Learning how to become a better investor is a never-ending process, from beginner to experienced. Becoming a better investor is no different than other aspects of our daily and professional lives. I am a big sports fan and playing tennis has been my game of choice since I was 15. Even as I’m older, I still find ways to get better and develop my “serve and volley,”, including taking lessons. In tennis, like in the market, even incremental gains can eventually, together, lead to big wins. If you want a little bit of background on the subject of full-time investing I touched on this topic in an article called, “So You Want To Be a Full-Time Investor, Follow These Ten Tips.”

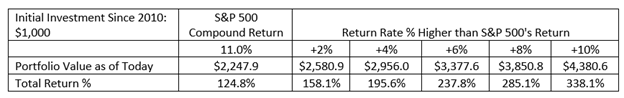

What would incremental returns look like if being a better investor allowed you to consistently outperform the S&P by as little as 2% annually? How about 4%? 10%? This table shows what a profound difference it can make:

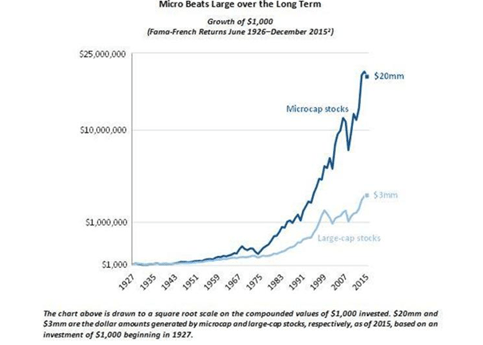

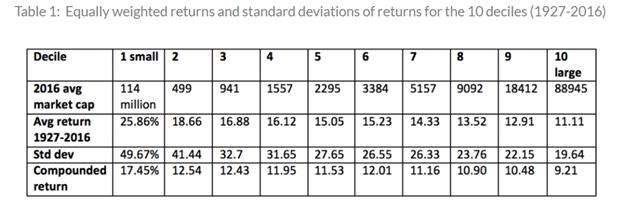

Investing in microcaps is one step that can give you better chances of beating the market by a wide margin. This article which breaks out the most liquid group of microcaps clearly proves this fact:

In Bobby Kraft’s interview with investor Mark Vonderwell, Mark points out the return individual investors can achieve by investing in the illiquid smallest of the smallest, clearly trounces the “Bigs.”

In any case, whether you are attracted to big caps, small caps or microcaps there are steps you can take to become a better investor and increase your returns. Enhancing your returns does not just come from getting better at buying undervalued stocks. It also arises from protecting your returns by understanding risk and emotional response.

Here are 5 tips to become a better investor that you might find useful:

1. Know how to let go of your losers

Have you ever been in a bad relationship where you knew you had to get out, but the “what ifs” kept you in? Then, at some point, you finally just said goodbye and never looked back? How good did that feel?

We are emotional people. There is no way of getting around it. I don’t know many investors that haven’t let their emotions, at some point in time, impact the way they invest. It’s especially true with microcap investors. We tend to make our stock battles personal.

One of the hardest things we face as investors is cutting the cord loose of a stock we are losing money on that we had high hopes for. This is a very delicate subject. You might associate selling your “loser” stock with failure or may have simply become so emotionally invested in the stock, that you can’t just see that your thesis might be wrong. You may have even developed a relationship with management. As time moves on, not resolving these flaws we will tend to compound the pain and suffering from the “What if I sell my loser and it goes up?” syndrome – instead of compounding returns

Whether you are a long-term fundamental investor or a short-term trader, you are going to be faced with situations that can be likened to symptoms of bipolar depression:

- The dramatic mood swings of bipolar disorder can interfere with your ability to make good choices, particularly during a manic episode.

- Symptoms of depression include intense sadness, emotional indifference, fatigue, and feelings of despair

- Mania often causes restlessness, anxiety, irritability, and impulsive behavior.

- People with bipolar disorder often do not recognize just how ill they are (a condition known as anosognosia) and may blame their problems on outside factors

Does any of this sound familiar? Of course, I am not saying that investors who go through these emotions are definitely bipolar. The point I am trying to make is that we need to avoid getting to emotional inflection points to become a better investor. Good therapy for this is just tricking the mind by accepting whatever decision you make and moving on. It can really be that simple. The more you do this and survive, the easier this exercise will become in the future. The unhealthy action is lack of decisions. Make a decision to sell stocks that you know deep down inside are “losers” and just move on, Robert Frost style.

Who cares if the stock you sold goes up? Remember what Tom Cruise said in Risky Business, “Sometimes you just got to say what the f***, make your move”. There will be other stocks to pick. You will be amazed at how much better of an investor you will become if you can move on. Remember, time is ticking.

Every day you waste sitting on a bad investment is time that you could be compounding your returns in a better one.

I only referenced one situation where a stock you may be holding on to is not cooperating, but the same separation anxiety logic can also be applied to stocks (that have become overvalued) that are running when you can’t pull the sell trigger. You run the risk of suffering an emotional setback if the stock falls and you haven’t taken some of your profit off of the table.

2. Don’t panic sell your best stocks

Just as emotions can blind you from making a move when you are hanging onto a bad stock, emotion can force you to sell stocks that are falling that you shouldn’t sell. The mania half of bipolar disorder causes impulsive behavior, such as selling a stock that is falling for no legitimate reason. The panic sell is a natural response that is going to happen to you — it’s sometimes referred to on financial media as capitulation. It tends to occur during market sell offs and crashes. There are a number of ways to combat this bad behavior.

- Know what you are investing in. I can’t believe how many investors do not know what they really own. Knowing your investment is the single best way to gain the confidence needed to avoid selling stocks today that will be tomorrow’s big winners.

- Get to know management. Ultimately, when we buy stocks, we are betting on management. Make sure you understand and agree with their plan for growth and ability to deal with road blocks. Having confidence in management teams will increase your confidence to stay the course when you are challenged by outlier stock volatility. When things are getting bad, give management a call.

- Walk away. When a stock is falling that you know is still cheap or has a bright future, just get the hell out of the office. Go work out, see a movie or bang on some drums, while things play out.

- Avoid margin. I admittingly do use margin. But, Being on margin will force you to sell great stocks, exactly at the time you should be buying them, if you had dry powder. Be careful!

If you do end up of selling a winning stock that is paralyzing your investment decisions, it’s not the end of world if doing so is therapeutic. After all, you can always buy it back

3. Don’t Over-analyze

This point may not jive with you, but it is relevant for me.

When I was in my junior year college, one of my first finance classes I took was portfolio management, early in the morning on Monday, Wednesday and Friday. My teacher seemed miserable and angry as he tirelessly argued for the efficient market hypothesis and tried to convince us that constructing a portfolio of more than 12 stocks was useless. When I asked my professor some questions in his office, he ignored me and told me to go home. He told me I was going to fail.

While in study groups, I was watching my fellow classmates break down formulas for hours, trying to “crack the code”. I knew I had to get out of that atmosphere and that investing is as much an art as it is a science. I decided skip classes to spend those mornings in the school library reading about companies, and what they do. The Value Line, S&P tear sheets and shareholder letters became my lesson plan. I kept it simple. Eventually, I passed with flying colors and went on to handily beat the averages with portfolios of both concentrated positions, as well as some with hundreds of stocks.

This practice followed me throughout my investing life. When you are analyzing companies and reading SEC filings, you must understand that there is a balance between a stock being too risky and not being investable. For example, do low margins compared to competitors mean that a stock is a bad investment, or that upside exists to margins with the right plan? Conversely, short sellers will often argue that a stock is fraudulent if margins are materially higher than comps in the same sector. While this may be the case, or while margins may revert to the mean, some companies also just do things better.

Dig deep into risk factors, but determine which ones are really relevant as opposed to making blanket opinions without proper research. I initially approach an investment from the vantage point of what can go right, and then look at the risk factors. Otherwise, I would wind up saying no to almost every stock I come across. It’s easy to find caveats on most stocks. It’s these same caveats that allows us to buy undervalued companies.

4. Don’t ignore boilerplate risk factors – you must read SEC filings!

Murphy’s Law: “Anything that can go wrong will go wrong”.

Avoiding over-analysis does not mean that you should be sloppy or complacent in your homework. As I mentioned earlier, investing is an art. Over time, you should learn that some boilerplate risk factors have a habit of becoming a reality. Two of the biggest that give me sleepless nights are significant customer concentration risk and unresolved legal issues.

When looking at customer concentration risk, ask yourself these three questions:

- Has concentration increased or stayed constant overtime? (becomes a riskier investment if it has increased)

- Are there factors that increase the probability that customers will have better options or take business in-house? (becomes a riskier investment if it has increased)

- Is management addressing this issue organically?

- Is management seeking out acquisitions that could broaden its customer base and create synergies and cross selling opportunities for its current product lines?

When looking at legal risks:

- Go directly to the “Legal Issues” section of past 10-Ks to see how often legal issues come up.

- If any legal issues are currently present, look to see if any of the following verbiage is present:

- “We don’t believe a negative outcome will have a material impact on our business”

- “A negative outcome could have a material impact on our business” (becomes a riskier investment)

- “We can’t determine what impact a negative outcome would have on our business at this time” (becomes a riskier investment)

Avoiding risk won’t make you a better investor, but understanding risk will. That is why I don’t always walk away when these risks are present, but it may impact my position size and cause a need to drill management harder on the company’s caveats than I normally would.

5. Learn how to say no and walk away

Waiting for your pitch is a great way to become a better investor. You don’t have to own every undervalued stock you come across. There are going to be times when you come across a stock you will be tempted to buy at a time when some of your quality stocks are not cooperating. To make room, you might be tempted to sell some of these high-quality stocks. I am all for re-balancing portfolios, but when you make a habit of playing musical chairs with your stocks, you run the risk of driving yourself nuts when the great stocks you sell finally go up and the great stocks you replaced them with go down. I create an “on-deck wish list” than I can deploy when stocks in my portfolio are sold because they have either reached my target or have turned into dogs with no future.

Conclusion to becoming a better investor

How you feel emotionally should not dictate your buy and sell decisions. Unfortunately, at times, your emotions will take over. After all, you are only human. An essential component to becoming a better investor is to realize that life goes on, and that making bad decisions is not the end of world. Making more correct and conscious intelligent decisions by lessening emotional responses and employing good research techniques will accelerate your path to prosperity.