Summary

- Best-case scenario: Lentuo International (LAS) failed to disclose that a related PRC entity controlled by its Chairman incurred RMB 250 million in debt is secured by the Chairman’s assets, including his ownership interest in LAS, and the revenues of LAS.

- Worst-case scenario: LAS failed to include the related PRC entity’s RMB 250 million debt in LAS’s consolidated financial statements for the period ended December 31, 2013.

- The undisclosed debt may be funding the build-out of car dealerships by the related PRC entity that could directly compete with LAS.

- LAS’s history of selective disclosures regarding its dealings with the related PRC entity leads us to believe that management intentionally omitted the details and potential impact of the debt.

After experiencing a 33% share price decline since May 19, 2014, LAS Chairman Hetong Guo and CEO Jing Yang on May 27, 2014 announced their intention to buy up to $1 million of LAS shares over the next year in the open market. What Chairman Guo failed to tell investors is that in 2013 he had secretly pledged his assets including his existing ownership interest in LAS as collateral for undisclosed debt totaling RMB 250 million issued by a related PRC entity under his control. Chairman Guo and CEO Yang also failed to tell investors that the related party’s debt was further secured by the revenues of LAS.

Background

LAS is a leading automobile retailer headquartered in Beijing. LAS operates 12 franchise dealerships, 10 automobile showrooms, one automobile repair shop, and one car leasing company. The dealerships operate under the “4S” brand.

Based on our research, LAS appears to be joining a growing list of ChinaHybrid companies that are not properly disclosing all of their material Chinese business dealings in their U.S. SEC filings. LAS is potentially facing a similar scenario to that of FAB Universal (FU), which we reported on November 18, 2013 had completed a $16.4 million bond offering in China that was not disclosed in its SEC filings. Following our report, the NYSE halted trading in FU shares and issued a delisting determination.

Our research uncovered evidence that Lentuo Electromechanical, a related party entity that owns LAS’s variable interest operating entities (“VIEs”) in China, issued RMB 250 million ($41 million) of debt in 2013 through two trusts made up of Chinese investors. We confirmed our findings through phone conversations with the management companies of the two trusts. LAS appears to have neither disclosed the debt nor its collateral in its 2013 20-F filed on May 15, 2014.

A key to the severity of our findings hinges on whether or not the debt should be consolidated into LAS’s financial statements.

Worst Case Scenario

If one or both of the Lentuo Electromechanical trust loans should have been consolidated and disclosed in LAS’s 2013 audited financial statements, then quite obviously:

- LAS’s auditor, Ernst & Young Hua Ming LLP, must reconsider its audit opinion on LAS; and

- LAS shares could suffer a substantial decline and trading halt while these matters are reviewed by regulators

Best Case Scenario is Still Very Bad

The legal entitlement to most of the profits of LAS’s Chinese operations is dictated by variable interest entity (“VIE”) contractual arrangements and not through direct ownership. U.S. investors put faith in LAS management, entrusting them not to take actions that jeopardize LAS’s claim to the Chinese operating companies’ cash flows. Whether by intention or coincidence, LAS’s corporate structure is unfortunately constructed such that management only selectively discloses actions taken by Lentuo Electromechanical, a related party that is the holding company of LAS’s VIEs.

Therefore in the best-case scenario, what we have uncovered is a very serious disclosure issue where management has intentionally failed to disclose that Lentuo Electromechanical raised funds in China collateralized by Chairman Guo’s assets, including his ownership interest in LAS, and the revenues of LAS.

Of further concern are indications that the funds raised by Lentuo Electromechanical are potentially being used to build car dealerships that could directly compete with LAS.

The Evidence

Due to its complex corporate structure (detailed below), by design LAS may only have to consolidate the Lentuo Electromechanical trust loans if the funds were used by LAS’s variable interest operating entities.

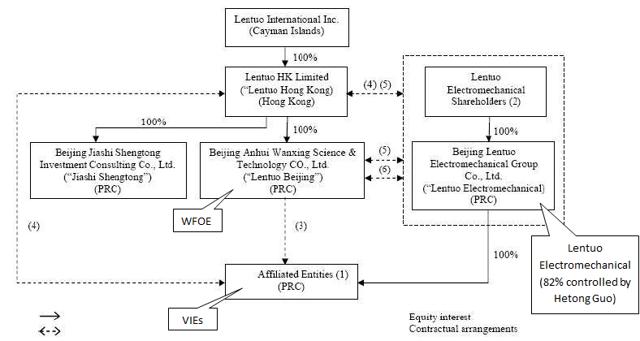

LAS’s corporate structure is diagrammed in its 20-F along with an accompanying list of variable interest operating entities, as follows:

(1) Affiliated Entity / Function

- Beijing Tuozhan Industrial & Trading Development Co., Ltd. / FAW-Volkswagen dealerships

- Beijing Aotong Automobile Trading Co., Ltd. / Audi dealerships

- Beijing Lentuo Chengxin Commercial & Trading Co., Ltd. / FAW-Mazda dealerships

- Beijing Yuantongqiao Toyota Automobile Trading Co., Ltd. / Toyota dealerships

- Beijing Tuojiacheng Commercial & Trading Co., Ltd. / Chang An-Mazda dealership

- Beijing Lentuo Huitong Automobile Sales Service Co., Ltd. / Shanghai-Volkswagen dealership

- Beijing Lentuo Tongda Automobile Sales Service Co., Ltd. / FAW-Volkswagen dealerships

- Beijing Tuozhan Automobile Repair Co., Ltd. / Automobile repair shop

- Beijing Lentuo Automobile Leasing Co., Ltd. / Automobile leasing

From the chart and list we can see that Lentuo Electromechanical is not one of LAS’s variable interest operating entities, but only the parent company of LAS’s VIEs that own the actual dealerships. Lentuo Electromechanical, rather than LAS or its VIEs, was the company that raised RMB 250 million from the two trusts. The key question is whether some portion of the RMB 250 million was deployed to build out LAS’s VIE dealerships, requiring consolidation of that portion of the debt in LAS’s financials. There is evidence that this may have in fact been the case.

LAS requires capital to grow its 4S car dealership footprint in China. Based on recent Chinese news, LAS’s related company, Lentuo Electromechanical, raised RMB 250 million in debt to help finance this expansion initiative. The first RMB 150 million was raised in China through a trust fund managed by Gansu Trust in December 2013, according to information obtained from the Chinese website, Trust-trust.com, as follows:

| 产å“å称 | 甘肃信托-è”拓集团贷款项目集åˆèµ„金信托计划 已售罄 | |

| Product Name: | Collective Fund Trust Plan for loan to Lentuo Group (Sold Out) | |

| å‘行机构: | 甘肃信托 | å‘行地: |

| Issuer: | Gansu Trust | Issuing place: |

| 预期收益率: | 10.5%-11.5% | 收益类型:固定型 |

| Predicted Return: | 10.5%-11.5% | Type: fixed return |

| æŠ•èµ„æœŸé™ | 24个月(åŠå¹´ä»˜æ¯ï¼‰ | 期é™ç±»åž‹ï¼š |

| Term of Investment: | 24 months (semi annual interest payment) | Type of Term: |

| 投资方å¼ï¼š | 资金æµå‘:工商ä¼ä¸šè´·æ¬¾ | |

| Type of Investment | Outflow of Money: loan to enterprise | |

| å‘行时间 | 2013-12 | 产å“状æ€ï¼šå·²å”®ç½„ |

| Issuance Time: | Dec. 2013 | Status: Sold Out |

| 资金è¿ç”¨æƒ…况: | 用于å‘北京è”拓机电集团有é™å…¬å¸å‘放信托贷款,å«åŒ—京奥迪4S店建设。 | |

| Usage of Fund: | Trust loan to Beijing Lentuo Electromechanical Group Co., Ltd., including Beijing Audi 4S Store construction | |

| 信用增级情况: |

|

|

| Credit Upgrade: |

Revenue generated from all 4S stores (including 4S stores under construction) of Beijing Lentuo Electromechanical Group Co., Ltd.

Land use right (commercial & service industry usage) and property at Mulintown, Shuiyi District, Beijing, owned by Zhonghe Investment Co., Ltd. (total construction area, 4939.30 m2 ownership and 170,900 m2 commercial land use right). Totally value of the mortgaged assets is 380.38 million. Mortgage rate is 39%.

Beneficial owner of Beijing Lentuo Electromechanical Group Co., Ltd., Guo Hetong and his wife provide unlimited joint and several liability. |

|

| 其他相关信æ¯ï¼š | ã€é¢„期年化收益率】 100万~299万 10.5%ï¼› 300万åŠä»¥ä¸Š 11.5%ï¼› |

|

| Other relevant info: | Predicted Return:1 million to 2.99 million 10.5%

3 million above 11.5% |

|

The RMB 150 million trust description contains the following statement:

“Trust loan to Beijing Lentuo Electromechanical Group Co., Ltd., including Beijing Audi 4S Store construction”.

Page F-58 of the 20-F states:

“…

D) Capital commitment

As of December 31, 2013, the Group has contracted but unpaid cost of RMB 25,000 (US$4,130) for the construction of a new Audi store which is in progress.

…”

Page 26 of the 20-F states:

“We are also constructing a new Audi dealership in Beijing.”

In Chairman Hetong Guo’s letter to shareholders dated May 22, 2014, he mentioned the new joint venture investment from Itochu “…that will also help us complete our new Audi 4S dealership in Beijing, whose construction began in November 2012.”

From the available information, it appears that either the RMB 150 million trust loan is being used to build LAS’s new Beijing Audi dealership (and therefore should have been consolidated, at least in part, into LAS’s financials) or is being used to fund a potentially competing Beijing Audi dealership owned by Lentuo Electromechanical that will not be consolidated into LAS’s financials.

An additional RMB 100 million was raised by Lentuo Electromechanical through a second trust fund, managed by a company perhaps aptly called “Inthedinghong Investment Co., Ltd.” A due diligence report for this trust fund is available online at Baidu Wenku. The basic information of the trust fund obtained from Baidu Wenku is as follows:

| 信托类型 | 有é™åˆä¼™å¯¹æŽ¥å•ä¸€ä¿¡æ‰˜é¡¹ç›®ï¼ˆFOT) |

| Type of Trust | Fund of Trust, Limited Partnership |

| 信托规模 | 10000万元 |

| Size of Trust | RMB 100 million |

| èµ·è´é‡‘é¢ | 100万元 |

| Initial Subscription amount | RMB 1 million |

| 预计年收益率 | 100-300万:10.5% ;(税åŽï¼‰300万以上:11%(税åŽï¼‰ï¼›500万以上:12% (税åŽï¼‰ |

| Predicted Annual Return | 1-3 million: 10.5% (after tax); >3 million: 11%(after tax); >5 million 12% (after tax) |

| ä¿¡æ‰˜æœŸé™ | 24个月 |

| Term of Trust | 24 months |

| 资金用途 | è”拓集团用于北京亚è¿æ‘汽车4S店和长春汽车4S店ç¹å»ºå’Œè¿è¥ |

| Usage of Fund | Construction and Operation of 4S shops at Beijing Yayuncun and Changchun of Lentuo Group |

| 收益分é…æ–¹å¼ | 按åŠå¹´åˆ†é…收益 |

| Return Distribution | Semi annual |

| 风险控制 | 1.内蒙工èŒå¦é™¢åœŸåœ°åŠæˆ¿äº§æŠµæŠ¼ç‰©æ€»ä»·å€¼è¶…2亿元,抵押率ä¸è¶…50%。2.è”拓信团实际控制人,éƒå’Œé€šä¸ºæœ¬ä¿¡æ‰˜è®¡åˆ’æä¾›æ— é™è¿žå¸¦è´£ä»»è¿˜æ¬¾æ‹…ä¿ã€‚

1)截æ¢åˆ° 2012å¹´11月,è”拓集团总资产约为8.53亿元,éƒå’Œé€šä½œä¸ºè”拓集团第一大股东æŒæœ‰é›†å›¢82%è‚¡æƒï¼Œçº¦æŒ7亿元资产。 2)å…¶æŒæœ‰è”拓集团旗下上市公å¸è”拓国际 14,965,646 股股票。 截æ¢åˆ°ç¾Žå›½å½“地时间2013å¹´1月22日,该股票收盘价为1.56美元/股,éƒå’Œé€šæŒæœ‰è‚¡ç¥¨å¸‚值约 2334.64万美元。 3. 截æ¢åˆ°2011年年底,借款人è”拓集团年销售收入超过37äº¿å…ƒï¼Œä¸”æ ¹æ®é¢„测,未æ¥ä¸¤å¹´å…¬å¸ç»è¥æ”¶å…¥å¯å®žçŽ°æ”¶å…¥è¶…过90亿元,故第一还款æ¥æºå¯é ã€å……è¶³ã€‚è” æ‹“é›†å›¢ï¼šåˆ›ç«‹äºŽ1994年,是ä¸å›½å¤§åž‹ä¸“业化的汽车销售åŠç»´ä¿®æœåŠ¡é¢†å…ˆä¼ä¸šã€‚2010å¹´12月10日,è”拓集团旗下è”拓国际公å¸(纽交所代ç :LAS)宣 布在美国纽约è¯åˆ¸äº¤æ˜“所挂牌上市,这也是ä¸å›½é¦–家在纽交所上市的汽车销售æœåŠ¡ä¼ä¸šã€‚ç›®å‰æ‹¥æœ‰11个æ£åœ¨è¿è¥çš„æ ‡å‡†4S店,其ä¸åŒ—京8家,天津ã€å¹¿ä¸œã€æµ™æ±Ÿ å„一家。 |

| Risk Control | 1. Land and property of Inner Mongolia Gongzhi College, total value RMB 200 million. Mortgage rate is less than 50%2. Guo Hetong, beneficial owner of Lentuo Group, provide unlimited joint and several liability.

1) As of Nov. 2012, total assets of Lentuo Group are RMB 853 million, as the biggest shareholder, Guo Hetong owns 82% of Lentuo Group, around RMB 700 million. 2) He owns 14,965,646 shares of Lentuo International, as of Jan. 22, 2013, its closing price is USD 1.56 per share. Total value of shares owned by Guo Hetong is USD 23.3464 million. As of the end of 2011, Lentuo Group’s annual revenue is more than RMB 3.7 billion. In the coming two years, the company can achieve more than 9 billion revenue. Therefore, the first source of pay back is reliable and sufficient. Lentuo Group: established in 1994, is a large professional automobile sales and service company. On Dec. 10, 2010, Lentuo International of Lentuo Group (NYSE: LAS) went public on the NYSE and is the first public automobile sales and service company. Currently, it owns 11 operating standard 4S stores, 8 of them are in Beijing; Tianjin, Guangzhou and Zhejiang each have one store. |

| å‹Ÿé›†è´¦å· | 户 å: 北京金åšæ¶¦æŠ•èµ„ä¸å¿ƒ(有é™åˆä¼™)托管银行: 平安银行股份有é™å…¬å¸åŒ—京æœå¤–支行

è´¦ å·ï¼š 1101 4479 0350 01 募集账å·ä¸‹é¢(打款备注:XXX(认è´äºº)认è´é‡‘åšæ¶¦XXX万元) 注明:填写户åæ—¶”(有é™åˆä¼™)”ä¸è¦æ¼æŽ‰ |

| Account Info: | Name: Beijing Jinborun Investment Center (Limited Partnership)Bank Info: Beijing Chaowai Branch, Ping’an Bank, Co., Ltd.

Please note: (Note: XXX(subscriber) subscribe Jinborun XXX 10 thousand) Note: please do not omit “Limited Partnership” in Name |

We called the respective management companies of both trusts (Gansu Trust and Inthedinghong Investment Co., Ltd.) and confirmed that both trusts were fully subscribed, and that Lentuo Electromechanical had obtained the proceeds from both trust loans by the end of 2013.

The Two Trust Loans do not appear to be disclosed in LAS’s Financial Statements

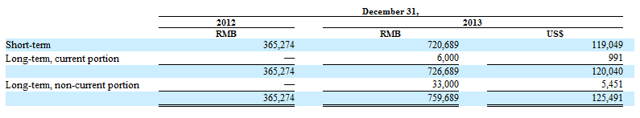

An analysis of the audited balance sheet footnotes disclosed in the 2013 20-F indicates that LAS never consolidated the trust loans. According to footnote 18 on page F-42, short-term and long-term loans at December 31, 2013 consisted of the following:

“The Group’s short-term loans were RMB-denominated loans obtained from banks and other financial institutions with interest rates ranging from 4.83% to 10.25% per annum and 5.60% to 10.20% per annum for the years ended December 31, 2012 and 2013, respectively. The weighted average interest rate on short-term loans outstanding as of December 31, 2012 and 2013 was 7.91% and 7.53% per annum, respectively. The short-term loans are repayable between January 2014 and November 2014. The unused lines of credit for short-term financing amounted to RMB 356,421 and RMB 668,680 (US$110,458) as of December 31, 2012 and December 31, 2013, respectively.”

Inspection of the maturity and interest rates of the short- and long-term loans disclosed in the 20-F compared to the terms of the two trust loans led us to conclude that the 250 million RMB trust loans were not consolidated into LAS’s financials for the following reasons:

1. Loan Maturity

- According to the available data, the trust loans pay interest semiannually and mature in two years. The non-current portion of LAS’s long-term loans disclosed on its balance sheet is only RMB 33 million. Thus the RMB 250 million trust loans maturing in two years do not appear to be included in LAS’s long-term loans disclosed on its balance sheet.

- Furthermore, LAS discloses on p. F-42 that it only has one long-term loan, obtained from Shanghai Pudong Development Bank, totaling RMB 39 million that is repayable over 5 years. This amount is allocated on LAS’s balance sheet as RMB 6 million (long-term, current portion) plus RMB 33 million (long-term, non-current portion.)

2. Interest Rate Analysis:

- The interest rates for LAS’s short-term loans range from 4.83% to 10.25% per annum and 5.60% to 10.20% per annum for the years ended December 31, 2012 and 2013, respectively.

- However, the interest rate range for two trusts is 10.5% to 12%, which is higher than the high end of the interest rates mentioned by LAS under bank borrowing.

Best Case Scenario Could Be Just as Bad for Investors:

Even if the trust loans should not have been consolidated into LAS’s financials, several very serious issues remain:

- According to the trust loan descriptions, all the revenue from LAS’s “4S” dealerships, LAS’s major revenue, appears to be pledged as collateral for the two trust loans. LAS never disclosed this in its SEC filings.

- LAS’s Chairman and largest shareholder, Hetong Guo, provided unlimited several and joint liability personal guarantees to the trusts. In the event of default, Chinese investors in the trusts could sue Hetong Guo and claim Guo’s LAS shares in court. LAS never disclosed this risk factor in its SEC filings.

- Even if the RMB 150 million trust loan is being used to fund a Beijing Audi dealership owned by Lentuo Electromechanical that will not be consolidated into LAS’s financials, it presents new potential competition to LAS’s Beijing Audi “4S” dealership.

- The RMB 100 million trust loan is slated to be used to construct two other “4S” dealerships (FAW-Volkswagen Beijing Yayuncun and FAW-Volkswagen Changchun) that if not consolidated into LAS’s financials could add additional “competition” between Lentuo Electromechanical and LAS. This risk is also not disclosed in SEC filings. We don’t think it’s farfetched to conclude that Lentuo Electromechanical is building dealerships it intends to operate in competition with LAS.

LAS Management is Clearly Aware of its Disclosure Obligations

LAS does disclose numerous aspects of its relationship with Lentuo Electromechanical leading to us question why management chose to omit the details of the trust loans and to conclude that the omission was no simple mistake. Note the following detailed series of disclosures of loans and guarantees by, for, and between Lentuo Electromechanical and various LAS entities from the 20-F:

“…

- In 2011, we engaged Lentuo Electromechanical, a company controlled by Mr. Hetong Guo, our founder, chairman and largest shareholder, as our agent in pursuit of an acquisition opportunity. In connection with this engagement, we provided a temporary funding in the amount of approximately RMB 186.8 million to Lentuo Electromechanical in anticipation of the potential advance payment to the seller by Lentuo Electromechanical on our behalf. When this acquisition opportunity failed to materialize, Lentuo Electromechanical promptly repaid the whole amount to us. In 2011, we also received interest-free short-term loans of approximately RMB 129.9 million from Lentuo Electromechanical in support of our operations, which have been repaid by us.

- In 2012, we received interest-free short-term loans of approximately RMB 47.4 million from Mr. Hetong Guo and Lentuo Electromechanical in support of our operations, which have been repaid by us. Mr. Hetong Guo guaranteed certain of our short-term loans that amounted to RMB 40.0 million as of December 31, 2012. Our dealerships also guaranteed certain short-term loans of their equity owner Lentuo Electromechanical, as required by banks, and the balance of such loans amounted to RMB 200 million as of December 31, 2012.

- In 2013, in anticipation of our business expansion, we paid approximately RMB 302.8 million ($50.0 million) to acquire two properties in Beijing from Lentuo Electromechanical and Beijing Lentuo Tongda Enterprise Management Co., Ltd., both controlled by Mr. Guo, respectively.

- In 2013, we also made new vehicle sales of approximately RMB 45.9 million ($7.6 million) to the minority equity holder of our GAC-Honda dealership. Mr. Guo and Lentuo Electromechanical guaranteed certain of our short-term and long-term loans that amounted to RMB 234.4 million ($38.7 million) as of December 31, 2013. Our dealerships also continue to guarantee certain short-term loans of Lentuo Electromechanical, which amounted to RMB 140.0 million ($23.1 million) as of December 31, 2013.

…”

Where are the guarantees for the two trust loans in these detailed disclosures?

Conclusion

There are several issues surrounding the two trusts loans totaling RMB 250 million we have discussed in this report. In a worst-case scenario, LAS has raised money in China without properly disclosing this event to investors and consolidating the debt into its financials. In a best-case scenario it would seem that LAS’s Chairman pledged his own stake in the U.S. listed company along with the rights to all the revenues of LAS’s Chinese operating companies to potentially fund direct private competition with the U.S. listed company. We thus seriously doubt the accuracy of LAS’s financial statements and disclosures reported in its SEC filings. We urge LAS’s auditor, Ernst & Young Hua Ming LLP, to reconsider its audit opinion of LAS, especially regarding the consolidation and disclosures related to the two RMB 250 million trust loans.

Disclosure: Short LAS

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.