- Sefe (PINK:SEFE)

- Great Wall Builders (PINK:GWBU)

- First Quantum Ventures (PINK:DIMI)

This brings us to Echo Automotive (OTC BB:ECAU). On December 3, 2012, when the stock was trading at $0.72, we informed GeoInvesting premium members that ECAU had the makings of a potential P&D:

“Company just became public through a reverse merger transaction and claims to be developing a set of technologies that it believes will reduce overall fuel expenses in commercial fleet vehicles by augmenting existing power-trains with highly efficient electrical energy delivered by electric motors. Although we have not noticed any promotional pump activity on the company yet, we will monitor the story for such developments since the industry they are playing in has been ripe with pump and dump activity.”

As it turns out, ECAU obviously did not disappoint. On January 13 2013, a promotional campaign commenced through DH Media. We received two mailers from two notorious third party P&D newsletters called Five Star Equities and The Bedford Report, both compensated by DH Media. These newsletters are owned and operated by Providence Media Strategies LLC.

A couple of weeks after we started to notice this promotional activity, on January 24, 2013 we stated:

“… we had been receiving new pump and dump material on this name. We added ECAU to our Speculative Screen on 12/3/2012 at $0.72. We mentioned the company had hired a third party for an “awareness campaign”. The email campaign seems to be in full gear as we have been receiving more pump newsletters in our inbox. Please see email pump campaign here.”

The stock responded and climbed to a high of $3.61 (an over 400% increase) on January 29, 2013.

Investors may be interested to know that The Bedford Report issued a bullish report on Longwei Petroleum (NYSE AMEX:LPH) on January 3, 2013, a couple of hours before we published our in-depth investigatory report on this company, a piece in which we contended LPH to be most brazen U.S. Listed Chinese company fraud to date. The company’s shares fell over 70% to $0.62 within one hour of our report. During LPH’s current halt, China’s State-owned CCTV news network confirmed some of our findings with their own on-the-ground research, finally coming to some of the same conclusions as us.

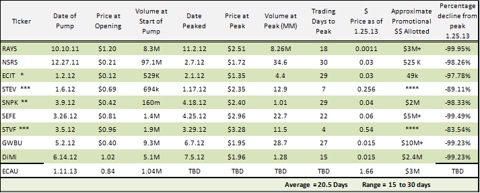

In our previous P&D articles we introduced the pump and dump time chart outlining the average life of a pump before an ensuing dump.

* ECIT Ecoland Intl. changed its symbol to NRBT.

** SNPK changed its symbol to PHRX

*** ECAU’s current IR firm, Crescendo Communications, LLC, also represented STEV and STVF. Furthermore, all three were/are being touted by a common character in the P&D world: Chuck Hughes

**** TBD

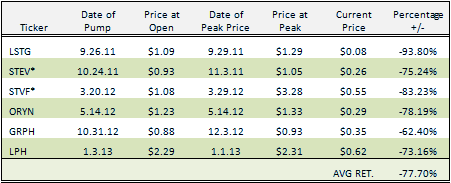

Please note that the same third party promotional characters behind the ECAU campaign were behind STEV and STVF, two stocks which eventually collapsed.

Since ECAU has been pumping hard for 13 trading days we believe the pump will end sooner rather than later. In fact the stock is already breaking down.

Through a holding company that is part of the corporate structure of ECAU, the company’s president along with the CEO received a combined 52.5 million shares as a result of the reverse merger transaction with a shell company, Canterbury Resources. At ECAU’s highest price these shares were worth nearly $200 million. The reverse merger transaction also resulted in the shareholders of the shell owning over 23,750,000 shares in free trading stock (after a forward 4 for 1 stock split), and were worth close to $90 million at ECAU’s high. Financing arrangements concurrent with the reverse merger have also created cheap shares through the issuance of warrants. This chain of events should not come as a surprise to veterans of the P&D space who will probably know that the profit tied up in these shares has to unwind, especially when considering the performance of the stock.

Too Good To Be True

Echo Automotive LLC (ECAU), a product of a reverse merger on October 15, 2012, is playing in a “green” industry that has facilitated past P&Ds.

“Its operations consist of Echo Automotive, Inc. which is “developing a set of technologies that it believes will reduce overall fuel expenses in commercial fleet vehicles by augmenting existing powertrains with highly efficient electrical energy delivered by electric motors powered by Echo’s modular plug-in battery modules.”

In simple terms, the company claims that its technology converts existing vehicles to hybrids.

Echo states that it has developed a revolutionary advanced plug-in hybrid electric vehicle (PHEV) technology, branded as EchoDriveâ„¢.

We find this amazing since according to the audited financial statement in the reverse merger document this fledgling development stage company logged a total of $461,000 in operating expenses and $423,000 from financing activities since its inception. We question that the company has been able to develop a ground breaking technology and test it on such a budget, especially since until its reverse merger operations consisted of selling carbon credits, with little success.

The company’s claim to fame is that its conversion process will be significantly less than that of the competition, yet it clearly appears too early to make such a claim:

“While the basic technology has been verified, we only recently have begun the commercialization of the complete plug-in hybrid electric vehicle (PHEV) system in preparation for our initial conversion of a vehicle. This limits our ability to accurately forecast the cost of the conversions or to determine a precise date on which the commercial platform for vehicle conversions will be widely released.” (Source: October 15, 2012 8K)

The company projects that:

- In order to keep operations at the current level, $3.0 million will be required over the next three months to cover our anticipated monthly expenses.

- In order to successfully execute its business plan including the planned development and marketing of current products, an additional $7.0 million will be required in long term financing. (Source: Q3 2012 10Q)

We find these funding assumptions hard to believe since as we will show, similar companies that require north of $100 million just to prepare their businesses.

Echo’s SEC filings also make it quite clear that the attainment of profitability is not in the cards anytime soon.

“Prior to obtaining customers and distribution for our products, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future.”

Dilution is a certainty and the company may already be in a liquidity crunch since the end of 2012:

“Our cash on hand and working capital will not be sufficient to meet our anticipated cash requirements through 2012. To date, our working capital has been a combination of private investments, private loans, shareholder capital contributions, and advances through promissory notes. We are currently seeking both short term funding to finance current operations as well as significant amounts of long term capital to execute our business plan.”

Even so, with zero sales, negative equity, and 75 million shares Echo’s capital structure may not be conducive to raising capital, even if it has a viable product:

“We are pre-revenue and in the developmental stage and therefore we do not internally generate adequate cash flows to support our existing operations Moreover, the historical and existing capital structure is not adequate to fund our planned growth.”

Finally, it appears way too early to recognize Echo’s ability to deliver results:

“Of even greater significance is that fact that we have no operating history with respect to augmenting existing power trains with highly efficient electrical energy delivered by electric motors powered by our modular plug-in battery modules.”

As we will discuss later, based on comparable companies, we value ECAU as little as $0.08 for investors who choose to consider it to be a legitimate operating entity. For those who believe it is another fly by night P&D, a valuation of $0.013 may be more appropriate.

How to Build Legitimacy 101

The Echo pump has worked well as ECAU appears to be riding the coattails of existing technology.

The Clean Futures Connection

ECAU has signed a licensing agreement with a company called Clean Futures LLC, allowing ECAU the use of its conversion technology. As part of this transaction, Clean Futures received warrants with an exercise price of $0.01. Thus far we have been unable to find much information on a company called Clean Future LLC, but it appears that it was established in April 2011. However, we did come across a website for Clean Futures Inc.

The Bright Connection

Bright Automotive (“Bright”) was once a well-recognized company in the same space. ECAU claims to have purchased some of Bright’s intellectual property. In the end, Bright did not receive the funding from the Department of Energy (“DOE”) necessary to continue operations, a failure which eventually led to Bright closing up shop in February 2012. The DOE tightened up its lending program to the alternative vehicle industry when Solyndra filed for Chapter 11 in September 2011 shortly after receiving $535 million from the government and $198 million from the private market.

Bright was in the process of creating a fuel-efficient line of plug-in electric vehicles, but…

“one of its main focuses was plug-in technology retrofitting. This involves taking a currently combustion engine powered car and turning it either into a hybrid or a fully electric car.”

Before Bright’s demise, its future actually looked promising. It had received around $22 million in funding from bellwether names such as Google Inc. (NASDAQ:GOOG) and a branch of General Motors, General Motors Ventures, LLC.

Apparently, after the DOE tightened is lending standards, Bright could not receive adequate funding or chose not to court venture capitalists. In total, Bright was asking for $450 million from the DOE. So this gives us quite a sobering glance at what it would take to commercialize some of Bright’s IP!

The fuel for ECAU’s promotional pump is not just comprised of the alleged purchase of Bright’s IP, but also includes the common P&D move of beefing up the Board of Directors and Advisory Boards with recognizable names. In this case John Waters, the founder of Bright, is a key figure head. He currently serves as part-time Chief Technology officer (CTO) for Echo Automotive. To our knowledge and per SEC documents, it does not appear that he has brought any funds to the table, meaning that ECAU, or should we say Bright, will have to start from ground zero. We do not know if John is aware of the P&D game.

A Pump and Dump Setting Could Not Ask For a Better Launching Pad

On May 22, 2012 ECAU claimed that it planned to spend $112,500 to purchase battery pack IP and other assets from Bright Automotive. Then on June, 28, 2012 ECAU claimed it had entered into a licensing agreement with Bright for $50,000:

“Bright hereby grants to Licensee a royalty-free, perpetual, fully-paid up, worldwide, non-exclusive, non-transferable and non-sub-licensable limited license to use the Battery Management Software and CAD of Exhibit A(l) (“Software”) and intellectual property of Exhibit A(2) (“Bright Intellectual Property”) to develop, modify and/or sell, offer for sale, market, distribute, import and export derivative works”

In consideration for the granting of this license, Licensee hereby agrees to pay to Bright a one-time up-front license fee in the amount of Amount of $50,000.”

Referencing the May 22, 2012 filing, a strange transaction occurred where ECAU loaned $50,000 to Flagship Enterprise Center (landlord for the facility Echo claims to rent) to purchase assets to be used by Echo.

Third party promotional letters wasted no time in touting ECAU’s dream. Promoters have insinuated that ECAU is a game-changer in its industry and have jumped all over the knowledge that Google (GOOG) and a branch General Motors funded Bright’s early development, but in our opinion fail to sufficiently articulate the significant hurdles posed by the following challenges:

- The $450 million in capital Bright needed to commercialize its IP.

- The extreme difficulty that similarly-focused companies have had in accessing capital and succeeding in this market, even with viable IP.

- The millions of dollars that a formidable competitor has received; a competitor that appears to be cornering the conversion market.

This green vehicle push has become the “green monster”, consuming capital at a rapid rate and claiming casualties. The mere fact that GM’s subsidiary invested $5 million in Bright does not substantiate Bright’s technology since it was never fully commercialized. Furthermore, that fact that many companies have failed after receiving hundreds of millions in financing drives this point home. One only has to reference past failures in this industry. For example, the Solyndra Chapter 11 also underscores how tough it is to succeed in the electric/hybrid vehicle industry.

This sequence of events forced us to seriously question the credibility and viability of ECAU’s story.

We find it illogical that just three months after Bright ceased operations, ECAU, a company that…

- Reported no revenues as its 2012 third quarter

- Sports negative equity

- Is operating with negative working capital

- With 75 million shares outstanding does not have a shareholder friendly capital structure for raising capital.

- We believe could likely require north of $200 million in financing

…was able to strike a deal to purchase/license valuable intellectual property for a couple hundred thousand dollars from a company that had raised tens of millions of dollars.

On the flip side, if Bright’s IP referenced in ECAU’s SEC filings is only worth $200,000, it tells us that the venture capital market does not see a future in it, or they would have certainly at least entertained paying for such a “ground-breaking” technology. ECAU wants investors to believe that a reverse merged company generating no revenue is going to be able to do what Bright could not – Raise some of the hundreds of millions of dollars Bright was seeking in order to bring its product to market. We can only bid good luck to ECAU and fortuity to investors who think ECAU will be among the first penny stock P&D to deliver long lasting business success. Some will say that Bright folded due to the DOE rejection. Well, only the strong survive. It seems that one company was able to survive the DOE’s tightened wallet and raise capital elsewhere from private equity and partnerships. ECAU needs to be aware that it is going up against an intimidating competitor with a significant head start – ALTe Powertrain Technologies.

Late To the Party – Assume For Arguments Sake That ECAU Is a Viable Operation

Despite the bold statements made in the promotional material describing ECAU’s opportunity, we don’t think that the company is close to being a viable competitor at this time. To really get a feel for what a legitimate company in ECAU’s space should represent, you can research ALTe Powertrain Technologies’ (“ALTE”) accomplishments and achievements. This private company has raised significant capital amid a difficult financing environment that has hurt its competitors.

ALTE descriptions:

“ALTe is developing range extended electric powertrains focusing initially on fleet vehicles such as taxis, limos, delivery trucks, vans and shuttle buses in the light to medium duty vehicle classes.”

“ALTe is the developer of the first range-extended plug-in electric hybrid powertrain used to repower light commercial vehicles. The system will be retrofit into existing fleet vehicles as well as used in “glider” applications of new vehicles to dramatically increase their fuel economy and lower emissions.”

The company focuses on retrofitting used commercial vehicles.

Its first product line will be retrofitting Ford Motor Co. F-Series trucks for commercial fleets. The trucks make up 55 percent of the commercial fleet market in the U.S.

Go here to see a demo of ALTE’s conversion process.

Ahead of the Funding Curve

A quick look at ALTE news flow will show that ECAU will likely have to raise millions of dollars to be in a position to compete with ALTE.

April 7, 2011 article from the NY Times:

“The company said it had also raised $16.5 million in private capital and that hundreds of millions of dollars will be needed to deliver a finished product.”

August 25, 2011 article from Crain s Detroit Business.com:

“Alte LLC has secured $100 million in financing to bring its range-extended powertrains for commercial fleets to market,”

December 2012 Article at thegreenjob.com:

“ALTE has raised $20 million in private equity, and is setting up a $200 million joint venture in China to manufacture and sell its conversion powertrain in Asia. $70 million is slated for R&D at its US location.”

Customer Pipeline/Product Adoption

ECAU has yet to ink contracts with suppliers for its components and has not identified which company it will use to fulfill its manufacturing needs. More importantly, the company has no customers at this time (Source: Q3 2012 10Q).

On the other hand, ALTE has all these ducks in a row.

In 2011 ALTE stated that:

“it has had interest to retrofit up to 900,000 vehicles with the Alte powertrain. Thomas expects production to start in the second quarter of 2012. He projected about $60 million in revenue next year.” (Revenue generation was subsequently been delayed by one year)

Furthermore ALTE:

“claims nearly 100 major fleets have driven an ALTe prototype vehicle. Ten are ready to do pilot programs of up to two dozen vehicles.”

“has demonstrated its powertrain technology in the United States by retrofitting Ford 150 trucks and Ford E350 vans for potential fleet customers.”

“has a big Fleet Advisory Board, as ALTe calls it, composed of dozens of companies such as Frito-Lay that operate big fleets.”

ECAU is name-dropping potential customers like FedEx, but our research indicates that it would face serious challenges in selling its product to a commercial customer base unless it first shows it can achieve mass production. ALTE mentions this dilemma and crossed this hurdle in 2012 when it secured a 4-year, $680 million deal with a Chinese customer to supply 27,000 power trains for trucks and vans. Our knowledge of ALTE strengthens our contention that ECAU could shape up as a Pump & Dump.

Valuation

Scenario 1

Investors who believe that ECAU is just another P&D will value shares as Shell Company. We will be aggressive and use $1 million as our shell price tag which equates to a price target of $0.013 per share. ($1 million aggressive shell valuation divided by 75 million shares outstanding).

Scenario 2

Some investors may choose to compare it to a publicly traded company. AMP Holding Company (OTCBB:AMPD) converts gas powered vehicles to electric. Like ECAU, AMPD generates insignificant revenues. Unlike ECAU, it claims to have the backing of a global truck manufacturer, publicly traded Navistar Intl Corp (NYSE:NAV). AMPD’s market cap is around $6 million compared to ECOU’s market cap of around $350 million at its peak. ECAU would have to trade at $0.08 to be on par with AMPD valuation. To be fair, AMPD is targeting a smaller market segment.

Scenario 3

Other Investors may choose to believe that ECAU is company that will take a stab at building a viable company such as ALTE.

Our research indicates that ECAU will have to raise significant funds to start generating meaningful revenue. We will be conservative and assume a $25 million funding requirement at $1.00 per share. This would put shares outstanding at about 100 million. We will also assume that ECAU:

- Will raise capital in 2013 and generate $60 million in 2014, matching what ALTE believes its revenue will be during its first revenue-generating year, and

- Will optimistically be profitable with 10% net margins right out of the gate, even though the company clearly mentions in its filing s that it will lose money for the foreseeable future.

In this scenario, ECAU will earn EPS of $0.06 in 2014. Using a P/E of 15 to 25 implies that ECAU would be worth $0.90 to $1.50. (Note that ECAU claims that it will require only $10 million to be in position to commercialize its IP, but based on our research we do not subscribe to this assumption.)

In our opinion, any legitimate valuation scenario is likely a far-fetched one since the company can be associated with the usual suspects of third party promoters. The shareholders that buys stocks based on these promotions knows how the P&D game is played and will not stick around as they attempt to guess when promoters and insiders may start to sell their shares. As we expected and as relayed to our subscribers, these parties end abruptly leading to shares free falling to just pennies.

Where Is The Proof?

The recent claims ECAU has made in its press releases and corporate presentation are certainly eye grabbing. Several facets of the story leave us wondering how transparent ECAU is being with investors.

Press Release Lacks Details

In a January 23, 2013 press release the company was proud to announce that it claimed to have had its first public display demonstrating its proprietary hybrid electric vehicle.

“For example, the vehicle we previewed today is capable of running as a HEV, PHEV or BEV with a simple push of the button. In BEV mode, it’s running completely under the propulsion of EchoDriveâ„¢ with the internal combustion engine turned off.”

We expected to find link to a video presentation or photos of this grand event, but so far we been unable to.

We have only been able to find a blueprint illustration of its concept presented on its website and a 5 minute clip of what we deem to be investor hype.

Pricing Transparency

Apparently, the cost to convert an existing commercial vehicle to a Hybrid using the EchoDrive system ranges between $10,000 to 12,000, which is much lower than competitors prices that can be as high as $30,000.

Electric vehicle companies cite battery costs as the overriding reason for the heavy price tag charged to perform conversions. For example, the cost of the batteries its competitors pay in their systems can reach north of $15,000.

If competitors are buying batteries at prices as high as $15,000, how can Echo claim that its total conversion process is cheaper than the battery itself. A plausible explanation would be that Echo is omitting battery costs from the conversion estimate. If this is the case, then their value proposition is significantly altered.

Basically, per the company’s investor presentation, it looks like the company it saying that its technology enables it to utilize a battery with 12 kHw vs. 48 kHw used by the competition. Better yet, it claims that there is no loss of performance in commercial vehicles when using the smaller batteries in conjunction with its technology. ECAU alleges that it also achieves cost savings because its EchoDrive can be easily bolted onto or retrofitted onto an existing vehicle’s powertrain. ECAU claims that it gives it a competitive advantage since its peers require the removal of the original powertrain to complete conversions.

ECAU’s IP seems like a gold mine, yet it chose to go public through a reverse merger transaction. Keep in mind that ECAU clearly states that the battery pack is not the only cost to consider:

“The EchoDrive components include an electric motor, power electronics, hybrid controller, battery cells, and modular battery-pack.”

More importantly, recall that the company disclosed:

“While the basic technology has been verified, we only recently have begun the commercialization of the complete plug-in hybrid electric vehicle (PHEV) system in preparation for our initial conversion of a vehicle. This limits our ability to accurately forecast the cost of the conversions or to determine a precise date on which the commercial platform for vehicle conversions will be widely released.”

Although we would like to see the company demonstrate its capabilities before blindly accepting its cost assumptions, inconsistencies we discuss next have raised some red flags.

The Flip Flop

It appears that there is one subtle inconsistency that indicates something is amiss in ECAU’s presentation of its business model. We came across a website that highlighted the ECAU story on November 29, 2012.

Here is a screen shot from this website which appears to be a page taken out of ECAU’s website.

Notice the following quote:

“The cost of the battery is expected to run between $10,000 to 12,000, which is perhaps a cost saving compared to some current compact car battery packs that begin at $12,000 to $15,000.”

This quote is somewhat perplexing. It is clearly saying that the cost of the battery is $10,000 to $12,000 which appears to contradict Echo’s claim that the entire conversion process will range from $10,000 to $12,000. This contradiction supports our opinion that ECAU’S conversion cost estimates may be off.

Moving on, we found it odd that we could not locate this quote at ECAU’S current website.

ECAU P&D: The Common Thread

Although a dissection of potential P&D business plan can give insight into the credibility of its story, this task is really not necessary for those who are not new to the P&D space. By now, investors should easily realize the presence of a common thread woven into pump and dump stories, no matter how alluring they appear.

The second that promotional activity commences in the penny stock world with the usual suspects is when we can begin to surmise that the target company has entered the pump and dump zone.

We have yet to see a P&D perform well much past the average dictated by our pump and dump clock.

So let’s take a closer look at Providence Media Strategies (“PMS”), the company that is funding the ECAU third party promotional campaign. PMS owns the following tout letters;

- BedfordReport.com

- EastwindResearch.com

- ElitePennyStock.com

- FiveStarEquities.com

- MomentumHunter.com

- PennyAuthority.com

- ParagonReport.com

- PennyLaneReports.com

For the sake of brevity, here is just a sampling of pump and dump stories affiliated with PMS which can give investors in ECAU a glimpse of what they can look forward to if they hang on to their shares too long:

*ECAU’s current IR firm, Crescendo Communications, LLC, also represented STEV and STVF.

Motivation for the Pump

Reverse Merger Process

P&D reverse merger transactions often create liquidity and shares with little or no cost basis.

A P&D scenario needs to be accompanied by ample volume so that participants of the reverse merger shell will have an environment to sell shares of stock in order to rake in huge profits. The process of ECAU’s reverse merger included a 4 for 1 forward stock split creating the perfect scenario to absorb increased share volume and over 20 million shares of freely trading stock owned by pre-merger shareholders.

As we mentioned earlier, through a holding company that is part of the corporate structure of ECAU, the company’s President t, Jason Plotke, and CEO, Dan Kennedy , received a combined 52.5 million shares as a result of the October 2012 reverse merger transaction. At ECAU’s high these shares were worth nearly $200 million.

Financing

A notable amount of Pump and Dumps attempt to build investor confidence by announcing financing arrangements. We deem these actions to be just a smoke and mirrors game. These financing arrangements are usually structured so that the provider of capital receives stock that will more than cover the amount of the loan commitment, especially with the onset of a successful pump campaign.

On July 13, 2012 Josh Lambert entered into a promissory note agreement, lending the company $65,000. In return:

“Within 120 days of the execution of this promissory note, Borrower will issue Lender warrants to purchase $65,000 of stock (130,000 shares) at no more than $0.01 per share.”

At ECAU’s high Mr. Lambert’s warrant s were worth about $470,000

On July 13, 2012, William Kennedy, CEO, entered into a promissory note agreement, lending the company $50,000. In return:

“Within 120 days of the execution of this promissory note, Borrower will issue Lender warrants to purchase $50,000 of stock (100,000 shares) at no more than $0.01 per share.”

At ECAU’s high Mr. Kennedy’s warrants were worth about $350,000.

Both note agreements carry a hefty interest rate of 21% and entitle the lenders to receive 1 share of stock at $0.01 for every $10 of outstanding debt at the end of each calendar month. These are essentially riskless loans as long as the stock is equal to or greater than $0.01 and the structure of the loan provides a great incentive for a “third party” pump campaign.

There are a few other factors to rationalize a pump:

Per the terms of a $2,000,000 financing agreement on May 16, 2012 an outfit called Hartford Equity allegedly committed to provide financing of not less than $2 million within twelve (12) months of this agreement.

The terms of this financing agreement call for Hartford to purchase common shares at $0.50 and included warrants at an exercise price of $0.75.

Based on information in SEC filings, we calculate that Hartford likely owns about 2.5 million shares of ECAU common stock (not even including the warrants) that were worth around $9 million at ECAU’s high; easily enough to reel in a profit from its investment in a company with no revenues and still honor its “commitment.”

Licensing Arrangements That Contain Warrant Clauses

On February 1, 2012 ECAU entered into a licensing agreement with a company called Clean Futures. Apparently Clean futures is allowing ECAU to use its “technologies” in its products. As part of the licensing agreement Clean Futures received warrants enabling it to purchase shares of ECAU’s common stock at 0.50.

We do not know if a related party relationship exists between ECAU and CleanFutures, but this is quite a deal for Clean Futures. We presume that the company has converted its warrants since:

“CleanFutures will have the right to sell the common stock at any time after the initial funding of ControlledCarbon subject to the terms of the voting rights agreement.”

We are assuming that the July 13, 2013 promissory notes and the Hartford loan have satisfied this requirement.

Dose of Reality: Investors Need To Wake Up

ECAU is possibly shaping up to be one of the most cunning pump and dumps we have come across due to the fact that it goes a long way to sprinkle specs of legitimacy across its story. Like many P&Ds, ECAU portrays an air of legitimacy by discussing:

- patents,

- trademarks,

- licensing agreements,

- potential relationships with fortune 500 names ,

- marketing material showing their products with Fortune 500 names imprinted on them, even though no relationship has been established (in this case ECAU is using the Fed Ex name)

- a billion dollar opportunity ,

- being first to market

- prepackaging an old story

We are not saying that investors can’t make money during the pump phase, but our P&D time chart and current price action indicates that ECAU is in the process of imploding. The clock is winding down…Tick Tock.

Disclosure: Short ECAU

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from tte use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.