On October 17, 2018, Form 4 insider transactions by the CEO of Ever-Glory International Group, (NASDAQ:EVK), where he made a direct purchase of 174,800 shares, prompted us to add the stock to our model swing trade portfolio at $3.25.

While the core focus of our strategies does not revolve around swing trading or day trading, our decision to do this was greatly influenced by our research which revealed that this significant purchase ($524,000) was the CEO’s first ever direct purchase of EVK since going public through a reverse merger in 2015.

In March 2018, we published an article, Insiders Are Betting Big On These 4 Stocks, and So Am I, briefly highlighting select stocks covered on our premium website, where insiders were backing up the truck. This four stock “portfolio” was up 145% at its peak and is still is up 30%, even after the market rout over the last 2 months.

Overall, we are beginning to see massive amounts of insider buying taking place in microcap names that have been decimated during the current market downturn.

We Don’t Mind Beating This Dead Horse

In our recent articles and research, we have emphasized multiple times the power of tracking insider transactions through Form 4 SEC filings. To brush up on the fundamentals and the codes in Form 4 filings, please refer to our write-up “Form 4 Filings: Insider Buying 101”.

Understanding the codes displayed in Form 4s is important because, as an investor, you want to distinguish between direct insider purchase/sales and indirect transactions related to things like options, warrants and compensation. You want microcap CEOs you invest in to have some skin in the game. This is especially true today with so much uncertainty in the market.

As usual, the media is scaring us by perpetuating the narrative that a recession is looming. The market rout that began in October has crushed microcaps more severely than larger cap stocks:

Cramer is on the air spreading rhetoric that the CEOs of bloated big caps are signaling weakness and recession fears. I prefer to look to the CEOs of microcap companies for answers. Even if we are heading into a recession, certain microcaps we cover are serving special niches of the economy that can thrive.

The delay in investor reactions to positive developments is greater than ever in microcaps and provides us with endless information arbitrage opportunities. For instance, take a look at medical device company Repro Medsystems (OOTC:REPR), one of our top performing Model Portfolio holdings. It took the market nearly 23 months to join Board Member Joseph Manko of Horton Capital Management, who had been buying REPR hand over fist in the 30 to 50 cents range. He is still aggressively buying to this day as high as around $1.50 and the market seems to still be ignoring him, as he makes up a good deal of the stock’s trading volume.

This article will focus on diving deeper into Form 4 filings to help guide you through SEC filings swiftly and efficiently as you look for microcap stocks to possibly add to your portfolio.

Going Beyond the Codes of Insider Transactions

As discussed in our original Form 4 article, SEC.gov is not the most user friendly site when it comes to locating certain information needed to make superior investment decisions. However, this can be your advantage over other investors who cut their SEC filing research short out of laziness or frustration. Gse Systems, Inc. (NASDAQ:GVP) and Evans & Sutherland (OOTC:ESCC) were two stocks we used in our initial Form 4 article to help us understand the codes. Insiders at Evans & Sutherland (OOTC:ESCC) are now starting to buy shares as the stock approaches its cash per share value of around $0.63. But let’s reference EVK to continue down the path of Form 4 arbitrage.

EVK is the product of a U.S. Listed China reverse merger transaction that took place in November 2005. The company:

“is a retailer of branded fashion apparel and a leading global apparel supply chain solution provider. Ever-Glory offers apparel to woman under its own brands “La go go”, “Velwin”, “Sea To Sky” and “idole” and currently operates over 1,300 retail locations in China. Ever-Glory is also a leading global apparel supply chain solution provider with a focus on middle-to-high end casual wear, outerwear, and sportswear brands. Ever-Glory serves a number of well-known domestic and international brands and retail stores by providing a complete set of services of supply chain management on fabric development and design, sampling, sourcing, quality control, manufacturing, logistics, customs clearance, distribution, and etc.”

The stock trades at a low P/E ratio of 4.6x and well below its tangible book value of $6.63.

However, I am in no hurry to invest in U.S. Listed China stocks given the large amount of fraud associated with many of them. If you are curious about the work we did to uncover a good deal of this fraud alongside investors such as Carson Block at Muddy Waters Capital, Andrew Left at Citron Research and Sahm Adrangi at Kerrisdale Capital, you can reference the article “The Evolution of China Reverse Mergers” and the documentary The China Hustle, produced by Mark Cuban and directed by Jed Rothstein.

I became interested in diving into EVK when my trading platform alerted me of a Form 4 purchase totaling 174K shares by the Chairman and CEO, Edward Yihua Kang. I quickly headed over to SEC.gov to retrieve EVK’s filings.

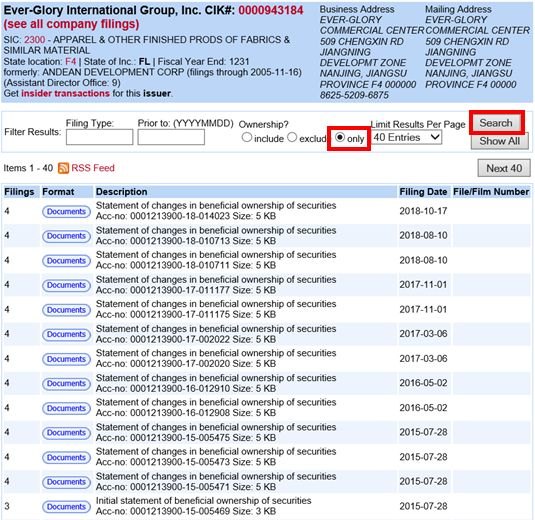

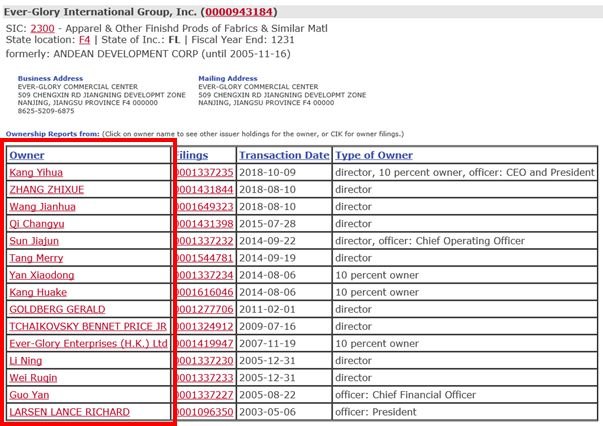

After selecting “Ownership Only”, we are left with a long list of Form 4 filings, covering transactions, significant shareholders and insiders. Here is a look at this Form 4 “master” page for EVK:

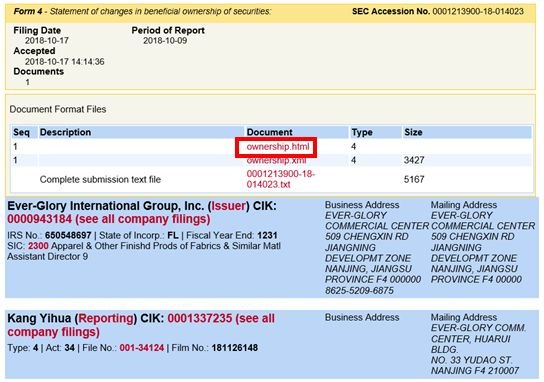

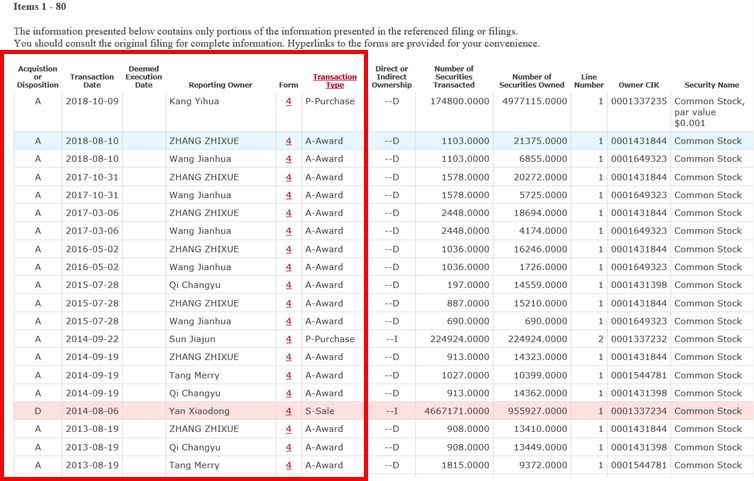

Here is a look at the page after selecting the Form 4 related to the CEO’s purchase disclosed on October 17, 2018:

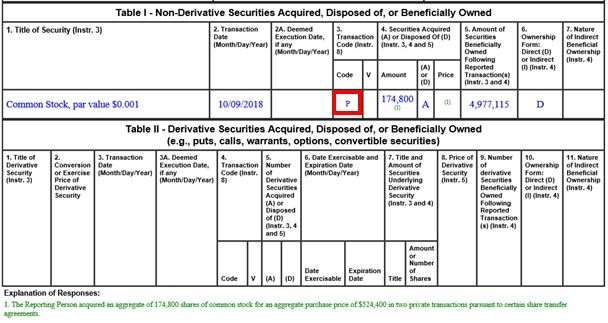

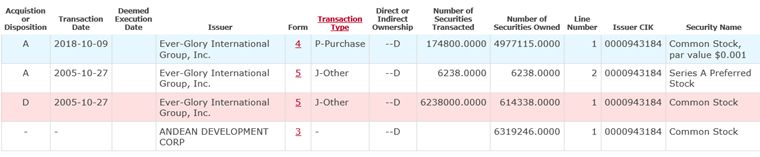

And, finally, here the actual Form 4 after selecting the first link under the document column:

As we can see from the code, “P”, Kang executed a direct “skin in the game” purchase of 174,800 shares, putting his total ownership at 4,977,115 shares, or ~33% of the total outstanding shares. The note at the bottom of the Form 4 reveals that the Chairman acquired his shares for $524,400 in two private transactions, which works out to ~$3.00 ($524K/174K shares). We really like when insiders take out big sellers in private transactions. It’s a great way to quickly eliminate upside resistance.

Although this activity quickly captured our attention, what really sparked my interest was that we identified this buy as the first major purchase of shares by the CEO since its early reverse merger in November 2005. Shortly after the Form 4 disclosure, the stock price moved up from $3.00 to hit a new high of $4.20, helped along by strong Q3 financial results on November 8, 2018:

- Sales of $125 million vs $120.3 million in the prior year

- Non-GAAP EPS of $0.21 vs $0.08 in the prior year

How did we come across Kang’s insider transactions history?

Rather than going through the list of Form 4s, one by one from the “master” page, there are a few ways you can actually round up a summary of all insider transactions onto one page and group transactions by individuals.

Research Path #1

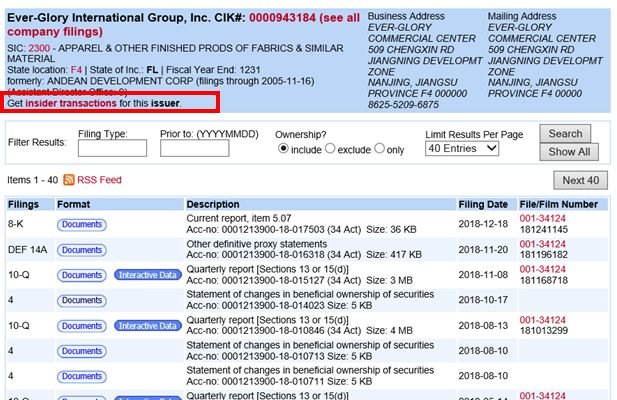

From the Company’s filing page click on insider transactions in the header:

This will send you to a summary page with a table listing EVK insiders and significant owners (Insider Table), along with a table listing all their Form 4 insider transactions (and their codes) as it relates to EVK (Detail Table).

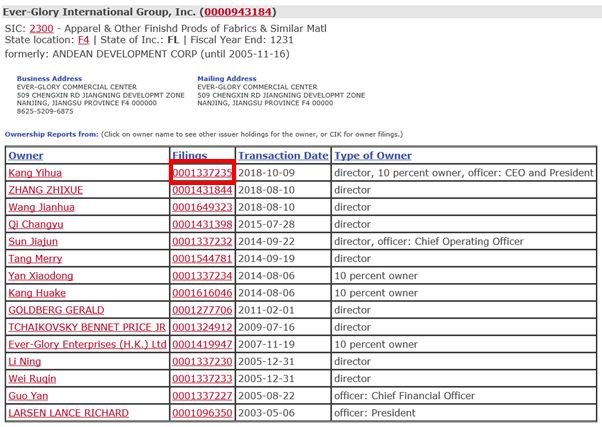

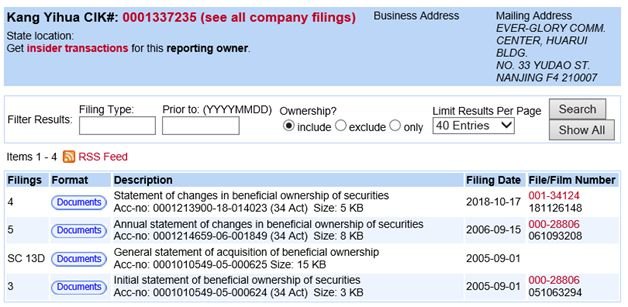

If your are curious, by selecting the name of an owner from Insider table (in this example, (Kang Yihua), you will be able to filter results to isolate all his/her activity (consolidated activity log) across all public companies they have transacted in…

… and by selecting a specific filings link…

…you see a list of all the documents filed (including ownership forms) ever filed by this person.

Research Path #2

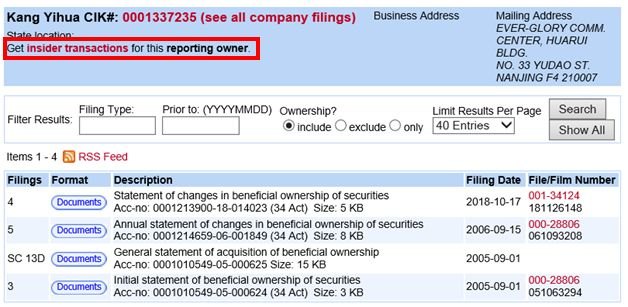

The steps in path one can also be initiated from the that lists all company filings by selecting the insider transactions link for the reporting owner.

Research Path #3

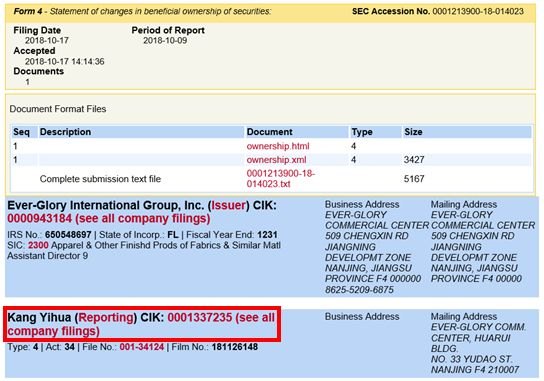

The consolidated activity log and consolidated Form 4 logs are also accessible if you select a Form 4 from the “master” page, which takes you here:

…and select “reporting” and “see all company filings”.

Conclusion

As we can see, until now, CEO Kang Yihua hadn’t made a single open purchase of stock since the reverse merger days (where the issuer was still shown as the shell company, Andean Development Corp, EVK eventually merged into).

Peter Lynch once stated:

“Insiders might sell their shares for any number of reasons, but they only buy them for one: They think the price will rise.”

Though our due diligence isn’t exhaustive, and regardless of our lack of deep dive on-the-ground due diligence on EVK, as well as Chinese reverse merger frauds that have surfaced over the years, form 4 disclosures accurately signaled and preceded a near-term increase in share price in EVK, and has us watching the stock more closely.