Summary

- We believe we’ve caught Fanhua Inc. in an outright lie: despite FANH stating on its recent conference call that they have no related party relationship with Liu Tingting and Yang Lin, we have concrete evidence that they do

- Others have pointed out that FANH transacts with related parties, something FANH management has denied. We now offer concrete proof through ID documents that they do. This leaves no ambiguity of the individuals in question, which helps avoid any possible confusion based on matching names.

- Today we ask: why would the company deny, on the record, dealings with related parties?

- GeoInvesting has an over decade long track record of helping expose billions of dollars in U.S. listed China based fraud

- It appears Fosun has given up on FANH: they announced the sale of their entire position in the company in a January 30, 2019 SEC filing

- We contend that FANH stock is completely uninvestable and that the company needs to be placed under deep scrutiny by auditors, analysts, investors and U.S. regulators

GeoInvesting Takes a Stance

It has been a few years since we have written a critical piece on a U.S. listed China based company. Since 2010, fourteen U.S. listed China based companies worth billions have been halted or delisted as a result of GeoInvesting’s due diligence.

Our expertise lies in extensive on the ground due diligence, and we have become proficient in sniffing out fraud by examining documents in China that U.S. investors and analysts can’t find or don’t make an effort to find. Even then, these documents can sometimes be hard or confusing to interpret. In almost every instance that we uncovered deceit in U.S. listed China based stocks and we were eventually proven correct, management has issued press releases and held conference calls saying we were wrong. It is just the game many of these companies play, delaying the massive losses investors inevitably suffer. Many of the dog fights we were in, and won, dealt with confusing disclosed and undisclosed related party issues that simple document analysis shed light on.

We think $FANH is shaping up to be one of those cases. Our research indicates that auditors will need to stringently examine this company before signing off on its 2018 audit, simply because we prove that FANH statements made in its JCap rebuttal press release and conference call denying its involvement in certain related party transactions are false. Management stated…

“Fanhua and its management and directors have no related party relationship with either of them.”

…when referring to Liu Tingting and Yang Lin, two names raised in the JCap report issued in late Janaury.

Today we provide direct evidence that no report has yet discussed that proves that this statement is incorrect and may carry large implications for FANH, its investors and its auditors.

This is especially true, given that FANH has moved hundreds of millions of dollars between itself and its related parties, some with companies FANH has claimed to have sold that JCap discussed in their initial report. Worse, we know this from only taking a look at few of the company’s related party dealings. We believe that in this regard, where there’s smoke, there could be fire. We know this from only taking a look at few of the company’s related party dealings. FANH also has several other investments, such as Beijing Baoping and Beijing Fanhua Small Loan, which have not been disclosed in its financial statements.

Finally, we view Fosun’s recent sale of its entire stake in FANH as anything but a continued vote of confidence in the company.

In August 2018, Seligman Research published a comprehensive research report exposing FANH’s questionable history and JCap Research recently followed with a new, scathing research report on the company in January 2019. Both firms called for potential 100% downside risk with FANH. After these two research reports, FANH provided rebuttals, which we closely examined and wanted to respond to today.

Our goal today is not to provide a lengthy rebuttal, but rather to point out with clarity how we believe FANH recently misled U.S. investors, who we don’t believe understand the magnitude of the misstatements made by the company on its recent conference call.

We Believe Liu Tingting and Yang Lin Are Related Parties

One of the claims made by JCap in its recent report was that FANH was self-dealing subsidiaries to related parties, who JCap identified as people named Liu Tingting and Yang Lin. The company’s defense is that JCap simply mixed up the names of two unrelated people with two individuals that have the same names (Liu Tingting and Yang Liu) that are related to the company. We wanted to look into this claim and, by tracking these individuals via ID number and not name, see if the company’s claims had merit.

On the company’s January 28, 2019 conference call, responding to JCap’s latest publication, FANH made the following statement about Liu Tingting and Yang Lin, two related parties:

However, these two individuals just coincidently have the same names with the shareholder of Sichuan Borui Xinrui who also surnamed Yang and the shareholder of Ruisike surnamed Liu. They are totally different persons. Fanhua and its management and directors have no related party relationship with either of them.

We believe this denial is an outright lie. Liu Tingting is a substantial shareholder of Beijing Ruisike, a company that was divested by FANH. Yang Lin a substantial shareholder of Sichuan Borui Xinrui, which holds 12 of FANH’s divested P&C insurance subsidiaries. How can FANH claim they have no related party relationship with these people or not know them at all?

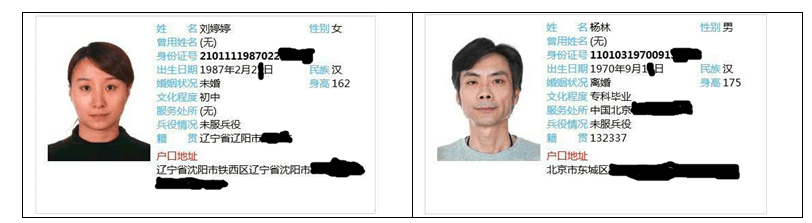

To avoid confusion, we pulled identification information for Liu Tingting and Yang Lin:

In China, each person only has one ID number, despite the fact that it’s possible for two people to have the same name. Given that information, we conducted our search based on Liu Tingting and Yang Lin’s ID numbers.

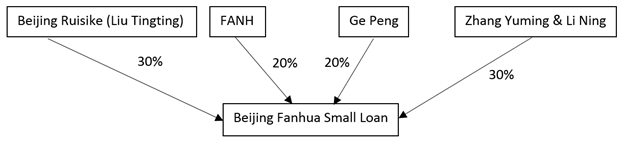

FANH claimed that there was no related party relationship between them and Liu Tingting. However, we found out that Beijing Ruisike (100% owned by Liu Tingting), FANH (via FANH’s affiliate Shenzhen Fanlian Investment Co., Ltd. 深圳泛联投资有限公司) and Ge Peng (FANH’s CFO) have a joint venture together called Beijing Fanhua Small Loan Co, Ltd, (北京泛华小额贷款有限公司).

This is the joint venture’s shareholder structure:

Considering the fact that Beijing Ruisike is located within FANH’s Beijing office (JCap explained the details in its report and FANH did not deny them in its response) and Beijing Ruisike has a joint venture with FANH and FANH’s CFO, Ge Peng, we do not know what more evidence we would need to present in order to prove that Liu Tingting is, in fact, a related party of FANH.

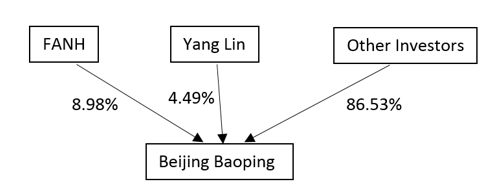

Similar with the relationship between Liu Tingting and Beijing Fanhua Small Loan, we found out that Yang Lin also has a joint venture with FANH, Beijing Baoping Science & Technology Co., Ltd. (北京保评科技有限公司),via FANH’s 100% owned subsidiary Beijing Fanlian Investment Co., Ltd. 北京泛联投资有限公司). Yang Lin is the legal representative of the joint venture and the ownership structure of the joint venture looks like this:

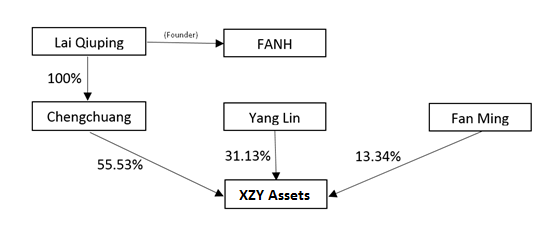

We also found a company called Xinzhiying Assets Management (Beijing) Co., Ltd. (鑫智盈资产管理(北京)有限公司) (“XZY Assets”), which is 31.13% owned by Yang Lin. The controlling shareholder (55.53%) of XZY Assets is Chengchuang (Shenzhen) Investment Co., Ltd. (承创(深圳)投资有限公司), which is 100% owned by Lai Qiuping, the founder of FANH.

JCap’s report already proved that XZY operates its business within FANH’s Beijing office and FANH did not dispute this fact in its response.

This is the current shareholder structure of XZY Assets:

The fact that Yang Lin has a joint venture with FANH and another joint venture with FANH’s founder Lai Qiuping, is, in our opinion, enough proof to establish a clear related party relationship between Yang Lin and FANH.

Did the divestment of the 19 P&C subsidiaries to Cheche involve funneling money/interests? Investors can judge for themselves, but we find it dubious that 12 of these subsidiaries, within a year later, wound up under the control of Yang Lin, a related party to FANH. Both Beijing Baoping (joint venture with Yang Lin) and Beijing Fanhua Small Loan (joint venture with Liu Tingting) are not listed in FANH’s annual report as its affiliates (FANH does not claim to ONLY list important subsidiaries, therefore all subsidiaries should be listed).

As we mentioned before, it is possible that two people can share the same name, but not the same ID number. Therefore, we believe that Liu Tingting, the owner of Beijing Ruisike, and Yang Lin, the owner of Sichuan Borui Xinrui, are clearly related parties to FANH.

Given this related party relationship and FANH’s denial, we believe investors should be highly concerned about the divestments to Liu Tingting, such as Fanhua Bocheng and FANH’s 12 P&C insurance subsidiaries.

Fosun Sold Their Entire Position in FANH

In April 2017, Fosun invested USD $29 million in FANH at a price of USD $8.837 per ADS with a one year lock up:

In April 2017, we issued and sold 66,000,000 ordinary shares to Fosun Industrial Holdings Limited for a total purchase price of US$29,162,100. Fosun held 5.34% of the total outstanding ordinary shares of the company at the time of the share issuance post-closing and its purchased shares were subject to a one-year lock-up. (2017 20-F)

In February 2018, Fosun registered these shares with SEC. Ten days after the announcement of the 521 Development Plan, on June 25, 2018, FANH filed a F3 explaining Fosun’s plan to sell its 3.3 million ADSs on the open market. Using the $29 per ADS from the 521 Development Plan as a mark, Fosun’s investment had increased 328% in less than eighteen months.

Fosun dumped FANH’s stock on December 31, 2018 and filed that it sold its position on Jan 30th, 2019, netting more than 250%. Due to the timing of this announcement, one could argue that it looks as if Fosun did not trust FANH’s management team and used the 521 Plan to sell the stock at a higher price.

Conclusion

FANH appears to us to just be a holding company that holds a range of investments that are incredibly difficult to analyze for outside investors. Opaque disclosures, coupled with the fact that the company deals with related parties and may not be forthcoming about these facts, causes great worry.

The organization covers all different kinds of products, ranging from life insurance, P&C insurance, investment funds, wealth management, consumer finance and claims adjusting. In fact, the Chinese website of FANH supports this claim.

FANH has sold various products across its many subsidiaries. This makes it difficult to try and pin down SG&A and cost of goods sold for different sub-sects of the business. Without being able to differentiate which companies are performing which tasks and (more importantly) which companies are recognizing which revenue and absorbing which costs, it’s impossible to assign a “fair market value” share price to FANH.

Even after JCap’s report, FANH tried to deny the fact that Liu Tingting and Yang Lin have a related party relationship with the company. We have now provided evidence that FANH established joint ventures with both Liu Tingting and Yang Lin. With this evidence, we can’t see how FANH can continue to deny the related party relationship with Liu Tingting and Yang Lin. We find it extremely worrisome that a US listed public company would deny, on the record, such an important aspect of its business.

We strongly encourage the company’s auditor, Deloitte, to take a deep dive into the details surrounding FANH’s claimed business as it is disclosed in the company’s annual report. Until the company makes very clear to its auditors and, more importantly, investors, how FANH is operating, we believe the company is clearly uninvestable and carries substantial risk of having to restate its financials, for example due to non-consolidation of its real estate joint venture that has existed since 2016, but was only disclosed in November of 2018.

FANH also has several other investments, such as Beijing Baoping and Beijing Fanhua Small Loan, which have not been disclosed in its financial statements. We believe the risk of delisting is very real as we don’t believe the company has met the requirements put forth by SEC disclosure rules and by standard audits.

We concur with JCap’s research and conclusion that FANH may have up to 100% downside.

Disclosure: Short FANH at time of report.

Disclaimer:

Please be advised that GeoInvesting™ is a research and publishing firm, of general and regular circulation, which falls within the publisher’s exemption to the definition of an “investment advisor” under Section 202(a)(11)(A) – (E) of the Securities Act (15 U.S.C. 77d(a)(6) (the “Securities Act”). GeoInvesting™ is not registered as an investment advisor under the Securities Act or under any state laws. None of our trading or investing information, including the Content, GeoInvesting™ Email, Executive Casts and/or content or communication (collectively, “Information”) provides individualized trading or investment advice and should not be construed as such. Accordingly, please do not attempt to contact GeoInvesting™, its members, partners, affiliates, employees, consultants and/or hedge funds managed by partners of GeoInvesting™ (collectively, the “Geoinvesting™ Parties”) to request personalized investment advice, which they cannot provide. The Information does not reflect the views or opinions of any other publication or newsletter.

We publish Information regarding certain stocks, options, futures, bonds, derivatives, commodities, currencies and/or other securities (collectively, “Securities”) that we believe may interest our Users. The Information is provided for information purposes only, and GeoInvesting™ is not engaged in rendering investment advice or providing investment-related recommendations, nor does GeoInvesting™ solicit the purchase of or sale of, or offer any, Securities featured by and/or through the GeoInvesting™ Offerings and nothing we do and no element of the GeoInvesting™ Offerings should be construed as such. Without limiting the foregoing, the Information is not intended to be construed as a recommendation to buy, hold or sell any specific Securities, or otherwise invest in any specific Securities. Trading in Securities involves risk and volatility. Past results are not necessarily indicative of future performance.

The Information represents an expression of our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical processes. Due to the fact that opinions and market conditions change over time, opinions made available by and through the GeoInvesting™ Offerings may differ from time-to-time, and varying opinions may also be included in the GeoInvesting™ Offerings simultaneously. To the best of our ability and belief, all Information is accurate and reliable, and has been obtained from public sources that we believe to be accurate and reliable, and who are not insiders or connected persons of the applicable Securities covered or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such Information is presented on an “as is,” “as available” basis, without warranty of any kind, whether express or implied. GeoInvesting™ makes no representation, express or implied, as to the accuracy, timeliness or completeness of any such Information or with regard to the results to be obtained from its use. All expressions of opinion are subject to change without notice, and GeoInvesting™ does not undertake to update or supplement any of the Information.

The Information may include, or may be based upon, “Forward-Looking” statements as defined in the Securities Litigation Reform Act of 1995. Forward-Looking statements may convey our expectations or forecasts of future events, and you can identify such statements: (a) because they do not strictly relate to historical or current facts; (b) because they use such words such as “anticipate,” “estimate,” “expect(s),” “project,” “intend,” “plan,” “believe,” “may,” “will,” “should,” “anticipates” or the negative thereof or other similar terms; or (c) because of language used in discussions, broadcasts or trade ideas that involve risks and uncertainties, in connection with a description of potential earnings or financial

performance. There exists a variety of risks/uncertainties that may cause actual results to differ from the Forward-Looking statements. We do not assume any obligation to update any Forward-Looking statements whether as a result of new information, future events or otherwise, and such statements are current only as of the date they are made.

You acknowledge and agree that use of GeoInvesting’s™ Information is at your own risk. In no event will GeoInvesting™ or any affiliated party be liable for any direct or indirect trading losses caused by any Information featured by and through the GeoInvesting™ Offerings. You agree to do your own research and due diligence before making any investment decision with respect to Securities featured by and through the GeoInvesting™ Offerings. You represent to GeoInvesting™ that you have sufficient investment sophistication to critically assess the Information. If you choose to engage in trading or investing that you do not fully understand, we may not advise you regarding the applicable trade or investment. We also may not directly discuss personal trading or investing ideas with you. The Information made available by and through the GeoInvesting™ Offerings is not a substitute for professional financial advice. You should always check with your professional financial, legal and tax advisors to be sure that any Securities, investments, advice, products and/or services featured by and through the GeoInvesting™ Offerings, as well as any associated risks, are appropriate for you.

You further agree that you will not distribute, share or otherwise communicate any Information to any third-party unless that party has agreed to be bound by the terms and conditions set forth in the Agreement including, without limitation, all disclaimers associated therewith. If you obtain Information as an agent for any third-party, you agree that you are binding that third-party to the terms and conditions set forth in the Agreement.

Unless otherwise noted and/or explicitly disclosed, you should assume that as of the publication date of the applicable Information, GeoInvesting™ (along with or by and through any Geoinvesting™ Party(ies)), together with its clients and/or investors, has an investment position in all Securities featured by and through the GeoInvesting™ Offerings, and therefore stands to realize significant gains in the event that the price of such Securities change in connection with the Information. We intend to continue transacting in the Securities featured by and through the GeoInvesting™ Offerings for an indefinite period, and we may be long, short or neutral at any time, regardless of any related Information that is published from time-to-time.