Since 2010, Geoinvesting.com has helped investors navigate the U.S. Listed Chinese company universe (ChinaHybrids) that has proven to be full of companies actively engaged in deceiving investors. As investors read our exposé on Longwei Petroleum Investment Holding Limited (LPH) today they need to realize that our due diligence process employed similar tools, such as video surveillance of operations, recorded interviews, and SAIC filing analysis that directly led to the halt and eventual delisting of numerous ChinaHybrids. Our exposure of the fraud perpetrated by Puda Coal (OTC:PUDA) and Yuhe (OTC:YUII) was ground breaking in that both managements actually admitted their deceit. Likewise, Alfred Little’s report on China Integrated Energy (OTCPK:CBEH) was the first to use video surveillance to prove fraud. Today’s report on LPH combines these approaches and allows us to make our strongest conclusion of fraud to date. The choice investors are left to make is very simple: Do I hold onto LPH and wait for the rhetoric that its management and its fee collectors will spout or do I sell out prior to what we believe is the inevitable trading halt and delisting, trusting in Geoinvesting’s due diligence and track record? The choice is yours and yours alone to make. We have made ours.

Longwei is reportedly engaged in the wholesale distribution of finished petroleum products in the People’s Republic of China (the “PRC”). LPH’s headquarters are located in Taiyuan, Shanxi Province, adjacent to and overlooking its Taiyuan fuel storage facility. LPH has a reported fuel storage capacity of 220,000 metric tons located at three storage facilities within Shanxi: Taiyuan, Gujiao and Huajie, which it claims have individual storage capacities of approximately 50,000 metric tons (“mt”), 70,000mt, and 100,000mt, respectively.

Unfortunately for owners of LPH stock, we have determined that the company’s purported business operations are massively overstated and a brazen fraud, on an order of magnitude unmatched before by any China-based companies we have seen. Furthermore, we have no faith in LPH’s auditor, Anderson Bradshaw. This is because the firm’s head of quality control, Russell Anderson, was the audit partner of YUII while he worked at Child, Van, Wagoner & Bradshaw. Russell failed to detect the massive YUII fraud we uncovered and did not resign until the YUII Chairman admitted fraud 5 days after we exposed them. Our exposé led to YUII’s delisting. LPH stock in our opinion is virtually worthless, completely un-investable and should be immediately delisted by the New York Stock Exchange (“NYSE”). We are sending all of our evidence to the NYSE and other securities regulators, just as we have done in prior cases.

Contents

Part I – Wholesale Fuel Sales Are Virtually Nonexistent

- 7 weeks (October 26 to December 13, 2012) of 24/7 time-lapse video surveillance of LPH’s Taiyuan and Gujiao fuel storage depots detected only 5 tanker trucks fueling at the two facilities, combined.

- In recent press releases and 8-K filings, LPH exaggerated its main Taiyuan and Gujiao facilities’ November 2012 sales by a factor of over800 times.

- In October 2012, prior to conducting our video surveillance, we discovered that the railroad spurs to the Taiyuan and Gujiao facilities were covered with vegetation and appeared unused in quite some time.

- Locals that we interviewed said that LPH’s business had been bad for a long time. We were told that the Gujiao facility had been almost completely idled since 2011, when it began losing money on fuel it sold due to unstable fuel prices since 2011.

- From December 9 to 22, 2012, we conducted 13 days of 24/7 time-lapse video surveillance of the newly-opened Huajie fuel storage depot and detected zero tanker trucks being fueled at the facility.

- CFO Mike Toups, by simply looking out of the Taiyuan office windows at the nearly idled tanker fueling station next door should have easily detected and prevented LPH’s brazen fraud given the amount of time he claims to spend at the facility.

Part II – Legal Issues Abound

- LPH never disclosed an investment of $32 million (out of a total commitment of $222 million) in a Tourism business made by its subsidiary Shanxi Zhonghe Energy Conversion Co., Ltd. (“Zhonghe”).

- LPH has eerie ties to Ming Zhao and Puda Coal Group (“PUDA”) through its Zhonghe and Huajie facility acquisitions. Investors may remember that Ming Zhao was the mastermind behind the massive PUDA fraud that the GeoTeam uncovered – a fraud which Ming Zhao tried to conceal with a bogus private takeover offer of $12.00 per share while the stock was halted.

- LPH’s minority interests in Taiyuan Longwei, owned by Mr. Cai Yongjun, are not reflected in its balance sheet as non-controlling interests.

- In its 2011 10-K, LPH claimed that Shanxi Heitan Zhingyou Petrochemical Co., Ltd (“Zhingyou”) was an operating subsidiary that had income tax due during the financial year ending June 30, 2011. However, in its 2012 10-K, LPH claimed that Zhingyou was a non-operating subsidiary in the financial year ended June 30, 2012 and did not have income tax due on June 30, 2011.

- The disclosed SAT/SAIC file by LPH on June 29, 2012 for the calendar year 2011 claimed that only Taiyuan Longwei Economic & Trade Co., Ltd. generated revenue and paid income tax and VAT tax. This contradicts the annual report (SEC) for the financial year ended on June 30, 2011 during which Zhingyou was still the operating subsidiary for the Gujiao facility.

1. Seven (7) weeks (October 26 to December 13, 2012) of 24/7 time-lapse video surveillance of LPH’s Taiyuan and Gujiao fuel storage depots detected only 5 tanker trucks fueling at the two facilities, combined.

Seven weeks (October 26 to December 13, 2012) of 24/7 time-lapse video surveillance of LPH’s Taiyuan and Gujiao fuel storage depots detected only 5 tanker trucks fueling at the two facilities, combined.

For 49 consecutive days, from October 26 to December 13, 2012, we performed uninterrupted 24/7 time-lapse video surveillance of LPH’s Taiyuan and Gujiao fuel storage depots, which together accounted for 96% of LPH’s total sales in the last fiscal quarter ended September 30, 2012. What we discovered was shocking. During this entire period we only saw only 5 tanker trucks fueling at the two facilities, combined.

Taiyuan Facility

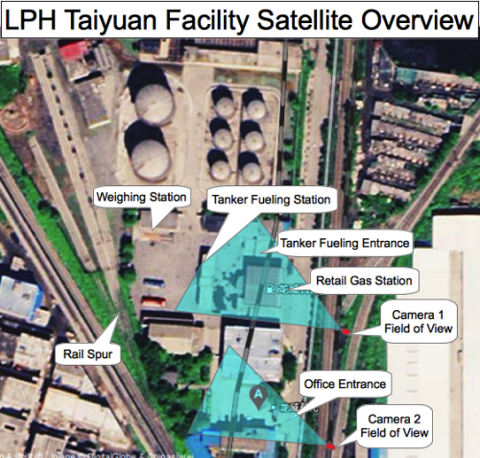

The following satellite overview image of the Taiyuan facility is marked showing the location and field of view of our cameras:

As shown in the overview image above, Camera 1 had a clear view of the Retail Gas Station, Tanker Fueling Entrance and a partial view of the Tanker Fueling Station. Camera 2 had a clear view of LPH’s corporate Office Entrance adjacent to the Taiyuan facility.

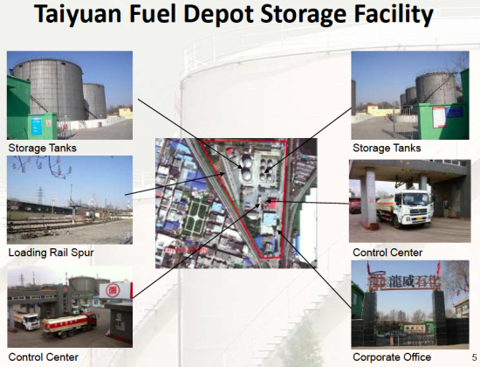

A comparison of our overview image with the following image from page 5 of LPH’s October 11, 2012 RedChip PowerPoint presentation confirms that we had our Camera 1 aimed at the Tanker Fueling Station (labeled “Control Center” in LPH’s image):

The following photo of the entrance to LPH’s corporate office (where CFO Mike Toups claims to spend half the year working) was taken from our Camera 2 on December 2, 2012:

LPH’s corporate office is the building pictured on the right (with the flags on the roof).

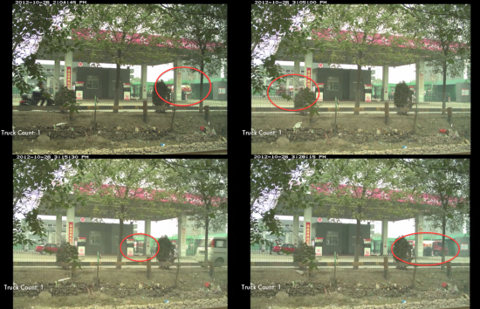

The following photos of the Taiyuan Tanker Fueling Entrance and Station were taken from our Camera 1 on October 26, 2012, showing the only tanker truck we ever saw fueling during the 49 days we filmed the Taiyuan facility. The tanker truck entered the Taiyuan facility at 2:04pm and departed at 3:28pm, as shown below:

The Tanker Fueling Station is located just behind the small retail gas station pictured above in the foreground (see the red taxi fueling). The Tanker Fueling Entrance is a gate shown on the right side of the pictures above. There is also an access gate on the left side of the retail gas station (pictured above) but during the course of our surveillance it appeared to be rarely, if ever, used. We observed a small amount of business at the retail gas station from locals during the daytime, limited by the poor location and the fact that the station offers only 90-octane gasoline and diesel fuel. We generously estimate that the average daily fuel sales at the retail station should not exceed 10 metric tons.

You can view 3 of our time-lapse surveillance videos of LPH’s Taiyuan Tanker Fueling Station filmed from our Camera 1 at the following links

We are sending the other 46 days’ videos from our Camera 1 as well as the videos from our Camera 2 to the New York Stock Exchange and the SEC Office of the Whistleblower.

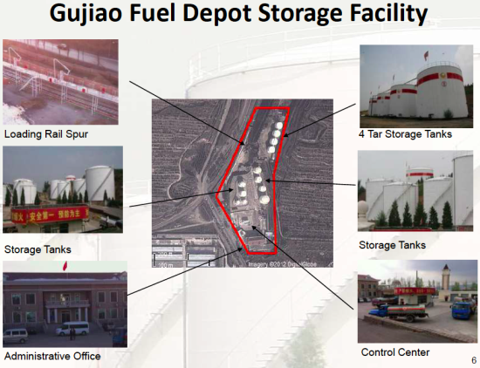

Gujiao Facility

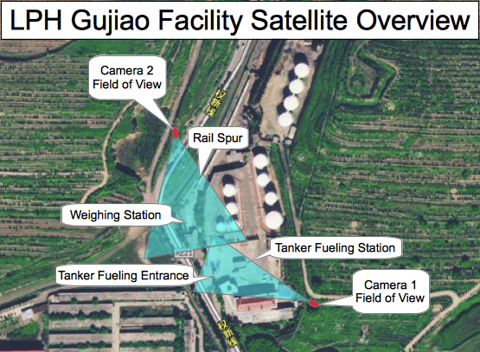

The following satellite overview image of the Gujiao facility is marked showing the location of our two cameras:

As shown in the overview image above, Camera 1 had unobstructed views of the Gujiao Tanker Fueling Station and the Tanker Fueling Entrance. Camera 2 had an unobstructed view of the Weighing Station and a partial view of the Rail Spur.

A comparison of our overview image with the following image from page 6 of LPH’s October 11, 2012 RedChip PowerPoint presentation confirms that we had our camera aimed at the Tanker Fueling Station (labeled “Control Center” in LPH’s image):

The following are images of the Gujiao Tanker Fueling Station taken from Camera 1 on November 27, 2012, showing one of only four tanker trucks we ever saw fueling during the 49 days we photographed the Gujiao facility (the other three tanker trucks showed up on October 29, November 13, and December 6, 2012):

You can view 3 of our time-lapse surveillance videos of LPH’s Gujiao Tanker Fueling Station filmed from our Camera 1 at the following links:

The dates of these three videos coincide with the dates of the Taiyuan Tanker Fueling Station videos we shared. Three of the four tanker trucks that fueled at the Gujiao facility during the 7 weeks of our surveillance can be seen in these surveillance videos. We are sending the other 46 days’ videos from our Camera 1 as well as the videos from our Camera 2 to the New York Stock Exchange and the SEC Office of the Whistleblower.

2. In recent press releases and 8-K filings, LPH exaggerated its main Taiyuan and Gujiao facilities’ November 2012 sales by a factor of over 800 times.

During the month of November 2012, our time-lapse video surveillance filmed only 2 tanker trucks fueling at the Taiyuan and Gujiao facilities, combined. For all practical purposes the Taiyuan and Gujiao facilities were nearly idle, with minimal sales coming from the small retail gas station selling fuel to locals in front of the Taiyuan Tanker Fueling Station.

The following table compares LPH’s reported combined November sales at its Taiyuan and Gujiao facilities to the bleak reality we filmed as part of our on-the-ground due diligence of LPH:

| Product Sales in Metric Tons | Source | ||||

| All 3 Facilities Oct-Nov 2012 | 86,128 | 12/20/2012 PR | |||

| All 3 Facilities Oct 2012 | (41,811) | 11/26/2012 PR | |||

| All 3 Facilities Nov 2012 | 44,317 | ||||

| Huajie Facility Nov 2012 | (8,990) | 12/19/2012 PR | |||

| Taiyuan + Gujiao Nov 2012 | 35,327 | ||||

| Average tanker truck capacity | 20 | ||||

| Taiyuan and Gujiao – Estimated total number of tanker trucks in Nov 2012 | 1,766 | ||||

| Actual number of tanker trucks observed in Nov 2012 | 2 | ||||

| Inflated product sales factor | 882x | ||||

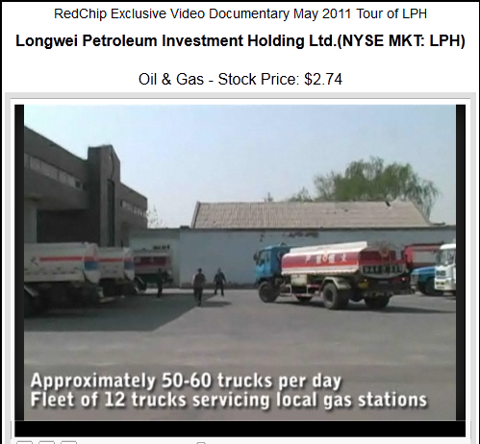

As shown above, by our estimates LPH brazenly inflated its November Taiyuan and Gujiao facilities’ combined product sales by over 800 times. In our recollection, no other China-based U.S.-Listed RTO has ever inflated its sales performance this much. (Note: Even if we include the maximum possible fuel sold by the small Taiyuan retail gas station (10mt x 30 days = 300mt) into our calculations, LPH still inflated its combined Taiyuan and Gujiao fuel sales by 875x.) Therefore we have to seriously question LPH’s CFO Mike Toup’s claims he makes 10 minutes 30 seconds into this May 2011 RedChip promotional video interview, where he states that:

“We’ve got anywhere from 50-60 trucks coming through [the Taiyuan facility] on a daily basis…”

RedChip CEO Dave Gentry then steps in front of the camera and states:

“So 50-60 trucks are coming through here per day…”

In the RedChip promotional video, there were at least a dozen trucks driving around inside the Taiyuan and Gujiao Tanker Fueling Stations. However, during our 49 consecutive days we filmed the two facilities, there were only 5 tanker trucks, combined. The RedChip promotional video sounds a lot like the March 2011 staged investor tour conducted by China Integrated Energy (“CBEH”), a fraud busted by Alfredlittle.com and delisted to the Pink Sheets after its auditor, KPMG, resigned in April 2011. LPH and RedChip made their promotional video in response to the CBEH debacle to try to convince investors that its Taiyuan and Gujiao fueling businesses were real. In fact, at 25 minutes into the promotional video, RedChip CEO Dave Gentry points out that CBEH was halted from trading and under SEC investigation for potential fraud after investors filmed its facility for four months and determined that the flow of trucks did not match the revenue and earnings that the company was reporting. Mr. Gentry then asks LPH CFO Mike Toups:

“To what extent have you verified what we’re seeing on the ground what we’re told in the financials is accurate?”

Mr. Toups replies:

“Dave, I’ve spent a considerable amount of time here in Taiyuan City working with the company, working with the management. I’ve really rolled up my sleeves in terms of understanding the financials…”

Mr. Toups then announces that LPH would set up webcams on its new website so investors could view the facilities and see the tanker trucks fueling. Nine months later, after repeatedly making excuses for delays installing the live webcams, Mr. Toups (on page 15 of LPH’s Q2 2012 earnings conference call transcript dated February 10, 2012) announced that the webcam project failed because “The Company deals with several sensitive industries in terms of some of the customers that we serve, the military or military-related customers, so we have not been able to come out through the Chinese firewall with the webcams or any type of a live feed.”

Our video surveillance proves that CFO Mike Toups’ claim of 50-60 trucks per day fueling at LPH’s Taiyuan facility is an outrageous exaggeration that Mr. Toups should be well aware of every time he visited the nearly idle Taiyuan facility. The real reason LPH never installed the webcams is because they have no business to film, as we observed during our 7 weeks of time-lapse video surveillance. LPH is defrauding its investors, just like China Integrated Energy, only on an even larger scale.

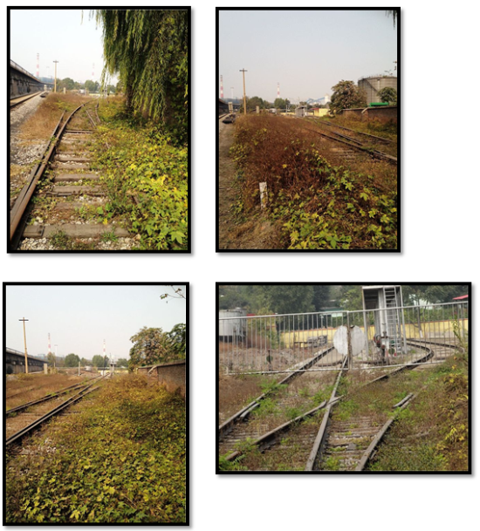

3. In October 2012, prior to conducting our video surveillance, we discovered that the railroad spurs to the Taiyuan and Gujiao facilities were covered with vegetation and appeared unused in quite some time.

LPH claims its Taiyuan facility is supplied with fuel by rail. However, our initial site visit in October 2012 found that the railroad tracks outside of the gate leading to Taiyuan facility were covered with vegetation as shown below:

Just like the Taiyuan facility, it appears the Gujiao facility had not been supplied with any fuel by rail in quite some time, as shown by our October photos of the railroad tracks leading to the Gujiao facility:

In this case, the vegetation has overgrown the tracks just inside of the railroad gate leading to the Gujiao railcar fueling terminal.

We conclude that for some time prior to our surveillance, neither the Taiyuan nor Gujiao facilities were being supplied with any material quantities of fuel.

4. Locals that we interviewed said that LPH’s business had been bad for a long time. We were told that the Gujiao facility had been almost completely idled since 2011, when it began losing money on fuel it sold due to unstable fuel prices since 2011.

We spoke with several locals who were knowledgeable about LPH’s recent business condition. Our key findings were:

- The Gujiao facility has been losing money and has been virtually idle since 2011.

- The Gujiao facility storage tanks are empty.

- The Taiyuan facility wholesale business is likewise virtually idle for a long time.

- The Taiyuan small retail gas station does more business than the Taiyuan wholesale business.

We recorded all of our interviews and are sharing them with the New York Stock Exchange and the SEC Office of the Whistleblower. To protect those filmed in the interviews, we will not publish the interviews in this report. Retaliation by Chinese companies against whistleblowers has been well documented by the media (for one example, check out www.publiccompanyprisoner.org)

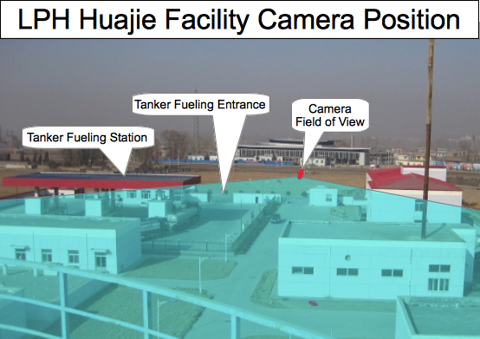

From December 9 to 22, 2012, after discovering that LPH’s Taiyuan and Gujiao facilities were almost completely idled, we decided to film LPH’s newly-opened Huajie facility, performing 13 days of 24/7 time-lapse video surveillance. Once again, we were shocked. We saw absolutely zero tanker trucks fueling at the Huajie facility.

The following image of the Huajie facility copied from LPH’s website is marked showing the location of our camera:

Our camera was placed in the field between the Tanker Fueling Entrance and the regional rail station (shown in the distance). We had an unobstructed view of the Gujiao Tanker Fueling Entrance and Tanker Fueling Station (as well as scores of amusing goats) as shown in the following sample photo:

You can view one time-lapse surveillance video of LPH’s Huajie facility at the following link:

We are sending the other 12 days’ videos of the Huajie facility to the New York Stock Exchange and the SEC Office of the Whistleblower.

To recap, all of the videos referenced above can be seen together here.

Conclusion Regarding Fuel Storage Facilities

LPH’s business at its 3 fuel storage facilities is in reality almost nonexistent, very likely since 2011, in sharp contrast to its recent press releases touting record October and November sales. In fact, based on our experience uncovering numerous frauds, LPH’s recently reported sales are the most exaggerated by any China-based company we have seen to date.

6. CFO Mike Toups, by simply looking out of the Taiyuan office windows at the nearly idled tanker fueling station next door should have easily detected and prevented LPH’s brazen fraud, given the amount of time he claims to spend at the facility.

LPH CFO Mike Toups has repeatedly told investors that he spends half the year in China, at LPH’s corporate office adjacent to the Taiyuan tanker fueling station. If Mr. Toups has been telling the truth about the amount of time he spends at the Taiyuan facility, then he could not possibly be unaware of the fact that the Taiyuan facility is nearly idled.

Mr. Toups claims to have over 12 years of experience with Asia-based companies. His experience as a director of Lotus Pharmaceuticals (LTUS – now $0.01/share) and interim CFO of Worldwide Energy and Manufacturing (WEMU – no longer trades due to the SEC revoking registration), both companies that were also clients of RedChip, should make him painfully aware of the prevalence of fraud in China.

Likewise, his participation in LPH’s Investor Relations response to the collapse of China Integrated Energy (CBEH – delisted), including his participation in the RedChip “documentary” showing how LPH was better than CBEH indicates that either Mr. Toups was aware and a part of LPH’s fraud, or else he has seriously exaggerated the amount of time and attention he has paid to LPH’s business operation. Based on our research, we are inclined to conclude that Mr. Toups is at best a very negligent CFO who seriously misled investors to believe that LPH was operating a meaningful business.

Part II – Legal Issues Abound

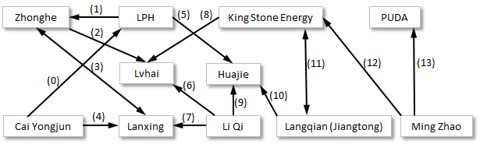

1. LPH Did Not Disclose A RMB 200 Million (USD 32 Million) Investment In A Tourism Business By Its Subsidiary, Zhonghe.

We learned that the Chairman of LPH, Cai Yongjun and Zhonghe, a claimed non-operating LPH subsidiary, own 10% and 90% respectively of a tourism project called Shengjing Mountain Tourism District, in Wendeng City, Shandong province. Shandong Jinriyue Tourism Development Co., Ltd. (“Jinriyue Tourism”), established in October 2009, was the company developing and managing the project. LPH never disclosed any details regarding its involvement in the project. Based on public information in China, as of November 2011, Zhonghe invested more than RMB 200 million (USD 32 million) in this tourism project and even planned to invest as much as RMB 1.4 billion (USD 222 million).

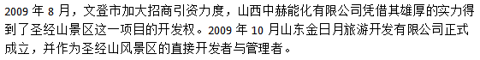

August 2009, Wendeng City intensified its investment promotion efforts. Shanxi Zhonghe Energy Conversion Ltd. [LPH subsidiary] obtained the Shengjing Mountain tourism district development rights by virtue of its strong financial capacity. Shandong Jinriyue Tourism Development Co., Ltd. was established in October 2009 as the direct developer and manager of Shengjing Mountain tourism district.

“The project has a total planned investment of RMB 1.4 billion from Shanxi Zhonghe Energy Conversion Ltd. [an investor] who is responsible for [funding the project’s] development and construction…”

“… At present, more than RMB 200 million has been invested [not disclosed in SEC documents] in the attractions and supporting projects under construction [that are to] be open to the public before November [2011].”

We also found some pictures where Mr. Cai Yongjun (LPH Chairman) is “escorting” local government officials around the project site.

Cai Yongjun’s picture on the tourism business site:

We also pulled the SAIC file of Jinriyue Tourism, in which the shareholder information is disclosed as follows:

Our research raises the following questions:

- Why didn’t LPH disclose its large investment in a tourism business, which is 90% owned by Zhonghe, LPH’s subsidiary?

- Where did the money invested in the tourism business come from?

2. LPH’s Huajie Acquisition Seems to Have Eerie Ties to PUDA and Its Chairman Ming Zhao

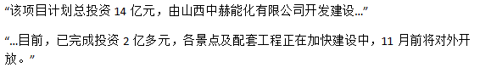

Longwei completed an Asset Purchase Agreement for the acquisition of the assets of Huajie Petroleum Co., Ltd. (“Huajie”) on September 26, 2012. On September 27, 2012, LPH announced that it paid RMB 700 million (approximately USD 110.6 million) for the assets.

“The Assets purchased from Huajie consist of fuel storage tanks with 100,000 metric ton capacity with accessory facilities and equipment, delivery and distribution platforms, including a dedicated rail spur and a vehicle loading and unloading station. The purchase also includes a 3,000 square meter office building and land use rights for approximately 98 acres of land adjacent to the main regional rail line.” (8-K, September 26, 2012)

LPH also disclosed that the assets were non-operational with no historical revenue.

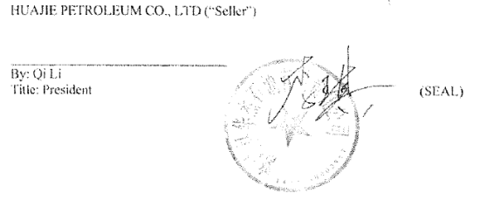

- Li Qi,

- LPH,

- Cai Yongjun, LPH’s chairman, and

- Ming Zhao, PUDA’s chairman

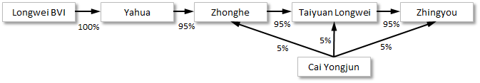

…are closely tied to one another as shown in the following diagram:

Notes:

– (0) Cai Yongjun is LPH’s chairman.

– (1) Zhonghe is a LPH’s subsidiary.

– (2) Zhonghe and Li Qi (6) jointly owned Lvhai which King Stone Energy (8)planned to acquire.

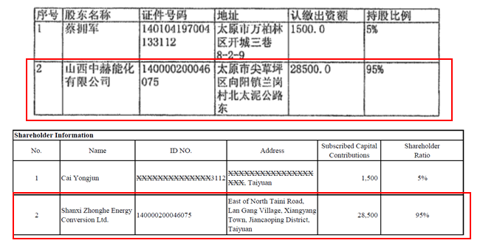

– (3) Zhonghe, LPH’s subsidiary, and Lanxing which is jointly owned by Cai Yongjun (4) and Li Qi (7), share the same address.

– (5) LPH acquired Huajie, whose legal representative is Li Qi (9), and whose shareholder is Langqian (Jiangtong) (10).

– (11) Langqian (Jiangtong) and King Stone Energy has a joint venture.

– (12) and (13) Ming Zhao controlled King Stone Energy and PUDA.

The details of the relationships are explained as follows:

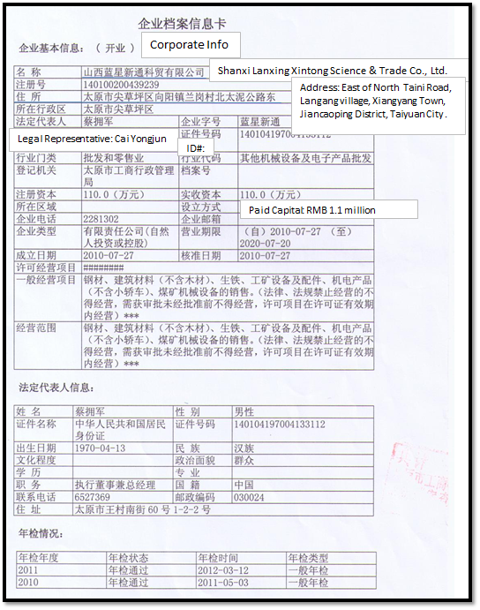

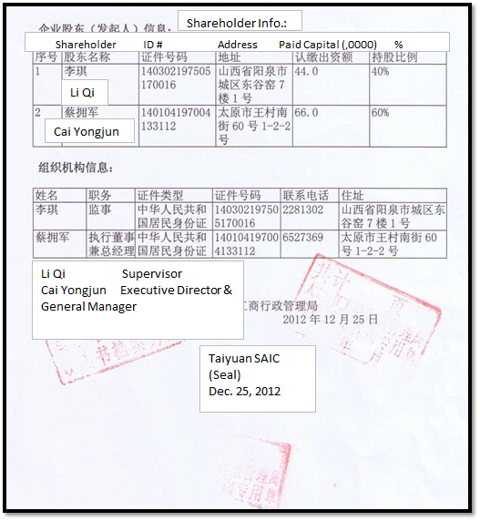

A. Li Qi and Cai Yongjun jointly own a company with the same disclosed address as Zhonghe. Li Qi and Cai Yongjun jointly established a company called Shanxi Lanxing Xintong Science & Trading Co., Ltd. (“Lanxing”) on July 27, 2010, as follows:

B. Li Qi and Zhonghe, a subsidiary of LPH, jointly owned a company called Shanxi Lvhai Mining Co., Ltd., which was eventually acquired by Hong Kong publicly traded King Stone Energy Group Limited (0663 HK) (“King Stone Energy”), a company controlled by Ming Zhao, PUDA‘s chairman.

On February 9, 2011, King Stone Energy made a disclosure regarding its acquisition of Shanxi Lvhai Mining Co., Ltd. including the following information:

“The company (“Shanxi Lvhai Mining Co., Ltd.”) was established as a limited liability company in the PRC on 13 October 1997 with registered and paid-in capital of RMB1,000,000. Since then, [LPH subsidiary] Shanxi Zhong He Neng Hua Company Limited (”Shanxi Zhong He”) (Shanxi Zhonghe Energy Conversion Co., Ltd.) held a 90% equity interest in LPH, and Mr. Wei Yong held a 10% equity interest in the company.

After two equity transfers transactions in August 2008 and July 2009, respectively, the company was owned as to 90% and 10% by Shanxi Zhong He and Mr. Li Qi, respectively.

On 15 July 2009, the registered capital of the company increased to RMB 10,000,000 and Shanxi Zhong He further injected RMB 9,000,000 into the company. Thereafter, Shanxi Zhong He’s and Mr. Li Qi’s equity interest in the company were 99% and 1%, respectively.

On 26 September 2009, Mr. Meng Haigui acquired, in aggregate, 55% equity interest in the company from Shanxi Zhong He and Mr. Li Qi. Thereafter, Mr. Meng Haigui’s and Shanxi Zhong He’s equity interests in the company changed to 55% and 45%, respectively.”

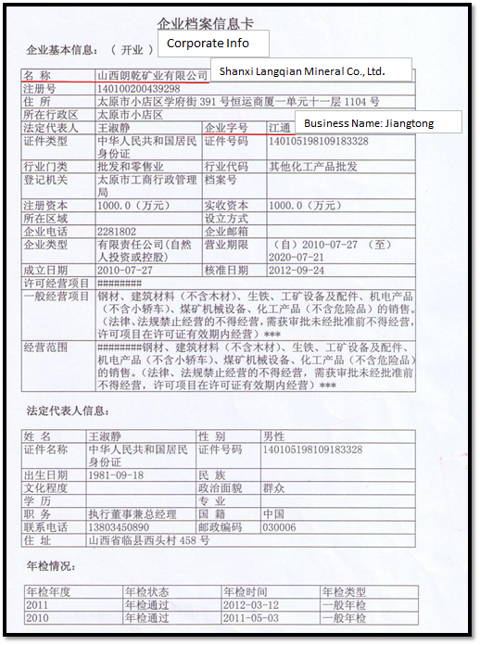

C. Huajie’s shareholder, Shanxi Langqian Mineral Co., Ltd. (former name: Shanxi Jiangtong Chemical Co., Ltd.), has a joint venture with King Stone Energy which is controlled by Ming Zhao, PUDA’s chairman.

On June 2, 2011, King Stone made an announcement regarding its joint venture with Shanxi Langqian Mineral Co., Ltd. and CITIC Trust, a company prevalent in the PUDA fraud story. According to the disclosure:

“The Board is pleased to announce that in furtherance of the Strategic Cooperation Agreement,

(Shanxi Puhua Deqin Metallurgy Technology Company Limited) (“Shanxi Puhua”), which is a subsidiary of the company established in the People’s Republic of China (the “PRC”), CITIC Trust and

(Shanxi Langqian Mineral Co., Ltd) (“Shanxi Mineral”), both being independent third parties not connected with the Company.”

On May 18, 2011, Shanxi Langqian Mineral Co., Ltd. (“Shanxi Mineral”) dismissed its former name, Shanxi Jiangtong Chemical Co., Ltd., as shown below:

Note: Shanxi Langqian Mineral Co., Ltd. changed its name from Shanxi Jiangtong Chemical Co., Ltd. on May 18, 2011.

Before this change, on March 14, 2011, Shanxi Mineral signed a letter of intent with Taiyuan Longwei to sell the Huajie facility to LPH.

Therefore, we can conclude that LPH has a very close relationship with King Stone Energy (HK: 0663) through LPH’s subsidiary Zhonghe and the acquisition of Huajie facility whose shareholder (Langqian, formerly Jiangtong) has a joint venture with King Stone Energy.

Experienced China RTO investors already know the intensive relationship between King Stone Energy and PUDA and that both were controlled by Ming Zhao, whom the SEC has charged with securities fraud in connection with PUDA.

3. LPH’s Minority Interests In Taiyuan Longwei Owned By Mr. Cai Yongjun Are Not Reflected In Its Balance Sheet As Non-Controlling Interests

In LPH’s SEC filings, the corporate structure is stated as follows:

| Subsidiaries | Country | Percentage ofOwnership |

| Longwei Petroleum Investment Holding Limited | British Virgin Islands | 100% |

| Taiyuan Yahua Energy Conversion Ltd. | PRC | 100% |

| Shanxi Zhonghe Energy Conversion Ltd. | PRC | 100% (“a”) |

| Taiyuan Longwei Economy & Trading Ltd. | PRC | 100% (“a”) |

| Shanxi Heitan Zhingyou Petrochemical Co., Ltd | PRC | 100% (“a”) |

The 2011 10-K contains the following footnote, designated by (“a”) in the above chart:

“A total of 95% of the ownership units are held by the LPH’s subsidiaries. The remaining 5% of the ownership units are held in trust for the benefit of the LPH’s subsidiaries in accordance with local Chinese regulations, therefore no non-controlling interest is recognized. The 5% ownership units are held in trust by our Chairman and CEO, Mr. Cai Yongjun, for the benefit of Taiyuan Yahua Energy Conversion Ltd. and Shanxi Zhonghe Energy Conversion Ltd. The 5% ownership unit held in trust for the benefit of Taiyuan Longwei Economy & Trading Ltd. is held by an individual who is also an employee of the LPH. This ownership structure is organized to comply with PRC and local business ownership requirements.

Taiyuan Yahua Energy Conversion Ltd., Shanxi Zhonghe Energy Conversion Ltd. and Shanxi Heitan Zhingyou Petrochemical Co. Ltd. are taxed pursuant to the New EIT Law with a unified enterprise income tax rate of 25%. None of these companies had income taxes due during the three month periods ended September 30, 2012 and 2011. Since these three entities have minimal business operations, the three entities are unlikely to have profits in future periods. As a result, all deferred tax assets and liabilities are deminimus, and management would have a 100% valuation allowance for all deferred tax assets.

The operating subsidiary of Taiyuan Longwei Economy & Trading Ltd. is taxed pursuant to the New EIT Law with a unified enterprise income tax rate of 25%. This entity had taxes due for the three month periods ended September 30, 2012 and 2011 of $6.2 million and $5.3 million, respectively.”

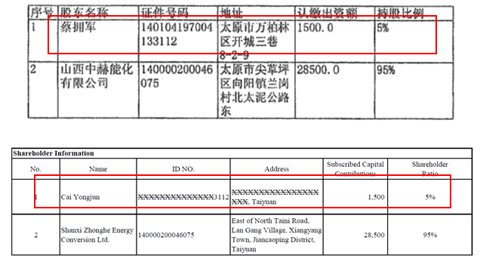

However, on June 29, 2012, LPH disclosed its Tax Reconciliation Report including a purportedly official Taiyuan Longwei SAIC report:

Sources:

- Chinese Version of the above image

- English Version of the above image

The SEC disclosure referenced in the above footnote of the 2011 10-K that states that…

“The 5% ownership unit held in trust for the benefit of Taiyuan Longwei Economy & Trading Ltd. is held by an individual who is also an employee of the LPH.”

…differs from what is disclosed in Taiyuan Longwei’s SAIC filing presented by LPH which reveals that Mr. Cai Yongjun, LPH’s chairman actually owns 5% of Taiyuan Longwei.

Based upon the SAIC file we pulled, the real corporate structure is as follows:

Therefore, in this circumstance, LPH should either execute a new agreement with Mr. Cai Yongjun regarding his 5% of Taiyuan Longwei and/or list Mr. Cai’s non-controlling interests in LPH’s financial statements. Also, LPH may also need to disclose the 5% “in trust” agreement to its shareholders and/or investors to make sure that it can abide by the “U.S. GAAP standard for consolidation without non-controlling interests.

4. Inconsistencies Between 2011 and 2012 Financial Reports Regarding Zhingyou’s Operating and Financial Information

LPH’s annual report (10-K) for the financial year ended June 30, 2012 contradicts information in its annual report (10-K) for the financial year ended June 30, 2011 regarding Zhingyou, the operating subsidiary of the Gujiao facility.

- In its annual report for the period ending June 30, 2011, LPH stated that Zhingyou (owner of its Gujiao facility), along with Taiyuan Longwei (owner of its Taiyuan facility), paid substantial taxes and reported large revenues.

- This is totally contradicted by LPH’s annual report for the year ending June 30, 2012 that clearly states Zhingyou had minimal operations and paid no taxes in its 2011 financial year.

Here are the specific details:

In the annual report for the period ending June 30, 2011, LPH disclosed that Zhingyou was the operating subsidiary for Gujiao facility as follows:

“The operating subsidiaries of Taiyuan Longwei Economy & Trading Ltd. and its subsidiary Shanxi Heitan Zhingyou Petrochemical Co. Ltd. (Gujiao operations) are taxed pursuant to the New EIT Law with a unified enterprise income tax rate of 25%. These entities had taxes due during the years ended June 30, 2011 and 2010 of $23.6 million and $16.7 million, respectively.

In the same annual report, LPH disclosed that the Gujiao facility generated revenue and sales volume in the two quarters (January 1, 2011 to June 30, 3011) of 2011 as follows:

| Gujiao Facility | Quarter ended

March 31, 2011 |

Quarter ended

June 30, 2011 |

| Product Sales Revenue | $ 51,408,000 | $ 50,072,000 |

| Sales volume | 48,076mt | 42,431mt |

However, in the annual report for the period ending June 30, 2012, LPH disclosed that it only has one operating subsidiary, Taiyuan Longwei Economy & Trading Ltd, and that Zhingyou became a non-operating subsidiary:

“Taiyuan Yahua Energy Conversion Ltd., Shanxi Zhonghe Energy Conversion Ltd. and Shanxi Heitan Zhingyou Petrochemical Co. Ltd.are taxed pursuant to the New EIT Law with a unified enterprise income tax rate of 25%. None of these companies had income taxes due during the years ended June 30, 2012 and 2011. Since these three entities have minimal business operations, the three entities are unlikely to have profits in future periods. As a result, all deferred tax assets and liabilities are deminimus, and management would have a 100% valuation allowance for all deferred tax assets.

The operating subsidiary of Taiyuan Longwei Economy & Trading Ltd. is taxed pursuant to the New EIT Law with a unified enterprise income tax rate of 25%. This entity had taxes due for the years ended June 30, 2012 and 2011 of $21.3 million and $23.5 million, respectively.”

Yet, for the fiscal year ended June 30, 2012, LPH claims that its Gujiao facility continued to generate substantial revenue.

| Gujiao Facility | Quarter ended September 30, 2011 | Quarter endedDecember 31, 2011 | Quarter ended March 31, 2012 | Quarter ended June 30, 2012 |

| Product Sales Revenue | $ 54,843,000 | $ 56,261,000 | $ 64,293,000 | $ 58,351,000 |

| Sales volume | 43,844mt | 47,542mt | 51,900mt | 47,140mt |

The only reasonable explanation for the change in the number of subsidiaries is that after June 30, 2011 Zhingyou ceased its Gujiao facility operation and Taiyuan Longwei operated both facilities: Taiyuan facility and Gujiao facility, in the fiscal year ended June 30, 2012.

However, it is not reasonable to assume that the Gujiao facility has been closed when we consider that, as of today, Zhingyou still carries the required Dangerous Chemical Distribution License. Therefore, we conclude that Zhingyou still exists and is still the operating subsidiary of the Gujiao facility. This raises the question:

- Why did LPH claim that Zhingyou suddenly is not an operating subsidiary when it appears to still operate the Gujiao facility?

The answer may lie in the SAT/SAIC filings that LPH disclosed as part of its reconciliation. Perhaps LPH did away with Zhingyou to avoid having to present Zhingyou’s SAT documents to U.S. investors, so that it could omit the true SAT filings of its Gujiao facility.

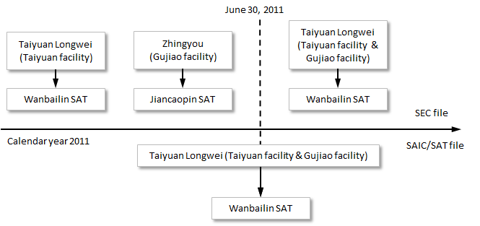

5. The Tax Reconciliation Report (SAIC/SAT file) provided by LPH on June 29, 2012 claimed that only Taiyuan Longwei generated revenue and paid income tax in the calendar year 2011. This contradicts LPH’s 10-K filing for the financial year ending June 30, 2011, which clearly mentioned that Zhingyou was also the operating subsidiary of the Gujiao facility and generated substantial revenue.

Quick Refresher on ChinaHybrid Subsidiary Financial Data Consolidation Regarding ChinaHybrids, we discussed the relevance between the SAIC/SAT and SEC files in past articles. By now, investors in this space should know that Chinese companies need to file their financial numbers to SAIC for each calendar year ending December 31. Chinese companies file their own financial numbers and never consolidate their subsidiaries’ financial data, except in situations where holding companies clearly make a note that their financial statements are consolidated for the whole group. LPH has never made such a consolidation statement in its filings.

Based on the above, we would have expected LPH to present SAIC/SAT information for its two subsidiaries (Taiyuan Longwei and Zhingyou) it historically claimed to have operated in 2011. But this was not the case, leading us to believe that LPH may not have provided investors with authentic SAIC/SAT filings, and leaving us wondering why the company omitted the 2011 Zhingyou SAIC/SAT filing.

The following diagram explains the different disclosures between LPH’s SEC file and its SAIC/SAT file regarding its operating entities:

In the SEC filings, LPH claimed that Zhingyou was an operating subsidiary for the Gujiao facility in the financial year ended June 30, 2011 and generated substantial revenue. LPH should have also disclosed the SAIC/SAT filings for Zhingyou to reflect its Gujiao operation for the first half of 2011. Yet LPH did not disclose any SAIC/SAT files regarding Zhingyou for its Gujiao facility operation.

Most importantly, based upon the LPH disclosed SAIC/SAT file, Taiyuan Longwei recorded Zhingyou’s revenue regarding the Gujiao facility for the first half of 2011 (January to June 2011) when Zhingyou was allegedly the operator of Gujiao facility.

The Gujiao facility operated by Zhingyou and the Taiyuan facility operated by Taiyuan Longwei are located in different districts and are covered by different SAT authorities.

Simply put, for 2011:

- Taiyuan Longwei should pay taxes for its operation to its local SAT office: Wanbailin District SAT; and

- Zhingyou should pay taxes for its operation to its local SAT office: Jiancaopin District SAT.

Ironically and contrary to PRC law and practice, Taiyuan Longwei allegedly paid all the corporate income tax and VAT tax that Zhingyou was legally required to pay for its Gujiao facility operation for the period ending June 30, 2011, when LPH clearly stated that Zhingyou was the operating subsidiary of the Gujiao facility.

LPH claims that Taiyuan Longwei allegedly paid all corporate income tax and VAT tax to the Wanbailin District SAT for both the Taiyuan facility and Gujiao facility. However, based upon the SEC files, Zhingyou was responsible for paying the corporate income tax and VAT tax for the Gujiao facility for the period ending June 30, 2011. Zhingyou is supposed to pay the corporate income tax and VAT tax to its own SAT office in the Jiancaopin District for the Gujiao facility operation before June 30, 2011. It is illogical that Taiyuan Longwei paid corporate income tax and VAT tax to its Wanbailin District SAT for the Gujiao facility operation before June 30, 2011.

We therefore question the authenticity and truth of the SAIC/SAT reconciliation disclosed by LPH on June 29, 2012.

Conclusion:

We could not believe that after three years in the market exposing the fraud that has occurred in the ChinaHybrid space that a company like LPH and its fee collectors still believe that they can peddle a story to U.S. investors that is almost certain in our opinion to end horribly. Not one part of LPH’s story holds credence, whether one looks at it from an operational or legal perspective; which is why we believe LPH is the most brazen fraud we have seen to date among China-based U.S.-listed companies. We view a halt and delisting as inevitable and would not be surprised if the SEC chooses to revoke LPH’s registration as a public company. LPH does not even deserve to trade on the Pink Sheets in our view.

Over the past few years we warned investors through our in-depth analysis about Subaye (OTCPK:SBAY), China Redstone (OTCPK:CGPI), Lotus Pharmaceuticals (OTCPK:LTUS), Puda Coal (OTC:PUDA), Yuhe (OTC:YUII), New Energy (OTC:NEWN), Orsus Xelent (OTCPK:ORSX) and Sino Clean Energy (SCEI). All now trade as penny stocks. SBAY, PUDA, YUII, ORS and SCEI all made investors suffer through de-listings. SBAY and PUDA were both charged with fraud by the SEC. We warned RedChip about LTUS. Now we are appealing to their sense of ethical duty to heed our warning about LPH and to not spend even one day longer backing a fraud.