For over seven years, GeoInvesting has been providing high quality China based research and due diligence. In more than 10 cases, our research has directly led to fraudulent companies being halted or delisted. In all of our cases, we pride ourselves on seeking out the truth and providing evidence-based investment analysis.

It is therefore natural that we wanted to look into the ongoing debate over Vipshop Holdings (NYSE:VIPS). The purpose of this article is to point out that we’ve come to some peculiar, even contrary, conclusions with regard to the granular details of the reports critical of VIPS that have been relied upon in the past few weeks. We feel that our analysis needs to be disseminated for benefit of both U.S. investors trying to weigh their investment theses on Vipshop, as well as for those simply examining evidence on both sides of the story.

Within days of the VIPS story going public we were able to mobilize our team in China, redeploy them onto this assignment, and arrive at evidence based conclusions that refute specific fraud allegations made against the company.

- Allegations that Vipshop Holdings doesn’t “own close to 500,000 square meters of logistics centers and office space in Tianjin” appear to be based on glaring misrepresentations of VIP’s 2014 20-F.

- Contrary to critical reports, our diligence found that VIPS does in fact lease warehouses from Goodman in Tianjin, and also owns a brand new separate logistics center next door.

- VIPS’ massive new logistics center in Ezhou clearly exists, despite critical reports claiming the company has not yet funded it.

- Sales volumes and traffic checks may have been done at the least reliable time: when VIPS was in the process of moving and building new logistics centers.

- While other reports had trouble finding VIPS’ small loans businesses, we’ve found two subsidiaries and provided their pertinent records.

- Our research indicates VIPS’ fixed assets are likely exponentially higher than critical reports claim. In the course of our research, we saw no apparent reason to doubt the company’s disclosed $308 million in property, plant and equipment.

- We question the value of pointing out that a small portion (less than 0.5%) of the company’s sales – two years ago – could have been imported.

Did a Glaring Misinterpretation of VIPS’ 20-F Lead to a False Alarm?

In a report out that was critical of the company, one of the first talking points that was challenged regarding Vipshop’s operational capacity was based on the allegation that Vipshop “disclosed that it owns 500,000 square meters of warehouse space in Tianjin.” From there, the critical report goes on to try and refute this statement, alluding to the fact that there could be wrongdoing on the part of the company. This is a point from a report out last week that claims to quote page 73 of VIPS’ 2014 20-F as follows:

“As of December 31, 2014, we have branches in Beijing, Shanghai, Tianjin, Jianyang, Ezhou, Foshan, Kunshan, and Zhaoqin, and own close to 500,000 square meters of logistics centers and office space in Tianjin.”

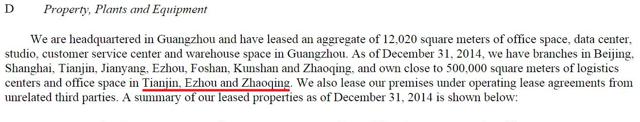

Except, when we went to the same 2014 20-F filing, it appears some crucial wording at the end of this sentence was suspiciously truncated and left out. We found it to say the following (page 73, 2014 20-F):

The correct statement, that VIPS owns 500,000 square meters of logistics space in all three of these cities, as opposed to just Tianjin, immediately calls into question the accuracy of the allegation that VIPS does not own 500,000 square meters of warehouse space in Tianjin. Whether this was a genuine mistake or not, changing a comma to a period ending this sentence, thereby dropping obvious relevant cities, is truly a shocking misrepresentation. Further, our findings on the ground indicate to us that in these three cities, VIPS owns at least the 500,000 square meters claimed in its 20-F, if not more.

VIPS Both Leases, and Owns, Logistics Centers in Tianjin

Critical reports also called into question the nature of VIPS’ buildings in Tianjin, asking whether or not they were owned or leased. In addition to its claimed ownership of facilities in Tianjin, it seems clear to us that VIPS alsoclearly discloses to leasing facilities in Tianjin.

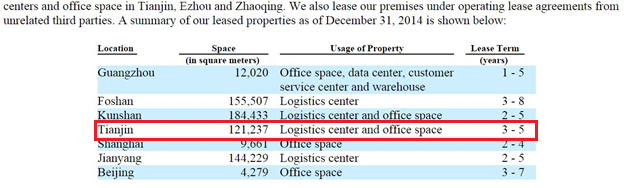

A recent report stated that VIPS has a “10 year agreement” to rent its Tianjin facilities from Goodman. The key question is: how much space does VIPS lease? On page 73 of the company’s 2014 20-F (again), we clearly see that 121,237 sq. meters of its logistics center and office space in Tianjin is listed as a “3-5 year lease term,” obviously a different term than described in the recent report, though likely not a major concern for investors:

This is a layout of VIPS’ Tianjin facilities, both leased and owned, via a satellite image, dated Feb. 4, 2015:

Using Google Maps, we measured the size of the upper group of facilities, inclusive of its four warehouses, and found it to be around 120,000 square meters – confirming the lease size claimed by VIPS.

On the same image, we can also see another facility that appears to be newly constructed (note the brighter, newer looking cement and lack of cars/trucks surrounding the facility). This newly constructed group of facilities is also inclusive of four warehouses. Based on our research, the newly built facilities are owned by VIPS, rather than by Goodman, as claimed in the critical report. We also independently talked to a Goodman manager, who confirmed the total size Goodman leases to VIPS reconciles with VIPS’s public disclosure. Under the newly built building owned by VIPS, you can clearly see the pink archway design that is recurrent at numerous VIPS facilities.

While performing our research, we found news out of China dated in October 2013 that spoke about the nature of the Tianjin projects:

å·²ç»æŠ•å…¥ä½¿ç”¨6万平方米,包括两个大型仓库ã€é£Ÿå ‚以åŠè®¾å¤‡ç”¨æˆ¿ï¼Œ”相关负责人曹å¼æ³‰ä»‹ç»è¯´ï¼ŒåŒ…括两个大型仓库在内的å¦å¤–5万平方米建ç‘主体已ç»å®Œå·¥ï¼Œé¢„计å¯äºŽæ˜Žå¹´3月份投入使用。…

唯å“会还将在å›åŒºå†…进行二期建设,”曹å¼æ³‰è¡¨ç¤ºï¼Œå”¯å“会二期项目åŒæ ·å 地250亩,但将由唯å“会出资建设,”主è¦è¿˜æ˜¯ä»“储物æµå»ºè®¾ï¼Œé¢„计2014å¹´3月开工

This roughly translates to:

60,000 square meters real estate are already being used, including two warehouses, canteen and equipment houses,” relevant representative Cao Shiquan introduced. An additional 50,000 square meters real estate, including two warehouses, is mainly constructed. It is predicted that it can be used by the next March (March 2014).

VIPS will also build a phase two project in this park.” Cao Shiquan introduced, VIPS phase II project also occupies RMB 250 mu land. But VIPS will be responsible for its construction, “mainly for warehouse and logistics center. It will start its construction from March 2014.

Combining this news from China with the satellite image, we conclude that VIPS leases the four warehouses totaling approximately 120,000 sq. meters (as it disclosed in its 20-F) from Goodman and owns its newly constructed four warehouses just south (in the photo) of Goodman’s facility.

We visited Goodman’s warehouse and VIPS’ warehouse in Tianjin on May 22, 2015. Based on our visit, we’ve concluded that there are around 1,800-2,000 VIPS employees working at the leased warehouse. The warehouse that VIPS owns has just opened and appears to be recruiting workers. As they are shown on the satellite image, VIPS’ warehouse is right next to the leased Goodman warehouse and there is a barrier that divides them. The pictures of Goodman’s warehouse and VIPS’ warehouse are as follows:

The Truth About VIPS’ Massive Ezhou Logistics Center

The very existence of VIPS’ Ezhou logistics center was called into question in one critical report, which inexplicably concluded that VIPS had made no investment in such a project and that VIPS “reports it has a warehouse in Wuhan, but not in Ezhou.”

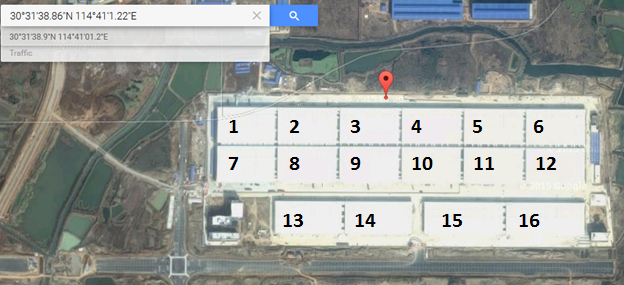

We believe that Vipshop’s Ezhou logistics center not only exists in 16 separate warehouses as reported in Chinese media, but also shows up brilliantly on this satellite image on Google Maps:

In the process of our research, we have also found news regarding the Ezhou logistics center that supports Vipshop’s presence there:

16个现代化大型仓库,一å—排开,从头看ä¸åˆ°å°¾ã€‚”æ¯ä¸ªä»“库2万平方米左å³ï¼Œè´§ç‰©æ¥è‡ªå…¨å›½å„地。”指ç€åº“æˆ¿å†…å‡ å排ç 放整é½çš„货架,唯å“会åŽä¸è¿è¥ä¸å¿ƒæ‹£è´§éƒ¨ä¸»ç®¡å™æ„Ÿå‘Šè¯‰è®°è€…,”客户在网上å‘出订å•åŽï¼Œ8å°æ—¶å†…就能安排出库。”

This translates to:

16 modern warehouses – each warehouse is around 20,000 square meters. Cargos come from all over China, pointing at shelf in the warehouse, VIPS Center China Operating Center Manager Sun Gan told the reporter, “after a client places an online order, the goods can be sent out from the warehouse within 8 hours”

The website of the Bureau of Land Resources of Ezhou conclusively states as follows:

唯å“会åŽä¸è¿è¥ä¸å¿ƒæ˜¯å”¯å“会自主建设ã€è‡ªæœ‰äº§æƒçš„物æµè¿è¥ä¸å¿ƒï¼Œè¾å°„湖北ã€æ¹–å—ã€æ²³å—ã€æ±Ÿè¥¿å››çœï¼ŒåŒæ—¶è¿˜è‚©è´Ÿç€å”¯å“会å¦å¤–四个物æµä¸å¿ƒçš„é…é€è°ƒæ‹¨ç‰ä»»åŠ¡ï¼Œæ€»æŠ•èµ„16亿元,建设总é¢ç§¯è¶…过46万平方米。

This translates to:

VIPS Central China Operating Center is constructed and owned by VIPS as a logistics center, covering Hubei, Hunan, Henan, and Jiangxi provinces. At the same time, it’s also used to deliver cargo for four other logistics centers, with a total investment 1.6 billion RMB and total construction area of more than 460,000 square meters.

These all seem to clearly refute the allegation that VIPS has made no investment in the Ezhou center, which misleads investors to believe the facility does not exist. Missing a gigantic logistics center with 16 warehouses appears to be yet another mind boggling miss – or possible misrepresentation – lending confusion to what is otherwise already a very complex investigation.

We visited the Ezhou facility on May 19, 2015 and we were told from several employees that this is a facility with purportedly more than 2,000 workers working on site. We also noticed that there is still some ongoing construction. Here are the photographs we took of the Ezhou facility:

Serious Flaws in Allegations Regarding VIPS’ Assets

We question the breadth and comprehensiveness of the SAIC data used in the critical reports to challenge Vipshop’s assets. Based upon the SAIC data disclosed in the reports, the total fixed assets of VIPS only amount to USD $5.8 million. We believe that the selection of SAIC records used were clearly incomplete and/or unreliable, thus the allegation that VIPS’ SAIC record’s PPE is $302 million lower than VIPS’ SEC PPE number, resulting in a $302 million overstatement of assets, is mistaken.

In one of the negative reports, the author discloses photos taken of VIPS’s Zhaoqing logistics center. We make the obvious assumption that based on these photos alone, this one logistics center could be worth more than the USD $5.8 million allegedly found in the SAIC records, as the negative reports did not challenge VIPS’ ownership of its Zhaoqing facility.

In our research process, we came across two land use right purchasesregarding the VIPS’ Zhaoqing facility that are apparently part of a series of land use right purchases for the Zhaoqing facility. These two land use right fees, paid by VIPS, total RMB 29 million (USD $4.7 million) for only 192 mu (about 31.5 acres).

VIPS’s Zhaoqing facility (in total, spanning more than 800 mu, or 132 acres) is around four times bigger than the 192 mu listed in these two land use right purchases. This indicates to us that the total cost of VIPS’ Zhaoqing land use rights alone may exceed the amount of fixed assets alleged in the critical report. This suggests to us that the SAIC records used in the critical reports may be inadequate or unreliable, and that we’re not ready to conclude that VIPS is a fraud based on this information.

Furthermore, in the process of conducting our research, we found that VIPS usually establishes one logistics company to own a facility and another separate e-commerce company to operate the business within the facility. For example, VIPS (Zhaoqing) Logistics Co., Ltd. owns the VIPS Zhaoqing facility and Hubei VIPS logistics Co., Ltd. owns the VIPS Ezhou facility. Meanwhile, VIPS (Zhaoqing) E-Commerce Co., Ltd. operates the e-commerce business at the Zhaoqing facility and VIPS (Hubei) E-Commerce Co., Ltd. operates the e-commerce business at the Ezhou facility.

Each logistics company is directly owned by a Hong Kong company, which is in turn owned by VIPS International Holdings Limited, as disclosed in the 20-F as a Hong Kong subsidiary of VIPS.

The negative report seems to fail to include the SAIC records of the VIPS Zhaoqing and Ezhou logistics companies that actually own the two respective facilities. These missing records could have accounted for the alleged $302 million PPE/fixed assets discrepancy between the SAIC records and the 20-F filing.

VIPS’ 20-F does not mention these logistics companies, as VIPS only discloses what it deems to be the “company’s significant consolidated subsidiaries and VIEs.” The critical reports may have overlooked VIPS’ disclosure and also may have failed to perform adequate due diligence to identify the true ownership of the two facilities, among others.

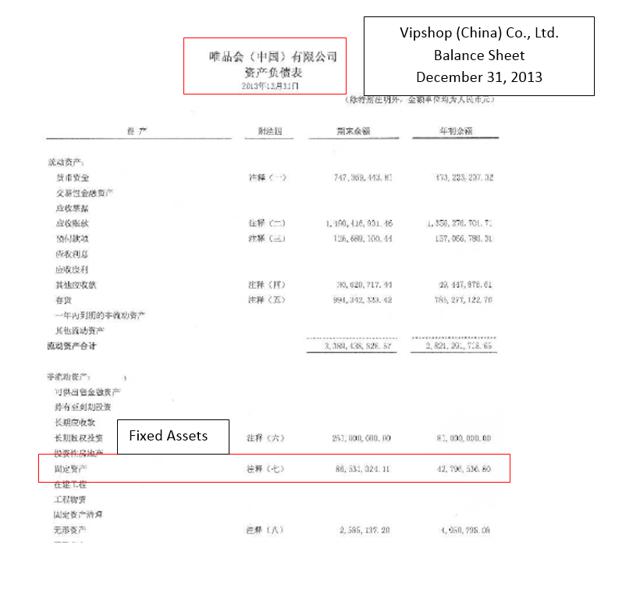

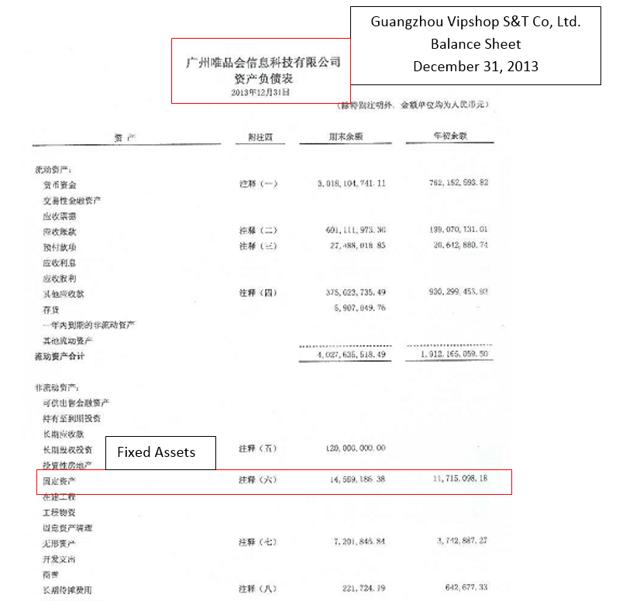

As part of our research, we obtained the SAIC files for Vipshop (China) Co., Ltd. (“WFOE”) and Guangzhou Vipshop Information Technology Co., Ltd. (“VIE”). Keeping in mind that neither of these two subsidiaries own the warehouses at Tianjin, Ezhou, or Zhaoqing, someone critical of the company may expect the fixed assets for these two subsidiaries to be nominal. Surely, they’d be expected to be well under the $5.7 million in fixed assets claimed by reports critical of the company. Instead, what we find is that WFOE’s fixed assets, as of December 31, 2013 are RMB 85.5 million and the VIE’s fixed assets, as of December 31, 2013 are RMB 14.5 million. Combined, this is about RMB 100 million, or about $16 million USD. Just these two subsidiaries alone seem to contain almost three times the $5.7 million USD in total fixed assets claimed by critical reports of the company. We believe that neither of these two subsidiaries include real estate, which would mean that VIPS is listing about $16 million USD in supplemental assets. This could obviously serve to refute the allegations concerning VIPS’ fixed assets being overstated.

Here are screenshots of the SAIC files we referenced:

Is More Clarity Needed on Improper Accounting Allegations?

While we’re not going to dive into the complexities of the forensic accounting questions raised in the Mithra Forensic Research report, we will say that this report seems thorough, well thought out and well-constructed. While considering the Mithra report, we want to note that we are also considering the following statements made by Paul Gillis, Professor of Accounting at the Guanghua School of Management at Peking University in Beijing, China. Mr. Gillis looks at one of the main accounting questions and concludes that:

“It is not possible to discern from the public information whether VIPS has the accounting right. The SEC is likely to soon ask the company and its auditors Deloitte some pointed questions about how they are accounting for consigned inventory, and that might flush out a problem or determine that the company has done things right. That is hard to do from a half a planet away, and neither the SEC nor the PCAOB can look at the books on the ground in China.“

“Accounting standard setters have attempted to clarify the accounting but have stumbled mightily. The Financial Accounting Standards Board (FASB) which sets US standards (as used by VIPS) and the International Accounting Standards Board (IASB) which sets IFRS, have been working on a joint project to come up with new revenue recognition standards, but the issue is so difficult the FASB has proposed to delay implementation until 2018. Mithra speculates that the new standard will make it tough for VIPS to keep doing what they are doing. It will be a long time before we find out.”

While we will refrain from drawing forensic accounting conclusions, it certainly seems that some of the questions raised with regard to “Gross vs. Net” fall in a grey area between certain rules.

In addition, we paid attention to the Wall Street Journal’s ambivalent view of “Gross vs. Net,” when they claimed that it doesn’t ultimately matter to the company’s net income line:

Mithra argues that Vipshop is mostly engaged in consignment. But its accounting is on a gross-revenue basis, leading to higher sales figures.

The truth is, it doesn’t really matter. Net profit would be the same under either method, and analysts are mainly valuing the company off multiples of earnings, not sales.

We do, however, believe that VIPS should take the more conservative approach to its accounting, whenever possible, and conform to the methods used by its peers. Again, we are not vetting nor contesting VIPS’ accounting. For now, we leave this issue to the SEC and VIPS to discuss.

Were Meaningful Traffic Checks Performed?

To the best of our understanding, 2014 was a year when VIPS was rapidly building its own logistics centers. It was in the midst of moving and building out its inventories from leased warehouses to a combination of leased and company-owned modern, if not state-of-the-art, new logistics centers. The old leased Beijing warehouse was transferred to a new Tianjin logistics center, theFoshan warehouse to a Zhaoqing warehouse, as well as a move from old to new leased facilities in Kunshan.

Pragmatic thinking, as well as our own experience trying to analyze the moves and expansion, leads us to conclude that observing the various warehouses at select points in time, rather than through continuous surveillance, might result in dubious findings.

The Nature of VIPS Small Loans

One of the critical reports suggests that several of VIPS’ small loan companies haven’t been disclosed to investors. It also suggests that it was unable to find the companies that were performing the lending.

In contrast, we identified two VIPS subsidiaries that are in the small loan businesses, Shanghai VIPS Small Loan Co., Ltd., which was established on Feb. 16, 2015, and Guangzhou Small Loan Co., Ltd., which was established on July 30, 2014. As these two companies were newly established, it is highly possible that as small companies they did not generate any substantial revenue to report in 2014. The critical report claims that VIPS issued loans totaling RMB 300 million (or about $48 million, 1.2% of the company’s total 2014 revenue).

As stated in the 20-F, VIPS only listed “the company’s significantconsolidated subsidiaries and VIEs.” Therefore, it could be possible that VIPS did not yet deem it necessary to list these two small loan companies in its filings.

The Minor Question of Importing Goods

A portion of one report questioned how products that were manufactured outside of China were sold and shipped as Vipshop products. We have failed to locate verbiage that would suggest that all products sold through Vipshop must be manufactured in China. The critical report doesn’t point out verbiage of this nature, either. Instead, it claims that the Vipshop “proposition is that it sells products that are in oversupply in China.”

The report goes on to note that brands being sold through Vipshop (it cites numerous luxury brands) don’t have direct relationships with the company. This doesn’t seem to add too many questions to the business model, which to the best of our understanding focuses on collecting and selling discounted items that weren’t sold through other retailers, not direct from the branded companies themselves.

The report cites a t-shirt that was made in Turkey and pants that were made in Vietnam. We don’t think this is any different than if you were to order the same products from Overstock.com or Amazon. Nor do we believe this to be any different than walking into a retailer like a T.J. Maxx and finding out that although it was “overstocked” in the U.S., the original product was manufactured in a different country, like almost all of the primary clothing products sold through brand name “discount” retail stores.

Finally, the report also goes on to question the amount of product that is being imported by the company. Import records indicate that about $650,000 in luxury items were imported monthly, totaling $7.7 million for the year. Not only are the import figures used from 2013 (2 years ago), but they didn’t represent a significant amount of the company’s revenue – even then. To put this into perspective, VIPS reported $1.7 billion in total revenue for 2013. The allegedly inappropriate imports thus only represent less than a half of a percent of the company’s total revenue (less than 0.5%). We are left to wonder how, or why, such an insignificant amount represents any meaningful departure from VIPS’ business plan?

Conclusion

While much more diligence would be needed for our team to draw definitive conclusions on the legitimacy of VIPS’ overall operations, we are able to conclude that a good deal of information used to support a critical thesis on VIPS which caused the stock to fall significantly appears to be inaccurate.

What we have discovered in the course of performing our due diligence is that there are serious questions that need to be asked about both recently issued critical reports. In particular, we believe the allegation regarding the $302 million discrepancy in PPE/fixed assets is wrong and we question whether it was drawn from negligence, or misunderstanding.

We have a history of helping spread the truth about companies both domestically and in China, and we hold ourselves to a high standard. We believe that it’s very serious to make allegations of fraud against a public company, and when doing so we try and look at both sides of the story. When reports are published that hold VIPS to high standards, it tells us that we should all hold ourselves to the same high standards.

We believe that before we can truly begin to assess any potential problems at VIPS, we have to first get the facts straight through adequate due diligence. We believe that as of today, the story cannot be fully told. We will continue working diligently and fact gathering on VIPS and will keep investors informed on what we find.

Disclosure: Long VIPS at time of report – Our holding of VIPS stock is intended to be a short term trade. As we perform more due diligence, we may or may not decide to take a longer term investment position.

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.