Summary

- Negative investor reaction to VOXX International (VOXX) Q1 financial results has created one of the best risk/reward opportunities we have seen in some time.

- VOXX is about to give GoPro (GPRO) a run for its money and attract a new breed of investors looking for sexy stories.

- We see VOXX shares increasing more than 50% after only conservatively considering the transformative developments taking place at the company.

Sometimes the market gives investors opportunities to take positions in companies that are quietly going through transformative phases while most market participants are focused on recent performance or are distracted by other issues. The GeoTeam has turned its attention to VOXX International (NASDAQ:VOXX). The company:

“…began as Audiovox over 45 years ago and has morphed into a worldwide leader in many automotive and consumer electronics and accessories categories, and now into premium high-end audio. The Company’s brands hold leading market positions across a wide-spectrum of consumer and automotive segments.” (Source: Various Releases)

We think shares of VOXX are poised to rise by more than 50%, giving shrewd investors a unique opportunity to buy the company’s shares before the market discovers undercurrents that should lead to increased margins, improved financial predictability, more investor appeal and ultimately an expansion of depressed valuation multiples. Here are the reasons we are very bullish on VOXX:

- VOXX International is a rare stock that has both a margin of safety on its undervalued core business and the opportunity to participate in the upside once the company launches exciting new technology products in fiscal Q3 2015 (beginning September 1, 2014).

- The company is aggressively expanding outside its core operations of retailing third party products to introducing its own line of products in high-growth areas.

- The market has yet to realize that VOXX has transformed itself from being an international distributor of electrical goods into a manufacturer, technology innovator and strategic investor.

- Under-the-radar catalysts in fiscal Q3 2015 when VOXX launches its 360Fly, a 360 Degree panoramic video camera (“action cameras”), which has been described internationally online as not only a threat to GoPro (NASDAQ:GPRO) but possibly a GoPro killer. The product has received rave reviews at CES.

- Management has stated that the 360Fly alone could drive double digit growth for VOXX as a whole. To put the action cameras potential into perspective, management estimates the market for such products to be over $1 billion, so even if VOXX’s products only capture a 5% – 10% market share the company’s revenues and, no doubt, its market valuation would soar. GoPro currently boasts a market cap of over $5 billion.

- VOXX has other substantial opportunities that could propel it even further in the next two years including:

- myris – an iris scanner which is an ultra-secure method of authenticating identities. myris negates the need for numerous complex online passwords and could revolutionize cyber security for individuals and enterprises.

- Solar powered antenna – VOXX is in talks with AT&T to develop long life solar powered antennas to track shipping containers. This product alone could generate hundreds of millions of dollars of additional revenue for VOXX.

- Management missed the mark with fiscal 2014 (fiscal year ended February 2014) guidance that underestimated retail market weakness leading them to lower guidance and triggering not only a decline in the share price but also a number of class action lawsuits alleging investors had been misled about the company’s outlook. This situation created a distraction and downward pressure on the share price and thus an opportunity for investors to buy into the potential upside with a significant margin of safety.

- Based on its core business alone VOXX is undervalued. It is currently trading at approximately 4x management’s expected EBITDA, 5.5x our expected, both of which very conservatively only include a fraction of potential benefits from 360Fly and myris.

We believe that the current weakness in the stock price of VOXX has created a significant margin of safety for investors and provides them with substantial optionality on the blockbuster products detailed later in this report. Our price target of $15/share only conservatively takes into account the transformative events taking place at VOXX, while it looks like analysts have only minimally baked them into their assumptions.

Why Is VOXX Trading So Cheaply?

Some investors may choose to view VOXX as old news and a boring play targeting low margin product categories heavily dependent on a cyclical automotive industry. In fact, over 50% of VOXX sales come from the auto industry.

VOXX is currently trading at less than $9.40 per share, giving it a market capitalization of $230 million. Management has guided EBITDA of $54 million to $55 million for FY2015 which suggests that VOXX is currently trading at only 5.4x forward EV/EBITDA and this does not consider the potential upsides of the new technologies and stronger US economy in the second half of calendar 2014. Additionally, VOXX currently trades well below its competitors on a current and forward EV/EBITDA multiple and price to tangible book value.

Peer Group Comparison* as of July 29, 2014

| Peer Group | Ticker | LTM EV/EBITDA | NTM TEV/Forward EBITDA | Price/Tangible Book Value |

| Dolby Labs | (NYSE:DLB) | 11.6x | 10.5x | 3.4x |

| Universal Electronics | (NASDAQ:UEIC) | 13.1x | 10.6x | 3.2x |

| Harman International Industries | (NYSE:HAR) | 17.7x | 11.6x | 5.3x |

| DTS Inc | (NASDAQ:DTSI) | 12.6x | 7.7x | 3.9x |

| GoPro | GPRO | 55.0x | 26.0x | 16.2x |

| VOXX International | VOXX | 7.8x | 5.4x | 1.6x |

* Based on Bloomberg

Reporting Consistently Strong Financial Results Has Also Been An Issue

VOXX was trading as high as $16.99 per share in January 2014 but has since fallen to less than $10 after it missed its Q3 and Q4 2014 guidance (ended November 30, 2013 and February 28, 2014, respectively). In short, investors perceived that VOXX management overpromised and under delivered. Management attributed the missed guidance to:

- Phasing out satellite radios which had been 15% of automotive revenue.

- VOXX’s Venezuela operations were severely affected by the local political and economic environment.

- A generally weak retail environment in Q4 2014.

- Exiting lower margin products.

VOXX also conservatively took a large non-cash impairment charge to reflect weaker than expected sales.

VOXX’s investor relations conveyed that management had not adequately taken the weak retail environment into account when providing guidance the last two years, while keeping expectations too high. We further understand that they believe they have rectified this issue and FY 2015 guidance has been given on a more conservative basis which could leave room for an upside surprise, particularly if the US economy improves as many expect in the second half of the year. In the Q1 2015 (May 31, 2014) earnings call, VOXX management reiterated unchanged guidance.

Ultimately, we believe that VOXX is a company in an important transformative phase as it exits low margin products and is on the verge of launching exciting new products that will change the face of the company and its prospects. Most investors, however, are looking in the rearview mirror and missing what is just ahead. Once investors realize that one of its many new products rivals those of the high profile and high flying GoPro, we think sentiment will do a rapid 180.

Revolutionary New Blockbuster Products And Other Catalysts For Growth

360 Fly

VOXX made a strategic investment in EyeSee360, the creator of the 360Fly, and signed an exclusive distribution agreement with the company. The 360Fly has been described online as a threat to GoPro (ref. TheGentlemansJournal, DesignYouTrust)and even as a potential GoPro Killer. Most market participants are too focused on a disappointing fiscal 2014 and the related class action lawsuits and have failed to account for the huge potential impact the 360Fly action camera will have on VOXX’s operating results, particularly beginning in fiscal 2016 (beginning March 2015).

The 360Fly is aimed at a much wider audience than the adventure-focused market targeted by GoPro. As per the film on its website, by filming 360 degrees, the 360Fly it will “capture all of life’s moments as they happen, missing nothing”. Its users will never miss a moment of their experience whether skiing with friends or a child’s birthday party and is “no longer biased by the individual taking the video”. The camera has other commercial applications in the security industry, sport broadcasting and others.

The market clearly has big expectations for the action camera market. This is demonstrated by GoPro’s market capitalization of over $5 billion. We believe that once the 360Fly is launched in fiscal Q3 (September) and begins to gain traction investors will view VOXX through a different lens and mark the stock’s value up considerably. Given VOXX’s current market cap of just $230 million is well supported by its core business investors are getting a no cost option to participate in the upside 360Fly offers.

VOXX will look to leverage both its strong relationships with numerous large retailers and to open new sales channels for the company particularly in sporting goods stores. Its strong presence and presentation in these retailers should allow 360Fly to gain market traction quickly. We understand that one major retailer wanted to put the 360Fly in all of its stores but VOXX decided on a more controlled rollout so as to not flood the stores with product and allow time to make course corrections, if necessary, as the product becomes available in more and more stores. The 360Fly is not expected to have a meaningful impact on sales and profitability until FY 2016 (March 2015). The slide below from a recent investor presentation list some of the impressive retailers that VOXX has strong relationships with.

Myris – “Prepare To Kiss Your Passwords Goodbye“

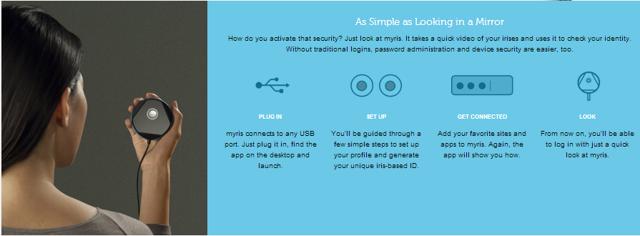

It’s not just the 360Fly action cameras that are about to hit the market, VOXX also invested in eyeLock, the developer of myris, which is about to revolutionize internet security and become a potential blockbuster product. myris is an iris scanning program that will authenticate a user by scanning both of his/her eyes and will replace the need for customers to remember numerous complex passwords. myris was a CES Editor s Choice Award winnerand recently won the prestigious reddot design award.

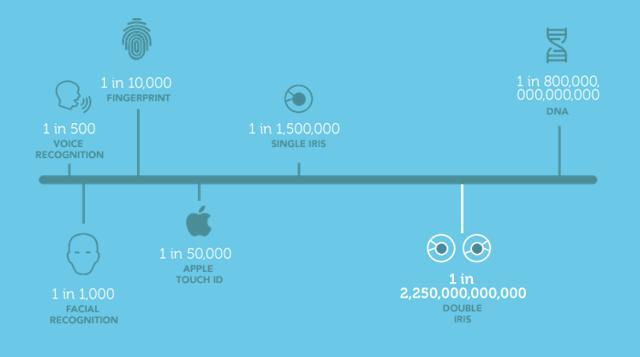

myris has incredibly attractive prospects because it is ultra-secure. By scanning both eyes there is a 1 in 2.25 trillion chance of generating a false positive and its intelligent sensors will only accept a “live” eye and not a photograph or movie. With the increasingly dangerous threat of hacking and the frightening specter of stolen passwords, cyber security is becoming ever more important and correspondingly a more lucrative market, and myris could be the most secure answer available.

The product will not only be marketed to retail customers, but VOXX is currently setting up a sales team focused on enterprise clients (financial institutions and hospitals have shown strong interests in the product) which should be significantly more lucrative. VOXX has also received unexpected interest from several security companies that specialize in residential and commercial perimeter security, which demonstrates how wide the market could be for myris. The product is expected to be launched in Q3 2015 (September 2014) but it will take time to set up large enterprise customers and is not expected to have a meaningful impact until FY2016 (beginning February 2015).

Solar Powered Antenna

VOXX has been working with both AT&T and Maersk, producing intelligent antennas used for asset tracking on all Maersk’s refrigerated containers worldwide. VOXX is working with AT&T and expanding its asset tracking offerings with a solar-powered antenna boasting a minimum ten year life.Management has stated that this new line of business could be explosive and add hundreds of millions of dollars in revenue longer term.

Car Connection

The car connection product monitors vehicle performance and safety. Users of the product are able to receive car insurance discounts, with good drivers potentially saving hundreds of dollars in insurance premiums. The product is newly available in Wal-Mart and is already available at Sears, Pep Boys and AT&T and in over 20,000 stores in the USA. Management does not expect a big impact in FY2015 but there should be solid growth potential over the next few years.

Shareholder Friendly Management

Shareholders are also benefiting from a management team that is focused on maximizing shareholder returns. We understand from VOXX’s investor relations team that management has been looking for potential acquisitions but have refused to overpay. As such, they have concentrated on improving the balance sheet by paying down debt until they find an attractive prospect. Long term debt was reduced from $149 million to $103 million in FY 2014 and then to $84 million in Q1 2015. Management stated in the Q1 2015 earnings call that if there are no acquisitions or fixed cost saving expenditures then they expect to reduce debt to less than $40 million in FY 2015, assuming free cash flow in excess of $40 million can be achieved.

VOXX’s founder and chairman of the Board, John Shalam, retains a 16.99% interest in the company which demonstrates that VOXX’s leadership has ‘skin in the game’.

2014 Hiccup, But Not End Of The World

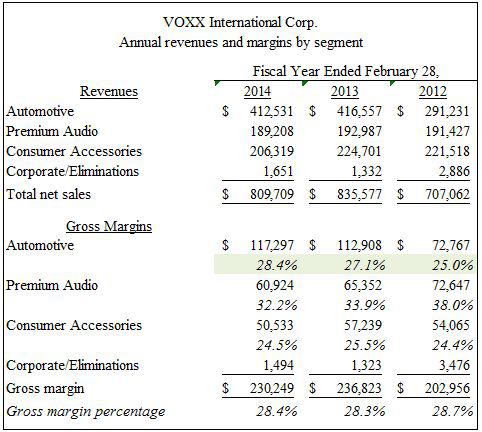

Let’s take a look at VOXX’s recent history. The Company’s financial performance for the fiscal year ended February 28, 2014 was uninspiring although gross margins for the automotive segment notably improved:

Adding to the company’s dull image and investor angst were a number of class action lawsuits initiated against the company and certain officers and directors alleging they misrepresented the company’s outlook for fiscal 2014. In our opinion the lawsuits are not going to materially impact VOXX, and management has done a good job explaining why fiscal 2014 financial results were disappointing relative to expectations. You can bet, though, that management will more likely err on the side of being too conservative with its guidance in the future. With that in mind management has reiterated its fiscal 2015 guidance and allowed for upside if second half retail sales are stronger than generally anticipated.

VOXX Has Strong Legacy Business Segements That Should See Rebound

VOXX has historically been an international distributor in the automotive, audio and consumer accessory markets; however, over the last couple of years it has expanded into manufacturing its own products and buying into companies with new exciting technologies. Following is an overview of VOXX’s business segments.

Automotive

VOXX’s automotive segment accounts for over 50% of revenues; 70% of these revenues is OEM related and mainly from its Hirschmann subsidiary which has been working with Daimler, Audi, Volkswagen and BMW for over 40 years. Hirschman provides antennas and digital tuners and is developing new technologies such as eHUB and the mobile multi-tuner which address the increased use of multi Wi-Fi devices. These relationships have good visibility for three to five years out.

The other 30% of revenues is from rear seat entertainment systems and remote start systems which are generally “add-ons” at the dealer/port level. These systems are becoming more common in SUVs, trucks and minivans for which sales have been growing steadily in 2014.

Premium Audio

Approximately 87% of premium audio revenue comes from their Klipsch brand. The brand develops and sells high-end surround sound and home theatre systems, sound bars, headphones and professional speakers. The brand has not performed as well as hoped so VOXX took an impairment charge in fiscal 2014 but management expects only a small decline in this business during fiscal 2015. The main challenges for VOXX’s audio business have been a saturated headphone market. Management has responded by exiting older inventory lines and focusing on higher margin products. Margin enhancements from new audio products are expected to impact Q3 (November 30, 2014) and Q4 (February 28, 2015) and have boosted advertising and sponsorship for the brand.

Consumer Accessories

VOXX has been transitioning from old technology such as mp3 players, camcorders and portable DVD players into Bluetooth speakers, indoor/outdoor speakers, portable audio and power charging units. They have also focused on diversifying the retailers they use, including moving into non-traditional ones such as Bed Bath & Beyond, True Value and The Home Depot.

This segment’s core products are expected to remain stable with future growth to be driven by the 360Fly action cameras and myris.

Valuation

Based on our conservative 8x 2017 EBITDA estimate, we value VOXX at $15 per share which is a 60% premium to its current market price. This calculation assumes that there is minimal growth in the core business with revenue growing at just 1.2% CAGR between 2014 and 2017. It also assumes no benefit from the solar powered antenna, growth in Car Connection or any increased business from the Mexican transition to digital. The model allows for only limited success of the 360Fly and myris to the extent that they amount to only 7.5% of total revenue by 2017, well below their potential impact. We also estimate that VOXX will eventually achieve gross margins of 29.5% which is below management’s expectations of over 30%.

It is worth reiterating that this valuation is based on conservative assumptions whereas its new product and other growth catalysts could prove to be explosive to VOXX’s valuation. The 360Fly on its own could cause a higher rerating of the stock in light of the market’s $5 billion valuation of GoPro, even if VOXX just captured 5% to 10% of GoPro’s market share.

With very conservative estimates valuing VOXX at a 60% premium to its current price and several exciting and foreseeable catalysts ahead, VOXX, at current levels, looks very cheap indeed. Furthermore, VOXX’s valuation multiples should expand as it continues to reduce its debt burden.

Conclusion

Investors have a low risk opportunity to participate in some explosive and sexy markets while having the comfort of knowing that at the very least they have invested in a company with deep roots and market presence with its legacy business.

VOXX International is a great story at a great price.