GeoWire Monthly, Vol. 3, Issue No. 5, May/June 2023 – Two Compelling Crowdsourced Stock Pitches

For our June 2023 GeoWire Monthly newsletter edition, we wanted to give you a glimpse into what we are starting to introduce as an exclusive feature for our Premium Members: Stock Pitches From Around the Web That Caught Our Attention and Worth Tracking. However, first, I wanted to talk about why we’re doing this.

By harnessing the collective wisdom of the crowd, we aim to capture valuable insights, identify emerging trends, and uncover promising investment opportunities.

The impetus for this idea began when we invited Vittorio Bertolini to explain his bullish thesis on $MPX, Marine Products Corporation: A Microcap Gem, that he published on Seeking Alpha on December 22, 2022.

In the following clip, he introduced the idea as part of the conversation with us. The stock has performed nicely, up 31% since the Podcast.

Let’s face it, there are tons of great unknown investors around the web that you have probably never heard of. And with articles published in so many places, it’s not easy to find them.

Pitches exist in places such as social media platforms, investment forums, expert blogs, and the popular research platform Seeking Alpha, which gives the investment community quite a diverse range of stock ideas and opinions.

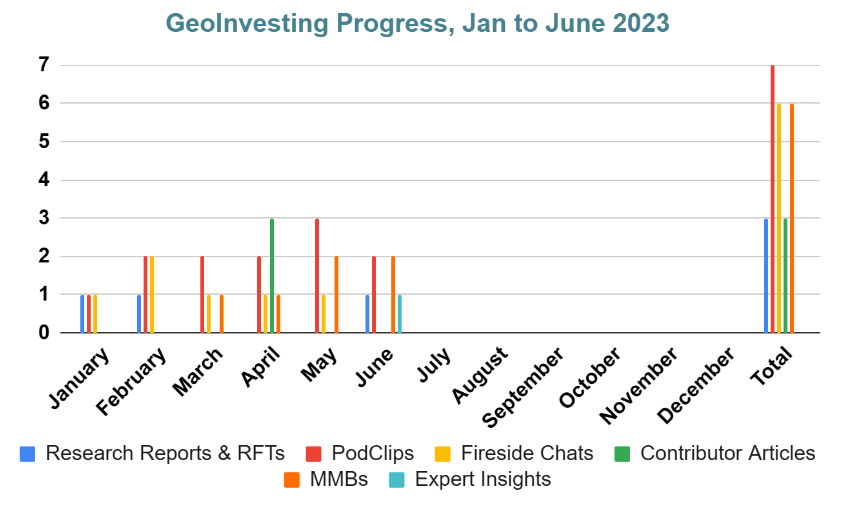

We have always been on the lookout for great investors to bring to the Geoinvesting investing network. Experiencing great returns has not been so easy since 2022. However, we noticed a nice little stat line at GeoInvesting.

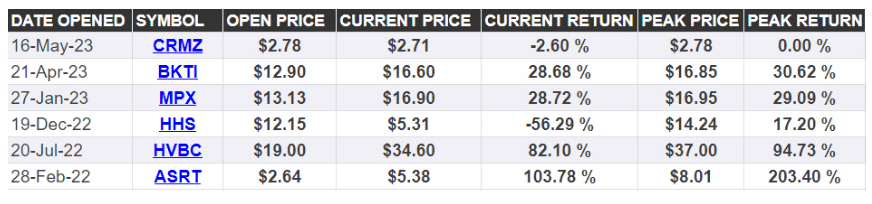

Since February 2022, 6 pitches by our research contributors, via video and written pieces, show an average peak return of 62.5% and an average current return of 30.73%.

Not included in this list is Blue Dolphin Energy Co (OTC:BDCO), a beaten up oil and gas play going through a debt restructuring. One of our members has been pounding the table on BDCO in our Premium Twitter feed since December 21, 2022. The stock is up 231% from $1.45 to $4.80 today.

By the way, I am not being selective in the way I’m representing these returns, as I have included every contributor selection received since 2022. I know it’s only a handful of stocks, but the current market environment calls for quality over quantity.

Now, given GeoInvesting’s belief that we are entering a new bull market, where certain types of microcaps will participate, we want to push our crowdsourcing efforts into overdrive and find around 10 more research contributors to invite to GEO before the end of the year.

1/25 #TheGreatHeadFake: Why we’ll look back at this market correction & conclude that it was a huge head fake. Mark my words, we’re entering a multiyear bull market for forgotten growth+value stocks. Fundamentals to take centerstage. #Thread

— Maj Soueidan (@majgeoinvesting) October 20, 2022

I will share some more details of how this selection process will work in coming weeks. But, I will tell you this…it’s going to increase the odds that the pitchers we invite will deliver great ideas.

With a track record of researching and analyzing Tier 1 microcap companies for over 3 decades, we possess the expertise necessary to review microcap pitches by our fellow investors. We are up for the challenge!

However, we recognize the overwhelming amount of information available in the market. With this in mind, let’s get to a few pitches that stood out to us, this time around from Seeking Alpha.

Each idea will include bullet of points from the author and a summary of the authors pitch

Stock Pitch 1: Good Times Restaurants: Attractive Multiple, Repurchasing Shares

- Company: $GTIM

- Author: Kingdom Capital

- Article Date: June 14, 2023

- Price at time of Article: $3.10

- Current Stock Price: $3.40 (as of close on 6/30/2023)

Percentage Increase: 9.67% - Author Price Target: $4.85 (The author believes that shares can possibly trade at 6 times trailing EBITDA based on the first article he wrote).

- Author’s Projected Percent Increase: This would translate into a percent increase of 56.4% over the latest article’s price.

What They Do

Good Times Restaurants Inc. owns, operates, franchises and/or licenses Good Times Burgers & Frozen Custard and Bad Daddy’s Burger Bar restaurants. The chain operates 35 locations: 33 in Colorado, and 2 in Wyoming.

Why We Chose GTIM

I have followed GTIM for years, but never felt compelled to buy the stock amid restructuring plans that seemed to always fail and a business that was very seasonal, losing money in the weaker quarters (seasonal businesses rarely trade at premium multiples). However, it has been a while since I reviewed the company, so I thought why not see how a new restructuring process is playing out.

Author’s Summary Points:

- Good Times Restaurants: Retiring shares, buying out joint venture interests, maintaining cash flow despite legal issues with White Winston Select.

- Management’s plans: Resolve lawsuit, complete buyback authorization, accelerate Bad Daddy’s unit growth, potential liquidation.

- Risks faced: Small size, illiquidity, potential losses from legal fight. Cushion provided by strong cash balance and well-aligned incentives for insiders.

Overview Of Kingdom Capital’s Bullish Pitch:

Good Times Restaurants has demonstrated a commitment to reducing shares, resolving legal issues, and sustaining strong cash flows despite ongoing challenges with White Winston Select. The management’s focus on resolving the lawsuit, completing share buybacks, and revitalizing unit growth for Bad Daddy’s positions the company for potential liquidation in the future. While risks such as its small size, illiquidity, and potential losses from the legal battle exist, the company’s robust cash balance serves as a protective measure.

The company has repurchased a good amount of shares, approximately 25% of the daily trading volume. Since last October 2022, around 600,000 shares have been retired. As of March 2023, Good Times Restaurants still had $2.7 million remaining in its buyback authorization and appears determined to utilize it quickly.

Management is expected to address the White Winston lawsuit, complete their buyback authorization, and resume the expansion of Bad Daddy’s units. Once these objectives are accomplished, it is speculated that the company may be liquidated. In the meantime, GTIM can use its cash flows to reduce the share count and potentially increase the payout upon a sale. Insiders in the company hold a significant ownership stake, aligning their interests with shareholders.

Stock Pitch 2: Envela: Major Expansion Could Boost EBITDA By About 50%

- Company:Envela Corporation (NYSE:ELA)

- Author: Gold Panda

- Article Date: June 6, 2023

- Price at time of Article: $7.59

- Current Stock Price: $7.36 (as of close on 6/30/2023)

- Performance: -3.0%

- Author Price Target: ”significant share price appreciation over the coming” years

- Author’s Projected Percent Increase: Not directly provided

What They Do

Envela is an ecommerce retailer focused on buying and reselling luxury assets such as jewelry, watches, rare coins, etc. In 2019 the company acquired ITAD USA and incorporated its business of recycling and reselling electronic products such as laptops and cellphones.

Why We Choose ELA

The ELA article caught our eye since the stock was already profiled by one of our research contributors in 2021, analyst Arham Khan of Eden Capital LLC. The stock is up 48% since then. So, we wanted to give our community an updated look at the company from another investor’s perspective.

Since the publication of Arham’s pitch in January 2021, the stock has seen a return of 56% from $4.67 to $7.32 today, and a peak return of 75% at $8.16

Arham’s bullish thesis revolved around:

- The company’s second-hand goods are recession-proof and experience increased demand during economic downturns,

- A growing demand and acceptance of second-hand goods as a whole

- Precious metals prices reached record highs in 2020

- The rapidly growing market of IT asset disposition is driven by factors such as the IoT, cloud software, and datacenter ecosystem, along with environmental and institutional catalysts.

Additionally, research has shown that the luxury resale market was valued at approximately $16 billion in 2020 and projected to reach $68 billion by 2028, representing a compound annual growth rate (CAGR) of over 15%.

Enter Gold Panda Pitch…

Summary Points of Gold Panda’s Bullish Pitch:

- Envela: Targeting four store openings by Q3 2023, aiming for retail business growth doubling in two years.

- Record Q1 2023: Envela achieved highest-ever revenues and EBITDA, with total sales up 2.1% YoY to $48.4 million.

- Currently trading at 12.6x EV/EBITDA. Potential ratio dropped to 8.6x in two years with successful expansion.

Overview of Gold Panda’s Bullish Pitch

Envela achieved record Q1 2023 revenues and EBITDA as a result of increased resale and recycling in its highest margin luxury assets segments.

Revenues increased 2.1% to $48 million (Year on Year) while EBITDA improved by 11.2% to $3.5 million. However, if not for higher sales and administrative expenses related to a newly implemented expansion plan, EBITDA would have grown more.

The expansion plan includes the company increasing its footprint in Arizona which comes with increased infrastructure costs.

It also includes opening 4 stores in the consumer segment by the end of Q3 2023, replicating its business model in Dallas and Charleston. It also includes the opening of 7 new jewelry stores over a period of 2 years.

The author “conservatively” projects that the company’s EBITDA could grow 50% to $22.9 million if all 7 stores were to open as planned. The company ended Q1 2023 with a net cash position of $4.7 Million and an enterprise value (EV) of $197 Million.

Given that it is an asset light business with a strong balance sheet, the author projects that the stock should be trading above 10x EV/EBITDA with further share price appreciation due to the company’s expansion opportunities.

~ Maj Soueidan, Co-founder GeoInvesting

GEOINVESTING PROGRESS: YEAR TO DATE