Just as for many of you, Peter Lynch was my investing hero when I first decided that I wanted to become a full-time investor. Although I was exposed to the stock market by watching my dad research and buy stocks while I was in high school, it wasn’t until college, when my dad passed down to me Lynch’s book, “One Up on Wall Street”, that I became hooked for life. Lynch’s approach to investing was the perfect fit for me. I entered college with no idea of what I really wanted to do and a limited knowledge base on stocks and finance. But Lynch showed how the average guy can learn how to pick stocks, and he did it in a way that is easy to understand. Most importantly, he laid out a step by step process to find a few good stocks among thousands that trade in North America. When I reflect back on decades of investing, I am reminded of why a lot if the general framework I apply to pick stocks was borrowed from Peter Lynch’s principles.

In 1998, Lynch introduced a stock picking lesson multimedia CD plan called “Stock Shop.” Portions of the lesson, highlighting various segments from Stock Shop, can be found on YouTube.

If you are a Peter Lynch fan, you will be familiar with most of what he talks about, as he quotes or opines on passages from his book. However, what gets lost in all his anecdotes and witty quotes is his 5-step process to help us define our stock picking universe. This was essential for me. It helped me understand that I had to find a way to reduce thousands of potential stocks into buckets I could manage.

“If you start by looking at the entire universe of stocks, more than 3000 stocks on the New York Stock Exchange alone and over 13,000 public companies in total, you will blow a gasket. So, I break stocks into categories, partly to make the job of researching more manageable.” Peter Lynch

After including the OTC market and Canada, the universe is roughly more than 20 thousand stocks that make up your stock-picking universe.

Lynch’s process for defining his stock universe began by putting stocks he was researching into 5 buckets:

- Slow growers

- Fast Growers

- Cyclical

- Turnarounds

- Asset Plays

Personally, my “buckets” of criteria have evolved over time. For example, when I was raw and first started investing, I spent most of my time searching for clean companies that were undervalued based on Lynch’s criteria.

- Trailing P/E<25

- Forward P/E<15

- Debt Ratio <35%

- EPS Growth >15% to <30%

- PEG Ratio (PE/EPS 3-5 Growth Rate) <1.2

- Market Cap < $5 billion

As I grew as an investor, I branched out to more buckets and expanded my valuation parameters, while narrowing the selection universe by putting a heavy emphasis on U.S. microcaps (around 10,000).

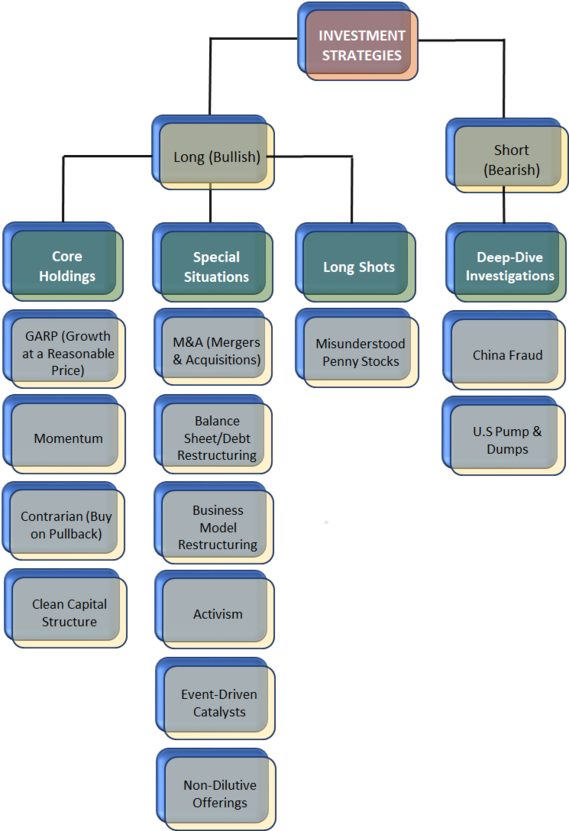

Some of my strategy buckets include:

Lynch also discusses the power of compounding and profiting from chaos. Some of the things he talks about are eerily relevant today. As the financial media and political noise challenges our ability to make smart investment decisions on a daily basis, Lynch’s message is clear: Ignore the noise and invest for more than a minute:

“I owned Dunkin Donuts for 12 years. I think I might have talked to them once every year. The story didn’t change a lot. You don’t have to worry about low-cost imports coming from Korea, when you own a donut company. You don’t have to worry about the economy. You don’t have to worry about someone investing a new computer chip. The story doesn’t change that much.” Lynch

“The stock market is a long-term investment. If you need to use the money anytime soon, you should not invest in stocks. This is the money you are willing to put in the market and leave it there for 5, 10, 20, 30 years. That is the kind of money you can do well with. If you are worried about it, don’t invest it.” Lynch

You can watch the “Stock Shop” video and read the transcript below. Please note that Lynch occasionally references interactive tools throughout his presentation that allow users to perform tasks and lesson plans. This would require that you have a CD that was part of Stock Shop. Lynch begins with his familiar message:

“You shouldn’t be intimidated. Everyone can do well in the stock market. You have the skills. You have the intelligence. It doesn’t require any education. All you have to have is patience, do a little research, you have got it. Don’t worry about it. Don’t panic.

Introduction

Host:

In 1990, Peter Lynch retired as manager of Fidelity Magellan, the nation’s largest stock mutual fund and one of the most successful.

In 13 years, he drove Magellan to a 2800% annual average gain. Quite Simply, Lynch has been recognized as one of the greatest money managers ever. He beat the stock market for so long, not by timing the market, but by picking the right stocks. Of course, no one can promise you Peter’s record, but you can learn a lot from him, and you don’t need a billion-dollar portfolio to follow his rules.

Presentation

Peter Lynch:

You Have an Edge

Hi, my name is Peter Lynch. For 13 years I managed Fidelity Magellan fund. Those are 13 amazing years. Nine times the market declined by 10% or more and I was very consistent. All nine times Magellan fund fell 10% or more. I learned a lot of lessons. I think they are true now. I think they were true 20 year ago and I think they will be true 20 years from now. I think I can help you do a better job of investing.

You can’t learn years of stock-picking experience in one night, but you have better stock picking skills that you realize, and you have advantages that no one in Wall Street has. In stock shop, I am here to help you find them and use them.

Power of Compounding

You may be wondering why stocks are so important for a long-term investment program. The short answer, over time stocks produce better returns than other investments. In the past 60 years, stocks have returned about 10% a year. Bonds have averaged at 6% a year. Treasury bills or Bank CD’s around 3%. That doesn’t seem like a big difference, does it? But the power of compounding makes an enormous difference over time.

Suppose you invest $50 a month and earn 6%. After 30 years you have over $50,000. Go ahead and play with the numbers yourself. If you clicked on the assumptions button on the previous interactive screens, [You would need the CD that goes along with Lynch’s Stock Shop lessons to view interactive screens] you noticed that the worksheets do not take taxes into account. When your investment is taxed, the government reduces your return every year. If you know you won’t need the money until retirement, you should place as much of your investments as possible into tax deferred accounts, like IRAs, Keoghs, 401K or 403b plans.

Because you don’t pay taxes on the money until it is withdrawn from the accounts, the power of compounding achieves the maximum effect, providing you the best return possible. The more time you have to let your earnings to compound, the better results you will get. A 20-year-old who invests $200 a month and earns 10% on his money all along, will have 1.1 million dollars at the time he was 60. A 35-year-old would have to invest $800 a month to have the same 1.1 million dollars at age 60. You are going to have a tough time getting that 10% return without at least some stocks in your portfolio.

Should You Invest in Stocks?

Before you start to invest ask yourself one question. “When will I need to use this money?”

The stock market is a long-term investment. If you need to use the money anytime soon, you should not invest in stocks. This is the money you are willing to put in the market and leave it there for 5, 10, 20, 30 years. That is the kind of money you can do well with. If you are worried about it, don’t invest it. The stock market is volatile. Individual stocks are volatile. The average range for stock in a year is 50% between its high and its low. Stocks go up and down, the market goes up and down. If you are investing with a one- or two-year time horizon, you should not be in individual stocks, you should not be in equity mutual funds. If you have been lucky enough to save up lots of money to send your children to college and there are starting school in two years, what are you going to do if the market goes down?

In the long term, 10, 15, 20 years or more, stocks have beaten bonds and bank certificates of deposits. In the short term there is telling what will happen. In 1987 the S&P 500 fell 33% from its August top to its October bottom. If you had the stomach to ride through that drop, you would have found that the S&P performance, from 1987 through 1992, still outperformed treasury bills and long-term government bonds, despite that decline.

If you want to double your money quickly and safely, fold it in half and put it in your wallet. Any other way you are simply gambling.

A good stock can take two, three, even five years before it really pays off. It is not two or three weeks. It is not two or three months. My best stocks have been my 5th, 6th, 7th year. Give your investments time to grow.

When to Sell

Many people ask me, when is the right time to sell a stock? Selling stocks is a matter of comparing stories. If story A is better than Story B, then Sell B and buy more A. If you own eight companies, you are playing eight simultaneous games of poker. So only stay in the games that you have the best chance of success. Now remember that stories rarely change overnight. It may take years for good one to be recognized by the market. Give your good stories the time to grow.

Profit from What You Know and See

Your advantage in picking stocks is your direct experience with companies as a consumer, on your job as a professional or as a neighbor. Use those advantages as a place to start looking for good stocks.

You have several things that you possess that will make you a good investor. They are inherent to your life. It is the field you work in. It is the area where you live, there may be some local company that is terrific. You are a consumer, you see some products, you see some services that are terrific.

We bought a Volvo, it was better than the American station wagons. It was safer. The price was right. I did a little bit of research. I found that Volvo the stock, Swedish company, was selling equal to its cash. You are paying almost nothing for the company. They had lots of other divisions that were doing terrific. Buying that car turned out to be a great way to begin researching the stock. Sometimes, people take things for granted. My field was the mutual fund industry. In the early 1970’s the industry grew slowly, but then it took off in the 80’s. Money piled into the money market funds and equity funds. Like an idiot, I missed stocks like Dreyfus, Pioneer, T. Rowe Price, Strategic investments, Franklin Resources. There were lots of companies that went up dramatically. This is my own field. All I had to do was buy these things. It was really dumb. Back in the 1950’s a fireman from New England noticed a factory in his town seemed to be hiring and expanding all of the time. This person didn’t have a great computer. He wasn’t a professional investor. He was just an observant neighbor. He decided to put $2,000 per year into Tambrands, then called Tampax. By 1972, the fireman was a millionaire just from using his local edge.

Investing is a personal thing. You have to do it by yourself. You don’t do it with a committee. You have to be able to have the emotional strength to stand the volatility of the market in general and stocks in general. The key organ here is not the brain, it’s the stomach. Do you have the stomach for this? Do you have the patience for it? You should be able to look in the mirror and say to myself, “What am I going to do if the market goes down”?

If you know something that will drive a company’s earnings higher, then you know something that will drive the company stock higher sooner or later. But you can’t just guess at it. You have to have some reasons, such as costs are coming down, are new products going to be a big hit? Research is developing a company’s story, an idea of why earnings should go up or down. It doesn’t mean sitting in the library for hours, reading SEC fillings or fiddling with a calculator. Research is exciting. It is very little math. When I owned Chrysler, it was the biggest position of my fund, when I was at a movie theater or at a sports event, I would run into somebody driving a minivan and I would ask them what do you think of the minivan? Would you buy another one? What do you like about it? People some would say, well it’s a little underpowered. They only have a four-cylinder engine. I knew they were already working on a six-cylinder engine. So, this is research.

Research starts with the things you know, your edge. If you are a mechanic, look at the tools you use. Which are the best? Which are the best value? Or if you are a doctor, see what new technology saves the insurer money, or software systems that reduce costs at hospitals. You probably already know a few companies quite thoroughly.

The amateur investor probably can follow between five and eight companies. They could lecture in these five or eight companies. They know them very well. There are 10,000 to 15,000 public companies in united states. There are lots more overseas. So, you don’t have to be experts on lots of companies. You just have to know a few very well.

It is a lot of fun. It only takes a few hours a month. It is not a full-time job. I owned Dunkin Donuts for 12 years. I think I might have talked to them once every year. The story didn’t change a lot. You don’t have to worry about low-cost imports coming from Korea, when you own a donut company. You don’t have to worry about the economy. You don’t have to worry about someone investing a new computer chip. The story doesn’t change that much.

McDonald’s earnings have gone up I think more than 80-fold over the last 30 years. The stock has gone up a hundred-fold. What made McDonald’s earnings continue to grow? If they just stuck with a cheap cheeseburger and cheap hamburger at lunch, they probably would have run into earnings problems 10-15 years ago. But they expanded their menu, they kept their costs low, they added breakfast, they went overseas. Every day they add two or three more restaurants. People thought there was no room for more McDonalds 5-10-15 years ago. They were wrong. If they had done the research, they would have said “Well there are a couple of hundred countries out there”. There are lots of places to grow.

Profiting from Chaos

Actual bad economic news, rising interest rates, wars, elections. Any of these can push the market down. If you are one of those people that pour over graphs, economic statistics or astrology charts, trying to figure out what the stock market is going to do next, you are wasting your time. No one can predict the market. You have to understand the market goes down. There have been 95 years this century, we have had 50 declines of over 10%. Of those 50 declines, 15 have been 25% or more. So about once every two years the market falls 10%, about once every 6 years it falls 25%. These are big drops. You have to understand that. That is the nature of the market.

In 1990, Saddam Hussein went into Kuwait. The banking system was in trouble. We had a recession. You had all his background noise. Lots of good companies that had nothing to do with wars, nothing to do with banking, they all went down in 1990. The market fell from 3000 and fell over 20%. This gave you a great opportunity to buy terrific companies at very good prices.

Behind every stock, is a company. If the company does terrific over a long period of time, the stock will do terrific. If the company does lousy, the stock’s going to do lousy. That’s all you are betting on.

There is a company that has had 35 years of double-digit earnings growth for every single quarter. We have had changes in supreme court, we had the stock market go up and down, we had changes in presidents, we have had recessions, we have had wars. All those things had no effect on Automatic Data Processing. So, every time the market went down, it gives you a chance to buy it.

You are saying I believe strongly that this company is going to do well. If you start to see symptoms that is not going to happen, the stock is going to very rapidly respond to that. If the company runs out of steam, the stock is going to run out of the steam.

Look at Fannie Mae. From July through October 1990, the standard & Poor’s 500 fell 21%. Fannie Mae fell from about $42 a share to about $26, even though earnings were still increasing. This was a terrific time to buy Fannie Mae. The company was doing well. Management was still great. The story was solid, and they had a very good business. But you got to buy the stock at a 38% discount.

Define Your Stock Picking Universe

If you start by looking at the entire universe of stocks, more than 3000 stocks on the New York Stock Exchange alone and over 13,000 public companies in total, you will blow a gasket. So, I break stocks into categories, partly to make the job of researching more manageable.

Putting stocks into categories is the first step in developing the story. At least you will know what kind of story it is supposed to be. The category tells you what questions you should be asking about a company. You simply can’t expect all stocks to behave the same. Basing a strategy on general maxims like sell when you double your money or sell when the price falls 10% is absolute folly. No formula will apply to all stocks. Different stocks behave differently. So, they require different approaches, different expectations and different kinds of stories. Suppose you have made a 50% gain on two companies. One is a fast grower with a long way to go and the other is a big lumbering slow growth company that is already saturated 95% of its market and that market itself is growing slowly. The 50% return is fantastic for the slow grower. The chances are it’s time to sell it. The same 50% return could be just the tip of the iceberg for the fast grower.

There are basically five categories.

- One would be fast growers

- Two would be slow growers

- Three will be cyclical

- Four will be asset plays and

- The fifth one would be turnarounds

At the end of this presentation you will have an opportunity to explore each category in more detail. In the meantime, remember, categories are guidelines. They are not hard rules. Some companies may not fit neatly into a category. Others may seem to be in two categories at once. Almost all companies change categories at some time throughout their lifetimes. Fast growers, if successful, will always eventually slow their growth. They will run out of places to go. Cyclicals, experiencing long down cycles may become turnarounds. Once recovered, they probably will be cyclical again. Use the categories as guides to help you build your story, but don’t let them limit the questions you ask or the research you do.

One thing we can say about companies in general. It is easier to go from $100 million in sales to $200 million in sales, than is to go from $10 billion in sales to $20 billion in sales. So smaller companies tend to have more upside potential than larger companies. But don’t dismiss all big companies out of hand. Some big companies defy their size and find exciting new ways to grow their earning. As well, good opportunities exist in companies that are cyclical, regardless of their size.

Fast Growers

When most people think about investing in stock market, they dream about investing in a fast grower. A company that is growing at over 25% a year. At 25% a year a company’s profits will double in 3, they quadruple in 6, go up 8 fold in 9 years. That is how you get a huge stock in a decade. There is not a lot of these, but they are very powerful, and the best part is, you don’t have to catch them just as they are taking off.

The beauty of growth companies is you have plenty of time. If you think they grow for 5 10 20 30 years, you don’t have to be there for the first year or the second year. You could have bought Walmart Inc. (NYSE:WMT) 10 years after they went public and made 30 times your money.

What makes a company grow earning so quickly? Either it is a rapidly growing industry, or it is a rapidly growing company in a slow growth industry. Rapid revenue growth and rapid earnings growth are the hallmarks of a fast grower. You just can’t buy any stock with hot earnings and hot sales. You have to check the balance sheet to make sure the company can keep growing. One way you can look at growth companies is to think of baseball. Normal baseball game has 9 innings. You should look at a growth company and say I don’t want to buy it when they are in the first inning. I want to buy it when they are in the second or third inning. They have got the formula right, they got lots of room to go. So you want to say to yourself this is a company that is very early in its cycle, like a McDonald’s when they’re only in a few stores or a Limited when they were only in hundred stores and they had lots of malls to go to.

Microsoft Corporation (NASDAQ:MSFT) was a company you could have bought 3 years after it went public. It made over 20 times your money. Sales and earnings were growing at several times the rate of the companies in the S&P500, in an industry that was exploding by leaps and bounds and it had a lot of potential both overseas and domestically. This was only the beginning of a 15 to 20-year growth cycle. You had plenty of time to get involved. There is this amazing company called Superior Industries International (NYSE:SUP). I think the stock went up over a hundred-fold. They were very good at making aluminum wheels. A lot of car companies went to aluminum wheels. The industry for autos wasn’t growing, aluminum wheels were growing dramatically, and they were the best at it.

Slow Grower

The fast growers get all the attention in the media, but there is nothing wrong with slow growing stock, provided you get it at a very decent price. Some would say to you, I am going to sell you a business for $100,000 and they are earning $50,000 a year. You say what is the bad news? You say, the bad news is that earnings are never going to grow. They going to earn $50,000 a year forever. So, this is a price earnings multiple of two. You pay $100,000 for $50,000 earnings. But they were never going to grow. You say, I don’t care. I’m going to get a $50,000 return every year. In two years, I get all my money back, then I make $50,000 a year on my hundred-thousand-dollar investment forever.

So sometimes, even for a company that has a very low growth rate in earnings, if the stock is selling at the right price, it may still be a very good deal. A slow to moderate grower will have earnings growth of 3% to 15% a year. One company that I was very lucky with was Service Corporation Internation (NYSE:SCI). It is a funeral home company that bought up local Family Funeral Homes, a very steady business. Service Corp could grow earnings at 15% a year when I owned it with very little problems.

A slow grower that turns into a no grower is a very bad news situation. So, when you start researching a stock, look for these signs.

- Steady earnings growth – You can find annual earnings growth rates in the research section as well as estimates for the coming year (through various sources).

- Rising dividends – Companies that raise their dividends each year have to have the earnings to do so. A rising dividend is normally a good sign for a stock.

- Room to keep growing – You want slow growers to go on forever. That is one reason I liked Service Corp International so much. This was a great stock to me in the 1980s. At that point it had a long way to go.

Cyclical Companies

Cyclical companies rise and fall with the economy. Typically, they make expensive big-ticket items that people buy when the economy is good. Things like houses, cars and furniture. When the economy is bad and people are worried about losing their jobs, they don’t buy big-ticket items. They are too broke or too scared that they will go broke. Don’t try to time a cyclical stock if you don’t have intimate knowledge of the business, if you don’t have an investor’s edge. Everyone in Wall Street tries to time cyclical stocks too. Because the stock market looks forward you could be left with a sinking stock even though the company’s earnings are terrific. You make your best money in a cyclical when earnings go from rotten to mediocre or from mediocre to pretty good. The danger point is when earnings go from great to spectacular. Somewhere between these two points, Wall Street will figure out there is only one way to go, that is for profits to go down some point in the future.

Just don’t buy in the hope. Wait for things to get better, prices to get better, capacity to shrink, inventories to go down, scrap prices to get better. Something ought to be happening. So, you just want to wait for something really to happen and then when it happens it is going to be big. Let us take a look at Chrysler.

In 1990, the company was selling for $10 a share. The economy was lousy. People were talking about Chrysler going out of business. But guess what – the economy came back; everyone’s old car was falling apart. As people made more money, they started buying new cars and because Chrysler had great products, the minivan, the Jeep and its first new full-size truck in 20 years, the stock was big. In addition, very importantly, the balance sheet was decent in 1990. This was not a company about to go bankrupt.

If it’s a cyclical, you are hoping for a dramatic turnaround in earnings. It is going to happen over two or three years. Earnings are going to go from a loss to huge profit. The stock is going to go up and you are going to get out. Make sure you are picking a strong company that can survive when the cycle goes down. That means good cash flow and low debt. If its cash flow is spotty or its debt is high and the downturn comes, the company faces the danger of going bankrupt.

Turnarounds

These are stocks that are battered down or they are hated companies, or they have been forgotten about, they are depressed price. But you have determined some one thing or a few things that have the potential for reversing this company’s fortunes independent of the industry getting better or the economy getting better. You will always have to do a balance sheet check on any company. This includes turnarounds. Do they have enough cash to make it through the next 12 months or the next 24 months? Do they have a lot of debt that’s due right now? These are important questions to answer. Make sure you understand and believe in the plan to restore corporate profits. It is all internal. They are doing something, either new product, new management, cutting costs, getting rid of something. Something inside the company that allows them to improve themselves.

Lots of turnarounds never happen, but a few winners can make up for lots of losers. What is important is to wait for the actual evidence of the turnaround occurring, not just the symptoms. The turnaround, you have plenty of time. So just don’t buy on the hope. Wait for the reality. Turnarounds are so big it is worth waiting to get some real evidence.

S.S. Kresge was a company going nowhere and in real trouble. They invented the Kmart formula. They rolled it out across the country. The stock went up over 50-fold. Kmart became a massive stock.

Look For Hidden Assets

Sometimes two and two equals eight. How could this be? Because a company has a hidden asset that is not reflected in the stock price. When Wall Street wakes up to the hidden assets, the stock could be terrific.

Want a great example? let’s look at Walt Disney Company (the) (NYSE:DIS). Walt Disney is an example of an asset play. After they opened up Disney World and after they have opened up Epcot, the company’s growth rate sort of slowed down. They were not growing very fast. And then they discovered there’s a lot of assets inside the company. There was a name Walt Disney. They started the Disney Channel. They started selling things that they sold at Disney World and the Disneyland, they started selling them everywhere. They use their licenses for Mickey Mouse and all their characters. Made a fortune on that. These are on the “books” for nothing. The company was loaded with assets. In addition, they had all that land inside of Disney World. Everybody had hotels outside of Disney World. They decided to use their land inside to develop more parks and they even had other companies come – these companies paid them money to build inside Epcot or inside of areas of Disney World.

So, what are hidden assets? Many companies, particularly old-line companies, companies that have been around 20 40 50 100 years or more, have real estate holdings whose true market value is not reflected on the balance sheet in the annual report. In many cases, the hidden asset is the company’s name and its reputation. Disney is one example of a company with a great name, so is Coca-cola Company (the) (NYSE:KO). That name can be a huge asset when the company rolls out a new product. This name is carried at little or no value on the balance sheet, whereas it is incredibly valuable. Companies like Intel Corporation (NASDAQ:INTC) and At&t Inc. (NYSE:T) not only make great products, but they have numerous patents for these great products. As long as they have those patents, no one can make the exact same product. That is a tremendous aid in any business.

Back in 1987, when the stock market had a major correction, Dreyfus fell to below its price of cash per share. The stock fell from over $50 to under $20. At that point it was selling for less than its cash. Anytime you buy a stock at less than its cash after subtracting all debt and it has good business, you are getting something for nothing.

Valuation Items

Earnings Matter

The price of a stock will follow the direction of earnings. In almost every case you can generally state, if the company’s earnings go up sharply, the stock is going to go up. If earnings go from very poor to mediocre the stock is probably going to rise. If they go from mediocre to good it’s probably going to have another rise, if it goes from good to excellent it’s probably going to have another rise. Or if a company’s earnings grow dramatically over a long period of time, the stocks probably going to go up dramatically.

Even if you have a Waterford Crystal Ball, you probably can’t predict a company’s earnings. But Wall Street is a whole army of people and make such predictions. By computer you can get Wall Street earnings estimates in the research section of the stock shop or through many other online services or you can go to your local library and find earnings estimates in Value Line or Standard & Poor’s. Obviously, you want to invest in companies whose earnings are expected to rise, but again these are just estimates. If you really understand a company, you should know how it plans to make earnings rise. If you know it has good growth prospects, then you will be better able to evaluate the company as an investment. You can’t predict the future, but you can learn from the past. A company with a long history of earnings increases and dividend increases is obviously a stable performer that has a reasonable chance to continue to perform well in the industry. Many times, that’s a good company to investigate further. Johnson & Johnson (NYSE:JNJ) Has raised its earnings something like 19 in the last 20 years. It has raised its dividend over 30 years in a row. But just because a company has had a great record in the past, does not mean earnings will grow terrifically well in the future. You have to have reasons for it. Strong growth and research and development, cost cutting, new products, great brand name and a terrific balance sheet were the items that made me optimistic about Johnson & Johnson. What was the outlook that it is going to keep continuing to grow? If they run out of steam, the stock is going to run out of steam.

Price earnings ratio (P/E)

The price earnings ratio (P/E) is something that some people make very complex. It is actually very simple. If a company is selling for $100 a share and they are earning $10, is has a price earnings multiple of 10. The P/E ratio can be thought of as the number of years it will take the company earn back the amount of your initial investment, assuming of course that the company’s earnings stay constant. Why look at P/E? It can tell you if you are paying too much for a stock. The higher the P/E, more expensive the stock relative the company’s future earning power. The lower P/E, the cheaper the stock. I use a rule of thumb to level out these differences.

- A fairly priced stock has a P/E that is about equal to the expected annual growth rate over the next three to five years.

- If the P/E is substantially higher than the growth rate, the stock is normally expensive.

- If the P/E is substantially lower, stock is probably cheap.

A stock’s PE, in part, depends on the industry it is in. When you look at a growth company, compare the company’s growth rate and its own P/E to that of the industry. All other things being equal, if you find a company with a much lower PE and a higher growth rate you are off to a good start. You can also compare a company’s PE to its own historical P/E. If the company normally sells for 25 times earnings, and now it is selling at 15 or less, you have to ask yourself why. The company could be maturing. Competition may be entering the field and its growth prospects may be uncertain. But maybe it’s simply been beaten down by some other factors and it is possibly a bargain. It is worth researching.

Back in the 1970s, Electronic Data Systems or EDS had a P/E of 500 times earnings. If you would have invested in a company with a P/E this high when Columbus discovered America and the company’s earnings stayed constant, you would just be breaking even today. In 1974, EDS performed very well, but the stock fell from 40 to 3, simply because the stock was so grossly overpriced relative to current earnings.

Dividends

Dividends are cash payments the companies make to the shareholders, usually every quarter. Nearly half the return the S&P 500 over the past 50 years has come from dividends. Dividends come from profits. If a company earns five dollars a share, they have the choice of paying out some of it to the shareholders in a form of a cash dividend. A stock’s yield is the annual dividend payout divided by its current price. The yield is the return you get on your investment every year.

One drawback – The IRS considers dividends as income. So, you have to pay taxes on dividends. Not all companies pay a dividend. Fast growers for example, almost never pay a dividend. They reinvest all of their earnings back into the company. Slow growers tend to pay out profits in dividends. It is their way of rewarding shareholders. Over time those dividends can add up. Some people have bought stocks for $5 a share and 20 years later they are getting $10 a share of dividends per year. Dividends do make a difference. Dividends are a great way to measure a company’s success, particularly a slow growing company. When a company raises its dividend every year, it raises the bar for its financial performance for the years that follow. Few companies want to cut their dividends. Investors clobber the stock, figuring a dividend cut is a sign of worse things to come. So, by raising a dividend 12 to 15% this year, the company is saying it expects earnings to be at least as good next year as they are now and probably rising by at least to 12 to 15%.

You can get a list of companies that raise their dividends many years in a row from Moody’s. There are some great names in this list. However, you can find warning signs in the dividends as well. A high yield isn’t always a good thing. If a stock is $30 and it is paying a $3 dividend, you might say wow that’s terrific. A 10% yield. But if the earnings are only $3.10 a share, then the company is essentially paying out all of its earnings in dividends. That is only ten cents to expand or to invest in more efficient equipment. If this continues for a number of quarters or years, the company will have very little room for any errors or setbacks. Eventually, the company will probably cut back or totally suspend its dividend. The stock price is going to tumble with it. Be careful with high-yield stocks, particularly when they are paying out a very high percentage of their earnings.

Balance Sheet

Any company’s operations can hit an air pocket from time to time. You have got to make sure your company can survive tough times. The balance sheet tells you about the company’s financial structure, how much debt it has, how much cash it has, and how much equity its shareholders have. There is nothing scary about a balance sheet. No story is complete without a check of the balance sheet. The basic concept of a balance sheet is that everything a company owns, its assets, are listed on one side. On the other side you find everything a company owes, its liabilities. The difference between what it owns and what it owes is its equity. Also called its net worth. Go ahead and explore this fictional balance sheet. Click any of the items on this balance sheet for an explanation of it. When you are ready to move on, click either the debt or cash buttons for a discussion of the two most important items on any balance sheet. Does the company have a lot of cash on hand, that’s great? A company with a lot of cash can buy more stock, make an acquisition or pay off all its debt. All moves that shareholders love to see. A company should have at least enough cash to pay off its short-term debt. If it doesn’t, it could have to keep borrowing more and more. If you subtract cash from short-term debt and long-term debt and the total is only one quarter of net worth, the company has a decent balance sheet. However, if short-term debt and long-term debt combined minus cash equals or exceeds net worth, then the company has a weak balance sheet. It is simple to recognize a strong balance sheet. No debt and lots of cash. Suppose a company has 20 million dollars in cash after subtracting all debt. If the company has 4 million shares outstanding, it has 5 dollars of cash per share of stock. If you buy the company at $10 a share, you are paying only $5 for the company and you are getting $5 a share in cash. That is a really amazing price. In fact, that means your real price is $5. If this company has a very solid predictable business, this extra cash is quite valuable. But if the company has lots of cash and is losing money, you still have to evaluate how quickly will they run through all that cash. That is all you really have to know. It is not much, but you should know it. You can look it up in the stock shop. If you don’t check your company’s survivability, you are not only skimping on your research, you are gambling. That is not why you invest in the stock market.

Check the debt. Most companies have some debt. But how much is too much? Add up the company’s long-term debt and total equity. That’s a good approximation of the company’s total capitalization, the money the company has available to grow its business in the future. Now, compare the long-term debt to total capitalization. If total debt equals half of the company’s capitalization or more, beware, that’s quite a bit of debt. To service that much debt everything has to work right. Things don’t always work just right. If debt equals 20% of capitalization or less, that is better. That’s fairly low debt. As usual, there is no rule without some exception. Debt in some industries like banking insurance and financial services routinely runs much higher than 20 to 50 %. Know the industry and what is normal for it when you evaluate a balance sheet. In many industries such as retailing and restaurants, companies have leases. They have commitments on buildings to rent for long period of time. Often, this form of debt will only appear in the footnotes. This is a very substantial form of debt. Look into the footnotes. See if you can see capitalized lease obligations. Add this back. This is an important exercise.

How To Increase Earnings

5 or 10 years ago, investment professionals had a big edge. They got more research and information than small investors and they got it sooner. But those days are long gone. Basic financial information is readily available from a dozen or more of different sources. Investment pros aren’t digesting all the good information and throwing just the scraps to the public anymore. Everyone has a seat at the table right now. Here are some places to get started. If a balance sheet provides a snapshot of a company’s financial position, an income statement tells you how the company got there. Income statements tell you how much money the company made or lost from its operations over some period of time. The basic formula is simple. You are asking how things went over the period, usually a quarter or a year. Over that time, you add up all the money the company brought in from selling products or services, then subtract all of the money the company spent to create those products or deliver those services. What is left is the net income. Net income is also referred to as earnings or profits. I hope by now you have been convinced that your story should always include an explanation of how the company plans to improve its earnings or to sustain its growth rate over time. There are only two ways for a company to increase earnings. They can increase sales or reduce costs. Most companies work to do both of these things. The income statement can help you figure out if the company is succeeding. Click any of the items on this income statement for an explanation of it. Once you have explored the income statement, click on increase sales or reduce costs to explore those topics some more.

Reduce Costs

If earnings equal revenues minus costs, then a valid way to raise earnings is to reduce costs. Reducing costs not only pushes up the earnings number, it makes a company more competitive. If two companies, both produce competitive products of similar quality, then the one who can build it more cheaply has the advantage. They can choose to charge less for the product and sell more than a competitor or can sell it for the same price and make much more money than their competitor. One way to measure cost reduction is to check out the costs listed on the income statement each quarter. But it is difficult to do so, because what you really care about is how costs are changing relative to revenues. One way to measure this cost of revenues is the profit margin. This number is not shown on the income statement itself but is calculated for you in the research section of the stock shop.

To calculate the number for yourself, just divide the earnings before taxes by the net revenues. The higher the profit margin, the more money the company makes for each product it sells. Once we have the profit margin as a tool, we can evaluate how successful the company is being in reducing costs. Unless the company has raised prices significantly, if the profit margin goes up then costs are going down relative to revenues. You can compare the profit margin of the company to the profit margin of a competitor or to the average profit margin of the industry. When a company that is highly profitable already must depend on cost-cutting to boost its profits even further, you have to be skeptical. If its profit margins are unusually high compared to the rest of the industry, there is a limit to how much additional profit it can squeeze out of the business by economizing. Ask yourself. Is there a long road of margin cutting ahead or are they already extremely efficient? Your goal is to feel as confident as possible with your story.

Increase Sales

How does a company plan to increase earnings? Sales growth is a single most important factor in growing earnings long term. So, you must ask yourself how the company is going to make sales rise. The company can expand its customer base. Selling its existing products to new customers brings in new revenue. When evaluating this strategy, consider how far the company is from saturating the market or its products. If a company is already selling to 98 % of its potential customers, there aren’t a lot left to reach. The company can introduce new products into its existing customer base. This is the most difficult, but potentially the most rewarding strategy. If the product catches on it can breathe new life into the company. Advantages like brand names and a good reputation come in very useful here. A company can also raise prices to increase revenues. That way, even though unit sales stay constant, revenues will still grow. Of course, the danger of raising prices is that the higher prices will drive customers to competitors or encourage new competitors to enter the market. The details of a company’s plan will vary by industry and by individual company. Just make sure you understand that plan and include it in your story.

Risk vs. Reward

Once you have built the story for your company, you have a powerful tool for judging the stock. But like any powerful instrument, you must use it wisely and carefully or you will get burned. Use your story to pick the right time to buy a stock. I promise you that the right time to buy a stock does not occur often. When I am following a stock, buying opportunities present themselves once or twice a year if I am lucky. I look for times when the potential upside is high and the potential downside is reduced. Understanding that balance is a key to successful stock investing.

You have to understand, stock picking is a risk reward trade-off. You have to know how much you are going to lose if you are wrong and how much you are going to make if you are right. The skill is to minimize your risk and maximize your reward. You can be wrong in this business. I have been wrong quite a bit. But you can be wrong and still make money as long as you have good stocks that more than offset your mistakes. I figure if I could be right 6 times out of 10, that’s a good batting average. When I pick stocks, I think of risk as a measure of my confidence in the story I have built. When I feel that my story is optimistic, solid and well researched then I have got a low-risk investment. If I am not too sure about how the story will turn out, then the risk is considerably higher. Don’t try to categorize risk by other measures, like small companies are riskier than large. In the late 1970s or the early 1980s Walmart was a lower risk investment than IBM because the Walmart story was nearly bulletproof. If a start-up company sounds exciting keep an eye on it. Perhaps a year or two later it will be over the hump, the story will be solid and there is a good time to consider investing. If you believe strongly in your company’s story, then you should not waste your time waiting for the ultimate buying opportunity. Investors who bought McDonald’s in the 1970s or Home Depot in the 1980s were happy almost any time they bought the stock. Even with these great companies during stock market corrections, the stock dipped and the story was solid. But if you held on for a reasonable amount of time you are a very happy camper.

Watch out for ridiculously high prices when a company is selling at several times its growth rate and earnings. Remember that’s what we talked about in the price earnings presentation. But in general, if a story is good you probably want to own it. Later, if a buying opportunity comes along, the stock falls well below its growth rate and the story hasn’t changed you can buy even more. Therefore, you can take advantage of market declines. Use the tools I have presented in this consultation to help make a judgment on your stock. If the story is sound, check the price, use the P/E ratio. Most importantly rely on your edge first to build your story then to find the right times to add or reduce your position.

Focus on the company. What is it making? Where is its money coming from? What is the competition doing? Ignore all the background noise. Just keep checking that fundamental story, see if it is valid, see if it is getting better, see if it is getting worse. Know what category your stock is in and how those stocks behave. If your stock isn’t behaving as you expect, try and find out why.

Be Prepared

If the answer changes the story, then think again. Keep your story up-to-date. Don’t check on it three times a day, but don’t just ignore it either and checking the price of the stock does not count. It is checking the fundamental story. Don’t expect to make a ton of money overnight. The stock market does provide the highest return for long term investments. But that’s not a month or two months a year. If you need the money next winter, you don’t have the tolerance to keep it tied up for the long term, then stocks may not be for you. Don’t forget to use your edge. These are all kinds of things that you know about because of where you live, what you do. You have lots of edges. Use them.

And finally, remember that stock picking isn’t gambling and it isn’t for everyone. You have to be prepared to do some work. You have to be prepared for market declines. If you enjoy doing research, enjoy learning about companies, you have the stomach for the ups and downs of the stock market, then investing can be a lot of fun. These principles of investing worked well for me. I hope they can help you.

you should not be intimidated. Everyone can do well in the stock market. You have the skills, you have the intelligence, it doesn’t require any education. All you have to have is patience, do a little research, you’ve got it.

To start researching your stocks, just click on research and remember that you can come back to consult Peter at any time.

Host:

Stock Shop

Welcome to stock shop where you can learn to pick stocks, research them and follow your favorites. The consultation part of the shop is where Peter Lynch explains how he thinks about stocks and how he makes his choices. These multimedia presentations describe some of the key concepts that will help you construct your portfolio. Just select the presentation of your choice from the list on the left and click the start button to share Peters thoughts and experiences. The research section is where you can create a list of companies that you want to research. You can download current data on any number of stocks and get Peter’s guidance on what to look for next and you can start to compile your own story for every stock you follow. Just select a stock and click on “details” to view the fundamental data about your stock.

And finally, at the bottom of the screen are all the tools you will need to explore and keep track of your discoveries in the stock shop. And now you can either select one of Peters personal presentations or if you want to get to work go straight to research.

Back to Lynch

A Good Story

You can’t just go out and buy a stock and hope it goes up. You have to have a reason why you think a stock will go up. You should be able to tell those reasons to someone else in just a few minutes. People who love stocks don’t talk about sports, they don’t talk about their dog, they talk about stories. A story is what is happening inside a company and signs that point to what is likely to happen in the future. I will be able to put it down in two paragraphs. It could be something like earnings are turning around, a new product, somebody’s gone out of business that was competing with them, they have just discovered oil, they have a new management, is their balance sheets getting better, they are getting rid of a losing division. There is a lot of different elements, but that’s what a story is and that’s what you rely on.

A good story is one that you could tell a fifth grader and he or she would understand. The more complicated the story more likely it is to fall apart. You just need one good simple story to buy a stock and then follow that story. Read through the story that I wrote for Toys “R” Us back in 1978. You didn’t need a degree from Business School to realize this company had a great formula and had lots of room to grow. The thousands of people who shopped there knew the store was great. I did the rest of the research I needed to fill in the story and bought the stock. Building stories like this one is how I decide what companies to own and which ones to stay away from. Remember that stories unfold over time. Companies are never stagnant. So, you have to stay tuned and sometimes make adjustments. Just like playing seven card stud poker or perhaps twenty-seven card stud poker, at the beginning of the game you only know some of the cards. You must place your bet accordingly. As each new card is revealed the game changes. You are forced to alter your betting strategy, perhaps even drop out of the game altogether.

Peter’s Lesson Plan

In the rest of this consultation I will show you how you can build stories for companies and invest more prudently in their stock. This consultation is divided into three sections. The assessment section helps you decide whether stocks are the right investment for you. Stock picking is not for everyone. These presentations will help you assess yourself.

In the story creation area, I will cover the basic concepts you need to create your story. You will learn how to approach a company’s story and why you have some advantages or even the most dedicated investment professionals.

In the last section we get down to brass tacks, talking about the actual elements and numbers you’ll need to include in your story. Use the start and next presentation buttons to move through the presentations in order or explore on your own using the list on the left. When you’re done, you’ll know how to build a story, how to monitor the key elements of the story and how to use that story to improve your understanding of when and when not to invest in a company stock.

You may find that stock picking is not right for you. At least not until you feel more comfortable with the risks of the market and the volatility of stocks. Even if this is the case, the Stock Shop can still help you become more comfortable with the stock market and researching companies. Use the stock shop to follow companies in a paper portfolio, a list of stocks you buy and sell only on paper. You develop your stock picking skills without taking any of the risks. Before long, you may be ready to start investing your real hard-earned cash.

Mutual Funds, A Viable Option

In the meantime, if you’d like to invest in stocks your best option may be an equity mutual fund. If you want to put some of your money in the stock market and you don’t have the time you are not willing to put in the effort, you don’t have the stomach to do the research, equity mutual funds are a great answer. Investing in mutual funds is also a way of making sure your investments are diversified. Mutual funds by law must invest in at least 20 stocks at a time, though most funds invest in far more than that. As a mutual fund investor, you are protected from the danger of one or two stocks dropping sharply in price. At most, they would only represent 5 or 10% of the fund. This would cushion the decline. Remember, the mutual funds are like any other investment, they carry real risks of losing your money and even though they can be purchased through many banks, they are not insured by the government. Since they are made up of individual stocks equity mutual funds are also volatile. You must do some research to evaluate and choose a mutual fund that will meet your temperament and your investment objectives.

CK

Hello, thank you for the great information which you have shared.

Would you if Peter’s stock shop is available still for purchasing?

GeoTeam

CK, sorry for the late reply. I’m sure you can find the book used somewhere. Or maybe a digital copy. A local bookstore might be able to help you out too. Good luck in finding a copy!!