MyoKardia (NASDAQ:MYOK), a leading precision cardiovascular medicine company, reported good data during 2015-16 on its drug, mavacamten, to treat hypertrophic cardiomyopathy (HCM), a condition that reduces the rate of heart contractions because of the thickening of surrounding heart muscles.

MyoKardia (NASDAQ:MYOK), a leading precision cardiovascular medicine company, reported good data during 2015-16 on its drug, mavacamten, to treat hypertrophic cardiomyopathy (HCM), a condition that reduces the rate of heart contractions because of the thickening of surrounding heart muscles.

Mavacamten, an oral, small molecule, modulates the function of cardiac myosin, the motor protein that drives heart muscle contraction. After MYOK initially proved the safety of mavacamten, the FDA in 2016 granted orphan drug designation for mavacamten to treat symptomatic oHCM, a subset of HCM.

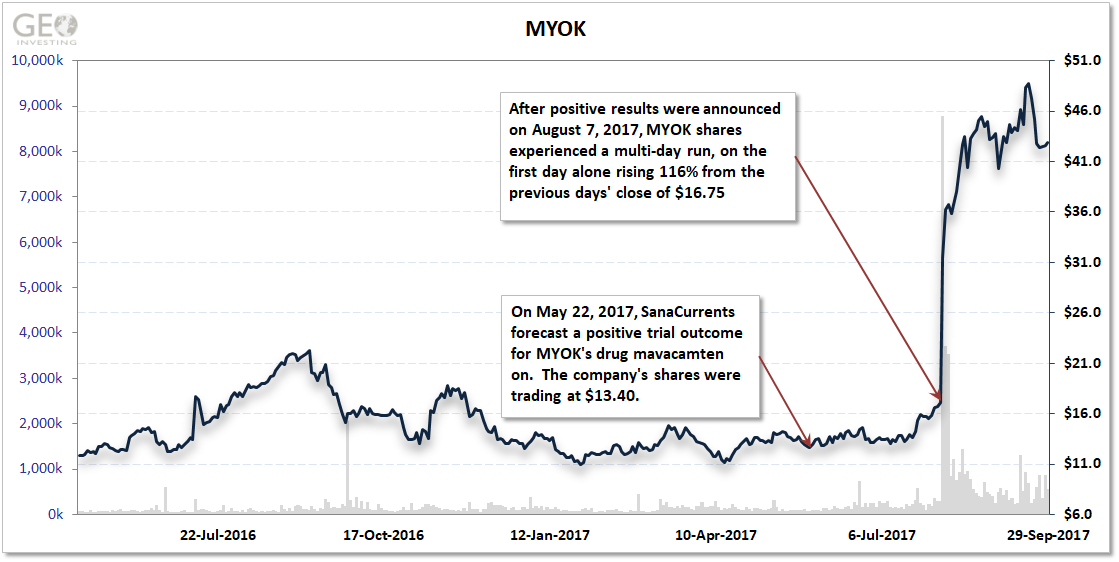

MYOK was set to report results of a phase II trial in the fall of 2017, which primarily needed to measure ventricular outflow in 12 patients. Previous studies indicated mavacamten could improve the outflow. SanaCurrents forecast a positive trial outcome on May 22, 2017 when MYOK shares were at $13.40.

The results were announced August 7, 2017. MYOK share rose to $36.20, or 170% after SanaCurrents’ forecast fora positive trial outcome.

What exactly did this mean for investors in MYOK shares? In 4 months, they netted at least $17,000 on a $10,000 investment after SanaCurrents’ initial forecast.