Since our initial report on January 17, 2012, the GeoTeam has continued to develop even more conclusive proof to support its case that L & L Energy never purchased the Ping Yi Mine on November 1st, 2009, which they claim represented 37% or their production capacity in 2010. After the Chinese New Year holiday, we contacted Mr. Hu Shiwei and Mr. Zhang Baoguo, the Ping Yi Mine owners, who control a combined 70% of its equity. They were enraged by the fraudulent activities of LLEN and said that they never transferred their interests of Ping Yi Mine to LLEN and/or its affiliated identities. The true owners of Ping Yi Mine provided the following:

- A video made by Mr. Hu Shiwei, The executive partner and legal representative of the Ping Yi Mine, in the office of the Notary Public showing the original business license and mining permit of Ping Yi Mine. In this video he also explained, with a written statement, the true ownership structure of Ping Yi Mine and other relevant matters. The gravity of the matter really hit home when he stated:

- LLEN’s claimed USD 3.9 million transaction to purchase the Ping Yi Mine never occurred. Mr. Hu Shiwei referred to this phantom transaction as a total scandal. He and his partners reserve the right to sue LLEN regarding the infringement

of their interests. - They strongly condemn the fraudulent activity of LLEN.

- LLEN’s claimed USD 3.9 million transaction to purchase the Ping Yi Mine never occurred. Mr. Hu Shiwei referred to this phantom transaction as a total scandal. He and his partners reserve the right to sue LLEN regarding the infringement

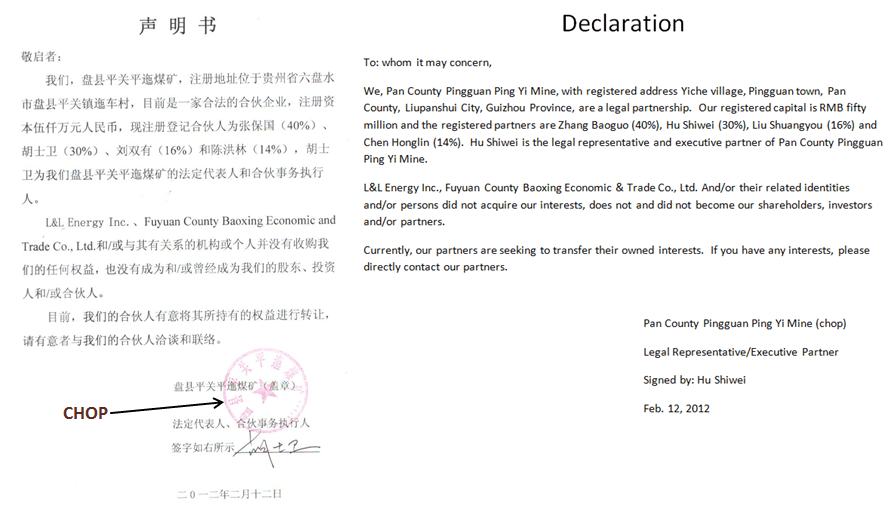

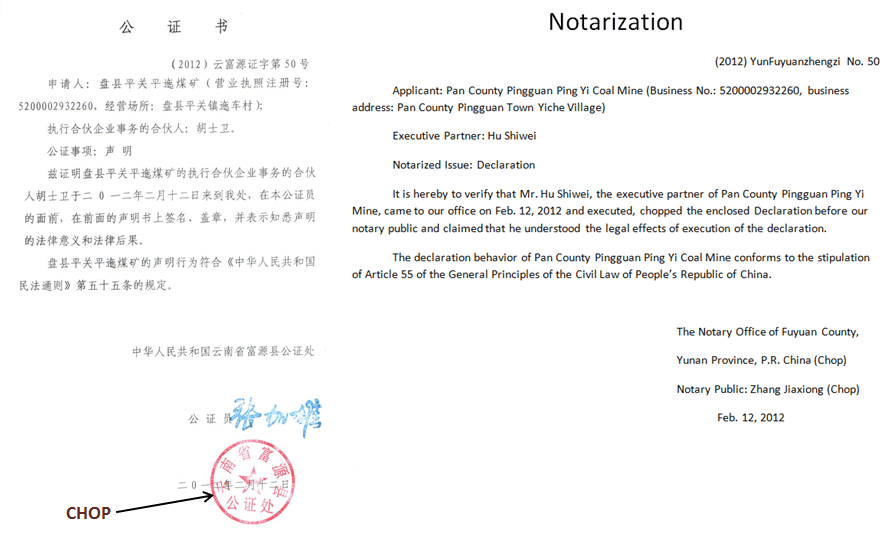

- NOTARIZED copies of the original identity card of Mr. Hu Shiwei, the Ping Yi Mine business license and the Ping Yi Mine mining permit which exactly match the current SAIC file on record.

- A notarized letter executed by Ping Yi Mine Legal Representative and Executive

Partner Hu Shiwei stating that LLEN does not and never did own the Ping Yi Mine.

The True Owners Of Ping Yi Mine Speak Out And State That LLEN Never Acquired Ping Yi Mine.

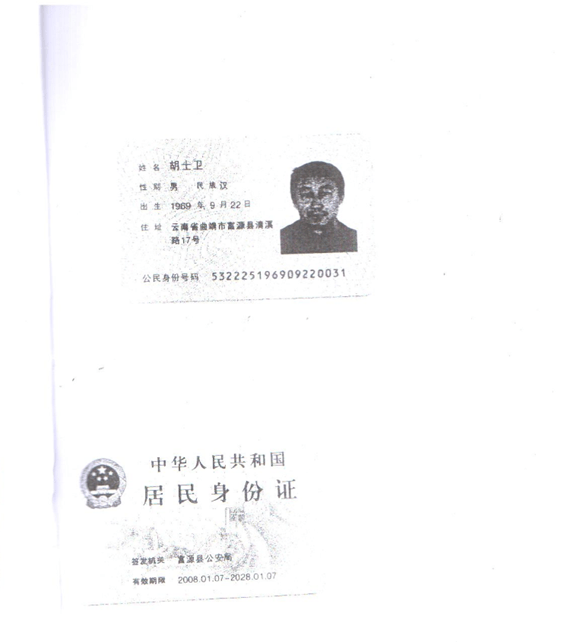

Upon our request, on Feb. 12, 2012, Mr. Hu Shiwei visited the Fuyuan County Notary Office, Yunan Province, which is the closest notary office to his home address, No. 17, Qingxi Road, Fuyuan County, Qujing City, Yunan province (see the ID Cardof Mr. Hu Shiwei below).

Identification Card of Hu Shiwei

As the legal representative and executive partner of the Ping Yi Mine, Mr. Hu Shiwei possesses all of the standard documents of the Ping Yi Mine. He provided a notary public clerk with the original business license, mining permit and his own identity card. The clerk made copies of these documents and notarized that these copies are the same as the original documents as seen below.

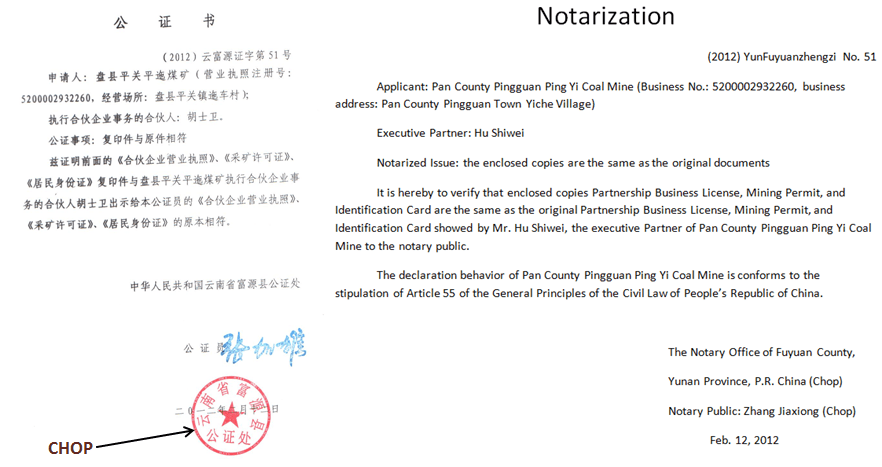

Furthermore, before the notary public, Mr. Hu Shiwei also executed a written statement (Declaration) which translates exactly as follows:

We, Pan County Pingguan Ping Yi Mine, with registered address Yiche village, Pingguan

town, Pan County, Liupanshui City, Guizhou Province, are a legal partnership. Our

registered capital is RMB fifty million and the registered partners are Zhang Baoguo

(40%), Hu Shiwei (30%), Liu Shuangyou (16%) and Chen Honglin (14%). Hu Shiwei is

the legal representative and executive partner of Pan County Pingguan Ping Yi Mine.L&L Energy Inc., Fuyuan County Baoxing Economic & Trade Co., Ltd. and/or

their related identities and/or persons did not acquire any of our interests, are

not and did not become our shareholders, investors and/or partners.

Also provided is a notarized document that states the Notary witnessed the executed, enclosed and chopped declaration as seen below.

To further dispel LLEN management’s multi-year hoax, Mr. Hu Shiwei also made a short video where he showed the original business

license and mining permit of Ping Yi Mine and explained with a written statement the ownership structure of Ping Yi Mine and other relevant matters.

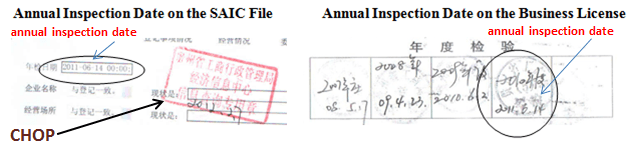

On February 7, 2012, we also obtained another copy of Ping Yi Mine’s SAIC file. Based on the SAIC file, the 2011 annual inspection date mentioned in the SAIC file is June 14, 2011, which is the same as the annual inspection date on the business license disclosed by Mr. Hu Shiwei and notarized by the notary public. All other information in the SAIC file is also the same as the information shown on the NOTARIZED business license and/or in the written statement.

LLEN’s Absurd Defense

In our initial report issued on January 17, 2012, we disclosed that the Ping Yi Mine was listed for sale on multiple web sites in China (and still is as of today). We also showed that the Ping Yi Mine SAIC file we obtained on January 13, 2012 revealed that L&L is not the true owner of Ping Yi mine.

LLEN’s response to our report should make even the most blindly bullish investors’ hearts skip a beat. They:

- didn’t marshal their lawyers and auditors who asserted that the mine’s ownership

couldn’t be in doubt. - didn’t offer any evidence proving that the sales postings were a hoax.

- didn’t offer any documents rebutting the GeoTeam’s findings.

Instead, LLEN issued a brief press release on Jan 17, 2012 claiming that our conclusions were wrong and stating that the Ping Yi Mine was indeed owned by them. In defense of management’s integrity and its investors’ capital, this is the sum total of what LLEN had to say for itself:

“L&L had not posted Ping Yi for sale and that the company never authorized or prepared such sale notices. Accordingly, the Company does not know the source of such notices.”

LLEN, to be clear, is resorting to grade school word games.

LLEN is asking its investors, auditors and regulators to accept that one of its key operating assets was wrongfully put up for sale and that it took no action to stop it or even attempt to figure out who was doing this to them. The GeoTeam is fairly confident that if someone tried to put Berkshire Hathaway’s Geico unit up for sale, or Goldman Sachs’ trading operations, they might at least try to get to the bottom of it, if only for appearance’s sake. To that end, the statement from Ed Moy, L&L Board Director and Vice President, is surely one for the record books:

“Last April, I led investors on a tour of our operations in Yunnan and Guizhou Provinces of China, which included a visit to Ping Yi Mine. Investors had a chance to meet and talk with our staff and local mine management. I can therefore confirm our ownership of Ping Yi Mine.”

In other words, Ed Moy only confirms that the mine exists (a fact we have never disputed) taking this to mean that LLEN owns the property.

Well, we have performed the simple steps that Ed and institutional investors should have taken to verify who really owns the mine. We will let investors decide who has provided the most compelling evidence:

- Ed’s tour?

- LLEN’s completely unacceptable press release? or

- Our government documents, transcripts, recorded conversations, notarized statements from the true owners of the Ping Yi mine and a video by the legal representative and executive partner of the Ping Yi Mine.

CONCLUSION

Our view is simplicity itself: LLEN has been making up wide swaths of its public filings for several years in a profoundly audacious bid to mislead investors, its auditors, NASDAQ and the SEC. They have been discovered and called out; all that remains is the day of reckoning for their Ping Yi Mine hoax. To date, many China Hybrids and their management teams have escaped criminal liability because they were entirely based in China. LLEN is different since it is a U.S. domiciled company with active headquarters on these shores and management directly subject to U.S. legal enforcement. Investors should be aware of the recent developments regarding the FBI’s involvement in the Chinese RTO market.

Disclosure: Short LLEN

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in

the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the

website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an “as is” basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use

of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.