Tito’s and Nachos

A few Fridays ago, after work, I went to a relatively new Mexican restaurant in Las Olas called El Camino, with a friend of mine, Ed. Las Olas is situated in downtown Fort Lauderdale between Fort Lauderdale Beach and the Riverfront, where the spring breakers, college kids and tourists hang out. It’s a great area to hang out in Fort Lauderdale without having to deal with a lot of the South Florida riff raff.

We arrived, ordered a couple of Tito’s on the rocks and talked stocks. Somewhere during our conversation, we became distracted by this stunningly beautiful woman sitting across the bar, alone. We thought it was funny to watch one guy after another get close enough to say something to her, but instead do nothing. The situation reminded Ed of a quote attributed to Michael Jordan.

Whenever Michael Jordan gets on the golf course and his friends ask how much money they’re betting against one another, rumor has it that his usual response is: “whatever makes you nervous”.

Ed eventually went home. I stayed around and had a plate of nachos, contemplating what he had said. Then I remembered a Tom Cruise line from Risky Business: “sometimes you got to say what the f***”.

I put my nachos down and decided to go talk to this woman. It turned out that we had a great conversation and that she was actually into the stock market. Who would have guessed? I felt like I owed Michael Jordan a debt of gratitude for convincing me to make a move that I, and most guys that night, were too nervous to act on.

Michael Jordan’s quote has great parallels to investing. I find it funny when people ask me what stocks they should invest in to make a lot of money, but then take no risk. Sorry, that’s not how it works. If you want comfort, buy a La-Z-Boy. The best returns are not going to be in the areas investors perceive as being the safest, where everybody is hunting. The pockets of the markets that make others nervous is where you want to be. Notice that I used the word “perceived”. The way a woman looks should not define her “risk profile” – so many other things come into play. I don’t look like I can play tennis, but you might be surprised – don’t judge a book by its cover! The same goes for investing in microcaps.

For example, let’s assume we are looking at a stock and two different scenarios. In one scenario, the company has a market cap of $1 billion and in the second scenario, the same company has a market cap of $300 million. Should the $300 million market cap scenario trade at lower valuation multiples just because it’s a microcap? Not in my book. But it might, due to unfounded risk perceptions that surround microcaps, regardless of quality.

Some would argue that microcaps see more price volatility because they are less liquid. However, the volatility of a stock does not determine the volatility of its cash flows. There are two general instances where volatility occurs at any market cap. The first is when you are just wrong and need to sell with the crowd (also known as when sh*t hits the fan).

The second is when emotional panic sell responses are triggered due to a falling stock, market corrections or overreactions to a bad financial reports that are just a short term road bumps.

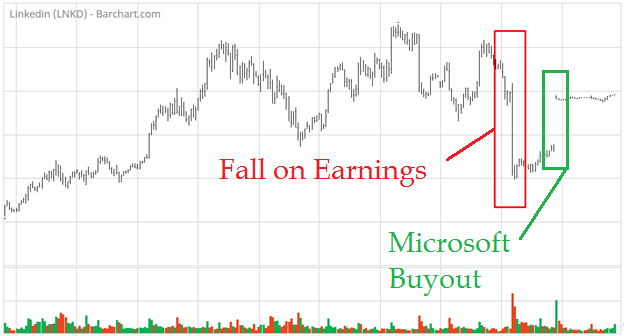

Remember when large cap LinkedIn fell 40%+ at market open on February 4, 2016 when it missed guidance? It was only shortly thereafter that the company was acquired by Microsoft at a nearly 50% premium.

Large caps and microcaps got clobbered during Q4 2018. The real questions then become: can you build confidence in your portfolio holdings to handle volatility when it matters most and are you right? The only risk that matters is the riskiness of a business. Like Peter Lynch said:

“Everyone has the brainpower to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and mutual funds altogether.”

We should be saying “thank you” to investors, as well as the financial media, who provide us with a chance to buy the same business on the cheap and then sell it to them at elevated valuations once the stock has risen to a market cap where they feel more “comfortable” buying it.

I agree that many, if not most, microcaps are not worth investing in. This is not because they are microcaps, but because they may be overpriced or may just be bad businesses. Our job as investors is figure out when the market is mispricing risk. With around 10,000 microcap stocks trading in North America, there are plenty of chances.

As long investors, you want to play in the areas of the market where there is a greater chance that people are mispricing risk, actually making the stock a “safer” bet than it appears. That’s why I love investing in microcaps: just the word microcap alone is something that people perceive as risky. If you can get over some of the stereotypes that go along with investing in microcaps and take steps to sharpen your research process, you can exploit amazing pricing inefficiencies in high quality microcaps that are not supposed to exist. (You can also take the opposite approach if you are a short seller).

Would you believe me if I told you that Autodesk’s top reseller in North America is a company that generates annual revenue of around $200 million, employs over 400 people, spans 50 locations across North America, has served 25,000 customers, is a microcap that trades on the OTC and has generated a compounded annual return of ~35% since 2010 for its investors? See our coverage of RWWI here.

Back To Jordan

While looking for that Jordan quote, I found an article in 2010 co-written by Craig Bestrom and Michael Jordan to help golfers improve their game called, 10 Rules For Maximizing Your Competitiveness. It’s a fantastic piece to read that I was instantly drawn to, not only as a source to improve my tennis game, but because each one of these 10 rules can be applied to investing at any market cap threshold. Here are his 10 rules, and how I’ve applied them to investing.

1. Focus on the little things.

“During my basketball career, I always told myself to focus on the little things because little things added up to big things. I equate making putts with making free throws, and my biggest mental challenge shooting free throws was in my second year, 1986, when I came back from a foot injury for the playoffs and had a 63-point game against Boston in the Garden. I had to make two free throws to send the game into overtime, and all I focused on was the basics –* I’m not gonna be short. I’m gonna extend and reach for the rim* — all the fundamentals that I had worked on at home and at practice for all those years. Golf is no different. Don’t assume, for example, that any putt is good. Make sure you putt every three-footer with conviction.

And keep score every time you play. I do.”

There are so many parts of the investment process that we ignore. These little things go a long way and end up being a very big part of our success. Examples include:

- Understanding how emotion impacts your investing decisions

- How to size your positions

- Making sure you routinely reassess your original thesis to see if things have changed

- Routinely reassessing your position sizing

- Not becoming cocky when you are on a streak

- Not being complacent when things are going well

The big things, like reading SEC filings, press releases, conference call transcripts, and interviewing management are obviously important. However, the little things help round out your research, manage risk and revisit conviction, helping you maintain your sell discipline or resetting price targets when the story has become even stronger.

2. Have total confidence in what you can do.

“If you have 100 percent confidence that you can pull off a shot, most of the time you will. I’ll never forget the time I was playing with Seve Ballesteros in Valencia [Spain]. It was just a fun round, but very competitive, of course. Seve misses a green, and his ball ends up right up against a tree. He has absolutely no backswing, and I’m thinking he’s out of the hole. Next thing I know, Seve’s on his knees with some kind of iron in his hands, and he’s choking down all the way to the hosel. He chips this thing, and it bounces onto the green to a few feet, and he makes par. Unbelievable!”

With investing, you gain experience by jumping in the pool, not just by collecting books. Your experiences and scenarios that you get yourself into while investing are how you will ultimately learn to succeed. It’s not necessarily a step-by-step basis. You think Seve Ballesteros was taught how to make that shot? He probably experienced a similar obstacle at some point during his career or during practice. However, even if the jam he got himself into was new, the confidence he has gained through the years can help him process information on the fly.

Find out, along the way, what works and what doesn’t work, keeping a journal both on paper and mentally. Learn how to do things that seem impossible, such as talking to CEOs and getting through SEC filings. I can’t believe how many young investors I talk to are amazed that we’re able to reach CEOs of microcap companies. These CEOs are usually very excited and willing to talk to retail investors because they know they’re a very important part of their company’s universe. CEOs of larger firms are going to cater to the institutional crowd that define their universe. You’ll probably never have 100% confidence when you invest in a stock, but if you put in the work to understand the company, understand what happens when the economy changes and how management has dealt with challenges in the past, you could build the confidence to hang in there when markets turn negative. If you don’t quite feel ready to make that phone call, start attending microcap investment conferences.

3. Don’t think about the prize; think about the work.

“At his basketball camps every year, Jordan would reward the kids shoes if they make a certain number of free throws or if they complete an around-the-world or something like that. But he always told them that if they’re thinking about the prize, they should be thinking about the work. Prepare, practice and perfect it. Do the work, and the prizes will come.”

This is such an important point. When I started investing, one of my goals was to be worth $1 million before I was 30. Yet, I didn’t really think about the money – I focused on how much I enjoyed investing, researching companies and interviewing management teams. I just wanted to become better at all of these things and put in the hard work. The money just came naturally, and I reached my prize two years ahead of schedule by primarily investing in undervalued no-name microcaps.

For many of us, the way we view money will change over time. When we are young, we can be driven by greed and the end game is to make piles of money, right now. As we go through life and are faced with more responsibilities, we focus on the fear of losing money. One of the biggest negatives of getting caught up in this greed/fear ying-yang dynamic is that it can cause you to focus on short term thinking, take the fun out of investing and eventually lead to suboptimal results. Greed can lead to short-term bets that are too big and fear can lead to short-term market timing, both leading to losses and developing a hate for investing in stocks.

Your first step to conquering these challenges is to tune out the financial media. I recently upgraded my phone and have refused to download any stock market apps. Whenever I focus on money, it hurts me. I routinely have to remind myself that it is not all about making money every day and not to stay down when I screw up. Success often magically has a way of finding you when you continue having fun while working hard. I know it sounds cliché, but it is 100% true, 100% of the time.

4. Keep it simple.

“There are a lot of correlations between basketball and golf, especially on the mental side. Whenever I played a big game, I tried to stick to things I knew I was capable of doing. I do the same in golf. I’ve seen Tiger hit that stinger, and I know it’s doable for me, too, but it isn’t a shot I’ve practiced much. Why would I try that in the heat of the moment?”

We’ve all heard the saying, “keep it simple stupid”(KISS). It’s really important to sense where you are in the evolution of becoming an investor. We all start the process with different skill sets. One of the coolest things about becoming a good investor is that you don’t have to be a genius and you can start later in life, like Chuck Akre did. Unfortunately, on Wall Street, there’s this feeling that if you use fancy words and talk about fancy investment strategies that you’ll earn more respect. But ultimately, your portfolio is what is going to bring you respect. You don’t have to trade options or FX to make money in the market. Start out by reading Peter Lynch’s book, “One Up on Wall Street” and trying some simple things that make sense. When teaching someone how to invest, I don’t even get into the “math”. I stress that it’s so important to know where to find information and how to interpret what it means.

For example, it’s important to know how to track insider buying or compare company earnings reports against related conference call transcripts to find things that might have been left out of the releases. There is plenty of time to learn to pursue more complicated strategies like understanding turnarounds and getting deeper into tearing apart financial statements.

I know we learn from failures, but I’d much rather have success early on in my career to build confidence. To this day, I still make the most of my money from applying the cleanest and simplest investment ideas, yet have gained the confidence to pursue more advanced strategies and research techniques.

5. Control your emotions until the round is over.

“Celebrating during a round can be a good thing if it inspires you to keep doing great things. But be careful not to overdo it. Sometimes, celebrating too much adds pressure and makes you feel like you’ve got to live up to it the rest of the round. Worse, your celebrating can motivate your opponent.”

6. Use tough losses for motivation.

“Turning negatives into positives has always worked for me. I think back to when I was cut from my high school basketball team as a sophomore. That was the biggest disappointment of my sports career, but it only made me work harder.”

Steps 5 and 6 go hand-in-hand. You’re probably sick of hearing it, but when it comes to investing, our behavior can be our toughest opponent. Did you know that during Peter Lynch’s 13 year epic run as Magellan fund manager at Fidelity, his fund averaged about 30% per years, while its investors averaged only ~5%. Why? Lynch found that most retail investors added money to the fund when markets were rising and sold when markets were falling. Controlling the emotions of fear and negativity may be the hardest obstacle you will be asked to tackle, when:

- it seems the world is ending

- your stock is not reacting to positive news the way you think it should

- one of your high conviction companies has a bad quarter or two and then performs horribly

- your colleagues are making money while you are not

- others don’t agree with your thesis

- you become depressed and feel lack of motivation to perform research

On the other hand, when stocks are doing great and we feel like nothing can wrong, we tend to:

- get greedy

- get complacent or lazy with respect to research

- follow up with management less

- relax our discipline by not adhering to previously set sell disciplines

- waste money on bets we should not take

I know there’s a few of you out there that probably panicked during the fourth quarter of 2018 by selling a stock after watching all of your gains disappear in a few weeks. This was probably followed by nausea, watching them go back up without you. We are not robots, none of us will ever be experts at this, but we can do things to try to combat behavioral biases. For example, the more familiar you are with the companies you’re buying and the more in-tune you are with management, the better prepared you’ll be to hang onto companies when things go bad or maintain your sell discipline when greed comes calling.

Combating negative emotion also means not putting yourself in a position where you will be spooked out of the market. Invest an amount of money to where you think you will not feel a need to panic. Manage your life and your margin at levels where you’ll be able to handle volatility, prolonged downturns in the market and when your strategy is failing, even when the market performing nicely.

7. Competitors always want to have something riding on the outcome.

“It isn’t the amount of money, it’s something to keep the focus at its highest. Whenever I meet people, they always have this idea that I like to play for big money. My line is always: *I play for whatever makes you nervous. *That’s enough to give me a competitive edge. It could be five dollars. It could be 10. It could be a shirt in the pro shop. It doesn’t have to be for $500,000 or a million. Sometimes it might be enough if we’re just playing for pride.”

We’ve all invested in longshot stocks with a little bit of money we can afford to lose. This is not going make you nervous, and thus, your research might not be as intense. It’s when we start making big bets and really suffer the consequences of being wrong that we step up our research. At least, this should be the case.

Remember when you had to cram for an exam at the last minute? I bet this is when you have accomplished some of your best work, under pressure, knowing everything was on the line. I don’t want to encourage you to make irresponsible bets, but at some point, you’re going to have to start investing like you mean it.

Aside from putting your money on the line, you also put your reputation on the line if you’re publishing articles, giving presentations and pitching your ideas at conferences. It’s important to know that it’s not easy to re-establish reputation once you lose it in the social media era we live in nowadays. A great way to challenge yourself is to start publishing articles, hopefully forcing you to do better research with your pride on the line.

Finally, ask yourself: “would I put my best friend or my mother in the stock?” If the answer is no, you might want to skip the idea. This is a tactic that has helped me is to identify my five best companies, even though I might hold 30 or 40 companies total. This method has really helped me considerably, especially since I share these ideas with other investors at GeoInvesting and during presentations. I recently went back and checked out all the stocks I’ve given at conferences or talked about via podcasts. Needless to say, I should have probably just put all money on those stocks and walked away.

8. I love trash-talking, and there’s an art to turning it into a competitive edge.

“Trash-talking is a means of (1) giving you confidence, and (2) taking your opponent’s mind off what he’s trying to do and putting a little more pressure on him. I don’t talk trash to demean people. I enjoy moments like that. I love competitiveness. So why would I do anything less?”

Trash-talking in the investing world comes in different forms.

Financial social media venues like Twitter have plenty of negativity, with bulls and bears constantly insulting each other. CEOs like Elon Musk of Tesla, Inc. (NASDAQ:TSLA) are bombarded, daily, by short sellers rooting for him to fail. I can only imagine if Jeff Bezos was launching Amazon.com, Inc. (NASDAQ:AMZN) today. He certainly had to deal with his share of criticism when Amazon went public in 1997, but it would probably be nothing compared to how he would have been attacked today.

Regardless, healthy criticism of companies is not a bad thing. After being a 100% bull for most of my career, my views on this subject have changed over the years because of GeoInvesting’s role in exposing 22 microcap pump and dumps and 13 U.S. listed China based frauds. Additionally, big cap accounting shenanigans are more rampant than ever due to investors’ shorter time horizons.

Regardless, I am not a big fan of cruel trash talking in lieu of constructive discussions between investors over differences in opinions. If you are like me and enjoy exchanging and comparing ideas with other investors, you might want to approach critique of others with a degree of respect as you express your alternate view. This means not flying off the handle when another investor calls you out on your ideas. I feel extremely lucky that I can be the only bull having dinner with a cabal of short sellers.

Trash-talking also means not being afraid to express your opinion about a company, write articles, pitch your ideas at conferences and give online presentations from time to time. The benefit of doing this is that you might receive useful criticism that exposes caveats you may have missed in your original thesis.

9. Nervousness is not a bad thing…

“I was nervous a lot of times before games. The key is, does that nervousness go away once the ball is thrown up because of your preparation and your routine. Once the game got started, I was back in my routine.

Golf can work the same way if you put in the work to prepare. Yeah, you’re going to be nervous on the first tee, but all it takes is one good shot, and that nervousness goes away. If you have doubts, nervousness will expose that. At some point you say, I know I can play this game. I’m gonna keep it simple. Fairways and greens. Make bogeys when I feel like I can’t make a par.”

All the things that we’ve talked about already can help us make better decisions for when we get nervous. Preparation, and the experience that you’ve accumulated over time, will help you handle nervous situations. With each nervous situation you go through, hopefully you come up out of each one more confident and more able to handle future challenges.

It’s natural to experience nervousness when you buy your first stock, start making big bets or need to control your emotions.

When I first started investing, on a scale of 1 to 10, my nervousness was at a 15 every quarter, waiting for earnings releases to come out on stocks I owned. I kept thinking about what was going to happen if I was wrong or if the worst-case scenario played out. However, I learned that our thoughts usually paint a far worse picture than what happens in real life. The more I invested and experienced negative outcomes, the more I began to see that even in the worst-case situations, I survived to fight another day.

Most of all, remember this: at some time during your stock picking journey, you need to stop collecting books and start collecting experience.

10. Learn from Tiger’s competitiveness.

“We’ll never really know which of the two of us is more competitive. He plays golf, and I played basketball. But he’ll do anything to beat you. One day we were playing with a friend of mine, Jacob Brumfield. He played pro baseball [with four major-league teams] in the ’90s. Jacob was so trash-talking Tiger that when we got to the 18th hole, Tiger told him he’d play every shot on that hole from his knees and Jacob could play normal. Now that is confidence. That’s the kind of stuff I’d do in basketball. Understand that Jacob is a 3- or 4-handicap who drives it about 270. So Tiger got to tee it up for every shot on the 18th hole, but he played them all from his knees — every shot! He tied Jacob on the hole with a bogey, but that was just as good as beating him.”

We have so many more free resources available to us today than we did years ago, so there is no more basis for the “I don’t have access to information” excuse. The downside to all of this information overload is that it can make it difficult to know where to start, and it makes the search for ideas more competitive than ever.

If you are a microcap investor, the upside is more enormous than ever. The changes in the regulatory environment, ETFs and record setting short-term time horizons of investors have reduced the thirst for illiquid, high quality, undervalued microcaps to a level that is the lowest point of any in my career. This means less competition for those of us who still love investing in quality microcaps.

Furthermore, using the KISS mantra, all you need to perform solid research are free resources like press releases, SEC/SEDAR filings, insider buying alerts, conference call transcripts and dime for a phone call to management. Also, don’t be afraid to pay for good sources of information to gain a competitive edge. The price to subscribe to research platforms has come down drastically giving the everyday investor more competitive power than ever. For example, Sentieo is an incredible research platform built and priced for the individual investor. See “Step 4” of one of our most read articles at GeoInvesting, So You Want To Be A Full-Time Investor? Follow These Ten Tips, for additional help on must-have research sources.

At some point, you might want to make a decision to move outside your comfort zone and “compete” with others to implement more complicated strategies. A good way to jump into this pool is by taking advantage of what we didn’t have years ago: social media, Seeking Alpha and countless other blogging sites that allow you to see how other people invest and how they compete in the stock market. Perhaps you will learn something from them and connect with a style to add another piece to your war chest. I never thought I would add short selling as part of my strategy, but now I am able to sprinkle short selling throughout my portfolio. Likewise, I never was big on investing in corporate restructurings, but now I feel very comfortable identifying turnarounds worth investing in and those to avoid.

We hope you enjoyed this article that appeared first at GeoInvesting. If you found this article useful and want to see more like it and receive see all of our model portfolios based on our investment process, please join here for a 7 day trial.

Maj Soueidan

Thank you Jim. I’m glad you enjoyed the article.

Maj

Jim McMaster

Excellent piece and advice Maj. I appreciate your insight and analogy!