GeoInvesting has spent the last couple of weeks trying to determine what the status of operations at Chinese online lottery service provider 500.com (WBAI) is. Conflicting reports have led us to examine theories that the company could be operating normally again soon, in addition to theories that the company could be in more trouble than it’s stock price and management team have led on. We’ve concluded to this point that 500.com could be in a non-revenue generating holding pattern that may not end sometime this year – or at all. One thing is for sure, we don’t think the company will be holding steady around $10 in the coming quarters.

GeoInvesting has spent the last couple of weeks trying to determine what the status of operations at Chinese online lottery service provider 500.com (WBAI) is. Conflicting reports have led us to examine theories that the company could be operating normally again soon, in addition to theories that the company could be in more trouble than it’s stock price and management team have led on. We’ve concluded to this point that 500.com could be in a non-revenue generating holding pattern that may not end sometime this year – or at all. One thing is for sure, we don’t think the company will be holding steady around $10 in the coming quarters.

- On Wednesday, February 25th, 2015 500.com Limited (NYSE : WBAI) issued a release stating that select online lottery services had been temporarily suspended in some provinces.

- On Monday, March 2nd, 2015 the company published a press release stating that it was suspending more services and as a result expected a “material adverse” effect on its financials.

- Today, we believe a majority of WBAI’s internet-based online lottery sales have been suspended indefinitely and that the company is in a non-revenue generating holding pattern.

- We have uncovered what we believe to be “conveniently” timed stock sales from an entity that may be controlled by a 500.com Board Member.

- We believe management is doing the bare minimum in communicating the potential severity of these events to U.S. investors.

The State of 500.com’s Online Lottery Business

Our beliefs about the state of WBAI’s online lottery business have been the result of our analysis of several media outlets, including

- 500.com’s own press releases

- Seeking Alpha blogs that “flew under the radar,” appear to be extremely detailed and accurate with their reporting over the course of months, and went unnoticed

- Musings on Twitter

- Other financial sites, like Street Insider

These sources, combined with our own research and internal analysis have led us to the following conclusions, which we believe to be accurate:

- According to blog reports, WBAI was initially granted “permission to explore” lottery sales, but may have overextended itself regarding what business it was permitted to take on and how it would keep track of transactions. The license the company was granted may or may not have been far more “provisional” than the company led on.

- According to blog reports, sentiment from higher up in China surrounding WBAI and its business practices has been negative.

- We’re told that the company has strong political connections which may have kept it afloat thus far. These connections could be in the process of working against the company.

- The central government was the first to implement an audit of the lottery system in November 2014, and it then passed some responsibility onto individual provinces to perform their own audits and research potential remedies.

- Blog reports say senior leaders were “shocked” to discover the level of corruption uncovered by the audit (it is unclear whether this references the central government audit or the local provincial one). The audit may have uncovered forged documentation.

- There is a push to make a policy change which could indefinitely suspend internet lottery sales in favor of implementing a nation-wide lottery IT network that could easily track, access, and audit the cash balances being moved.

ADDITIONAL RECENT HISTORY OF 500.COM

It has been about a month since we suggested to our members that WBAI could potentially beat its earnings estimates for its Q4 2014 results. When earnings surprised us to the downside, we were left with several questions and we are continually in the process of examining our research data to assure its integrity. After earnings, we reached out to management to try and set up a call, but we have yet to receive a response from the company. Since then, we have reached out to investor relations contact Linda Bergkamp and asked for more transparency from the company. We’ve received no information aside from the company’s scarcely worded press releases.

Aside from earnings, the last month of trading has continued to be an extraordinarily volatile one for WBAI.

The above chart shows support drifting out from underneath the stock as it reported earnings and then subsequently continuing to fall. In an effort to provide more context and understanding as to how we arrived at where we are today, let’s examine the last two months.

On February 11th, the company reported earnings that missed analyst expectations, sending the stock lower by about 11%. WBAI was expected to earn $0.27 on revenue of $22.54M and it reported earnings per share of $0.23 on revenue of $23.57M. The disappointing numbers surprised us and led to a roughly 10% decline in the stock. The stock closed at $18.01.

During the abbreviated trading week (due to President’s Day) of February 16th, rumors started to spread across the internet that the “government plans to revoke the company’s online sports lottery license” and that CEO Man San Law had been detained by Chinese authorities. The stock opened the week at $17.25 and closed on Friday at $15.66. No commentary was offered by WBAI management.

On the 23rd of February, an e-mail began making its rounds on Twitter that seemed to show the company’s IR team denying the rumor that Mr. Law had been detained and stating that the company’s business “continues to operate normally.” A screenshot of that e-mail is below.

When we spoke to WBAI’s IR team via phone on the 23rd, we were assured that the company was looking to respond to these rumors by issuing a press release. The IR representative commented to us that the IR firm was trying to get in touch with management in order to prepare a response, but that it was taking longer than usual because of Chinese New Year. We found it slightly unnerving that the bottleneck preventing prompt disclosure to U.S. shareholders at the time could have been WBAI management. We believe the prompt and responsible thing for management to have done would have been to address the rumors far earlier in the week. We were told over the phone, again, that the company denies the rumors regarding its CEO and it believed them to have been purposefully spread during the Chinese New Year holiday.Without word from management, the stock closed on the 23rd at $12.81.

On the morning of February 24th, the company received an upgrade from 86 Research, who upgraded the company from “accumulate” to “buy”. Our inquisitiveness began turning to frustration on the 24th, when four separate calls made by us to WBAI’s IR representative in the U.S. weren’t picked up or returned.

Also on the 24th, Deutsche Bank put out a note stating that WBAI was “sailing through very choppy seas” and pointing out that “no member of senior management has been investigated by government authorities over the past several months.” The note also states that business was suspended from February 18th to February 24th, which is normal during Chinese New Year.

The note concluded that if the already suspended services wind up being the only change, it will only amount to less than 10% of the company’s total revenues. The fear priced into the stock comes from speculation that there may be future services in alternate provinces that may need to be suspended. Deutsche also comments that its channel checks suggest that the company’s gross merchandise volume is on track for Q1 to meet guidance of RMB1.7-1.8B. The stock closed on the 24th at $12.83 and we know now that far more suspensions have taken place.

Early on February 25th, the company’s official account on Weibo (a social platform in China that is similar to Twitter in U.S.) made a post which clearly seems to show pictures of the company’s CEO participating in a welcome ceremony, ostensibly for the first day back to work after the Chinese New Year holiday. The Weibo posts are time-stamped on the 25th and appear to show traditional red envelopes used during Chinese New Year festivities, but the pictures included don’t have detailed timestamps on them.

On the morning of Wednesday, February 25th, the company finally issued a statement which said:

“…certain provincial sports lottery administration centers to which the Company provides sport lottery sales services plan to temporarily suspend accepting online purchase orders for lottery products, in response to the Notice on Issues Related to Self-Inspection and Self-Remedy of Unauthorized Online Lottery Sales (the “Notice”), which was jointly promulgated by the Ministry of Finance, the Ministry of Civil Affairs and the General Administration of Sports of the People’s Republic of China on January 15, 2015.”

The release then talks about provincial and municipal responsibilities for conducting inspections and enforcing remedial measures (if necessary) within their respective jurisdictions. These reports are due to three organizations within the Chinese government, including the Ministry of Finance, on March 1st:

“The Notice requires provincial and municipal government branches, including financial, civil affairs and sports bureaus, to conduct inspection and take remedial measures for unauthorized online lottery sales within their respective jurisdictions. The scope of inspection includes, among other things, commercial contract arrangements, online lottery products, lottery sales data exchange, online lottery sales channels, and sales commission fees in connection with unauthorized engagements of online sales agents by lottery administration centers. The Notice further requires a formal report on the result of the self-inspection and self-remedy be submitted by each provincial or municipal government to the Ministry of Finance, the Ministry of Civil Affairs and the General Administration of Sports of the People’s Republic of China by March 1, 2015.”

WBAI noted that the four high frequency services they offer have been shut down by these investigations so far, and that those services accounted for 9.6% of total revenue in 2014. The stock pushed as low as $9.55 on the 25th, nearly a 45% decline from the two weeks prior.

WBAI concludes by stating that they “believe such measures would have long-term beneficial effects on the lottery market in China.” They also reiterated that they have “obtained the approval from the Ministry of Finance to provide online sports lottery services on behalf of China Sports Lottery Administration Center.”

At first read, we thought the title of this press release was far worse than the content contained therein. To be safe, a 15% reduction in next year’s EPS would put estimates at $1.19/share. While this uncertainty of continued operations looms, however, we think “all bets are off.”

During the afternoon of February 25th, we again spoke to WBAI investor relations in an attempt to discern how many provinces have reported and how may have yet to report. We also asked about why the CEO rumors were not addressed by the company in its press release. We were told to e-mail the company about the provincial data – we did, and we’re still awaiting a response. When we asked if the rumors about the CEO were “patently false,” we were told that they were. As of the time of preparing this article, we never wound up hearing back from WBAI investor relations, or management.

On February 27th, Analyst Alan Hellawell III at Deutsche Bank downgraded WBAI to “HOLD” from “BUY” and lowered its price target from $20 to $11.

On the morning of March 2nd, WBAI issued a press release announcing that the company was informed on February 28th that “the remaining provincial sports lottery administration centers to which the Company provides sport lottery sales services” plan on temporarily suspending online purchasing for lottery products. The company stated in its release that this would have a materially negative impact on the company’s financials.

WBAI stock traded lower pre-market on this news. Oddly, when the market opened, the stock ran up from $7.67, where it opened, to over $10 on this “materially adverse” news. On March 2, the company traded about seven times its daily average volume.

By March 4th, the stock had advanced (again, on the heels of this “materially adverse” news) back up to over $12 a share – a 57% gain from the lows that the stock touched on the morning of the news. This left us, and undoubtedly other WBAI investors wondering:

- What, exactly, is going on here?

- Does someone have the inside track on news to come?

We were dumbfounded about the trading on a day when the sentiment should have been “vanilla” negative. That trading, as you’ll read, may just be the tip of the iceberg.

Throughout the rest of March, WBAI has been in a trading range between $9 and $13.

Most importantly, since the company disclosed the larger suspension of its services, it hasn’t offered a subsequent update which leads us to believe that operations are still suspended and have been for a month now.

“CONVENIENTLY” TIMED STOCK SALES BY A BOARD MEMBER?

We’ve also uncovered some interesting stock sales that have occurred while this saga has been playing out.

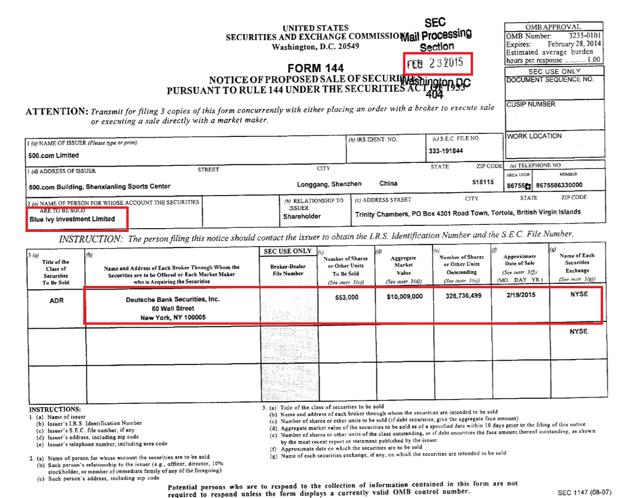

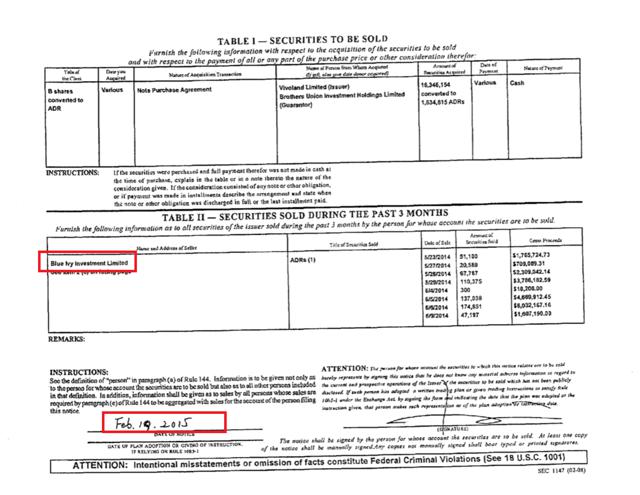

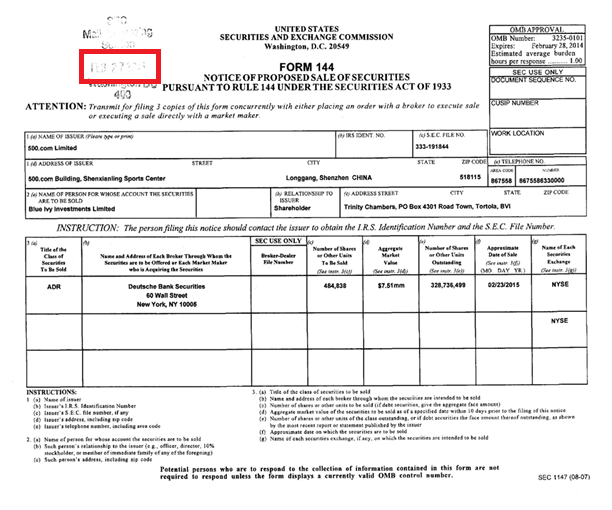

On February 23rd, there was a Form 144 (Notice of Proposed Sale of Securities) filed with the Securities and Exchange Commission that showed the intention of a stock sale of 553,000 shares by “Blue Ivy Investment, Ltd.” The “approximate date of sale” was listed as February 19th. Here is what a copy of the Form 144 looks like:

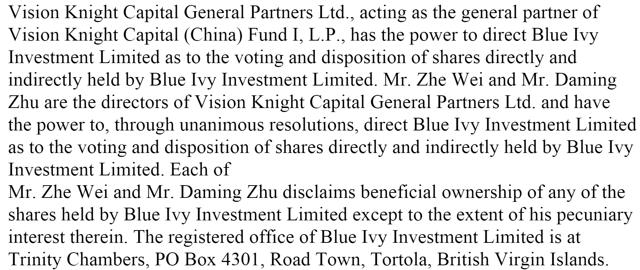

As we can see from this Form F-1, Blue Ivy Investment, Ltd., can be controlled by Vision Knight Capital.

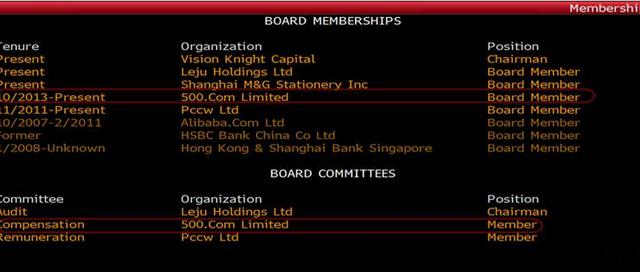

We find it to be an interesting “coincidence” that Mr. Zhe Wei, the Chairman of Vision Knight Capital, also happens to be on the Board of Directors at WBAI.

As you can see from the two captures below, the trading volume from Deutsche Bank (the market maker denoted on the Form 144) increased dramatically from the 2/1/15 to 2/17/15 period (where it traded only 490,478 shares):

Versus the 2/19/15 to 2/23/15 period, where it traded 1.53 million shares:

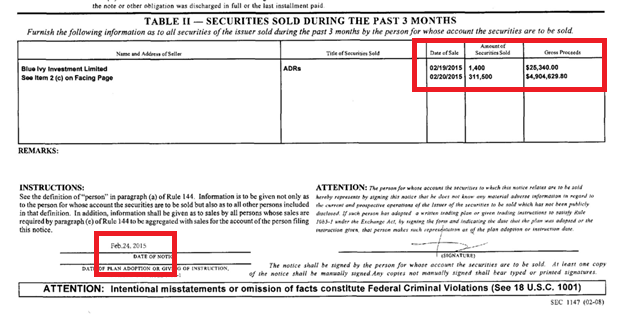

In a subsequent Form 144 acquired by us, we can see that Blue Ivy did, in fact, sell 312,900 shares on 2/19 and 2/20. This Form 144 was filed on February 27.

Could Zhe Wei have directed Vision Knight Capital to act on behalf of Blue Ivy Investment, Ltd. and sell WBAI stock knowing that materially negative news was going to be delivered to shareholders in just days?

OUR INVESTMENT THESIS: WE’RE SHORT, BUT HEDGED

Our intention for writing this article is to give U.S. investors transparency about the disturbing nature of WBAI’s volatile business, these stock sales and some clarity as to what the future might hold for 500.com. The management of WBAI, we believe, has done a poor job of communicating with shareholders and, specifically, being timely. As the equity in the company has fallen significantly in the last two months, management has missed countless chances to address its U.S. investors in a timely fashion:

- The company could have commented about the Notice on Issues Related to Self-Inspection and Self-Remedy any point after it was issued on January 15th (per the company’s press release).

- The company could have addressed rumors at any point between earnings and today, a lengthy 14-day period where the stock fell nearly 50%.

- The company could have issued more details with regard to the timeline of the self-regulating reporting process, as it stands today. How many provinces has WBAI been suspended in and how many are they waiting on reports from?

- How much revenue has the company brought in for the month of March?

- Is the company expecting to have the suspension lifted in April? If not, what type of revenue projection is the company going to make?

Leaving U.S. investors hanging out to dry while these key questions remain up in the air is an unprofessional and cavalier attitude toward the company’s shareholders. We believe it is this seeming disregard for timeliness that has caused class action lawyers to surface en masse on February 25th, as they are likely picking up the scent of negligence. Additional class action lawyers put out press releases throughout March.

While we realize Chinese New Year was nearly a week long event and a major holiday, we refuse to believe that a management team whose priorities lie with its shareholders would allow a 7-day gap in communication for a holiday. If you’re looking for a stock to invest in where management is professional and timely, WBAI isn’t a great place to look. We’re convinced that even though there is a nominal chance that WBAI could have a rise in business if suspensions are lifted, there’s also risk of significant loss for common shareholders here. One thing that we’re sure of is that WBAI shouldn’t stay parked at current levels into the next quarter. Either it’s going to find itself back in business, or this is the beginning of a march downward for both the company and its stock.

The sale of 312,900 shares of stock from an entity that appears to be controlled by a WBAI board member is even more disturbing. This stock sale, combined with WBAI’s oddly timed run up on March 2nd where the company released “materially adverse” news, gives us reason to be cautious and skeptical. Additionally, we question the continued run up of WBAI in the days following the March 2nd news.

The biggest “tell” to us is the fact that since 500.com released a statement saying they expect a materially adverse effect on their financials, they’ve said nothing else. As public disclosure works in a layered series of precedents set by what the company discloses, we can’t assume anything aside from our thesis that the company has brought in very little revenue for March. The longer we go without hearing an update, the longer the company is likely going without generating revenue.

The stock, for the time being, could be semi-propped up by the company’s newly implemented $30 million stock buyback program, authorized in late February of 2015.

For now, and the foreseeable future, 500.com seems to be laden with risk. Everything hinges on the future of the company’s now defunct services in China, and we’re likely to not have clarity on that for a while. With the company’s past, we’re not exactly banking on them disclosing information in a timely manner to U.S. investors.

We can confidently state that we believe the company will be much lower or much higher in the coming months – there’s a case for each scenario, even if we think the short case is stronger. All signs point to the company being in real trouble here, but the unexpected nature of Chinese company operations and the volatility of the Chinese government’s decision making tell us that a spike up on resumed sales isn’t impossible. We are currently short WBAI, with a small hedge, and we advise caution to U.S. investors.

To stay ahead of the market with GeoInvesting arbitrage and learn about investment ideas not yet digested by the market, Sign up now for More Research and Insight