Park City Group (PCYG) describes itself as a “cloud-based, big data, SaaS software company” that sells inventory management and supply chain software. Management has stated that PCYG’s future growth is centered on its relationship, executed on May 18, 2013, with ReposiTrak, its key “customer” that “pays”PCYG subscription fees for the EXCLUSIVE right to use some of its software. We believe there is significant evidence that PCYG has been less than transparent about its growth engine and most important customer. Despite the fact that PCYG’s trailing non-GAAP net income is nil, its stock has nearly tripled since the consummation of the ReposiTrak deal and trades at 13x EV/Sales, 13x P/S, and 112x EV/EBITDA . We will show why we believe that at most PCYG, currently trading near $9.00, should at a maximum be trading closer to $3.50 which is where it was before ReposiTrak was baked into the share price as the “key growth driver”.

Our research shows that:

1. ReposiTrak, the source of meaningful annual license and management fees for PCYG during its Fiscal year ended June 30, 2013, is a development stage company that generates little or no revenue and is past due on the majority of these fees that have been booked as revenue. Without ReposiTrak’s financial impact, PCYG’s stated revenue growth would decrease from positive 12% to Zero. In fact, PCYG has acknowledge ReposiTrak’s inability to cover its operating costs and other financial obligations with a disclosure in an exhibit of one of its SEC filings which includes the following passage (ReposiTrak was previously known as F&D):

“F&D is currently seeking financing necessary to adequately capitalize F&D and fund its operating expenses and financial commitments, including its subscription payments.”

2. Management uses accounting practices, that are likely GAAP exceptions, to record uncollectable subscription revenues and management fees and give the appearance that PCYG’s financial statements are sound despite the fact that disclosures in the most recent 10K clearly state that ReposiTrak is well past due on and unable to pay the majority of these fees.

3. It is very likely that ReposiTrak should be considered a related or controlled entity and is not accounted for or disclosed as such. This tactic allows PCYG to keep booking revenues from ReposiTrak without recognizing its expenses or even disclosing ReposiTrak’s true revenues and expenses. If ReposiTrak’s operating performance was made public we suspect the bloom would quickly come off this overhyped venture.

4. PCYG has agreed to use its own shares to compensate ReposiTrak founders for their original investment in the company.

- PCYG has an option to acquire 75% of ReposiTrak’s issues and outstanding shares for just $100,000. As part of this agreement, the majority owner of ReposiTrak, Leavitt Partners, has agreed to dispose of at least 66% of its ownership interests for its share of the $100,000 consideration to be paid by PCYG. The PCYG option implies the total grossed up value of ReposiTrak is $133,000.

- It looks like PCYG is essentially bailing out ReposiTrak’s seed investors for the value of their original investment ($1.0 million) only 15 months after the consummation of the software licensing deal.

5. PCYG has conducted securities offerings with individuals (For example, Rodman and Renshaw) that have known connections to publicly traded companies that have previously been accused of fraud.

The Elevator Pitch- Details Buried In Exhibits of SEC Filings Shed Light

PCYG’s increased revenues in 2013 and stated growth strategy are, as exhibits in SEC filings prove, based almost entirely on ReposiTrak, a quasi-related party that is staffed, financed and, in fact, if not technically, controlled by PCYG. PCYG SEC Filing exhibits also reveal that the majority of the revenues attributed to ReposiTrak have been classified as past due by PCYG. As a result, (85%) of the license revenues and management fees that PCYG charged ReposiTrak during the fiscal year ended June 2013 have proven to be uncollectable. Given this reality, the company reclassified the accounts receivable due from ReposiTrak to notes receivable, thereby avoiding the recognition of appropriate allowances for doubtful accounts, which is a form of kicking the can down the road. Eventually,ReposiTrak has to pay or the balance due will be written off.

More importantly, PCYG treats its relationship with ReposiTrak as an independent contractor even though, as we will show, ReposiTrak is essentially part of PCYG. We believe ReposiTrak should more appropriately be accounted for as a subsidiary or division of PCYG. If ReposiTrak was treated as such,PCYG could not book revenues from them since ReposiTrak is generating little to no revenue on its own behalf and the costs associated with the business would have to be recorded as current period expenses.

The current arrangement appears to be a clever scheme whereby PCYG spends shareholder capital to fund a startup company, and makes it appear, by booking uncollectable management fees, that ReposiTrak is reimbursing this capital outflow, while at the same time allowing PCYG to book uncollectable subscription revenues from ReposiTrak. Thus, the relationship with ReposiTrak had an immediate and, in our opinion, unjustified positive impact on PCYG’s financial statements. In fact,PCYG’s reported revenue growth in 2013 (FY June 30) of 12% appears to be almost entirely due to past due license and management fees billed to ReposiTrak.

In Management’s Words, PCYG’s Future Depends on ReposiTrak’s Success

The company’s CEO stated in a speech given at a recent conference in Dallas that ReposiTrak is focused on the worldwide issue of food safety in the supply chain and that it will be:

“…named by the most prominent opinion makers in the industry as the industry standard platform for tracking and tracing”…

There is little doubt that PCYG’s long term viability and growth story is reliant on ReposiTrak. PCYG Management has stated as much:

“… ReposiTrak is also well positioned to become the leading component of Park City Group’s business, and a significant contributor to improving food and drug safety.”

How important is ReposiTrak to PCYG?

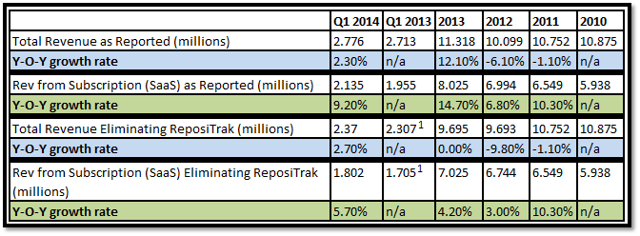

If ReposiTrak’s revenues were eliminated from the consolidated operating results in 2013, the first year of contribution, PCYG’s 2013 consolidated sales growth turns to no growth at all from positive 12%. (See Exhibit A)

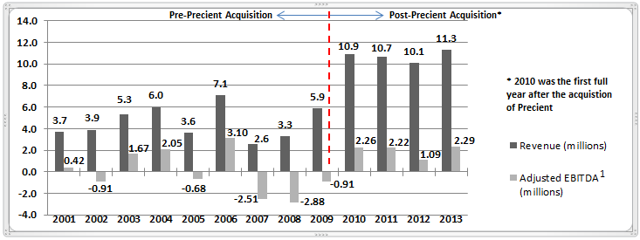

PCYG has failed to deliver consistent organic top line growth and has logged lumpy profitability and losses since it became a public company through a reverse merger in 2001. PCYG’s revenues in 2008 were only $3.3 million, less than the $3.7 million the company reported in 2001 when it became a public company. Then, in 2008 PCYG started billing clients on a monthly basis instead of one time license fees. To accelerate this SaaS initiative, PCYG acquired Precient Applied Intelligence, a developer of patented retail supply chain solutions and services, in January 2009, giving the company a temporary boost in revenues (Precient was generating revenues of $9 million). “SaaS” revenue now consists of about 71% of total revenues, up from around 50% in 2010. But it seems that the organic growth anticipated when Precient was acquired did not materialize. Revenue growth since then has been flat, increasing from $10.9 million in 2010 (first full year of Precient) to only $11.3 million in 2013. 2013 Adjusted EBITDA of $2.3 million nearly matches adjusted EBITDA achieved in 2010. See Exhibit B for more detail on PCYG’s unimpressive past.

Revenues Attributed to ReposiTrak Boost PCYG’s 2013 Performance

Given its uninspiring past, PCYG needed something new to drive growth and investor interest. Management seems to have found the “future” with ReposiTrak, a company that:

“…provides food and drug retailers and their suppliers with a cost-effective service to help protect their brands, and reduce regulatory and financial risk associated with the rapidly evolving Food Safety Modernization Act.”

PCYG got the “desired benefit” from its fee arrangement with ReposiTrak in FY2013, reversing two straight years of declining revenues since 2010, the first full year of Precient’s revenue contribution. Investors, however, should not take the positive impact of the revenues PCYG is booking for ReposiTrak at face value.

PCYG’s Recognition Of ReposiTrak’s Revenues Is Highly Suspect

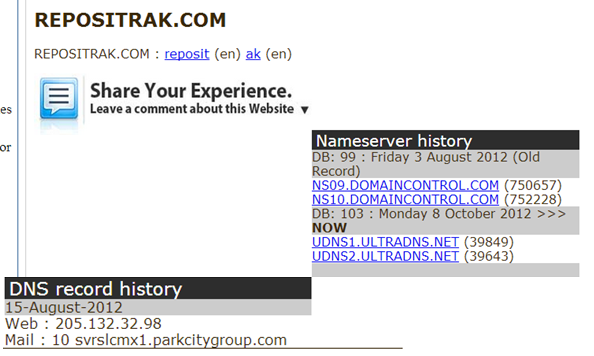

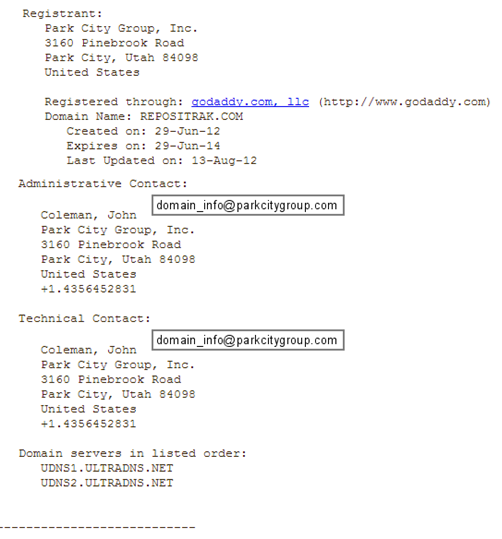

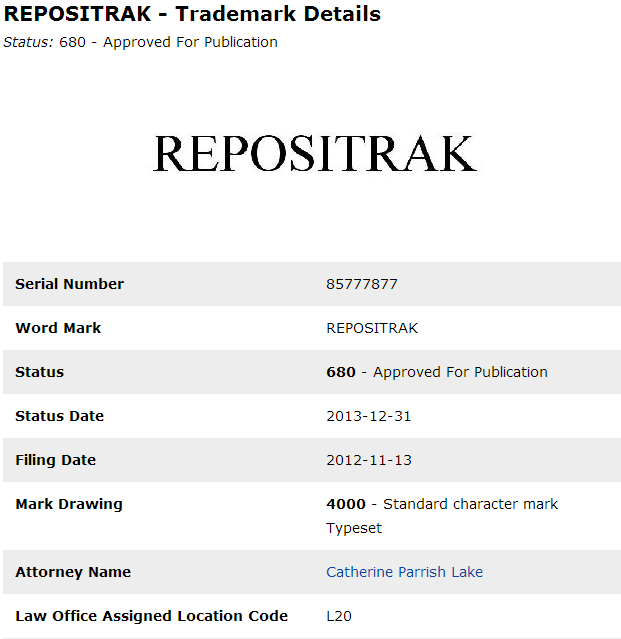

We have several issues with PCYG’s recognition of revenues from ReposiTrak. The amounts due to PCYG from ReposiTrak are apparently not collectible. So even if the revenues are recorded there should be a substantial allowance for doubtful accounts applied against the balance due from ReposiTrak. And, the license and management fees do not appear to be based on an arm’s length transaction. PCYG has stated that it does not own ReposiTrak, despite evidence that proves it owns the ReposiTrak trademark and web domain. We will show that PCYG owns, finances, staffs, houses and effectively controls ReposiTrak.

ReposiTrak’s Inability To Meet Its Financial Obligations Owed To PCYG- A Sale Is Not A Sale Until The Cash Is In The Till

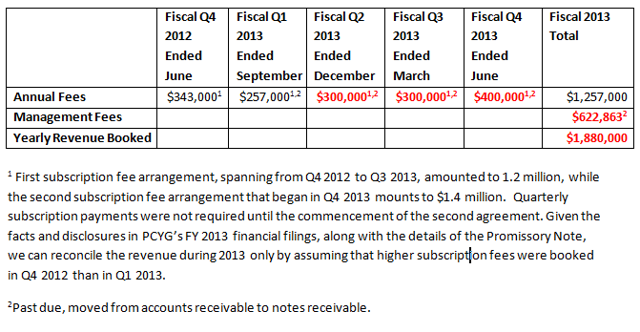

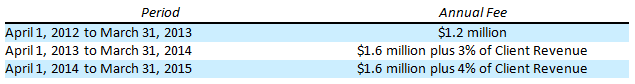

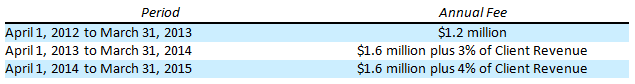

A subscription fee relationship executed in April 2012 (Q4 of FY ended June 30, 2012), and later amended twice, between PCYG and ReposiTrak, includes the following fee schedule:

It also states that PCYG will pay ALL expenses necessary to provide management services and maintain Business Expense which it will bill ReposiTrak plus a 5% gross-up.

During the fiscal year ended June 30, 2013, PCYG recognized $1.26 million in subscription fee revenues and $622,833 in management fees from ReposiTrak.

The first indication that ReposiTrak is having problems meeting its financial obligations is apparent in the following passage taken from PCYG’s 10K FY 2013:

“For the year ended June 30, 2013, total revenue attributable to ReposiTrak under the Original Agreements was approximately $1.88 million, of which $1.6 million was paid in the form of a promissory note issued by ReposiTrak to the Company.”

Interestingly, the majority of ReposiTrak’s 2013 revenue contribution to PCYG was paid with a form of an “IOU”. Digging deeper, Exhibit 10.19 of the 10K discusses delinquent fees owed to PCYG from ReposiTrak. ($1 million past due subscription fees to use its PCYG software plus $622,863 management fee and expenses):

“The parties agree and acknowledge that a portion of the Annual Fees for the period April 1, 2012 to April 1, 2013 and the first installment of the Annual Fees for the period April 1, 2013 to April 1, 2014 are past due (“Past Due Fees“), which Past Due Fees total $1 million.”

“The parties agree and acknowledge that the Management Fee and Management Expenses incurred for the period April 1, 2012 to April 1, 2013 in connection with the provision of Management Services is $622,863, which amount will be added to the balance of and shall be paid to PCG pursuant to the terms of, the Original Note.”

The verbiage in the above passage…

“pursuant to the terms of, the Original Note. “

…is referring to a promissory note, 8% annual interest, issued to PCYG by ReposiTrak in the amount of $1,622,863, consisting of these past due subscription fees and unpaid management fees/expenses. Investors can view the details of the promissory note in exhibit 10.20 of the 2013 10K:

“ReposiTrak, Inc., a Utah corporation, (the “Company”), promises to pay to the order of Park City Group, Inc., or its registered assigns (“Holder”), the principal sum of One million Six hundred Twenty-two thousand Eight hundred Sixty-three Dollars ($1,622,863), on the earlier to occur of April 30, 2015 or the date of termination of that certain Omnibus Subscription”

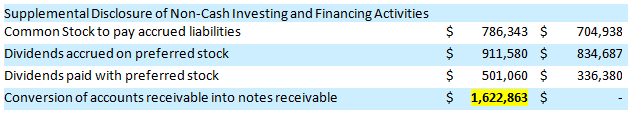

It is apparent that the promissory note arose from uncollectable accounts receivable that were booked as revenue in 2013. This assumption is confirmed with the following accounting entry reflected on page F-5 of the 2013 10K showing the entire notes receivable was reclassified from accounts receivable:

Thus, there is no question that the $1.62 million notes receivable is comprised of accounts receivable generated from its relationship with ReposiTrak that could no longer be classified as such without recording a substantial allowance for doubtful accounts. The fact that the due date of the notes could extend to 2015 has also led us to conclude that ReposiTrak is apparently unable to pay its bills and/or that PCYG believes ReposiTrak is not close to generating meaningful sales and cash flows from operations. Due to interest, the note has grown to $1,655,807 as of Q1 2014 ended September 30, 2013.

We view the designation of the amounts due to PCYG as Notes Receivable as a façade. Companies often reclassify accounts receivable to notes receivable when it becomes evident that the timely collection of the balance due is uncertain or materially past due. Conveniently, it can serve as a way for a company to avoid/delay increasing the allowance for doubtful accounts entry and taking a charge on its income statement. If the balances are uncollectable, the financial statements should reflect the net realizable value of the amounts due from ReposiTrak. We believe management is skirting GAAP by reclassifying what are clearly uncollectable accounts receivable as notes receivable. Exhibit C includes an analysis of revenues PCYG booked from ReposiTrak over the last five quarters.

The net result of our findings is that at least 85% of ReposiTrak’s 2013 revenue contribution of $1.88 million to PCYG is unlikely to be converted to cash. Investors should note that the issue of whether PCYG realizes value from the ReposiTrak notes receivable or not is no small matter.

Despite ReposiTrak’s inability to meet its financial obligations, management continues to exercise wide discretion in how it recognizes revenues from ReposiTrak, a venture for which its success is still up in the air, by issuing an “I Owe You” when it is deemed that ReposiTrak can’t honor its commitments:

“1.5.2 of the Exhibit 10.19, Omnibus agreement: Annual Fees shall be paid in cash or alternatively, in the event ReposiTrak has insufficient cash on its balance sheet to pay the Annual Fees, as determined by ReposiTrak in its sole discretion, such Annual Fees may be paid by issuing to PCG a senior promissory note in substantially the form attached hereto as Exhibit A (each, a “Note“).”

“The Parties further agree and acknowledge that in the event ReposiTrak has inadequate cash on its balance sheet to pay PCG the Management Fees and Management Expenses at such time as the same are due and payable under the terms of this Section 2, such amounts shall accrue and shall be paid by issuing to PCG a Note, which Note shall reflect all amounts due PCG by ReposiTrak during the applicable quarter for Management Fees and Management Expenses incurred during such quarter.”

Really, At the Sole Discretion of ReposiTrak?

Eliminating the ReposiTrak notes receivable (and therefore revenues) would for all intents and purposes debunk investors’ enthusiasm over the ReposiTrak’s growth prospects, and even its viability. PCYG’s management clearly agrees with us as is evidenced by the following passage on page 15 of PCYG’s 10K for the year ended June 30, 2013:

“In the event of a default under such notes, the Company’s financial results, including its financial condition, may be materially and adversely affected.”

ReposiTrak Is Clearly Controlled By PCYG

ReposiTrak is controlled by a consulting firm called Leavitt Partners, a firm run by former Utah governor Michael Leavitt. Based on the documents included in this report, we believe that Leavitt is allowing PCYG to use ReposiTrak as an independent, third party entity so it can book revenues (without recognizing the associated expenses) through what appears, in fact, to be a related or controlled party.

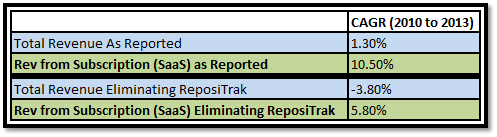

Just like we have seen in China, third party ownership on paper does not always mean the entity is really an independent third party. According to Utah government documents, the only two directors of ReposiTrak are Michael Leavitt and his lieutenant Rich McKeown (see Exhibit D), who we believe have limited roles in actually operating the company.

We think PCYG uses a very loose interpretation of “independent contractor” in order to record revenues from ReposiTrak but not its operating expenses. Referencing a statement from an exhibit to the first subscription agreement:

“PCG is acting as an independent contractor hereunder and shall not be deemed to be engaged in a joint venture, partnership, agency relationship, or similar arrangement for purposes of this Agreement. Each party is responsible for the conduct of its own personnel.”

We disagree with Management’s claim that ReposiTrak is a third party entity and PCYG is serving as an independent contractor in an arm’s length relationship. Nothing could be further from the truth:

- PCYG Management’s Dubious Assertion They “Don’t Own ReposiTrak”

PCYG’s management states that ReposiTrak is a robust solution created through collaboration between Leavitt Partners and Park City Group. In the Three Part Advisors 2013 Southwest IDEAS Conference held in Dallas, Texas, November 21, 2013, the CEO of PCYG, Randy Fields, said that “We don’t own ReposiTrak“. Admitting ownership, of course, would mean that PCYG could not record subscription revenues and management fees and would probably have to consolidate ReposiTrak operating results with its own. And, more importantly, ReposiTrak’s revenues and operating results would be visible to investors. If that were to happen, the market would likely discover the ReposiTrak emperor has no clothes.

Contrary to Mr. Fields’ assertion, ReposiTrak’s own website states that the company is partially owned by PCYG, “ReposiTrak is a partnership jointly owned by Leavitt Partners and Park City Group….”

http://repositrak.com/about-repositrak/

- PCYG Provides All Of The Resources Necessary To Run ReposiTrak’s Day To Day Operations

The current operating arrangement between PCYG and ReposiTrak illustrates just how dependent ReposiTrak is on PCYG. Among the business activities that PCYG performs for ReposiTrak are sales support and activities, accounting processes, software maintenance and development, customer implementations, customer support, and other administrative services. Given the broad array of activities performed by PCYG on ReposiTrak’s behalf, one has to wonder what if anything ReposiTrak does on its own behalf. You be the judge on who is running ReposiTrak. See Exhibit E at the end of this report for the details of PCYG’s involvement in ReposiTrak’s day to day activities.

The bottom line is PCYG appears to be spending shareholder capital to run ReposiTrak and then billing ReposiTrak for reimbursement of such fees (counted as revenue), that ReposiTrak can’t pay.

- PCYG and ReposiTrak have Adjoining Office Space

PCYG entered into a lease for office space in Salt Lake City of September 12, 2012, just months after consummating the ReposiTrak deal. According to the mailing addresses disclosed in the contract between the two companies, the companies occupy adjoining office space in the same building:

| If to ReposiTrak:

ReposiTrak, Inc. 299 S. Main Street Suite 2300 Salt Lake City, Utah 84111 Facsimile No.: Telephone No.: _____________ Attention: Chief Executive Officer |

||

| If to PCG:

Park City Group, Inc. 299 S. Main Street Suite 2370 Salt Lake City, Utah 84111 Facsimile No.: 435-645-2100 Telephone No.: |

||

- Calls To ReposiTrak Are Directed To PCYG Employees

We called ReposiTrak’s customer service line, and the phone was answered by PCYG personnel or their answering machine. There are no employees of ReposiTrak listed on LinkedIn, nor does the website direct the user to anyone actually employed by the company.

|

|

|

|

PCYG Boasts A $160 Million Market Cap. Insiders Place Much Less Value On The Enterprise.

Arguably, the majority of the market value ascribed to PCYG is based on the promise investors see for ReposiTrak. It therefore stands to reason that ReposiTrak’s investors would benefit most from this market bonanza. ReposiTrak’s leading investor is Leavitt Partners. The Omnibus agreement reveals that Leavitt partners own a controlling interest (at least 51%) in ReposiTrak:

“Leavitt beneficially owns a substantial and controlling interest in all currently issued and outstanding shares of capital stock issued by ReposiTrak”

PCYG places great value on its relationship with Leavitt partners. The following is a quote from a press release touting PCYG’s relationship with Leavitt:

“Leavitt Partners and Park City Group Unite to Build a Global Food and Drug Safety Registry:

By working with Leavitt Partners, our clients gain access to the most experienced team of food and drug safety experts on the planet, and the combination of the two organizations ensures that all regulatory requirements are efficiently and cost effectively met.”

Given how valuable the market perceives ReposiTrak to be, it is striking how easily and cheaply Leavitt and ReposiTrak’s other investors are willing to part with their shares. Leavitt, for example, has executed an agreement giving PCYG the Option to acquire 75% of ReposiTrak’s issued and outstanding shares for $100,000 (which would value ReposiTrak at $133,000). If PCYG exercises this option, Leavitt has agreed to surrenderenough shares so that it will only own 17% of ReposiTrak after the transaction. Please see Sections 3 and 4 of the September 23, 2013 Omnibus Agreement for all the details of the Option and Share Surrender agreement. When reading the Option agreement, notice that it makes reference to, “Exhibit B hereto (“Shareholders Agreement”)“…

“As a condition to the exercise of the PCG Option, PCG shall agree to be bound by, and shall execute an agreement of joinder in respect of, ReposiTrak’s Shareholders Agreement dated as of January 1, 2013, a copy of which is attached as Exhibit B hereto (“Shareholders Agreement”).”

…but omits this exhibit from the filing. This exhibit would likely disclose who owns ReposiTrak, a detail, in our opinion, that PCYG management may not want investors to know.

We find it curious that Leavitt would part with its shares so cheaply. Why not, for example, try to exchange their illiquid ReposiTrak shares for liquid PCYG shares?

It’s not just Leavitt that is willing to sell. The Omnibus agreement discloses that ReposiTrak issued shares to 16 investors for a consideration of $975,045. And now, per a stock exchange agreement,PCYG has granted them the option to exchange their shares for $1 million worth of PCYG stock. Please see section 5 of the Omnibus agreement, “Stock Exchange”.

Per verbiage in an earlier amendment of the Subscription agreement (sections 3 and 4) filed on June 20, 2012, it is revealing that the structures of the option and stock exchange agreements seemed to have been in place well before ReposiTrak received the $975,045 investment:

“Client (ReposiTrak) hereby grants to PCG an option to acquire Six Hundred and Sixty Thousand shares of Client’s common stock. The option is exercisable in increments and at any time during the option period in PCG’s discretion upon payment of $100,000 for all shares or a pro rata portion for any other increment.”

“PCG hereby grants to Client the right, but not the obligation, to exchange (“PCG Exchange”)any of the Client’s common stock that Client sells to outside investors (the “Client Shares”), up to a maximum amount of $1.0 million.”

The only thing we can surmise from these agreements is that they seem to speak to a lack of confidence of ReposiTrak’s shareholders in the business. If that’s the case, why not exchange their illiquid shares for whatever value they can realize? Whatever the motivation, the fact that ReposiTrak’s shareholders are willing to give up their shares so easily raises the issue of just how much the business is really worth. This begs the question; are the ReposiTrak investors right about ReposiTrak’s value, or is the market?

Links to Colorful Characters

PCYG conducted a PIPE offering executed in March 2013, where shares were registered on May 13, 2013 through Dawson James, a small Florida brokerage firm.

“In the Private Placements on March 14, 15 and 22, 2013, we issued 756,858 shares of Common Stock and Warrants to purchase an additional 249,763 shares of Common Stock to a group of accredited investors (the “Investors”), resulting in gross proceeds to us of approximately $2.64 million. Dawson James Securities, Inc. (“Dawson James”) acted as the sole placement agent for Private Placements to certain Investors on March 14, 2013.”

The bankers on the deal for Dawson, Craig M. Schwabe, Noam Rubinstein, Mark Viklund, and MichaelVasinkevich, joined the firm in September, 2012. We are particularly concerned because these individuals were all previously employed by Rodman and Renshaw. Rodman was the lead on many public offerings by fraudulent Chinese companies, and we are skeptical of the due diligence capabilities of this group given the numerous past blow ups at Rodman. Almost immediately after the placement in PCYG, the team promptly resigned from Dawson.

Is ReposiTrak Living Up To Internal Expectations?

Investors should not assume that the revenues PCYG records for license fees billed to ReposiTrak have anything whatsoever to do with what ReposiTrak is billing its customers. PCYG’s subscription revenues represent a minimum guarantee whether ReposiTrak has revenues or not. ReposiTrak’s revenues represent actual sales to end users. Unfortunately, investors do not have visibility into ReposiTrak’s revenues and operating results. That’s because ReposiTrak is conveniently treated as an independent entity that PCYG licenses its software to. The fact that ReposiTrak is unable to meet its financial obligations speaks volumes about how the company is performing, and the evidence is not encouraging.

For example, the fact that the due date of the notes receivable could extend to 2015 indicates that management does not expect ReposiTrak to generate meaningful revenues and cash flows from operations anytime soon. This is evidenced by the wide latitude management exercises on how it recognizes revenues from ReposiTrak. As the balances due from ReposiTrak build up, management, per the Omnibus agreement, can simply kick the can down the road by continuing to convert accounts receivable to notes receivable without addressing the underlying issue that the receivables are not collectable.

We found it particularly interesting that PCYG has altered the percentage of revenue fees it would receive under the subscription agreement with ReposiTrak. Under the first two arrangements (May 22, 2012 & June 20, 2012) PCYG would not take any percent of revenue fees until revenue exceeded $12 million and $17 million, respectively. The second amendment filed on June 20, 2012 actually disclosed ambition fees based on a percentage of sales assumption as high as $150 million! The third agreement (Omnibus) filed on September 23, 2013 now has no restriction on revenue levels. Apparently at one time, the sky was not the limit for ReposiTrak. We believe management may have realized that its expectations for ReposiTrak generating significant revenues during the current contract span (3 years) were unrealistic since it appears that ReposiTrak has generated no significant product revenues in the 21 months since the 36-month fee arrangement was executed. See Exhibit E at the end of this report for a summary of the changing fee arrangements.

At the end of the day, this charade can only go on for so long. Eventually, somebody has got to pay and the evidence to date is that unless ReposiTrak is able to ramp up its business quickly and start generating meaningful revenues and cash flows from real world customers, it is not going to be them. These circumstances could make the PCYG story a house of cards that is based on company press releases referencing potentialpartnerships, pilot studies and endorsements. What is conspicuously absent from the ReposiTrak picture is actual revenues from real customers.

ReposiTrak’s Revenue Model Appears Dubious

One likely explanation for the slow ramp up of ReposiTrak’s business is its revenue model. The company’s website states the following:

“ReposiTrak is a no cost, easy-to-use solution that reduces the liability created by food safety issues in your supply chain. Through pro-active management of all your suppliers’ documents (from indemnification agreements to insurance certificates, etc.); by performing robust and timely traceability of products (including ingredients)all the way through the supply chain from farm to fork; and by identifying where product likely is and how much is there. You’ll save time and money in the event of a recall.

We help you manage your risk and liability in three ways: (1) document management, (2) tracking and tracing from farm to fork and (3) by identifying where contaminated product or ingredients may be in your supply chain.

Our service is free to retailers and wholesalers.

We charge your supplier less than cellphone bill ($100 per month, per facility).

It’s easy to get you started and easy to use.

We have the unique capability of gathering information once and sending it on to any other trading partner or system, so you can save time, money and effort.

We are a highly-regarded, existing, secure, cloud-based, scalable system.”

There are challenges associated with ReposiTrak’s hub (retailers and wholesalers) and spoke (their suppliers) business model. The service is “free” to retailers and wholesalers meaning they don’t have a great deal of equity in the program. And, the cost burden both associated with subscription fees of $100 per facility AND the cost of assembling documents, gathering data and entering it in the system is entirely on the suppliers.

- Exactly what is in this for the suppliers other than keeping the retailers or wholesalers happy?

- Can the retailers and wholesalers compel their suppliers to use the system and comply with the costs of initially populating the system with data and then maintaining that data over time?

- And, who sells the suppliers on the system, signs them up, trains them, provides customer and technical support, and ensures they are using the system properly?

Frankly, the entire model seems like a utopian systems solution for well-meaning and worthy causes that will not be easily sold and implemented on a large scale.

PCYG Is Not a High Growth SaaS player/Valuation:

We do not consider ReposiTrak to be a meaningful factor when valuing PCYG shares. At an EV/S of 13 PCYG is clearly overvalued, especially given what we consider to be its dismal growth track record. And we think the market valuation of PCYG shares pre-ReposiTrak of around $3.50 reflects this sentiment.

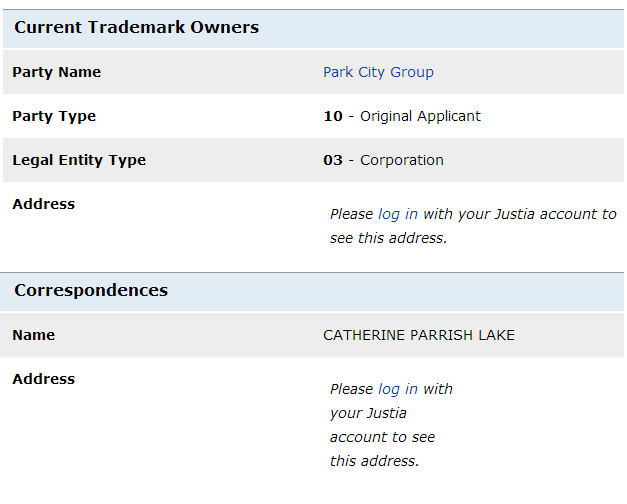

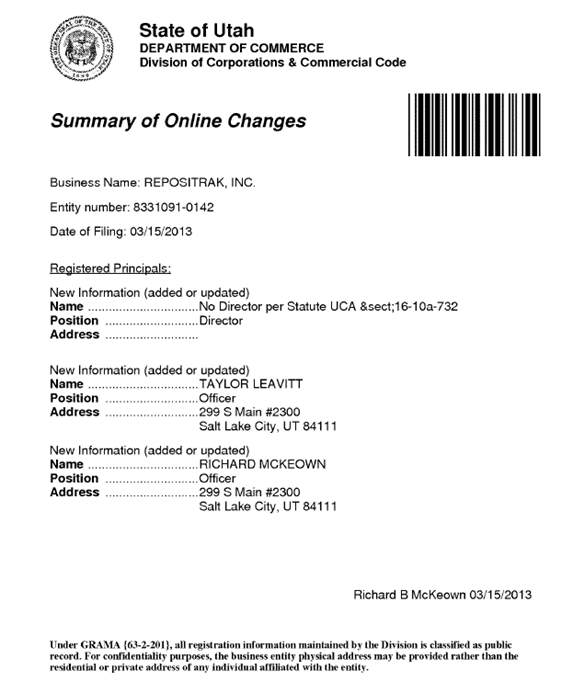

If one were to eliminate ReposiTrak revenues from consolidated 2013 and first quarter 2014 sales, the already unimpressive growth story would worsen. The compounded annual growth rate (CAGR) in total revenues from 2010 (first full year of Precient) to 2013 decreases from 1.3% to negative 3.8%. However, management touts its subscription specific growth rate as the proper metric to gauge its performance. But that measure is no better. The CAGR in Subscription revenue from 2010 to 2013 decreased from 10.5% to 5.8% without ReposiTrak. Also, subscription revenue since FY2012 (first impact of ReposiTrak) is substantially reduced for every annual period and Q1 2014. These observations are extremely important since management has clearly indicated that ReposiTrak is expected to be PCYG’s future. The tables in Exhibit A illustrate our point.

We think most investors would agree with our sentiment that this type of growth from a “SaaS” model, especially after eliminating ReposiTrak, does not justify anywhere near the tier one valuations PCYG shares are commanding. In fact, top tier SaaS companies generally are required to exhibit at least 20% + top line growth.

Here is a table of the take out EV/S multiples of some high profile publicly traded SaaS companies with revenue growth of at least 20% that helped us conclude that with or without ReposiTrak, PCYG is clearly mispriced based on its EV/S of 13.

| EV/Trailing Sales at Takeout Price | Date of Takeout | |

| Eloqua (ELOQ) | 8.2 | Dec-12 |

| Market Leader (LEDR) | 5.9 | May-13 |

| ExactTarget (ET) | 7.6 | Jun-13 |

| Responsys (MKTG) | 6.6 | Dec-13 |

Conclusion

At this time we think positive investor sentiment over ReposiTrak is misplaced. The stock is being helped along by company press releases talking of potential partnerships, pilot studies and endorsements. We conclude that ReposiTrak is a high cost and high risk call option that is losing value quickly due to its apparent inability to generate revenues and pay its bills. The $133,000 value ReposiTrak’s investors have placed on the company based on the option and share exchange agreements executed with PCYG speaks for itself. Furthermore and, perhaps most importantly, formidable, more established and better capitalized competitors, with partners such as Cisco Systems, Inc. (CSCO), Microsoft Corporation (MSFT), Oracle Corporation (ORCL) and Motorola, have already created software products that address the Food and Safety Modernization Act. The leader in this space, PLEX Systems received a $30 million capital infusion in December 2012 (see Exhibit G).

We have no problem that PCYG is pursuing new areas of growth, but we do have a problem with its revenue recognition practices. At best it appears to us that PCYG is using shareholder money to “fund” a startup venture, recognize uncollectible revenue, while already making ReposiTrak investors whole before receiving meaningful cash flow from the venture, not knowing if the endeavor will ever pay off or to what magnitude. At worst it appears that management is playing some type of shell game.

Exhibits

Exhibit A: Comparison of PCYG Growth with and without ReposiTrak

If one were to eliminate ReposiTrak revenues from consolidated 2013 and first quarter 2014 sales, the already unimpressive growth story would worsen. The compounded annual growth rate (“CAGR”) in total revenues from 2010 (first full year of Precient) to 2013 decreases from 1.3% to negative 3.8%. The CAGR in Subscription revenue from 2010 to 2013 decreased from 10.5% to 5.8% without ReposiTrak. Also, subscription revenue (which includes highly touted SaaS) since FY2012 (first impact of ReposiTrak) is substantially reduced for every annual period and QI 2014. These observations are extremely important since management has clearly indicated that ReposiTrak is expected to be PCYG’s future. The table below illustrates our point:

1See Exhibit C for how we derived ReposiTrak quarterly subscription fee contribution

Exhibit B: PCYG Revenue and Adjusted EBITDA – 2001 to 2013

There has been little if any core growth of PCYG’s revenues historically and management has not shown the ability to consistently execute its business plan. Despite this lackluster performance, PCYG’s current market valuation would have investors thinking the company is growing rapidly with boundless potential. But this is simply not the case. The company has failed to deliver any consistent organic top line growth and has logged lumpy profit and losses since it became a public company through a reverse merger in 2001.

PCYG’s proprietary technology, which is intended to help clients reduce inventory and labor costs, was developed at Mrs. Fields Cookies. We don’t think investors should place undue faith in the systems of a company that ended in Chapter 11 bankruptcy or, for that matter, in management that has failed to implement a successful growth strategy at Mrs. Fields or, so far, at ReposiTrak and PCYG. Consider, for example, that PCYG’s revenues in 2008 were only $3.3 million, less than the $3.7 million the company reported in 2001 when it became a public company.

Perhaps in response to anemic/unpredictable growth, PCYG changed its name from Fields Technology to Park City Group in 2008, the same year management started billing clients on a monthly basis instead of one time license fees. Concurrent with the changed billing strategy, the company began to refer to itself as a Software-as-a-Service (“SaaS”) company, and upon filing its 10-K for the period ended June 30, 2008, the company introduced its “SaaS Initiative” (Page 9 of 10K). The company then acquired Precient Applied Intelligence, a developer of patented retail supply chain solutions and services, in January 2009.

The Precient acquisition facilitated the company’s transition to a SaaS/cloud model giving it a boost in revenues as Precient had an annual revenue run rate of around $9 million. But it seems that the organic growth anticipated when Precient was acquired did not materialize. Revenue growth since then has been flat, increasing from $10.9 million in 2010 (first full year of Precient) to only $11.3 million in 2013. 2013 Adjusted EBITDA of $2.3 million nearly matches adjusted EBITDA achieved in 2010. The following chart reflects PCYG’s revenue and EBITDA performance before and since the Precient acquisition:

1 Adjusted EBITDA was calculated by adjusting net income for non-cash items and non-operating income/expenses.

Exhibit C: Analysis of revenues PCYG booked from ReposiTrak over the last five quarters.

We postulate that a $1 million capital infusion into ReposiTrak (see share exchange in Omnibus agreement) that may have helped fund some of the initial subscription payments has been depleted and that business has not been self-sustainable

Exhibit D: The only two directors of ReposiTrak are Taylor Leavitt (Michael Leavitt’s son and Partner and Managing Director at Leavitt Partners where he heads the company’s Equity Practice) Rich McKeown (President and CEO of Leavitt Partners):

Exhibit E:Who Really Runs ReposiTrak

“…

PCG will train Client and its customers on the solution limited to the services outlined above and governed by the Management and Operating Agreement between PCG and Client.

PCG will setup and configure the necessary data exchanges and formats between the Client’s customers and PCG to enable the services outlined above and governed by the Management and Operating Agreement between PCG and Client.

1) Management Services. Manager shall provide to Company as required by Company the following management services (“Management Services”), including but not limited to: sales support and activities, accounting processes, software maintenance and development, customer implementations, customer support, and other administrative services, together with:

a. All equipment (the “Equipment”) required by Company in connection with the Business including but not limited to: computers, facsimile machines, copiers, transcription and reproduction equipment and other office equipment and furniture;

b. filing and general clerical services;

c. maintain appropriate levels of business insurance;

d. systems administration;

e. general accounting and reporting functions including accounts receivable, accounts payable, GAAP accounting, annual and other regulatory filings, and such other assets and services as may be required from time to time;

f. governance functions, including the issuance of a complete set of internal controls complying with SOX404 and testing and maintaining the set of internal controls;

g. establishment and maintenance of SAS70 or SOC2 certification; and

h. utilization of various internal and external accounting and tax resources to maximize Company’s ongoing enterprise value. Completion and filing of all applicable income, sales and employment tax returns, completion and filing of all relevant regulatory documents and preparation of regular financial statements for Company’s Board of Directors and management, among other activities.

2) Business Expenditures. Manager will pay all expenditures necessary to maintain the Business including, without limiting the generality of the foregoing or the provisions of paragraph 1, rental payments, and the cost of all supplies required by Company in carrying on the Business and all phone and utility bills.

3) Location and use of Equipment. The Equipment shall be located and used only on Manager’s premises and shall not be removed without prior written consent of Manager. The Equipment shall be maintained and operated by competent employees only. Manager shall pay all expenses of purchasing, operating and maintaining the Equipment and shall insure the Equipment against normal perils, with loss payable to Manager.

…”

Exhibit F: Changing Fee Arrangement of the Subscription Agreement:

Fee Arrangement from Original Agreement spanning from April 1 2012 to April 1, 2015:

| Annual Subscription | $1,200,000 plus 10% of Client revenue in excess of $12,000,000 |

June 20, 2012 PCYG filed an amendment to the original agreement, making it exclusive and disclosing the following changes to the fee structure:

“The Annual Subscription fee shall be changed to $1,200,000 for the first two years of the term of the Subscription Agreement and the “10% of Client revenue in excess of $12,000,000” provision shall be eliminated. Beginning in year three, the Annual Subscription fee shall be $1,200,000 plus the applicable percentage of Client Subscription Revenue as more particularly set forth in Table 1 below”

| Client Subscription Revenue | Percentage Fee |

| $0 – $17,000,000 | 0% |

| $17,000,001 – $100,000,000 | 7% |

| $100,000,001 – $150,000,000 | 5% |

| $150,000,001 and up | 3% |

September 23, 2013 Amendment, Omnibus:

Exhibit G: Small Sampling of Some Players Tacking Food Safety to Counter PCYG opinion that Repositrakâ„¢, the Industry Standard Food Safety Platform

PLEX Systems- The Leader

“Plex Systems Inc. is the developer of the Plex Online Food Safety Management System(FSMS) and Plex Online ERP, a cloud ERPsolution serving the food and beverage industry. Plex Online FSMS offers industry-leading features for virtually every department within a processor, including Manufacturing Operations Management (MOM) / shop floor control; Electronic HACCP with integrated SPC; instant traceability and recall management; and Enterprise Resource Planning (“ERP“) for finance and management. Plex Online FSMS’s comprehensive functional coverage delivers a “shop floor to top floor” view of enterprise operations, enabling management to run its business at maximum efficiency.

Plex Systems Inc., provider of Plex Online FSMS, the leading enterprise Food Safety Management System, today announced that Senior Solution Engineer Tom Nessen will speak at the Food Safety Summit, a comprehensive education program for the entire food industry, April 17-19 at the Walter E. Washington Convention Center in Washington, D.C.”

- Founded in 1995

- Notable Partners: Cisco, Microsoft, Motorola

- Recent Fund Raising: $30 million by Accel Partners in December 2012

“An integrated part of AssurX’s complete solutions for the food and beverage industry, AssurX Compliance Management software centrally manages safety issues and compliance matters from farm to table. It allows companies to efficiently detect, analyze, track, correct and prevent food safety and noncompliance issues (for FDA, USDA, EH&S, HACCP, ISO 22000 and more) across all production-and even into the supply chain. By automating and connecting all related processes, the system increases product safety levels and reduces the costs of regulatory compliance.”

- Founded in 1993

- Notable Partners: Microsoft, Netsuite, Oracle, VMWare,

- Notable Customers: J.M. Smucker Company, Sara Lee, Seagram’s, Frito Lay

“EtQ’s Food Safety Management software system has been pre-configured to specifically address the requirements of HACCP, ISO 22000and SQF, BRC, and IFS food safety processes. EtQ’s unique modular approach provides unparalleled flexibility and automation. The modules are tightly integrated to deliver a best-in-class Food Safety software solution for Food and Beverage industry-ensuring safety from farm to fork.”

- Founded in 1998

- Notable Customers: The Coca-Cola Company, Starbucks, Morgan Foods

“As agricultural goods progress from field to fork they require attention, tracking and integrity. We offer an end-to-end supply chain range of services that reduce risk, ensure quality and improve productivity. We help ensure the integrity of the food chain by managing crops, enhancing seed development, conducting soil testing and harvesting, moving products through the global supply chain and managing trade inspection at export and import. SGS is a multinational company headquartered in Geneva,Switzerland which provides inspection, verification, testing and certification services. It has more than 80,000 employees and operates over 1,650 offices and laboratories worldwide.”

- Founded in 1878

“SYSPRO provides the means to handle the complexities of the food and beverage industry where the challenges of regulatory compliance, quality, perishability, the demand for faster inventory turns and deliveries and safety issues mean that time-to-market is all-important.

According to SYSPRO, the company’s ERP software enables food manufacturers and distributors to fully comply with the newest provisions of the FDA Food Safety Act.”

- Founded in 1978

“Safefood 360 is the food safety software solution you have been waiting for. Over the last 20 years food businesses have come under significant pressure to implement, maintain and adapt to continuously changing legal and commercial compliance requirements. Time, resources and knowledge are required to maintain this compliance in the form of a food safety management system. This is where Safefood 360 breaks new ground. Like your current paper based system, it covers all the requirements of food safety management but helps you get the job done smarter, better, faster. Please take a little time to review our features and see how Safefood 360 will change how you manage food safety forever.”

- Founded in 2009

“Burton Software (www.BurtonSoftware.com), maker of Icicle, as a solution for middle and small food manufacturers. Steven Burton is the founder of Burton Software which offers the first affordable cloud-based solution to improve the safety of the world’s food supply. Icicle, the flagship technology enables companies involved in the production, processing, and distribution of food products to develop and verify food safety plans. Icicle is the HACCP (Hazard Analysis Critical Control Points) solution that improves the quality and safety of products by developing tools that manage food safety plans, document procedures, and carries out inspections.”

- Founded in 2006

“SafetyChain Software’s SafetyChain for Foodâ„¢ helps the food and beverage industry manages safety and quality compliance in real-time – preventing non-compliant ingredients, raw materials and finished product from coming in or going out. SafetyChain for Food’s affordable solution modules help save time, save money and create efficiencies that contribute to the bottom line. SafetyChain for Food is a global, Software-as-a-Service solution, designed for fast deployment and even faster ROI.”

- Founded in 2011

“Our cloud-based software, which automates and streamlines formerly paper-based processes, is used by more than 300 businesses worldwide

Accurate and timely insight into your delivery operations can shrink costs, reduce lost and late deliveries, and improve customer satisfaction and retention – all critical to staying ahead of the competition. Airclic’s products for the food industry can increase efficiency and productivity of your operations by providing visibility and control into every step of the supply chain, including product location, delivery status and driver productivity – ensuring superior operational efficiencies, on-time deliveries and maximum product freshness. This software gives you the competitive advantage your company needs to thrive in today’s challenging business climate.”

- Founded in 2000

“With Myappsanywhere’s hosted Microsoft Dynamics ERP and CRM applications and Appolis ‘WithoutWire Warehouse, you can create a full-scale, field-to-fork supply chain-all in the cloud.”

- Founded in 2007