Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

For real time analysis of our coverage universe, including new high conviction ideas and additions to our model portfolios, if you are not already a premium subscriber, consider supporting our movement by becoming a premium member today. GeoInvesting, 16 years and counting!

Today, I want to address a comment made by a personality on X with a large following and a subscription service of his own, albeit not in investing. I like to give credence to the fact that investing in high-quality microcaps can produce outsized returns, and in doing so, I often cite some statistics that support my suppositions, especially when it comes to setting the record straight on negative stereotypes surrounding microcaps.

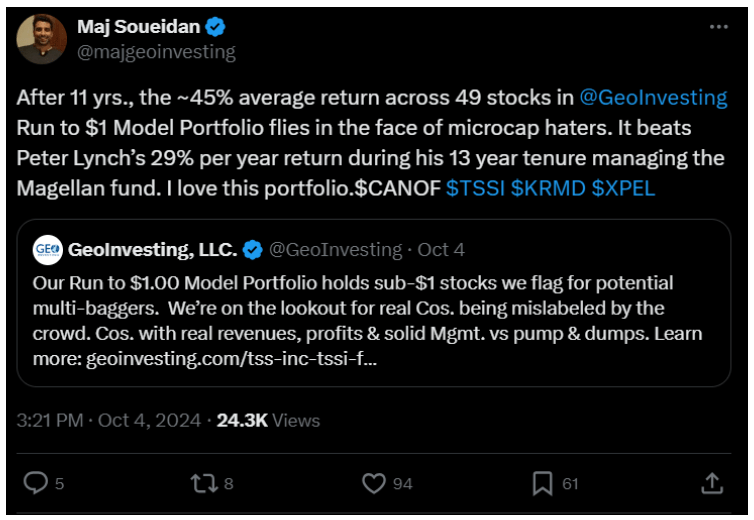

His comment was in response to my own stat-based tweet that did just that. A popular Model Portfolio that we make available on our premium portal, the Run To $1 Model Portfolio (R21), has caught some attention lately due to one of our long-covered stocks, Tss, Inc. (OTCQB:TSSI), comfortably surpassing the one-dollar-mark (with plenty of volume, I might add). Since the stock’s addition to the portfolio, it is up over 2200% as of the close on Friday. And then, California Nanotechnologies Cor (OOTC:CANOF) (CNO.V) recently joined TSSI in this “Hall of Fame,” with a return of 182.69% since being added to the R21 on July 10, 2024.

In visiting the performance of the portfolio, I thought it a suitable time to put out what I surmised might be a well-received tweet for those that agree with my assessment that even though sub-$1 stocks can catch some flack, if you pick the right ones, you can certainly win out in the long run.

Plus, it’s tough to argue against Peter Lynch, no matter your beliefs when it comes to smaller capitalized stocks. He grew the Magellan Fund from $19 million to $14 billion, investing in companies like Toys R Us and Gap, Inc. (the) (NYSE:GAP) when they were microcaps. Lynch went on to achieve average returns of 29% per year over the course of 13 years (1977-1990).

Whether or not you want to shrug off or appreciate R21’s average return of 45% over an 11-year span is up to you. You either subscribe to the concept of making smart money or you don’t, but the reply that caught my attention was a little non sequitur and frankly slightly short-sighted given the nature of how this individual makes money. A little more on that later. Here was his response:

…let’s not ignore the bits of confirmation bias that followed from a few people that also likely gave little thought as to why we do what we do.

Believe it or not, there is a bit to unpack from this small exchange, but I’ll try to keep my rebuttal bite-sized. All in all, I’m glad this was brought up since it tends to be an elephant in the room, and I hope it reinforces the decision that our premium subscribers made to join GeoInvesting, since we started offering a premium subscription in 2014, and helps clarify our purpose for those still considering the platform for the go-to place for organic microcap research, sprinkled with contributor stock pitches.

P.D. might also want to reference our short-selling work uncovering fraud and pump-and-dump schemes and the risk we took placing real money bearish bets when no one believed us. Read more about this period of GeoInvesting in a documentary about this work in the China Hustle and in “The Evolution Of U.S. Listed China Based Frauds.”

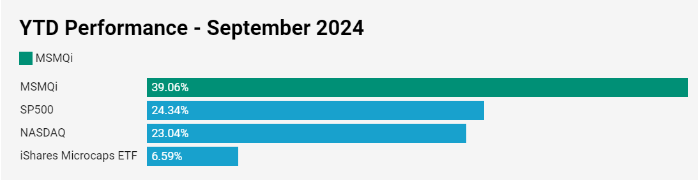

By the way, before I start unpacking the bulk of P.D.’s comments, I can admit that we are in agreement on one thing—a diversified portfolio strategy can mitigate some of the risks that are associated with investing in microcaps. This proof can be seen by the return of the Microcap Quality Index (MSMqi). Stocks that meet certain quality factors are added to the MSMqi when they hit certain multibagger markers. The stats:

- 70% of stocks in the index are up.

- 52% reached a return of at least 50%.

- 77% reached a return of at least 20%.

- 35% have reached a multi-bagger return of at least 100% & 1,000%.

- The average time to multi-bag has been about 10 months.

- 7% have been acquired.

And don’t even get me going on our Infrastructure screen, which includes 25 stocks at an average current return of 352.93%, but we should mention that 5 of those stocks were acquired at an average premium of 192.5% over the prices we identified them.

If these stats are not enough, 10 out of our first 11 Buy on Pullback Model (BOP) Portfolios beat the major stock indexes, while they were open. BOP 12 (includes 8 stocks), launched on September 6, is already beating the indexes, topping the NASDAQ by 9.87% (22.84% vs. 12.97%). Our BOPSs include stocks trading on weakness due to investor fear and panic.

After taking all this in, those that question our fee based approach might conclude that we are not charging near enough for our subscription investment platform—but not to worry—changes are coming.

We Do Own the Stocks, But Can’t Own Them All

The assumption that we don’t “eat our own cooking” is misguided. We do own many of the stocks we cover, but it’s not feasible to own every single one, especially when you have limited funds. That being said, I currently own all of the open positions in the R21 and all 8 stocks in our new high conviction Open Forum Focus Model Portfolio. And one more thing. I do use leverage. So, let’s put P.D.’s unresearched comments to bed.

Well, I do not own all 99 stocks in the MSMqi or all the stocks in the GeoInvesting Infrastructure screen….yet! So, congrats P.D., you got me there.

Sharing Knowledge and Helping People Achieve Goals

Just like you, our mission goes beyond personal gain. We get immense satisfaction from helping others achieve their financial goals. Through our service, we aim to provide opportunities that many might not have discovered on their own. It’s about giving back to a community of like-minded individuals. Helping others grow is part of what drives us. We’ve received over 100’s of unsolicited testimonials over the last 16 years from investors and CEOs. You can see some of them here, but here is one of our favorites, from the CEO of Spok Holdings, Inc. (NASDAQ:SPOK).

Building a Collaborative Community

Building a community means we’re part of something bigger. Through collaboration, some of our best stock ideas have come from our subscribers. Investing isn’t just a one-way street—it’s about contributing, learning, and getting feedback from a premium group of people who share a passion for the same thing. In fact, one of our early multibaggers came from an incredibly talented investor in our network, where this special situation stock warrant play rose over 3600% in several weeks. P.D. would have been proud of us, since our subscription was free back then.

So far, the 17 stock pitches from our contributors in 2024 are up an average of 27.9%.

Reputation Gains Access to Management

Being visible, reputable, and influential in the microcap space gets us (and in turn, our subscribers) access to CEOs, management teams, and other insiders that others can’t reach. This “Board Room” access is invaluable. If we didn’t run this service, those doors might not open as easily for us and our followers. Here is a complimentary look at some of these Skull Session events, which also includes conversations with some of the best microcap investors and industry experts.

Capitalism and Charging for Expertise

Why do investment institutions charge fees? Why do financial planners? Is P.D. suggesting there shouldn’t be a monetary exchange for expertise? Charging for a service doesn’t undermine the value of what we’re offering; Running a subscription service helps sustain the research we do, which benefits both our subscribers and ourselves, especially in market downturns.

So yes, like P.D., I am seeking supplemental income.

Engaging with Followers and Building Dialogue

P.D., you’ve likely engaged with other professionals in your field—so do we. We connect with people or provide value beyond subscriptions. We often have conversations with both subscribers and non-subscribers, free of charge, just to help people. If you want, let’s have a phone or Zoom call. I’m open to having that dialogue.

Education as Part of the Service

We don’t just pick stocks; we educate. Education is vital in the investment world, and we’re proud to provide insights that empower others to make informed decisions. Does P.D. believe universities or institutions shouldn’t charge for this? Education has value, and charging for it allows us to maintain a high standard of service. That being said, most of our over 1500 articles we have published over 16 years are not behind a paywall, including one of our most popular, “So You Want To Be Full-Time Investor? Follow these 10 Steps.”

High-Quality Research Takes Time and Resources

When you see the returns we’ve achieved, it’s easy to focus on the numbers, but behind each of those picks is countless hours of work. High-quality research isn’t something you can automate or shortcut. It involves:

- Financial Analysis: Digging into quarterly reports, balance sheets, income statements, and cash flow to assess a company’s financial health.

- Industry Trends: Understanding the broader industry trends that may affect a stock’s future performance.

- Management Interviews: Speaking with executives and insiders to gain deeper insights into the company’s strategy, challenges, and opportunities.

- Monitoring Ongoing Developments: Keeping up with news, regulatory changes, and company updates to ensure our recommendations remain relevant and up-to-date.

- Due Diligence: Vetting companies beyond just the numbers—looking at competitive positioning, potential risks, and even the people behind the company. This also includes on the ground site visits.

All of this takes time, expertise, and often requires access to resources that aren’t readily available to the general public. By charging for the service, we can fund this in-depth research process and deliver it to our subscribers in a way that saves them time and offers a high level of confidence in the information they receive. This isn’t just about “good investors don’t sell investment advice”. Honestly, if you do know anything about GeoInvesting, we clearly say we are not advisors, nor do we give recommendations. We’re also not shy to explain when we’ve erred and taken our lumps.

Now, P.D., back to what you do. Can you give me a reason why you wouldn’t just take your own advice and get in shape in a vacuum, without charging people? You are probably good at what you do, but at the end of the day, how much do you really care about your subscribers, and how good does it make you feel to better their quality of life?

Go to our latest Monthly Forum to get a glimpse of how engaged we are with our investor community. But you will have to be a Premium Member to view the event.

|

At the beginning of every month, We hold a live video session, with a slide presentation, where we over what happened in our entire coverage universe over the previous 30 days. We discuss everything from the best earnings reports, new stocks we’re researching and most importantly, our NEW feature, where we highlight our favorite stock of the month. GeoInvesting Open Forums are archived for your convenience. Furthermore, the slide presentations, which have important information, as well as links that you may want to reference for your own research purposes, are made available to download., |

~ Maj Soueidan

The Remainder Of This Premium Weekly Review Is Only Visible To Paid Subscribers Of GeoInvesting. To access our expanded coverage on Select Microcap stocks & More, Subscribe below.

Please don’t forget to consider supporting GeoInvesting with a premium subscription if you enjoyed this content, and want to see more of it. Complete this short survey to let us know you’re engaged and interested.

200+ multibaggers and counting

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)

steven waldman

Let’s not forget the investor conference work you do which also benefits your subscribers.

Maj Soueidan

Hi Steven, as always, thanks for your support. Those Skull Session chats are one of the favorite things I like doing at Geoinvesting. Stay tuned this week for a surprise special event 🤐