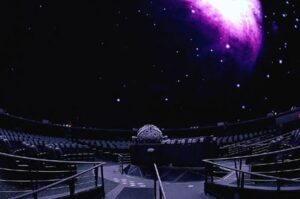

A strong backlog and the potential nearing of a settlement of its pension liability issue by the end of March 2015 could lead to a sharp increase in Evans & Sutherland (ESCC) shares. Shares are trading at a significant discount to GeoInvesting’s calculated tangible book value of around $0.80 if we assume that the pension liability is resolved. ESCC produces and sells visual display systems used primarily in full-dome video projection applications, dome projection screens, and dome architectural treatments in the United States and internationally.

On 4/3/2014, we highlighted a bullish special situation catalyst in the ESCC story. Clues in SEC filings hinted that management was highly optimistic that it would settle a past due pension liability, which would meaningfully and positively impact its net income (from loss to profit) and significantly increase tangible book value per share. Unfortunately , at that time, no timeline was provided as to when management expected a resolution of its pension liability issue. You can read a full recap here.

Finally, in its Q3 2014 10-Q, ESCC provided specific language that dictates that it is highly likely that it would settle its pension liability by January 15, 2015. It’s worth noting that this should also resolve a default notice recently received from one of its lenders that arose as a result of the situation.

ESCC Shares – Tangible Book Value of $0.80

Although we expressed some optimism that without pension liability ESCC shares could move closer towards its tangible book value per share of $0.80, we also mentioned that the company’s inability to consistently grow its business could limit valuation expansion. In fact, over the past several years the company has only stated that it would maintain current sales levels. To us, it looks like ESCC ‘s growth trajectory is about to take a major leap forward which could lead to significant valuation multiple expansion.

Yesterday, near the close of trading, the company reported its year end 2014 results:

- Sales for 2014 were $26.5 million, compared to sales of $29.6 million for 2013; for Q4 2014, $6.43 million vs $11.12 million in Q4 2013.

- The net loss for 2014 was $1.3 million or $0.12 per share, compared to a net income of $1.2 million or $0.11 per share for 2013; Q4 2014 – net loss of $0.05 vs Q4 2013 EPS of $0.18

- Revenue backlog as of December 31, 2014 was $28.2 million compared to a backlog of $17.2 million as of December 31, 2013.

While the numbers look dismal at face value, there are plenty of reasons to be optimistic, including a surge in company backlog and two year visibility.

The company’s comments on the decrease in sales for 2014:

“sales decline was due to unexpected changes to customer schedules, which delayed several installations and not the result of a downward trend in the business. To the contrary, new sales bookings were extraordinarily strong, leading to a 65% increase in the sales backlog to $28.2 million as of December 31, 2014 compared with backlog of $17.1 million as of December 31, 2013. Sales prospects remain very strong, which supports an encouraging outlook for 2015 and 2016. We believe that sales for 2015 will exceed sales recorded in 2014, which is expected to lead to improved results.”

Update on settlement of pension liability:

“We have made significant progress toward the settlement of our Pension Plan liabilities through the distress termination application process. Recent correspondence with the Pension Benefit Guaranty Corporation indicates that the application process should result in a settlement of the Pension Plan liabilities on terms that should enable the Company to continue to operate as a going concern.”

Backlog to sales multiplier

Since we have not interviewed management, we looked at the relationship between historical year end backlogs to forward 12 months revenues relationships for 7 years to help us forecast 2015 sales. Based on the company’s sales-to-backlog ratio average of 1.52 over the last 7 years, 2015 sales are projected to be $42.8 million. (7 year sales to backlog ratio range was 1.23 to 2.06)

The major considerations and potential caveats that we are still following:

- It’s still unclear how the pension liability will be resolved, whether it will be a one time hit or amortized over several years.

- We’re unsure as to the gross margin tied to the work contained in the company’s backlog

- The company deals with large products, so we anticipate that revenue growth could still be lumpy moving forward

- While management expects 2015 sales to exceed 2014 levels, it does not provide any further details about how much of an increase is expected.

- Previously, management expected the resolution in mid January, so we need to take the end of March comments with a grain of salt.

- As stated before, we have not interviewed management for well over a year.

To see the remainder of ESCC coverage, please go here.

To stay ahead of the market with GeoInvesting arbitrage and learn about investment ideas not yet digested by the market, Sign up now for More Research and Insight