ALLEducation (161)GeoWire Monthly (38)GeoWire Weekly (313)Video Case Study (7)Written Case Study (30)

🔍

Last week was packed with updates across several stocks in our microcap coverage universe, showcasing a mix of momentum, business shifts, and bullish setups heading into Q2 2025...

The next two or three weeks are going to be busy with an onslaught of fourth-quarter 2024 microcap earnings reports coming out in bunches. However, last week was still a fairly busy week in the...

We launched Buy on Pullback Portfolio #13 near the end of the day on Friday.

Recognizing that markets often overreact, we’ve carefully handpicked a basket of 8 microcap stocks that have gotten...

Some people might say that the data center industry itself is currently at a crossroads already and in a “hot or not” debate in the sphere of investing. In some corners, there are mixed signals...

While many investors are panicking over last week’s market performance, we see this as an opportunity. These are exactly the types of market conditions that allow us to execute our Buy on Pullback...

Reading press releases is one of the most important (and often overlooked) aspects of microcap research. Yet, reviewing them across multiple financial news wires is often cumbersome and...

Decades of micro-cap research taught me that hidden details in press releases can reveal opportunities that result in outsized investment gains. To capitalize on this, my team and I developed a...

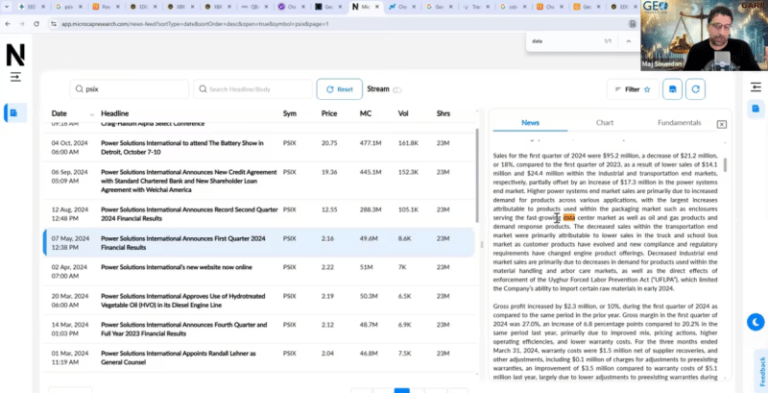

In This Month’s GeoWire Gearing Up for The Starting Five Virtual Conference #4, And Reflecting on #3 Uncovering Two Micro-Cap Multibaggers Through Press Release Research: PSIX and CSBR The Role...

Our open forum events often kick off with an introduction, where I talk about some things that are on my mind. February’s introduction was inspired by a conversation I had with a colleague.

Our...

We are adding a niche medical device company to our Run to One (R21) Model Portfolio. It is an under-the-radar growth story where management believes the company’s specialized products, rapid...

One of my goals at GeoInvesting, as well as at my new Substack, is to continue to highlight some of the best investors in the microcap space to help all of us generate alpha. Hand-picking these...

A recent development has positioned a little-known company for what could be a significant transformation.

With a new customer that has the potential to double the size of the business and improve...

All CategoriesEducationGeoWire MonthlyGeoWire WeeklyVideo Case StudyWritten Case Study

🔍

No posts found.

Load More

![As Quality Microcaps Dominate January, More Pitches Come into Geo’s Pipeline [GeoWire Weekly No. 171]](https://geoinvesting.com/wp-content/uploads/2025/01/Nostradamus-768x459.png)