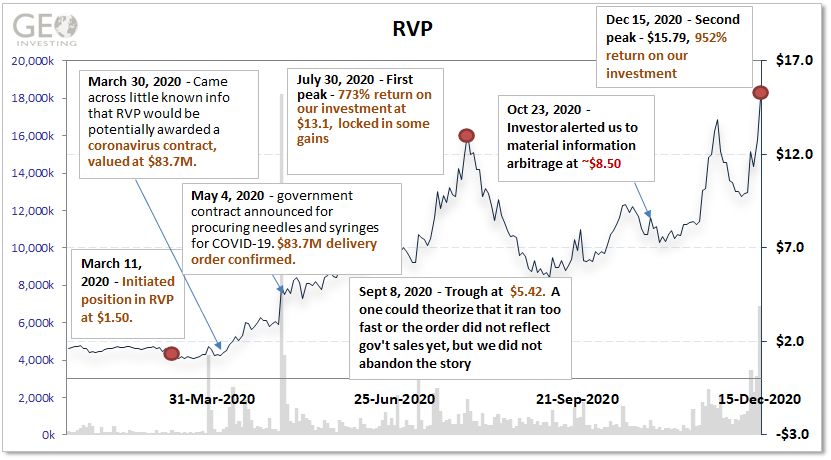

On this episode of Avoiding the Crowd with Maj Soueidan, the case study of Retractable Technologies, Inc. (NYSE:RVP) is discussed. With vaccines now being delivered and seemingly there being a light at the end of the tunnel, Maj wanted to describe a case study that was relevant to what’s been happening in 2020, as well as a company that took you on a classic microcap Information Arbitrage journey.

Information Arbitrage Journey

- Continuous insider buying by CEO as the company battled lawsuit with BDX concerning unfair marketing practices and patent infringement issues.

- Investors failed to realize that that Retractable had been winning the legal battle.

- Investors unfairly punished shares after the court ruled in RVP’s favor after the final proceedings, but no monetary award was issued in the company’s favor.

- Regardless, the companies agreed to settle claims with one another, and to not pursue further actions on the patent infringement claims.

- RVP has a best in class product that had flown under the radar and gone unnoticed by investors, until recently (COVID-19 catalyst).

- A long standing $83.8 million government contract that had yet to be executed was amended to include COVID-19 language. At the time of the amendment, the market cap of RVP was $50.3 million.

- We found township meeting minutes that showed the U.S. government would fund the construction of new facilities for RVP to address the volume of syringes needed to combat COVID-19.

- Result – RVP stock price increased from $1.50 when we initiated our bullish coverage for GeoInvesting premium members on March 11, 2020 to an intraday price of $15.50 as of 12/15/2020, or a 930% rise. (Stock peak by day’s end was $15.79)

Key Dates In Our Research

Jason Song

Do you still own shares of rvp? Do you have any new info on their production and new contacts?

GeoTeam

Hi Jason,

You can check out our longs here – https://portal.geoinvesting.com/v2/screen.aspx?id=28

Take care 🙂