If you are a premium member make sure you sign in to see All the exclusive content In This Issue.

This week’s Microcap Information Arbitrage Weekly Wrap-Up is ready — spotlighting key moves, missed signals, and overlooked opportunities in our 1,500+ coverage universe built since 2009.

—

Summary Of What’s In This Weekly Wrap-Up

This week included two research-driven updates tied to defense exposure and emerging industry trends we’re watching in the drone space. Velo3d, Inc. (NASDAQ:VELO) announced a sizable government contract but also disclosed a private placement, while Optex Systems Holdings, Inc. (NASDAQ:OPXS) gave us early indications of exposure to drone-related defense trends.

Also, the MS Microcaps Press Release research tool received a big update. You can now create watchlists for stocks you own or are tracking, as well as set up filters to bring in new ideas. I can tell you that I’ve started using these features, and they are helping me tremendously to catch and respond to new information more quickly, compared to manually searching through press releases. To close out the week, we’ll highlight an article focused on how sprinkling small starter position bets can become some of your biggest winners, over time.

Here’s a closer look at all of this:

—

Earnings and Research Updates

Velo3d, Inc. (NASDAQ:VELO) announced a major win this week: a $32.6 million contract with the Department of War’s Defense Innovation Unit under “Project FORGE.” The goal is to resolve key manufacturing bottlenecks in a major U.S. weapons program using VELO’s additive manufacturing platform. The contract includes collaboration with the Navy and a prime contractor, and positions the company to potentially roll out the largest format Laser Powder Bed Fusion (LPBF) printing system in the country.

In the same breath, VELO lowered its full-year 2025 revenue guidance to $45–$55 million from its prior range of $50–$60 million, citing disruption caused by the Q4 government shutdown and subsequent recovery.

Management took advantage of the 94% rise in the stock over the last two weeks to close a $30 million private placement, with shares priced at $8.25, well below the highs of around $15.

You may have heard me get bent out of shape when companies raise money that don’t really need to raise money. However, in this case, I think it was the right move, given that VELO is still losing money and has a nice contract pipeline that needs to be filled. Hopefully, this will be the company‘s last raise needed to get to profitability sometime in 2026.

Our view? This is a meaningful step forward. The contract alone reflects more than half a year’s worth of revenue based on recent performance. But the lack of clarity around the contract’s timeline and knowledge that these types of contracts are more preliminary in nature before full-scale contracts are awarded have to be considered.

In other news, it’s been a year since we identified Optex Systems Holdings, Inc. (NASDAQ:OPXS) as a potential stealth beneficiary of the growing defense drone market. Now, we finally got our first public clue: via a LinkedIn post from the company itself, hinting at involvement in drone optics.

This may seem like a small data point, but it’s the first explicit link between OPXS and drone-related defense systems, and supports the underlying theme we’ve been tracking. With defense budgets favoring unmanned systems and autonomous targeting, this could be a tailwind that’s just beginning to show up in public disclosures. This is especially relevant since the US government just made an announcement that drone manufacturing has to be done in the US and not outsourced.

Don’t miss the latest microcap research Updates. Subscribe today.

That said, management has already warned that the first half of 2026 could be soft due to lingering shutdown effects, so we’re tempering short-term expectations. But for longer-term positioning, this is an important development. Here’s a related PodClip if you want to listen.

A key enhancement was made to the InfoArb Monitor this week: users can now build theme-based watchlists (like catalysts, turnarounds, buybacks, or management interviews) directly within their research workflow.

The system pushes out real-time email and in-platform alerts when new press releases hit for any ticker on a list. It’s a huge boost for staying organized and catching early developments, especially in under-the-radar names.

The feature is live now, and more refinements are on the way. We’re building this with one goal in mind: helping you catch actionable information before it’s obvious to the rest of the market. Here’s a video demo showing how to use it.

Stepping back from the week’s headlines, we’ll close with an article on scaling into conviction over time, which was published recently on the Microcap Investing Cliff Notes Substack.

—

| The Weekly Wrap-Up is meant for those in a hurry, along with those who want to spend a weekend hunting for ideas or quickly catch up what we talked about during the week. Our Weekly Wrap-Up brings together everything we discussed during the week in our morning emails and premium alerts, as well as new information and high conviction ideas that we did not communicate that you should know about. From earnings coverage, new research coverage on stocks, picks and research from our subscribers to event highlights from our monthly open forum that takes place to the beginning of each month and interviews with management teams and investors. 📬 Missed any emails this week? You can catch up on all of them in one place — just check out the full archive here. |

—

Feature

Planting Seeds [Investment Process]: You don’t have to always go big

I’ve been fooling around with playing the guitar for 20 years or so. It’s not an easy instrument for me to play. Unfortunately, it just doesn’t come as natural for me as I’d like. I have to work really hard at it. Still, like many guitarists, I got caught up in wanting to play blazing fast, like Yngwie Malmsteen.

Eventually, with the help of a guitar teacher in Florida, Dyce Kimura, I began to see that I didn’t always have to go for that fast solo to have success. As a matter of fact, it was causing me years of frustration and holding me back from getting better. Sure, once in a while, I would hit a nice fast solo, but I often didn’t even know why.

In reality, some of the greatest guitar solos don’t start loud or fast. They start small, with simple melodies or phrases.

Though the role of the guitar solo in music is not as center stage these days, you can go back and listen to some of the best rock guitar players of the ‘70s, ‘80s, and ‘90s and notice how they would build into a solo at the right time.

Of course, if they wanted to go fast all the time, they absolutely could. But speed isn’t always the point.

David Gilmour of Pink Floyd was a master at slow melodic phrasing that said more with fewer notes than most players say with a flurry of them. Just listen to his second solo in Comfortably Numb, and you’ll get it. It’s often cited as the benchmark for melodic, slow-burn guitar.

Stay up to date with our latest posts. Subscribe today.

Even Eddie Van Halen, who could go blazing fast whenever he wanted, didn’t have to in order to wow you. One of my favorite songs of his is “316.” He wrote it for his son, Wolfgang, after he was born. It’s actually one I’m able to hack away at. 🤣

Eddie actually praised Gilmour:

“David Gilmour is the benchmark of less being more. He has proved that shredding and fast playing is not the benchmark of mastery level. Gilmore never wastes a note; he builds his solos like a painter; every note, every bend, every tonal inflection has merit… David’s solos paint a picture in the minds of his listeners. Something that really is a testament of his talent as a guitar player.”

Neal Schon of Journey also comes to mind as one of those melodic blazers. Think Separate Ways.

I thought about this topic over the weekend when I was practicing my soloing to a chill melodic backing track, taking a break from some stock research. I didn’t try to go fast, and it felt awesome. By my fourth round playing against the track, I put in a few fast licks here and there, and it worked perfectly.

It’s like I just learned a little bit more about the track and where it allowed me to go without hurrying, so that when I strike hard with that quick riff, it sounded perfect vs. a bunch of jumbled notes

Well, of course, as you would expect, I immediately tied that experience into investing. I didn’t fully realize it at first, but the way I approached playing that backing track over the weekend is exactly how I approach investing sometimes.

So many of my best stocks didn’t start as big, high-conviction, go-all-in positions. They started as small seeds or exploratory bets, without even thinking about a MultiBagger possibility or if they had to be perfect on day one.

Covering Over 1,500 microcaps. Subscribe Today.

When you think about it… psychologically, those positions are easier to make. Why? Because these will likely be smaller position size bets, where you don’t lose sleep at night. Furthermore, they allow you to listen to the story as it develops instead of forcing a conclusion upfront.

Planting seeds lets you sprinkle the portfolio and participate early without having all the answers.

And just like songwriting, not every seed turns into a hit. The point isn’t to be right immediately or all the time. The point is to give some interesting ideas room to grow.

But here’s the part that matters most… and you may have heard me talk about this on “X” or other posts I’ve written…. sprinkling only works if your process is good.

If your investing process is broken, it doesn’t matter whether you’re a high-conviction investor, a seed planter, or a mix of both. Bad process scales failure. The same is true in music. No amount of speed saves a player who doesn’t understand phrasing, timing, or feel.

And by the way, I’m obviously not saying to never take big positions right out of the gates when you see the right pitch. But don’t ignore the ones that don’t look obvious.

Just like a great guitarist doesn’t need to shred for the sake of shredding, investors shouldn’t size up for ego. Do it because the setup is right, and when the conviction is earned.

So, what am I really saying?

Sometimes it’s ok to plant early and let the melody develop. And when it’s time to play loud, let it fucking rip and play it without hesitation.

—

| If you enjoy performing press release research or think you will see value in a tool that expedites your press release research process, you should check out a press release tool my team is building by going here. |

—

Weekly Performance Stats From The Microcap Universe

A useful research resource for identifying potentially undervalued momentum stocks and beaten-down names that may rebound over time.

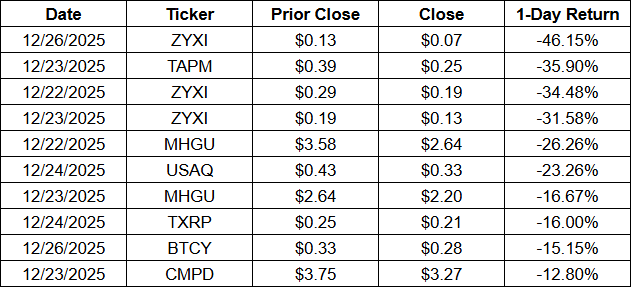

Biggest Single-Day Movers of the Week

These are stocks that recorded the strongest one-day move (up or down) during the week.

- Largest Single-Day Gainers

- Largest Single-Day Losers

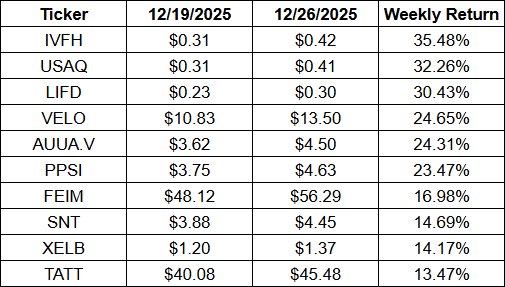

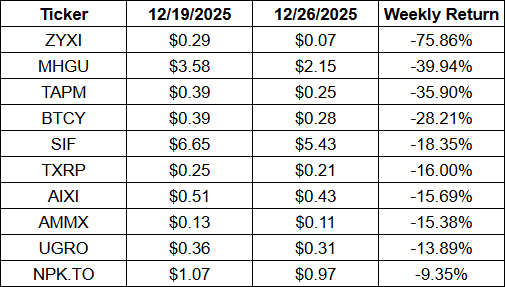

Weekly Top Gainers and Losers

These are the top 10 stocks with the largest overall gains and losses for the entire week.

- Top 10 Gainers – Weekly (December 22, 2025 – December 26, 2025)

- Top 10 Losers – Weekly (December 22, 2025 – December 26, 2025)

New 52-Week Highs and Lows

These are stocks that reached new 52-week highs or lows during the week.

- New 52-Week Highs

- New 52-Week Lows

——

Sorry, the full post is only available for paying subscribers. If you are already a paying subscriber, please make sure you are logged in. To become a paying subscriber please click on the link below

(We also offer a new very popular monthly subscription option).

gain Exposure to our expanded coverage on Our 1500+ Microcap Universe, Subscribe below.

200+ multibaggers and counting

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)