On September 8, 2016, the Minister of Finance in China issued an announcement regarding an investigation and suggested punishment for five companies that were found to defraud the Chinese government for electric vehicle (“EV”) subsidies. This may

Bloomberg reported this incident and listed those five companies’ names. They are: Gemsea Coach, Chery Wanda Bus, Shenzhen Wuzhoulong Motors Group, Higer Bus Co. and Shaolin Bus. Serious fines are going to likely be coming for these companies. For example, Gemsea Coach may be cancelled for national subsidy eligibility, and all of the produced EVs in 2015 may not be subsidized, potentially clawing back the entire national subsidy already paid to the company in 2015. For the other 4 companies, the government may claw back the national subsidy received for the 2,416 EVs they sold and may issues fines. These 4 companies’ eligibility of receiving national subsidies will likely be taken away effective 2016.

Today, new light was shed on this issue when a Chinese article from Sohu Finance added more color. According to the article, the reporter obtained a so-called [paraphrased] “Important Information Notice” that has been circulated within the new energy companies’ circle. According to the Notice, in addition to these 5 example companies that were on the list announced in the MOF’s statement, there are many more companies that are involved in this potential subsidy fraud.

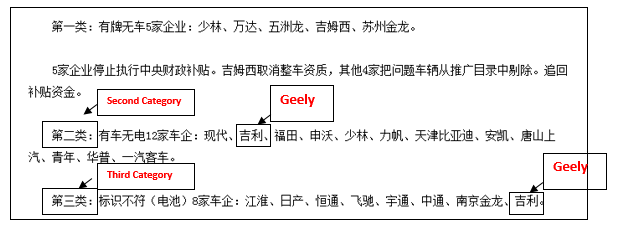

In this Notice, the first category contains all 5 companies mentioned in the MOF’s statement. The second category was for vehicles that were found to have no batteries or have their batteries potentially moved. The third category is for vehicles with batteries installed that do not match what the company claimed. The second category has 12 auto companies’ names and the third category has 8 companies’ names under it.

Geely’s name showed up in both the second category and third category reported in the article, as you can see from the below translation.

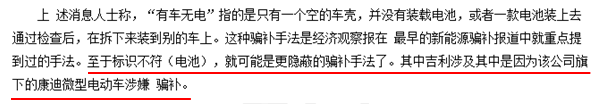

The article cited a person familiar with the matter regarding the third category. The person commented that using a battery that isn’t what the company has claimed is a more subtle way to cheat the subsidy. According to the article, the reason why Geely is involved is because the company’s Kandi micro electric vehicle is suspected as defrauding this subsidy (see red line highlights below).

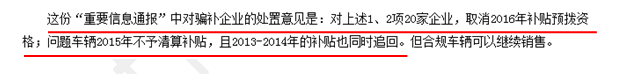

The suggested punishment for these 20 companies, according to this Notice in the article, is that the 2016 subsidy pre-pay eligibility is cancelled, the questionable EVs’ subsidy in 2015 will not get paid and the subsidy received in 2013 and 2014 could be taken back by the government. EVs by these companies not found to be in violation are allowed to continue to be sold.

At the end of the article it states that no government authority has confirmed this Notice. If this Notice is real, and Kandi (NASDAQ: KNDI) and Geely are involved with this national subsidy issue, then KNDI could face serious repercussions, as the company might need to pay back all of the national subsidy money received in 2013 and 2014. Additionally, the subsidy the company could receive in 2015 might now be up in the air. If 2016 subsidy eligibility is to be cancelled due to this subsidy defrauding issue, the company’s guidance for 2016 might be materially negatively impacted.

One caveat is that we have not vetted that the Geely mentioned in this article is the Geely JV with Kandi, although the article states that the scrutiny on Geely is due to Kandi’s micro electric vehicle.

Our preliminary analysis regarding amount of subsidies received by the 50/50 JV Company between Geely and KNDI, Kandi Electric Vehicles Group Co., Ltd., is as follows:

| (in USD millions) | 2013 and Q1 2014 | Q2 2014 | Q3 and Q4 2014 | 2015 | total |

| National subsidy received | $31.8 | $31.8 | $44.3 | $59.6 | $167.5 |

As you can see, $167.5M in USD could potentially be at risk. As of the Form 10-Q from Q2 2016, Kandi is reported to have about $34M in cash in USD. We look forward to a company comment on this matter.

DISCLOSURE: We have established a speculative short position.

Bill Watts

Kandi President Hu in a Bloomberg interview said Kandi was cleared of any suspicion in the PRC subsidies cheating investigation.

Payment of subsidies to all EV manufacturers has been delayed by the subsidies cheating investigation. This has suppressed Kandi’s stock price. Kandi (Nasdaq: KNDI) via its Kandi JV (with Geely) is due to receive approx $110M PRC subsidy check for 2015 balance of 16,120 EVs + a similar amount as prepayment for 2016. For perspective, this is equivalent to approx 80% of Kandi’s market cap.

Bill Watts

Link to Bloomberg interview: tinyurl .com/ hbzzuqj

(copy-paste and remove spaces)