On October 25, 2016, we issued a report asking whether Sino Grandness Food Industry Group was “rotten at its core”. In our report, we took a critical look at the company’s operations by deploying our team on the ground to its subsidiaries’ facilities in China. We also looked at the status of the company’s proposed upcoming IPO and a proposed rights offering the company has recently put forth. You can read our entire write-up at the above link.

The company issued a response on October 30, which we encourage you to read in full. This report partially confirms our findings but leaves some basic facts in dispute. After reviewing the company’s response, we stand by the work in our original report and offer up the following points as a continued rebuttal. We want to address five key points in this report:

- The company apparently doesn’t know that it has a production facility at Beiti Village

- The company has offered little clarity to investors regarding its outsourced sales

- We believe the company’s argument for seasonality doesn’t hold up, as we stated in our original report

- We believe the company is wordsmithing its way around an answer regarding its SAIC filings being amended

- The company proposing a rights offering tells us everything we need to know about whether or not they need, or are seeking, capital

Does the Company Know It Has a Facility at Beiti Village?

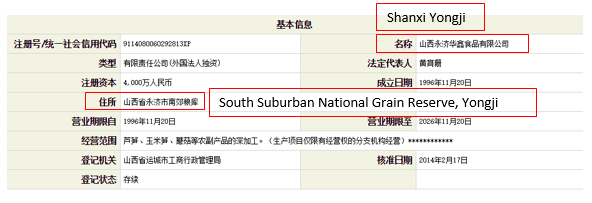

In its rebuttal, Sino Grandness confirmed that it has a facility at the State Grain Reserve; a facility that we visited in August of 2016. The facility at the State Grain Reserve is listed as Shanxi Yongji on the company’s SAIC file. Here is the registration for this subsidiary:

In its rebuttal Sino Grandness disputed the fact that there is a facility at Beiti Village. The company stated in its rebuttal:

“The reference in the Report to “Beiti Village” is erroneous, the Company does not operate any facility at “Beiti Village.”

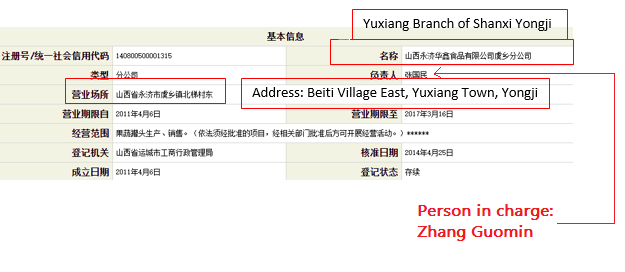

But the fact of the matter is that we found that Shanxi Yongji has a manufacturing facility at Beiti Village. It’s registered under the name of “Yuxiang Branch, Shanxi Yongji”. The person in charge for this branch is listed as “Zhang Guomin,” who can be found in SGFI’s 2015 Annual Report listed as Deputy Chief Production Officer of SGFI. Here is the subsidiary’s SAIC file:

As we stated in our original report, we found a production facility in Beiti Village and the gate guard at the facility confirmed to us that the facility belonged to Shanxi Yongji. It’s hard for us to believe that Sino Grandness’ management team has forgotten that it has a facility at Beiti Village. Perhaps our photographs will help jog their memory. In the meantime, we strongly urge Sino Grandness to conduct an internal audit regarding its assets and management.

Questions About Outsourced Sales

In “Appendix 2” of the company’s response, when commenting about Grandness (Hubei) Foods Co., Ltd, SGFI stated:

“…The business of the Group consists of (i) own production of canned products and beverages for sales, and (ii) purchases from third party suppliers of canned products and beverages for sale to customers (“Outsourced Sales”). By merely looking and commenting at the individual SAIC files of the Group’s subsidiaries, it is not reflective of the overall performance of the Group.”

In all of SGFI’s previous filings we reviewed, it didn’t disclose to what extent, if any, its canned business was outsourced, despite previously disclosing that its beverage business did outsource. Although the beverage business’ total production capacity is claimed to be 50% self-production and 50% outsourcing, the actual revenue contribution from self-production versus outsourcing is unclear, per SGFI and Garden Fresh Group’s (beverage business) disclosure.

For transparency purposes, we would urge the company to disclose the exact revenue contribution from self-production and outsourcing for both its canned goods and beverage business, as well as their outsourcing contractors’ names and corresponding products/revenue contribution.

Addressing Questions of Seasonality

We are not surprised that Sino Grandness has used seasonality as an answer to rebut our report. We understood, and continue to understand, that Sino Grandness’ businesses, both in beverages and canned products, are seasonal. As we stated in our original report, we sought year over year comparisons of production volume, rather than “on season” versus “off season” comparisons.

Since Sino Grandness has chosen to cite seasonality as an excuse, we would again urge the company to disclose its exact revenue contribution from self-production and outsourcing for both canned and beverage business per production facility, as well as their outsourcing contractors’ names and corresponding products/revenue contribution. We would also urge the company to provide numbers to reconcile its seasonality claims.

Key Omissions from the Company’s SAIC Filing Statement

Sino Grandness confirmed most of our SAIC numbers but also provided a lawyer’s letter to try and prove that it would be impossible to amend SAIC numbers after June 30th of each year, per new law passed in October of 2014 preventing such amendments. We have to immediately note that Sino Grandness did not directly reject the fact that some of Garden Fresh’s SAIC numbers may have been amended as we showed.

To justify very low SAIC numbers for its manufacturing subsidiaries, Sino Grandness claimed that those subsidiaries are only cost centers and that they do not generate revenue. The company claims most revenue is generated at Shenzhen Grandness and Shenzhen Garden Fresh, two of its trading companies.

This claim does not make sense to us. In the event that those manufacturing subsidiaries are only cost centers, they should still have sizeable intercompany revenues from SGFI’s trading companies. At worst, these manufacturing subsidiaries may book the cost of goods sold of those manufactured products to their individual income statements, while associated revenue may be directly booked to the trading companies. If this was the case, these manufacturing subsidiaries’ net income should be substantially lower than their current numbers.

Another possible explanation for the income statement we obtained could be a “processing on order” mechanism between manufacturing subsidiaries and trading companies. Should this be the case, the manufacturing subsidiaries should only book processing fees as its revenue and relevant cost of goods sold on its income statement. Sino Grandness did not mention this possibility in its response and we would ask that SGFI provides more clarity surrounding these numbers and their respective accounting treatment.

The Company’s Proposed Rights Offering

SGFI stated its proposed rights issue announced on September 30, 2016 was separate and independent of the proposed IPO of its beverage business (Garden Fresh). While this may be correct, it is easy for a potential investor to look at the company’s proposed rights offering next to its Hong Kong IPO which is listed as “lapsed” and conclude that the company is in need of capital. We are certain we are not the only entity that has questioned the company’s cash position as a result of its IPO lapsing and it proposing a dilutive rights issue at a discount.

Conclusion

We appreciate the opportunity to bring clarity to these five key points and we look forward to helping investors get the transparency that they deserve with regard to Sino Grandness moving forward. As stated above, we continue to stand by the findings in our original report.

Disclosure: Neither GeoInvesting, nor any of its employees, has a short position in Sino Grandness due to vague trading laws in conjunction with research reports in Singapore.

Disclaimer

You agree that you shall not republish or redistribute in any medium any information on the contained in this report without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in this report should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the report may or may not be suitable to you or for your particular circumstances. Unless otherwise noted and/or explicitly disclosed, GeoInvesting, its affiliates, and the third party information providers providing content to the report may hold short positions, long positions or options in securities mentioned in the report and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the report. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.

Our research and reports express our opinions, which we have based upon generally available information, field research, inferences and deductions through our due diligence and analytical process. To the best of our ability and belief, all information contained herein is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer. However, such information is presented “as is,” without warranty of any kind, whether express or implied.

See Full Disclaimer here – https://geoinvesting.com/terms-conditions-privacy-policy/