Summary

- We offer a rebuttal to all four of XXII’s counterarguments to our piece published Wednesday (yesterday) morning.

- Rather than worry about the nuanced arguments XXII made in its rebuttal, we believe investors should be more interested in what XXII management did not address.

- We stand by our research and original sourcing and believe that XXII could be offering up even more smoke in its rebuttal.

- We continue to advise caution to shareholders who are funding XXII’s $47M failure and lining executive’s pockets

We disagree with the rebuttal by XXII’s management and stand by the sourced facts in our original article. XXII claims that the “misleading and inaccurate statements are too numerous to address,” but we think if the four they picked out to address are their best points, shareholders should be extremely worried. Additionally, we will welcome further rebuttal from XXII management, should they find it necessary.

Specifically, we respectfully offer the following rebuttal to management’s four points released in Wednesday’s press release (source 3):

1. XXII rebuttal statement:

“In fact, 22nd Century Group went public in January 2011 with approximately 27 million shares. Currently the Company has approximately 59 million shares outstanding, not the 108 million alleged by the author.”

Our response:

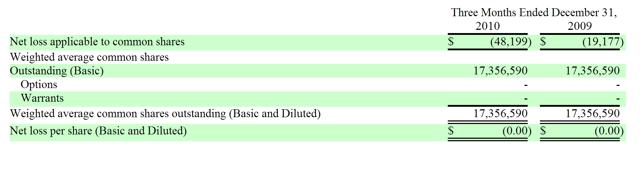

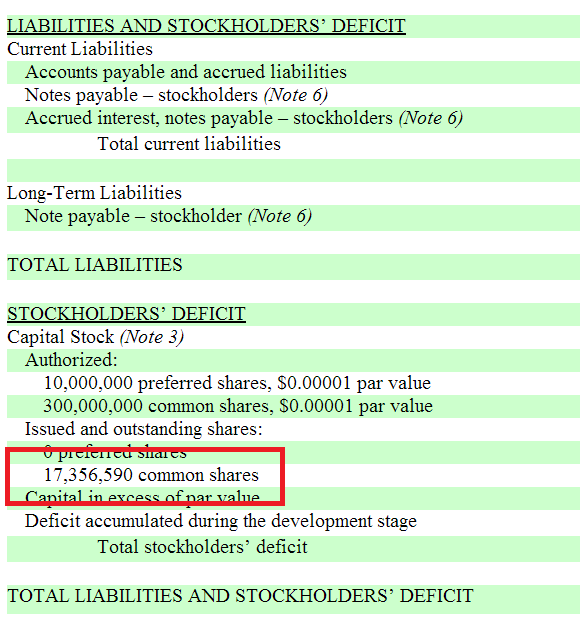

We note that the number of shares, as referred to as “quadrupled” in the article counts the fully diluted amount of shares as represented in our original chart in the article — from 2010 to 6/30/14. Taking 2010 out of the equation, as to comply with XXII’s rationale, we still note that in XXII’s first 10-Q filing from January 2011, they list 17.3 million common shares outstanding (source 1). From that date, the total share count has risen to over 69 million fully diluted (inclusive of warrants and options).

Further, the same filings note that there are no outstanding warrants from the three months ending December 31, 2010. Again, we are referring to fully diluted share count in 22nd Century’s first 10-Q filing from January 2011. While the company is stating there were 27 million shares when they went public, we again note that the January 2011 filing lists 17,356,590 outstanding common shares.

We make the point that the fully diluted share count, which now stands at 69.0 million+ is four times the amount of total shares listed in the company’s initial 2011 10-Q (4 * 17.3M = ~69.2M). Therefore, we believe our commentary to be correct. If we were to use the next SEC filing form 10-Q from May of 2011, which lists 27 million common shares outstanding, we would still point out that this number has more than doubled in less than 3 short years (common shares only). That means that shares bought at $3.00 in 2011 would be worth less than $1.50 today at the same market cap. We still consider this to be an alarming amount of dilution, as a product of the company needing to sell shares in order to fund itself.

Further, to address the point that we alleged there were “108 million” shares outstanding, we would advise XXII to take another look at our article, as we clearly note more than once that our calculations date back to 2010 and that the number “108” doesn’t appear in the entire text of the article at any point. We simply never say there are 108 million shares, we note the 69 million figure (fully diluted) in our chart that corresponds with this section of the article.

We believe that XXII took the 27M shares it alleges to have had in January (despite the filing saying something different) and multiplied that by four (27 * 4 = 108) to come up with this figure and obfuscate the point we were trying to make.

2. XXII rebuttal statement:

“The author asserts that 22nd Century is in default of a license agreement with a major university. This is patently false. Further, just today, 22nd Century signed a new license agreement with the same university that the author falsely alleges that the Company is in default with.”

Our response:

We stand by our analysis and the referenced letter from NCSU to XXII which we sourced as our precedent in stating that XXII owed NCSU certain monies and was supposed to complete Phase III clinical trials for X-22 as part of that agreement. If XXII can provide a publicly filed precedent that governs this issue (that post-dates the referenced letter), we would re-examine this statement. Further, we find it extremely serendipitous for XXII that they signed a new license agreement on Wednesday, the same day our piece was published. We encourage readers to think about the interesting timing there.

3. XXII rebuttal statement:

“Contrary to the author’s assertions regarding stock promotion and sales, officers and insiders have never engaged in stock promotion and have made minimal sales of 22nd Century Group common stock; in fact, management and insiders retain more than 95% of their Company common stock. Collectively, officers of the Company directly and beneficially own approximately 28% of the total outstanding shares.”

Our response:

While we note that officers and insiders themselves may not have personally engaged in stock promotion with regard to XXII, we stand by all of our fully sourced claims that the CEO had been targeted by the SEC for manipulation in the past. We also stand by our claim that shares have been doled out for “investor relations” and professional services – most of which we believe to be promotional in nature. Further, while insiders may still retain significant ownership of the company, we remind shareholders that executive total compensation for officers (via the company’s most recent proxy) of the company ranges from $186k/year for the company’s CFO to Mr. Pandolfino’s salary at an astonishing $687k/year. Mr. Pandolfino is being paid $687K of shareholders’ money/stock and only has some patents, a failed X-22 clinical trial, a track record of menial non-sustained revenue, and a $47M deficit to show for it. This stands in stark contrast to Mr. Pandolfino’s rebuttal comment that he has “devoted essentially his entire net worth” to XXII. It would appear from filing disclosures he reaps a significant income from XXII, as opposed to devoting his income to XXII.

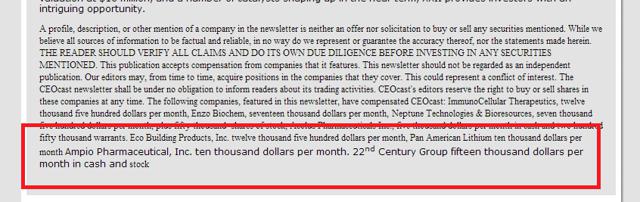

Additionally, we note items like the CEOCAST source that states that CEOCAST was specifically being paid “fifteen thousand dollars per month in cash and stock” by XXII. Considering Mr. Pandolfino says himself that he was at the helm of XXII during those days, we believe he or one of his executives ultimately had to sign off on a check for these funds. This sure looks like paying for promotion to us.

4. XXII rebuttal statement:

“Contrary to the author’s assertions, 22nd Century has never abandoned any of its products. The Company is continuing its efforts to develop X-22, a cigarette intended for use as a prescription smoking cessation aid, and has an active investigational new drug application with the FDA. Various independent clinical studies continue to validate the efficacy of the Company’s products for harm reduction and smoking cessation.”

Our response:

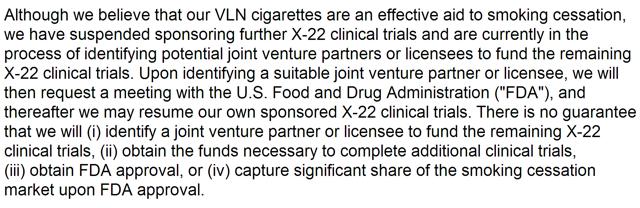

While we note that XXII alleges that independent clinical studies continue, we stand by our research backed by the company’s own public commentary on X-22 trials; which we again will include here from the company’s last public filing and which states clearly that the company has “suspended sponsoring further X-22 clinical trials” (source 2):

Summary

We believe Mr. Sicignano’s statements at the end of the company press release issued on Wednesday to be more of the same from XXII; promises of future growth without tangible sustained revenue to back it up. We believe statements like “MSA Authorization is imminent” and “hundreds of tobacco retailers have expressed interest in carrying the Company’s super-premium RED SUN® brand” are more of the same fluff; none of which has accounted to meaningful sustained revenue in the past.

As we stated in our first article, we view the MSA authorization as negligible. Again, we note that becoming a signing member of the MSA is an optional choice for a cigarette manufacturer and that there are a number of smaller cigarette makers that opt out of the MSA to sell as a “non-participating manufacturer” (“NPM”). So, we don’t view it as a game changer, but it will likely make for another nice press release.

We would ask why Mr. Sicigniano failed to name any of the “hundreds of tobacco retailers” that he’s referring to. Could we see 75 of those names? 50? Any? Will they be like Orion in Poland who has signed a letter of intent to manufacture XXII’s product three months ago, yet doesn’t appear to mention XXII or its products on its website (Sources 5, 6)? Additionally, Mr. Sicignano’s statement about “exploring important joint venture opportunities in Asia” offers no names or material content.

We continue to reiterate that this company has an accumulated deficit of $47M and that it has suffered losses every year since it’s been a public company.

We also note that if the company was progressing in a fashion beneficial to shareholders after three years, it would have been able to post more than $16K in revenue this past quarter. Again, we ask about filtered cigars. We remind shareholders that we could not find the word “cigar” in the 2013 10-K. Why is the company’s sole revenue from the past quarter from a product that the company hasn’t talked about? It’s numbers like these that led us to our initial doubts about the company’s ability to monetize going forward.

With regard to Mr. Pandolfino’s track record with the SEC, while we acknowledge that his indiscretion was 23 years ago, we would like to also note that Mr. Pandolfino was accused by the FTC in 1999 as having violated the provisions of the Federal Trade Commission Act (source 4). The FTC stepped in when Mr. Pandolfino’s “Alternative Cigarettes, Inc.” company appeared to be making false and misleading claims, alluding to the fact that the company’s cigarettes did not have the same carcinogens as smoking normal cigarettes. The FTC, more interested in the truth, filed this in its initial complaint:

Through the means described in Paragraph 5, respondents have represented, expressly or by implication, that smoking Pure and Glory cigarettes, because they contain no additives, chemicals, flavorings or preservatives, is less hazardous to a smoker’s health than smoking otherwise comparable cigarettes that contain additives, chemicals, flavorings or preservatives. Through the means described in Paragraph 5, respondents have represented, expressly or by implication, that they possessed and relied upon a reasonable basis that substantiated the representation set forth in Paragraph 6, at the time the representation was made. In truth and in fact, respondents did not possess and rely upon a reasonable basis that substantiated the representation set forth in Paragraph 6, at the time the representation was made. Among other reasons, the smoke from Pure and Glory cigarettes, like the smoke from all cigarettes, contains numerous carcinogens and toxins, including tar and carbon monoxide. Therefore, the representation set forth in Paragraph 7 was, and is, false or misleading.

While we acknowledge that people can change their ways with age, we continue to see this as a red flag.

We believe that if you have a checkered past, such as in the case of Mr. Pandolfino, that you have an even greater responsibility to the markets to not surround yourself with entities who have a past of promotion (Crede Capital), bank fraud (Michael Wachs), bankruptcy (Rodman & Renshaw) and bribery (Joseph Anderson) (source 7).

It is our mindset that being a public company is a privilege; in the private sector you can’t post losses every year since inception and pay yourself $680k/year because you can’t simply go to the market and sell stock whenever you need more money. The private sector necessitates results in order to continue growth, but the public markets offer a unique option of acting non-profitably while continuing to line the pockets of insiders and Board members. That liability is transferred onto the common shareholders, generally. Part of the fiduciary duty that comes with that privilege is being transparent, disclosing everything the market should need to know, and working in the shareholders’ best interests. We do not believe XXII executives have acted in this fashion at all.

If you are long XXII, we would inquire as to whether or not we disclosed items that you didn’t know about the company. If we did, and something gave you pause, we’d suggest you inquire with the company as to why this information wasn’t as readily available as we’ve made it.

We reached out to IR on Tuesday of this week to see if we could get some answers to questions that we had. IR failed to comment on any of the three main questions that we had, and we felt as if we were rushed off of the phone. IR did, however, return an e-mail Wednesday afternoon to us, letting us know that they could not comment on our question about the what the additional BAT milestones are (which still hasn’t been publicly disclosed) and confirming that the company had shipped the 450,000 packs mentioned in its April 2013 press release.

With regard to XXII claiming that we are here to “dupe and scare investors into selling”, we would counter by stating that our intention is only to bring the truth to light from a realistic standpoint, as much as company insiders may not want to face the reality of the $47M hole they’ve dug themselves into since becoming a public company.

Rather than opine on these small technicalities in which XXII tried to make an argument out of in its response, we believe that shareholders would be much better served reiterating these questions to themselves:

- Do I want to invest in a company where the CEO has been charged with manipulating stock by the SEC and “false and misleading” claims by the FTC — at any point in his life?

- Why has the company lost so much money (to the tune of $47M) since it’s been a public company?

- Why hasn’t the company offered clear guidance as to when they hope to turn a profit?

- Why have none of the “big things” offered up by the company panned out as of yet?

- Why has the total, fully diluted share count since the company’s filing in January 2011, quadrupled?

- When is the next dilutive financing coming?

We continue to urge caution to XXII shareholders.

Sources:

- XXII 10-Q For the quarterly period ended December 31, 2010

- XXII 10-Q For the quarterly period ended June 30, 2014 (Item 2)

- XXII Rebuttal, via Business Wire

- Federal Trade Commission

- Reuters

- Orion s Website

- GeoInvesting Article on Seeking Alpha — “22nd Century Group: A Lot Of Smoke, Not Enough Fire”

Disclosure: Short XXII

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.