Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

For real time analysis of our coverage universe, including new high conviction ideas and additions to our model portfolios, if you are not already a premium subscriber, consider supporting our movement by becoming a premium member today. GeoInvesting, 16 years and counting!

Highlights

|

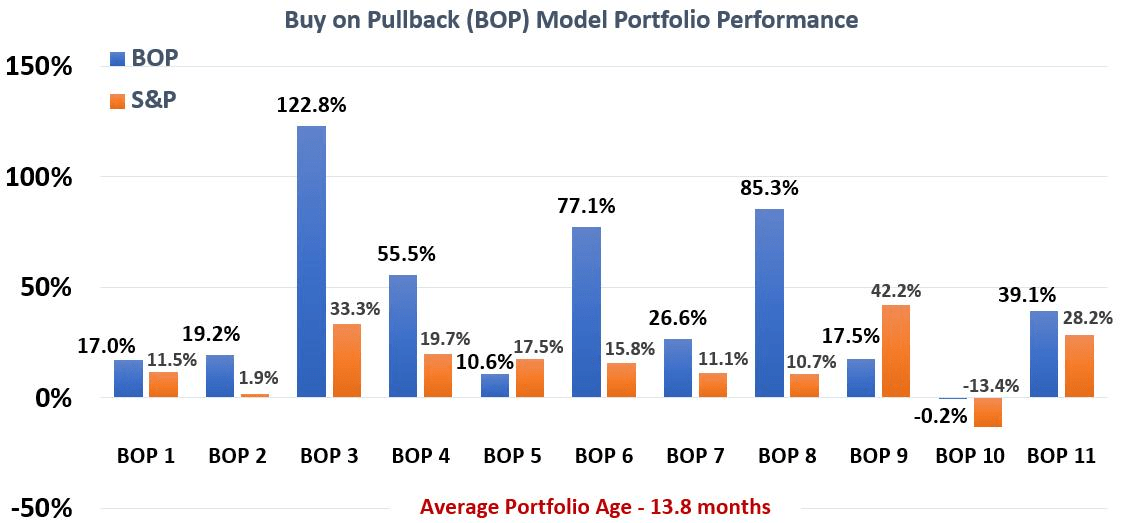

BOP #12 Strong Out Of The Gate

Before I get into the purpose of this Weekly Update, I’d like to highlight the performance of GeoInvesting’s Buy on Pullback (BOP) #12 Model Portfolio, launched on August 6, 2024. Talk about timing! All seven stocks are in positive territory, with the darling of the bunch having already hit a peak return of 55.74% in just 15 days (current return of 52.85%). The current average return of the portfolio stands at 12.5% and is represented by a diversified set of industries:

- Construction & Infrastructure

- Power & Energy (Data Center Relevant)

- Electronic components

- Medical Devices

- Document and contract software platform

- Semiconductors and AI Software

- Cloud Communications

There are some fantastic, super high-quality names in BOP #12. I think it has a fighting chance to beat our best-ever performing pullback portfolio, BOP #3.

Buy on Pullback Model Portfolio #13 Already has an outperformer on the list, but there are 6 Others primed to perform. Check them out Now or Subscribe to GeoInvesting’s Premium Service for Access.

With that said, we are considering closing BOP #11, and are probably a little late on that anyways. We’ll let you know soon.

Late Day 26% Friday Pop In Perma-pipe International (PPIH)

We’ve been toying around with Perma-pipe International Holdings (NASDAQ:PPIH) since June. If you’ve been following the story, one of the uncertainties that surround PPIH is its history of inconsistent financial performance. However, long-term growth tailwinds may have arrived, due to the company’s involvement in long-term infrastructure projects going on in the Middle East. Just maybe, Perma-pipe International Holdin (NASDAQ:PPIH) Value Trap standing might be starting to prove investors wrong. A big $46M contract late in the day, Friday, sent shares 26% higher on the news.

A July 2024 Open Forum clip covers the set-up and related risks.

Reconnecting with Sean of Deep Sail Capital

This past week, we were able to pass along replays of the interviews I had with the management teams of three companies – Lakeland Industries, Inc. (NASDAQ:LAKE) (replay), Creative Realities, Inc. (NASDAQ:CREX) (replay) and Bk Technologies Corporation (NYSE:BKTI) (replay) – that I agreed to go on record with at Semco Capital’s 4th Annual CEO Networking Event to help give them a platform to answer questions about their businesses. It certainly was a change of pace from the usual Zoom-style meetings that we hold with company execs, so there was an added level of anticipation and excitement at the prospect of in-person meetings with both the executives and peers alike.

Speaking of which, at the event, I got a chance to reconnect with Sean from Deep Sail Capital, a familiar face with whom, in an August 2023 Investor Insights Skull Session, we discussed his investment strategies, supported by some of his most important tenets when considering companies for investments:

- High quality business models.

- Outstanding management.

- Substantial long term growth prospects.

- Reasonable valuations.

The networking event provided the perfect opportunity to invite Sean to come back on the show to catch up and explore the evolving landscape of value investing since 2022 and what’s working in the short-selling environment.

During our initial meeting, we delved into the intricacies of growth at a reasonable price (GARP) value investing, which balances growth potential with reasonable valuations—a philosophy reflected in Deep Sail’s focus on companies like Shelly Group AD (SLYG.DE), a company he highlighted in his Q1 2024 Investor Letter.

Sean’s recent Q1 and Q2 2024 letters stress the importance of owning quality companies that can withstand market volatility.

Additionally, his fund’s performance in short positions, particularly with companies like Affirm Holdings, Inc. (AFRM) (-39% for the first half of 2024) and Archer Aviation Inc. (ACHR) (-43% for the first half of 2024), helps to unwrap Deep Sail’s proficiency in navigating the short-selling environment.

Being that Sean sees the current market environment as one of bifurcation between higher flying AI-driven tech stocks and the rest of the market, it should make for an engaging follow-up discussion.

“2024 has been a bifurcated market, where only a few mega tech stocks have done well, and the rest of the market is flat to down. The Russell 2000, as we sit right now (July 9th), is up just 0.4% year to date. That means the average stock in the Russell 2000 is negative year to date, and the Magnificent 7 is holding up the index. The market returns in recent months have been largely driven by the strong performance of large technology companies, especially those involved in AI. Nvidia stands out as a leader in the AI chip market with their H100 chips, which are an essential capex spend for anyone trying to explore an AI product. Nvidia’s stock price has more than doubled since the beginning of the year, with a year-to-date return of 122%.”

However, Sean also talks about the positive sentiment shift towards smaller cap stocks that occurred since the encouraging July 2024 inflation report.

We are set to explore these themes further, particularly how the current market dynamics influence value investing and short-selling strategies.

We’ll most likely get into his analysis of Shelly Group, so I thought it would be a good idea to quickly summarize the main points of Sean’s thesis on the company before our sit-down.

Deep Sail Q1 2024 Highlight – Shelly Group AD (SLYG.DE)

Shelly Group, a Bulgarian company specializing in smart home and IoT devices, is recognized for its DIY-friendly products that offer affordability, ease of use, and programmability. The company has rapidly grown its revenue from zero to $75 million in just five years, driven by its focus on delivering superior value to customers. Shelly’s products have gained a strong following, particularly in the DIY community, and are known for their versatility and open programmability, distinguishing them from competitors that offer more closed systems. The company’s expansion into new product lines and markets, including a significant opportunity in the US, positions it for continued high growth.

Deep Sail points out that the management team, led by co-founders who hold large stakes in the company, is highly aligned with shareholder interests, ensuring a strong focus on long-term growth. The summary contends that Shelly Group is well-positioned to capitalize on its growth potential, with expectations of a 40% compound annual growth rate (CAGR) through 2026. The company’s asset-light model and recurring revenue from its Shelly Premium App further enhance its prospects. As of the writing of Deep Sail’s letter, the company was trading at a forward EV/EBITDA of 21x, They considered Shelly Group to be a compelling investment with the potential to grow into a multibillion-dollar company, supported by its expanding global presence and innovative product offerings.

And I guess while we’re at it, Kraken, the feature of his Q2 letter will most likely come up, so here is another primer based on Sean’s analysis of the company…

Deep Sail Q2 2024 Highlight – Kraken Robotics Inc. (KRKNF) (PNG.V)

Kraken Robotics Inc., a Canadian marine technology company, has emerged as a key player in underwater exploration and autonomous underwater vehicles (AUVs).

Two companies we track in the space are Coda Octopus Group, Inc. (NASDAQ:CODA), which has been struggling to achieve momentum in its new product offerings, leading to lumpiness in its quarterly results, and Koil Energy Solutions, Inc. (OTCQB:KLNG), one of our newest stocks that we added to our Open Forum Focus Stocks Model Portfolio.

Sean believes Kraken is uniquely positioned in the market, as it offers advanced products like the SEAPOWER batteries, which are believed by many to be unmatched in their operational depth of 6000 meters. Kraken’s technologies are integral to major defense projects, including Anduril’s Dive-LD and Ghost Shark programs, which could generate significant revenue opportunities. With its strong partnerships with global navies and a focus on innovative sensor and battery solutions, Deep Sail believes that Kraken is well-poised to capitalize on the growing demand for AUVs, also positioning itself as a potential multi-billion-dollar defense contractor.

Deep Sail believes the company’s growth prospects are further supported by its strong management team and expanding global presence. Kraken’s ability to provide high-value products in a niche market gives it a significant competitive advantage. The potential scale of its involvement in defense projects like Anduril’s could lead to a stronger financials, with the possibility of becoming a major player in the defense industry. Given these factors, Deep Sail concludes that Kraken Robotics represents a highly compelling investment opportunity, with a strong likelihood of achieving significant long-term growth.

By the way, GeoInvesting Subscriber, Mark Gomes , has also been a big fan of Kraken.

Disclaimer: These summaries are purely based on Sean’s theses and in no way reflect my opinions or represent any due diligence that I have performed on Shelly or Kraken.

–

The remainder of this post is only visible to paid subscribers of GeoInvesting.

Please don’t forget to consider supporting GeoInvesting with a premium subscription if you enjoyed this content, and want to see more of it. Complete this short survey to let us know you’re engaged and interested.

200+ Multibaggers and counting