiting the on-label market to the low hundreds. Additionally, due to monetary tightening, we expect that EU countries will seek the cheapest form of treatment and once the cheaper competitors are approved, AEGR’s EU market could be de minimis.

Prescribing Physicians Required To Use Legally Available Drugs And Be Well Informed About Intended Uses

Prescribing physicians are required to use legally available drugs and be well informed about their intended uses. The following is from the FDA’s website:

“Off-Label” and Investigational Use of Marketed Drugs, Biologics, and Medical Devices – Information Sheet

Guidance for Institutional Review Boards and Clinical Investigators:

Good medical practice and the best interests of the patient require that physicians use legally available drugs, biologics and devices according to their best knowledge and judgment. If physicians use a product for an indication not in the approved labeling, they have the responsibility to be well informed about the product, to base its use on firm scientific rationale and on sound medical evidence, and to maintain records of the product’s use and effects.”

Doctors Face Malpractice Liability As JUXTAPID Is Being Prescribed Off-Label – Including To Children

Analyst reports indicate AEGR has been notified that doctors are prescribing the drug outside of the FDA criteria. At the Canaccord conference management said they had 463 prescriptions outstanding with the majority in the US. If that’s true, alarm bells should be going off that doctors are prescribing off-label since the number of prescriptions exceeds the entire addressable market in the US. Simply put, to reach 463 patients AEGR would have had to reach every known HoFH patient in the US and then some. And, that wouldn’t account for the fact that competing product, Kynamro, would have surely been prescribed to some patients.

“And at the time of our second-earnings second quarter earnings call, we demonstrated that we are off to a good, strong launch; and in fact, the global prescriptions year to date at that point in time are 463 scripts globally, the majority of these in the United States. And while that’s also very encouraging and a great start to the script production, I will also note that it’s important to not assume that every one of these prescriptions is going to ultimately result in a patient on therapy39.”

BAML and Jeffries surveys have found that physicians are prescribing the drug to patients diagnosed under wider criteria, maximally treated LDL-C>300mg/dL that the FDA rejected40,41:

Of particular note is that AEGR is finding it harder to get patients from lipidologists, the specialists in the field being targeted, than from cardiologists who appear to be less cautious in prescribing the drug. This supports our view that the drug is being overprescribed as doctors writing these prescriptions either don’t understand or do not know the limitations placed on the drug’s use by the FDA. It is likely that AEGR marketing programs and tactics are strong contributing factors to JUXTAPID’s being over-prescribed.

Question – Robyn Karnauskas: And as a follow-up, are lipidologists not wanting to use the drug? And when you go to Europe when you are developing trackers in Europe, are you focused the tracker more on the cardiologists versus lipidologists?

Answer – Marc Beer: So I would not say that lipidologists are not willing to put them on the drug. We get a lot of patients that come in from the lipidologists. I will say that they have fewer patients in their practice. They tend to study the patient longer and it takes them longer to put somebody on therapy because I think that they are trying a lot of different products at the same time.

The cardiologists not that case. The cardiologists tell us that we are seeing 35 patients today, we are very busy, we’ve got to get the patient out of harm’s way quickly. We can’t make every patient a study and they tend to put the patient on therapy quicker than a lipidologist. But both are treating effectively and we are getting good support. When I look at it city by city, we look very carefully at the KOLs. We’ve got good support KOL by KOL.

CEO Marc Beer’s additionally confesses he knows JUXTAPID is going to non-HoFH patients:

“It also looked a little bit broader, and it showed that if physicians do try to take this into the severe HE population, that there’s somewhere between 4,000 and 5,000 patients that could fall into that category in their mind; now, again, yet to be determined how they’re going to – what percentage of that patient population they’re going to use it in, but there’s a severe HE population out there that some physicians are going to try to use this product in, and we’ll try to support their efforts of getting it reimbursed, but not marketing to it.42“

It gets even worse, Marc Beer states that the drug is being prescribed to children as per the Q IV 2013 conference call transcript below:43

With increased regulatory scrutiny and the fear of potential malpractice suits, doctors are likely to prescribe less JUXTAPID to non-HoFH patients, especially children who could be severely affected by the liver toxicity. It makes us wonder what AEGR is telling the cardiologists, who lack the same expertise as the lipidologists in this matter.

Not Your Garden Variety Risk Factors

AEGR’s recently filed Form 10-K for the year ended December 31, 2013, includes disclosures and risk factors that should alarm investors. The disclosures regarding challenges from the FDA, DOJ and Brazilian authorities are not just boiler plate risk factors used as a means to cover management should the worst case risks become reality. In AEGR’s case there really are wolves at the door that could ultimately torpedo JUXTAPID and even bring the company down.

FDA Has Teeth And Its Actions Could Imperil AEGR

In late 2013, AEGR received a warning letter from the FDA alleging that certain statements about JUXTAPID made by the company’s CEO during two broadcast interviews on the CNBC television show, Fast Money, promoted a claim that JUXTAPID has an effect on cardiovascular morbidity and mortality and that JUXTAPID is effective as a monotherapy. These would be considered as unapproved uses.

The FDA’s warning letter should not be taken lightly.

“Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject a company to administrative or judicial sanctions. These sanctions could include, among other things, the FDA’s refusal to approve pending applications, withdrawal of an approval, imposition of a clinical hold, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, civil money penalties, fines, refusals of government contracts, debarment, restitution, disgorgement, or civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.”

DOJ’s Investigation Of AEGR’s Marketing Practices Damage AEGR’s Image And JUXTAPID Brand

In late 2013 AEGR received a subpoena from the U.S. Department of Justice, represented by the U.S. Attorney’s Office in Boston, Massachusetts, requesting documents and other information pertaining to the promotion, marketing, and sale of JUXTAPID in connection with a government investigation of the company’s practices.

“While we intend to vigorously defend ourselves, we may not be able to resolve this matter without incurring significant fines, sanctions, or other consequences that could have a material adverse effect on our business, financial condition, or results of operations. Even if we can resolve this matter without incurring significant penalties, responding to the subpoena has been, and is expected to continue to be, costly and time-consuming. Moreover, this investigation could adversely impact our reputation and the willingness of physicians to prescribe lomitapide for their HoFH patients, and may divert management’s attention and resources, which could have a material adverse effect on our business, financial condition, or results of operations.”

Government Authorities In Brazil Investigate Whether AEGR Employees Violate Anti-Corruption Laws With Prescriptions Of Lomitapide

Questions about AEGR’s business practices are not restricted to the US. Apparently, the same business practices that have the company in hot water and under scrutiny of the FDA and DOJ also apply internationally.

“Our activities outside the U.S. or those of our employees, licensees, distributors, manufacturers, CROs, or other third parties who act on our behalf or with whom we do business could subject us to investigation or prosecution under such foreign or U.S. laws. We are aware, for example, that governmental authorities in São Paulo, Brazil are conducting an investigation to determine whether two of our employees have violated anti-corruption laws in connection with prescriptions of lomitapide written in Brazil. …… If our activities in Brazil or in any other country outside the U.S. are found as part of this or any other investigation to be in violation of any laws or any other governmental regulations that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, and fines. In addition with respect to the investigation in Brazil, we may experience a reluctance of physicians to prescribe JUXTAPID, or a delay or suspension in the government’s ordering process, while the investigation is ongoing, or if our activities are found to have violated applicable laws. These and other risks of international business relationships may materially adversely affect our ability to attain or sustain profitable operations.”

The trifecta of the FDA warning and the DOJ and Brazilian investigations of AEGR’s business practices could be damaging to the JUXTAPID brand. Investors should be mindful that these issues surfaced in late 2013 and early 2014 so they did not materially affect Q IV 2013 operating results. Q I 2014 and beyond are an entirely different matter.

Insurance Companies Are Not Going To Play Ball

Even if AEGR gets past the FDA, we don’t expect insurers to easily pay up to $295,000 a year. In the past, insurance companies have successfully defended suits against them over not reimbursing off-label patients. We have identified 36 insurance policies that give some disclosure regarding coverage of JUXTAPID. Here is a quote from the 2013 10-K that highlights this boilerplate risk that is becoming a reality:

“Our ability to meet expectations with respect to sales of lomitapide and revenues from such sales, and to attain profitability and positive cash flow from operations, in the time periods we anticipate, or at all, will depend on a number of factors, including the following:

the willingness of insurance companies, managed care organizations, other private payers, and government entities that provide reimbursement for medical costs in the U.S., the EU, Mexico and Canada and in other countries in which we may have or may receive approval to market lomitapide, to provide reimbursement for lomitapide at the prices at which we offer lomitapide without requiring genotyping or imposing any additional major hurdles to access;”

As set out below, 11 of the 36 insurance reimbursement documents we found did not have any details regarding their criteria for authorization for the drug. Based on the results we found from the remaining insurance documents, only one was a positive for AEGR selling to both on and off-label markets. The remaining 96% of the plans demonstrate just how precarious AEGR’s position really is and how difficult it will be for them to monetize not just the off-label market but also its on-label market. Investors should also be aware, that once the PCSK9 drugs are released in 2016 the insurance companies may take an even harder stand against AEGR’s JUXTAPID.

Of the 25 insurance remaining plans, we found the following:

- Four plans, 16%, did not cover JUXTAPID

- Five plans, 20%, will only allow JUXTAPID if the patient has tried and is intolerant to Kynamro, its main competitor.

- Nine, 36%, of the insurance companies require strict compliance with the FDA’s HoFH definition and as such would not reimburse doctors prescribing off-label.

- Five plans, 20%, JUXTAPID was listed as a non-preferred brand which means that since there is likely to be an alternative preferred brand a copayment is required. Given the cost of JUXTAPID we would be surprised if patients could afford the drug under these plans.

- One plan, 4%, covered JUXTAPID but required coinsurance since it is a non-preferred brands.

- One plan, 4%, preferred JUXTAPID over Kynamro.

Additionally, with all nine of the plans that disclosed pre-authorization criteria requiring the strict adherence to FDA criteria, we believe that is likely that many of the plans that did not disclose the criteria for reimbursement would also require on-label use of the drug. Therefore, even if the FDA and DOJ were not there to strictly enforce the FDA criteria, the insurance companies will be the de facto enforcers by simply not paying. The following chart details our findings:

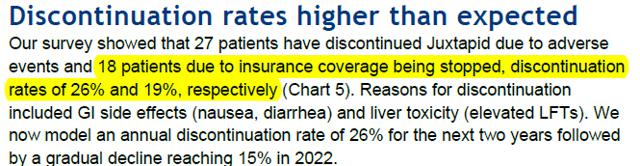

Our belief that insurance companies will not reimburse for the use of JUXTAPID carte blanche is supported by the BAML survey44 which found that 18% of patients who had been prescribed the drug had to drop out due to a lack of insurance coverage.

As much as AEGR would like to get around the FDA’s highly restrictive criteria, the insurance companies will not. At nearly $300,000 per year as a lifetime commitment there is simply too much money at stake. AEGR may be able to help some patients get reimbursements for drugs prescribed off-label but it is unlikely that they can achieve this for all of them.

Competition Will Potentially Usurp The Entire Off-Label Market And Part Of The On-Label Market

Competition is intensifying with larger and better financed competitors that have either developed or are developing drugs are likely to erode AEGR’s on-label and potential off-label market. These drugs are cheaper and some are significantly safer, based on current trials, with the PCSK9 inhibitors being the most attractive on both counts.

AEGR has found itself in a very unusual position for a manufacturer of an orphan drug because there is another drug Kynamro, produced by Sanofi Genzyme, that also has orphan status and is targeting the same HoFH population. Both drugs are specifically designed for a population that is estimated to be just 300 cases in the US. There are advantages and disadvantages to both drugs although, possibly due to price ($176k vs. $295k)45, we have found that a number of insurance companies will only reimburse the use of JUXTAPID if the patient can’t tolerate Kynamro (RegenceRx, GHP Family, Boston Medical Centre and KyHealth).

Analysts have argued that patients would prefer JUXTAPID over Kynamro because they would rather not have an injection which has caused painful reactions at the place injected. Kynamro’s developers have recently announced that they have identified why reactions were caused and have remedied the problem, which could lead to patients returning to use Kynamro46. Additionally, analysts have not considered that the difficult and laborious aphaeresis process, still recommended to be used where possible with JUXTAPID, is not recommended with Kynamro47. Further, these drugs are a lifelong commitment and JUXTAPID requires sustenance of a more difficult diet regimen, with less than 20% of energy coming from fat48. JUXTAPID patients have also suffered from serious stomach issues49 which may make a lifelong commitment to the drug more difficult to sustain and less assured. Kynamro is also expected to gain market share as Genzyme continues to invest substantially in the Kynamro opportunity50, with resources that AEGR do not have at their disposal.

With continued investment, insurance preference and improved patient experience, we expect that Kynamro will take a significantly larger market share than analysts assume, challenging AEGR’s ability to hold market share.

More worrying is development of PCSK9 inhibitors by a number of large pharmaceutical companies including Amgen, a partnership between Regeneron and Sanofi, Roche Holding AG, Pfizer and Alnylam in collaboration with The Medicines Company (MDCO). These drugs are targeted at treating hyperlipidemia, of which FH is one type. It is expected that these drugs will be most effective for HeFH patients but are also having a positive effect on some HoFH patients. Once these drugs enter the market, expected to be around 2016, they will threaten both AEGR’s on and off-label markets since the drugs are substantially more affordable and, based on trials to date, significantly safer.

Amgen, for example, is developing a PCSK9 inhibitor, AMG-145/Evolocumab, which is expected to be released in 201651. The drug was not expected to be effective in treating HoFH patients. However, Amgen has recently announced positive results in a Phase 3 trial on patients with HoFH52. Based on earlier results the drug has been just as effective on some HoFH patients (three out of the eight patients trialed)53.

With an annual cost of AMG-145 being $10-15k54 and no severe side-effects (FDA had raised a general concern of neurocognitive issues with other lipid-lowering therapies but Amgen has not seen any signs for this in its trials so far55), we expect that this will be the drug of choice for patients and insurance companies wherever possible and is likely to have a dramatic impact in reducing AEGR’s off-label market and take some market share of the its on-label market. The BAML analysts’ survey found that 52% of physicians expect PCSK9 inhibitors to be prescribed ahead of JUXTAPID and Kynamro – and that is just in the HoFH space56. Based on price and safety, it is likely to be the drug of choice wherever it is just as effective as JUXTAPID or Kynamro.

AEGR has already found that HoFH patients have already been signed up for trials for these anti-PCSK9 drugs that could gain approval by 2015.

“Some HoFH patients who might otherwise be candidates for treatment with lomitapide are committed to, or candidates for, clinical studies of anti-PCSK9 antibodies or may be prescribed an anti-PCSK9 antibody once approved. Based upon the status of Phase 3 clinical programs, we believe one or more PCSK-9 products could receive approval as early as 2015. This may make it more difficult for us to generate revenues and achieve profitability.”57

There are other potential non-PCSK9 inhibitor competitors for the HoFH market including Anacetrapib, developed by Merck Sharp & Dohme Corp (MRK), which is a fully enrolled Phase III study expected to be completed in June 201458. There are few commercial details regarding the Merck-sponsored drug but nevertheless it is potentially more competition in a minute niche market. Even if AEGR manages to have their drugs prescribed to non-HoFH patients and somehow get them reimbursed they will still be faced with significantly cheaper and safer competitors with fewer and less severe side effects which will be favored by both patients and insurance companies. All of these factors are likely to dramatically reduce AEGR’s off-label market and have a significant impact on its on-label HoFH market as well.

On-Label Market Is Suffering From Increasing Discontinuation Rates And A Meaningful Number Of Non-Starters

At the end of Q II 2013, 463 patients were reported to be in therapy. At the end of Q IV, that number declined to 430. That’s not exactly robust growth for JUXTAPID. The flat to declining patient count probably reflects a greater dropout rate than anticipated. Currently, 15% (vs. 10% earlier estimate) of patients drop out after starting treatment. Dropouts typically occur during the first month or two of the commencement of treatment. Management is confident they have enough data to assume the dropout rate will hold steady at 15% going forward. We doubt that is the case. What’s unknown is how patients tolerate treatments and the strict diet regimen over time; most active patients only began treatment within the last six month. We don’t know how many patients are currently using the drug or for how long. Also, we don’t think it is plausible that insurance companies will pay the annual cost for the drug ($235,000 to $290,000) over time particularly with less expensive alternatives from competitors on the horizon. Additionally, the BAML survey found that 26% of patients dropped out due to adverse events, not to mention the additional 18% drop out rate due to coverage issues which were discussed earlier.

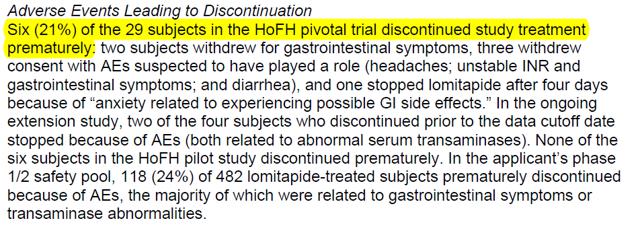

The clinical trials also had a higher dropout rate, 21%, due to side effects59, as per the company’s disclosure to the FDA below:

As per the QIV 2014 results, AEGR found that patient-elected non-starts are more “meaningful” than assumed. A greater number of patients than expected who were prescribed, including some with insurance preauthorization, elected not to start treatment. This issue surfaced in the second half of the year, when patients were first being brought onboard and AEGR started reporting revenues. Management put a brave face on this issue by stating that with more information/education, patients will sign up in the future.

Increasing discontinuation and patient non-starts are affecting AEGR’s small on-label market, so it’s not looking good for AEGR and JUXTAPID no matter how you look at it.

Patent Expires In 2015

The US patent will expire in February 2015. However, AEGR has applied for an additional five-year patent term extension under the Hatch Waxman law60. We do not know whether AEGR will receive the extension, which remains a major risk.

What Investors Don’t Know Can Hurt Them

One of the red flags we noted during the Q IV 2013 investors conference call was a statement by CEO, Marc Beer, that management’s goal is to provide top line revenue results but not the lomitapide prescription and patient metrics needed to understand the top line. The following quote is from a transcript of the conference call:

“As you know, our goal has been to move away from providing detailed lomitapide prescriptions and patient metrics and shift focus to our top line revenue guidance, with revenue results serving as the best barometer of our business. We do understand though, however, that the investor desire to have more visibility into the business. So I do not plan to go back necessarily to the detailed metrics that we laid out in the first half of ’13, nor do I plan on revisiting metrics for each of our quarterly calls this year.”

Mr. Beer is basically saying that he understands investors’ desires to have more visibility into the business, but he’s not going to give it? Further, he is not going to discuss previously disclosed metrics and guidance. We are baffled that investors and, for that matter, the SEC would accept such a brazen attitude regarding the disclosure of data essential for investors to have visibility into a business. After all, the data regarding prescription and patient metrics are readily available so why not disclose it? At a minimum, investors should be able to track the number of patients taking lomitapide, how long they have been on the drug, the number of patients who began therapy and later dropped out, the number of new prescriptions and how many actually began therapy and how many elected not to start. We can only surmise that disclosing this data is uncomfortable for management because the drug and business are not performing as planned and they do not want to be held accountable for previous statements and guidance. AEGR’s management might be more comfortable not disclosing essential information but we as investors are not.

Conclusion

AEGR is a one drug company. So goes JUXTAPID, so goes the company. The evidence to date is that the drug is floundering in the market. We have not included a valuation analysis in this report because JUXTAPID is an all or nothing proposition for AEGR. As stated earlier, the current market price suggests that AEGR will treat 1,800 patients worldwide. As demonstrated throughout this report, this scenario is highly unlikely since many of these would be off-label prescriptions which face so many independent challenges including, regulatory risk, EU requiring genetic tests, insurance companies only reimbursing on-label, increasing on-label competition and cheaper safer drugs targeting both the on and off-label markets. If AEGR survives one or two they are likely to be hit by the others.

AEGR’s Chief Medical Officer, who should know more about the HoFH market than anyone else, and their US and International and Global Supply President, who should know more about the sales aspect of the market than anyone else, do not retain any stock they receive through options grants and sell immediately as their options are exercised. If they do not believe in the AEGR story, then why do you?

Disclosure: Short AEGR

———————

Footnotes

1 Most notably by Matt Berry – http://www.3footcrowbar.com/

2 Deutsche Bank Comments on Aegerion Pharma (AEGR ) and HOFH PCSK9 Data, March 17, 2014

3 Homozygous familial hypercholesterolemia (HoFH) in Germany: an epidemiological survey

4 Familial hypercholesterolaemia is underdiagnosed and undertreated in the general population: guidance for clinicians to prevent coronary heart disease: Consensus Statement of the European Atherosclerosis Society

7 AEGR Earnings call Q2 2013

8 AEGR Earnings call Q2 2011

9 JPMorgan Healthcare Conference Jan 14, 2014

10 AEGR Earnings call Q2 2011

11 http://en.wikipedia.org/wiki/L.E.K._Consulting

12 AEGR S1/A Sep 17, 2010 p. 2

13 AEGR 2012 10-K p.9

14 AEGR Corporate Presentation, March 2011

15 AEGR 5th Annual Canaccord Genuity Cardiovascular, Diabetes & Obesity Conference, December 2010

1710-Q Q1 2012, p.25

19 Lomitapide For the treatment of homozygous familial hypercholesterolemia: Endocrinologic and Metabolic Drugs Advisory Committee, October 17, 2012, slide 44

20 Endocrinologic and Metabolic Drugs Advisory Committee Meeting October 17, 2012, p.23-24

21 FDA probes cognitive impact of new cholesterol drugs

22 Citi research report dated March 17, 2014

23 Wall Street Gets It Backward On Amgen Cholesterol Drug

24 Aegerion Pharmaceuticals Inc at Cowen Health Care Conference, Boston March 4, 2014

25 BAML AEGR report dated January 7, 2014

26 Jeffries AEGR report dated May 10, 2013

28 FDA Center For Drug Evaluation And Research: Endocrinologic And Metabolic Drugs Advisory Committee, Wednesday, October 17, 2012, p. 360

29 FDA Center For Drug Evaluation And Research: Endocrinologic And Metabolic Drugs Advisory Committee, Wednesday, October 17, 2012, p.361

30 FDA Center For Drug Evaluation And Research: Endocrinologic And Metabolic Drugs Advisory Committee, Wednesday, October 17, 2012, p. 348

31 Food And Drug Administration Center For Drug Evaluation And Research Endocrinologic And Metabolic Drugs Advisory Committee, Wednesday, October 17, 2012, p. 320

33 JUXTAPID Prescribing Information, June 2013

34 JUXTAPID Risk Evaluation and Mitigation Strategy (REMS) Program

35 European public assessment report (EPAR) for Lojuxta

36 AEGR 2012 10-K p.29

37 AEGR 2013 10-K p.29

38 AEGR 2013 10-K p.14

39 Aegerion Pharmaceuticals Inc at Canaccord Genuity Growth Conference – Boston Aug 19, 2013

40 BAML AEGR report dated January 7, 2014

41 Jeffries AEGR report dated May 10, 2013

42 Aegerion Pharmaceuticals Inc at Deutsche Bank dbAccess BioFEST – Boston Mar 21, 2013

43 Q4 2013 Earnings Call

44 BAML report dated January 7, 2014

45 Competitive Headwinds: the Beginning of the Kynamro and Juxtapid Story

46 Isis Pharmaceuticals, Inc at Cowen Annual Health Care Conference, Boston March 4, 2014

47 Kynamro Prescribing Information

50 Isis Pharmaceuticals, Inc at Barclays Global HealthCare Conference, Boston March 14, 2014

51 Ph.III results a boost for Amgen in PCSK9 race

53 Citi Research – Triathlon Day 2: PCSK9 Shakedown: An Analysis of What’s to Come – Room for Multiple Players But Who Will Be King? March 18, 2014 Slide 51

54 Citi research report dated March 17, 2014

55 FDA probes cognitive impact of new cholesterol drugs

56 BAML report dated January 7, 2014

57 AEGR 2013 10-K p.14

58 Clinical Trials – Efficacy and Tolerability of Anacetrapib Added to Ongoing Lipid-Lowering Therapy in Adult Participants With Homozygous Familial Hypercholesterolemia (HoFH) (MK-0859-042)

59 Lomitapide For the treatment of homozygous familial hypercholesterolemia: Endocrinologic and Metabolic Drugs Advisory Committee, October 17, 2012, slide 44, p.12

60 Mark Fitzpatrick – Aegerion Pharmaceuticals Inc at Jefferies London Healthcare Conference, London Nov 25, 2013

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.