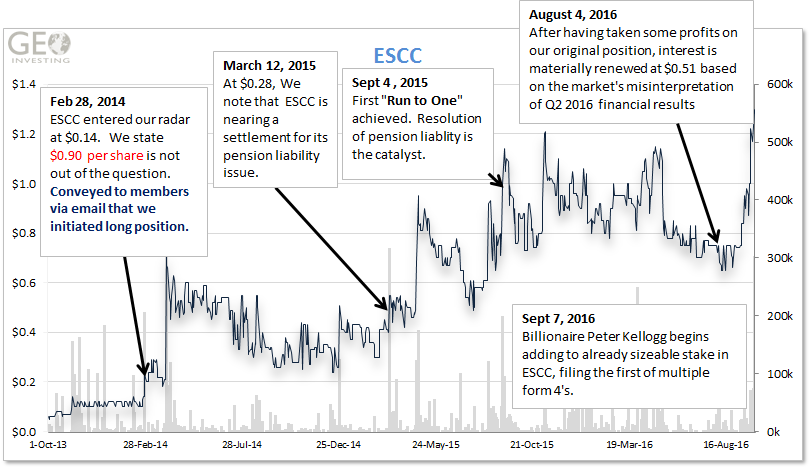

Our ongoing coverage of Evans Sutherland (OOTC:ESCC) is a great example of the kind of hidden opportunities that many investors overlook. ESCC is an idea we brought to our premium members and has persistently paid off for us. The common strategy we used? Buying the dip on misunderstood news. Our first run with the company netted us multi-bagger returns. This time around, buying on the dip has also rewarded us and our members who believed in ESCC. The company’s stock is once again gaining steam, and we think for good reason. We are not the only investors that have discovered this little know gem that is a leader in the graphics technology industry. Well-known billionaire investor Peter Kellogg continues to add shares in the open market, even during the stock’s strong push forward. He now owns nearly 30% of ESCC, which is possibly a reflection of his confidence in ESCC’s bright future. Or maybe he has different plans.

Partial Catalog of Shows – Peter Kellogg Has Good Taste

It’s Only a Matter of Time

While we’ve often said (about many of our investment ideas) that it’s only a matter of time before the public digests information that we have found before our research peers, otherwise known as “business intelligence before it’s news” or information arbitrage, we believe that this time has elapsed for ESCC. Market participants at this point have had plenty of time to perform their own diligence on ESCC and come up with the same conclusions that we have conveyed to our premium members again and again at depressed stock prices.

Now that its second “Run to One” journey is complete, we thought it an excellent opportunity to offer how we’ve covered the company since February 28, 2014 (Yes, over 2 years ago!). It was at that time when we first noticed that there was a past due pension liability issue weighing on the company that if resolved we thought could lead to extraordinary stock returns. If you’re wondering how that turned out, continue reading and hopefully you’ll appreciate how GeoInvesting’s research stands apart.

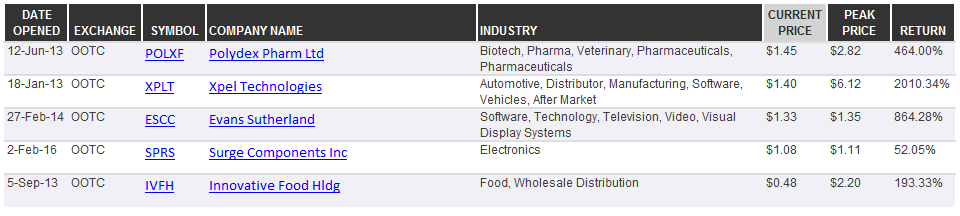

About Our Run to One Theme

While focusing on stocks that trade over $1.00 has been our bread and butter for years, we also research and are always on the lookout for stocks that trade under $1.00 to try to identify potential multi-baggers with even more extraordinary returns. We view these stocks as long-term lottery tickets. Many of them have “hair,” but that is why they trade under $1.00. So if you are long-term investor with an appetite for risk this strategy may appeal to you. One thing that differentiates us from other newsletters and micro-cap sites is that if we decide to look at a stock that is trading under one dollar per share, it must be a company with real revenues, a favorable capital structure and a competent management team. Not one trick pump and dump ponies.

Below are a handful of companies that we have brought to our members’ attention that have successfully attained $1 per share. We are actively tracking and/or own another three stocks that we feel have the potential to follow the same bullish pattern.

* Screenshot from Portal

GeoInvesting Research Log for ESCC

NOTE: This is the type of research that our premium members get on a daily basis. Our commentary and analysis is purely proprietary and we receive no monetary compensation from companies for the dissemination of this research. We rely on the organic adoption of our research as we feel that is the best way to convey awareness to the investing public.

Friday, February 28, 2014

ESCC ($0.14) – engages in the production and sale of visual display systems used primarily in full-dome video projection applications, dome projection screens, and dome architectural treatments in the United States and internationally. Reasons for tracking:

- We believe ESCC presents a potential special situation opportunity rather than a growth opportunity. The company had good Q3 2013 financial results.

- Sales for the third quarter were $8.5 million, compared to sales of $5.4 million for the third quarter 2012.

- Net profit for the quarter was $1.0 million or $0.09 per share compared to a net loss for the third quarter 2012 of $1.1 million or $0.10 per share.

- This appears to be the first time ESCC has reported a quarterly profit since going public in 2002. Company guidance infers that it will report EPS of at least $ 0.07 for the fourth quarter 2013, and that it may be able to maintain profitability going forward.

- Unfortunately, this story is not without significant risk, as is the case for stocks with depressed valuation. The company’s balance sheet reveals a $33 million pension liability that has resulted in stockholder equity being negative. A special situation opportunity arises from a possibility, through negotiations with relevant regulatory bodies (ERISA), that the company may be permitted to settle its pension liability, thereby removing it from the balance sheet.

- We presume that if the company is successful with this endeavor, and given its improved cost structure, shares would see a significant lift somewhere between its ash per sale of $0.40 and to its tangible book value of $0.90

- Another positive aspect to the story is that an increasing interest rate environment should lower the pension liability.

Caveat:

- It is still unclear to us if the company can maintain profitability at a lower level of sales revenue that it reported in the third quarter 2013. The company is also not ready to commit to consistent growth. Please see linkfor full management commentary.

Thursday, March 12, 2015

ESCC nearing settlement of its pension liability issue – shares could increase materially

ESCC ($0.28)

A strong backlog and the potential nearing of a settlement of its pension liability by the end of March 2015, could lead to a sharp increase in ESCC shares. Shares are trading at a significant discount to GeoInvesting’s calculated tangible book value of around $0.80 if we assume that the pension liability is resolved. ESCC produces and sells visual display systems used primarily in full-dome video projection applications, dome projection screens, and dome architectural treatments in the United States and internationally.

On 4/3/2014, we highlighted a bullish special situation catalyst in the ESCC story. Clues in SEC filings hinted that management was highly optimistic that it would settle a past due pension liability, which would meaningfully and positively impact its net income (from loss to profit) and significantly increase tangible book value per share. Unfortunately, at that time, no timeline was provided as to when management expected a resolution of its pension liability issue. You can read a full recap here.

Finally, in its Q3 2014 10-Q, ESCC provided specific language that dictates that it is highly likely that it would settle its pension liability by January 15, 2015. It’s worth noting that the settlement of the pension liability should also resolve a default notice recently received from one of its lenders that arose as a result of the pension liability issue. Although we expressed some optimism that a resolution of the issue would lift ESCC shares closer towards its tangible book value per share of $0.80 (with no pension liability), we mentioned that the company’s inability to consistently grow its business could limit valuation expansion. In fact, over the past several years the company has only stated that it would maintain current sales levels. To us, it looks like ESCC‘s growth trajectory is about to take a major leap forward which could lead to significant valuation multiple expansion.

Yesterday, near the close of trading, the company reported its year end 2014 results:

- Sales for 2014 were $26.5 million, compared to sales of $29.6 million for 2013; for Q4 2014, $6.43 million vs $11.12 million in Q4 2013.

- The net loss for 2014 was $1.3 million or $0.12 per share, compared to a net income of $1.2 million or $0.11 per share for 2013; Q4 2014 – net loss of $0.05 vs Q4 2013 EPS of $0.18

- Revenue backlog as of December 31, 2014 was $28.2 million compared to a backlog of $17.2 million as of December 31, 2013.

While the numbers look dismal at face value, there are plenty of reasons to be optimistic, including a surge in company backlog and two year visibility.

The company’s comments on the decrease in sales for 2014:

“sales decline was due to unexpected changes to customer schedules, which delayed several installations and not the result of a downward trend in the business. To the contrary, new sales bookings were extraordinarily strong, leading to a 65% increase in the sales backlog to $28.2 million as of December 31, 2014 compared with backlog of $17.1 million as of December 31, 2013. Sales prospects remain very strong, which supports an encouraging outlook for 2015 and 2016. We believe that sales for 2015 will exceed sales recorded in 2014, which is expected to lead to improved results.”

Update on settlement of pension liability:

“We have made significant progress toward the settlement of our Pension Plan liabilities through the distress termination application process. Recent correspondence with the Pension Benefit Guaranty Corporation indicates that the application process should result in a settlement of the Pension Plan liabilities on terms that should enable the Company to continue to operate as a going concern.”

Backlog to sales multiplier

Since we have not interviewed management, we looked at the relationship between historical year end backlogs to forward 12 months revenues relationships for 7 years to help us forecast 2015 sales. Based on the company’s sales-to-backlog ratio average of 1.52 over the last 7 years, 2015 sales are projected to be $42.8 million. (7 year sales to backlog ratio range was 1.23 to 2.06)

The major considerations/potential caveats that we are still following:

- We are still unclear of how the pension liability will be resolved, whether it will be a one-time hit or amortized over several years.

- We’re unsure as to the gross margin tied to the work contained in the company’s backlog

- The company deals with large products, so we anticipate that revenue growth could still be lumpy moving forward

- While management expects 2015 sales to exceed 2014 levels, they do not provide any further details about how much of an increase is expected.

- Previously management expected the resolution in mid-January, so we need to take the end of March comments with a grain of salt.

- As stated before, we have not interviewed management for well over a year.

Tuesday, September 8, 2015

ESCC ($0.99) shares hit highest level in almost 5 years; Maintaining our long position

In May, we stated that despite being up 492% from our initial special situation alert on 2/28/2014, we were maintaining our long position in ESCC. Shares are now up 614% from that point. Over the last couple of months, the company’s settlement of a pension liability, which we wrote about here, gave shares a boost. ESCC shares spiked almost 30% on Friday as well, at about 10 times normal trading volume on no noticeable news. As of today, the company’s backlog is at near record levels. The stock continues to trade around $1 and we remain long. The key for ESCC to continue to perform strongly is if the company can show investors they can grow past 2015. Stay tuned for any change in our disclosure.

Tuesday, November 10, 2015

ESCC ($1.12) Reported Strong Q3 2015 Results

In May, we stated that despite being up 492% from our initial special situation alert on 2/28/2014, we were maintaining our long position in ESCC. Shares are now up 700% from that point. Over the last couple of months, the company’s settlement of a pension liability, which we wrote about here, gave shares a boost.

Yesterday, during the trading day, ESCC reported strong Q3 2015 results:

- Sales were $9.4 million, compared to sales of $7.7 million for the third quarter 2014.

- Net income was $0.9 million or $0.08 per share compared to a net income for the third quarter 2014 of $0.6 million or $0.06 per share.

- Backlog as of October 2, 2015 was $29.2 million compared to backlog of $28.2 million as of December 31, 2014.

With the pension liability behind them, we believe it has enabled the company to increase order flow and continue to fill its backlog which is evident in the sequential increase from Q2. For the first nine months of 2015, ESCC has reported NON-GAAP EPS of $0.21. The company expects this trend of profitability to continue. Quote from press release:

“we were profitable in each of the first three quarters of 2015 before the non-recurring pension related charges. With the healthy backlog and sales prospects, we anticipate sales at levels that should continue to yield profitable results for the remainder of 2015.”

We continue to hold our long position.

Monday, May 9, 2016

ESCC ($1.14) — Fueled by strong earnings and its pension liability relief, ESCC is trading near 52 week highs. Shares are up over 700% since our initial special situation alert on 2/28/2014. While the Company stated they anticipate sales at levels that should continue to yield profitable results in 2016, ESCC will be facing some tough EPS comps throughout 2016. We have reduced our position size.

Tuesday, May 10, 2016

ESCC ($0.97) – As we stated in our earnings preview email yesterday, ESCC is facing tough EPS comps throughout 2016. We have reduced our position size, but remain long.

ESCC reported Q1 2016 results during the trading day yesterday:

- Sales of $7.9 million vs $8.0 million in the prior year

- Non GAAP EPS of $0.03 Vs $0.06

- Backlog as of April 1, 2016 was $22.3 million compared to backlog of $26.3 million as of December 31, 2015

Quotes from management:

“The revenue backlog decreased, but remained relatively healthy at April 1, 2016. The decrease in the revenue backlog was attributable to a low volume of new sales bookings due mostly to the timing of prospective customer decisions. The April 1, 2016 revenue backlog and a strong sales prospect list support an encouraging outlook for the remainder of 2016…

We continue to expect variable but reasonably consistent future sales and gross profits from our current product line at annual levels sufficient to cover or exceed operating expenses and meet our obligations including the Pension Settlement Obligation. The net income for the first three months of 2016 brings us closer to the elimination of our shareholders’ deficit and our goal of building shareholder value. With the settlement of the Pension Plan liabilities, we expect our improved financial position to present opportunities for better results through the availability of credit and stronger qualification for customer projects.”

Although not a great quarter, it seems a delay in orders from some of its customers negatively affected the quarter and the backlog. The fluctuation in quarterly results is a common occurrence with ESCC. Management feels confident it will be able to replenish the backlog moving forward.

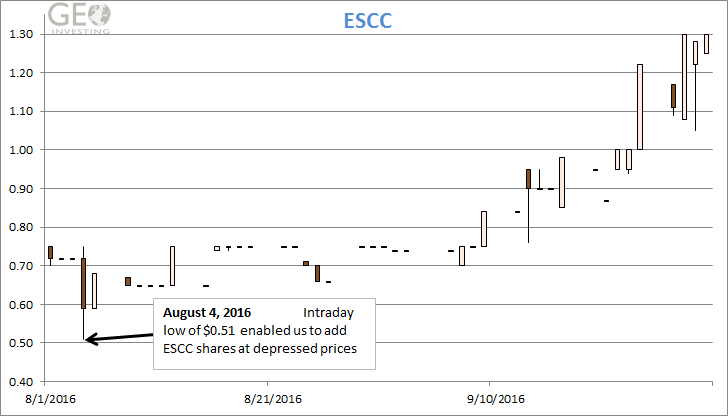

Friday, August 5, 2016

Information arbitrage (“InfoArb”) is one of the biggest opportunities in the microcap investing space. It exists when information that is public is not picked up on by the financial media, analysts, or investors of a specific company. InfoArb also occurs when investors misinterpret press release content. We spend most of our time at GeoInvesting looking for and researching these information arbitrage opportunities. Luckily, another one landed in our lap yesterday afternoon.

Evan & Sutherland – A Classic Microcap Information Arbitrage Opportunity

Evans & Sutherland Computer Corporation (ESCC) is a company that we have been long and following since 2014. Technically, ESCC is too small to be considered a microcap. With a market-cap of only $7 million ESCC is technically a nano-cap,

Evans & Sutherland Computer Corporation (E&S) focuses on the production of visual display systems used primarily in full-dome video projection applications, dome projection screens, dome architectural treatments, and content for planetariums, schools, science centers, other educational institutions and entertainment venues. It operates in the visual simulation market segment. The Company through its subsidiary, Spitz, Inc. (Spitz), is a supplier of planetarium systems, dome projection screens and other dome displays.

Our first go-round of information arbitrage on this company was when we bought shares at levels near $0.28. In February 2014, we identified a potential catalyst in a past due pension liability that was depressing the stock price. Disclosures in SEC filings, but not in press releases, clearly communicated that the pension liability issue would be settled imminently. We initially targeted a range of $0.40 to $0.80 level for the company if the pension issue became resolved, which it eventually was in April 2016. The stock went on to reach a high of $1.21 before pulling back to the $0.75 range on the heels of unexciting Q1 2016 results in May. You can read all of our past ESCC coverage here.

Double Dipping Isn’t Always A Bad Thing

The company released its second quarter 10-Q report yesterday afternoon and the stock immediately sold off 30% hitting a low of $0.51. On a precursory glance the quarterly performance was dismal. Revenues came in at $5.0 million, down almost 50% from the same quarter last year. The company posted a GAAP loss of $0.09, although narrower from the loss $0.24 they posted in the year prior.

The information arbitrage opportunity is in the management discussion and analysis in the 10-Q, where management made the following comments:

The second quarter of 2016 produced only $5,268,000 of sales. This unusually low sales volume was attributable to the timing of customer deliveries of planetarium systems and a temporary drop in backlog from low sales orders in the first quarter of 2016. The low sales volume resulted in under-absorption of fixed overhead which negatively affected gross profit. Also considerable resources were expended on product demonstrations at a major bi-annual planetarium conference resulting in higher than normal selling expenses. As a result, we reported a net loss of $969,000 in the second quarter of 2016 which offset first quarter net income to produce a net loss of $733,000 for the first half of 2016. This variability in the timing of sales orders and customer deliveries are an element of our business that occasionally affect results in this way.

While the results of operations are disappointing, a healthy volume of new sales orders in the second quarter of 2016 helped the sales backlog rebound almost to the level at the beginning of the year. In addition, significant new orders already booked early in the third quarter of 2016 and several promising prospects attributable to positive reactions to recent product demonstrations are expected to sustain a healthy sales backlog for the remainder of 2016. The sales backlog and customer delivery schedules support our positive outlook for higher sales levels and profitable results for the second half of 2016.

As you can see, despite the terrible-looking revenue numbers, there seems to be a reasonable explanation. Management’s optimism for the future has us nibbling shares at these depressed prices. We believe that when the rest of the market digests this commentary, ESCC will return to or surpass prior levels. These are chances you normally only get with microcap stocks.

When the company eventually issued a press release we noticed subtle differences between it and the related 10-Q. Pay particular attention to the bold.

This unusually low sales volume was attributable to the timing of customer deliveries of planetarium systems and a temporary drop in backlog from low sales orders in the first quarter of 2016. The low sales volume resulted in under-absorption of fixed overhead, which negatively affected gross profit. Also, considerable resources were expended on product demonstrations at a major bi-annual planetarium conference, resulting in higher than normal selling expenses. As a result, we reported a net loss of $1.0 million in the second quarter of 2016, which offset first quarter net income to produce a net loss of $0.7 million for the first half of 2016. This variability in the timing of sales orders and customer deliveries are an element of our business that occasionally affect results in this way.

While the results of operations are disappointing, a healthy volume of new sales orders in the second quarter of 2016 helped the sales backlog to rebound almost to the level at the beginning of the year. In addition, significant new sales orders already booked early in the third quarter of 2016 and several promising prospects, attributable to positive reactions of recent product demonstrations, are expected to sustain a healthy sales backlog for the remainder of 2016.

The statement in the 10Q about getting back to profitability and increased revenue expectations for the remainder of 2016 is not in the press release.

Valuation

We estimate that ESCC’s baseline annual revenue and EPS can hold around 30 million and $0.10, respectively. In the meantime, as it explores growth opportunities now that the pension issue is behind it, we do not think it’s unreasonable that shares should trade at an EV/S to 1.0 or, $2.86. Looking at two of the closest publicly traded comps, Ballantyne Strong (BTN) and IMAX Corporation (IMAX), supports this opinion.

BTN designs, integrates, and installs technology solutions for the retail, financial, government, and cinema markets worldwide. The company operates in two segments, Cinema and Digital Media.

IMAX operates as an entertainment technology company specializing in motion picture technologies and presentations worldwide.

BTN is the better comparable for ESCC because of its size and the challenges it has faced to profitably grow its business.

As we continue to review ESCC’s results and provide updates in a timely fashion, we’ll also remain committed to be on the lookout for more information arbitrage opportunities in the microcap universe that we can all benefit from. An interview with ESCC management is on our to-do list.

Wednesday, August 17, 2016

ESCC Note to Hit Seeking Alpha Today

Our information arbitrage note on ESCC that was issued to members 2 weeks ago will be made public today on Seeking Alpha. Recall the following information arbitrage we pointed out after ESCC’s earnings were released:

While the results of operations are disappointing, a healthy volume of new sales orders in the second quarter of 2016 helped the sales backlog rebound almost to the level at the beginning of the year. In addition, significant new orders already booked early in the third quarter of 2016 and several promising prospects attributable to positive reactions to recent product demonstrations are expected to sustain a healthy sales backlog for the remainder of 2016. The sales backlog and customer delivery schedules support our positive outlook for higher sales levels and profitable results for the second half of 2016.

See our full information arbitrage opportunity note here.

Tuesday, September 13, 2016

ESCC ($0.83) – On September 9, 2016 via premium tweet we stated that a large shareholder added 16,900 shares at open market prices. In a Form 4 filed yesterday after hours, Peter Kellogg added another 31,000 shares on September 8th and 9th. These recent Form 4’s bring Peter’s total stake to over 2.9 million shares, the majority held by IAT Reinsurance Company, which Kellogg is the majority shareholder.

Peter Kellogg was the CEO of IAT Reinsurance Company. He is on the Forbes list as an American businessman and philanthropist with estimated net worth of $3.4 billion. See full background here.

The recent purchases coincide with the management changes that were announced on September 6, 2016. We will continue to track the Form 4 filings to see if Mr. Kellogg continues to increase his stake.

Monday, September 19, 2016

ESCC ($0.98) – Billionaire investor Peter Kellogg continues adding shares of ESCC. On Friday, September 16, 2016 after the market close, Mr. Kellogg filed a form 4 showing he added another 80,500 shares (@ $0.92). This marks the third form 4 in the last 10 days bringing his total to 129,500 shares during that time frame, and his total to over 3 million shares held (directly & indirectly). The majority of the shares are held by IAT Reinsurance Company, which Peter Kellogg is the majority shareholder.

Wednesday, September 21, 2016

ESCC ($0.87) – Over the past week we have been highlighting that Billionaire investor Peter Kellogg has been adding to his already sizable position in ESCC. Yesterday after the close, Peter Kellogg filed another form 4, the fourth in the last two weeks and also filed a 13D/a updating his current ownership stake. With the recent purchases, including the 13,500 filed yesterday, Mr. Kellogg owns 3,066,618 shares or 27.4% of the total outstanding shares. We are beginning to find it intriguing that Peter Kellogg is increasing his position size in an illiquid name. What we do know is that Kellogg has been a shareholder for at least 15 years, an indication to us that he has a good feeling about the company’s prospects.