After logging annual losses since 2012, Tsakos Energy Navigation Limited (TNP) turned in a profit in 2014, marking what GeoInvesting believes to be the beginning of positive business trends that could drive the company to continue to grow. Even as the company was reporting losses in prior years it was growing revenues at a nice clip. Much of this growth can be attributed several to factors. In particular:

After logging annual losses since 2012, Tsakos Energy Navigation Limited (TNP) turned in a profit in 2014, marking what GeoInvesting believes to be the beginning of positive business trends that could drive the company to continue to grow. Even as the company was reporting losses in prior years it was growing revenues at a nice clip. Much of this growth can be attributed several to factors. In particular:

- Lower energy prices have resulted in increased demand for oil and natural gas, as implied by TNP management comments.

- The company is experiencing better margins due to the positive effect of lower oil prices, translating into more favorable expense to fuel its ships.

- A tight supply of tanker ships is positively affecting the rates that TNP can charge its customers.

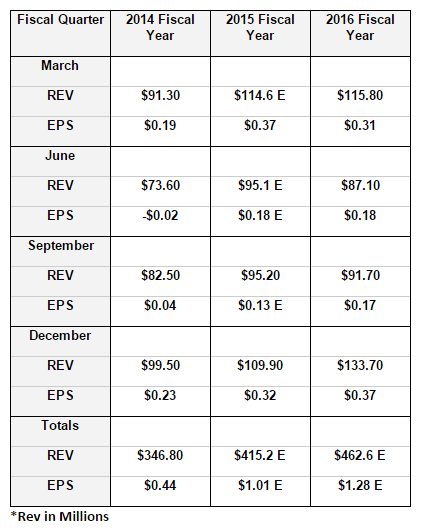

Analyst estimates indicate the company will experience solid top and bottom line growth for the next 4 quarters and next two years.

Tsakos Lays Out Positive Business Trends

The following passage from the company’s Q4 2014 financial press release lays out the positive business trends.

“It is a great pleasure to report significant profitability in 2014. It is also encouraging that 2015 has started with very strong rates. The market fundamentals including the low cost of oil and the negative fleet growth is reassuring for, at least, the medium term prospects of our industry, ” stated Mr. Nikolas P. Tsakos, President and CEO of TEN. “Through our counter cyclical investment strategy and flexible chartering policy, TEN has become a prime beneficiary of the rewards the tanker markets are offering. We strongly believe that the Company’s sound fundamentals and prospects, particularly in the strong market we are currently navigating, will be soon reflected in our share price and further enhance our shareholders value,” Mr. Tsakos concluded.

Following on the impressive take-off in the latter part of the third quarter of 2014, crude tanker rates continued to surge through the fourth quarter and first quarter of 2015 and remain firm fueled by low oil prices that supported a boost in consumer demand around the world that has led to increased imports. In addition, the depressed price of crude has generated a contango effect, which removed a meaningful amount of tonnage from the market while the continuation of slow steaming, which despite a small uptick in average speeds, avoided additional capacity being added to the available “for charter” fleet. All these factors, coupled with the limited growth of the fleet over the last 12 months (indeed some tanker categories could even experience negative fleet capacity growth this year) and the manageable order book provide TEN with utmost confidence for solid tanker markets over the medium term. This realignment in market fundamentals has created a solid underlying strength in the overall crude and product tanker markets, especially evident in spot fixtures, and as a result they have allowed TEN, with 73% of remaining 2015 available days on spot or spot related contracts, to enjoy significant benefits from operating under such market related and flexible charters.”

GeoInvesting thinks TNP could trade trade at 10X 2015 EV to EBITDA or $14.91.

Caveats

- GeoInvesting has not performed an analysis on the age of the company’s vessel fleet (this could impact the it’s need to raise capital).

- The company’s high reliance on debt financing would add an element of risk if business conditions turned negative.

- Marine transportation companies can surprise the market with the announcement of diluted equity offerings out of the blue.

To stay ahead of the market with GeoInvesting arbitrage and learn about investment ideas not yet digested by the market, Sign up now for More Research and Insight