Contributed by FG Alpha Management for GeoInvesting, LLC

Summary

- Vuzix Corporation (Nasdaq:VUZI) is a promoted stock with a history of ugly financials including negative cash flow, negative margins and a consistent reliance on equity sales to fund its business

- The company admits in its 10-K that it has had an ongoing informal SEC inquiry related to its financials since May of 2016

- CES awards that the company consistently touts are awarded to hundreds of conference participants and appear to have minimal requirements for qualification

- Vuzix appears to have not updated its iPhone/Android apps since 2015 and the full launch of its M300 product, supposedly in “full production” in Q1 has yet to commence

- Dilutive equity raises are likely needed to continue to fund operations, which will put continued short term pressure on shares of VUZI

Introduction

There is little doubt that the augmented reality and virtual-reality space is going to be a fast-growing market over the next decade. However, we feel that Vuzix (VUZI) investors may have their heads in the optimism clouds, as the reality of VUZI’s performance and credibility of management may not match the potential of the sector.

In order to survive, we think that Vuzix needs either significant proprietary technology or a vibrant user-base with a robust developer ecosystem. The company appears to have neither.

The company has told investors that its newest offering, its M300 glasses, have been in “full production” since Q1. The product is still only offered as a “pre-order” on the company’s website and our calls to the company about a launch date led a sales representative to tell us they had “no idea” when the launch would commence. Missed deadlines and lack of wide sales have led analysts covering the company, like Maxim, to reduce or push back their revenue estimates each time they renew coverage of the company. We predict the company will yet again miss revenue estimates when it reports this week.

Additionally, several CES awards that company has heavily promoted over the last few years actually look as though they were simply honorable mentions, a distinction widely sprayed on over 440 products at last year’s CES conference.

While retail investors remain hopeful about the company’s future 5 or 10 years down the road, we want to call focus to an ongoing SEC inquiry that is happening right now. The “informal inquiry”, as the company describes it in its 10-K has been taking place with a focus on the company’s financials since May of 2016. Could this inquiry potentially be looking into cash leaving the company to any number of consultants?

Finally, the company’s financials remain distressed and there is little doubt that they will need to issue equity to survive at this rate. While they have been able to raise funding through Chardan — not exactly Goldman Sachs — we expect the quality of future raises to get worse and their corresponding dilutive effects to also get worse for shareholders.

Competition & No New Product Development

The augmented reality/virtual reality market is as yet undeveloped, but already faces a staggering amount of competition. A recent piece by TechCrunch called “The Reality of AR/VR Competition” shows approximately 150 competitors in the market.

There’s an old adage in venture capital: “What will you do when Google enters your market?” In the case of Vuzix, what will they do now that Google, Apple, Facebook, Sony, Samsung, Microsoft, Nokia, Garmin, Fitbit, Qualcomm, Blackberry, and about 140 others have already entered their market?

In the case of Vuzix’s up and coming products, its M300 model is supposed to be the next big release from the company. In March, the company gave an outlook on its conference call that indicated the product was in “full production”:

“The M300 is now in full production, but the end of this we should be at production run rate of 1000 to 1500 per month, we’re unparallel [sic] bring up Asian manufacturing lines to lower cost and expand production capacity. The M300 is also on a continual software optimization program where software update being rolled out on a regular basis.”

They also blamed the poor sales of the company’s M100 product on customers ostensibly waiting for the M300 release:

“Since we’ve first introduced the M300 it’s the [Indiscernible] in 2016 many customers have been waiting for it and it’s been reflected in our lower sales of the M100 during the year.”

Finally, the company states that the M300 is “rolling off the production line”. They claim they wanted to be at a run rate of 1500 units per month by the end of the first quarter:

“For comparative purposes this same process took over six months to complete for M100. The bottom-line the M300 is now rolling [off the] production line which taken every day and have orders like every coming off the lines with growing demand as we move from VIPs and start turning migration orders. [sic]

Finally, we will shortly be opening to the M300 to general customer[s] in the middle market. Production is also running and we expect a consistent run rate of approximately 1500 units per month at the end of this quarter of only trend of early Q2. With Vuzix enterprise sales team has not sat idle during this early late stage of M300.”

It’s now Q2, and the M300 is still only available for pre-order on the company’s website.

In addition, we phoned Vuzix on May 8, 2017 to try and get information as to when pre-orders for the M300 would begin shipping. The sales representative we spoke to told us that they had “no idea” and directed us to fill out an online inquiry form, which we did. We have yet to receive information on a release date for the product.

Intellectual Property Stagnation

The company claimed on its most recent conference call that its patent portfolio has increased by nine new patents/pending patents:

“Finally, over the last year or so Vuzix’s patent portfolio have increased with the total amount of nine new patent and patent spending. Let me just wrap up quickly here. 2017 is already proven to be a pivotal year for Vuzix and the entire smart glasses industry. We have B11 focus on the enterprise market as the M300 ramps into production.”

But when we searched for patents on our own, we reached different conclusions. Based on a search of the USPTO patent application database, it appears the company failed to even file a single patent in 2016. In fact, the most recent patent application is as of September 10, 2015, according to our search.

From the latest 10-K, Vuzix’s products appear to include little in the way of proprietary hardware technology:

“We do not currently own or operate any manufacturing facilities for microdisplays, one of the key components in our products.” Furthermore, “we do not manufacture the integrated circuit chip sets, optics, microdisplays, backlights, printed circuit boards or other electronic components which are used in our products.”

Given that Vuzix’s glasses run on outside software as well (Android), the company faces vertical integration challenges on just about every level. We believe that the physical design of the glasses is appealing, but aside from the aesthetic appearance of the device itself we are left questioning what Vuzix has that could be considered a durable edge.

A statement made by Vuzix board member and newly appointed COO Paul Boris seems to acknowledge the lack of sustainable differentiation among device-makers. Outside of his board duties, Boris is GE Corp’s Vice-President of Manufacturing Industries. In an article by IT World Canada in January of this year, Boris described how GE is overseeing pilot programs to test 4 AR headsets, including Vuzix’s. As he put it, “the device on some level is a commodity, it’s just a mechanism for serving the data in the right context.” He further stated “we’ll try all of them.”

Cadaverous Software Ecosystem

In the absence of a clear hardware advantage, we looked to the company’s software ecosystem. The company states in its recent 10-K, “We are building an eco-system of developers around these smart glasses.” We find little evidence to suggest that these efforts have been successful to date. The Company apps in the Android and Apple stores show very little activity.

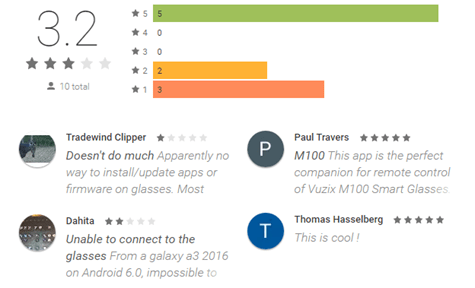

The Android store shows 10 ratings and 4 reviews, as displayed below. Almost comically, one positive review appears to be written by Vuzix CEO Paul Travers himself, with the second positive review appearing to be written by Vuzix’s manufacturing consultant Thomas Hasselberg.

Among the non-employees of Vuzix, the 2 reviews were both negative and stated the following:

Dahita (November 2016):

“Unable to connect to the glasses From a galaxy a3 2016 on Android 6.0, impossible to connect to the glasses, even though the BT connection happened smoothly. Very frustrating as there are no help available.”

Tradewind Clipper (November 2015):

“Doesn’t do much Apparently no way to install/update apps or firmware on glasses. Most preinstalled apps on glasses (Skype, Instagram, etc) are unusable. App is totally different from Vuzix documentation.”

Despite the deficiencies outlined by the above users, the app was last updated on Android on September 22, 2015. It appears that nobody is home.

The Apple Store app seems even less active as there are not enough ratings for the Vuzix App to even display the rating. The app was launched in June 2015 and was last updated November of the same year.

In order to make significant inroads into AR, Vuzix will need to compete against large companies that already have thriving ecosystems. Given the above, we not only question whether Vuzix will be successful but whether they are even earnestly attempting to compete.

VUZI’s Overhyped CES “Awards”

One of the key points that lends apparent credence to Vuzix’s technology is the validation earned through numerous awards at the CES conference. The Consumer Technology Association is the owner and operator of the CES showcase, an annual event spotlighting innovative consumer technology. Every year at CES, companies enter their products into the Innovation Award contest aiming to win industry recognition. Entries are submitted to 28 award categories and the highest rated product or technology in each category is awarded the “Best of Innovation” title.

Vuzix ostensibly performs extremely well at the CES competitions, which it has repeatedly noted in press releases and its SEC filings. Examples include a November 2016 press release by the company announcing “Vuzix Awarded Four CES 2017 Innovation Awards for its Upcoming Blade 3000 Smart Sunglasses”. Similarly in November 2015, the company announced “Vuzix Awarded Eight CES 2016 Innovation Awards, Including ‘Best of’ in Gaming and Virtual Reality for iWear® Wireless Video Headphones”.

Despite heavily promoting these awards, a closer look shows that for the most part rather than winning the coveted “Best Of…” category, Vuzix’s products are usually deemed “honorees.” According to the CES website, an honoree simply denotes “a product or technology that scores above the threshold set for a specific category.”

The threshold doesn’t seem particularly limiting. According to the contest rules, a product is qualified for entry as an honoree merely by paying entry fees and filling in all the sections of its online entry tool. In 2016 alone there were approximately 447 total honorees.

Vuzix seems to be hyping its “wins” while in most cases it is simply one of hundreds of honorees that are awarded participation trophies for paying the fee and satisfying basic minimum criteria.

In one instance when Vuzix actually won the “Best Of” designation, it didn’t seem able to translate the victory into meaningful product adoption. In January 2016 Vuzix won the “Best of” award in Gaming and Virutal Reality, but despite winning the accolade the company sold only $395,052 iWear sets that year. Furthermore, per the company 10-K filed December 2016, Vuzix took an inventory write-down on its iWear product citing intense competition and pricing pressures:

“The Company wrote down to net realizable value all of its component and finished goods inventory related to its iWear Video Headphones resulting from the decision in early 2017 to reduce the suggested retail selling price to a price below the cost. The total write down provision totaled $1,124,401…”

(source: 10-K, pgs 31-40)

From the Amazon reviews of the iWear, none of the 9 Verified Purchaser reviews rated the product above 2 stars. The product garnered an overall rating of 2.5 stars across its 20 ratings.

By Vuzix’s account, it appears the product may not have actually been ready for full production despite entering iWear into the CES competition and ultimately winning. From the same filing we see that Vuzix took a hit on their manufacturing and overhead costs due to a need to rework the iWear manufacturing process mid-year:

“Manufacturing overhead costs rose primarily due to increased salaries and production labor costs of $198,862, with over half related to iWear rework costing.”

(source: 10-K, pgs 31-40)

Part of this award-winning flop might be explained by again examining the rules of the CES competition. The entry and judging process for the competition states that a product sample isn’t even required, although judges may ask for one. We’re unclear on the value of a contest that issues awards when judges aren’t even required to test the very products they are judging.

Given the above, we question the company’s ability to translate the CES “awards” to actual shareholder value under the best of circumstances.

Stock Promoters Pushing VUZI

In 2016 Vuzix reported revenue of only $2,127,378, representing a -22.64% drop from the previous year. However, despite a failure to generate meaningful product sales the company has been very successful at selling its stock via secondary offerings. In 2016 the company raised $21,112,500 through 2 common stock offerings (source: 10-K, page 39). The larger of the 2 offerings was a November 2016 offering for $14,500,000, with Chardan Capital Markets acting as sole placement agent. Chardan happens to be one of 2 analysts covering Vuzix (with a buy rating, in case there was any doubt).

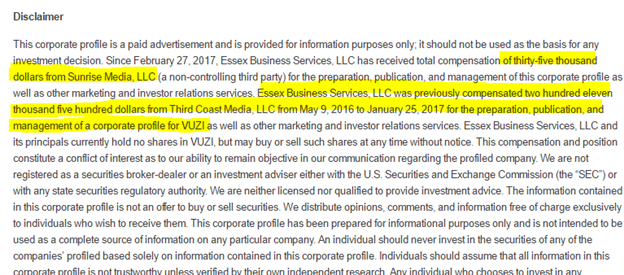

We are uninspired by the fact that Vuzix generated almost 10x more cash from stock sales than from revenue, but we also find it predictable given the apparent dedication to stock promotion efforts. Beginning in early 2015, the company appeared in several paid microcap promotional sites including The Tech Stock Report, and MicrocapResearch.com.

In Vuzix’s company profile in The Tech Stock Report, the website acknowledges receiving $246,500 as of March 2017 from 2 entities (Third Coast Media, LLC and Sunrise Media, LLC.) Payment was described as being for the preparation of the profile and other marketing and investor relations services.

Third Coast Media, LLC appears to be a Wyoming business registered to Steve Naremore, editor of penny stock website StockCommander.com, and Matthew Watabe, director at website RagingBull.com which features an array of “millionaire traders and experts”. We were unable to find more details on Sunrise Media, LLC which is believed to be a shell entity.

Another promotional website, MicrocapResearch published several articles on Vuzix and acknowledged the receipt of $20,000 from one article and $10,000 for another from an “unrelated third party”. We did not perform an exhaustive search of stock promotional websites for more paid material touting Vuzix.

Beyond external stock promotion efforts, Vuzix has relentlessly promoted token corporate accomplishments via its own press releases. The company issued 80 press releases during 2016 alone, touting numerous appearances at industry trade shows, investor conferences, and sponsorships, among other items.

VUZI Remains in Financial Distress

For the 2nd year in a row, Vuzix reported weaknesses in disclosure and internal financial controls. Any sign of material weakness is concerning, but we find this to be even more so given how bad Vuzix’s financials look as is. Many of Vuzix’s key metrics appear as if pulled from a dream sequence in Alice in Wonderland:

- In 2016, the Company had a gross margin of -54%. In other words, it cost them 54% more to produce the goods than the goods actually sold for.

- Freight costs accounted for 24% of the cost of sales. Such high freight rates may make sense if shipping steel beams via helicopter but Vuzix is shipping lightweight headsets and glasses that retail for up to $1,000.

- The Company has increased its operating loss with remarkable consistency. Operating losses have increased in each of the past 5 years, with a 5 year CAGR of 34.53%.

- The Company generated 62 cents in sales per every dollar invested in sales and marketing.

The company has not only consistently slowed sales over the past 5 years, but their products have also become less profitable. Sales have grown at a 5-year CAGR of -8% while CoGS have grown at a 5-year CAGR of 7.05%.

Beyond headline figures, the company shows several troubling irregularities:

- From 2015 to 2016, research & development costs increased over 93%, jumping from $3,595,437 to $6,947,878. Despite the massive surge in R&D, the company failed to even file a single patent in 2016, based on a search of the USPTO patent application database. As noted above, the most recent patent application is as of September 10, 2015, according to our search. Despite the apparent lack of patentable advancements, the justification for this massive increase is described by the company as follows:

“The majority of these amounts being spent on outside contractors which assisted in the development work” (source: VUZI 2016 10-K)

We would be interested to learn more about these outside contractors that ‘assisted’ in the R&D and accounted for the majority of the cost increases.

- From 2015 to 2016, SG&A also increased over 88%, jumping from $1,798,041 to $3,394,580. (VUZI 10-K pg. 10) This cost spike occurred despite an apparent reduction in headcount. From 2015 to 2016, the company cut its full-time North American staff in “sales and marketing, distribution and customer service” from 7 to 6. European staff of 3 contractors remained the same.

- Vuzix’s filings acknowledge that they have a “small” European office, but the address listed on their contact page is the address of their European auditor, King Loose & Co.

- (See King Loose & Co. contact us page available at http://www.kingloose.co.uk/contact.htm. See Vuzix (Europe) Ltd 2015 Full Accounts available at https://beta.companieshouse.gov.uk/company/06561455/filing-history/MzE1NzU1MDYxMWFkaXF6a2N4/document?format=pdf&download=0)

- David Lock is the “Director of Operations EMEA Region for Vuzix Europe Ltd. His consulting firm, DRL Associates Ltd. (“DRL”) is located at the same address and is also audited by King Loose & Co.

- (See CompanyHouse Vuzix (Europe) Limited available at https://beta.companieshouse.gov.uk/company/06561455)

- King Loose appears to be a very small shop, which may support the control issues identified by Vuzix’s auditor.

SEC Conducting Inquiry as Company Sprays Money to “Consultants”

The company has also been undergoing an informal inquiry by the Securities and Exchange Commission, which it disclosed in 2016. As the company states in its current risk factors disclosures:

On May 24, 2016, we received a letter from the SEC, dated May 19, 2016, notifying us that the SEC is conducting an informal inquiry relating to us, and requesting that we produce certain documents relating to our internal control over financial reporting. We have produced the requested documents and thus far have not received requests for additional information. If, in connection with this informal inquiry, the SEC determines to take action against us, our financial position could be adversely affected.

While we know that the inquiry is related to the company’s financial reporting, as that is what they disclose, we are left with little detail after that. Perhaps the company’s aggressive use of consultants and third parties to develop its products could be at the center of an investigation like this. In the same filing, Vuzix described the “costly external contractors” in relation to its R&D spend. In a year where Vuzix doesn’t appear to have filed for new U.S. patents or updated its software we can’t help but wonder where the money went.

Conclusion: VUZI Still Has a Questionable Past and Unproven Future

We strongly believe the AR/VR market could grow substantially over the next five years. We have already seen small successes in augmented reality, like the launch of Pokémon Go. VUZI may also attempt to continue controlling the narrative, despite poor financial numbers, by touting future potential products and possible partnerships. While we believe these statements will ultimately prove to be meaningless unless the company can produce in its financials, investors should make themselves aware of the risks associated with companies that are pumped through paid promotions that supplement rosy-sounding narratives.

But the reality of the situation should be clear: with this sector-wide inflection point for AR/VR still in the future, we believe investors need to address the harsh realities of VUZI’s business as it operates today. With a heavily crowded field and the lack of a clear intellectual property advantage, we believe VUZI isn’t anywhere as close to catching and riding this wave as investors think.

Management has incessantly touted the potential of its products, but a history littered with manufacturing delays and murky sales guidance doesn’t inspire confidence. While some could argue that financials don’t matter at this stage in the game because VUZI is a development company, that doesn’t change the fact that VUZI is likely going to need more cash injections from stock sales in order to continue its business. As we already stated, these stock sales will likely become progressively more dilutive as the company’s needs accelerate.

Going long VUZI is a bet that the company is going to introduce something groundbreaking and cash generative, against all odds, before the dilutive effects of financing wear the value of shares too thin. This is a bet that we just don’t think is worth it.

Disclosure: FG Alpha Short VUZI at time of article.

Disclaimer

You agree that you shall not republish or redistribute in any medium any information contained in this report without our express written authorization. You acknowledge that GeoInvesting nor FG Alpha are registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting nor FG Alpha have provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, FG Alpha, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, FG Alpha, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, FG Alpha, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, FG Alpha, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting nor FG Alpha shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

The research contained herein expresses opinions which have been based upon generally available information, field research, inferences and deductions through due diligence and our analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com/terms-conditions-privacy-policy