Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

For real time analysis of our coverage universe, including new high conviction ideas and additions to our model portfolios, if you are not already a premium subscriber, consider supporting our movement by becoming a premium member today. GeoInvesting, 16 years and counting!

Highlights

|

Important update: We have added a lot of features since founding GeoInvesting 16 years ago. We are in the early phases of updating our premium services page to reflect these feature upgrades that you might be unaware of. You can see that here.

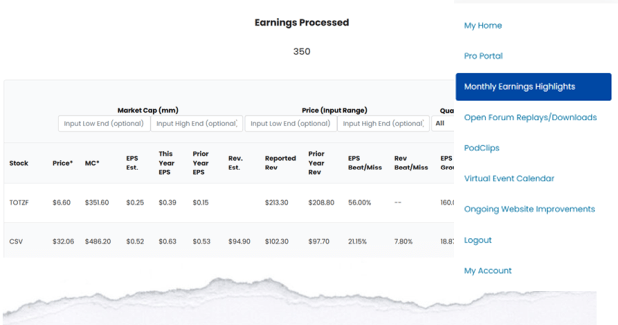

Well, as promised, this past week got heavy with earnings reports. However, next week is when the bulk of microcap earnings reports will come through the wires. In total, we highlighted 38 earnings reports in our morning emails last week, which we archived in a filterable table on our website. You can view this information here by selecting ‘My Home’ and then monthly earnings highlights from the sub menu as shown in the image below:

There are five stocks that we are very interested in following moving forward, but more on that later in this update.

There are five stocks we thought were most interesting (including a new data center company we’ve been watching) – 4 on which we had some additional comments because we think they have multibagger potential.

With a Premium Subscription you can Get Access to Our research on these stocks.

New Investor Insights Skull Session With Breakout Investors Analyst Sam McColgan

Our Skull Sessions are interviews with microcap management teams, investors, and industry experts that provide GeoInvesting subscribers with in-depth insights into microcap companies and investment strategies, be it through casual conversations with investing peers on their investing styles and stock pitches, or with company management, who elaborate on recent developments, and long-term growth prospects. They are designed to give investors a “first mover advantage” by delivering timely and valuable information that can help in identifying potential multibagger opportunities, as well as opportunities for further investment education.

After a bit of a hiatus, we’re excited to get back to hosting more Investor Insights Skull Session events. Why? Alpha Alpha Alpha!

During these events, investors often pitch some of their best microcap to small cap ideas and we are obsessively focusing on quality over quantity with these events. For example, in 2024, we published 10 pitches from our investor network, where some of them were pitches given during Skull Sessions. As of Friday, the cumulative return of all these pitches is 458.75%, for an average of 41.70%. The average high return was 118.31%.

So, we are going to turn on the spigot and start inviting more quality investors to pitch their best small to microcap ideas to Geoinvesting. Combined with the Stocks our own team is publishing, this is going to add a tremendous amount of value to the Geoinvesting community.

On that note, I recently conducted an interview (8/2/2024) with Sam McColgan (@sammccolgan), a young analyst from Breakout Investors’ publication on SubStack, Ahead of the Curve. I really enjoyed this chat, because Sam is starting to cut his teeth as a full time investor, and I really like some of the approaches he applies to investing in microcap.

Sam McColgan’s investment strategy centers around four key principles: Momentum, Monopoly, Margin of Safety, and Management. He looks for stocks with strong price and fundamental momentum, ensuring quicker price realization. He targets companies with a monopoly in their niche or those that are best in class, securing a competitive edge. Sam emphasizes the importance of a margin of safety, focusing on undervalued stocks to minimize downside risk. Finally, he prioritizes investing in companies with high-integrity and competent management teams, believing that strong leadership is crucial for long-term success.

Sam McColgan on His “Four Ms” Investment Strategy

He also discussed his convictions on a few stocks – Vislink Technologies, Inc. (NASDAQ:VISL), Crexendo, Inc. (NASDAQ:CXDO), Creative Realities, Inc. (NASDAQ:CREX), Nexgel, Inc (NASDAQ:NXGL) – which we’ve clipped out for you.

Sam McColgan on Finding Hidden Gems, the Case for Vislink Technologies (VISL)

Sam McColgan on Betting on Crexendo (CXDO), his High-Conviction Investment

Sam McColgan on Why he’s Bullish on Creative Realities (CREX)

Unlocking Potential: Sam McColgan’s Insight on NextGel’s (NXGL) Market Edge

Skull Session Management Briefing With Crexendo (CXDO)

Staying with our NEW goal of hosting timely video events with microcap management teams (as we talked about here preceding our spotlight on California Nanotechnologies Cor (OOTC:CANOF)), on Wednesday morning (pre-market), we hosted a Management Briefing Skull Session with the COO and president of Crexendo, Inc. (NASDAQ:CXDO), Doug Gaylor, to breakdown their strong second quarter results reported after the bell on Tuesday, where sales grew 16% to $14.7 million and adjusted earnings per share grew 75% to $0.07. But the main reason for the meeting was to understand the opportunities that Microsoft’s exit out of the unified communication space might present for the company since that leaves 500 licensees up for grabs, compared to the stated 230 that CXDO has today.

Below is a clip that talks about Crexendo’s opportunity from the Microsoft exit.

(Premium log in required to view)

We also learned that CXDO still has another $1 million dollars in expense reductions, yet to be reflected in its net income, due to the migration of some of its customers on the company’s legacy cloud platform to its new Net Sapiens platform, which it acquired on June 2, 2021. So, it’s impressive that the company has been able to achieve some high EPS growth over the last few quarters, even without the anticipated expense savings (that we thought would be baked into the numbers already) from the migration. That should leave some good upside potential to beat fiscal 2025 analyst estimates currently standing at $0.25 (2024 is $0.24).

Below is a clip where we talk about the anticipated expense reduction of one million from the culmination of the legacy cloud platform migration, which should occur by the first quarter of 2025.

(Premium log in required to view)

Doug also addressed my concerns about the company issuing a shelf, disclosed via a prospectus several weeks back. He was adamant that the company would only use the shelf for a very accretive acquisition that was bigger than the company could consummate with its current cash on hand, which will still allow the company to make some nice tuck in acquisitions.

Open Monthly Forum: July Review

Finally, we also held our usual LIVE Monthly Forum last Tuesday, where we summarized the entire month of developments within GeoInvesting’s Coverage Universe.

Forum Focus Ideas

We revealed our 3 new microcap multibagger Focus Picks of the month. We usually give one new focus pick per month, but since we didn’t convey one in July, I decided to give two bonus picks.

Get all three NEW Multibagger Focus Picks.

One of them, as you probably would have guessed, was Cipher Pharmaceuticals, Inc. (OTC:CPHRF) (TSX:CPH) due to the undervaluation of its shares, when taking into account that sales and earnings will double after its latest acquisition of ParaPRO’s Natroba operations for $89.5 million.

Based on our more granular analysis, we have refined our price target for Cipher’s stock. While our initial projection suggested an over 50% increase, we now estimate that within one year, the stock could reach a price range of $$13.80 to $23.00, based on a P/E range of 15x to $25x . This target assumes no growth and is based on the combined valuation of Cipher and its just completed acquisition. Importantly, this valuation does not yet factor in the potential upside from management’s strategy to Aggressively grow the acquired assets and leverage the competitive advantage of the scabies product, which offers a complete cure and could drive significant global growth. Given the the revenue of the acquired assets of around $20 million relative to the industry size of the scabies market, valued at $225.8 million in 2023, and projected to grow at a CAGR of 5.2% from 2024 to 2030, the growth potential is substantial.

What I liked about this month’s open forum Focus Stock additions is that because we were able to give three stocks, it lent to a good diversity of speculative versus pure value. Two of the stocks we added, including CPHRF, we would describe as classic undervalued GARP, low risk ideas. The other, we would consider more of a speculative idea. We decided it would be nice to throw in a speculative, high growth option, given the overall performance success of the Focus stocks. There are currently six open positions in this model portfolio.

BOP #12 Is Officially Here

With BOP #11 reaching average peak returns of 55.76% and amid a volatile market, we also started our highly anticipated launch of the Buy On Pullback Model Portfolio #12 with three stocks. Due to trepidation in the market over the past few weeks, all three stocks have either fallen on decent earnings reports or have not reacted as bullishly as we thought they should. The current return of BOP #11 is 36.09% as of close on Friday.

The most egregious price drop was a cloud communication company in the Communication Platform as a Service (CPaaS) space, where, by the way, one of Konatel, Inc. (OTCQB:KTEL)’s divisions also competes, as does Twilio Inc. (NYSE:TWLO). Think of CPaaS players as providing software to enhance the functionality of cloud communications services like unified communications and contact center software platforms (Crexendo, Inc. (NASDAQ:CXDO), Altigen Communications, Inc. (OTCQB:ATGN), Ringcentral, Inc. (NYSE:RNG), and 8×8 Inc (NASDAQ:EGHT))..

The stock fell over 40% to $15.78 since it reported Q2 numbers that we thought were pretty decent. Sales rose 19% to $174 million, while EPS rose 81% to $0.29.

Can you imagine owning a stock that grew like that, and where management issued strong guidance… and the stock got destroyed? This market is just ruthless!

The stock Is a perfect example of why we started our Buy On Pullback model portfolio series in 2016 to take advantage of irrational downward stock price activity. We think it will regain the entire post Q2 earnings drop, equating to at least 39% upside.

The company is benefiting hugely from the growth in customer service contact centers that are utilizing new ways to efficiently interact with clients, including AI, as was posited in our last February 23, 2024 Management Briefing with Jerry Fleming, the CEO of Altigen Communications, Inc. (OTCQB:ATGN).

…and with CXDO’s CEO, Doug Gaylor, on January 18, 2024:

Below is the full discussion on BOP #12.

(Premium log in required to view)

~Maj Soueidan

The remainder of this post is only visible to paid subscribers of GeoInvesting.

Please don’t forget to consider supporting GeoInvesting with a premium subscription if you enjoyed this content, and want to see more of it. Complete this short survey to let us know if you’re interested.

200+ Multibaggers and counting