What is worse than seeing a big chunk of your profits in a stock you are long disappear in one trading session? Not seizing the moment to add to your position if the story has actually improved!

We have been long temporary staffing company BG Staffing Inc Common Stock (AMEX:BGSF) since October 6, 2015 @ $13.35. Shares reached a high of $17.00 on May 23, 2016. The stock traded down 17.3% to close at $13.53 on Friday May 27, 2016 after announcing the public offering of 1,075,000 newly issued shares of common stock priced at $14.00 per share. Prior to the offering BGSF had 7.1 million shares outstanding. The newly issued shares will account for 13% of the total shares outstanding after the offering. Roth Capital Partners and Taglich Brothers, Inc . are book running the offering. Taglich already has coverage on BGSF, but Roth is new to the story, meaning that they are probably going to take advantage of the drop in shares to initiate coverage, recommending that their retail client base buy the dip.

The company targets three areas of the temporary staffing industry:

- The Light Industrial segment provides temporary workers to primarily distribution and logistics customers needing a flexible workforce.

- The Multifamily segment is a leading provider of front office and maintenance personnel to the multifamily housing industry.

- The IT Staffing segment provides highly skilled IT professionals with expertise in SAP ERP, SAP BI, Hyperion, Oracle ERP, Oracle BI and Peoplesoft.

Before BGSF got slammed, the stock was in striking distance of its 52 week high of $17.00 reached on May 23, 2016 and matched on May 26, 2016. We view the drop in BGSF shares as a classic information arbitrage opportunity that we are looking to profit from after investors put two and two together and realize that the offering, in our opinion, reduces the risk profile of the company while at the same time being accretive to earnings per share.

In addition to BGSF fitting our information arbitrage theme, the company also embodies one of the growth + value propositions we look for: fat dividend + sales, EBITDA and EPS growth, selling at too low of a valuation. BGSF is rewarding its shareholders with regular quarterly dividends along with organic and acquisition driven growth:

| GeoInvesting 2016 EST. | 2015 | 2014 | 2013 | 2012 | |

| Rev | $260.5 est | $217.5 | $172.8 | $151.7 | $76.7 |

| Non-GAAP EPS | $1.22 est | $0.83 | $0.51 | $0.28 | $(0.28) |

| EBITDA | $22.5 est | $17.9 | $11.6 | $10.8 | $5.5 |

| Dividend per share | $1.00 est | $1.00 | $0.15 | $0.00 | $0.00 |

At its current price, BGSF’s dividend is yielding 7.4%, while shares, based on our upwardly revised estimates ($1.29 for fiscal 2016), are trading at a forward P/E and EV/EBITDA multiple of just 11.1 and ~5.5 respectively.

We are baffled that the stock traded down $2.83, closing below the offering price of $14.00. Ultimately, we believe the stock should trade back up and surpass to its previous high of 17 once investors realize the offering is slightly accretive and not dilutive.

Confusion Leads to Information Arbitrage Opportunity

What is information arbitrage? An arbitrage exists when a disconnect between stock prices and available public information on a company is noticeable, and monetarily worth pursuing. Sometimes the mispricing is due to investors misinterpreting company developments, as we believe to be the case with BGSF. We think the confusion has to do with investors not fully grasping how management will deploy the offering proceeds and the extent to which all shareholders will benefit going forward.

Let’s look at what management stated it would use the public offering proceeds for as outlined in the press release issued by the company regarding the offering:

The Company intends to use the net proceeds received from the sale of the common stock to reduce outstanding indebtedness.

Notice that management did not provide any clarity on how much debt it was paying down, what pieces of debt it was paying down and if the overall transaction would be accretive or dilutive to earnings per share. So we think it’s possible that investors decided to assume the worst case scenario of dilution, perhaps until management offers more “obvious” clarity on the impact of the transaction to earnings per share.

However, investors that made the effort to read the “use of proceeds” section of the public offering prospectus disclosed in Form 424B5, page S-10, already know the answer to some of the “information gaps” in the press release.

The company’s preliminary prospectus states the net proceeds from the offering will be used to pay off ALL (not some) of its high cost debt:

“We intend to use all of the net proceeds from this offering to pay off the indebtedness outstanding under our senior subordinated credit agreement with Patriot Capital III SBIC, L.P. and Patriot Capital III, L.P. (collectively, “Patriot”) and to temporarily reduce outstanding indebtedness under our revolving credit facility with Texas Capital Bank, National Association (“TCB”). None of these lenders will be participating in this offering in any capacity.”

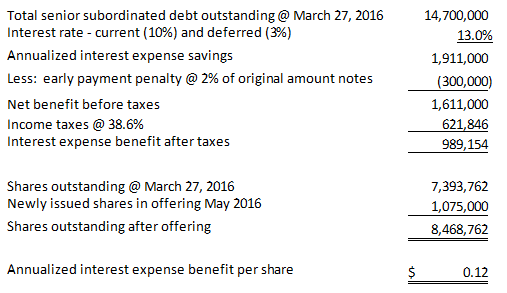

The senior subordinated debt to be paid was approximately $14.7 million as of March 27, 2016, and bears an annual interest rate of 13%:

“The PC Subordinated Debt bears interest at 10% per annum, paid quarterly plus a compounding deferred interest of 3% per annum. Additionally, we pay an unused commitment fee of 0.25% per annum on the unfunded portion of the revolving credit facility. Repayment under the subordinated credit agreement is subject to an early repayment fee of 2% of the original principal amount of the related notes.”

Reduction of debt and interest expense is accretive to EPS

We estimate the reduction of debt will save BGSF over $1.9 million annualized interest expense. The benefit in the first year will be reduced by an early repayment fee of 2% but still totals around $1.0 million net of income taxes or $0.12 per share based on the estimated shares outstanding after the offering ($0.14 in future years without early repayment fee):

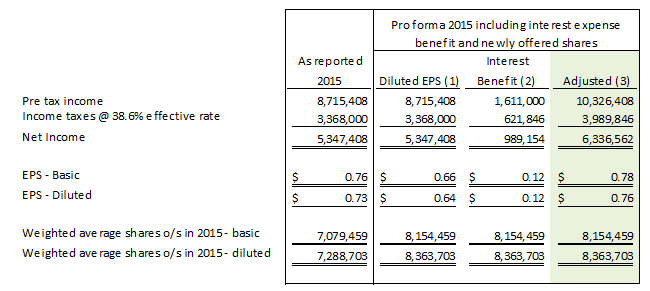

The benefit of lower interest expense more than offsets the dilutive effect of the offering. The following chart assumes the annualized net benefit of reduced interest costs and issuance of 1,075,000 new shares as of the beginning of 2015. Note the dilutive effect of the newly issued shares is around $0.10 but the benefit of reduced interest expense is $0.12, making the offering and reduction of debt accretive.

We think that, at a minimum, BGSF should have held its pre offering price as the benefits of reduced interest expense are accretive to EPS and offsets the impact of dilution.

Proceeds for offering and reduction of debt shores up balance sheet making dividend policy more secure

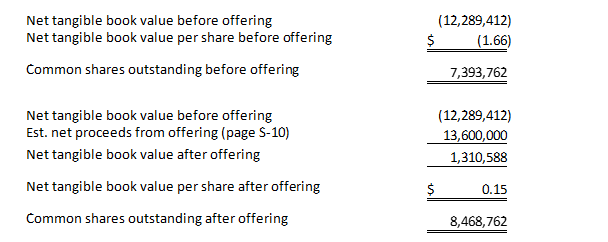

Investors should also note that the offering markedly increases BGSF’s net tangible book value per share from a deficit of ($1.66) before the offering to an estimated $0.15 after the offering.

Also, the company’s debt to equity ratio drops from around 1.20 to 0.40. We think it is possible that the company’s improved balance sheet could lead to an expansion in its valuation multiples, while providing the company with increased flexibility to pursue its acquisition driven growth strategy.

Placing Some Faith in Taglich Brothers

We have had some decent success investing in stocks that Taglich covers, especially when they have skin in the game. In February 2009 coming out of the global recession we coded Orchids Paper Products Company (NYSE:TIS) as a GeoBargain, taking a sizeable position at ~$10.00. Taglich had about a 14% stake in TIS at this juncture. TIS embodied a similar growth + value story as BGSF in that the company was paying a fat dividend (which it was increasing) and growing its earnings and EBITDA. Although we sold the stock around $18.25 in February 2010, at its current price of $31.60 TIS is trading near its all-time highs of $34.20. In the case of BGSF, Taglich also has some significant skin in the game. Affiliates of Taglich Brothers beneficially own more than 10% of the stock.

- Michael N. Taglich, who beneficially owns approximately 8.4% of our common stock, is a principal and the president and chairman of Taglich Brothers

- Robert F. Taglich, who beneficially owns approximately 6.4% of our common stock, is a principal and a managing director of Taglich Brothers

- Douglas E. Hailey, an employee of Taglich Brothers who owns 80% of the equity of Taglich Private Equity LLC, and Richard L. Baum, Jr., an independent contractor for Taglich Private Equity LLC who owns 10% of the equity of Taglich Private Equity LLC, are members of our board of directors

Needless to say, we don’t think Taglich would approve or support a move that would be not detrimental to the company or jeopardize the dividend policy.

Positive Industry Tailwinds

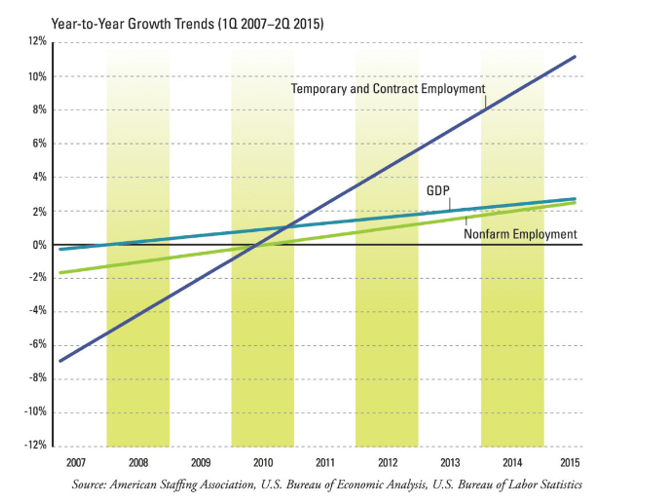

The temporary staffing growth rate in the United States has outpaced growth in GDP and overall employment post the Great Recession.

A major factor fueling the temporary staffing industry is that the amount of employee turnover, the rate at which incoming employees replace outgoing employees over the course of a year, has been high. As an economy improves people have more job options to choose from and more offers coming their way. Furthermore, the inability of the economy to gain consistent traction is forcing companies to hold off on long-term commitments, so they turn to temporary staffing over permanent placement decisions.

“Businesses seem to be adjusting their employment strategies to better weather the economic volatility. In addition to directly hiring permanent employees, companies are increasingly turning to staffing services to augment their workforces and enhance their flexibility and agility in accord with the ebb and flow of the economy.”

“These trends suggest that a fundamental, or secular, shift is helping to drive demand. And, at least until the next economic downturn occurs, the staffing and recruiting industry is forecasted to continue growing faster than the economy and overall employment–creating an abundance of temporary, contract, and permanent employment opportunities for job seekers.”

Conclusion

In our view the market overreacted to BGSF’s offering by marking the shares down without regard to the benefits of using equity to pay off high cost debt which offsets the dilutive impact of the newly issued shares. Once investors digest the implications of the company’s reduced debt and related interest expense, we expect the shares to recapture the value lost, and then some, following the completion of public offering (June 2, 2016).

Caveats

- The company still $14.9 million outstanding on its line of credit

- In order to maintain its current dividend payout the company will end up spending more money on dividends because of the increase in shares outstanding. Some investors may want to have more assurance that the company will continue to maintain a healthy payout ratio, something we will know soon at the end of June 2016. But we do know from verbiage in the prospectus that the company does plan to continue paying dividends.

- As usual a growth model fueled by acquisitions can run into execution problems.

- Even though the temporary staffing trends have been positive for several years and are expected to remain positive going forward in 2016 the U.S. economy is still walking a fine line. Any derailment in economic progress could affect investor sentiment for staffing companies.