GeoInvesting is currently short Great Basic Scientific (GBSN), a rapid diagnostic medical test (Nucleic Acid Assay Testing) firm. We first alerted GeoInvesting premium members that we identified red flags associated with GBSN on March 30, 2015.

In our March 30 e-mail to premium members, we stated:

We are taking a closer look at GBSN, as just 3 months after it went public we received a promotional pump e-mail newsletter. The stock was up strong in Friday’s session (up 40%). Our initial due diligence is beginning to reveal a number of red flags.

In our April 7, 2015 e-mail to premium members, we stated:

Rapid diagnostic medical test firm Great Basin Scientific (GBSN) went public on October 9, 2014. The IPO was underwritten by Dawson James Securities, Inc, out of Boca Raton, Florida. This immediately gave our team cause for concern due to Dawson’s past regulatory infractions and its association with one of its previous brokers, arrested in connection with his participation in a “nationwide Ponzi Scheme.” Furthermore, Dawson has had investment banking relationships with other stocks we consider to be pump and dumps, as well as with a high a profile Chinese company accused of fraud whose registration was revoked by the SEC. But more importantly, while Yahoo, GOOG and other financial portals indicate that GBSN has only 5 million outstanding shares, a February 2015 secondary offering created convertible preferred stock and warrants that will allow an additional 35 million shares to flood the market.

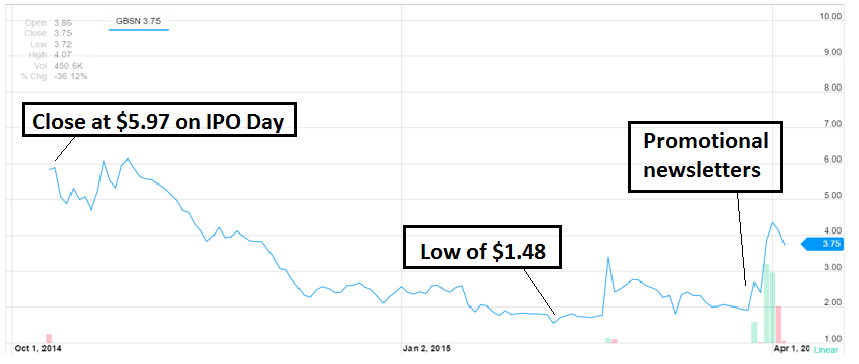

GBSN reached an intraday trading high of $9.08 during its October 2014 IPO debut, before closing at $5.97. Since its IPO, GBSN shares had been in a steady decline, touching $1.48 on February 10, 2015. A pump campaign initiated by several promotional newsletters last week (Friday, March 28, 2015) has helped push the stock as high as $5.40 as of April 1, 2015.

See our full email alert bulletins here.

Just yesterday, another skeptic of GBSN posted this article on Seeking Alpha, claiming that “penny stock newsletter pumps don’t end well.” We agree with the premise of this article and today we’ll offer what our due diligence has turned up, some of which corresponds with this report.

Great Basin Scientific went public on October 9, 2014. The company currently only has one product on the market:

“Our C. diff diagnostic test is our first and only assay cleared by the FDA for commercial sale.”

Dawson James Securities, Inc.’s History Suggests Great Basic Scientific Could be a Pump & Dump

The IPO was underwritten by Dawson James Securities, Inc. out of Boca Raton, Florida. This immediately gave our team cause for concern due to Dawson’s past regulatory infractions and its association with one of its previous brokers, who was arrested in connection with his participation in a “nationwide Ponzi Scheme.” Dawson has had investment banking relationships with other stocks we consider to be pump and dumps as well. They’re also connected with a high a profile Chinese company, Fuqi International (FUQI), accused of fraud by the SEC who also revoked their registration. More importantly, while Yahoo, GOOG and other financial portals indicate that GBSN has only 5 million outstanding shares, a February 2015 secondary offering created convertible preferred stock and in-the-money warrants that could allow an additional 39 million shares to flood the market.

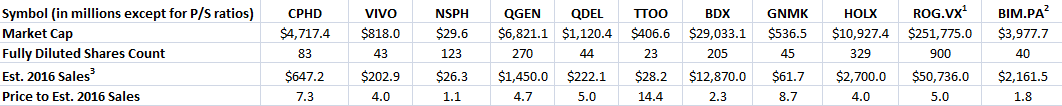

After reading company filings, we also learned the company faces competition from at least 11 larger competitors (based on revenue estimates) with revenues ranging from $20 million to $49.8 billion compared to GBSN’s 2014 annual revenue of $1.6 million.

GBSN reached an intraday trading high of $9.08 during its October 2014 IPO debut, before closing at $5.97. Since its IPO, GBSN shares have been on a steady decline, touching as low as $1.48 on February 10, 2015. A pump campaign initiated by several promotional newsletters last week (Friday, March 28, 2015) helped push the stock as high as $5.40 on April 1, 2015.

Consider the GeoTeam Pump and Dump Track Record

Investors who may not be familiar with GeoInvesting’s pump and dump track record should take note of our 100% success rate in predicting that shares of pump and dumps we exposed would fall dramatically. Previous pump and dumps that we’ve covered include examples like:

- CLDS, which fell from $139 to $1.38 (adjusted for 1:100 reverse split)

- GNIN, which fell from $0.57 to $0.01

- ECAU, which fell from $0.72 to <$0.01

- DIMI, which fell from $1.54 to $0.15

- GWBU, which fell from $0.44 to <$0.01

- RAYS, which fell from $1.55 to <$0.01

- TALK, which fell from $0.99 to <$0.01

- NORX, which fell from $0.45 to <$0.01

In addition to these, tickers like APPG, XXII, WSTI, AHII, and PGFY round out a list of 16 pump and dump stocks that GeoInvesting has successfully reported on and shorted. Of these 16, nine currently trade at $0.01 or lower and four trade at $0.30 or lower.

Great Basin is a molecular diagnostics company that commercializes breakthrough chip-based technologies and is dedicated to the development of simple, yet powerful, sample-to-result technology and products that provide fast, multiple-pathogen diagnoses of infectious diseases.

Our reasons for tracking Great Basin Scientific as a pump and dump

- Several promotional pump letters have just begun touting GBSN

- A promotional newsletter made reference to the company’s low float of about 2 million shares as an impetus for the stock to rise rapidly. The newsletter fails to tell investors that the company’s fully diluted share count is closer to 44 million, consisting of convertible preferred stock and warrants with an exercise price of $2.55.

- We find it odd that promotional campaigns began shortly after a secondary offering in late February 2015 that created the preferred stock and warrants.

- Dawson James Securities, Inc., the underwriter of GBSN’s October 2014 IPO and its February 2015 secondary offering, is headquartered in Boca Raton, Florida where many pump and dumps we have come across are born.

- Dawson’s apparent inability to prevent violations by its brokers is concerning. It looks like Dawson has a checkered past, including FINRA violations and failure to prevent one of its prior brokers from playing a role in a Ponzi scheme:

In December 2012, their former representative Jason Knapp of Corinth, New York, was arrested for operating a ponzi scheme which had victims across the country, including Boca Raton, FL, and New York. More information on that here.

According to FINRA records on their BrokerCheck website, Knapp worked for Dawson James Securities from September 2008 until June 2012.

According to the PostStar, Knapp had previously worked for Dawson James Securities, Inc. of Boca Raton, FL, and had raised investment capital in connection with a company call SteepleChase Group, claiming returns on investment would be over 18%. It is alleged that he used new investors’ money to pay prior investors and spent a portion of the money earmarked for investment on personal travel, including trips to casinos.

- The following deficiencies have been cited by FINRA, which carried with them a $75,000 fine.

- Broker’s disclosure of potential conflicts of interests to clients

- Brokers trading in opposite directions of solicited customer transactions

- Unauthorized trading

- Suitability

- Excessive trading

- Free riding

- Concentrations of securities in client accounts

- Wash sales

- The firm failed to investigate numerous “red flags” relating to the activities of a broker

- Given these infractions and Dawson’s association with other stocks we consider to be pump and dumps, we are concerned that Dawson may not be adequately preventing its brokers from participating in pump and dump activities. Furthermore, given that the pump campaign on GBSN began shortly after its October IPO and its February secondary offering, we are forced to question ifDawson and/or pre IPO/secondary offering investors are behind the alleged campaign to some degree.

- Dawson has had investment banking relationships with four other publicly traded companies (ATOS, SIBE, AMPD, BHRT) that we classify as pump and dumps (supported by promotional emails from newsletters). Three are trading for pennies. All are trading well below the prices from which respective pump campaigns commenced.

- Dawson was one of the underwriters of the IPO of Fuqi International,Inc (FUQI). FUQI was a high profile U.S. Chinese Company accused of fraud, and subsequently got halted, delisted and had its registration revoked.

“The Commission (SEC) brought another fraud action against a China based issuer and its chairman. This time the case focuses on the lack of internal control and a series of unauthorized cash transactions that were repaid. SEC v. Fuqi International, Inc., Civil Action No. 1:13-cv-995 (D.D.C. Filed July 1, 2013).

Fuqi is a PRC based jewelry company whose chairman, president and CEO is defendant Yu Kwai Chong, a Chinese national. The company made a public offering of securities in March 2010. Its shares were traded on the NASDAQ Global Market. Eight months after the stock sale the company announced it would restate the first three quarters of 2009 due to accounting errors. Its earnings had been overstated by 12% to 23%.

While completing the restatement the outside auditors discovered that between September 2009 and November 2010 Mr. Chong had directed the transfer of about $134 million in over 50 transactions from firm bank accounts to accounts at other banks for three jewelry companies in China. The transfers were booked as “other payables” or “prepaids.” The board of directors was unaware of the transactions.”

- GBSN appears to be in continual need of capital, and they have a high cash burn rate. They raised $8 million during the IPO in October of 2014, giving them a post IPO cash balance of $11 million. At the time of GBSN’s $24 million secondary offering in February of 2015, the cash balance was sitting at about $2 million. GBSN’s 2014 annual sales were a meager $1.6 million compared to a fully diluted market cap of around $158 million.

We are still in the process of performing our due diligence into the company’s product and competitors. However, here are some of our initial thoughts:

- GBSN is not the only company with Nucleic Acid Assay Testing. There are several mentioned by the company including:

- Cepheid (NASDAQ:CPHD)

- Nanosphere Inc. (NASDAQ:NSPH)

- Meridian Bioscience Inc. (NASDAQ:VIVO)

- Qiagen N.V. (NASDAQ:QGEN)

- Roche Diagnostics (ROG.VX)

- Quidel Corporation (NASDAQ:QDEL)

- T2 Biosystems Inc. (NASDAQ:TTOO)

- Becton Dickinson And Company C (NYSE:BDX)

- Genmark Diagnostics Inc. (NASDAQ:GNMK)

- Hologic Inc. (NASDAQ:HOLX)

- BioMerieux (BIM.PA)

Based on management’s commentary (GBSN business update conference call transcript on 03/18/2015, given the number of customersand revenue from each customer, it appears that management is expecting to report revenues from the C. diff Test between $3.4 million and $3.96 million going into 2016. Our estimates for total company revenue in 2016 are based on the verbiage from the most recent 10K, which states:

“Our material increases in revenues since the inception of our business have been attributable to increases in the volume of goods being sold as a result of increases in the number of customers. As of December 31, 2014, we only have one commercial product, our C. diff assay and the average price has not materially changed since its commercial release.”

That means if we reference management revenue targets based on its only commercially available product, shares are trading at a price to sales of 42.8 on our 2016 revenue calculation, or about 3 times the most richly valued comp (TTOO).

We have summarized selected data points for competitors that were mentioned in GBSN’s 10K.

note1: financial numbers are based on currency exchange ratio of 1.05 USD per CHF.

note2: financial numbers are based on currency exchange ratio of 1.10 USD per EUR.

note3: estimated 2016 sales are from Yahoo Finance.

- It appears that the company may not even own some of its technology: (Page 10, 2104 10K)

- We hold non-exclusive licenses to key technologies from BioHelix related to isothermal amplification of nucleic acid targets, utilizing helicase-dependent amplification, or HDA. The term of this license agreement extends until the expiration of all the patents associated with the licensed patent rights, or until such time as we elect to terminate with 30 days’ notice. This license is limited to the fields of human diagnostic testing utilizing our solid chip surface detection and contains diligence and U.S. preference provisions. To date, these technologies have resulted in three issued U.S. patents, one issued European patent and one pending international patent family. In addition, these technologies may include related technologies that BioHelix may develop in the future. The BioHelix technologies are the basis of our nucleic acid amplification approach. In May of 2013, Quidel Corporation, a competitor of ours, purchased BioHelix. We pay a royalty fee for the licensing of this technology based on a percentage of our “Net Sales” of assays using these technologies (as defined in the license agreement).

Again, this is a preliminary overview of our take on GBSN and more details may be forthcoming as our due diligence progresses. Be advised that when dealing with speculative pump and dump style stocks, especially in the biotech arena, there is always a risk of unexpected and unreasonable runs upward.

To stay ahead of the market with GeoInvesting arbitrage and learn about investment ideas not yet digested by the market, Sign up now for More Research and Insight