Introduction

Our opinion regarding the validity of the Yuhe Int`l Inc (GREY:YUII) story has been a volatile one. As the Chinese RTO universe was tumbling down during the past year, YUII was one of the few ChinaHybrids we still held a long position in. However, in September 2010 we unwound that position due to our suspicion that the company was about to tap the equity market for capital at what we feared would be a poor valuation. Just one month later YUII did in fact climb aboard the dilution train. Despite our reservations about the equity offering, though, we reinitiated a long position in YUII shares prompted by:

- The strong pricing of the offering. Although we felt that the P/E multiple for the transaction was sub-par, the offering was completed at a premium to prevailing market prices at the time of the offering.

- The appearance that YUII would use proceeds from the offering to consummate accretive acquisitions.

- Knowledge that SAIC filings were in line with SEC filings.

Given our long position in YUII we decided to perform more extensive due diligence (“DD”) of the company to justify our investment. It was our expectation at the time that we would eventually increase our exposure to YUII shares.

We began our DD process two months ago. The initial findings were encouraging. We were able to confirm the existence of 15 of YUII’s “legacy” farms and they all appeared to be in good shape.

However, our optimism began to wane once we shifted our focus to concerns about YUII’s planned acquisition of 13 farms from Dajiang Enterprise Group Co., Ltd. Soon afterwards, we issued an alert to GoeInvesting members that we had initiated a small short position in YUII shares pending further DD. That DD led us to conclude that YUII may have misappropriated $12.1 million in the Dajiang acquisition and had misled investors regarding the details surrounding that transaction.

Background of Intent to Acquire Dajiang’s Farms

As background, YUII originally announced the acquisition of Dajiang’s farms in December 2009. At the time, the company claimed it paid an 80% deposit ($12.1 million) against the purchase price and said the transaction would close by March 2010. The first disclosure regarding this transaction in a SEC filing follows:

- Form 8-K (Dec. 31, 2009): Under the First Agreement, Dajiang agreed to transfer to Weifang Yuhe a total of thirteen breeder farms (the “Farms”) with a total area of 560 mu (approximately 37 hectares) at a total consideration of RMB 103,870,000. The transfer consideration is to be settled in two installments with the first installment in the amount of RMB 83,000,000 being payable on or before December 31, 2009 and the balance being payable within two months following completion of the transfer. Payment of the first installment has been made.……. The transfer of the Farms will be completed in or around the beginning of March 2010.

Despite YUII’s assertion that the transfer of the Dajiang farms would be completed by March 2010, the company apparently made limited progress in closing the transaction for more than a year after it was first announced. Following are additional disclosures YUII made in its SEC Filings regarding the transaction:

- 2009- Form 10-K: On December 24, 2009, PRC Yuhe entered into an agreement to purchase thirteen breeder farms at a total consideration of RMB103,870,000, approximately equivalent to $15,191,891. As of December 31, 2009, PRC Yuhe has paid 80% of the total consideration, or RMB 83,000,000, approximately equivalent to $12,139,472. The remaining balance will be paid within two months after formal delivery of the farms, expected in early March 2010.

- Form 8-K (January 4, 2010): The aggregate purchase price for the 13 breeder farms is RMB103.87 million (approximately $15.2 million). Pursuant to the agreement, Yuhe already paid 80% of the purchase price on or before December 31, 2009 and will pay the remaining balance within two months after formal delivery of the farms, expected in early March 2010. ……… These farms will add 600,000 sets of parent breeders for Yuhe by the third quarter of 2010.

- 2010-Form 10-K: On December 24, 2009, PRC Yuhe entered into an agreement to purchase thirteen breeder farms for a total consideration of $15,709,792, equivalent to approximately RMB 103,870,000. As of December 31, 2010, PRC Yuhe has paid 80% of the total consideration, or $12,553,314, equivalent to approximately RMB 83,000,000. The remaining balance of $3,156,478, equivalent to approximately RMB 20,870,000, is expected to be paid by the end of December 2011.

YUII updated the disclosure concerning the acquisition in the 2010 Form 10K stating the remaining balance of the Dajiang transaction was expected to be paid by December 2011. We found no mention in the company’s public filings of why the date had been changed. However, since we did not participate in most of YUII’s investors conference calls we don’t know if the issue was discussed then. Regardless, given the new timeline for the closing we did not expect a near term resolution of this issue.

On May 16, 2011 the company announced in a press release regarding the QI 2011 financial results that it had officially taken possession of 11 farms from Dajiang as of the date of the release. There was no reference to what happened to two of the 13 farms YUII originally contracted to acquire from Dajiang. Following is the excerpt from the press release disclosing the Dajiang transaction had been completed:

“As of the date of this press release, the Company had officially taken possession of 13 breeder farms from its previous acquisitions conducted in December 2009 and July 2010. Of these, 11 breeder farms were taken over from Weifang Dajiang Corporation, and two breeder farms were taken over from Liaoning Haicheng Songsen Stock Farming and Feed Co., Ltd.”

Certain aspects of the Dajiang acquisition struck us as odd including the payment of an 80% deposit on the transaction rather than a more prudent 20% or 25% down payment. Also, the 16 months between the execution of the agreement and claimed transfer of 11 chicken farms is excessive. Finally, we are intrigued by the convenient timing of when YUII claimed that the transfer of the farms became official since it coincided with the date of the QI press release.

Chairman and General Manager of Dajiang Denies Acquisitions

Dajiang’s Chairman and General Manager Vehemently Stated in Two Telephone Conversations that YUII Did NOT Acquire Dajiang’s Farms

Once our interest in the Dajiang transaction was piqued we decided to reach out to the Chairman and General Manager of Dajiang and get his perspective on the transaction. We obtained the Chairman’s name, Mr. Xuejiang Zheng, and telephone number from the Dajiang’s 2010 SAIC filing (attached).

On June 8th and 9th 2011, Geo’s investigator called Mr. Zheng, the Chairman and General Manager of Dajiang Enterprise Group Co., Ltd. In both calls Mr. Zheng categorically stated that YUII did NOT acquire the farms owned by Dajiang. Further, YUII never had serious negotiations with Dajiang, much less execute an agreement to acquire the farms. Key comments made by Mr. Zheng during the telephone conversations concerning YUII’s claim to have acquired Dajiang’s farms and other comments regarding YUII follow:

First Call with Chairman Zheng, June 8, 2011

Geo’s investigator initially called Mr. Zheng on June 8th and identified himself as a representative of an investment fund interested in acquiring chicken farming operations in China. Since Mr. Zheng did not know who he was talking to he was less forthcoming in the first call than the follow up call made the next day. Despite his reticence to be too open during the first call he did reveal the following details concerning YUII’s claims to have acquired Dajiang’s farms:

- Mr. Zheng stated he knew of YUII but categorically denied there was ever an agreement for YUII to acquire Dajiang’s farms. It should be noted that he also denied having been contacted by representatives from YUII.

- He further stated that YUII is a company with a very poor reputation in the local business community that is generally thought to be on the verge of bankruptcy.

- He was interested in having discussions with our investigator concerning the sale of Dajiang’s farms.

Second Call with Chairman Zheng, June 9, 2011

Geo’s investigator made a second call to Mr. Zheng the following day. This time Zheng was more forthcoming about a discussion he did in fact have with YUII representatives in 2009 and provided details regarding the meeting.

- Mr. Zheng was approached by YUII in the fall of 2009. He stated that only one discussion concerning Dajiang and its operations took place and there were no formal negotiations for YUII to acquire the farms.

- YUII’s representative shared with Mr. Zheng that the company was in the process of raising capital in the US markets and having an acquisition of Dajiang’s farmswould help that process. They wanted Mr. Zheng to “do them a favor” and work with them to come up with a deal that would be attractive to US investors.

- Zheng stated that YUII’s offices are located close to Dajiang’s so he knew of the company. He stated that YUII is, “not a good company and did not have strong capacity.”

- YUII proposed a fake deal which would result in Dajiang’s farms being listed under YUII’s name. The idea was for YUII to rent the farms from Dajiang or enter a joint venture with Dajiang so YUII could claim control/ownership.

- Zheng was initially somewhat intrigued that he could use an investment from YUII to renovate and upgrade his farms but he was put off by YUII’s unprofessional approach and shady propositions.

- Zheng rejected YUII’s approach and there were no further discussionsbetween the two companies.

The bottom line is that according to the Chairman of Dajiang, YUII did NOT acquire Dajiang’s farms and there is and never was an official agreement in place for them to do so. The transcripts and recording of these two conversations are enclosed to this report.

Full Transcript of Second Call

Internal Controls

Examination of SEC Documents Give Context to the Internal Control Environment in which YUII Executed its Alleged Acquisition of Dajiang’s Farms

During the course of our ongoing on-the-ground due diligence we began scouring SEC documents to gain insight into YUII’s operating history and disclosures that might be relevant to the alleged acquisition of Dajiang’s farms. Our key findings are as follows:

Material Internal Control Weaknesses and Possible “Rubber Stamp” Audits

YUII attempted to upgrade auditors by engaging Grant Thornton (“GT”) in December 2009 to complete the 2009 audit. GT replaced Child, Van Wagoner & Bradshaw, PLLC (“Child”). Child is the firm that had served as YUII’s independent auditor since March 31, 2008. GT discovered prohibited related party loans and material internal control weaknesses during the firm’s initial audit work. Management caused the related party loans to be paid prior to the end of 2009. Despite management’s best efforts to resolve the related party issues, ongoing material weaknesses in YUII’s internal controls compelled GT to resign as independent auditor effective March 5, 2010.

YUII’s Audit Committee accepted GT’s resignation and reappointed Child as independent auditor effective March 9, 2010. Since Child had done the 2008 audit and interim audit work for the 2009 audit prior to GT’s appointment, the firm was able to reassume the role of independent auditor and complete the audit in time for the Form 10-K filing on March 31, 2010. However, the timing of Child’s reappointment and the filing of the Form 10-K makes us wonder just how thorough the 2009 audit could have been under the circumstances. Even allowing for the interim work done prior to year end, it is surprising that Child was able to seamlessly complete the audit on such short notice. We also wonder how Child has been able to accept the same internal control weaknesses that compelled GT to resign as independent auditor. It appears that Child is not operating under the same standards as GT.

It should be noted that YUII did in fact make efforts to resolve its internal control weaknesses. The company obtained outside professional assistance in an effort to address and correct the internal control weaknesses prior to filing the 2009 Form 10-K. It appears that these efforts, however, did not eliminate all of YUII internal control deficiencies as the 2010 10-K revealed that internal controls are still not effective due to activities that took place in early 2010. YUII has stated that it has since put measures in place to remedy its internal control issues. Any such remedies would be post theDajiang acquisition.

In the case of YUII, it is vitally important for investors to understand some of the factors that internal control policies address. We can directly reference YUII’s 2010 10K for details:

“Internal control over financial reporting includes those policies and procedures that:

(i) Pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the Company’s assets;

(ii) Provide reasonable assurance that transactions are recorded as necessary to permit preparation of the consolidated financial statements in accordance with U.S. GAAP, and that the Company’s receipts and expenditures are being made only in accordance with appropriate authorization of the Company’s management and board of directors; and

(iii) Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assetsthat could have a material effect on the consolidated financial statements.”

We find such information particularly relevant for a company such as YUII that has been growing through acquisitions. This is especially relevant to the Dajiang transaction since it appears unlikely any remedies to correct internal control deficiencies would have been put in place before payment for the alleged acquisition took place.

Other Aquisitions

Other details in the 10-K regarding YUII’s practice of acquiring some of its suppliersalso gives us pause.

We were particularly struck by the details surrounding the following acquisition of five farms:

“On July 14, 2010, PRC Yuhe entered into an asset purchase agreement with Liaoning Haicheng Songsen Stock Farming and Feed Co., Ltd. (“Haicheng Songsen”), and Mr. Jiang Zhaolin, the controlling shareholder of Haicheng Songsen.

Pursuant to the Purchase Agreement, PRC Yuhe agreed to buy certain assets of Haicheng Songsen, including five breeder farms with a total area of approximately 52 acres and buildings totalling approximately 63,174 square meters in Haicheng, Liaoning Province, China, for a purchase price of $3,214,335 (RMB 21,252,540). As of December 31, 2010, PRC Yuhe had paid $2,458,111 (RMB 16,252,540). The remaining balance of $756,224 (RMB 5,000,000), is expected to be paid by the end of August 2011. Concurrent with the purchase, the Company issued 300,000 restricted shares of its common stock to Mr. Jiang Zhaolin pursuant to a service agreement (the “Service Agreement”) between PRC Yuhe and Mr. Jiang Zhaolin. Pursuant to the Service Agreement, Mr. Jiang Zhaolin agreed to provide PRC Yuhe with certain services related to completion and closing of the Transaction in consideration for the restricted shares of common stock of the Company calculated at a price of $10.00 per share with total consideration equivalent to approximately RMB 20 million. On the issuance date, the 300,000 restricted shares were valued at $2,736,000, based on the closing market price of $9.12 on that day”

Note that as was the case with the Dajiang “acquisition”, there was an 80% deposit paid on the transaction as well as an excessive period of time between the agreement (July 2010) and the anticipated closing of the acquisition (August 2011). Also note that the controlling shareholder of Haicheng Songsen received 300,000 restricted YUII shares as closing fee valued at $2.7 million. Does $2.7 million paid for services related to the completion of a transaction valued at $3.2 million seem reasonable? Finally, as of the end of QI 2011 YUII had taken possession of only two of the five farms acquired.

More recently, YUII announced the acquisition of yet another 10 farms in December 2010:

“On December 31, 2010, PRC Yuhe entered into an asset purchase agreement, collectively, the Purchase Agreements, with each of Mr. Liu Tiezhu, Mr. Liu Kaichun, Mr. Luo Xingshi, Mr. Xu Zhenming, Mr. Shan Jichun and Mr. Xin Yubin, collectively, the Sellers. All Sellers are unaffiliated with the Company. Pursuant to the Purchase Agreements, PRC Yuhe agreed to purchase from the Sellers, and each of the Sellers has agreed to sell, certain assets, including, in the aggregate, ten breeder farms with an area of 558.4 mu, approximately 91.0 acres and building coverage of approximately 136,740 square meters in Henan and Liaoning provinces of China, for an aggregate purchase price of approximately RMB 108.7 million, or approximately $16.4 million. Mr. Xu Yubin will receive approximately 431,848 restricted shares of the Company’s common stock calculated at a price of $10 per share with total consideration equal to approximately RMB28.6 million, or approximately $4.3 million. These restricted shares, which have not yet been issued, will be subject to a six-month lock-up period. The other five Sellers will receive an aggregate cash consideration of approximately RMB 80.1 million, or approximately $12.1 million. The Purchase Agreements are subject to customary closing conditions and are expected to be closed in the first half of 2011.”

Notice that these two acquisition arrangements appear to have been negotiated with at least three individuals who were suppliers to YUII.

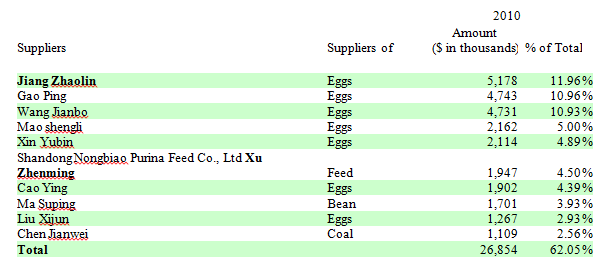

PRC Yuhe’s suppliers (including distributors of suppliers) in 2010 were as follows:

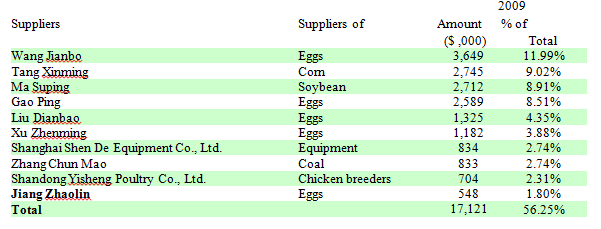

Adding to our belief that YUII’s recent acquisitions should be further scrutinized is that, Jiang Zhaolin was YUII’s biggest supplier of eggs in 2010 after supplying only 1.8% of its eggs in 2009. That increased level of business with Zhaolin would seem to help justify YUII’s rationale for the acquisition.

PRC Yuhe’s suppliers (including distributors of suppliers) in 2009 were as follows:

The GeoTeam recognizes the benefits of vertical integration but we view YUII’s acquisitions with extreme skepticism for the following reasons:

- Red flags and risk factors discussed in the next section.

- Weak and accommodating internal controls.

- The propensity of a number of ChinaHybrid companies to deceive through related party transactions and suspect acquisitions.

Cash Management Practices Raise Red Flags

- YUII’s 2010 Form 10-K filing disclosed, “The Company uses company-controlledpersonal bank accounts of certain of its employees for transit purposes to transact a substantial amount of its business and the Company transacts asignificant amount of its business in cash without using bank accounts.”

- YUII reports $42 million cash as of QI 2011, yet continues to take out short term loans for “liquidity needs”.

- Despite having $42 million in cash, the company’s 2010 Form 10K reports beingdelinquent on “employee benefit payments” of around $600,000 at December 31, 2010. Given the company reports having $42 million why wouldn’t they just pay the benefits liability with existing cash?

- The company reported in its Form 10-K filings less than $1,000 of AR for the years ended December 31, 2008 and 2009, and no AR for the year ended December 31, 2010. How is that possible? Did management really run a $67 million revenue business during 2010 entirely on a cash basis?

- Despite having a beginning cash balance in January 2010 of over $14 million and an ending cash balance at December 31, 2010 of over $35 million, the company only generated $35,000 of interest income during 2010 according to its 10-K filing. Even a 1% yield on an average cash balance of $24 million would have generated $240,000 of interest income during the year. Does management maintain its cash balances in non-interest bearing accounts and, if so, why?

Risk Factors

Certain Risk Factors Disclosed in the SEC Filings are NOT “Boiler Plate”

The following risk factors are disclosed in the company’s SEC filings:

- The Company’s construction projects may be challenged by the relevant government agencies. The Company has not obtained relevant government approvals and permits, including the planning permit, construction permit and the environmental permit, with respect to two of its projects involving the construction of breeder farm and feed stock production. The constructions of these two projects may be challenged by relevant governmental authorities and the Company’s business operations may be interrupted or suspended.

YUII needs to offer more color on this issue. How long as this issue been open? Does this issue have anything to do with the following disclosure?

- Further approvals are required for the land that the Company leases from village committees. The Company has entered into several land lease agreements respectively with certain local village committees in Weifang city for use of certain land owned by such villages. According to relevant PRC law, prior to entering into the lease agreements with the Company, the village committees must obtain the consent of at least two-thirds of the members of the respective village as well as the approval of the relevant people’s government. However, these village committees have not completed the required consent and approval procedures. Although the Company has not received any notice from any governmental authorities challenging the validity of these lease agreements, the Company cannot assure you that its use of the leased land will not be challenged in the future, which may adversely affect the Company’s business, results of operations and financial condition.

Once again, YUII needs to clarify some issues. Why has YUII been unable to close this chapter in its history? Have the villagers not accepted YUII payment terms? Is YUII unable or unwilling to make agreed payments? Is YUII involved in an illegal lease scenario?

- Past incomplete disclosures may cause certain investors to rescind their past investment in us. The Company filed a Form 10-K/A (Amendment No. 1) on October 15, 2010 to amend its previous SEC filings to supplement certain disclosures with respect to a general, verbal and informal understanding between Mr. Gao Zhentao and Mr. Kunio Yamamoto at the time of a share transfer agreement dated October 18, 2007. Pursuant to such understanding, all or part of the shares of the Company’s common stock issued to Mr. Kunio Yamamoto would be transferred to Mr. Gao Zhentao in the future in consideration of Mr. Gao Zhentao’s commitment to management of the Company’s business operations and future achievement of the financial targets set forth in a Make Good Agreement on March 12, 2008. The general, verbal and informal understanding may result in invalidation of the Company’s corporate restructuring in 2007 as described in the risk factor entitled “Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies and corporate restructuring by PRC residents may have adverse effects on the Company’s business, results of operations and financial conditions.” Such past incomplete disclosure may cause investors who purchased the Company’s shares pursuant to the Registration Statement on Form S-1 filed with the SEC on May 12, 2008, as amended, to rescind their purchase of the Company’s shares based on the Registration Statement on Form S-1, in which case the Company’s may be required to purchase from such investors their shares at their initial purchase price. This may have an adverse effect on the Company’s business, financial condition or results of operations, as well as on the trading price of the Company’s common stock.

What are the implications for US investors?

Conclusion and Valuation Scenarios

We remain short YUII, but investors will have to draw their own conclusions and make their own investment decisions.

For us, the YUII story comes down to one simple truth: the Chairman and General Manager of Dajiang categorically stated that there was never an agreement for YUII to acquire Dajiang’s farms. Simply put, the transaction never happened. That of course brings into question:

- Where did the $12.1 million deposit really go?

- Where did the increased production capacity in 2010 10K come from?

- Were 2010 financial results overstated?

- Why does YUII still plan to pay the remaining balance for an acquisition (Dajiang) that appears to have not taken place?

- Do improprieties exist with regards to YUII’s other acquisitions?

- How can investors place trust in YUII’s management in the future?

We also can’t ignore the implications of other disclosures in YUII’s SEC filings. For example, the 10-K disclosures regarding past due employee benefits payments and unfinished business related to completing the transfer of lease rights leads us to ponder Dajiang’s chairman’s assertion that YUII is not as substantial and financially sound as they lead investors to believe.

There are other issues that give us pause regarding the YUII story including:

- How the company carries out its business transactions without going through its own bank accounts;

- Certain balance sheet items that do not make sense such as the lack of AR;

- Acquisitions of suppliers;

- Internal controls that have not been effective, leaving investors vulnerable to possible improprieties.

Valuation:

The financial markets have no tolerance for companies that may have violated investors’ trust and neither do we. And, the environment of ChinaHybrids has worsened in recent months after a series of proven and alleged frauds in the space have grabbed the attention of investors and regulators. In fact, just last week the SEC formally announced that it will be stepping up its investigations of Chinese small cap companies. We assume this means the pace at which the SEC takes action against companies that appear to have misrepresented themselves to investors will quicken.Also, brokerage houses are beginning to limit the ability of customers to buy Chinese RTO stocks on margin and even prohibit customers from initiating new positions in some names. The reality of these developments has only begun to sink into the market’s psyche. We, therefore, have a hard time envisioning a scenario in which YUII shares will not be punished severely by investors once the gravity of our findings sinks in. Given the overall market environment, we can’t justify the risk of owning shares in a company that may have violated investors’ trust.

So how can we value YUII shares? This a difficult task for us since we do not trust the financial data presented in YUII SEC filings. Valuing YUII becomes even more problematic when we consider management may be misappropriating cash when making alleged acquisitions. What possible claim would investors have on that cash and what recourse would they have against a company located in China?

However, some investors may view YUII’s situation differently and wish to value the company based on its reported cash. Others may instead look to the inferred cash per share based on the interest income generated in 2010. Whatever valuation approach is used, investors should consider possible events that would adversely affect YUII’s shares including:

- A potential SEC investigation;

- Management and/or Board Member resignations;

- Auditor resignation;

- Further negative DD findings as this story unfolds;

- Analyst downgrades; and

- A trading halt.

From our perspective, we are simply not interested in trying to derive a base value for YUII shares or deciding if a chicken farming operation will attract suitors to take the company private. We will let the market speak to these points. Likewise, we will not be influenced if YUII announces plans to buy back shares in the open market or supportive “paper” it offers in its defense. Shares of CCME, CHBT, SCEI and a host of other companies received only a temporary lift from such moves. In the end, from our point of view, we do not consider YUII shares as investable. The risks are just too great and cannot be quantified at this time.