Welcome to The GeoWire , your Source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Recommended Reading From Around the Web, Important Tweets of the Week, Premium Weekly Wrap Ups, Featured Videos, and More. Please hit the heart button if you like today’s newsletter and reply with any feedback.

If you are new or this was shared with you, you can join our email list here. Or you can click here to get all of our premium content.

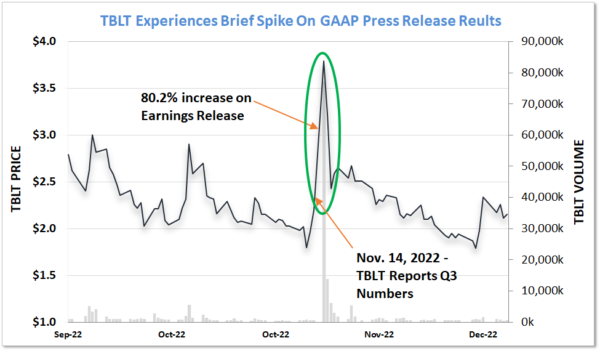

On November 14, 2022 Toughbuilt Industries, Inc. (NASDAQ:TBLT) a favorite target for day traders, rose 90.2% on the heels of Q3 financial results. In a press release, the Company reported that it had logged in a nice profit, seemingly reversing its history of losses. Three days later the stock gave back all the gains.

Why? If you dug beyond the press release, you would’ve noticed that the company actually lost a good deal of money. However, in an opportunistic twist, the company raised money into the rising stock price. I’ll come back to TBLT in a second.

The facts surrounding TBLT spawned another idea for a tweet thread that we plan on sharing with you soon.

Learn Through Our Tweet Threads

In the waning months of 2022, we sought, through Twitter threads, to begin deconstructing some of the major tenets I have applied in my full-time investing journey to keep GeoInvesting churning out microcap ideas since 2007.

So far. We have published 5 Tweet Threads through the @Geoinvesting and @Majgeoinvesting twitter handles:

- The Great Head Fake – GARP Investing (Maj)

- A Lesson on Sales/Backlog – Taylor Devices, Inc. (NASDAQ:TAYD) (Geo)

- InfoArb Case Study – Hudson Technologies, Inc. (NASDAQ:HDSN) (Maj)

- Interviewing Company Management Tips (Maj)

- Muscle Maker, Inc (NASDAQ:GRIL) Turnaround (Geo)

We are about to publish a fourth stock Twitter thread highlighting a stock that fell ~50% on November 1 after it reported Q3 earnings. The conference call transcript clearly indicated that investors misinterpreted the Q3 press release, which omitted important aspects of the business that minimized the negative assumptions investors made from the release. The stock is slowly recovering as the fourth quarter earnings report approaches, but is still ~40% off the price it traded before it fell.

It almost seems unbelievable that what started out as a solitary, pre-digitized journey to bring clarity and microcap idea generation to investors is now a full fledged, peer-supported community of like-minded individuals who see the value of what we do.

We’ll keep up with bringing you the threads in 2023, not only because it helps us stay close to our roots, but for the mere fact that it keeps our chops sharp and aids in the discovery and expansion of investing theories that support our style.

Revisiting GAAP vs Non-GAAP Earnings

On that note, in 2016 we addressed the dichotomous approach to understanding the differences between generally accepted accounting principles (GAAP) and non-GAAP earnings. There are ways they should be scrutinized when trying to get a sense if numbers being reported by a company are a true representation of what is going on at the net income level. Non-GAAP financials are also referred to as “adjusted.” For example, “adjusted earnings per share (EPS) or “adjusted earnings before interest taxes & depreciation & amortization (EBITDA).

Because we plan on delving into this subject in a Tweet thread that we anticipate will engage our investor network and extensions thereof, we feel it is a good idea to give another primer on the subject, especially since GeoInvesting’s Premium Subscriber base has grown substantially since 2016.

If part of your investment strategy is executing bullish or bearish short-term stock trades on earnings report news flow, it’s extremely important to understand if the GAAP and Non-GAAP earnings per share numbers being reported in a press release are “clean”.

As a short term trader, you are faced with the dilemma of having to act fast so a trade does not get away from you vs. acting too fast, because the market will eventually correct stock price movements based on misinterpretations by the herd. The same conundrum exists if you are predominantly a longer term investor, especially if you own a stock that reported earnings you might have to sell into if they were bad or maybe buy more if they were good.

For the beginner investors reading this article, earnings per share is a measure of a company’s profitability that is calculated by dividing the company’s net income for a given period by the number of its weighted average common shares outstanding during that period. As such, it is the most widely used measure of a company’s per-share profitability and is a key metric used to evaluate a company’s performance and stock price.

“If you can follow only 1 bit of data, follow the earnings – assuming the Co. has earnings. I subscribe to the crusty notion that sooner or later earnings make or break an investment in equities. What the stock does today/tomorrow/next week is only a distraction.”

– Peter Lynch— Maj Soueidan (@majgeoinvesting) December 26, 2022

Regulators set GAAP reporting standards that publicly traded companies need to adhere to. Non-GAAP earnings per share reflect adjustments (additions or subtractions) to GAAP earnings. For example, GAAP earnings could include non-cash gains/charges/expenses, non-operating gains/losses or one-time/temporary expenses. Some examples include:

- Non cash gains or losses resulting from items related to valuation adjustments of derivative instruments issued by the company, such as warrants.

- Writing down the value of an acquired asset that has fallen in value (non cash).

- Restructuring costs (one time or temporary).

- Gains or losses on the sale of assets (non-operating).

Additionally, companies will include stock-based compensation as a (non cash) expense for GAAP reporting purposes, an expense that is often added back to GAAP EPS to calculate Non-GAAP EPS..

Our previous article on GAAP vs. Non-GAAP highlighted how disparities between the two can lead to an element of Information Arbitrage.

Here a two InfoArb set ups you can explore:

Scenario 1

Company only reports GAAP EPS in its press release. Your own homework reveals that Non-GAAP EPS is either higher (buy more or go long the stock) or lower (sell or go short) than GAAP EPS.

Scenario 2

Company reports GAAP and Non-GAAP EPS in its press release. Your own homework reveals that the company’s Non-GAAP EPS calculation either underrepresented GAAP EPS (buy more or go long the stock) or was too aggressive vs. GAAP EPS (sell or go short).

These tasks are important when we are determining if a company meets profitability standards of our Tier One Quality Microcap checklist.

Back to TBLT

So, how can we more clearly represent the propensity of knee jerk reactions to company earnings? TBLT Is a perfect case study to explore. It’s a company that designs and manufactures tools and accessories for the professional and do-it-yourself construction industries.

When the company reported a profit for its quarter 3, 2022 earnings on the morning of November 14, 2022, it’s quite possible that some algorithms and day traders swooped in, in a mad rush, to buy the stock feverishly, pushing the volume to a whopping 207x the normal volume, and the stock 90.2% higher than the previous day’s close. There were obvious losers, since the price stayed there for less than 3 days.

In the Q3 2022 press release TBLT reported the following GAAP net income:

“Net income in the third quarter of 2022 was approximately $539 thousand, or $0.03 per share, compared to a net loss of approximately $9.0 million, or $(11.18) per share in the third quarter of 2021.”

The company provided no further details on the net income calculation and did not provide financial tables in the press release.

Likewise, management did not expand on the net income calculation in the company’s third quarter conference call. This is all they said:

“We recorded a net income of $539,000 for the three months ended September 30, 2022 as compared to a net loss of $9 million for the three months ended in September 30, 2021.”

The irony here is that the company technically did not do anything wrong since regulators only require that companies report GAAP earnings.

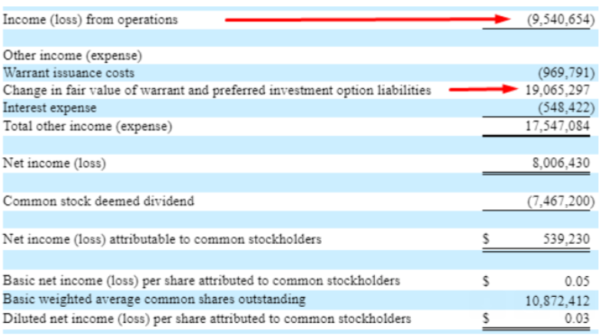

However, the related 10-Q filing showed that the company actually had a $9.5 million operating loss for the quarter and had a one time gain of $19.0 million in the change in fair value of warrants (a non-recurring item) benefitting the net income line.

This is a classic case of showing why the calculation between GAAP vs Non-GAAP is so important. GAAP EPS was $0.03 for the quarter, while true Non-GAAP loss was near $1.60 per share for the quarter.

The gave up all of its gains, presumably after smart investors solved this puzzle and on the heels of private placement the company entered, with the details being filed in an 8K with the SEC on November 18, just 4 days after the earnings report was published.

This is a classic case of why those with tunnel vision who rant and rave on Twitter, criticizing companies who report Non-GAAP EPS, have it wrong.

Ask these investors what they think of TBLT’s GAAP EPS.

While it’s true that too many companies abuse Non-GAAP reporting, GAAP can also misrepresent earnings per share. Our job as investors is to determine if a GAAP EPS number accurately represents a company’s earnings power and/or if Non-GAAP adjustments are too aggressive or conservative.

Stay tuned for our Tweet Thread on GAAP vs. Non-GAAP and have a great week.

Hi, part of this post is for paying subscribers

JOIN NOW

Already a paying member? Log in and come back to this page.

Our premium members also…

Get Access all Model Portfolios

Receive GeoInvesting Premium Alerts

Access to all stock pitches and Research Reports

Attend live interviews and fireside chats

Interact with the GeoTeam in Monthly Forums

Get in-depth stock research on 1000’s of microcap stocks

Thanks for joining thousands of other investors who follow GeoInvesting

Your free subscription includes first access to:

- Monthly publication of “The GeoWire” Newsletter sent to you the first Tuesday of every month, covering case studies, stats and fireside chats.

- Weekly emails highlighting the past week’s coverage at GeoInvesting sent 3x a month.

Get more out of GeoInvesting by trying us our premium package for free.

Step 1 – Receive quality research investment Ideas, model portfolios and education

Step 2 – Interact with us about our favorite ideas and the research that supports it; gain insight through all tools geo offers

Step 3 – Decide to build portfolios based on our research and Model Portfolios and updates including convictions, additions and removals of holdings.