Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

By Maj Soueidan, Co-founder GeoInvesting

Before I get into a reflection on the book Damsel In Distressed: My Life In the Golden Age of Hedge Funds, by Dominique Mielle, I’d like to point you to a few tweets I recently posted that I’ll parlay into the theme of today’s topic – capitalizing on market inefficiencies and how Mielle’s history of being an early investor in distressed asset classes rhymes perfectly with the edge that microcaps provide.

On December 16, I quickly commented on the aversion that people have towards microcaps, which is quite astonishing to me given that the quality gets swept into the melee of bad karma brought upon by the junk that gave the space a bad name in the first place:

Can’t recall a time in our 30+ yr career, where microcaps have been so hated, amid:

-Pump & dumps graduating to NASDAQ

-Rule 211

-15 Yrs of luring investors into toxic deal flow

-2022 reset

-Return of China pump & dumpExactly the time to bet on left for dead quality microcaps.

— GeoInvesting, LLC. (@GeoInvesting) December 16, 2023

Then On December 20 I tweeted that I am still pounding the table on my opinion from October 2022 that we are in the early innings of a multi-year GARP microcap bull market.

This is just getting started my friends. So, strap on your seat belts:

✅Old style fundamental investing is sexy again

✅Boring becomes beautiful

✅GARP Valuation multiples to expand

✅MEME “investors” won’t be the only millionaires in townStill pounding the table on this👇 https://t.co/EO8TjfmCbt

— Maj Soueidan (@majgeoinvesting) December 20, 2023

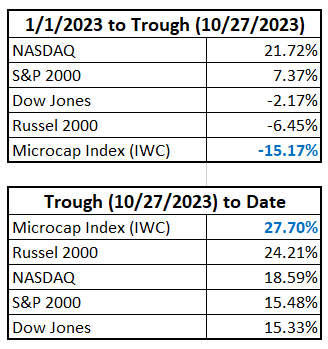

The Russell 2000 Small Cap Index and the iShares Microcap ETF (IWC) exploded higher by over 24.21% and 27.70%, respectively, over the last 2 months (since October 27), trouncing the next best performing index, the NASDAQ, by nearly 5.62% and 9.13%, respectively. Yet, we are still in the very early innings of a microcap growth a reasonable price (GARP).

However, the year to date returns of the Russell 2000 and IWC indexes up until this big move were dismal vs. the other major indexes, with the iShares being down a whopping 15.17%!

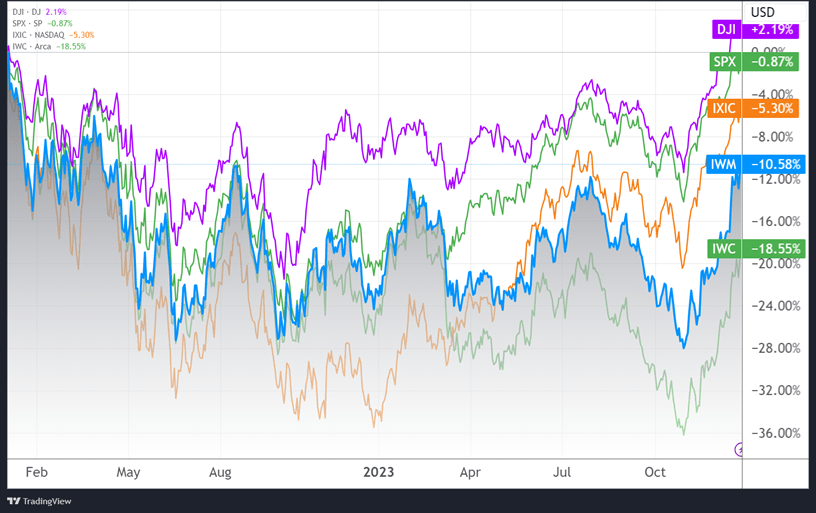

If you look at a longer term chart, January 2022 to date, you can still see that the disparity between the worst performing index, the IWC, and the best performing, apparently safer Dow Jones index, is still an eye-opening 20.74%, showing that although there was just a nice 2-month bounce, there is still a lot of ground to make up.

Some might hold the opinion that the small and microcap moves are dead cat bounces. And can you blame them?

Microcaps are still hated, and will be hated for years to come. The 2021 amendment to SEC Rule 211 that spelled out new reporting standards OTC companies need to comply with in order to be quoted by a broker dealer combined with the Great Reset of 2022 have not helped the microcap cause.

However, the microcap universe has just gotten too cheap. You are starting to see shareholder activism pick up and some companies are starting to get aggressive to lock shareholder value. Just a few weeks ago, a private equity firm called me to inquire about setting up a fund to acquire microcap stocks that are “too cheap and should not be public.”

With interest rates being normalized and investors caring about whether or not companies can generate earnings and cash flow, they are going to begin deploying their microcap fund allotment into quality microcaps as opposed to just Meme and profitless microcap long shots.

That brings me to Dominique Mielle’s book published on September 7, 2021, Damsel in Distressed: My Life in the Golden Age of Hedge Funds. It’s an awesome book that partly delves into the art of capitalizing on market inefficiencies and a perfect proxy to drive the microcap investing edge point home. Mielle was a partner and senior portfolio manager at Canyon Capital, a $25 billion hedge fund, for 20 years, specializing in distressed asset investing.

“Damsel in Distressed” is not your typical investment book. It’s not a dry compilation of financial jargon or a formulaic guide to wealth-building. Instead, Mielle offers a no filter journey through her career as hedge fund analyst and portfolio manager, which included creating innovative financial products to exploit inefficiencies in the market. Her memoir provides great examples of how she exploited inefficiencies to give her an edge investing in distressed assets.

Mielle also talks about how fast investing edges can disappear once the “crowd” appears.

For example, take this quote on when she talked about the evolution of the hedge fund industry:

“Hedge funds make money by capitalizing on market inefficiencies, which are always fleeting opportunities. In the short term, once enough funds exploit them, the inefficiencies vanish and with them, the sources of alpha”

She goes on to talk about how hedge funds managers lost their edge as the space got crowded.

Mielle’s career was built on capitalizing on market inefficiencies, which she described as fleeting opportunities. Her stories resonated with me right out of the gate because her emphasis on gaining an investment edge in inefficient markets is in such parallel with being a microcap investor. It gives me goosebumps.

For example, One of the most significant inefficiencies she discusses is informational scarcity in the ’90s. During this time, information was hard to obtain, especially for non-institutional investors who had to rely on brokers or wait for reports to arrive by mail. Mielle recalls how the SEC’s requirement for electronic financial filing on EDGAR in 1996 revolutionized access to information, leveling the playing field for all investors.

She explains that the evolution of technology, regulatory changes, and increasing competition were instrumental in eroding these inefficiencies over the long term.

When it comes to information, microcap investors feast on the information edge gained from the space attracting a limited number of investors competing with each other. While it’s true that technology and other changes have eroded some of the inefficiencies of the past, the microcap market can still be extremely inefficient with respect to the time embargo it takes for information to be found by enough investors so that the price of a stock fully reflects the information.

I could easily make an argument that in some ways, even though the stock market is more efficient in terms of the availability of information, the number of investors looking for information on microcap stocks is lower than ever, thus providing an ample amount of inefficiencies to profit from.

It’s incredible to be able to access conference call transcripts or SEC filings to find legal and free public information that you know will dramatically and positively impact the value of a stock you are researching before the crowd find it…information like sales backlog, industry growth data and management’s outlook on the business, not always present in quarterly financial press releases of microcap companies.

This time embargo edge can’t be exploited in large cap stocks like Alphabet Inc. (NASDAQ:GOOG) or Apple Inc. (NASDAQ:AAPL) when the entire world is “listening.”

This is why microcaps offer such a compelling opportunity over their larger counterparts, given the first mover advantage that can be exploited.

Mielle’s reflection on the bursting of the internet bubble and, more so, the telecom bubble between 2000 and 2002 underscore the narrative that significant gains are often found in markets that are unloved and less competitive. The bubble era was characterized by wild speculations in technology, dot com and telecom stocks.

After bursting, once loved high flying stocks and sectors became the most hated areas to invest in. The unprecedented collapse of the telecom sector is where Mielle and Canyon set their eyes, where “equity investors lost two trillion dollars in the telecom sector out of a seven trillion in total market capitalization”:

“It is impossible to overstate the depth of the Abyss from around September 2000 to 2002. The Dow Jones telecom index dropped at 86% and the wireless index at 89%, a telecom calamity.”

Being that investing in distressed assets was Mielle’s expertise at Canyon, they focused heavily on the debt markets, where once investment grade debt of many telecom companies became junk bonds:

“The telecom bust “was a financial calamity of epic scale with enormous consequences to all market participants shaking not only the equity market where the.com was mostly concentrated and the public mostly affected, but also the investment grade bond junk bond and leveraged loan markets in the US and beyond.”

“Companies began to fall on hard times when investors who had wholeheartedly financed the expansion (since the deregulation of the telecom industry in 1996) until then suffered losses in the.com crisis and became reluctant to extend further capital. As it started the demise of the cash hungry telecom companies leveraged to the hilt and dependent on investors’ appetite for their equity and debt to continue funding their business model.”

While Canyon was not alone investing in the distressed assets from the dot-com and telecom bust, the supply of distressed opportunities hugely outweighed the demand from distressed hedge funds at that time. This “lack of competition” is what allowed hedge funds specializing in distressed assets to trounce the Standard and Poors 500 index from 1999 to 2002 by 61%:

“The world was littered with cheap assets and bargain companies. Yet there were precious few investors with a deep enough understanding of the bankruptcy process to profit from buying companies that have fallen on hard times, along with the wherewithal the mandate and the money to take on the risk. It is no surprise then that under these circumstances, the hedge fund industry vastly outperformed the market for 2000 2001 and 2002.”

“If you had invested $100 in the s&p in 1999, you were left with little more than $62 By the end of 2002. While the same $100 invested in a distressed hedge fund grew to $123.”

In fact, Mielle attributes the lack of competition as the “decisive factor” in their (hedge funds) outperformance.

“It was this unique confluence of events that gave rise to an immensely profitable business, a tiny pot of money going after a giant pool of opportunities.”

To put this into perspective, 3000 hedge funds, with about $400 billion in assets, existed when Mielle started her career with about $400 billion in assets and only $5 billion dedicated to distressed investing.

“There were 16 times more assets in bankruptcy than investors were able to rummage through them. There was a flood of bankruptcies and Canyon was swimming in opportunities. And it was not only Telecom, unrelated industries were in equal disarray for different reasons.”

Today, there are over 30,000 hedge funds, globally.

And it shows in the stats:

“From 2000 to 2008 distressed hedge funds beat the S&P 500 and the high yield indices in eight out of nine years. From 2008 to 2019 distressed funds did not beat the S&P 500 in a single year and beat the high yield index only in 2013 and 2014.”

This is a perfect parallel to investing in microcap stocks, with one twist.

It’s been over 30 years since I started investing in microcaps as a full time investor and the asset class is still hated, maybe more than ever. This is true, despite the overwhelming empirical evidence that microcap returns far outpace large cap stocks by a wide margin over time. Some sources to back this up:

- Inefficiency Breeds Opportunity in Small Cap Equities, by O’Shaughnessy Asset Management

- Microcap Quality index

So, while large cap only investors, microcap haters and Mielle have to contend with increasing competition in strategies that are finding success, microcap stock pickers have the luxury of searching for opportunities in a pool of around 10,000 stocks in North America (50% of total stocks), while arguably, the competition has been declining or at least staying level.

It’s a dream set-up, especially if your strategy is value investing, or whatever you want to call buying undervalued stocks producing revenue and earnings, a style of investing that was not broadly in vogue for the past 15 years. But mark my words, it’s quietly coming back. And it’s going to be back for several years and lead to massive expansions in valuation multiples. Get used to seeing the big mover lists being occupied by more and more legit companies as opposed to MEME and pump and dump stocks.

The rally we just witnessed in the small and microcap indexes is child’s play. The best is yet to come and in fact what I am talking about is already gaining momentum. Stay tuned for an update on proof that microcap value is back with a vengeance via a microcap quality index I created that the returns of the Russell do not convey. As a matter of fact, the Russell 2000 is just starting to play catch up to this index.

While microcaps will always offer investors a chance to achieve market-beating returns, if I am right about the broad multi-year bull market microcap value is about to experience, the juicy returns are going to attract more investors. So, you might want to consider paying attention to microcaps now to gain a first mover advantage.

Some of my best microcap investment returns were achieved within the early years of the recovery from the dot com crash. The 2022 reset has some very similar characteristics to that crash, where the Dotcom Boom signified a time when value investing took a backseat to the appeal of speculative stocks. However, the subsequent Dotcom Bust reaffirmed the importance of fundamental analysis and responsible investing re-emerged as a trusted approach to identifying stocks with real intrinsic value.

The following passage from Mielle’s book, which includes a quote from David Tepper, drives the first mover advantage home and is a good place to end:

One media image that stuck is that legendary distressed investor David Tepper, who kept a giant pair of brass testicles on his desk and was said to rob them for good luck. The truth is more nuanced. Here is an actual quote from David Tepper.

“For better or worse, we are a herd leader. We are at the front of the pack. We are one of the first movers. First movers are interesting – you get to the good grass first, or sometimes the lion eats you.”

Everyone is scared and confused when the market tanks. No one sees opportunities on a consistent basis. The best investors make genius trades and disastrous bets.

My point is that a hedge fund investor is just a regular guy (rarely a gal, unfortunately) who’s trying to make money for investors and agonizes over investments, revisiting them every day, every minute until the market closes–in his shower, at dinner and over the weekend–and repeats it all on Monday.

The job is to look for value bargains and inefficiencies which usually crop up when things are messy and ugly. There are times when you recognize early and unequivocally that the market is handing you a bargain; the telecom prices provided such a backdrop.

The reason why distressed bonds made so much money back then is not because we were geniuses, not because of nerves of steel, wheels of iron or testicles of brass. It was because of timing, of the confluence of the newness and modest size of the business relative to the market structure and outlandish number of bankruptcies.

In other words, happy circumstances.”

—

If you are a premium subscriber and not currently logged in, you can log in here to view The Associated Premium content. Once Logged in, Just click on The link for The Latest Issue Listed At top of your Home Page.

If you are not a premium subscriber, please JOIN HERE.

—