The best investment theses are simple: Blue Bird Corporation (NASDAQ:BLBD) already has a committed buyer

Note: We first published this article to members on the morning of July 27, 2016. We summarize why we think a takeover bid of around $13.00 by American Security (owner of 57% of BLBD shares) will not consummate at that price. A similar article was published later in the day on Seeking Alpha and we agree with most of that article’s thesis. However, the article points out that activist shareholder Spitfire (owner of 7.3% of BLBD shares) will not be able stop the acquisition.

“I do not think Spitfire can stop the transaction. The buyer owns a big stake in the company and will close the deal. However, the fact that we have such an investor inside the company will force the Board of Directors to ask for a decent price.”

We disagree with part of this opinion that Spitfire can’t stop the transaction. Our research indicates that according to Delaware law, in a conflict of interest situation, either a majority of the non-affiliated (shareholders not affiliated with the acquisition parties) float must vote in favor of such a transaction before it will consummate, or an independent committee has to approve the transaction. Thus, Spitfire can rally the troops to thwart the deal. Reference page 32, part C here.

Summary

American Securities, a private equity firm, wants to take Blue Bird Corporation (NASDAQ:BLBD) private BLBD just went public in February 2015 through a reverse merger after which Cerberus affiliates, the former private owner, still owned 57% of the company American Securities recently bought a 57% stake from Cerberus; the transaction was completed in June 2016 We believe American Securities understands they are pretty much committed to an acquisition; this is why they threw out a low-ball offer by issuing a non-binding letter of intent to acquire the rest of the outstanding shares at a discount to market price

Background on the Situation

Blue Bird Corporation designs, manufactures, and sells school buses and replacements parts for school buses. Since its formation in 1927, Blue Bird has sold more than 550,000 school buses, and has approximately 180,000 buses in operation today. Blue Bird’s longevity and reputation in the school bus industry have made it an iconic American brand. Blue Bird differentiates itself from competitors by solely focusing on school buses.

Most of you already know their products. For example, the 2007 Blue Bird Vision:

After a time of operational and financial difficulties in the early 2000s, Blue Bird was acquired through a bankruptcy filing by affiliates of private equity firm Cerberus Capital Management in 2006; under the guidance of Cerberus, the business was turned around and operating metrics steadily improved.

Being a private equity firm and thus having a shorter term investment horizon, Cerberus eventually had to unwind their position. Cerberus Capital Management affiliated funds sold Blue Bird to the public through a reverse merger with a shell company called Hennessy Capital Acquisition Corp in February 2015; the Cerberus affiliated seller is a Dutch company called Traxis B.V. After the reverse merger, Cerberus affiliated funds still owned 57% of the company.

Developments after the Reverse-Merger

Private equity firm American Securities Corporation, announced in June 2016 the completion of an acquisition of 57% of the outstanding shares of Blue Bird Corporation from Cerberus affiliates On July 20 th, American Securities sent a non-binding letter of intent to acquire the rest of the outstanding shares not currently owned by American Securities Corporation The letter implied a take-over price in the range of $12.80 to $13.10 per share; the stock currently trades above $13.90 per share A conservative Discounted Cash Flow (DCF) model – the valuation method that has most credibility in the case of litigation in a Delaware court – yields a stock price which is at least 23% greater than the proposed bid; assumptions used for our DCF are mostly below management’ implied guidance Valuation multiples support the DCF conclusion Alternatively, a reasonable P/E of 15 on 2017 analyst EPS estimates of $1.34 yields a price target of $20.10, around 50% higher than the American Securities takeover bid.

We believe the valuation method offered by American Securities is flawed and we do not expect it to hold up in a Delaware court. See link to letter above. The valuation offered up by American Securities uses historic stock prices to support their conclusion. We find this overly simplistic. Spitfire Capital Management filed a 13D, voicing their intention to fight the proposed “take-under”

“Simplicity is the outcome of technical subtlety. It is the goal, not the starting point.” – Maurice Saatchi

Now that you have read and understand the history, and the fairly complex transactions Blue Bird has gone through, it is time to narrow down the investment thesis to its core.

American Securities is largely already committed to an acquisition.

American Securities is a private equity firm, their intention is to make changes on an operational level to increase the value of their holdings. LPs typically do not want them to have positions in publicly listed equities for an extended period of time. American Securities already owns 57% of the shares; a position that is not easy to unwind in the public markets – it seems as if there is no reasonable way for them to step back from a takeover. One could easily argue that they are in a long squeeze of sorts.

Additionally, private equity funds have a limited lifespan, meaning that American Securities cannot waste too much time before taking over BLBD because it limits the time they have to make operational improvements and exit the position once the fund nears the end of its lifetime. This goes back to the basics of the time value of money. The company is essentially being forced to be decisive and get a deal finalized quickly. In order to do so, we believe they will – for one or all of numerous common sense reasons – raise their bid for the company.

We believe American Securities understands the dynamic of the situation and this is why they “low balled” their offer to begin with. We reiterate the crux of the situation: the best buyer is one that is already committed to a purchase, and American Securities fits this bill easily.

Appendix:

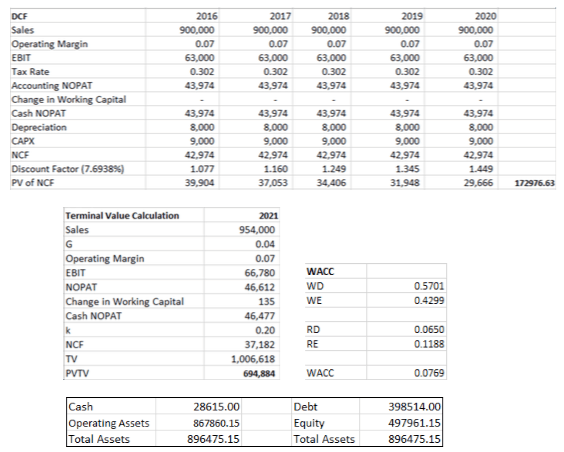

Discounted Cash Flow Analysis

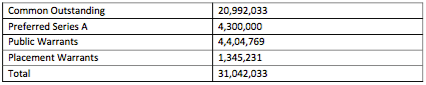

Share count on an as-converted basis

Implied per share price on fully diluted basis per common stock: $16.04

Supplementary Valuation Material

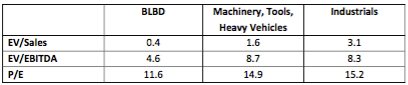

Relative Valuation (ttm basis, source Thomson Reuters)

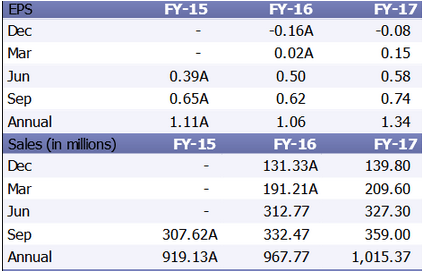

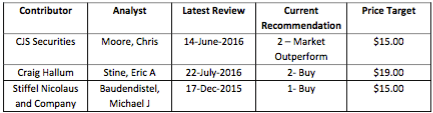

Analyst Estimates

Slightly more aggressive DCF

- Assuming operating margin of 9%

- Assuming a beta of 1

Yields a price per common stock of $43.11