Apptigo International (APPG) is one of the most obvious pump and dump (P&D) cases we have come across since we began investigating P&D’s in our inaugural report Raystream (RAYS), which now trades at $0.001.

Some of the characters associated with APPG have deep roots in the P&D game. One character in particular that caught our attention was Lyle Hauser. Hauser’s company, The Vantage Group, is well entrenched in the APPG story. The Vantage Group owns APPG preferred stock that is convertible into 15,925,000 common shares.

Mr. Hauser has ties to at least six past pump and dumps either through being an executive of these companies or by providing capital to them through diluted financing transactions (convertible securities) via The Vantage Group Ltd., a company where he holds the position of Chairman and CEO. Three of these stocks trade for less than two cents with two of these three received temporary suspensions from the Securities and Exchange Commission (SEC). Two of the six had their registrations revoked by the SEC.

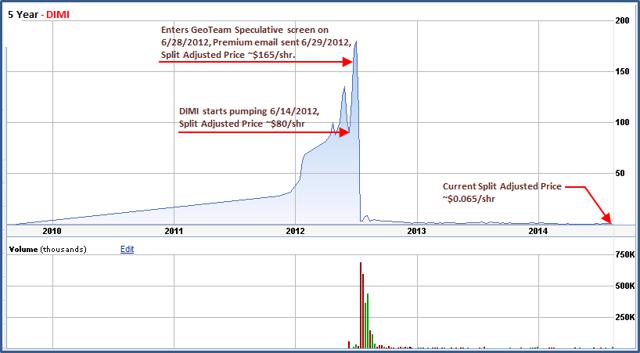

In 2012 we actually exposed one of Hauser’s recent P&Ds, DiMi Telematics International, Inc. (DIMI). The stock fell from $1.38 to $0.04 (Pre reverse split) in four trading sessions. Aside from Lyle Hauser, APPG and DIMI share another trait. Both companies enticed investors about their involvement in the “sexy” mobile app space. We think investors will easily put the pieces of the APPG puzzle together resulting in a quick dump of its shares along the same magnitude as DIMI’s pump two years ago. In Q2 of 2014, APPG even admits in its filings that it has not even begun to market its app.

Here is a November 23, 2011 iHub message board post from an investor expressing frustration over his opinion that Lyle Hauser has a propensity to be involved with P&Ds.

“What a bunch of crooks. This is a just one of the many penny stock scams run by Lyle Hauser. It fact, his latest scam just registered about a week ago is First Quantum Ventures, Inc. or DiMi Telematics dimispeaks.com

DiMi Telematics’s common stock trades on the OTCQB under the symbol “FQVE”

If you read the Form 8-K submitted about a week ago, you’ll see Roberto Fata and Barry Tenzer which are the same crooks involved in another penny stock scam enacted by Hauser, Motorcars Auto Group Inc., formerly Associated Automotive Group Inc.

How many years are we going to have to look on after pump-and-dump and other penny stocks scams before the SEC acts? All the investors lose, and they profit. Hopefully the Securities and Exchange Commission will indict him and his coconspirators this time.”

We are confident that our negative sentiment on APPG will be shared by other investors if they perform a simple web search on “Lyle Hauser Vantage Group pump and dump”.

| Lyle Hauser / Vantage Group LTD. | ||

| Ticker | Pump Campaign | Price as of August 14, 2014 |

| APPG | YES | $1.39 |

| DIMI | YES | *$0.0065 |

| GRBD | YES | Registration Revoked |

| LFXG | YES | $0.0001 |

| MAGI | YES | Registration Revoked |

| WLKF | YES | $0.0001 |

| MDFI | YES | $0.03 |

*adjusted for 1 for 100 reverse split in February 2014

We conclude that APPG is just another P&D that is worth nothing more than what we think it would fetch as a shell company ($500,000/45 million fully diluted shares), or $0.01.

Background

APPG completed its reverse merger on April 14, 2014. The shell that APPG merged into was called Bailus Corp., trading under the symbol BALI that went public through a self-underwritten IPO in 2013 (S-1). Using the self-underwritten IPO route is a common way to bring shells to market. It’s cheaper than a traditional IPO and “cleaner” than buying a shell that has gone through many transformations. We noticed that Thomas E. Puzzo (more on him later) was the legal counsel for BALI per its S-1 filing. Puzzo can be traced back to past shells that ended up housing P&Ds. BALI’s primary business was that of buying and selling horses in Ireland, which appears not to have panned out based on revenues disclosed in its only 10-K filing.

Although some investors may think APPG has only 29 million shares outstanding based on its Q2 2014 filings, the reverse merger resulted in 45.15 million fully diluted shares, after accounting for a 3.5 for 1 forward stock split and convertible preferred shares:

- Vantage Group: 15,925,000 (if converts preferred stock)

- David Steinberg , Co-owner of company that merged into shell that is now APPG: 8,575,000 free trading shares

- Casey Cordes, Co-owner of company that merged into shell that is now APPG: 8,575,000 free trading shares

- Unaccounted: 12,075,000 free trading shares

So with APPG trading around $1.40, the Vantage Group, David Steinberg and Casey Cordes are potentially worth $46 million by owning shares of a zero dollar revenue-generating company. And they have had ample time to cash in on some of their shares. APPG has traded over 11 million shares since we noticed the commencement of a promotional campaign launched by Fly under the Radar Stocks (“FLURS”) in early August.

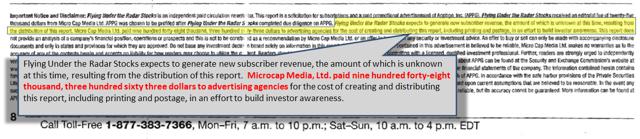

The online promotional campaign website landing page discloses that FLUR received $25,000 from an entity called Micro Cap Media Ltd. However, it fails to disclose the full extent of Micro Cap Media’s budget to promote APPG. But luckily one of our GeoInvesting followers provided us with a disclaimer from a hard mailer he received disclosing that Micro Cap Media’s budget is nearly $1 million to “build investor awareness.”

APPG, or Déjà Vu?

APPG’s self-written description goes like this:

“Apptigo is a non-conforming, highly creative agency, corporate incubator and investment vehicle headquartered in Miami, Florida. Apptigo is focused on designing, developing and bringing to market cutting edge, mobile apps that “entice the soul,” “stimulate the mind” and “make downloads worth downloading and experiences worth experiencing.”

If you think this sounds like a broken record, it’s probably because you are familiar with the events surrounding DiMi Telematics International, Inc. which also introduced its app business venture to investors. Lyle Hauser was one of the three founders of the Company. On July 9, 2012 we informed our GeoInvesting Premium members that we were seeking to short shares of DIMI when the stock was trading at $1.83. Shortly thereafter, our July 17, 2012 short thesis expose, “DiMi Telematics Implosion Underway” correctly predicted shares would quickly plummet. On July 18, 2012 the stock closed at $0.04. This was one of the quickest and most devastating pump and dump cycles we have ever witnessed. (Please note that the stock currently trades at $0.65 because the company executed a 1 for 100 reverse stock split in February 2014.)

There is still more to this déjà vu story. Just like APPG, DIMI was spinning a sexy story hyping its involvement in the mobile app space.

“Available for the iPhone, iPod Touch and iPad for the price of $0.99, Green Genie is an app that provides its users with a massive collection of green projects and resources, making it a comprehensive guide to sustainable living. It provides a breakdown of certified green products and technologies, glossary of green terms, collection of essential reading, links to the best green web sites and organizations, and links to various carbon footprint calculators. Users can also submit their own ideas, projects and resources. As of June 1, 2012, Green Genie had nearly 14,000 active app subscribers.”

“In addition to providing DiMi with a new high margin revenue stream, Green Genie provides us with a powerful marketing platform that we can now leverage to aid our Company in achieving our underpinning mission: to reduce the collective carbon footprints of consumers, commercial businesses, government agencies and industrial enterprises on a worldwide basis,” stated Barry Tenzer, President and CEO of DiMi.”

Subsequently, GeoInvesting stated:

“We conclude that DIMI’s recent acquisition of the software application Green Genie is nothing but a sideshow, which we believe is a pathetic attempt to distract investors from the fact that they are not generating meaningful sales from their flagship software. A distraction maybe one thing, but the comical statement implying that DIMI now has a “new high margin revenue stream” is another.”

Hauser’s Connection To Five More Pump And Dumps

Our article on DIMI highlighted several P&Ds that Lyle Hauser/the Vantage Group had ties to.

Motorcars Auto Group Inc

Here is a quote from our DIMI article on MAGI:

“In 2002 Tenzer and Hauser collaborated together at Motorcars Auto Group Inc.,(MAGI) subsequently renamed Hauser Motorcars Auto Group Inc.), where Mr. Tenzer was the CEO and Hauser the majority shareholder via his private equity firm, the Vantage Group in which he is the sole-owner. The last news item that we were able to reference was one on September 8, 2010 that revealed the possibility of the SEC suspending trading in Motor Auto Group, symbol MAGI, We were not able to find a stock quote on the symbol. Reuter’s last MAGI headline on September 24, 2010 indicates that its symbol had been deleted, with no subsequent symbol change.”

We later learned that MAGI’s registration was revoked by the SEC.

Life Exchange, Inc, ($0.0001)

Here is some intelligence about the Life settlement P&D, LFXG, from our DIMI article:

“Life Exchange, Inc.(PINK:LFXG) was another alleged pump in which Mr. Hauser was part of, owning 45 Million shares or 25.465% of the Company. Here is a 13D filing showing that The Vantage Group held the shares. The Seattle Times reported on this P&D in a February 26, 2006 article titled “Life Exchange tries a twist on pump-and-dump ploy” where it discusses an “investment letter” named “Investment Trader Trends” that attempted to dupe investors out of their money with empty promises of “600% returns or more.” LFXG is currently priced at $0.001.”

More importantly, LFXG was one of 17 companies where trading was suspended to “combat corporate hijackings.”

SEC Suspends Trading in 17 Companies to Combat Corporate Hijackings

“The Commission temporarily suspended trading in the securities of the 17 companies because of questions that have been raised about the accuracy and adequacy of publicly disseminated information concerning their status as publicly-traded companies. Specifically, certain persons appear to have either: 1) usurped the identity of defunct or inactive publicly traded corporations, initially by incorporating new entities using the same names as each of the defunct entities, or 2) reinstated defunct publicly traded corporations without authorization. (Rel. 34-60707)”

Medefile ($0.0026) and Global Roaming, registration revoked

The third and fourth P&Ds that we tied to Hauser were Medefile International Inc. (MDFI), recipient of several pump campaigns over the years, and Global Roaming Distribution (GRDB)

Here are two more passages from our DIMI article:

“Lyle Hauser currently owns shares in MDFI which appears to be a family owned Pump and Dump that has been promoted in many newsletters, including but not limited to this one we highlight here. The company is currently being run by his brother Kevin Hauser, who is the CEO. Kevin was gifted 200 million shares in 2011 by his brother Lyle Hauser

Mr. Hauser became a shareholder of Global Roaming Distribution (GRDB) in conjunction with a reverse merger transaction consummated on September 8, 2007. GRDB was highlighted in an article called “Memorial Day pump and dump (with emphasis on the dump)“. The article stated that GRDB dropped 70% over a five day period on “no news” but was pumped using “amazingly optimistic advertisements”.

The SEC issued a trading suspension on MDFI on at least one occasion.

After being sent to the Grey sheets in 2010, the SEC revoked GRDB’s registration on November, 27, 2014.

Walker Financial Corp ($0.001)

After performing more due diligence on Hauser and the Vantage Group we came across another P&D that we did not highlight in our DIMI report, Walker Financial Corp. (WLKF), formerly Walker international Industries. The stock also invited a trading suspension order from the SEC in February 2014:

“The federal securities laws allow the SEC to suspend trading in any stock for up to ten trading days when the SEC determines that a trading suspension is required in the public interest and for the protection of investors.”

Although we were unable to find any P&D material on WLKF we found the following warnings on otcmarkets.com.

“…

OTC Markets Group Inc. (“OTC Markets”) has discontinued the display of quotes on otcmarkets.com for this security because it has been labeled Caveat Emptor (Buyer Beware) for one of the following reasons:

- Promotion/Spam without Adequate Current Information – The security is being promoted to the public, but adequate current information about the issuer has not been made available to the public. OTC Markets believes adequate current information must be publicly available during any period when a security is the subject of ongoing promotional activities having the effect of encouraging trading of the issuer’s securities. At such instances, as a matter of policy, when adequate current information is not made available, OTC Markets will label the security as “Caveat Emptor.” Promotional activities may include spam email, unsolicited faxes or news releases, whether they are published by the issuer or a third party.

- Investigation of Fraud or Other Criminal Activities – There is an investigation of fraudulent or other criminal activity involving the company, its securities or insiders. When OTC Markets becomes aware of such investigation, the companies’ securities may be subject to Caveat Emptor.

- Suspension/Halt – A regulatory authority or an exchange has halted or suspended trading for public interest concerns (i.e. not a news or earnings halt).

- Undisclosed Corporate Actions – The security or issuer is the subject of a corporate action, such as a reverse merger, stock split, or name change, without adequate current information being publicly available.

- Unsolicited Quotes – The security has only been quoted on an unsolicited basis since it entered the public markets and the issuer has not made adequate current information available to the public.

- Other Public Interest Concern – OTC Markets has determined that there is a public interest concern regarding the security. Such concerns may include but are not limited to promotion, spam or disruptive corporate actions even when adequate current information is available.

…”

Other Cast Of Characters Connected To The Pump And Dumps And/Or The Penny Stock Game

APPG Counsel, Thomas E. Puzzo

We have linked Mr. Puzzo to at least four pump and dumps:

| The Law Offices of Thomas E. Puzzo | ||

| Ticker | Pump Campaign | Price as of August 14, 2014 |

| RAYS | YES | $0.00019 |

| OROE | YES | $0.35 |

| PUGE | YES | $0.08 |

| LIDO | YES | $0.00 |

| TPNI | YES | $0.04 |

APPG Investors Relations Firm: Elite Financial Communications Group (EFCG)

EFCG was IR for DIMI and MDFI, both of which had ties to Hauser. EFCG’s publicly traded client list (not including APPG) is riddled with penny stocks:

| APPG IR FIRM | |

| Ticker | Price as of August 14, 2014 |

| CDEX | $0.03 |

| STJO | $0.32 |

| TNTY | $0.11 |

| UNLI | $0.09 |

| ACEL | $0.05 |

The Hype

Much of the current hype surrounding APPG is over its dating app, “Score – Match Maker” (Score). It looks like the company is attempting to ride the popularity of the Tinder dating app that has gone viral, with over 10 million downloads on Android. Tinder is also available in the Apple (AAPL) store. “Score” is only available in the Apple store and as far as we can tell has attracted an insignificant amount of downloads and is still in beta.

“The first application developed by Apptigo is SCORE, which was introduced to market for beta testing in June 2014. SCORE is an interactive dating game that allows people to determine their compatibility through answering online questions. Users of the application can choose to invite anyone to play by:

- Entering a queue that shows other active players and sending invitations through the queue

- Using the interactive map that shows pins of all the people who are available to play in a specific geographic region; and

- Inviting friends through email, phone number or social media contact lists.

We do not intend to commence our marketing campaign for SCORE until completion of the beta testing, which we estimate will occur by approximately September 25, 2014.” Q2 2014 Filing

Our understanding from one of our team members that downloaded Score, the app, like Tinder, attemptsto match people based on user distance settings, age, sex and various questions. After the questions are answered, little blue dots populate a map of compatible people. A major problem we see with the app is that users can’t see pictures of other users on the map unless they click on the blue dots.

Tinder is quick and simple. A user chooses location, age and sex, and moments later pictures/profiles are displayed. Next, the user swipes left if they don’t like what they see and right if they like what they see. A match is made when users randomly like each other. In our opinion, the ability to view pictures is a must for a mobile dating app.

Ultimately, we don’t think Score, an app that we deem to be inferior to other much more established players in the space, has even a small chance of succeeding in its business plan based on this intense competitive environment.

If Score wants to compete, APPG is going to have to pony up massive amounts of dilutive capital to catch up to its competitors that have already spent millions of dollars to acquire members. Luckily we can compare APPG to a publicly traded comp that is similar to Tinder called Meetme (MEET).

“More than one million people [link inserted for reference]use MeetMe every day to meet new people in their local communities or anywhere in the world and Over 200 million messages are sent per month.. We believe a dramatic shift is underway in the multi-billion dollar dating industry, and that the industry is anchoring towards free with lowered pricing [bolded for emphasis]and dramatic investments in free services by existing players.”

So APPG, with Zero revenues plans on taking on companies like MEET in an industry where product prices are decreasing? This means that APPG will have to spend enormous marketing dollars to build a massive membership base to earn ad revenue. MeetMe has spent $19 million just in marketing expense since 2010. Its revenues for 2013 were $40 million compared to the stock’s market cap of $85 million. APPG’s Q2 2014 revenues were Zero, while its fully diluted market-cap is sitting at $63 million.

APPG aspirations are even more challenging given that it appears Tinder just received $500 million from Iac/interactivecorp (IACI).

“IAC is a leading media and Internet company focused on the areas of search, applications, online dating, media and eCommerce. Ranked by Fortune magazine’s annual standing of the world’s most admired companies in the Internet Services & Retailing sector for many years, IAC’s network of sites has over a billion total monthly visits in more than 100 countries and is the 11th largest network in the world. The company is headquartered in the Chelsea neighborhood of New York City and has business operations and satellite offices around the world.”

Need we say more?