Amazon.com (NASDAQ:AMZN) may not only be gearing up to accept cryptocurriences as a means of payment, but I also believe that the company could be on its way to creating one of the world’s largest cryptocurrency exchanges in a move that would, I believe, be extremely synergistic for Amazon and would likely help them generate a substantial new revenue stream.

A lot of speculation is being tossed around with regard to Amazon’s potential involvement in cryptocurriences going forward. As bitcoin sustains levels over $10,000, it is being speculated that Amazon may soon accept bitcoin as a method of payment, a move that not only would lend credibility to bitcoin but one that could also create some additional demand for bitcoin itself.

It has been reported that Amazon has gone out and registered some domain names that appear to be associated with cryptocurriences. Last week, the following was reported on by CNBC:

Amazon has secured three new domain names related to cryptocurrency, sparking speculation that the e-commerce giant could be preparing a move into the cryptocurrency space.

However, Amazon Pay’s VP Patrick Gauthier told CNBC last month that Amazon had no plans to accept cryptocurrency because there hasn’t been much demand yet, and Amazon may simply be protecting its brand name.

The domains are: amazonethereum.com, amazoncryptocurrency.com, amazoncryptocurrencies.com.

Trade publication DomainNameWire was the first to report on Amazon’s move. The report said Amazon registered for the domains on Tuesday.

The media and financial pundits all pretty much rushed to the conclusion that Amazon may soon be accepting cryptocurrencies on its site as a method of payment.

This led not only to a litany of stories and social media discussion about it being a possibility, but also to the price of bitcoin getting a boost. My first look at the news resulted in drawing a conclusion that could have an even further far reaching set of consequences, and that is that Amazon may look to set up its own cryptocurrency exchanges. No one has speculated as such so far, but it seemed to just naturally make sense as a conclusion to draw.

When I took one look at these domain names, that is how they read to me. What would be the point of going out in registering a domain name like these if you were simply going to use one of the digital currencies on the website as a method of payment? A domain name is a placeholder for a bigger project than that and, the thought of Amazon exchanges was literally the first thing that popped into my mind when I saw the domain names. I literally said out loud “they’re going to set up exchanges”.

Why do this? First off, it is a burgeoning marketplace with an extremely long runway ahead of it. Coinbase, for instance, just went out and was able to easily raise money to expand its software offering at a valuation well north of $1 billion now. The notion of being able to take a fee off of every transaction in the future is, I believe, a promising runway for new revenue growth. In addition, the managing of exchanges is would be an extremely synergistic enterprise for Amazon as not only do they already have the massive computing power necessary to run their own exchanges and potentially mine for cryptocurrency themselves, but they are already one of the world’s largest marketplaces and the addition of cryptocurrencies to their arsenal would likely be a self-fulfilling prophecy that helps bolster the value of the cryptos that they would be transacting in.

Using all of their resources to run a cryptocurrency exchange could be one of the best new runways for revenue growth that Amazon could possibly enter into at this stage in the game. It is a new industry, it is expected to continue growing, there are limited players in the space and doing so would be synergistic with Amazon’s already existing hardware set up and its primary role as a retailer.

Revenue Potential for Future

Bitcoin appreciates: The ways that Amazon would be able to generate revenue from such a move would be twofold. The first is that, assuming Bitcoin continues to appreciate, the exchanges holdings would rise in value. Assuming Amazon also begins mining bitcoin and the price continues to appreciate, the potential for a small profit off of bitcoin itself is possible. This is the method that companies like MGT Capital Investments (OOTC:MGTI) are trying to use; mining for bitcoin and just hoping the price goes up.

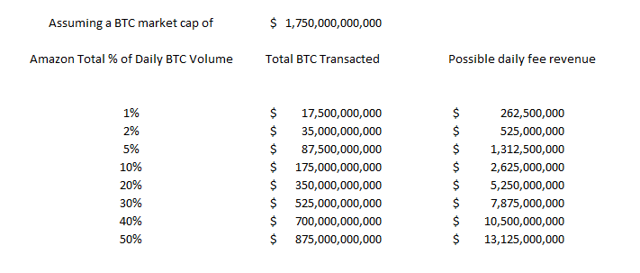

Exchange fees: There have been numerous estimates about what the final “market cap” of Bitcoin could wind up being. Some articles predict as much as $1.75 trillion in Bitcoin possibly being traded each day. From that, I worked up some scenarios.

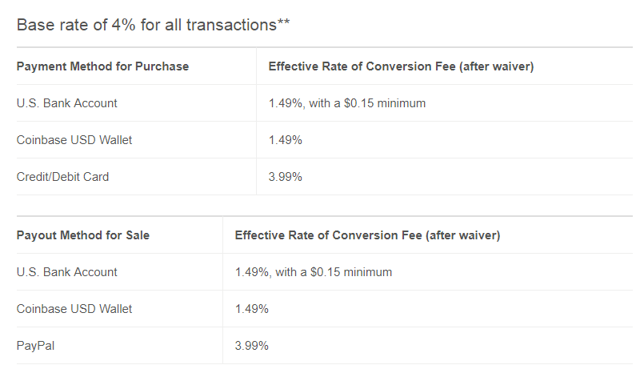

Coinbase charges a fee of 1.49% to buy and sell bitcoin, per their website,

Assuming the Bitcoin can wind up trading $1.75 trillion per day (which admittedly is an extremely aggressive assumption and would price BTC at about $100,000 per BTC), I can then try to make some assumptions about what type of revenue Amazon would be able to generate in a best case scenario — and whether these prospects would make it worth it for AMZN to pursue this industry.

For the above model, I assumed 1.75T in BTC changes hand each day and then laid out fee assumptions (based on 1.49% of a fraction of how much total BTC traded in a day that Amazon would account for). In a case where BTC ever got exponentially more valuable, the potential for a serious revenue stream occurs. If AMZN transacts 1% of all daily BTC with a $1.75T market cap, it could stand to make as much as $262M per day in revenue. From there, estimates just get ridiculous. Yes, these assumptions are aggressive, but they show that there’s a real potential revenue stream here. While modeled aggressively, it’s clear that there’s something worth investigating for Amazon. In addition, the above estimates don’t include potential transactions of other cryptocurrencies such as Ethereum and Litecoin, two other coins supported by most major exchanges like Coinbase.

Conclusion

Regardless, this will be a positive not only for the cryptocurrencies themselves, but also for Amazon. The company could also very easily go out in acquire Coinbase if they wanted to as a means for jumpstarting this business.

For existing Amazon shareholders and possible new entrants that are buying here near all-time highs, an entry into this industry could produce extremely positive results for Amazon stock. Not only could it possibly be a new revenue generator for the company, but associating a company with cryptocurrencies has been one of the most effective ways to make a stock rally, as denoted by companies like Overstock.com (NASDAQ:OSTK), who recently rallied due to its involvement with blockchain technology and a forthcoming ICO.

The clues could be right in front of our faces with these domain names. Amazon would not be setting up domain names like the ones that it has set up if it was only going to be accepting digital currency as a means of payment, I believe. I think the Amazon digital currency and cryptocurrency marketplace exchange is coming soon and I think it will do great things not only for the credibility of digital currency, but for Amazon itself.

GeoInvesting intends to stay on top of the cryptocurrency markets, so to get any updates on our findings you can subscribe or opt-in here, if you have not already.

~Chris Irons, GeoInvesting Senior Writer

Shane Walton

Hey why are you referring to BTC as over 7400? Is this a super old article. I am very interested to know. Warm regards, Shanos

GeoTeam

Shane, sorry for the confusion…the article was written and in the queue for a while. It looks like it got pushed through by our system (probably due to scheduler), but does not change the thesis. References to btc prices have been revised.