Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

For real time analysis of our coverage universe, including new high conviction ideas and additions to our model portfolios, if you are not already a premium subscriber, consider supporting our movement by becoming a premium member today. GeoInvesting, 16 years and counting!

Highlights

|

After a little bit of a hiatus, in 2024, we added two stocks to our Run to One Model Portfolio.

Our Run to One Portfolio looks at sub-$1 stocks for their long-term potential as multi-baggers. Many of these stocks have their challenges—that’s why they trade under $1—but we’re on the lookout for real companies with real revenues and solid management, not pump-and-dump schemes.

Now, almost 11 years later, the stats across the 49 stocks in the Run to $1 Portfolio have been quite impressive, showing that long-term patience pays off.

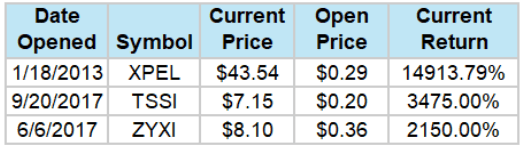

Tss, Inc. (OTCQB:TSSI) Actually began its journey on GeoInvesting as an inclusion in our Run to One Model Portfolio launched in January 2013. With a current return of 3475%, it’s now the second best performing stock in this model portfolio, behind Xpel, Inc. (NASDAQ:XPEL).

If $1 was invested in each of the stocks at the time of their inclusion in the model portfolio, it’d be worth $291 today. To put in a little better perspective for value creation, now say that $1000 instead of $1 was your buy decision. That equates to $291,000 for a total return of 493% or an average return of 45% over approximately 11 years. That beats Peter Lynch’s average return of 29% per year during the 13 years ( 1977 to 1990) that he managed the Fidelity Magellan fund.

Quality exists, even in stocks under a dollar

These stats prove the negative stereotype that “all penny stocks are junk stocks” is not based on facts.

Many of our big Run To $1 winners have grown revenue to substantial levels.

- KRMD revenue from $10 million in 2014 to $30 million by 2023 (and from $1 million when I first bought the stock around) 2007/2008

- ZYXI grew revenue from $11 million in 2014 to $184 million by 2023

- XPEL grew revenue from $30 million in 2014 to $396 million by 2023

My point is, as investors, there’s more alpha in referencing facts than in the negative rhetoric the financial media throws at us every day.

While there’s certainly a lot of junk in penny stock land, the reality is that the stock market in general, across all price ranges, contains plenty of low-quality companies.

We are not blind to this fact. That’s why, out of the approximately 10,000 microcap stocks in North America, we believe fewer than 2,000 are even worth considering under our criteria for quality or high-probability turnaround potential. Many of these will trade under one dollar. And that’s where the stocks in our Run To $1 model portfolio originate from.

Why am I bringing up the Run to One Model Portfolio today?

California Nanotechnologies exceeds the $1.00 mark

Last week marked a significant milestone for California Nanotechnologies Cor (OOTC:CANOF) (CNO.V), which crossed the $1 mark ($1.26), the 27th Run to One stock to do so. We added CANOF to the portfolio on July 27, 2024 at a price of $0.37. In short, the company creates and shapes solid products for its customers using nanomaterials – for example, different types of smaller metal products

In the following video clip from our July 11, 2024 Fireside Chat, the CEO provides an overview of what the company does.

It’s also a great time to point out that another stock, that we added to the model portfolio this year, is also gaining momentum.

It’s also a great time to point out that another stock we added to the model portfolio this year is gaining momentum…

We believe it has strong potential to join the ranks of our Run to One success stories.

Newest stock added to Run to $1.00 Portfolio in 2024

This stock is currently trading at a price-to-earnings (PE) ratio of only 5.8x, largely because the market has misunderstood its business model and future direction. The company is aggressively buying back shares, is profitable, and is moving into new markets that should diversify its risks, improve its business profile, and contribute to expanding its P/E multiple.

Back to TSSI and our Q3 EPS expectations

Going back to TSSI, I’m in the process of laying out some thoughts regarding the company’s expected financial performance for Q3 2024.

JOIN TO NOTIFIED OF GEO’s NEW TSSI FINANCIAL ANALYSIS

Below is part of the transcript from our fireside chat where the CEO weighs in on the data center industry ecosystem and TSSI’s role within it:

Maj Soueidan, Co-founder GeoInvesting

…help us understand where modular fits in this whole thing a little better. That would be helpful.Darryll Dewan, CEO TSSI

Okay, so let’s step back. We like doing complex builds. You know, if you’re going to do onesie and a twozie projects, and you’ve got older technology, that’s not really our focus. We want to take on the complex builds, especially around what we call the HPC (High Performance Computing) segment, where we’ve built up expertise.What’s really kicked into gear now is AI. Anybody in this space knows that AI is transformational. This is huge stuff, and what we’re seeing right now is the demand from large companies that are scrambling to get GPUs and power to build out their models as fast as they can. We’re facilitating that demand with our partner.

A server today, specifically an AI server that’s air-cooled, weighs around 250 pounds and costs a couple hundred thousand dollars each. You put eight of them in a rack, with some cabling and fiber, tuck that in the back of a truck, and that’s a lot of valuable assets being transported down the freeway. The game has changed in terms of the complexity and scale of the builds.”

At TSSI, we’re helping these companies by taking on the complex integration of their technology and delivering high-quality rack solutions. They prefer to have these systems built offsite and delivered fully integrated, so they’re ready to go. This is where we fit into the data center ecosystem — we make sure these high-end systems are built and delivered efficiently, saving them time and effort on site.

By the way, stay tuned for our next monthly open forum invitiation! At the start of each month, we host a live video presentation to review the past 30 days of activity across our coverage universe. We’ll discuss key highlights such as standout earnings reports, new stocks we’re researching, and—most importantly—our NEW endeavor, a spotlight of our favorite stock of the month. For your convenience, all GeoInvesting Open Forums are archived and available for viewing anytime.

The remainder of this post is only visible to paid subscribers of GeoInvesting.

Please don’t forget to consider supporting GeoInvesting with a premium subscription if you enjoyed this content, and want to see more of it. Complete this short survey to let us know you’re engaged and interested.

200+ multibaggers and counting

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)