This transcript is referenced from Maj’s piece on emotion and investing, and using Lauren Templeton’s approach she elaborated upon in her Google Talk in March of 2017 on getting to know your brain as a basis from which you can start to learn how to manage your behavior. You can see this post here.

Thanks for having me speak today. I am very excited to join you here. I run a registered investment advisory firm, located in “Lookout” mountain Tennessee, which is that satellite community in Chattanooga. And I am focused exclusively on global value investing.

So, most people when I can speak to them want to know a little bit about my very famous great uncle Sir John Templeton. He pioneered global value investing. Now I know that a lot of you are younger and may not be very familiar with his career, so I thought we would hit some of the highlights.

[layerslider id=”38″]

So, Uncle John was born in 1912 in a tiny town in Tennessee called Winchester Tennessee. It is where I grew up and it’s where my parents still lives to this day. He was the youngest of two sons.

He left Winchester Tennessee to attend Yale University. It was during the Great Depression. And during his time at Yale University, he received a letter from his father, my great grandfather, saying that he can no longer afford college tuition, even to the tune of one more dollar.

Uncle John often remarked to me that that was one of the best things that ever happened to him in his entire life. Instead, he went out and got several jobs and also started playing poker. And he was a very good student of probability. But he graduated from Yale University in 1934 at the top of his class. He was president of Phi Beta Kappa, which is the oldest and most well-known honor society in the United States. He was the recipient of the Rhodes scholarship and he went and attended Balliol College at Oxford, where he graduated with a degree in law in 1936.

He left Oxford on a trip around the world with a friend. They visited 27 countries and it was a trip that shaped his view point for many years to come. He ended up at the 1936 Olympics in Berlin where he saw the building contingency of Nazi soldiers.

He was known as pioneer in value investing and international investing. Money magazine named arguably the greatest stock picker of the 20th century. Before he died he gave most of his wealth to some foundations. The Templeton foundations which fund the world’s largest cash prize. So the Templeton foundation gives out the Templeton prize once a year and it always exceeds the Nobel Prize because he was after all an intensely competitive person and he wanted it to always be the world’s largest cash prize.

Lots of interesting people have won the Templeton prize and it’s given out for progress and spirituality and religion.

Now, I like to start off my presentations with a few of his quotes and just to familiarize yourself with his investment strategy if you are not already familiar. First:

- “Major cause of higher prices is higher prices. But when the trend is reversed then lower prices lead to still lower prices. To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards.”

- “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell.”

- “An investor who has all the answers doesn’t even understand the questions.”

- “If you want to have better performance than the crowd you must do things differently from the crowd. “

And lastly:

- “People are always asking me where the outlook is good, but that is the wrong question. The right question is where is the outlook most miserable.”

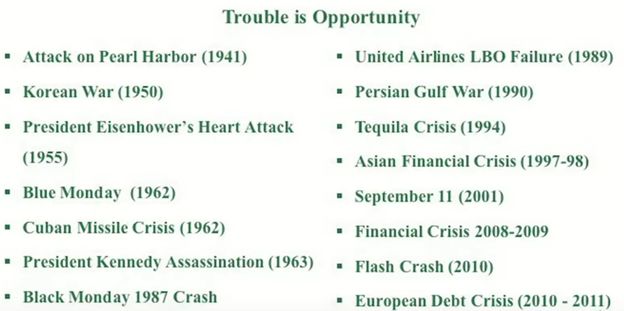

So, my uncle always had a desk plate in his office that simply read “trouble is opportunity”. And we have had those replicated and have them in my office as well. It is a really good reminder of his investment philosophy.

But today I want you to all be global trouble hunters with me and we are going to look at some historical points of trouble and then also some trouble that might be brewing in the future.

So, this requires some imagination. I want you to imagine that you have worked really hard your entire life. You have been a saver. You have done all the right things, made those decisions, the hard decisions to save and you have invested your capital in the market.

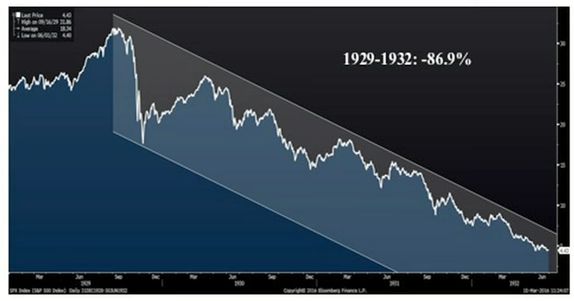

This is the stock market crash of the Great Depression, where investors lost 87% in three years.

This stock market crash almost took out the father of value investing, Benjamin Graham. But Sir John and Warren Buffett are well known and students of Benjamin Graham, but it almost demolished even the father of value investing.

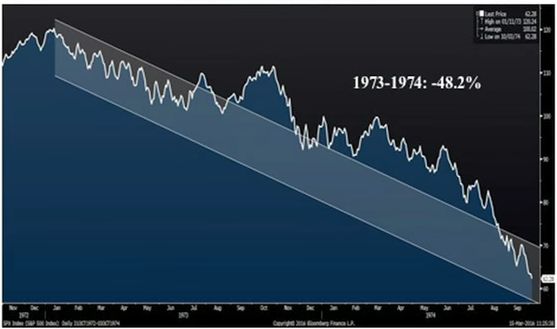

Here is a graph of 1970’s bear market.

This decline is only 48%. Would you be a buyer at the bottom? If you think so, remember that this stock market crash occurred with runaway inflation, skyrocketing unemployment, oil embargos, gas shortages and rationing. What would have been your perspective at the bottom of this market?

Would you be buying stocks? Or would you be hiding under your desk?

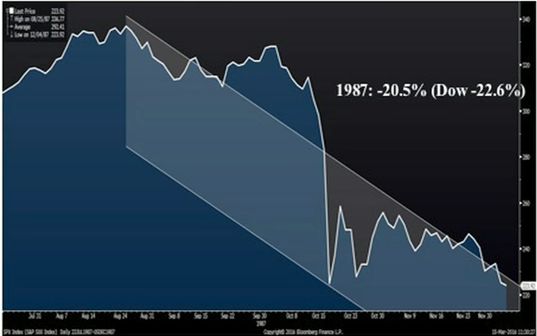

This is a well-known crash in the market. The Dow Jones lost 22% in one day. Now, I actually remember this crash. My dad was a stockbroker at Dean Witter Reynolds and I remember being in the living room at home with my mother. My dad came home from work and he asked her to step outside the hall and he closed the door. And I imagine that he told her that they had lost probably 25% of their net worth that day. It was not a sad day in our home though. I just remember him doing that.

Uncle John was well known on this day for saying “this is going to make our returns for years to come”. He was a buyer that day.

Now my husband did that recent revision of the book, “The Templeton Touch”. And when he was writing that book we went and interviewed a lot of famous money managers that knew my uncle. And we interviewed one of his old employees, named Marty Flanagan. Marty is now the CEO of Invesco. But Marty said on the day of the crash in 1987, Uncle John and got up, left the office to go walking the surf for an hour. He did that every single day.

A lot of value investors have this built into their daily schedule, whether it is “Mohnish’s nap room” or some type of physical activity. But he got up like it was no other day and he left and he went and walked in the surf and when he came back to the office he was greeted by a bunch of young analysts who said “John don’t you see what the market is down how could you have left office”. And he said boys sit down. I have good news and bad news. The bad news is we are in a bear market and the good news is it is almost over.

Now we have also interviewed a broker that had an open line to his office that day and that broker tracked all the purchases in a ledger and calculated the return two years later and Uncle John had made 200% on those investments that day. Now, if you had just held on to your investments, the Dow was back up to where it was before the crash two years later.

If you had invested on index tracking the Dow at the bottom, you which had a 60% return off the bottom.

So it just something remembered during these events.

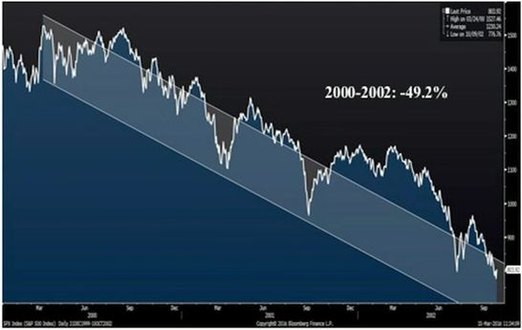

This is the dot com bubble crash, where the market lost 50%.

This is the S&P 500. The NASDAQ lost almost 80% during this crash. I also remember this one well as I was working as a sales assistant at Morgan Stanley to two technical analysts. It is kind of the antithesis for all things Templeton. But I was there and the wealth affect was in full view. I mean they were steak dinners and champagne nights and it was a new IPO every day. People were so excited. And I made the regrettable error of going down to the Lyford Cay Club meeting with my uncle and asking him what tech stocks are you buying.

And he just shook his head at me any he said, “You know Lauren, when I was a child I would walk from my house in Winchester Tennessee to the town square and my brother would go with me. And we would gather in the yard of a home and lots of people would gather and eventually the owner would come out and flip a switch and lights would come on and light up the house and that was the spread of electricity.”

He said now, “I went back and calculated it in the time to get out of the stocks was two years prior to that”. And then he walked me through every bubble he had seen in his lifetime. And he told me on that day that he was shorting tech stocks, which took you know a lot of courage during that market, but he was using a strategy referred to as the “IPO lock up strategy”.

So, he knew that even the insiders of these companies knew their companies were overvalued and that they would take the first chance they got to sell the shares. So, he was short stock seven days prior to the IPO lock up expiration and cover about ten days later. I never ask him how much money he had on during that trade, but we have heard he had $400 million in short positions and that he made over 90% on many or most of those traits.

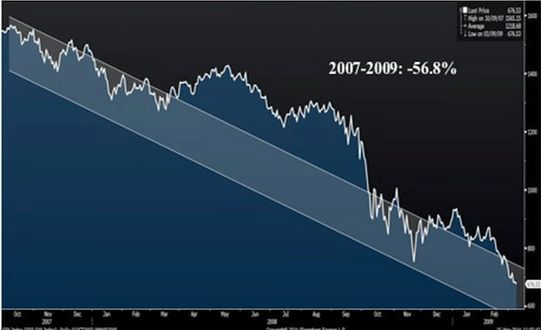

So that was a really interesting time and then of course you all remember the most recent financial crisis where we had almost a 57% market correction.

Now that was a great day for me and actually was pregnant with my first born child during that and she was born on March 10th, 2009, the market lows for on March 9th, 2009. So, I remember vividly buying stocks in the delivery room and the nurse came in and told my husband to shut down the computer and I looked at him and said did you get the orders filled. Because we had been buying stocks for months prior to that event and we knew that the markets for being really irrational with valuations and we wanted to buy as much as we could.

Now market corrections and crashes are a staple to the market they’re going to happen. It is not if, it is when. So since 1900’s there have been a 125 corrections. Corrections are defined as a drawdown of 10% or more peak to trough.

There have been 32 bear markets defined as a 20% drawdown or more peak to trough. So, you are going to spend about 1/3 of your life in bear markets. Bear markets come along every 3 to 3 ½ years. Corrections come along every year.

Really good investors have learned to harness the power of the bear market to boost their returns for years to come. That’s really what distinguishes an average investor from a great investor.

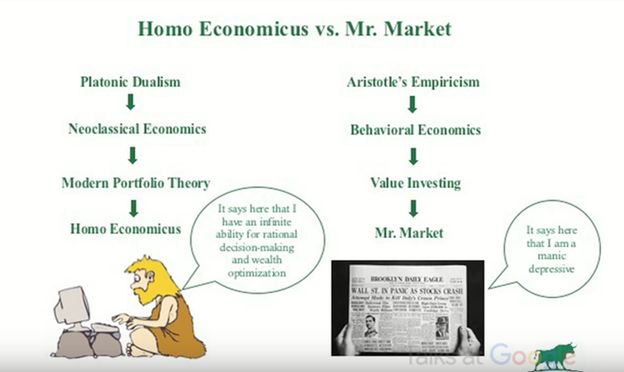

So, I don’t know how many of you are familiar with this term “Homo Economicus”. But despite looking just a bit like my husband in college, it is actually an academic term used to define man as a perfectly rational wealth maximizer with the infinite capacity for rational decision making. I mean do you think Homo Economicus exists? I don’t. And despite that, Homo Economicus is used all the time in finance and economics.

So, most of western philosophy and academia preaches Plato’s mind body split and the predominance of rational thinking. Students in business school are taught to calculate risk using standard deviation and beta and Homo Economicus really supports this model.

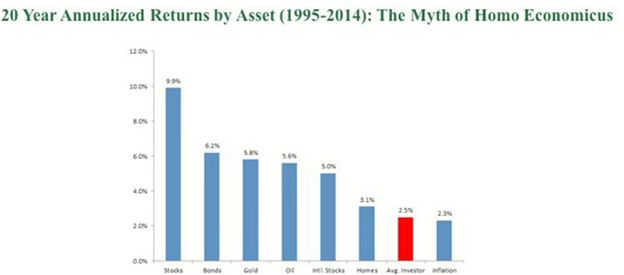

But value investors saying no we don’t buy that. You know intrinsic value often differs from price. Risk is simply paying too much for security and really the returns bear this out. The returns support a value investors perspective. Here we have a graph showing the twenty year annualized returns by asset class.

And as you can see stocks had returned 9.9%, bonds 6.2%, gold 5.8%, oil 5.6%, international stocks 5% and homes 3.1%. The average investor 2.5%.

Now, how is that possible if all these asset classes outperform the average investor? It’s because people are really terrible decision makers and they are often times buying high and selling low.

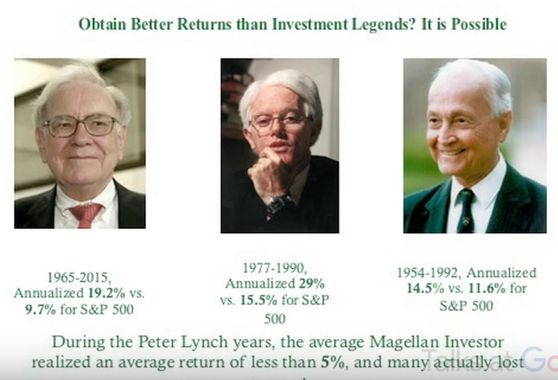

I am a really good southern girl and I was raised on a diet of BLTs, but in my family we call them Buffett Lunch in Templeton’s. These are three of the greatest investors and their track records and they are remarkable.

I think one thing to highlight is that Warren Buffett has an incredible vehicle for investing.

Peter Lynch and Sir John, both managed mutual funds. Mutual funds are terrible vehicles for the manager, because people are always giving you money at the wrong time and taking it way away at the wrong time. So, they are very very difficult to manage.

And this is a really important point.

So, Peter lunch when he was annualizing 29%, conducted a study and he wanted to know what the average investor in Magellan had earned. And what he found was that the average investor had earned 5% and many had actually lost money. He was annualizing 29%.

So again, investors are constantly doing the wrong thing. When a manager runs up, they give him money, when the manager draws down they take it away and that was how the average investor earned 5% or lost money when the product they were investing in was annualizing 29%.

Now, this is something I want you to remember. What is a really easy way you could have outperformed Buffett, Lynch or Templeton sitting at home in your pajamas eating potato chips? But the way you could have done it is you would have simply added money every time they drawn down. Arithmetically, you would have a higher return than these managers.

So, investing can be very complex. But it can also be very simple. And I always tell our investors when they walked through the door. “This is a partnership. I am a tool in your toolbox. But if you give me money after I have had a big run up and you take it away when I draw down, together we are going to produce a really poor return. So, the investor has some responsibility in this. If you are not good at controlling yourself, you should use a dollar-cost averaging program or something like that to remove your emotions from that process. But I think that’s really really important to remember.

So you can invest with the best manager in the world, but if you can’t control yourself and you are constantly putting in money at the wrong time and taking away at the wrong time you are going to have really poor returns. But there is a reason for your poor returns and you all have an excuse for your lousy investment returns. That should make you feel pretty good. There is a biological reason for this.

So, researchers at the University of Pennsylvania have found that the human retina can process ten million bits of information per second. This is about the capacity of an Ethernet connection. Your other senses add about a million more bits of information per second. So, the total band width that the human brain is about eleven million bits of information per second. But the human only about forty bits of information make it to the human conscious. So, the way the brain works is it’s typically taking this information and processing it in a region known as the prefrontal cortex. The prefrontal cortex is involved in decision making and complex cognitive behaviors, self-control, but it’s very analytic and it’s a very slow part of your brain.

So, we think of the brain you can think of the brain as sort of taking an information through a fire hydrant and the prefrontal cortex is like a slow leaky faucet dripping out.

Now, when your eyes and ears sense danger or if you turn on CNBC and the markets crashing and they have always got this fabulous music playing in the background that really heighten your anxiety. The problem is that your brain bypasses the prefrontal cortex and sends information to an area called the Amygdala and Amygdala controls your fight or flight response. Amygdala is a much faster process. Processes information much faster and to do so it relies on something called Mental shortcuts or behavioral finance experts call this Heuristics. And it’s these mental shortcuts that often times get investors into a lot of trouble when they are investing.

So, I think reading about behavioral finance is really fascinating and there are a lot of books out there and I would encourage you to pick one up and read about it because once you are aware of these mental biases you actually become a better investor. You know why you are reacting on that way to really scary information.

But some of the best examples are my favorite examples often occur in Vegas. So, people have the tendency to segregate money based on user even though all dollars are created equal and they treat those dollars very differently. And there is also something called “The found money effect”. So, I think the most interesting observation of this is in Vegas when investor walks and pops down a $1000. And let’s say they do really well and they win $500. That investor will do totally different things with the money. So, with the original $1000 they come with, they may pay their mortgage, their phone bill but that $500, that found money effect, they may go buy a new expensive pocket book or they go out to a fancy restaurant they normally wouldn’t dine at and that’s why all the shops exist around Vegas. And they have actually videotaped people in Vegas and this effect is so strong that some people actually will put the money in separate pockets. The money they came in goes in this pocket, the money won goes in this pocket.

The other really fascinating example of this and sort of the real world is the lottery. I was actually at my local rotary club one day and somebody came in to speak to us about the Tennessee lottery and the history of it and when they first started the lottery in Tennessee, it was not popular at all. They did not sell many tickets. And then somebody came up with the brilliant idea of letting people pick the numbers to go on their ticket. And sales exploded. It was the illusion of control.

So, had the probability increase that these individuals would win the lottery? No. Not at all, but they felt like they had more control over it. And this happens in the market all the time.

My dad has always told me “Lauren. Don’t confuse genius with the bull market”. And that’s a really good example of that. Right? So, whether its day traders in the dot com error or its house flippers during the housing boom. There is a tendency to have this illusion of control. Right? So, you make some money and you think “Hey I’m really smart. You know I have really got some control over the outcome of this next trade that I am going to put on. You start to take on more and more risk. And that’s how bubbles start to happen in the financial markets.

Now, I know being this close to Stanford, you guys all know about the famous marshmallow test. I have seen other people come and speak to you about the marshmallow test. I was looking at videos. But this really is an interesting experiment.

So for those of you who don’t know, the Marshmallow test was a series of experiments run at Stanford University in the 1960’s and 1970’s. During the marshmallow experiments and they would put one marshmallow down in front of a child and they would say you can eat this marshmallow now, or I’m going to leave the room and when I come back if the marshmallow is still, here I will give you two marshmallow. Now, obviously the child that was able to wait is better at delayed gratification. It is also correlated with higher test scores and better achievement in life.

But what they found is that two thirds of these kids cannot delay gratification and wait for the person to come back to get the two marshmallows.

And this is a really important point when it comes to investing. So, human beings have a really difficult time controlling themselves. What this little boy is actually responding to is a hormone produced by the stomach called Ghrelin and it is one of the weaker hormones produced in the human body. And if 2/3rd of these kids could not resist that hormone, investors really have little short at resisting these stress hormones that the brain floods the body with during times of panic.

So, it is very difficult to buy at the bottom of the market and you very well may be a genius and you work here at Google, so I assume that most of you are. But if you are not good at controlling your emotions, you will never be a good investor.

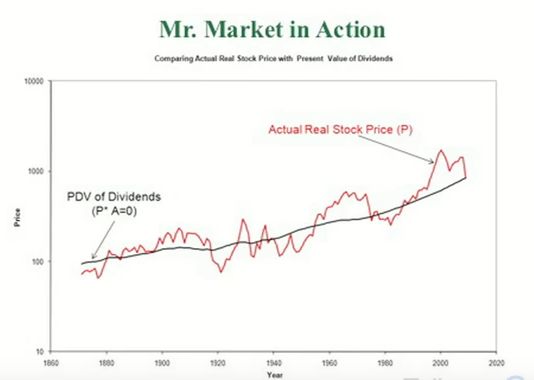

This next slide is really the hallmark of every value investor. I mean this is it. This is value investing.

This is a slide that shows the present day value of the S&P 500 going back to 1860, the index didn’t exist back then with a piece together what it would be. And the red line shows the actual real stock price. So, as you can see the two lines vary. And James Monty is the person that says “Stock prices are fourteen times more volatile than the underlying fundamentals of the business.” This means that’s either fourteen times more than Maalox you are going to eat on annual basis because you’re so upset or fourteen times more the opportunity that you are going to have to distinguish your return pattern and to do things differently than the crowd, have better results than the crowd.

So, this is really important.

Now Saurabh said that — you guys wouldn’t mind if few family pictures and that actually I should feel free to bring — So I’m going to show just a few, because it relates to Uncle John and how he develops this technique of buying at the bottom of the market.

So this is my great grandfather, Sir John’s father.

He was the entrepreneur and he was a lawyer, he sold insurance, he was also in cotton gins and here is a picture of him standing in front of some cotton mills in Tennessee. But he had an office in Winchester, Tennessee. There it is on the second floor and it faced the town square.

So, during the Great Depression when farms would come up for auction, he would simply look out his window, and if the auction produced no bidder, he would walk down his stairs, go to the courthouse steps and buy the farm for cents on the dollar.

And it was witnessing this over and over again as a young person that really made a big impact on Sir John’s investment style and the way he learned to buy at the point of maximum pessimism.

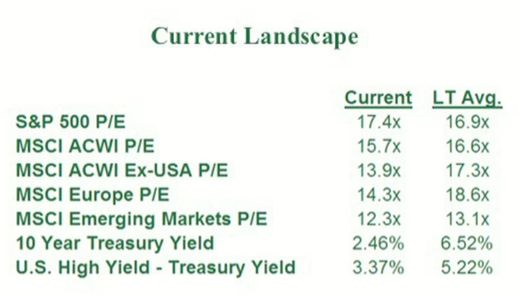

So, really quickly, what does all that mean for today, how is this applicable to you and the current market. Well here is just a really basic, very basic valuation slide.

So how are things kind of looking? Well the US looks a little, you know, fairly valued, overvalued. Things are looking a little better in Europe. Even cheaper in the emerging markets. But the worst Risk-Reward relationships are really in the fixed income market at this point.

And I would like to give you just a little bit of information on that.

So, currently right now in the United States, 11,000 people reach retirement age every day and this will continue to occur for the next 10-15 years. A lot of these people have saved for retirement using something known as the 4% rule.

The 4% rule simply states that you can withdraw 4% every year. You can inflation in just that withdrawal every year in a 60-40 bond portfolio. And that money should last you thirty years.

So, that is kind of been a rule of thumb for financial planners and that is how people save for their retirement.

The problem is that the real rate of return required for this relationship to hold true is 5.6%.

So, if you put an inflation expectation on that, you will come up with something in the area of 8 – 8 ½ % nominal returns required for the 4% rule to work.

The problem is that the S&P 500 is currently yielding 5.6%. Ten year treasuries 2.47%.

You do a weighted average return of that is if you’re running a 60-40 bond portfolio and you come up with 3.4%, is way short of the 8 – 8 ½ % rule, return required for the 4% rule to work.

So, this is a problem and investors are really faced with three different choices.

They can work longer, and we think that’s about 9 to 10 years longer. They can spend less, save more. People aren’t real good about that. Or they can somehow increase their investment returns. And we think this is what this population is really relying on. They are trying to increase their investment returns.

So let’s think about that. What are the ways you could increase your investment returns. Well in a traditional world or if you are thinking about a 60 – 40 portfolio, which I know no one runs anymore, but for simplification purposes, we are going to talk about a 60 – 40 portfolio.

You could increase your equity allocation. So, is that a good idea now in the market? When valuations aren’t really screaming the buy signal.

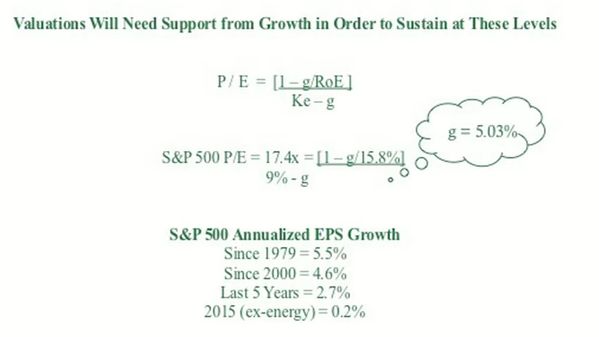

This is an equation known as the Gordon growth model and it looks really complex, but what I want to know is you can take the current P/E of 18.5 for the S&P 500 and you can plug it in to this equation, and you can come up with what the growth forecast is.

So here the “g” comes out to be 5.03% and that’s growth in earnings. Okay! Is that realistic or is it not?

Well here is some data to help you decide. Since 1979, annualized EPS growth has been 5.5%, since 2000 4.6%, in the last five years 2.7%. In 2015 it was 0.2% ex- energy. So, at our company we think this is a little bit unrealistic to think that growth and earnings is going to be 5.03%.

So, we’re thinking that you know equities are overvalued to fairly valued right now and if you are a retiree, this might not be a good time to increase your equity allocation. So, what else could you do? Well you can increase the yield in your bond portfolio. And we think this is really what investors have been focused on, which ties back and to the awful risk-reward that I talked about in the beginning of the presentation.

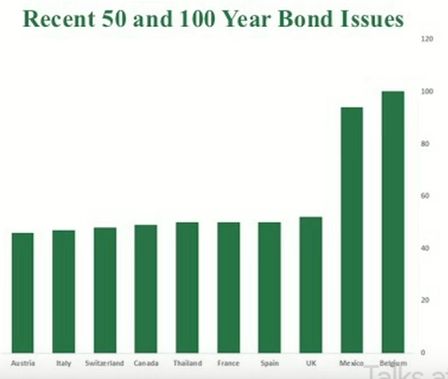

Here is just a graph that shows the recent 50 and 100 year bond issues.

Okay. And in fixed income there are two ways to increase your yield. You can go out on maturity or you can take on credit risk. That’s it. So, we think that people have been doing both. So, here is a really good example that people have been going out in maturity to increase yield.

One of the problems with that is simply the duration on these instruments. So, right now a 30 year US treasury has a duration of about 18.5 years. If you don’t know what duration is, it means that for a 100 basis point move in interest rates, you are going to have a decline in the price of the bond of 18.5%. Okay we have had about a 100% move from the mid 2016 lows in interest rates.

So, I think there is you know especially with the retirees, I think there is this idea that you can’t lose money in fixed income. And you can’t if you hold the bond to maturity. But a lot of these people are invested in bond funds and bond ETFs and they are really surprised when they are opening up their statements and they are seeing this. You can lose purchasing power by the way.

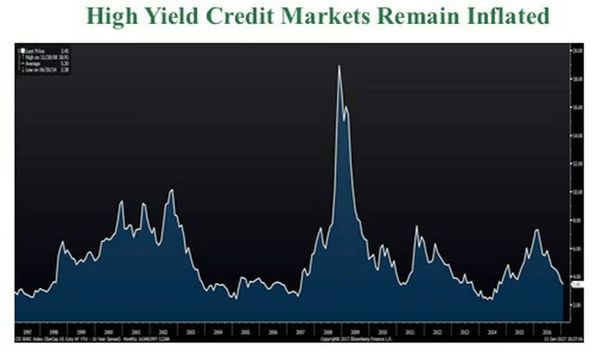

The other thing you can do is take on more credit risk and here is a graph of high yield credits spreads, which are really close to a historic low again. I mean I think we hit the historical low in the past twenty years in 2014.

But right now I own credit spreads are 3.45. I think the historic average is like 5.47 or something like that. So, investors are clearly taking on more credit rested increase yield.

If you want to Google, a really interesting example of investors taking on just I think unbelievable credit risk. Google PIK toggle bond. And if you are not familiar with this instrument, it’s a bond issue that allows the issuer the ability to pay the creditor back in more bonds if it can’t afford the cash coupon. So, it’s basically an admission, when they issue the bond that we’re not so credit worthy and we might not be able to pay you back, but if we can’t we’ll just pay you back with more debt.

And people have been buying this. I mean if you look at that issuance of PIK toggle bonds, they have exploded since the financial crisis. Why would anybody buy these instruments? But they do and so that shows you that investors are truly reaching for Marshmallows right now.

There is a really well know retailer, I won’t tell you who it is, but you can figure it out. But they are owned by private equity firm. And in 2013 they issued a $500 million PIK toggle bond issuance. They immediately issued themselves special dividend to get paid. And then in 2015, they activated the toggle and the bonds started trading at 30 cents on the dollar.

So, another thing to remember about the current market environment that we are in right now as everybody things, corporations are so much healthier than they were pre-crisis. Wrong. Corporate debt is back up to pre-crisis levels and the sad thing is that this debt has not been used to finance growth in many cases. It has been used to repurchase shares, it has been used to issue special dividends.

So, we think that investors are reaching for marshmallows in the bond market. We think the companies are reaching for marshmallows and I guess my parting piece of advice to you would be simply this.

Uncle John was once asked if he could name one word, one piece of advice for investors in one word, what would that be and he simply said “patience”.

Now, if you are honest with yourself and you know you are not a patient person and you were totally that kid, because I know you all live in this area that participated in the marshmallow experiment and you ate the marshmallow and you just don’t want to admit it today, you can, you can do this. This is my favorite picture of my uncle ever and it’s a picture of him reading the wall street journal at the North Pole.

So, I one time asked him about his experience managing money in the Bahamas. And he said you know my returns got a lot better when I moved here and I said oh that’s interesting. Why do you think that is? And he said well you know I think it’s because I get the Wall Street journal a few days later than everybody else.

So, when you think about that the tendency to herd and social proofing is so powerful in the financial markets that investors often benefit by simply removing themselves from the herd. The best investors in the world aren’t usually in the financial centers, like New York and London. Warren Buffet is in Omaha Nebraska. And Sir John manage money over a grocery store in the Bahamas. They have removed themselves from the herd and so if you have trouble controlling yourself, turn off CNBC. Don’t look at your stocks every day. And just remove yourself from the herd.

—

Saurabh Madaan:

So, thank you once again. Fantastic. So it was really nice to learn about Sir John’s personal side as well as a how you mentioned the importance of biases and the role that our mind plays. You mentioned the “Mohnish’s Nap room”, talked about meditation. I was curious, do you have any personal habits or routines that you personally use. It might also be interesting to just hear about what your average day looks like for somebody who doesn’t really know you that well.

Lauren

Well I work out daily. I feel like I have to do it. So, either play tennis or go running or lift weights or something like that. But I think there are a lot of strategies you can use to kind of control stress and focus as an investor and one of the things that we do just from an investment perspective is that we keep a list of securities in our drawer that these are the stocks that we want to own, that currently are not priced the way that we want them to be. They are not value stocks.

What are some names on the list?

But during a market correction we pull our list out and we go to work. And there is a really and palpable psychological shift when you do that, because I do think that even the most seasoned investors can get nervous during that market correction or market panic. But something happens psychologically when you shift your focus to the possibilities and you pull the list out, this is the list you have created when you were very calm and you’re thinking rationally. And you pull the list out you start entering buy orders. Something shifts and it’s really powerful and I would encourage you all to keep a short list of securities in your desk drawer and during the next correction or panic use that to put in your buy orders.

Saurabh Madaan:

You also mention your time in, I think 2001 as a sell side analyst when Sir John was shorting tech stocks.

Just curious since you are in the Silicon Valley here now, what do you think of the tech industry now is it that, do you see the same sort of bubble like behavior that you did that time?

Lauren

Well I kind of anticipated this question. So, a lot of investors are talking about the hefty evaluations out in Silicon Valley right now and I think for me I am more focused on the private equity world and the valuations in that world are really amazing what people are paying for companies and the markdowns that have occurred in private equity portfolios this year have been extreme in many cases.

So, we oftentimes don’t invest in tech stocks. When we do it is generally because we purchase them during a market correction and it is hard for a value investor to buy tech, we do own Google shares though and a few others. We own Alibaba as well. And so, we buy a few tech names here and there, but it’s usually during a market correction.

Saurabh Madaan:

You said mutual funds are terrible vehicles for investing and you were also talking about how the average investor in a mutual fund actually earned much less even when the manager did very well. So even from the investor’s perspective, I find it curious and yet you yourself run a mutual fund.

Lauren

No, I did not run a Mutual Fund.

Saurabh Madaan:

A Hedge Fund?

Lauren

Hedge Funds are separately managed accounts.

I think and what I was referencing in our presentation is the in a mutual fund is a really horrible thing for the investment manager. Okay. Because people can add money. They are constantly buying in when let’s say you’re a value manager and people are buying and now you have more money to invest in an overvalued market. You know it’s an overvalued market. And also mutual funds usually have like a 5 – 10% Max cash cap. So even if you are a value investor, investors are you know pouring in more and more money because the market is hot and you know it is almost impossible to find a value stock but you have a 10% Max cash cap on that and you are having to put money to work at a time when you don’t even think it’s a good time to put money to work. And then the market corrects and everything is on sale, you want to go out and buy everything and guess what? Investors are taking money away from you. And so, you maybe even faced with having to sell securities in your portfolio at the bottom of the market. So, investors force this activity.

Saurabh Madaan:

So, even amongst money managers who run separately managed accounts or in a similar structures, the same dynamic off investors exists. Do you have, do you have any thoughts on what might be a better vehicle, may be permanent capital like you referred to Warren Buffet? You know what are your thoughts on that, just more broadly speaking?

Lauren

Right, well investing in a vehicle like $BRK.A or on something that doesn’t, and mutual funds have distributions every year. So, really that’s the gift the US government has given you, is that you can put your capital into a vehicle like Berkshire Hathaway and it just continues to compound and you don’t pay tax on it until you sell it. So, I think the holding companies are really interesting to look at. We have a large investment in a company in Canada called Fairfax. That Fairfax does pay a dividend. So, you know those are great investment vehicles as well. The mutual funds are fine for anyone, you know even really experienced investors. They are good investment Vehicles. They are just difficult to manage.

Saurabh Madaan:

Good. And just a couple more. You mentioned how when things are down, when there is maximum pessimism that is where you want to look and there is this idea of buying bargains that was popularized, goes back to Ben Graham, buying stocks cheap and when you read Warren Buffett’s letters and his interviews, he also credits Charlie Munger of opening his eyes to another way of in a quality based investing.

And as a student of physics, I have learned that of course action is equal to reaction. So, I kind of mentally related to mean reversion things that go up, come down and so on, but also there is this law of inertia that I relates to quality businesses and maybe my mental model has it all, but I’m just trying to explain my question better here. If you have a quality business with the moat and runway. Investing in that verses, investing in cheap bargains. Do you see these two differently or do you think they could be both part of investor’s tool kit.

Lauren

I think they can be both part of an investor’s toolkit. Its fine paying more for a quality company and they certainly deserve a spot in your portfolio. We have ten core positions that we would consider high quality companies that we have paid a little bit more for and they stay in our portfolio and then we reserve sort of the rest of the slots in the portfolio for positions that fall into this maximum pessimism type of theme. So, they are either neglected stocks that aren’t very well followed by Wall Street or they are opportunities that we have found that points of maximum pessimism.

Saurabh Madaan:

That makes sense.

One final question. Talking of biases behavior, the manic depressive nature of Mr. Market, you know what I took away from that is that being a successful investor takes a lot of self-awareness and self-introspection to begin with I guess so.

If I were to flip that and ask you, what do you think are some of your weaknesses as an investor?

Lauren

Oh! That’s a dirty question.

Saurabh Madaan:

You didn’t expect this one.

Lauren

I do think you are right and really good investors are really honest with themselves. I think you have to know yourself really well to be a good investor. I would say my weakness might be on the on the self-discipline. So, and I have said, used this phrase before, my husband said don’t ever say that in front of anybody again. That is really horrible, but I will tell this you today. I am a greedy investor. So when I buy a stock and it turns out to be successful, I also have the illusion of control and think I’m a genius and have a tendency to maybe want to revise our models a bit. We can hold it for a bit longer even though you know it’s blown through our approximation of an intrinsic value. So, I would say that’s probably where I fall more.

Saurabh Madaan: So any final questions in the room for Lauren? Lauren if you could repeat the question.

Lauren how do I make a sell decision? So our sell discipline is as well defined, probably to compensate for my weakness that we just discussed that when we purchased a stock we’ve already on calculated our approximation of intrinsic value and actually before we purchase a stock our caveat is that we have to see 50% upside to our approximation of intrinsic value. So what we do is a series of valuation screens to drill down into the bottom depths of the market and then we’re generally running a discounted cash flow model on the company. It depends on the industry, you know if it’s a financial stock maybe a dividend discount model or something like that, but generally we are doing a DCFs. So we know we know we have this range where we think this is the fair value of the company.

And as the stock starts to approach that price we start looking for replacements. Now how it works in the company is that we have this massive spread sheet with all of our positions on it and were constantly monitoring to see in 10% of fair value, or what at fair value, what’s gone through fair value, can we find a replacement, what is that look like and like right now we’re sitting on between you know depending on the portfolio as 15-25% cash that is all organic that is not a decision that we made and said hey we want to target 20% cash. It happens organically in the port folio, because as things start to hit fair value we liquidate them we need to find a replacement but in a fairly valued or ever valued market finding replacement becomes much more timely and it takes more time. It’s harder to find, may take you know a month, month and a half to find a replacement.

The question was in regards to core positions in the portfolio and portfolio turnover and if core position should remain longer and you give them a little more leash to run. Yes that’s what we do here.

Saurabh Madaan: In larger sizes I guess also in terms of allocation.

Lauren Yeah we have a maximum 6% allocation now. Our core portfolio is smaller than 50%. I think you totally I mean this is a conversation that we have very frequently in our house. So what he is talking about is one time I was in the Bahamas and I was visiting with my uncle and he said I don’t even remember what we were looking at to be honest but he said, I want you to hear the investment universe, I want you to to jag on get fly back to Atlanta come back and visit with me in a month and I want every you know company in this country and I want it ranked five P/E ratio and I was like okay.

I’m just going to get my computer and we’ll do it right now and then there it was, because we just downloaded all that information from Bloomberg and it was available immediately ranked by P/E ratio or any other ratio he wanted to see. I mean it is all instantaneous. And he was amazed by it, because when he was managing money I think a lot of people think he was a great macro investor but he really wasn’t he was using I mean he might have been, but that was not his technique. He was using on value line to rank stocks by hand using valuation metrics.

Seeing it really blew his mind that I could download information on any company in the world at the snap of my fingers and I could look at it nine ways to Sunday and make decisions. I do think that edge is gone. Now this industry is so highly competitive. So the edge now is psychological.

We have that conversation all the time in our house but it usually goes more like this “gosh! if we could have been managing money back when he was that would have been amazing”. Now I don’t know that we would have done all the work that he did. He believed that his edge was in something called the doctrine of the extra ounce which we talk about one in my family. So you just do a little more work than your peers just a little more work. Those are the most successful people in the world is the doctrine of the extra ounce of work that you put in. The extra report, the extra meeting you take the extra book you read. That is kind of how he looked at.

Saurabh Madaan: So Lauren can you elaborate a little bit more on the psychological edge. Explain to us what do you think that is and how can an investor better develop it.

Lauren I think people can develop it, you know your brain is constantly sort of being molding itself and that process called plasticity. But you can train yourself to be a good investor where you have to do is put capital to work during these moments of panic and crises and reap the benefits of that and then you know your brain learns “oh! it’s like Pavlov’s dog”. There’s a reward at the other and oh I’m starting to look forward to the next event.

And now not only do we look forward to corrections in crashes in our office I mean we’re kind of we’re past that we want them to come.

And now we’re trying to anticipate where they might come which is why I focus so much of the slides at the end of the presentation on the fixed income market because we really think that there is trouble brewing in the fixed income market and we’re laser focused on finding opportunities so if that unwinds the way we think it will that will capitalize on that.

Great! fantastic so thank you so much for their amazing talking for answering our questions.