Contributed by FG Alpha Management

Summary

- Rental car industry titan Hertz (NYSE:HTZ), as well as CAR Inc.’s (0699.HK) Chairman Lu, have both sold almost all of their CAR Inc. shares prior to Q1 2016.

- After comparing CAR Inc. to its peer and shareholder, Hertz, we believe the company is using a questionable depreciation method to help boost its bottom line.

- Skyrocketing related party transactions between CAR Inc. and UCAR, its biggest customer, raise additional red flags about CAR Inc.’s business operations.

- Our on-the-ground due diligence, which covered up to 70% of UCAR’s business, indicates UCAR’s daily rides may have dropped by about 30% in the last 6 months

- CAR Inc.’s gloomy business outlook and the deterioration of UCAR’s business both lead us to believe that CAR Inc. is a sell.

CAR Inc. (0699.HK) is a car rental company based in China that we believe is demonstrating several red flags to the market. Our on-the-ground due diligence in China indicates to us that the company’s largest customer — a related party called UCAR who comprised 40% of CAR Inc.’s revenue for the first half of 2016 — is experiencing a significant sequential decline in the second half of 2016.

We intend to point out numerous reasons for concern regarding CAR Inc., including a declining workforce and declining business from its main customer. In addition to this, we’ll point out growing related party transactions and lower profitability, as well as use of a questionable depreciation method, which we believe is not in line with the industry standard and is being gamed in order to boost the company’s operating income and net income.

UPDATE April 2020: Why is this article still relevant? Because Luckin Coffee Inc. (NASDAQ:LK), the “Starbucks of China”, was just busted as a fraud and fell 80% in one day. It was a recent IPO last year, supported by big banks. The person behind LK is also behind Car Inc., whose stock also plummeted on the heels of that relationship.

We are also going to point out that Hertz, a titan in the rental car industry and formerly one of CAR Inc.’s largest shareholders, as well as CAR Inc.’s Chairman Lu both sold nearly all of their respective stakes in CAR Inc. by Q1 2016. We believe this is cause for immediate alarm. Hertz could know the rental car industry better than any company on the planet and could reasonably be the first to recognize a deterioration of business or other negative factors that would call for selling out of an investment in a fellow rental company.

According to the company’s 2015 annual report, CAR Inc. “operates as the largest car rental company in China, offering comprehensive car rental services including short-term rentals, long-term rentals, finance lease and sales of used rental vehicles.” CAR Inc. went public on the Hong Kong Stock Exchange on September 19, 2014 with an initial offering price of HK$8.50 per share. The company issued a total of 490.3 million shares (including an exercise of its over-allotment). The net proceeds from the company’s IPO after deducting issuance related costs were RMB 3.18 billion.

Major Shareholder Hertz and Chairman Lu Sold almost all their Shares in CAR Inc.

There were several reputable investors with ownership in the company after its IPO. According to this announcement, Hertz Holdings, a wholly-owned subsidiary of Hertz Global Holdings (NYSE:HTZ), owned 16.2% of the company. Additionally, Amber Gem, an affiliate of the private equity company Warburg Pincus, owned 18.3%. According to public filings, between September 2015 and March 2016, Hertz Holdings sold 341 million shares of the company at an average price around HK$10.8 per share, reducing its equity interest from 16.1% to 1.73%, at which point Hertz Holdings ceased to be a substantial shareholder of CAR Inc. In May 2015, Amber Gem disposed of 168 million shares at a price of HK$18.5, 7.1% of CAR Inc. After the sale, Amber Gem still held a roughly 11% equity interest in the company.

Hertz Holdings has been a CAR Inc. shareholder since 2013, prior to its IPO. It’s reasonable to assume that if Hertz Holdings believed in CAR Inc.’s business over the course of the long run, it wouldn’t be selling almost its entire position in the company. Additionally, Chairman Lu sold his entire stake in CAR Inc. in March 2016. These sales are troublesome to us and immediately prompted us to look further into the company.

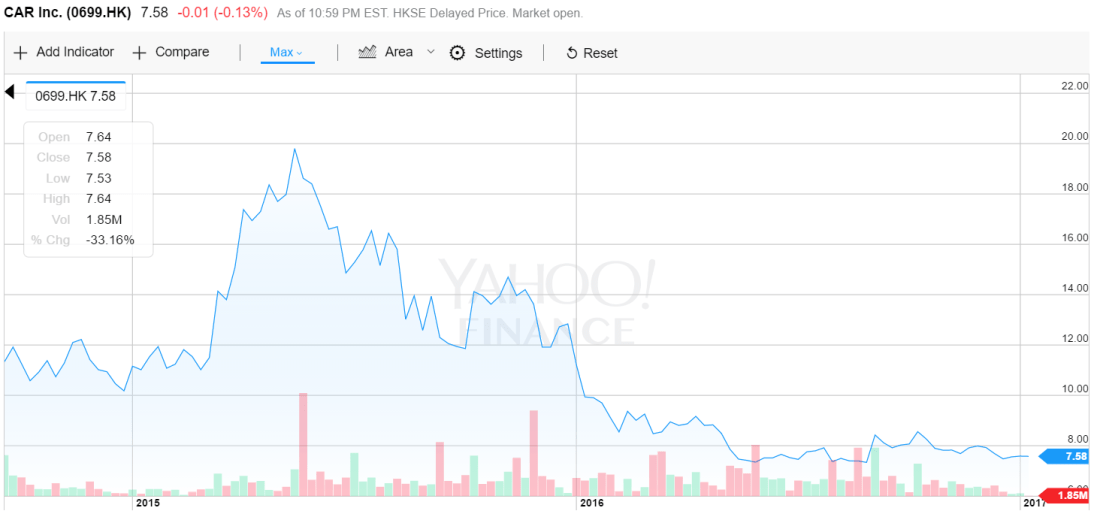

As we can see from a chart of CAR Inc.’s stock price since its IPO, it has dropped from its peak in the middle of 2015 to less than HKD 8 within the last 18 months. We expect this downward trend to continue.

Source: Yahoo Finance

CAR’s Questionable Depreciation Method Differs Greatly from Industry Leader and Shareholder Hertz

Since the car rental business is such an asset heavy business (rental cars and equipment, primarily), depreciation of these assets is one of the most significant costs a company like CAR Inc. faces.

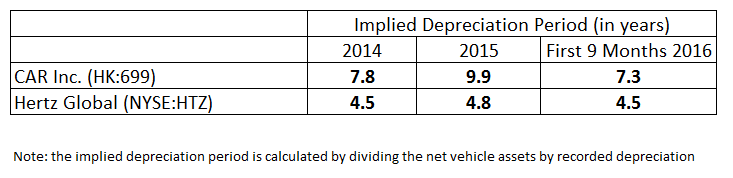

For example, “Depreciation of rental vehicles” was 23.4%, 21.4%, and 24.5% of “Rental revenue” reported by CAR Inc. in 2014, 2015, and the first 9 months 2016, respectively. It is understood that companies should be reasonable when choosing their accounting standard to depreciate their assets. However, when comparing the implied deprecation period between CAR Inc. and Hertz Global, we notice a sizeable gap. As you can see in the chart below, Hertz consistently chooses to depreciate its vehicles over a 4.5 to 4.8-year period. CAR Inc., on the other hand, depreciates within a range of 7.3 to 9.9 years.

The effect on the company’s revenue from this longer depreciation period is obvious: the less depreciation, the higher the company’s operating income and net income.

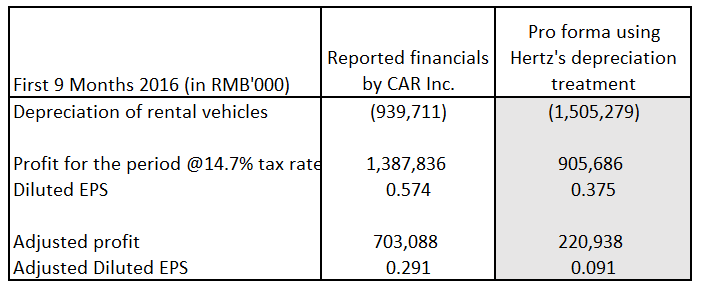

Take the financial results reported by CAR Inc. for its first 9 months in 2016 as an example.

“Depreciation of rental vehicles” was reported to be RMB 939.711 million, and the “Rental vehicles” asset was recorded to be RMB 9,084.434 million (with an implied depreciation period of 7.3 years). If the implied depreciation period for CAR Inc. was modified from 7.3 years to Hertz Global’s more modest (and likely more reasonable) 4.5 years, then “Depreciation of rental vehicles” would be RMB 1,505.279 million. Under the amended circumstance, the company’s reported diluted EPS and adjusted EPS would be reduced dramatically. The following table shows the drastic difference in these two scenarios:

You can see that both net profit and adjusted net profit after tax decrease dramatically when you apply Hertz’s depreciation treatment to CAR Inc. Based on its current stock price of HK$7.58 (~RMB 6.76) as of January 06, 2017, CAR Inc. is trading at a P/E of around 17.4X the annualized adjusted diluted EPS reported by the company. However, it is trading at an astonishing P/E around 55.5X the pro forma annualized adjusted diluted EPS using Hertz’s depreciation treatment.

It is clear that aggressive accounting around CAR Inc.’s depreciation of its key assets helped boost its bottom line. Investors need to be aware that if CAR Inc.’s accounting treatment of depreciation was closer to methods used by industry leader and shareholder Hertz, the company’s bottom line could be negatively affected to a large extent.

Related Party Transactions as a Percentage of CAR Inc.’s Revenue Are Skyrocketing

Total revenue reported by CAR Inc. in 2015 was RMB 5.00 billion and according to the company’s disclosure, revenue from its vehicle rental services provided to UCAR (NEEQ:838006), a related party of CAR Inc., was RMB 1.63 billion (32.6% of CAR Inc.’s total revenue) in 2015. On July 22, 2016, UCAR listed on the New Third Board in China.

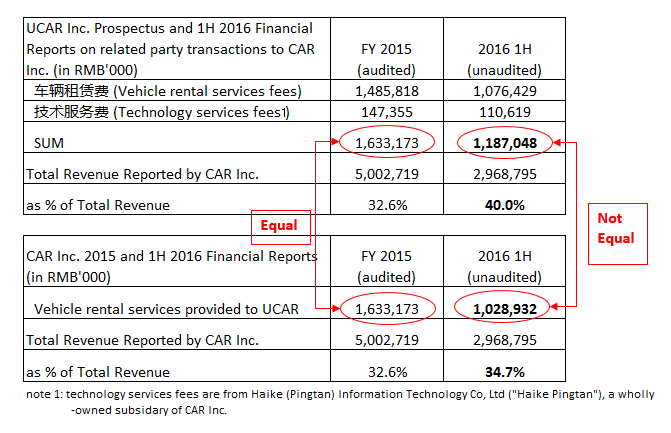

Of this RMB 1.63 billion of UCAR’s revenue contribution to CAR Inc.it appears that RMB 1.49 billion was for vehicle rental services fees and RMB 147 million was for technology services fees to Haike (Pingtan) Information Technology Co, Ltd (“Haike Pingtan”), a wholly-owned subsidiary of CAR. Inc (data according to UCAR’s public file, p.295).

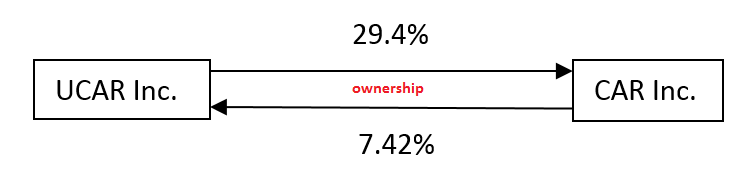

In March 2016, UCAR’s equity interest in CAR Inc. increased from 5.24% to 29.21% as a part of a joint share transfer from Hertz and Chairman Lu to UCAR Inc. At the same time, CAR Inc. also holds 7.42% of the total outstanding shares of UCAR Inc., according to UCAR Inc.’s first half 2016 financial report.

As if these related party transactions were not enough of a red flag on their own, the amount of related party transactions as a percentage of CAR Inc.’s total revenue seems to be increasing meaningfully as time goes on.

Based on CAR Inc.’s first half 2016 financial report (p.69), revenue from its vehicle rental services provided to UCAR was RMB 1.03 billion, which was about 34.7% of CAR Inc.’s total revenue during this period. Based on UCAR’s financials from the first half of 2016 and adding vehicle rental services fees (RMB 1.08 billion) and service fees to Haike Pingtan (RMB 111 million) using the same method of calculating these transactions in 2015, UCAR Inc.’s revenue contribution to CAR Inc. would have been about RMB 1.19 billion, instead of RMB 1.03 billion. This would account for about 40.0%, instead of 34.7%, of total revenue reported by CAR Inc., as compared to 32.6% for all of 2015. The discrepancy in these related party transactions from CAR Inc.’s reported number and the number that is derived from UCAR Inc.’s reported financials is yet another red flag.

Below is a chart that illustrates this discrepancy of these related party transactions, as reported between CAR Inc. and UCAR Inc.

Because UCAR Inc.’s revenue contribution to CAR Inc. has been increasingly significant, UCAR’s business development is very important to CAR Inc.’s business operations and financial results. Because of its importance to CAR Inc.’s success, we have looked further into UCAR’s operations.

Because UCAR Inc.’s revenue contribution to CAR Inc. has been increasingly significant, UCAR’s business development is very important to CAR Inc.’s business operations and financial results. Because of its importance to CAR Inc.’s success, we have looked further into UCAR’s operations.

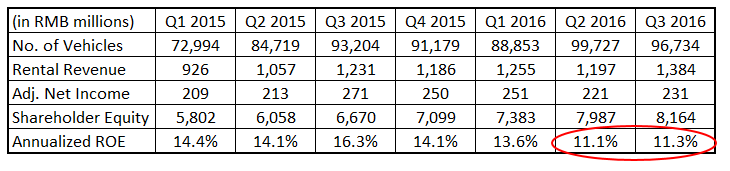

Decreasing Profitability Along with Skyrocketing Related Party Transactions

Even though CAR’s fleet size has increased by 32.5%, from 72,994 vehicles at beginning of 2015 to 96,734 vehicles by Q3 2016, its net income did not grow much over the last six quarters. To the contrary, its net income even declined in Q2 and Q3 2016 compared with Q1 2016. As a result, CAR Inc.’s ROE has declined from a range of 14-16% in the first three quarters of 2015 to around 11% in the most recent two quarters.

source: company filings and proprietary analysis

We found that CAR Inc.’s ROE was declining while UCAR’s business was expanding. Our on-the-ground due diligence, which we will discuss in detail, indicated to us that UCAR is downsizing for various reasons. It is reasonable to assume that CAR Inc. may wind up indirectly bearing the costs of UCAR’s downsizing, and that this could a put pressure on CAR Inc.’s revenue and net income in the future.

Our Research and Due Diligence of UCAR Show Drastic Declines in the Business

UCAR is a ride-hailing company that operates in mainland China mostly by employing its own drivers. It offers customers more expensive rides than Didi and Yidao, which are two other companies that are categorized as ride-sharing companies in mainland China.

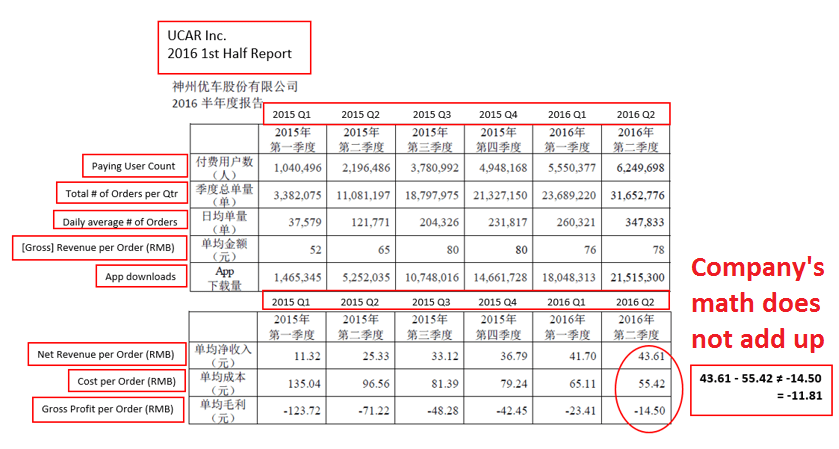

In UCAR’s first half 2016 financial report, it disclosed operating metrics such as total number of orders per quarter, average number of orders per day, average gross/net revenue per order, etc.

Based on UCAR’s financials from the first half of 2016, as shown in the chart above, in Q1 and Q2 of 2016, the total number of orders reported by UCAR increased 600% and 186%, respectively, as compared to the same period last year. Daily average number of orders for Q2 increased 33.6% compared to the same number in Q1 2016. UCAR reported RMB -14.50 as its Gross Profit per Order in Q2 2016. This number is not equal to “Net revenue per Order” minus “Cost per Order,” the calculation method applied to all other quarters in the chart.

Employee count also paints a gloomy picture of UCAR’s business. As disclosed by UCAR in its first half 2016 results (page 31), UCAR’s total number of employees decreased from 42,288 in the beginning of 2016 to 35,812 as of the end of June 2016. It is reasonable to assume that the majority of this decrease comes from a reduction in drivers, as a majority of UCAR’s employees are drivers.

In Q4 2015, total orders were 21.327 million according to UCAR’s report. This number increased to 23.689 million and 31.653 million in Q1 2016 and Q2 2016, respectively. It is incredibly difficult for us to believe that with a decrease of over 6,000 employees during those two quarters, that the total number of orders increased 11% and 34% sequentially.

To seek answers to these questions, we decided to conduct on-the ground due diligence on UCAR’s business. To no surprise of ours, the due diligence we conducted indicates to us that UCAR not only did not grow, but instead potentially shrank from the first half of 2016 to the second half of 2016.

During our due diligence process, which lasted several months, we visited Beijing, Shanghai, Shenzhen, Guangzhou and numerous other Tier 2 and Tier 3 cities across different parts of China. From these cities, our key findings are:

1. Drivers are leaving the company in droves as their income has materially decreased

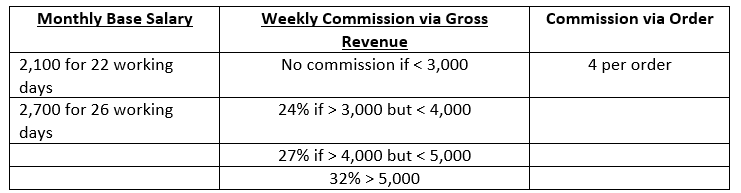

Based on our due diligence, we found that UCAR drivers’ income has decreased materially due to changes in commission fees and the company’s fuel subsidy program. Drivers’ income in different cities that we visited consists of the same sources, including a monthly base salary and commission via both gross revenue and orders. Because of the difference in size, economic scale and living expenses related to each individual city, drivers’ income may differ depending on location. Based on our on-the-ground due diligence, drivers experienced different levels of salary decreases nationwide. In the following example, we use a typical UCAR driver in a typical Tier 2 city to try and exemplify an estimated salary decrease. The decrease in income would be comprised of:

a. Commission fees

The calculation for each driver is:

Salary = Monthly base salary + weekly commission via revenue + commission via order

Currently, in a Tier 2 city, a typical driver’s salary calculation was reported to us as follows:

Note: Salary and Revenue In RMB

We learned from drivers that a typical driver in a Tier 2 city can take around 70 orders per week, during a six-day workweek. As commission per order decreased from RMB 13 per order to RMB 4 per order stage by stage, weekly commission earned by a driver could decrease by around RMB 600. This means a driver’s income in a Tier 2 city could decrease by around RMB 2,400 per month.

b. Fuel subsidy program

When UCAR started its business, the company gave a credit card to drivers to fuel their cars. However, due to uncontrollable fuel costs, UCAR has changed its fuel subsidy program during the first half of 2016 from city to city. We learned from speaking to drivers that the company has only been paying for fuel costs based on the customer’s travel distance. Different cities have different programs and methods for calculating this, including:

- (Travel distance with customer + vacant travel distance *(20-40%))*real fuel cost per kilometer

- Travel distance with customer* fixed amount per kilometer

- (Pick up distance + travel distance with customer + vacant travel distance *(20-40%))*fixed amount per kilometer

Due to this change, drivers pay for part of their vacant travel costs from their own pocket for their daily work. We were also told that in December 2016, UCAR announced another round of fuel cost programs, which cut even more fuel subsidies for drivers in some cities. These changes in the company’s fuel subsidy program can decrease a typical drivers’ income by another RMB 600 per month. Combining this with a RMB 2,400 per month loss on commission, a typical driver in a Tier 2 city’s monthly gross income can decrease around RMB 3,000.

2. Decreasing fleet size following departure of drivers

Drivers in most cities we visited indicated to us that they are not happy with their decreasing salary. Many drivers we spoke to are either leaving the company or plan to leave the company. These conversations indicate to us that in cities UCAR already occupies, especially Tier 1 & 2 cities, the company’s business has already reached its peak without further growth on the horizon.

In Beijing, several drivers told us that there could be thousands of cars already retired — drivers were leaving the company and that more and more cars were found idle and parked at various UCAR garages.

In one Tier 2 city we visited, we learned that there were around 1,000 cars, but that UCAR recently just retired more than 170 sedans, replacing them with less than 50 new cars, a net loss of 120 vehicles in this city.

In a Tier 3 city we visited, we were told that it once had around 100 cars. However, it only had around 60-70 cars in Q4 of 2016, indicating that the total fleet size had decreased by around 30 to 40%.

In some cities, drivers told us that UCAR has to employ only one driver per car where it used to employ two drivers for a percentage of its fleet. It’s reasonable to assume that this will have a negative effect on the company’s top line, as it results in less total driving hours per vehicle.

3. The company faces severe competition in big cities and low margins in small cities

As we will show, UCAR’s business is not growing and may even be shrinking in Tier 1 cities. Despite UCAR being focused on growth in smaller cities, we are pessimistic that new Tier 3 business will offset the business the company is losing in Tier 1 cities.

For Tier 3 cities that we visited, the local market is generally very small. A typical Tier 3 city can have less than 300 cars, while some Tier 3 or Tier 4 cities may have less than 100 cars.

Based on information provided by the company, UCAR serves slightly less than 60 cities in China. Based on our due diligence, as the cities got smaller, revenue per order decreased accordingly. A comparison of the RMB 78 gross revenue per order given by UCAR to what we found in some Tier 3 cities uncovered some noticeable divergences. For instance, in some Tier 3 cities, a typical gross revenue per order can be as low as RMB 30-50. There is no leverage from order volume in these Tier 3 cities; orders per day are not substantially higher than those of Tier 1 and 2 cities. Accordingly, margin per order and revenue per car in a Tier 3 city may also be substantially lower than the numbers provided by the company. The effect of smaller cities is simple: moving business into Tier 3 cities means watering down margin and revenue per order.

4. Order numbers claimed by UCAR’s Chairman Lu as recently as December may not be reliable

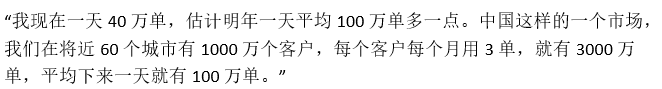

We noticed that UCAR/CAR Inc.’s Chairman Lu made the following claim during an interview in late December 2016:

Translation [paraphrase]:

“We have around 400K orders per day. It is estimated that by next year (2017) we can achieve little over 1 million orders per day on average. In the China market, in near 60 cities, we have around 10 million users. In the event that each user places three orders per month, there shall be 30 million orders, averaging 1 million orders per day.”

In Q2 2016, without disputing whether the number is accurate or not, UCAR claimed to have 348 thousand orders per day. Based on this number, it is safe to say that UCAR’s Chairman Lu tried to claim an approximate sequential ~15% daily order number increase from Q2 2016.

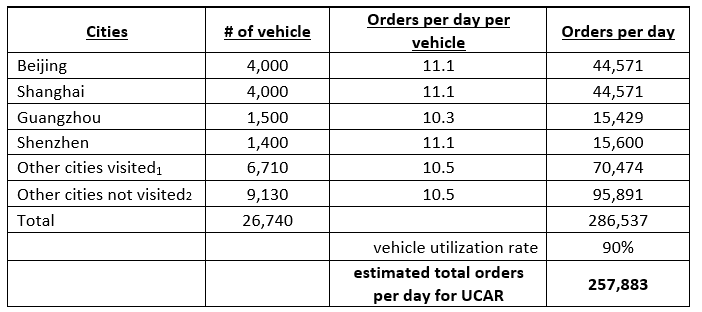

However, based on our on-the-ground due diligence and what we believe to be reasonable assumptions, we estimate that UCAR’s daily order number for the fourth quarter could be as low as 250,000 orders per day, if not lower, without considering its newly added U PLUS/U+ car sharing business. The chart below summarizes our on-the-ground due diligence from Q4 2016 and our assumptions made to derive the total orders per day for UCAR.

Note 1: Based on numerous cities we visited, covering Tier 1, 2 and 3 cities. These estimated numbers were given by different drivers in these cities, which may not be accurate.

Note 2: number of vehicles in those cities that we did not visit is assumed based on the size and economic scale of each city, comparing to those visited cities.

Note 3: Based on our estimates and assumptions, we believe that cities we visited carry around 66% of UCAR’s total fleet, which could contribute up to around 70% of UCAR’s total business.

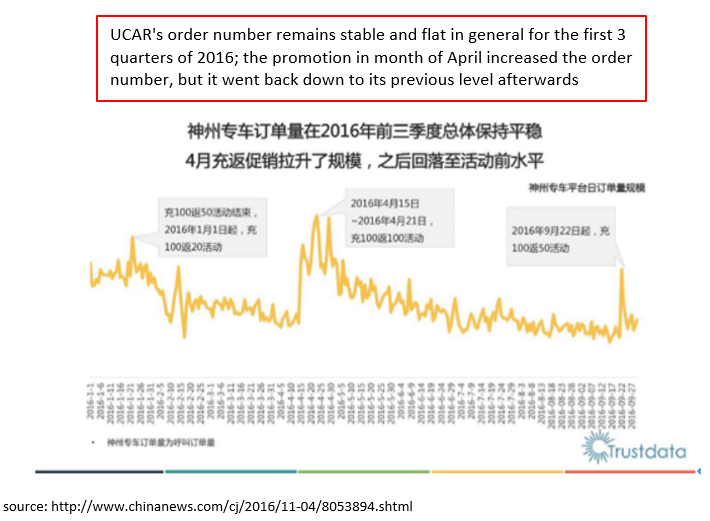

In April 2016, UCAR had a big sales promotion (pay RMB 100, get another RMB 100) which substantially boosted its daily order numbers for UCAR’s public listing in July 2016. Based on Trustdata, after UCAR’s listing, UCAR ran only a small sales promotion (pay RMB 100, get another RMB 50) in September 2016. Aside from that, UCAR only ran a daily “normal” promotion, offering riders to “pay RMB 100 and get RMB 20 extra.”

Due to the lower promotion/discount, it’s reasonable to expect that daily order numbers would quietly decrease, as both shown by Trustdata and our on-the-ground due diligence. Trustdata’s data table shows the following:

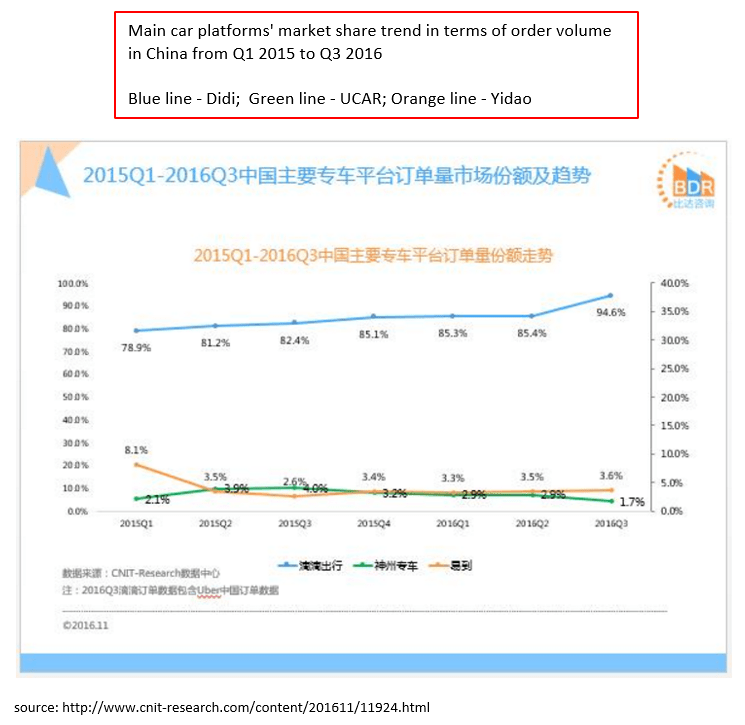

Data from CNIT-Research shows that UCAR’s market share by order number in Q1 and Q2 2016 was 2.9% and 2.9%, respectively, as compared to 2.1% and 3.9% in Q1 and Q2 2015. In Q3 2016, UCAR’s market share went as low as 1.7%. It is hard to imagine, with such a rapid decrease in market share from the first half of 2016 to Q3 2016, that Chairman Lu still claims a 15% order number increase.

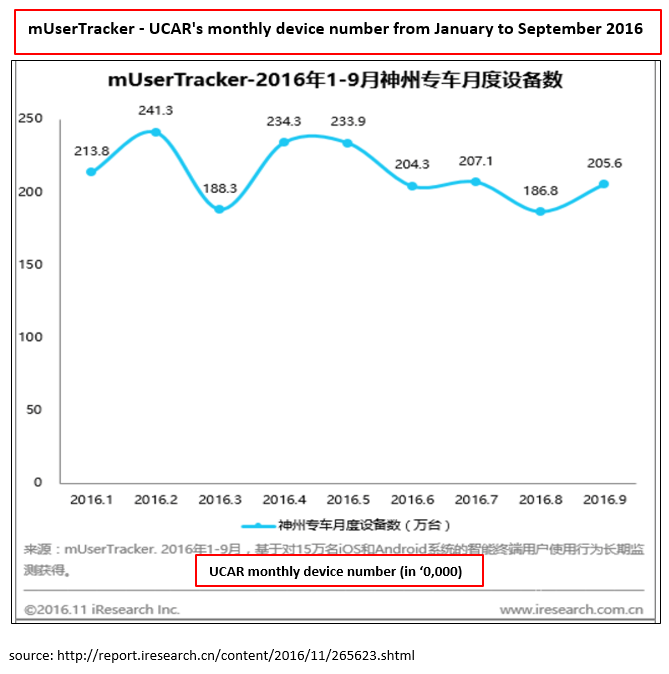

Along with Trustdata and CNIT’s data, iResearch Inc. shows that monthly devices for UCAR have been relatively flat for 2016, possibly even suggesting a slightly downward trend if we smooth out the effects of promotions that the company ran in April 2016 and September 2016.

The iResearch Inc. data is shown in the chart below:

Based on our on-the-ground due diligence and third party research, we concluded that UCAR’s guidance of 400 thousand orders a day is unreliable, and that UCAR’s number of daily rides may have actually declined by around 30%, from 348 thousand in Q2 2016 to 250 thousand in Q4 2016.

Without considering the newly added U+ serviced by UCAR, we believe the claim made by Chairman Lu that UCAR could reach one million orders per day in 2017 is totally unreasonable.

5. Recent regulation in Beijing and Shanghai puts extreme risk on UCAR’s business

During December 2016, Beijing and Shanghai implemented regulations on ride-sharing and ride-hailing companies, making it mandatory for drivers at these companies to have a local “hukou” (city resident identification). Due to these regulations, only local residents can be drivers for UCAR.

This requirement will probably affect these companies’ businesses negatively, as many drivers do not have a local “hukou” in these two cities for UCAR. A recent media report in China listed several negatives for UCAR under these new rules:

- Based on a survey of drivers, up to 80% of UCAR’s drivers do not have the necessary “hukou” to drive in Beijing.

- Shanghai also needs drivers to have Shanghai’s “hukou”, which applies to every platform company.

- Order volume from Beijing and Shanghai might account for more than 20% of total order volume for UCAR, according to an investment professional, and its business will largely be affected under these two cities’ new rules.

We learned that the Beijing government gave ride-sharing and ride-hailing companies another five months (until May 2017) to implement these new rules. In Shanghai, the local government has already started to implement these new rules gradually.

Based on our on-the-ground due diligence, and similar to the Chinese media report, we believe that at least 80% of UCAR’s drivers in Beijing and Shanghai may not be local citizens, but rather immigrant workers from other provinces. With the company’s decreasing salary and low pay, it is hard to imagine that local citizens in Beijing and Shanghai will join UCAR as drivers to take the place of immigrant workers. Therefore, it is reasonable for us to predict a catastrophic drop of UCAR services in both Beijing and Shanghai, which could negatively impact more than 20% of UCAR’s total orders. We already learned about a substantial decrease of cars in service in Beijing during Q4, and it appears this decrease could be even worse in coming quarters.

6. UCAR started its car sharing business in Q3 2016 with less relying on CAR Inc.

In September 2016, UCAR launched its “U+” car sharing platform, which is the same concept as Didi and Uber. For this U+ car sharing platform, UCAR does not rent cars from CAR Inc. but only provides a car sharing platform without any charge to those drivers. Based on the information given by Chairman Lu, U+ is expected to be an important revenue generator for UCAR going forward. Therefore, we believe it is reasonable to expect that UCAR’s contribution to CAR Inc.’s revenue may decrease.

Conclusion

Based on our analysis of comparing CAR Inc. to an industry peer Hertz, who sold most of its shares in the company and is no longer a substantial shareholder of CAR Inc., we believe CAR Inc. is using questionable depreciation methods to help boost its bottom line.

In addition, the increasing amount of related party transactions between UCAR and CAR Inc. and the inconsistent calculation of CAR Inc.’s disclosed related party transaction amount with UCAR in first half 2016 as compared to fiscal year 2015 are both red flags to us.

Our on-the-ground due diligence on CAR Inc.’s significant related party, UCAR Inc., indicates to us that:

- Many of UCAR’s drivers in China are either leaving or planning to leave the company due to decreased salary, partially attributed to both commission changes and the fuel cost subsidy program change put forth by UCAR.

- UCAR’s business growth seems to have peaked and the prospect of its growth in the future is likely hindered by various factors.

- New regulation in Beijing and Shanghai puts additional immediate risk to UCAR’s business operation.

- UCAR’s total number of orders in Q4 2016 is likely much less than what UCAR’s Chairman Lu claimed in a recent interview in December 2016. Even compared with Q2 2016, UCAR’s total number of orders seems to have declined in Q4 based on our due diligence.

The possible shrinking business of UCAR, a significant related party of CAR Inc., is also a major risk to CAR Inc.’s growth in the future. In an event where UCAR sees itself returning vehicles to CAR Inc. and/or not continuing to pay CAR Inc. as much in rental fees as it has done previously, it is easy to imagine that CAR Inc. may run into severe financial difficulties in the near future.

Based on our analysis and on-the-ground due diligence, we believe that CAR Inc.’s stock price as of the writing of this report does not reflect the company’s current operations and future business prospects. We believe CAR Inc.’s stock will move meaningfully lower in the near to mid-term.

Disclosure: Short 0699.HK at time of report

[/MM_Member_Decision]

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the contained in this report without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

Our research and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com//terms-conditions-privacy-policy/