https://geoinvesting.com/wp-content/uploads/2021/10/GeoWire-Header.png

WHAT YOU MISSED FROM GEOINVESTING THIS MONTH

DECEMBER 2021, Vol. 1, ISSUE 03 (Download available soon)

STUDS VS. DUDS

Stud – Pharmchem Inc (OTC:PCHM)

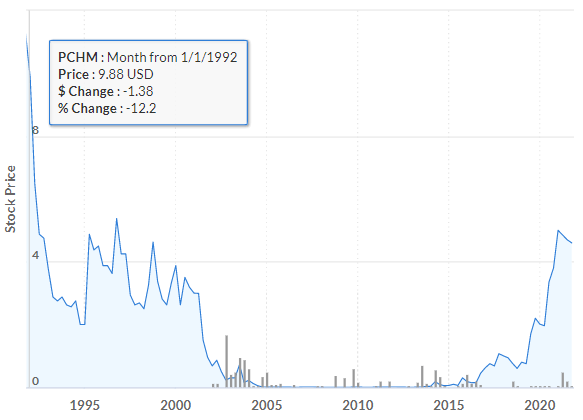

In May of 2013, we began coverage on Pharmchem Inc (OTC:PCHM) because of a shareholder letter from the CEO that detailed the direction of the company. PharmChem invented the “Sweat Patch” that monitors the level of specific types of narcotics in a person’s body. Most of the company’s revenues are generated when local courts prescribe the Sweat Patch as a means to monitor certain drug levels of people while they’re on probation or parole.

PCHM was a left for dead microcap that went from around $10 to mere pennies when their urine testing product business had to be shut down when their main customer went bankrupt.

The CEO resurrected the company by starting to market its under-marketed Sweat Patch product. Since then, as of December 2020, the company has;

- Grown revenue from $2.52 million in 2014 to $6.67 million.

- Grown net income from $433,995 in 2014 to $1.9 million.

- Paid $0.50 in total dividends since 2017

You could have received your entire initial cost of an investment in PCHM in the form of dividends if you purchased stock when we highlighted it for members on December 2, 2016.

The stock has responded well and at $4.70 has risen 6,600% since our initial coverage in 2013 and stands a current increase of 1,075% since we announced a position in the stock in December 2016. (See chart above)

This is evidence that proves once again that not all microcaps are microCraps.

Despite being on the verge of shutting down many years ago, PCHM’s Sweat Patch proved to be very successful, and helped resurrect the business. In the future, now under the direction of a new Board, the company is looking to increase the Sweat Patch’s market reach by both innovation and the expansion of the test to include the detection of different drugs. At the same time, the new Board aims to unlock substantial value for PharmChem shareholders. For example, the board just approved

—

Dud – A Turn-Around Story Stopped In Its Tracks Due to Covid-19

We are still betting that this dud can turn into a stud. Companies spearheading turnaround efforts in the midst of COVID-19 unfortunately had two things to prove. First, that they could successfully navigate multiple unknowns that we are all keenly aware of today (Supply chain disruptions, cost of materials increases, etc). Secondly, with all things remaining the same – that they would have been able to effectively restructure in the first place, even if things didn’t go exactly as planned. This held true for a communications infrastructure services and equipment provider we’ve been following since late 2019. The company operates two divisions. Their wireless segment supplies the labor to help telecom carriers like At&t Inc. (NYSE:T) and T-mobile Us, Inc. (NASDAQ:TMUS) modernize their tower infrastructure, including 5G. Their telecom division sells used/refurbished network and communication equipment to telecom carriers and businesses.

While other technology companies experienced meteoric boons at the height of COVID, this one languished in comparison as 5G buildouts came to a halt. We did, however, still enjoy a peak return of 252.71% following the initiation of our position in September 2019, before the markets were rocked by COVID. We currently stand at about break even.

Although the stock tried to make a few recoveries after the March 2020 “COVID Lows”, the pressure on it has proven to be a little too much to bear, and now we have to acknowledge what’s changed under the hood.

Currently, this company is suffering recurring losses and is in violation of debt covenants.

On a high note, we still believe this company can execute its turnaround. It has mentioned that it is slated to reach profitability by Q1 2022 as 5G build-outs by telecom companies are back in full force. Furthermore, because the company’s telecom division sells used equipment, it is benefittng from supply chain bottlenecks that are all over the news, which make it more difficult for its customers to purchase new equipment.

MONTHLY HIGHLIGHT

Inflation Is Not The End Of The World

Inflation seems to be a topic that is impossible to get away from in recent weeks. Every news outlet continuously features hyperbolic chatter on the topic. Through our “round-the-clock” due-diligence on the companies in our coverage universe, we have noticed that many of them are making adjustments to their business models to help combat inflation pressures.

Companies like Eastern Company (the) (NASDAQ:EML), an industrial hardware manufacturer, and Muscle Pharm Corp (OTC:MSLP), a global provider of leading sports nutrition & lifestyle branded nutritional supplements, have suffered accordingly.

In our November 2021 Open Forum for premium members, we mentioned we wanted to see if management had addressed issues that negatively impacted gross margins in EML’s Q2 earnings report. Per their Q3 report, It seems they swiftly tackled these issues and we are looking forward to seeing a continued improvements in Q4, as referenced in this statement from their Q3 press release”

“Our businesses have been more successful at passing on cost increases by raising prices during the quarter. Gross margin in the third quarter increased to 24% compared to gross margin of 23% in the second quarter of 2021. We believe that recent stabilization in the prices of many of our raw materials and shipping rates will translate into continued improvement in our gross margins in the coming quarters.”

In MSLPs recent Q3 conference call, management added:

“We made strategic operational decisions this quarter to set our company up for success and strong sales growth in the fourth quarter and subsequent year. This, combined with the supply chain shortages across our industry did, however, come at the expense of our top and bottom line in the third quarter.”

There is no doubt that many companies are feeling the strains of inflation in their day to day operations. We are looking forward to covering all of the innovative ways companies plan on tackling these challenges.

Inflation and The Stock Market – Avoid All The Noise

We also can’t help but continue to add to the increased chatter about inflation in the recent weeks and months by analyzing some trends. The chart below provides some broad perspectives on this issue.

https://geoinvesting.com/wp-content/uploads/2021/12/CPI-all-urban-consumers-1980-to-present.png

Source: fred.stlouisfed.org

US inflation accelerated in the past year and continues on its path higher. Rightfully, the markets are worried about this development.

Take a look at the development of weekly wages in the past forty years.

https://geoinvesting.com/wp-content/uploads/2021/12/employed-full-time-median-weekly-real-earnings-1980-to-present.png

Source: fred.stlouisfed.org

If you adjust for inflation, the wages have barely moved. Although COVID created a slight anomaly, they are up only about 8% in the past forty years.

While this conversation can become a bit more complex, we’d simply stress this important take-away – inflation can threaten a company’s bottom line through increasing wages and pressuring gross margins, but the stock market does not care. If you want to go one step further, one might say that the market even potentially drives the inflation cycle.

https://geoinvesting.com/wp-content/uploads/2021/12/market-drives-inflation-cycle.png

Source: macrotrends.com

SPY is up over 850% in the past forty years. Even if you adjust for inflation, the return is well over 500%.

Thus, we believe investing in stocks, and especially microcaps, can provide a much needed shield from the inflation of real life costs. And always remember, great companies are able to adjust their operations to mitigate external shocks, even if at the cost of short-term pain.

Research and Idea Pipeline (What’s Next)

GeoInvesting focuses on finding Tier One OTC companies that check off most if not all the criteria of our “10 Point Checklist,” which you will find listed below.

Through Maj’s career as a full time investor, spanning over 3 decades, he has focused on interviewing well-vetted CEOs from companies with long operating histories and management focused on growing their businesses, not stock price movement.

This is why we are pleased to announce that on Thursday the 16th at 4PM EST, we will be hosting our next Fireside Chat for our Premium Members with a company that Maj feels has many cookie cutter characteristics exhibited by some past multibaggers in our coverage universe. We recently shared a video on GeoInvesting’s Pro Portal highlighting Maj’s Deep Dive Due Diligence Research session on the company. It showcased how new management is set to capitalize on capturing market share. It’s worth noting that we think the multibagger move we are predicting will be accompanied by favorable capital allocation strategies in the form of stock buybacks and special dividends.

Maj had actually invested in the stock early in his full-time investing career,.late in the company’s growth cycle. However, he is now excited to be revisiting the company’s story after nearly 20 years. During our initial vetting interview with the new management team, we were pleased to hear that the company is going back to core strategies that were abandoned by legacy management. We believe this can lead to the company growing its market share from under 10% to a majority of the market.

In the end, we are viewing this company as a rare but classic Tier One quality microcap company that meets all 10 Tier One parameters. It’s only in the microcap universe that you can consistently buy these types of companies at a significant discount to their potential value before the rest of the crowd hops in.

Premium Members are going to receive their invitation to learn more about our newest Tier One company. You can too by hopping into a GeoInvesting Subscription here.