Based on the success we have had investing in the software as a service (SaaS) space, we have set out to identify companies with similar traits as SaaS firms. One of the aspects that attract investors to SaaS companies is a business model that lends itself to a recurring revenue stream and a sticky customer base. Furthermore, early entrant investors who apply less traditional valuation metrics (rather than common P/E analysis) to such companies are able to gain an advantage since the attainment of EPS is not often an early goal. A priority for these companies is to heavily invest in marketing to quickly build a loyal customer base that will set the foundation for consistent cash flows and future profitability.

Based on the success we have had investing in the software as a service (SaaS) space, we have set out to identify companies with similar traits as SaaS firms. One of the aspects that attract investors to SaaS companies is a business model that lends itself to a recurring revenue stream and a sticky customer base. Furthermore, early entrant investors who apply less traditional valuation metrics (rather than common P/E analysis) to such companies are able to gain an advantage since the attainment of EPS is not often an early goal. A priority for these companies is to heavily invest in marketing to quickly build a loyal customer base that will set the foundation for consistent cash flows and future profitability.

Our recent 2013 articles on SaaS companies Selectica (NASDAQ:SLTC), Eloqua (NASDAQ:ELOQ), Responsys (NASDAQ:MKTG), Vocus (NASDAQ:VOCS), and Exacttarget (NYSE:ET) highlighted such opportunities. The average return since the inception of our coverage currently stands at around 30% (42% at their highs).

We also search for companies whose stock prices have yet to reflect publicly disclosed positive developments. Please see our recent article on Gain Capital Holdings (NYSE:GCAP)as a point of reference point; the stock is already up around 33% since the date of our report’s publication. In general, our focus has been to identify stocks:

- that trade at a relative discount to their peers

- with growth prospects in which near term catalysts should create immediate value for shareholders.

This is why we have decided to highlight Global Telecom & Tech Inc (AMEX:GTT)and code the stock as our next GeoBargain.

GTT’s Attractive Trends

Like a SaaS company, GTT has built a predictable revenue model supported by a loyal customer base. Similar to GCAP, shares have yet to fully reflect a transformative acquisition completed on April 30, 2013 that will double GTT’s customer base and boost its revenue base by 64%, helping it achieve significant bottom line results for the first time since it went public through a SPAC transaction in January 2005.

The company has announced a number of positive events over the past several months that have helped shares quietly rise around 50% year to date. Still, we think that this may just be the beginning. In our opinion, GTT is poised to more than double as a number of catalysts continue to play out.

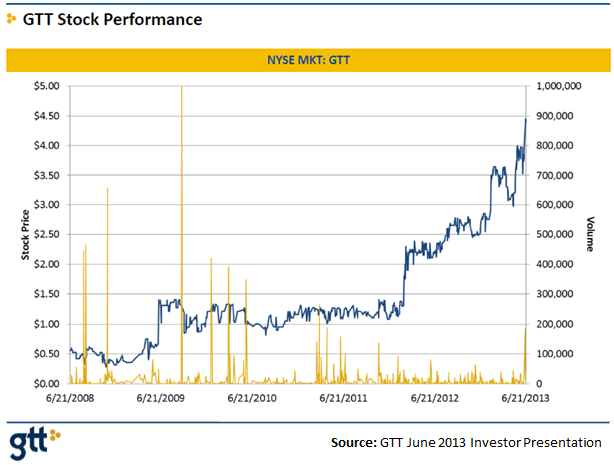

Investors who choose to focus on past GAAP EPS performance and a seemingly leveraged balance sheet will not see the big picture. The company has been EBITDA positive since the third quarter of 2007 and has grown its EBITDA at a compounded annual rate of 47% from 2008 to 2012. Furthermore, after adjusting for acquisition related integration costs, shareholder compensation, and other non-operating items, historical non-GAAP EPS portrays a more realistic positive growth trend compared to just GAAP EPS. Early GTT investors who looked beyond traditional EPS valuation metrics have seen their investments grow more than 700% since 2008.

GTT Stock Performance image

It appears that the GTT has finally reached an inflection point that will soon allow profitability to accelerate toward new levels. Analysts expect that the consummation of a recent transformative acquisition will put the company in a position to report EPS of around $0.90 in 2014. This is very significant when one considers that GTT’s highest annual non-GAAP EPS performance to date has been $0.15. The stock is currently selling at a meager P/E of 5 times analyst 2014 EPS estimates – this should finally bring a new wave of investors to the GTT story who value companies on EPS multiples. Furthermore, GTT is selling at valuation multiples well below that of its publicly traded comparable, Cogent Communications Group, Inc. (NASDAQ:CCOI), which is selling at a P/E multiple in excess of 50 times 2014 EPS estimates. Similar valuation gaps exist when referencing other multiples such as EV/EBITDA and EV/S.

We don’t think it will be long before more investors find GTT since, on June 14, the company was up-listed from the bulletin boards to the NYSE; we believe that this significantly increases the potential investor base and should result in greater trading liquidity and further potential sell-side analyst coverage.

History

The Company was incorporated in Delaware in January 2005 as Mercator Partners Acquisition Corp., a SPAC looking to merge or acquire operating businesses. In October 2006, the Company acquired all of the outstanding capital stock of Global Internetworking, Inc. (“GII”) and European Telecommunications & Technology Limited (“ETT”), both of which were funded in 1998 and operated in design, delivery, and management of data networks and value-added services. Mercator then changed its name to Global Telecom & Technology, Inc. and completed the consolidation and integration of GII and ETT into GTT in 2007 and is currently headquartered in McLean, Virginia.

Understanding GTT

From GTT’s website:

“GTT provides customers with innovative connectivity solutions by utilizing our own network assets – linking over 250 Points of Presence across North America and EMEA – and extending them through our 800 partners worldwide. Our Network as a Service proposition delivers flexible, reliable and scalable network infrastructure, capable of both public and secure private networking. We simplify network deployment by removing the complexity of multi-vendor solutions while offering the cost efficiencies of a single partner. For over 15 years GTT has provided world class project management, rapid service implementation and global 24/7 end-to-end solution monitoring and support.”

Said more simply, the company helps its customers connect to the internet and securely send and retrieve data throughout their network infrastructures. GTT also allows other network providers to service their own needs by allowing access to its network.

Customers use GTT’s network to:

- Communicate and/or send and receive data throughout their organizations (Government, Global Enterprise).

- Ensure that they have enough network coverage/bandwidth to deliver content to their own customers (Netflix, YouTube, SaaS providers).

- GTT’s solutions enable providers of media to lease its networks (internet service providers) to deliver services where they do not have their own network or elect not to use their own network.

GTT’s customers can opt to use either its public network infrastructure and/or a more secure private setup.

One Stop Shop

In order to recognize why companies need GTT’s services, it’s important to understand the challenges that surround connecting to and communicating in the “cloud”. No internet service provider has complete network coverage. For example, if a U.S. customer needs to operate over the “cloud” globally or throughout the U.S., without GTT’s services they would have to use those of multiple network providers. GTT solves this problem by leasing (as a reseller, off-net) the infrastructure of other ISP networks/suppliers (such as from Comcast) which it then layers onto its own network. GTT builds its own network (on-net) by installing routers globally at various “points of presence” (PoP). PoPs are located at co-location centers (aka “carrier hotels”). GTT then leases services of a company like Juniper Networks, Inc. (NYSE:JNPR) to connect its routers.

In order to recognize why companies need GTT’s services, it’s important to understand the challenges that surround connecting to and communicating in the “cloud”. No internet service provider has complete network coverage. For example, if a U.S. customer needs to operate over the “cloud” globally or throughout the U.S., without GTT’s services they would have to use those of multiple network providers. GTT solves this problem by leasing (as a reseller, off-net) the infrastructure of other ISP networks/suppliers (such as from Comcast) which it then layers onto its own network. GTT builds its own network (on-net) by installing routers globally at various “points of presence” (PoP). PoPs are located at co-location centers (aka “carrier hotels”). GTT then leases services of a company like Juniper Networks, Inc. (NYSE:JNPR) to connect its routers.

“A key aspect to being a dominant player in this space is amassing PoPs. With over 200 PoPs across North America, Europe and Asia GTT is a top 5 IP transit provider in the world and one of the largest Ethernet networks in the world.”

By combining its own network with the networks of over 800 suppliers worldwide, the company is able to offer highly competitive pricing to its clients globally. Whether its clients need Wide Area Network (“WAN”) Services or Dedicated Internet Access (“DIA”), GTT can help choose the best of breed technologies and services from hundreds of telecom carriers worldwide, managing the entire network and allowing clients to work with only one provider. This basically creates a one-phone-call-to-make approach to telecommunications management.

The majority of GTT’s revenues are derived by the sale of three product offerings:

- IP transit

- Ethernet

- Private Line

An easy way to understand the distinction between these offerings is that the Ethernet and Private Line services offer more secure and have greater network coverage than IP services. The Ethernet service is more robust than the Private Line service.

The company believes that its competitive advantages include, but are not limited to:

- A technologically advanced network that increases speed and reduces “information bottlenecks.”

- Wide geographic coverage.

- Ability to meet customer bandwidth needs as they grow (scalable).

- An abundance of relationships with suppliers of bandwidth which gives customers several connectivity options; One stop shopping by building ISP providers networks on to its own.

Five reasons for optimism

1. Strong Management Team

GTT acquired its first two operating companies, (Global Internetworking, Inc. (GII) and European Telecommunications & Technology Limited (ETT), in 2006. After the company experienced accelerated post-acquisition losses, it hired the current CEO, Rick Calder, in 2007. Mr. Calderhas over 25 years telecom experienceand has held numerous board and executive positions at Comsat, Global TeleSystems, LCI, Qwest, MCI, Axcelis, Pendrell, Penske, and Sonus Networks. Overall, GTT’s Board of Directors has had extensive exposure to the telecom industry.

Mr. Calder’sfirst order of business was to eliminate redundancies between GII and ETT, and define a clear path for the company’s growth. Next, he appended GTT’s focus of solely a reseller of network services to also include the construction its own network. This put the company in a better position to achieve higher gross margins and increase its geographic presence. He also set out to implement an acquisition strategy, clearly define target customers and expand product offerings. By the third quarter of 2007, the company had already turned EBITDA positive.

2. Underserved Customer Niche

Being a niche player in segments of a market that larger competitors ignore creates tremendous opportunity to fill a void. GTT targets companies and geographic regions that larger players like AT&T and Comcast can’t service efficiently. The small to medium size customer comprise GTT’s “sweet spot”, as well as regions that do not offer enough revenue opportunities for bigger competitors. Its single provider solution is perfect for the lesser served small to medium sized enterprises with tighter budgets that are not typically pursued by larger providers. We learned that the threat of future competition from the likes of AT&T and Comcast is not a high-grade concern, since such firms are averse to leasing network coverage that extends beyond their own infrastructure on which they have spent significant funds to build. Likewise, the threat of severe competition from smaller players is somewhat hindered by the capital commitment needed to install routers and lease the infrastructure required to connect the routers.

We really like the overall theme of GTT’s strategy; a simple approach of serving its customer base by eliminating the need for multi-vendor solutions for network deployment and offering them a single provider solution.

With revenues approaching $200 million and a potential target market estimated to be about $20 billion, GTT has a tremendous opportunity to continue carving out a niche market presence.

3. Transformative Acquisition

The Company has grown significantly through bolt-on acquisitions over the years. Since 2007, GTT acquired and successfully integrated 14 companies into its business operations,realizing cost synergies within one to two quarters in most cases. The most notable acquisitions include:

“…

Tinet (April 2013)

- 1,000 clients and expanding networks in 24 countries.

- Expanded network infrastructure.

- Established GTT as 5th largest IP provider in the world.

nLayer Communications (April 2012)

- 100 clients and network in 26 cities.

- Improved network infrastructure while eliminating redundant overlapping network costs.

- Accretive transaction, fully debt-financed.

Packet Exchange (June 2011)

- 485 clients and network in 23 cities.

- Expanded network depth and breadth (Core Switching, Asia and Europe POP’s).

- Accretive transaction, fully debt-financed.

WBS Connect (Dec 2009)

- 400 clients and network in 50 cities.

- Expanded data service portfolio (Ethernet, IP).

- Beginning of GTT Network build.

GII & ETT (October 2006)

Acquired by Mercator Partners, integrated into single public company.

- Reached positive EBITDA in 3Q 2007

…”

The largest single event the company has achieved is the acquisition of Tinet from Inteliquent (NASDAQ:IQNT), which had been IQNT’s global data business. IQNT provides services to telecom providers, helping them deliver their network reach. With the divestiture of Tinet, IQNT’s major focus is the delivery of voice versus data services.

On April 30, 2013, GTT acquired Tinet for approximately $52.5 million (less than one times sales) and also announced a debt financing and restructuring allowing them to complete the transaction and to leave the company adequately funded for growth. IQNT acquired Tinet on October 1, 2010 to expand its data connectivity product offering. However, it appears that it has chosen not to aggressively pursue this offering.

All other acquisitions aside, this one will prove to be a game changer for GTT as it nearly doubles the size of the company. GTT’s focus on providing data connectivity services should enable it to jumpstart Tinet’s growth that took pause while under the helm of IQNT.

This acquisition should be highly accretive to GTT’s financials. At over 40%, Tinet’s EBITDA margin as disclosed in IQNT 2011 10-k filed with the SEC, is triple that of GTT’s current EBITDA margin. Post synergy, management expects GTT to exit 2013 in a position to generate $200 million in revenue and $30 million in adjusted EBITDA for the combined entity. We estimate that this EBITDA run rate would translate into EPS of around $0.50 in 2014 (analysts are actually forecasting $0.90). Relative to GTT’s standalone 2012 results, these numbers compare to an 86% increase in top line growth, three times EBITDA growth and a 600% increase in non-GAAP bottom line growth.

| We think that GTT could easily exceed its assumed $30 million adjusted EBITDA 2014 run-rate guidance. Pre-Tinet, GTT was on track to achieve 2013 adjusted EBITDA of around $14 million. IQNT’s 2011 10Kdisclosed that Tinet’s EBITDA alone was approximately $30 million on $65 million in revenues. So, GTT could be well on track to approaching $40 million in EBITDA and blowing away our 2014 non-GAAP EPS estimate. Taking this information into account makes analyst EPS 2014 estimates of $0.90 very achievable. |

With the Tinet acquisition, GTT will serve over 2,000 customers across nearly 100 countries and allow the company to cross-sell or up-sell many of these new customers on incremental services. The transaction makes GTT one of the top five IP transit providers in the world and one of the largest global Ethernet interconnection networks. Acquiring the Inteliquent data business accelerates the company’s plan toward becoming a more asset-based network solution provider, which should improve margins.

GTT has a history of quickly integrating acquisitions. Post-transaction, the company should have a manageable debt load and is expected to generate enough free cash flow such that debt repayment or further acquisition opportunities will both remain as options.

Once GTT integrates Tinet, we expect the company to continue its acquisition-based growth strategy, as there are numerous acquisition opportunities available both in the U.S. and globally. The company’s management sees a large M&A pipeline with over 15 active opportunities in Enterprise, Government, and Carrier segments, which represent over $400 million in revenue and over $50 million in pre-synergy EBITDA potential. With future acquisitions, GTT plans to focus on adding strategic network assets, expanding service offerings, adding new clients, and increasing its geographic presence.

4. Favorable Business Model

- A Predictable Model– GTT receives a monthly recurring fee under contracts typically ranging from one to three years. The contracts revert to a month-to-month agreement at the end of their initial period. It appears that the company currently receives around $9,000 per customer per month and has not lost pricing power over the last four years, all of this amid increasing competition.

| Current (Taking into account Tinet) | 2012 | 2011 | 2010 | 2009 | |

| Number of customers | 2000+ | 1000+ | 1000+ | 700 | 700 |

| Revenues | $180M Run Rate | $107.9 | $91.2 | $81.1 | $64.3 |

| Monthly revenue per customer | 8K | 9k | 8k | 10k | 8k |

According to the above table, another trend that becomes clear is the company’s customer base retention and accrual.

The nature of GTT’S business should give its management high visibility, which in-turn should lead investors to embrace financial guidance with a high degree of confidence.

- Profitability Inflection Point Achieved / Operating Leverage —Ultimately, bottom line growth drives stock performance, and any time a company reaches sustained profitability it is typically an exciting time to be a shareholder. GTT achieved $4 million in Operating Cash Flow in 2012 and is currently on track to easily surpass this number. The company generated Operating Cash Flow of $2.4 million in the first quarter 2013 as revenues grew 7% year-over-year to $26.4 millon, and EBITDA increased by 36% to $3.6 million. Gross margin expanded to 33%, compared to 29% reported in the first quarter 2012, driven largely by network cost reductions, higher gross margins from recently acquired customers, and a shift in the business to more on-net services (owned network as opposed to leased). Adjusted EBITDA margin also expanded from 11% reported in the first quarter 2012 to 14%, demonstrating improvement in operating leverage. Additionally, the operating and cost synergies from the Tinet deal, through the reduction of duplicative expenses and the broadening of the product offerings, should prove to generate a second leg of organic growth and margin expansion following the integration.

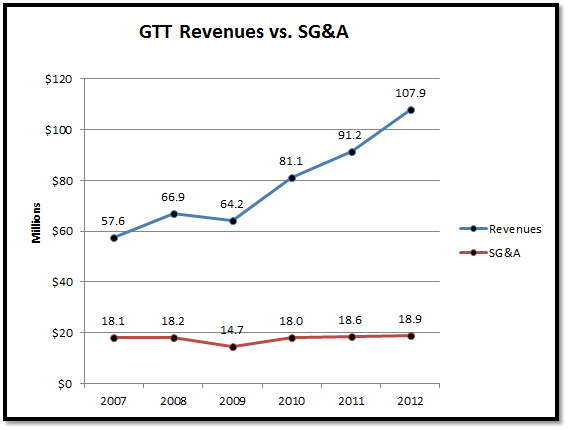

The operating leverage highlighted by GTT’s business model and its ability to successfully integrate acquisitions synergistically is clearly apparent by looking at the relationship between revenue growth and selling, general, and administrative (SG&A) expenses since 2007.

- Low Relative Capital Requirements — As a cloud network provider, and due to its business model which partially relies on partnerships with other suppliers in order to utilize their networks instead of solely trying to grow its own PoP, GTT benefits from a less capital intensive business model compared to that of traditional facilities-based carriers. As of the end of first quarter 2013, GTT only had $6.5 million invested in PP&E. This allows GTT to instead invest in expanding its service offerings and adding new clients.

- Leverage is the Company’s Friend— The Company recently restructured its balance sheet to increase its total borrowing availability as well as to reduce the cost of capital to close the Tinet acquisition. Management believes that it is now sufficiently capitalized to fund and grow existing operations. A high debt burden is less concerning with a model where revenues are recurring and there is little customer attrition. Eventually, as cash flows grow, management will be in a position to use less debt to execute its growth strategy. While the debt burden appears high based on GTT’s operational performance, the company’s track record of growing its EBITDA and being profitable on a non-GAAP basis proves that it can manage its debt, allowing it to both service and rapidly reduce the principal balance based on pro-forma expected 2013 results.

Furthermore, GTT historical debt ratios are in line with those of Cogent Communications.

Leverage Multiples

| Ticker | Company | Net Debt to EBITDA (2008-2012 average) | Net Debt to Equity TTM (2008-2012 average) | Interest Expense to EBITDA (2008-2012 average) |

| CCOI | Cogent Communication Group | 1.58 | .82 | 0.27 |

| GTT | Global Telecom & Technology | 1.98 | .97 | 0.17 |

5. Look Beyond the Obvious

The improvements in financial performance have been a result of both revenue growth and cost reductions. The company is benefitting from the hiring of approximately 15 new sales reps, network cost reductions, higher gross margins from its acquired customers, and the pursuit of more profitable services.

Looking beyond GTT’s historic GAAP EPS performance, one will notice that growth in EBITDA has been more than impressive. EBITDA has been growing consistently since 2007, both as a dollar value and as a percentage of revenue, reaching 12.5% in 2012, compared to 9.8% in 2011 and 8.2% in 2010. GTT generated a 2008 — 2012 EBITDA compounded annual growth rate (CAGR) of 47%. As a result, despite a reported GAAP loss in 2012, we believe that management has done a great job of growing both the company’s revenues and EBITDA. (The loss in 2012 EPS was primarily attributable to a significantly higher amortization expense in 2012 compared to 2011 – $7.3 million vs. $3.9 million – stemming from the nLayer acquisition in April 2012 and a much higher interest expense – $4.7 million vs. $2.5 million.) Furthermore, non-GAAP EPS performance portrays a more realistic positive growth trend compared to just a GAAP EPS comparison.

Select Financials

| 2014 Est. | 2013 Est. | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | |

| Revenue | $2004 | $160 | $107.9 | $91.2 | $81.1 | $64.2 | $67.0 | $57.6 |

| EBITDA | $304 | $201 | $13.5 | $9.0 | $6.7 | $4.2 | $2.0 | ($0.1) |

| GAAP EPS | TBA | TBA | ($0.08) | $0.01 | $0.08 | $0.03 | ($2.85) | ($0.35) |

| NON GAAP EPS | $0.50 – $0.862 |

$0.052 – $0.091 | $0.10 | $0.15 | $0.13 | $0.10 | ($0.07) | ($0.16) |

1GeoTeam Estimate; we assume about $2.0 million of non-operational items will be recorded in 2013 and 2014, which is probably light due to the size of the Tinet acquisition. We also only assume that GTT will report 2014 EBITDA of $30 million which is well below the $40 million implied when wrapping in Tinet annual EBITDA of about $27 million as disclosed in IQNT filings.

2Analyst Estimate

32014 analyst EPS estimates are higher than ours since they assume 2014 EBITDA will be $37 million.

4This is based on company commentary and assuming that Tinet revenues just remain stable.

2012 GAAP EPS was impacted by higher interest costs, a factor that could also impact 2013 EPS. Short-term integration costs associated with Tinet could also negatively affect 2013 GAAP EPS. However, GTT will begin to make a dramatic leap forward in the achievement of non-GAAP profitability as it moves through the second half of 2013 and enters 2014. We think that GTT can report at least $0.50 in non-GAAP EPS for 2014, while analysts estimate it will report 2014 EPS of around $0.90. More importantly, we expect EBITDA to continue to grow rapidly.

These factors should bring a whole new wave of investors who value companies on EPS metrics into the game. Shrewd investors will continue to focus on EBITDA growth.

Valuation

GTT trades at a discount to its peers; a discount that should be eliminated as revenue and earnings growth drives share price.

The company currently trades at approximately 3.6x EV/EBITDA and 0.7x EV/Sales for 2014, substantially below those of CCOI, which are 14.1 and 4.3, respectively.

On a pro-forma basis, using our low end 2014 EPS estimate, GTT currently trades at only an 8.6x its forward P/E, also significantly below CCOI (51). As the company’s revenues and earnings grow and it proves its ability to successfully integrate the Tinet acquisition, we expect GTT to benefit from expansion of its valuation multiples.

Based on existing comparable valuations we believe that GTT can trade…

- at least at 15x P/E on our low end 2014 EPS estimate of $0.50, equating to a near term price target of $7.50

- at 10x EV/EBITDA on our low end 2014 EBITDA estimate of $30 million, equating to a near term price target of $9.50

… and still remain conservatively priced.

These targets correspond to about a 120% and 200% upside, respectively, from current prices depending on the multiple used.

Applying a P/E of 15 times the more aggressive analyst 2014 EPS estimates of around $0.90 would translate into a price target of $13.50.

Please see the valuation charts below: (Based on 7/30/2013 closing price)

Notice that GTT is trading well below every growth multiple of Cogent’s we have referenced even though its growth rates are higher.

Price/Earnings Multiples

| Ticker | Company | P/E TTM | P/E on 2013 EST | P/E on 2014 | EPS Growth 2013 vs 2012 | EPS Growth 2014 vs 2013 |

| CCOI | Cogent Communication Group | 143.3 | 130.2 | 51.2 | 10% | 155% |

| GTT | Global Telecom & Technology | 46.6 | 86.0 – 47.6 | 5.0 to 8.61 | Negative | 855% – 1600% |

1 range is based on analyst EPS estimate and on GeoTeam EPS estimate.

EV/EBITDA Multiples

| Ticker | Company | EV/EBITDA TTM | EV/EBITDA on 2013 EST | EV/EBITDA on 2014 | EBITDA Growth 2013 vs 2012 | EBITDA Growth 2014 vs 2013 |

| CCOI | Cogent Communication Group | 14.1 | 13.0 | 11.1 | 14.0% | 17.1% |

| GTT | Global Telecom & Technology | 9.2 | 6.6 | 4.4 – 3.6 | 47.8% | 85.0% |

1Range uses 2014 EBITDA of $30 and $37 million

EV/Sales Multiples

| Ticker | Company | EV/S on TTM | EV/S on 2013 EST | EV/S on 2014 EST | Sales Growth 2013 vs 2012 | Sales Growth 2014 vs 2013 |

| CCOI | Cogent Communication Group | 4.7 | 4.3 | 3.9 | 11% | 11% |

| GTT | Global Telecom & Technology | 1.2 | 0.8 | 0.7 | 49% | 25% |

We agree that CCOI’s higher valuation multiples may be warranted since it…

- Is currently less leveraged,

- Is larger (revenues are over $300 million)

- Is currently in a much better working capital position

… But the discrepancy is too wide given the divergent growth prospects and GTT’s track record of managing its debt load. And we believe as GTT grows its risk profile will improve.

Normally, we adjust our P/E valuation analysis to reflect that a company is paying a normal tax rate if it is apparent that it will begin paying taxes in the near future. As of year-end 2012, GTT had $25.3 million in net operating loss (NOL) carry-forwards that will be used to offset future income for tax purposes. The NOLs consist of $20.7 million in foreign NOL and $4.6 million in U.S. NOL. These NOLsdo not expire before 2020, which gives the company ample time to enjoy the full benefit. Thus, we believe it is appropriate to not adjust our EPS estimate to assume a fully taxed scenario.

Those that do not share this opinion can still find solace in the fact that GTT would still be worth $8.30 after applying a fully adjusted tax rate to our 2014 EPS estimate. Conservative investors may also want to discount GTT shares due to its highly leveraged position, or they can just reference our lower EPS estimate, compared to those of analysts. In the end we believe most investors will place heavier weight on EBITDA multiples.

Caveats

- Very low historic ROA and very low/negative ROE.

- Historically very low operating margins and very weak or negative earnings.

- The company has accumulated $48 million in deficit over its 15-year operating history, which indicates the lack of historical GAAP profitability.

- Tinet acquisition looks very promising as it significantly increases the company’s size and scale, but that will depend on successful integration – this is not always easy when the acquisition is that large relative to the company size. Also, eliminating “redundancies” between the two companies could lower employee morale and create a lot of in-fighting

- Relatively high interest expense could become a problem if things go wrong or slower than expected with the Tinet integration.

- Very low trading volume even after the up-list to NYSE.

- A majority of the company’s assets are intangible, with about 50% of all assets as goodwill, which could imply that the company is overpaying for acquisitions. Also, given the high level of goodwill that results from an acquisition strategy, there is always a risk of a big write-down, which will result in a cosmetically weak GAAP quarter if something goes wrong. In the year ending December 31, 2008, the company recorded impairment to goodwill and amortizable intangible assets of $41.9 million, in aggregate, due to problems with its first two acquisitions, which is eventually rectified.

- Negative working capital position leaves less room for error.

- Competition from larger telecoms and ISPs could be a risk in the long run as the company grows.

Disclosure: Long GTT

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.