Contributed by FG Alpha Management for GeoInvesting, LLC

Summary

- Eros’ $95 million outstanding revolving credit facility balance is believed to be due end of this month and the company was downgraded last week by S&P from B+ to B-

- The revolving credit facility is estimated to represent over 82% of the company’s current cash balance

- Eros’ new dollar bond issue was intended to “help refinance its upcoming maturity and remedy its tight liquidity situation,” yet Eros states its postponement doesn’t have “any effect on its liquidity position”

- Eros failed to price its new dollar bond offering last Tuesday and “does not have a timeline for re-approaching the market” according to a Global Capital report

- As of December 2016, the company had current liabilities and off-balance-sheet contractual obligations due within 1 year totaling $434.3 million and cash & equivalents of only $135.8 million

We Think The Wheels Are Falling Off at Eros

In today’s article about Eros Plc (EROS), we want to offer what we believe to be concrete proof that the company could be approaching a catastrophic liquidity crunch. With the company “postponing” a bond offering this past week due to lack of interest by the high yield market and S&P downgrading the company from B+ to B- just days later, we think the wheels could be ready to fly off at Eros in a stunning way.

On Wednesday March 8, we published a report detailing a former Eros co-producer’s allegations from a class action complaint that the company was “channeling money to family members”. The company responded on March 9, stating that the lawsuit was “without merit” and that the court was “considering its dismissal”. We appreciate the company’s opinion on the lawsuit, and we intend to follow the adjudication process intently, particularly any evidence relating to witness allegations of Eros channeling money to the family of insiders and/or potentially overstating user numbers. Regardless, we believe the company’s current liquidity situation is of immediate concern and needs to be examined closely.

If the company was unable to price and fill this bond offering, how are they going to deal with their revolving credit line — believed to be maturing at the end of this month — especially given that the amount due on this line is approximately 82% of the company’s cash on hand and the company can’t seem to consistently generate cash on its own?

While the company claims that the offering postponed due to changes in “credit market conditions,” other reports say the bond offering failed because “people aren’t really chasing risk”. The company also stated in their response that they believe their inability to access the bond market doesn’t “have any effect on its liquidity position or its operations”. We believe this choice of words to be extremely revealing: what kind of company, in the liquidity position that EROS is currently in, makes this type of flippant statement about its liquidity position? It is clear that this bond was to be used to bail the company’s revolving line of credit out. Why do they qualify this statement by saying they “believe”? It is our interpretation that this statement is starkly at odds with reality: you either know this will affect your liquidation position or you don’t. Short of a hasty dilutive equity offering that would theoretically have to dilute shares by high double digit percentages and destroy the stock price to just meet this year’s obligations, we think the company is quickly running out of options.

The Anatomy of a Liquidity Crunch

According to the terms of Eros’ $125,000,000 revolving credit line, the facility was set to expire on January 5th, 2017. The agreement stated that “Final Maturity” is “the fifth anniversary of the date of this Agreement, or if that day is not a Business Day, the immediately preceding Business Day”. The agreement was initially dated January 5th, 2012, hence the believed original expiration 2 months ago on January 5th.

We found it remarkable that the company would simply let the termination date of its credit agreement pass without making a disclosure about how they would deal with it. We found it especially remarkable since the amount drawn on this revolver is over 82% of the company’s cash balance and a forced repayment of the facility could reasonably put the company into a relatively serious liquidity crunch.

The company released earnings on February 21st, 2017, yet made no mention of any terminations, negotiated extensions, or new agreements in relation to the revolver, any of which we believe would be material subsequent events.

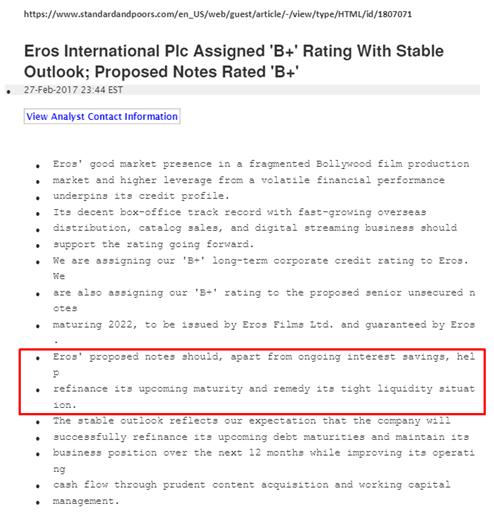

Then, suddenly on February 27th, S&P Global Ratings announced that Eros International Plc received a rating for their new proposed senior unsecured notes. Per the S&P release, the notes were intended to “refinance its upcoming maturity and remedy its tight liquidity situation.” S&P analysts also shared that the company had paid $20m of its revolving facility, with the balance of approximately $95 million extended until the end of March.

The rating assigned by S&P was B , four notches below investment grade, putting it in the bucket of obligations that are “regarded as having significant speculative characteristics.” S&P noted in their release “we may lower the rating if Eros is unable to refinance its debt maturities.”

On Wednesday March 8th, Global Capital reported that Eros failed to price its bond offering. As one Hong Kong portfolio manager noted in the article, “The window closed for them. For Eros to sell, you just need everyone to chase anything.”

Despite the seeming failure of the bond offering, Eros CEO Jyoti Deshpande suggested that Eros simply walked away from the $200- $230 million offering due to the yield being unattractively high. Per an emailed statement to Business Standard:

“We have a strong balance sheet and we continue to enjoy healthy relationships with our group of existing lenders and have now got the benefit of positive feedback from bond investors as well, even though we decided to not go ahead with the deal at this instance.”

We view this statement as highly dubious. If the company had a healthy relationship with the provider of their revolving facility, why not extend beyond 2 months and just renew? The current terms on the revolving credit facility are ‘LIBOR 1.90% to 2.90% and mandatory cost’ versus the bond offering which was initially launched at 8.25%, according to GlobalCapital. Additional reports noted that the offering failed to attract attention, and was pulled after widening the final price guidance to 9%.

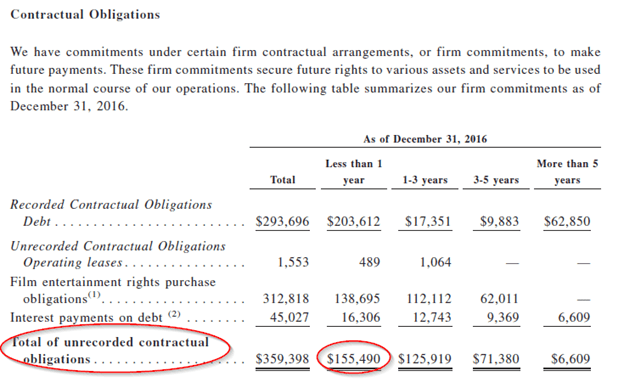

Additionally, the company’s looming maturities do not seem to give much room for error. As of the most recent fiscal quarter ended December 2016, the company had $126.1 million in debt due within 1 year. The bond prospectus also detailed $155.4 million in unrecorded contractual obligations due in less than 1 year as of the same date.

(source: EROS bond prospectus page 78 )

Between the debt, off-balance-sheet obligations due within a year, and other current liabilities the company needs $434.3 million to meet its obligations. As of that same date there was only $135.8 million in cash & equivalents. (Note: The total current assets as of that date were $363.7 million, though that figure includes $220.6 million in receivables, an account that has been called into question in other critical reports.)

Disclosure: Author Short EROS at time of article

Conclusion

Eros seems to be quickly approaching a wall of debt and contractual obligations and has not provided investors a clear sense of how they intend to climb over it. We are uninspired by the radio silence from management on issues relating to (a) its apparent extension of the revolving credit facility and (b) its overall refinancing needs and objectives.

As the company indicated on its recent conference call, they don’t expect to be cash flow positive this fiscal year. Given the recently pulled bond offering and the seeming end of month deadline to refinance, we have genuine questions about the solvency of the business.

We believe a dilutive equity raise at prices near 52 week lows could be the only option left for EROS to generate some liquidity. Any equity offering would only temporarily solve problems for the company and would probably result in significant dilution and massive pressure on the stock price. The negative effects of such an equity raise at low prices are obvious: more pain for shareholders who have already seen EROS fall by more than 70% from its highs as a public company and a company whose future cash flow prospects are questionable.

Appendix

- Reconciling our 82% of cash number:

- Current cash as of Dec. 2016 was $135,821 and the revolver was $115,000 as of that date. However, according to both the S&P ratings analyst and the bond prospectus pg. 63 “We prepaid $20 million principal amount of outstanding amount under the facility after December 31, 2016 from cash on hand. As of February 19, 2017, an aggregate principal amount of $95.0 million was outstanding under this facility.” In other words, when netting the 20m prepayment we estimate $95,000/($135,821-$20,000)= 82%

- S&P comments on proposed use of bond offering:

Disclaimer

You agree that you shall not republish or redistribute in any medium any information contained in this report without our express written authorization. You acknowledge that GeoInvesting nor FG Alpha are registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting nor FG Alpha have provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, FG Alpha, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, FG Alpha, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, FG Alpha, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, FG Alpha, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting nor FG Alpha shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

The research contained herein expresses opinions which have been based upon generally available information, field research, inferences and deductions through due diligence and our analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com//terms-conditions-privacy-policy