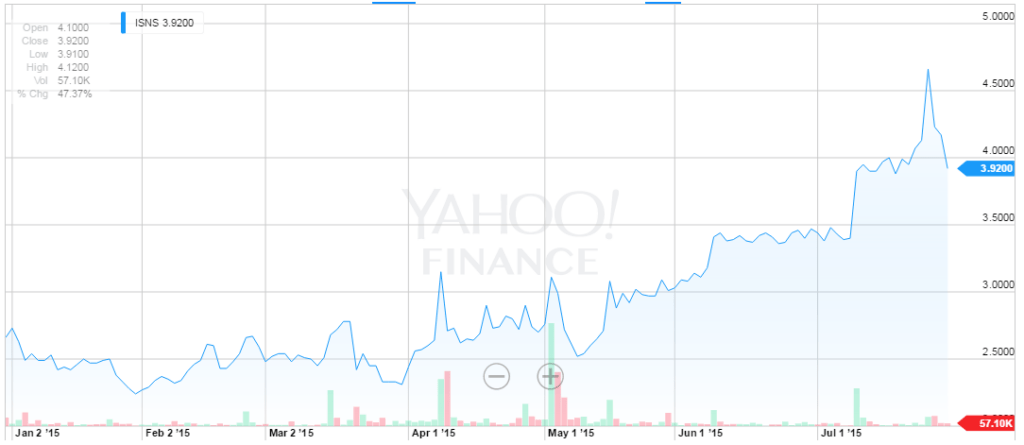

GeoInvesting was once bearish on Image Sensing Systems Inc. (NASDAQ:ISNS) due to the irrational move the stock made when the body worn camera hype lifted a broad basket of stocks with video/security business segments. Shares moved from $2.38 to $9.94 in 6 days. We published our short thesis article on September 4, 2014 when the stock was trading ~$8.00. Now, after the company reported strong bottom line Q2 2015 results and offered some commentary indicating that a turn-around process may be in place, we are taking a closer look at the company to determine if there are fundamental reasons to now be bullish. From a technical perspective, the year-to-date chart looks impressive.

ISNS Strong Bottom Line Q2 Results

ISNS reported strong bottom line second quarter 2015 results:

- Sales of $5.2 million vs $5.9 million in the prior year

- Non-GAAP EPS of $0.09 vs loss of $0.20 in the prior year

Quotes from management included:

“During the second quarter, we continued to see the results of the actions we’ve taken over the past few quarters to position ourselves for profitable growth,” said Dale Parker, Image Sensing Systems’ interim chief executive officer. “Margin levels improved significantly in the second quarter, and we believe that these levels are sustainable going forward. We have been successful in building scale into our operating platform, and we were particularly pleased to see an adjusted operating profit in the second quarter, reversing prior period trends. We continue to see our break-even point improve and are confident that we will return the company to historical profitability levels.”

We do not have a position in the stock but will continue our due diligence and determine what valuation metrics to apply to shares.

Our premium members always get it first. To take advantage of our information arbitrage ideas, full research reports, action alerts and information not yet digested by the market. Sign up now for More Research and Insight.