by GeoContributor Craig Bach

Gaining an advantage over investors scrambling to gain alpha in the large cap arena can be a daunting task due to the speed and dissemination of information. Share prices of these companies quickly assimilate hidden or obvious changes in value brought on by various developments. This is not always the case in the micro-cap arena where our team is amazed at the opportunities that investors are slow to pounce on. Yet, we are thankful for this market inefficiency that many refuse to acknowledge.

By now GeoInvesting followers should know that our team has a strong track record of exploiting hidden clues telegraphed by management teams of micro-cap gems before the masses do. On March 18, 2013 we disclosed our long position in Rf Industries (NASDAQ:RFIL) to GeoInvesting premium members at $6.39. We believe that RFIL is one of those gems and could rise to a range of $8.75 to $13.00 from its current share price in the upper $6 per share range. We have noticed significant volume coming into the stock over the past couple of trading sessions, making shares poised for a breakout move.

RF Industries engages in the design, manufacture, and/or sale of communications equipment (cables and connectors).

Using History as a Guide

We believe that RFIL’s share price will be propelled by the same forces that led to above average returns for investors who bought Orchid’s Paper (TIS) and Ceco Environmental (CECE) after we published bullish articles on Seeking Alpha.

Orchid’s Paper, 3 Catalysts That Could Boost Orchids Paper

Ceco Environmental (CECE), Why Ceco’s Dividend Increase Translates Into A Higher Price Target

Both of these companies telegraphed their respective price moves when their boards of directors approved meaningful increases in quarterly dividend payouts.

We consider a dividend boost of at least 25% to be meaningful. On November 10, 2011 TIS announced that its board of directors approved an increase in the company’s quarterly cash dividend by 100%. The stock was trading at around $13.00 at the time of our Seeking Alpha article. We told our readers that we thought that this development could send shares to at least $17.00. Two quarterly dividend increases later of 25% and 20%, TIS now trades around $23 (TIS is currently a GeoBargain with a near term price target of $27.50).

On March 9, 2012 CECE announced that it was increasing its quarterly dividend per share by 40%. We told readers that this event could cause shares to appreciate to at least $10.50 from around $8.00. The company subsequently boosted its dividend again, this time by 29%. Shares recently attained a 52 new week high of $14.32.

On March 18, 2013, RFIL’s Board of Directors approved an increase of the quarterly dividend by 40%, raising its annual rate to $0.28. This increase came on “the heels” of an accelerated dividend payment for the 2012 first Quarter which was paid on December 28, 2012. These actions demonstrate management’s confidence going forward.

The closing price of RFIL the day prior to the dividend announcement was $6.19 when the market had assigned a dividend yield of approximately 3.2% to its shares. As of RFIL’s closing price of $6.75 on March 25, 2013 its yield stood at 4.15%.

Borrowing the logic from our TIS article, a portion of a stock’s dividend yield is comprised of a risk premium. The higher the perceived risk, the higher the dividend yield.

So has RFIL’s risk profile changed?

RFIL’s four divisions are all experiencing double digit growth as its products are benefiting from the acceleration of the infrastructure build out in the communication/telecommunication/wireless industry. The company has introduced a new product to address the needs of wireless operators (Optiflex), diversified its customer base and decreased its reliance on some volatile market segments it serves.

The OptiFlex cable is a hybrid power and communications cable designed and built for wireless service providers who are updating their networks to 4G technologies. It is worth noting that in its 2012 10K RFIL asserts that:

“presently, there are no other companies that manufacture a product that is similar to the Optiflex hybrid fiber optic cable assemblies for use by wireless service providers.”

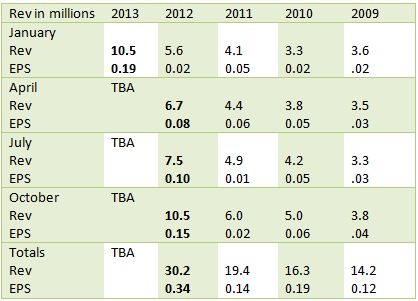

The enhancements RFIL has made to its business have led to more consistent growth. After sporadic quarterly EPS growth over the last several years, RFIL has displayed stellar growth in both revenue and EPS over the past four quarters, a trend we think can continue at least over the next two quarters where comps should be easy to beat.

Seasonality has been an issue with RFIL, but the changes management has made and the outlook for the markets it serves could mitigate this concern and smooth out quarterly financial results. In fact, the company’s 2013 first quarter did not exhibit the seasonality the company has been accustomed to in the past.

When one combines RFIL’s dividend payment developments with a more consistent growth profile it is logical to presume that the company’s risk profile is at least as good as it was yesterday, meaning that shares should rise to bring the dividend yield back to 3.2%.

Valuation

In order for RFIL’s dividend yield to equal 3.2%, shares would need to rise 30% to $8.75 which would translate into a trailing PE of 16.8 compared to consistent EPS growth over the last 4 quarters that has averaged well in excess of 50%. Thus, we do not think it is unreasonable that shares could soon trade at a trailing PE multiple of 25 or $13.

Conference Call Offers Insights

We listened to the 2013 first quarter conference call to gauge the potential risks as well as near-term growth opportunities for RFIL. During the question and answer segment of the conference call management stated that the build out for infrastructure will be strong. Therefore, we feel that the year over year revenue and EPS comparisons moving forward will present easily beatable targets. These sentiments were also echoed by management in the first quarter press release.

One concern or potential risk that we wanted to gain clarity on during the conference call was the impact on RFIL’s operations as it delivers the last installment of a $2.6 million Los Angeles County Fire Department contract dealing with a wireless system upgrade. During the question and answer segment of the conference call, management revealed that this order contributed $530 thousand dollars to the first quarter results. Although encouraging, it is still not significant in comparison to the $10.5 million dollars in revenue generated during the quarter. Although the completion of this order in the upcoming quarter may not be immediately replaceable, the broad cross section of momentum that was shown in the 2013 first quarter should lead to strong revenue comparisons as RFIL forges ahead.

Conclusion

Overall, based on the markets and product lines that RFIL serves combined with the strong U.S. infrastructure build out, we believe that RFIL has a bright future at least in the near-term. It is possible that RFIL’s recent performance has yet to reflect the positive catalysts we have discussed and offers eager investors a unique opportunity for above-average returns.

Disclosure: Long RFIL

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from tte use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.