Summary

Summary

- MGT Capital Investments (AMEX:MGT) Is slated to issue 43.8 million shares, currently valued at over $150M, to purchase assets of software companies D-Vasive and Demonsaw. That works out to about 191% dilution to the current share structure.

- As of March 31, 2016, D-Vasive (which actually owns Demonsaw) had a little more than $1,000 in cash in the bank, $5,000 in total assets and less than $10,000 in total revenue

- MGT likely to further ruin its share structure moving forward as need to raise capital continues, even if one is to believe in the $5,000 in assets they’re issuing $150M+ in stock for

- Pump and dump scenarios often attempt to disguise players who are involved in the story or selling stock. The case of MGT appears to be no different.

- Robert Ladd, CEO, appears to have dumped more than 380,000 shares of stock for his family members from May 12th to May 17th, 2016.

Preface

Today we intend on sharing more details of our research into MGT Capital Investments.

Of the most interesting facts we’ve discovered, we’ve found that when John McAfee left McAfee Associates “during his prime” in 1994 (while the company was doing $31M of net revenue), the market value of the company was no greater than MGT’s current valuation with revenue of de minimis. We have to raise skeptical questions like, “What would MGT’s capital structure look like before it even got to a point where it was doing $30M in revenue? $50M in revenue? $100M in revenue?”

Starting with a capital structure like MGT’s, we believe shareholders are faced with a situation where the most optimistic scenario is diluted so much amongst shareholders that it has a very muted effect.

This dilution, to the tune of over $150M in stock, is taking place to acquire companies with assets of less than $10,000, as disclosed in MGT’s recent preliminary proxy.

The divergence between illusion and reality can only hold for so long. Eventually, time will reveal all. MGT is no different. In due time, we believe everything will be revealed … and expectations will meet reality.

The Circus Needs to Stop

It has been approximately 2 months since our first article regarding MGT Capital Investments. At that time, we said that the information in that article was only a small part of our overall due diligence. We will now offer up some more information that we believe is relevant not only to the potential “pump and dump” aspect of this operation, but also to the “valuation” of the stock as the company’s asset purchase closing date approaches.

First, let us backtrack a little and pick up on the potential “pump and dump” theme that was present in our original article. At the time, we were concentrating on the idea that Barry Honig had supplied funding to the company in the form of exercising warrants, that corporate funds were potentially used to hire stock promoters, and that Barry Honig and the company’s CEO could be dumping stock into said promotion. We were wrong. Well, not really. We just didn’t have the complete story.

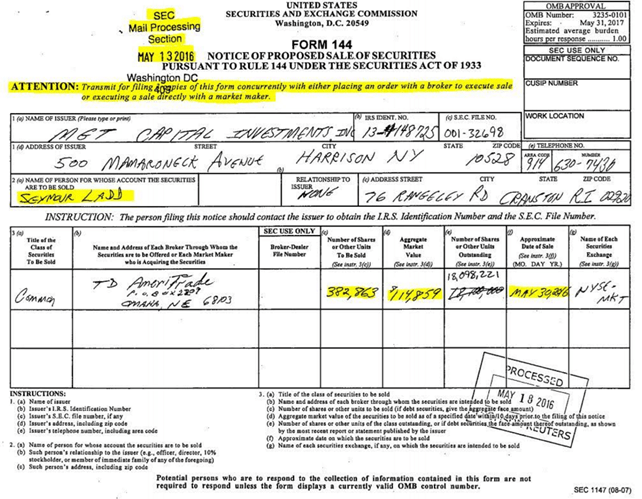

Turns out, MGT’s CEO, Robert Ladd, may have not started out dumping his own stock, but don’t let that make you think he may not be profiting from this MGT promotional campaign. This Form 144 can offer up some clarity:

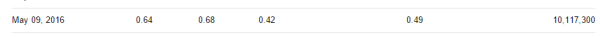

From the following 144 filing, we learn a few things:

1) Robert Ladd is acting as an attorney for someone named who appears to have the last name “Ladd” (appears to say Seymor Ladd).

2) Robert Ladd seems to have prepared this document on May 10th, 2016. With the news of the Asset Purchase Agreement coming on May 9th, 2016, suggesting that Robert Ladd was well-prepared to dump this stock — could this be because he knew that he was paying for a stock promotion that would give him the opportunity to dump stock? Could this be a pre-meditated pump and dump?

3) The person for whom Robert Ladd is executing trades is Seymour Ladd, a gentleman who lives in Cranston, RI. A little digging shows that Seymour Ladd is likely none other than Robert Ladd’s father.

4) Robert Ladd dumped more than 380,000 shares of stock for his family members from May 12th to May 17th, 2016. They would bring in more than $667,000 from the dump.

They say that a picture is worth 1,000 words, so here is a graphic to better explain what happened:

This all came off as suspiciously well-timed on the part of MGT’s CEO, Robert Ladd, who also happens to be a Chartered Financial Analyst. We believe it is safe to say he knew exactly what he was doing.

Perhaps he and the powers that be both did, in fact, know exactly what he was doing, and maybe it is completely kosher for a CEO to approve funds for a stock promoter like StockBeast so that he can potentially liquidate the family holdings at higher prices.

In addition to the SEC, another 3-letter authority might be interested in pulling at some of the strings. The following information is for illustrative purposes only in the sense that investors in MGT should have access to as much information regarding their past and possible future financiers as possible.

It has already been shown in our previous article that roughly 5.7 million shares were printed between April 13, 2016 and May 23, 2016.

‘Go back to the 8-K from October 2015. The shares were subsequently registered and that registration statement was declared effective – 2.8 million shares for the initial investment plus 5.6 million more via the warrants, for a grand total of 8,400,000 shiny new shares.’

And from the most recent 10-Q:

‘In May 2016, the Company issued 5,280,296 shares of common stock in connection with exercise of warrants, resulting in gross proceeds of $2.2 million.’

As shown in the October 2015 8-K, the lead investor for that financing was Barry Honig. Also previously shown in our first article was this link to the Offshore Database Leak that shows the offshore entities tied to Barry Honig. We believe you can double check that you have the right Barry Honig by cross-referencing the address in the Offshore Database with the Palm Beach County Property appraiser.

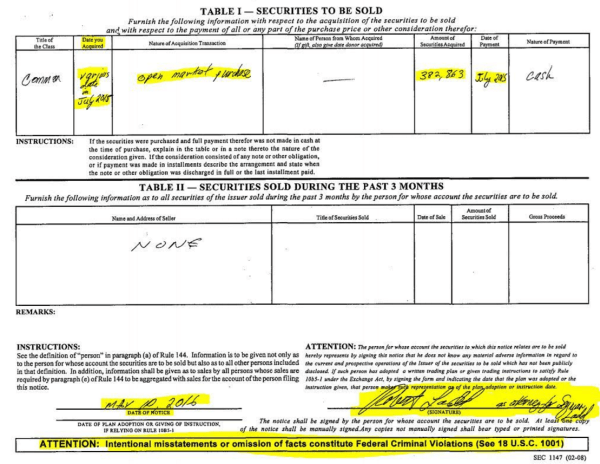

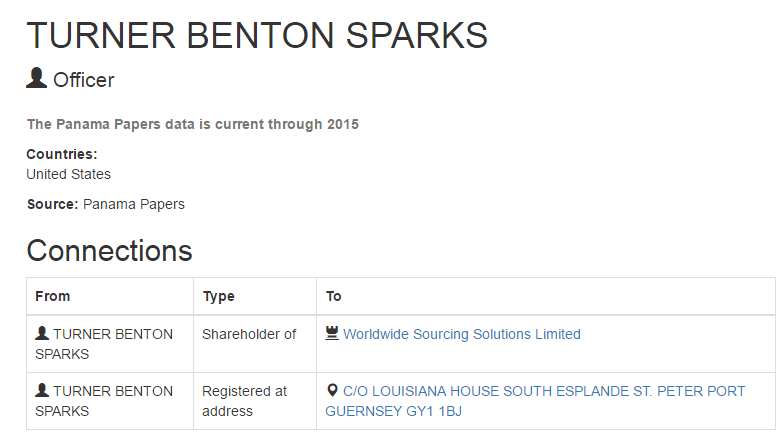

Clicking on his entity set up by Mossack & Fonseca, Worldwide Sourcing Solutions, LTD, will bring up all of the people associated with that entity. You might notice that this list of people includes the Brauser family. We raised questions about Brauser and Honig working together while denying a working relationship in our last article on MGT.

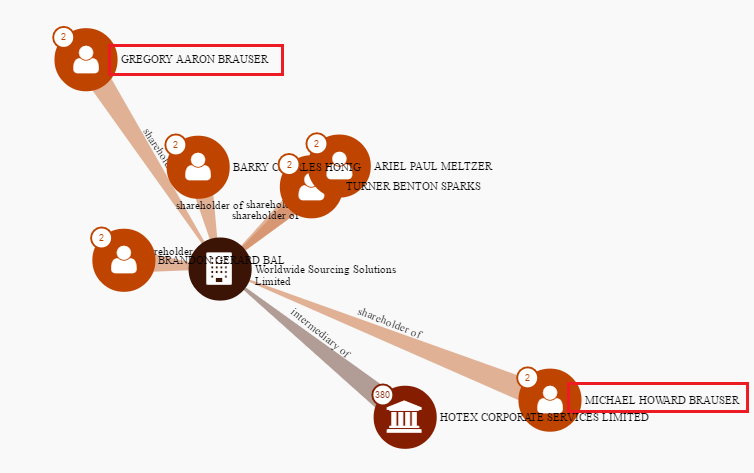

You might also notice the standup comedian, Turner Benton Sparks, who lists a California address. Oddly enough, he also has a listed address in PanamaDB in Guernsey. If you do not know where Guernsey is, then do not feel ashamed. It is a small Channel Island most famous for being a tax haven and for being placed on the EU’s tax haven blacklist last year.

If you look at the actual address listed, then you will see that it matches up with these guys, IAM Advisory. Pay particular attention to the bottom of that page where it says the following:

If you look at the actual address listed, then you will see that it matches up with these guys, IAM Advisory. Pay particular attention to the bottom of that page where it says the following:

“Our investment advisory service is most effective when total assets exceed $10 million.”

Why would a California resident, who appears to be a stand-up comedian, need a Guernsey-based advisory service that caters to people handling more than $10,000,000?

Who knows? We surely do not.

If you are still clicking on those nodes, then you undoubtedly have found Brandon Gerard Bal, who shows a Boca Raton address, although he does not appear to own the property listed. Like Turner Sparks, Brandon Gerard Bal lists a curious address in PanamaDB – Geneva, Switzerland – Home to Mirabaud & Cie. Brandon Bal also joined Honig and Brauser as a selling shareholder in VPCO, another pump and dump that is now listed with a zero bid.

Finally, there is Hotex Corporate Services. They act as an intermediary to hundreds of companies located throughout Asia/Pacific Rim. While it is impossible to know exactly what all of those companies do, it is an interesting side story.

Moving from the analysis of who was dumping stock into the paid stock promotion, thanks to a recent PRE14A filing made by MGT, investors can finally get a peek at what exactly it is that they are buying.

Sometime in August 2016, a shareholder meeting will convene to decide things like:

- Should we reverse split the stock a lot or just a little?

- Should we authorize the issuance of 43,800,000 shares (“Purchase Price Shares”) of Common Stock to certain sellers (“Sellers”) set forth on the signature page of that certain Asset Purchase Agreement?

- If we do issue all of those shares, then should we also increase the number of shares that the company is authorized to print since we will have then maxed out the possible dilution to current shareholders?

- Should we employ John McAfee?

We will help shed light on the first 3 questions, and we will save the last question for another day.

First, MGT will need to do a reverse split because of the minimum listing requirements of the exchanges. Here are MGT’s own words:

“We expect to utilize a reverse split only if required to meet initial listing requirements of the New York Stock Exchange (NYSE) or NASDAQ. The NYSE (not the NYSE MKT, where MGT is currently traded) has a minimum share price standard of $5.00 for a new listing.”

The current share price of ~$3.50 is well below $5, hence the meeting to decide about a reverse split.

Next comes a bigger problem: The issuance of 43.8 million shares for the assets of D-Vasive and Demonsaw.

When the original APA was drawn up (linked in this May 9 8-K), it is true that MGT stock was trading at about $0.42 to $0.68 cents.

This would mean that MGT was placing a value on D-Vasive of just more than $10,000,000 by agreeing to issue them 23.8 million shares. A few weeks later, the stock pump had taken place and MGT’s stock had settled in at a price around $2.50. At that point in time, MGT put forth another APA in which they outlined the purchase of Demonsaw for an additional 20,000,000 shares. This would suggest that MGT (and the somewhat extraneously-influenced market) would value the assets of Demonsaw at about $50,000,000. At the same time, the 20,000,000 shares that would be issued to D-Vasive had grown in value to nearly $60,000,000. This dilution has not happened yet, so the effects of the dilution have not yet been felt.

If shareholders approve this issuance, the dilution effects will be massive. The effect on the stock price can happen over night, once the market figures out the effect the dilution will have.

Currently, MGT is trading around $3, which means that the shares that they will issue to D-Vasive/Demonsaw are currently worth somewhere near $130,000,000. There are currently about 23.8 million shares out, which means that current MGT shareholders will be diluted by approximately 191%. This is to suggest that today’s claim on an MGT asset will be reduced by approximately 66% once the dilution takes effect. Here are MGT’s own words to describe the situation:

‘The APA does not affect the rights of the holders of outstanding Common Stock. However, the issuance of the Purchase Price Shares pursuant to the terms of the APA will have a dilutive effect on the existing stockholders’ voting power. Upon issuance of the Purchase Price Shares upon Closing, D—Vasive Sellers would hold approximately 63% of the outstanding shares of our Company and would be our largest stockholders. D—Vasive Sellers may be in a position to exert influence over our Company and there is no guarantee that the interests of D—Vasive Sellers will align with the interests of other stockholders.’

Let’s get a look at what MGT shareholders will get in return for this dilution. Before looking at the financial statements of D-Vasive it is important to note that the previously mentioned Asset Purchase Agreements have been amended in the following fashion:

‘D—Vasive has also acquired all of the membership interest of Demonsaw LLC’

and

‘Pursuant to the terms of the APA, the Company has agreed to purchase assets (“Purchased Assets”) integral to the D—Vasive Business, including but not limited to applications for use on mobile devices, intellectual property, customer lists, databases sales pipelines, proposals and project files, licenses and permits. Among the Purchased Assets is 100% of the membership interest in Demonsaw LLC’

So, D-Vasive has acquired all of the membership interests of Demonsaw, and MGT will acquire D-Vasive.

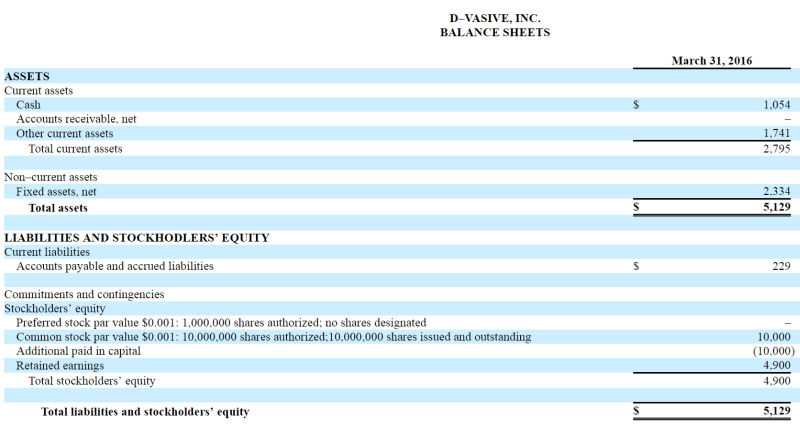

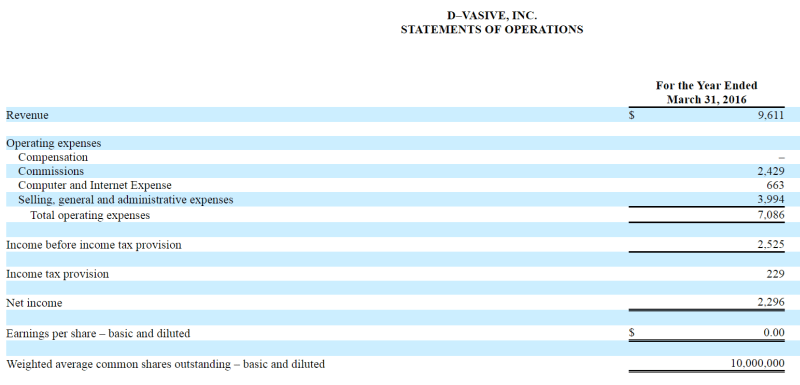

Now, let’s take a look at those D-Vasive financials from the preliminary proxy:

As of March 31, 2016, D-Vasive had a little more than $1,000 in cash in the bank. They had a little more than $5,000 in total assets. They had less than $10,000 in total revenue.

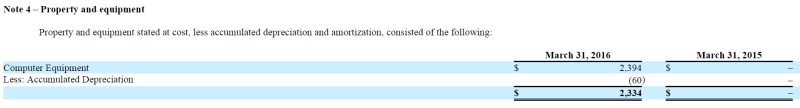

46% of D-Vasive’s total assets were fixed assets, which are actually better described as Computer Equipment, seen here:

46% of D-Vasive’s total assets were fixed assets, which are actually better described as Computer Equipment, seen here:

Notice that D-Vasive did not seem to own a computer until at least April 1, 2015. And, if these financial statements include Demonsaw, then Demonsaw didn’t own one, either. Either way, it seems ludicrous to conceive that a company that is going to change the face of global computer security did not own a computer until last year.

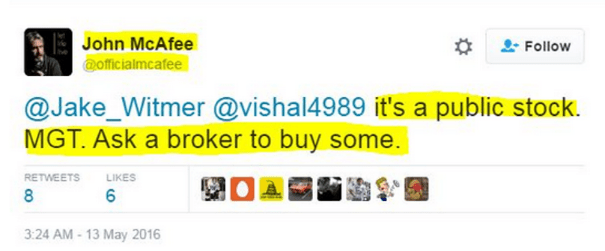

What is more troubling is the fact that MGT’s management thinks that diluting its existing shareholders by 191% is a good idea in exchange for acquiring these assets. Remember, the CEO dumped his family’s stock and stock for himself, so the dilution isn’t affecting him to such a degree anymore. The financiers dumped, too. At least some of the people left buying and holding are the ones who received email marketing blasts or who were, perhaps, following the Twitter advice of John McAfee who was telling people to call their broker and buy stock. Of course, McAfee has an indirect, vested interest in saying such things, since Future Tense is to receive money based on how high the stock can go:

c. Value Bonuses . If, during the first twelve (12) months of the initial Term of this Agreement, the volume weighted average price (“VWAP”) of the Company’s common stock is equal to or greater than $1.00 for each of ten (10) consecutive trading days on the NYSE MKT exchange, then Consultant shall be entitled to receive a cash bonus in the amount of $250,000 to paid within thirty (30) days of such triggering event. If, during the first twelve (12) months of the initial Term of this Agreement, the VWAP of the Company’s common stock is equal to or greater than $2.00 for each of ten (10) consecutive trading days on the NYSE MKT exchange, then Consultant shall be entitled to receive an additional cash bonus in the amount of $350,000 to paid within thirty (30) days of such triggering event.

Both of those strategies, buying on the advice of an email or a Tweet, are probably not viable ones to achieve positive, long-term investment goals, and execution of such strategies will most likely prove to be disastrous for those who hold this one long enough.

For those who do trust their financial future with the abilities of the legendary John McAfee, we must present at least a little bit of clarity on the valuation situation.

The fact remains that during the year leading up to May 2016, MGT stock traded well below $1 and even as low as 18 cents with some days where total liquidity was less than 2,000 shares, or less than $500 worth of total volume. The total market capitalization was at times, only a few million dollars. According to the NYSE Rule Book:

802.01C Price Criteria for Capital or Common Stock

A company will be considered to be below compliance standards if the average closing price of a security as reported on the consolidated tape is less than $1.00 over a consecutive 30 trading-day period.

In the event that at the expiration of the six-month cure period, both a $1.00 closing share price on the last trading day of the cure period and a $1.00 average closing share price over the 30 trading-day period ending on the last trading day of the cure period are not attained, the Exchange will commence suspension and delisting procedures.

Couple that with the company’s own words from their 10-K filing:

If our Common stock is delisted from the NYSE MKT LLC, the Company would be subject to the risks relating to penny stocks.

If our Common stock were to be delisted from trading on the NYSE MKT LLC and the trading price of the Common stock were below $5.00 per share on the date the Common stock were delisted, trading in our Common stock would also be subject to the requirements of certain rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These rules require additional disclosure by broker—dealers in connection with any trades involving a stock defined as a “penny stock” and impose various sales practice requirements on broker—dealers who sell penny stocks to persons other than established customers and accredited investors, generally institutions. These additional requirements may discourage broker—dealers from effecting transactions in securities that are classified as penny stocks, which could severely limit the market price and liquidity of such securities and the ability of purchasers to sell such securities in the secondary market. A penny stock is defined generally as any non—exchange listed equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

Please forgive our scrutiny here, but this company exhibited many of the market valuation characteristics of a classic penny stock up until May 2016. Even then, it took a classic “bulletin board style” paid stock promotion by people with names like StockBeast to jam the price higher.

Now, we certainly do not need to outline the thousands of pumped up stocks whose stock prices have been temporarily buoyed by stock promotions, chat room chasers, and message boards riddled with stock shills that have existed prior to MGT. What we will point out, however, is that as is quite often the case with these propped-up stocks, it is not the easily-influenced equity “market” that determines the value of these companies with little to no assets and no positive cash flow. Rather, it is the debt market that will determine the value. The reason for this is simple. The guys who are supplying the money to the company in need will not be influenced by an email from StockBeast. They will crunch the real numbers, and they will determine what the stock is actually worth. Therefore, it will not be until we see the terms of the obviously much needed financing that we will get a gander at what “the market” says about the valuation of MGT.

This brings us to the part of the shareholder meeting where they will decide if they should increase the number of authorized shares from 75 million to 250 million. The answer here is simple. If you want to complete this asset purchase, then you have to increase the authorized shares. D-Vasive has no real assets – much beyond what is perhaps a nice laptop. They have no positive cash flow. So, the question becomes “how much money will they need to raise in order to deliver what would be a nearly 1/4 billion dollar market cap at fully diluted current price levels?”

This is where longs say something like, “but, you are not taking into account John McAfee and what he will deliver.”

And this is where we remind longs of what would be considered ancient history by today’s 140 character limit standards.

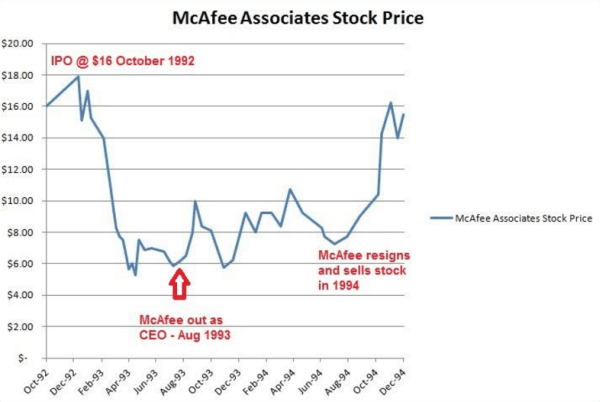

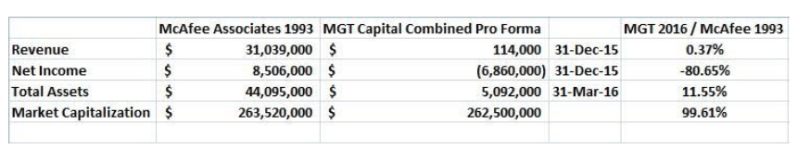

First, let us show this image again:

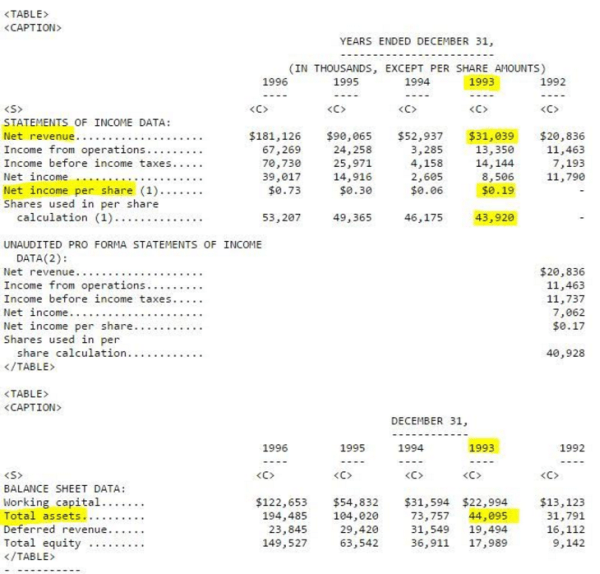

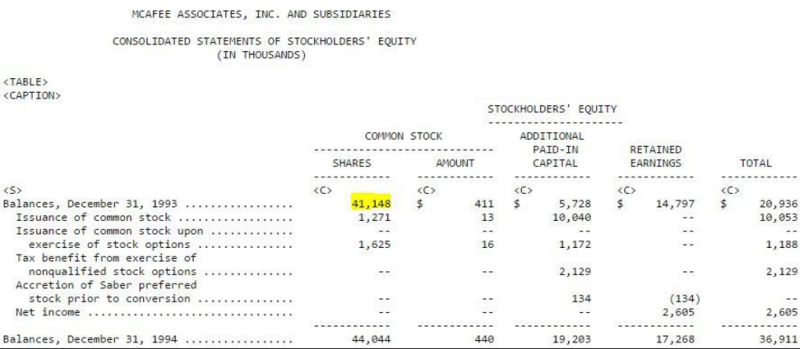

The above graphic shows the early evolution of John McAfee’s first public company, McAfee Associates. As outlined in our previous article, John McAfee “departed” McAfee Associates in August 1993. At the time, the stock had fallen roughly 66% from its peak shortly after its IPO debut. McAfee would later resign and dump his McAfee Associates stock in 1994. We have already shown that. Here is what we have not shown, until now – the McAfee Associates financial statements for the early 1990s:

In 1993, when John McAfee exited his position as CEO of McAfee Associates, the company had roughly $31 million worth of revenue. They had net income of $8.5 million. They had total assets in the amount of $44 million. They had positive working capital to the tune of $23 million.

And, perhaps the most important part?

They had roughly 44 million shares fully diluted (actual share count was closer to 41 million):

So, what was the market capitalization of John McAfee’s flagship corporate achievement in life when he left its helm?

Roughly $264 million.

Refresh. What would the current market capitalization of MGT be if its recent price of $3.55 per share were applied to the fully diluted share count of roughly 75 million?

$266 million.

That is to say that MGT’s fully-diluted market capitalization (if effecting the proposed asset purchase agreement today) would be slightly GREATER than that of McAfee Associates when John McAfee was in his supposed prime.

Here is what they might look like side-by-side:

So, investors must decide what the people who will finance this venture think it is really worth, because their terms will eventually dictate the price of the equity. Shareholders can be sure that Barry Honig will have his hands in the mix. Maybe that is a good thing. He is certainly a shrewd and accomplished businessman. However, one does not achieve the level of his success by overpaying for things. We also doubt if organizations like Mossack Fonseca, IAM Advisory, and Mirabaud & Cie, are part of one’s life because they are advising that person to supply funding to microcaps with no assets or cash flow at equity market prices. Time will tell.

Finally, we consider some thoughts put forth by some longs, as well as by John McAfee, himself, regarding the so-called naysayers (we prefer the term “realists”):

They start with the specific argument that the to-be acquired assets and John McAfee have no value. That is not an argument, it is merely their opinion, and one that has cost them money. That in turn makes them angry, spicing up their valuation opinion with personal attacks. Notwithstanding our stockholders’ desire to expose illegal shorting activity and the brokerage firms behind illegal stock lending, we plan to stay above the dirt. There’s another old market saw, ‘He who sells was isn’t his’n buys it back or goes to prison.’

Maybe John McAfee has does have some incalculable value. Maybe since 1993, John McAfee has gained worldly experience that will make him a more effective CEO for MGT than he was for McAfee Associates.

However, it is also possible that things like xanax-induced driving arrests could be tell-tale signs that Mr. McAfee has passed his prime. Maybe John has surrounded himself with a great team, like Nolan Bushnell – founder of Atari. True, but perhaps only the DeepMind of a short seller would remember hitting the bids of the Uwink stock promotion. Unfortunately, expanding on all of these things and more will have to be a story for another day. This is still only a small portion of the due diligence that has been conducted.

Until such a time that the proposed Asset Purchase Agreement is executed, the microcap equity market that is dominated by email blasts, chat rats, and message boards will have to decide if they want to be holding this valuation through the actual merger. Will they hold it until the necessary financing is announced? Will they hold it until these shares become free trading? The divergence between illusion and reality can only hold for so long. Eventually, time will reveal all. MGT is no different. In due time, we believe everything will be revealed … and expectations will meet reality.

We continue to believe that the SEC needs to step in and halt the circus that is MGT.

Robert

Ok great history lesson. But anything about the future. Your main point is character assignation. The blind bulls are raving about products. Maybe JM involvement in this is like Bill Shaetner was with Priceline. As for the dilution maybe it’s called for to enable proper control of the company. Maybe they will be restricted and vested over time. But they are making it public. You have to give them that. This is no secret. So if your agenda to dissuade or warn anyone it’s duly noted. Nice article though. Gives due diligence a new meaning. Abe Lincoln chopped down the cherry tree. He became our president. Bill Clinton smoked weed. He became our president. GWBush had a dui. He became president.

Will

Sorry my friend. Abe Lincoln did not chop down a cherry tree. George Washington. Lincoln freed slaves. History lesson. Class dismissed

Facepalm

huh?